MRI Equipment

A new era ushering in with 0.2T VLFS MRI

The newly cleared low field strength MRI systems by the USFDA, is poised give the entire population access & this modality.

Medical imaging has come a long way, having endured many trials and tribulations over time. Since Wilhelm Röntgen won the Nobel Prize in 1901 for his expansive contributions to physics and the eventual development of X-rays, radiology and imaging technology has grown to be a sophisticated and essential component of modern medicine. Today, the practice of healthcare is incomplete without the intricate value provided by various imaging methods, including computerized tomography (CT) scans, ultrasound, and magnetic resonance imaging (MRI).

The combination of deep learning MRI reconstruction, enhanced electronics, Covid-19, and newly cleared low field strength MRI systems by the USFDA has ushered in a new era for very-low (0.2T) field strength (VLFS) MRI.

What is most impactful about portable, VLFS MRI is not just the reduced cost, ease of siting, reduced safety risk, and reduction of artifacts, associated with higher field strengths, but also the ability to substantially expand access of MRI to a much wider variety of clinical indications and environments, as well as bring it to areas of the world where MRI is prohibitively expensive or impractical. This will allow the specialty of diagnostic radiology to fundamentally re-imagine how MRI is used. For example, MRI could be considerably expanded with the introduction of VLFS MRI systems to operating rooms, intensive care units (ICUs), emergency departments (EDs), and in emergency transport vehicles.

In order to make the most positive impact on patient care, radiologists and clinicians, who understand the advantages and limitations of emerging VLFS systems, will need to work together closely to plan, test, and practically implement new indications and protocols for MRI. Potential indications could include use of rapid intra-operative evaluation during cervical spine and other surgical procedures, patient monitoring in a neuro or other ICU, screening of trauma and other patients for cord contusion in the emergency department, rapid head scanning for stroke/trauma in an emergency transport vehicle, or even a quick and comparably expensive MRI scan as a substitute or adjunct for a subset of orthopedic conventional radiography studies.

The phrase low field strength MRI typically conjures up antiquated MRI scanners with noisy, fuzzy images that are limited to a subset of orthopedic and a few other applications. The general perception is that 1.5T MRI scanners are the minimum required for most applications and that 3T MRI systems are significantly better, especially for more demanding applications, such as neuroimaging and other more complex sequences. This perception is reinforced by insurance payers. While the ACR does not specify a lower limit for MRI field strength (although it does specify a whole-body scanner), a subset of payers will not reimburse for studies performed on scanners with a field strength below 0.3T.

Currently commercially available whole-body lower field strength MRI is mostly limited to a single open MRI scanner that operates at 1.2T with specialized MRI scanners below 1.0T marketed for very few and specific clinical indications, such as hand imaging, upright/weight-bearing extremity imaging, or for real-time guidance in radiation oncology. High-field MRI (1.5T or higher) represents about 85 percent of the market size in Europe and North America.

Around the world, the spectrum of field strength used for MRI scanners varies considerably. For example, in Europe and North America, 15 percent to 18 percent of the existing MRI systems are 3T and approximately 66 percent utilize 1.5T units. In the United States, 1.5T and 3T scanners are being purchased in approximately equal numbers and dominate new sales. In China, on the other hand, the percentages are substantially different with 8 percent of systems at 3T, 45 percent at 1.5T, and the remaining 50 percent lower than 1.5T. These commercial MRI systems are relatively expensive to purchase and site at any field strength throughout the world; consequently, only 10 percent of the population has access to MRI.

Despite this general impression, low-field strength MRI actually does not necessarily mean low resolution or poor image quality. Much of this perception has been due to the strong trend toward higher field strength for new MRI scanners since the 1980s and, thus, is confounded as a comparison of new versus much older technology. However, the 1.5T accepted basic standard for field strength has not changed in the past 30 years, while the quality of MRI images has improved dramatically, underscoring that field strength is only one of the many factors in today’s high standard of image quality.

The major limitation of low-field strength is reduced-bulk magnetization of nuclear spins, resulting in reduced signal compared to noise. This can be compensated for in many ways, but the most basic is signal averaging, which increases the signal-to-noise ratio by the square root of the number of averages. Unfortunately, this currently means an impractically long scan time for the current generation of low-field strength systems to maintain comparable signal-to-noise ratios.

The Covid-19 pandemic has accelerated the trend toward distributed imaging in diagnostic radiology. One of the best examples of this can be seen in the preference for performing portable chest radiography in the emergency department during the pandemic rather than PA and lateral chest radiographs in radiology

The Covid-19 pandemic has accelerated the trend toward distributed imaging in diagnostic radiology. One of the best examples of this can be seen in the preference for performing portable chest radiography in the emergency department during the pandemic rather than PA and lateral chest radiographs in radiology. Similarly, VLFS MRI scanners located in clinical areas, such as the ICU and ED could offer the ability to minimize flow through a medical center of potentially infectious patients or those vulnerable to infection.

Companies that previously spearheaded the high-field MR revolution are now exploring lower-field strength technology. For example, Siemens’ Magnetom FreeMax with a field strength of 0.55T, when compared with 1.5T low-field MRI system, demonstrated increased safety for patients with metallic interventional devices, which allow an MRI-guided right heart catheterization in patients with metallic guide wires. This system was also found to reduce image distortion in the upper airway, cranial sinuses, lungs, and the bowel.

At this time, the only commercial, portable MRI system that has received 510(k) clearance from the FDA as a portable ultra-low field imaging device is available from Hyperfine Research, Inc. This system can be wheeled to a patient’s bedside; it plugs into a standard wall outlet, and can be operated using a wireless tablet. The system has a field strength of 0.064T, utilizes a permanent magnet, and weighs approximately 1400 pounds. The system, thus, has the potential to be sited in the ICU, ED, or in orthopedic or other clinics, and, potentially, in a mobile vehicle, such as an ambulance.

In many ways, analogous to the emergence of ultra-portable ultrasound systems, portable and distributed MRI systems will challenge our current thinking on MRI scan reimbursement, accreditation, utilization and appropriateness criteria, turf issues, and credentialing issues.

There will be ongoing questions about whether the studies should be acquired by non-MRI, sub-specialty technologists, and whether they will be interpreted by radiologists, as well as the potential for substantial over-utilization and the potential for a falsely negative study, resulting in a more comprehensive, higher field strength MRI scan not being performed. On the other hand, the potential for a major expansion of MRI into new hospitals and outpatient locations and even onto emergency vehicles for point-of-care service, into new indications for cost-effective yet higher accuracy patient evaluation, and as a more sensitive indicator of disease than CT or ultrasound or conventional radiography is exciting.

Radiologists have demonstrated incredible creativity and innovation in the application of MRI to an extraordinary number of anatomic, vascular, functional, and interventional applications. Portable, ultra-low field MRI will undoubtedly add a whole new dimension to this potpourri of patient care options, and will eventually bring MRI to that 90 percent of the world’s population that has been waiting for it to finally arrive.

The market bounced back in 2021, with government back in action after the drastic decline in 2020, attributed to the lower procurement by the private sector, almost no buying by the government hospitals in the pandemic, accompanied by the health cess introduced in the Union Budget 2020. For the first time, in 2021, CT as a modality overtook MRI; the trend is expected to go back to MRI being the larger segment in 2022.

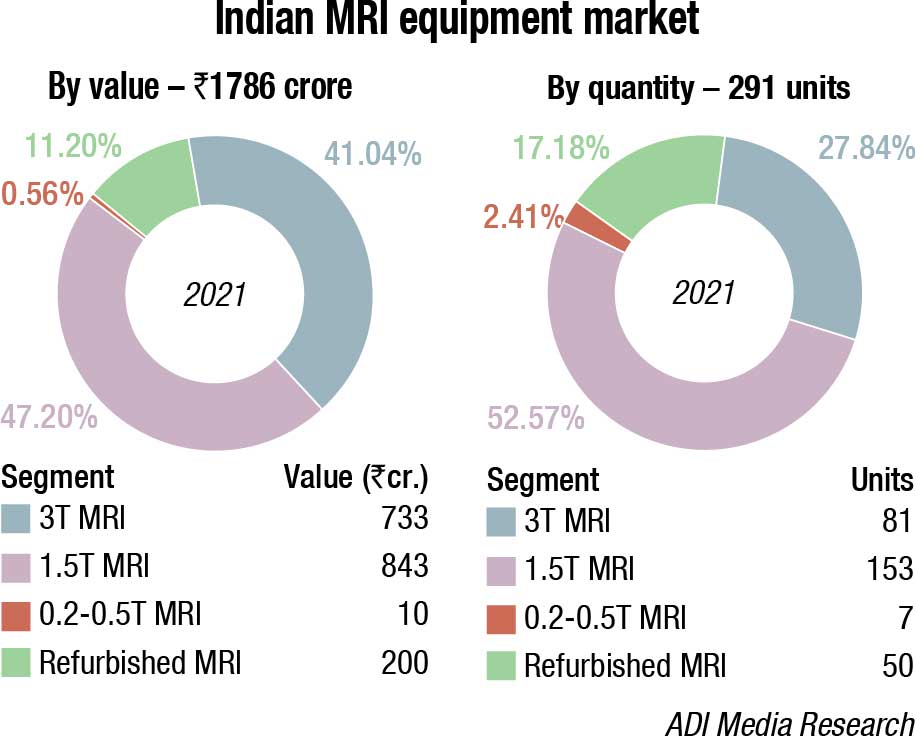

The Indian MRI equipment market for 2021 is estimated at ₹1786 crore, and 291 units, by quantity. It is projected to witness a CAGR of 9.34 percent to grow to ₹3320 crore by 2026. The two premium segments, 3T and 1.5T systems, dominate the market with a combined 88 percent share by value, and 80 percent share by numbers.

The Indian MRI equipment market for 2021 is estimated at ₹1786 crore, and 291 units, by quantity. It is projected to witness a CAGR of 9.34 percent to grow to ₹3320 crore by 2026. The two premium segments, 3T and 1.5T systems, dominate the market with a combined 88 percent share by value, and 80 percent share by numbers. Within these two segments, in 2021, 3T scanners have been the more popular machines, with a 52.5 percent share by value, while 1.5T contributes 47.2 percent. The refurbished systems continue to have an 11 percent share, by value. The 0.2T–0.5T machines are gradually losing out, only seven units were sold in 2021, with Hitachi being the preferred brand.

The estimated number of MRI scanners installed across India is around 2800, of which the majority are 1.5T systems. 3T scanners are more common in metros and Tier-I cities, and account for approximately 50–65 percent of the MRI market in those regions. Although 1.5T scanners still have the largest market share, the 3T systems are the ones contributing to the market growth. On an average, the annual market across government hospitals and medical colleges amounts to 40–60 MRI scanners, and is cyclical. Private hospitals and diagnostic imaging centers account for about 230 new MRI scanners in a year. The volume of low-field-strength systems is stagnant at present.

|

Major vendors* in Indian MRI |

||

| Tier I | Tier II | Others |

| Siemens, Philips, and GE | United Imaging | Hitachi & Toshiba |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian MRI equipment market. | ||

| ADI Media Research | ||

The prohibitive cost of MR scanners limits their accessibility for the general population in our resource-poor environment. A 12–18 percent GST and 18 percent customs duty, amounting to 30 percent, is making it a challenge to invest in medical capital equipment. The central government might want to take a cue from the Gujarat state government that, barring in its large cities, offers a 20 percent cashback on medical equipment to the hospitals, encouraging the setting up of medical facilities in the smaller cities of Gujarat. Most of the MR scanners are concentrated in the metros and Tier-I cities. Penetration in rural areas is negligible. Also, the stringent requirements regarding power supply, a trained workforce, service, and maintenance are difficult to address at the peripheral level.

On the positive side, in the last decade, there have been many government initiatives to equip teaching hospitals across India with high-end MR scanners. Also, many new tertiary-care teaching hospitals are being set up across the length and breadth of the country, and are being equipped with state-of-the-art imaging equipment. Several state governments in the country are also providing novel and advanced MRI solutions to their customers. In July 2021, the Punjab Government announced the launch of a novel project, under which CT and MRI centers will come up in around 25 government hospitals. The government will build novel diagnostic and monitoring centers and purchase novel MRI systems. The government has also been promoting a Make in India campaign to bring down costs, and adapt MRI to local requirements. As a result, a number of promising lightweight MRI scanners are in an advanced stage of development here. The corporate sector has also set up hospitals in Tier-II and Tier-III cities, which will help to improve accessibility for the rural population.

Major limiting factors in MRI are the prohibitive cost, the need for trained personnel, and the complex infrastructure requirement for MR scanners. A cheaper lower-field-strength scanner that requires simpler infrastructure and can leverage recent advances – such as automated study planning, compressed sensing, innovative k-space filling strategies, remote support for troubleshooting, and deep-learning-aided image generation – would go a long way to making MR available to the Indian population. It would reduce both the capital and operational expenditure required for things, such as helium top-ups, and could be used in areas where trained personnel is scarce.

By utilizing the currently available technologies, it is possible to achieve good-quality diagnostic images with lower-field-strength scanners without a significant time penalty. There is a distinct need for low-cost MR scanners, which can use optimum technology and provide good-quality images. In countries like India, where trained personnel may not be available in small cities, it would further help if such scanners allowed the remote execution of MR protocols. This would be a major step toward making MR imaging more accessible in resource-poor regions of the world.

Dr TBS Buxi

Head – Department of CT Scan & MRI,

Sir Ganga Ram Hospital, New Delhi Latest innovations in MR are aimed at better healthcare outcomes at lower cost of care with improved patient and clinician experience. The latest and major breakthrough in MR innovation is the commercial availability of sustainable helium-free, fully sealed 1.5T MR magnet for outstanding clinical outcome. More recently, Artificial Intelligence (AI) has started playing a major role in improving workflow at the scanner and also the MR image quality. AI-powered MR workflows in new MR scanning platforms integrate intelligence, guidance, and the ease-of-use, resulting in enhanced scheduling efficiency and faster scanning with improved patient comfort and confident diagnosis. AI-enabled motion-detection camera like Vital-Eye is getting integrated in the latest MR scanners for automated breathing detection by replacing conventional respiratory belts and improving patient comfort and output image quality. Moreover, to make MR scanning even faster, power of AI has been coupled with the latest MR scan acceleration methods like Compressed-SENSE, and introduced this next-generation technique to deliver superfast high-quality MR images for confident diagnosis to address some of the major challenges of traditional MR scanners.The overall attempt is to make MR a fruitful, less stressful experience. Higher gradients and newer applications and body-hugging coils have resulted into an era of friendly MR systems.

As far as the usage pattern is concerned, the bulk of the work at most sites is craniospinal imaging, followed by musculoskeletal imaging. Use of MR imaging for the evaluation of abdominal and chest diseases is generally confined to large tertiary-care and academic centers. In metro cities, there are many centers of excellence engaged in high-end research, including advanced applications like whole-body imaging, MR elastography, diffusion-weighted imaging (including intravoxel incoherent motion and diffusion kurtosis imaging), perfusion imaging, and texture analysis. These techniques have been used in India not only for the traditional oncology applications but also for diseases endemic in India, such as tuberculosis.

India is poised to hold nearly 35 percent of the South Asian market during 2021–2031. MRI equipment vendors are focusing on widening their respective product portfolios and developing MRI systems. Moreover, various start-ups are receiving venture capital investments to develop portable MRI machines. One such instance is the ₹35-crore investment by Zoho, in September 2021 in Voxelgrids – an MRI tech start-up based out of Chennai. The company manufactures 1.5T MRI scanners (comes with imaging software) that are lightweight, portable, and easy to install, operate, and maintain even in remote locations.

With the possibility of invasive rhino-orbital mucormycosis (IROM) post-Covid-19 infection, conjunctive use of CT, which depicts bone destruction and other reactive bony changes along with MRI, which reveals characteristic findings of soft-tissue thickening of the involved sinuses with extension of disease to the orbits, cavernous sinus, dura, hard palate, skull base, and intracranial structures, is being done in the Indian hospitals. Accurate diagnosis and early recognition of the disease and its extension with appropriate use of these techniques helps to initiate appropriate and timely treatment, which is vital to prevent a fatal outcome.

Global MRI is projected to grow from USD 7.94 billion in 2021 to USD 12.25 billion in 2028 at a CAGR of 6.4 percent. The rise in CAGR is attributable to this market’s demand and growth returning to pre-pandemic levels once the pandemic is over.

The global MRI equipment market was estimated at USD 7.55 billion in 2020. The global impact of Covid-19 has been unprecedented and staggering, with the market witnessing a negative impact on demand across all regions amid the pandemic. The global MRI equipment market exhibited a lower growth of 4.3 percent in 2020, compared to the average year-on-year growth during 2017 to 2019, estimates Fortune Business Insights. The market is projected to grow from USD 7.94 billion in 2021 to USD 12.25 billion in 2028 at a CAGR of 6.4 percent in the 2021–2028 period. The rise in CAGR is attributable to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

By strength type, 1.5T MRI systems hold a high market share of 46.7 percent, and the segment is set to expand at a CAGR of 6.4 percent through 2031.

The 1.5T segment’s supremacy is partly due to the large installed base of these systems around the world. Several major industry companies, including GE Healthcare, Siemens, and Phillips, have a robust product range dedicated to this type of imaging equipment. They also have a product line that covers a wide range of applications. In terms of volume, this segment led the global market, and it is one of the largest stockholders in terms of value. 1.5T short-bore MRI machines are standard technology for MRI scanners in the United States and other significant geographies. A 1.5T MRI scanner is faster than a lower-resolution MRI scanner and is appropriate for abdominal and chest MRI studies.

The more-than-1.5T segment is also anticipated to account for the highest CAGR with the increasing adoption of high-strength imaging systems. They have superior imaging qualities, such as higher spatial resolution.

Open MRI systems account for roughly 57.6 percent of the market by architecture type, and this trend is projected to continue. Open MRI equipment, especially for oversized/obese patients, eliminate claustrophobia and provide best patient comfort. Additionally, cryogen-free open MRI systems that use permanent magnets reduce maintenance expenses, proving to be a cost-effective solution.

In terms of imaging techniques globally, MRI is one of the most common imaging techniques used. It is often considered indispensable in terms of diagnosis, treatment, and management of various critical illnesses. The development of this system is considered a massive milestone in medical imaging as the procedure is non-invasive, potentially harmless, and produces detailed images of the human body’s abnormalities. The number of cancer and trauma cases is increasing, and, in those cases, the use of such imaging systems for diagnosis is increasingly used. For example, as per National Cancer Institute, by 2040, it is projected that the number of new cancer cases will increase by 29.5 million, and the number of cancer-related deaths to 16.4 million per year. Therefore, such an increase in the number suggests using MRI as an imaging technique, augmenting the market growth.

Amidst the foremost used Covid-19 screening options, imaging is preferred by most healthcare professionals as it provides a primary diagnosis in a short time. MRI has been used comprehensively to study Covid-19 and its effect on different patients in each demography. Enhancement in radiology imaging techniques has allowed the industry to build smaller and portable low-magnetic-field equipment. People with underlying disease conditions can face more serious complications due to the pandemic. Therefore, this leads to an increase in the adoption of imaging systems during the pandemic. Some of the trends present in the MRI equipment market include the increasing adoption of high-strength systems, which enable even further detailed imaging. The global market for this equipment is projected to exhibit steady growth.

In 2021, according to World Health Organization (WHO), the leading cause of death worldwide was cancer, which accounts for nearly 10 million deaths, and new cases of cancer will be diagnosed in that same year. For instance, breast cancer, one of the most prevalent forms of cancer worldwide, can be efficiently imaged with MRI equipment. This equipment also enables the efficient imaging of areas affected by strokes, a common neurological event. According to the Centers for Disease Control and Prevention (CDC), as of January 2020, an estimated 795,000 individuals in the US suffer from strokes every year. At the same time, the increasing scope and application areas of this imaging technique are also boosting their adoption and, subsequently, propelling the MRI equipment market growth.

Another key driving factor that is expected to contribute substantially to the growth of the global market is the increasing technological advancements in imaging equipment. Some of the technological advancements include the launches of open MRI, which aids in the effective medical imaging of claustrophobic and overweight patients. The technological advances also involve improvements in field strength and computing power of the imaging equipment. These have led to faster imaging timings, better imaging quality, and higher spatial resolution due to advances in the equipment’s pulse sequences. New and technologically advanced products from key market players, such as Siemens’ product offering of Magnetom Terra, the first-ever 7T MRI system approved for clinical use, have also driven the market growth. These ultra-high-field systems are primarily concentrated in the developed markets of North America and Europe. Estimates published in 2020 by Elsevier stated that the number of 7T imaging systems in the world exceeds 70, with more installations expected in coming years. The product launches and the need for cutting-edge medical imaging are further anticipated to boost the demand for these systems and fuel global MRI equipment market growth.

High costs of equipment coupled with other limitations to limit market growth. Despite the increasing demand for technologically advanced imaging systems for the efficient management and treatment of chronic diseases, certain critical limitations are restricting the growth of the global market. One of the significant factors limiting the market’s development is the higher costs associated with the installation and maintenance of imaging equipment. Installation and proper maintenance of these systems often require complex infrastructure and associated costs, which many medical institutions can often not undertake or provide. A significant number of the installed base of the MRO systems is located across countries in the emerging market, such as the Asia-Pacific.

These lead hospitals and diagnostics centers in these regions to purchase refurbished MRI systems to meet their imaging needs. The refurbished systems are available at a substantially lower cost than installing a newer system. Hospitals and other healthcare institutions in developing countries often opt for these systems due to their cost-effectiveness. At the same time, another critical limitation is the voluntary product recalls of a number of imaging systems due to reasons, such as human error. It has also adversely impacted the market growth.

North America dominated the market and accounted for the largest revenue share of 38.2 percent in 2021. Increasing incidence of chronic diseases in this region, which includes breast cancer, cardiovascular disorders, and neurological diseases is creating a demand for imaging analysis. The region is expected to maintain its dominance in coming years. Technological innovations coupled with the growing incidence of chronic conditions are anticipated to spur the growth of the market.

Rapidly growing European countries, such as the UK, France, and Germany that have a high per capita income and well-defined healthcare policies are showing increased demand for advanced diagnostic imaging modalities. In addition, constant technological advancement in the region, along with large investment made in healthcare research, is expected to propel the segment growth.

Asia-Pacific is expected to experience the fastest growth with the increasing geriatric population and growing demand for advanced imaging modalities. Moreover, the growing medical tourism industry in Asian countries is anticipated to augment the advanced medical imaging industry growth. Countries, such China and Japan, are creating growth opportunities with rapidly expanding healthcare service industry, presence of skilled healthcare staff, and advanced healthcare facilities and services at a lower cost than developed countries of North America and Europe.

A new neuroimaging technique can detect biochemical changes in the brains of people with multiple sclerosis (MS) early in the course of the disease, paving the way for faster treatment evaluation and other potential benefits, according to a study published in the journal Radiology. MS is a disease of the central nervous system that can cause fatigue, pain, and impaired coordination. It affects nearly 3 million people worldwide, and its incidence is rising. There is no cure, but physical therapy and medications can slow its progression.

Lesions to the brain’s signal-carrying white matter are the most readily detectable manifestation of MS on MRI. The lesions, linked to the loss of the protective coating around white matter fibers called myelin, represent only macroscopic tissue damage. A means to find changes in the brain at an earlier microscopic or biochemical stage would be beneficial.

An advanced imaging technique known as proton MR spectroscopy is a promising tool in this effort. MR spectroscopy of the brain can detect several metabolites, or substances produced during metabolism that have potential relevance for MS.

Researchers in Austria used the technique to compare biochemical changes in the brains of 65 people with MS with those of 20 healthy controls. They deployed an MRI scanner with a powerful 7-Tesla (T) magnet.

The results showed reduced levels of an amino acid derivative called N-acetylaspartate (NAA) in patients with MS. Lower levels of NAA have been linked to impaired integrity of neurons in the brain. People with MS also showed elevated levels of myo-inositol (MI), a compound involved in cell signaling. Higher levels are indicative of substantial inflammatory disease activity.

The metabolic alterations in normal-appearing white matter and cortical gray matter were associated with disability.

Researchers said the results show a potential role for 7T MR spectroscopic imaging in visualizing MS pathology beyond demyelinating lesions.

“MRI of neurochemicals enables the detection of changes in the brain of multiple sclerosis patients in regions that appear inconspicuous on conventional MRI,” said study senior author Wolfgang Bogner, Ph.D., from the High Field MR Centre at the Medical University of Vienna in Vienna, Austria. “The visualized changes in neurochemistry of normal-appearing brain tissue correlated with the patients’ disabilities.”

The changes detected by the new imaging technique have significant clinical applications, according to study lead author Eva Heckova, Ph.D., from the High Field MR Centre at the Medical University of Vienna.

Some neurochemical changes, particularly those associated with neuroinflammation, occur early in the course of the disease and may not only be correlated with disability, but also be predictive of further progression, such as the formation of multiple sclerosis lesions.

While more work is needed to confirm the results, the results support 7T MR spectroscopic imaging as a valuable new aid in the care of people with MS.

If confirmed in longitudinal clinical studies, this new neuroimaging technique could become a standard imaging tool for initial diagnosis, for disease progression and therapy monitoring of multiple sclerosis patients and, in concert with established MRI, might contribute to neurologists’ treatment strategies.

The researchers are working to further improve the image quality of the new technique and fully integrate it for use in routine clinical MRI scanners.

“In parallel, we will continue our ongoing longitudinal clinical study to validate its ability to detect clinically important pathologic changes in the brain of multiple sclerosis patients and to evaluate the efficacy of different treatment regimens earlier than other currently available clinical tools,” Heckova said.

Similarly, scientists at the University of Tsukuba demonstrated how conventional MRI machines can be retrofitted to detect sodium ions, using a cross band radio-frequency repeater. This work may allow for new medical diagnostics to be performed without expensive new equipment.

MRI has become a crucial part of the medical toolkit for non-invasive visualization of internal organs. MRI machines operate by placing the patient in a very strong magnetic field, which will cause the nuclear spins of atoms in the body to align in the same direction, essentially acting like tiny magnets. Then, a radio-frequency (RF) signal of a very specific frequency is applied, which has the ability to flip the direction of the spins. When the nuclei relax back to their original aligned state, the precession of these spins about the magnet field direction can be measured by RF detector coils to determine the concentration of that particular atom. The majority of MRI machines in use today are optimized to look for the presence of hydrogen (1H) nuclei, which are naturally abundant in the body as a component of water molecules. Retrofitting such a machine for detecting other isotopes, like sodium-23, would require a great deal of expensive hardware upgrades.

Now, a team of researchers at the University of Tsukuba have demonstrated a proof-of-concept method for equipping a conventional MRI machine with the capability to image sodium-23 by installing a cross-band RF repeater system. This is a device that receives signals at a certain frequency and rebroadcasts them at a different one.

Clinical MRI systems have continually improved over the years since their introduction in the 1980s. In MRI technical development, the developments in each MRI system component, including data acquisition, image reconstruction, and hardware systems, have impacted the others. Progress in each component has induced new technology-development opportunities in other components. New technologies, outside of the MRI field, for example, computer science, data processing, and semiconductors, have been immediately incorporated into MRI development, which resulted in innovative applications. With high-performance computing and MR technology innovations, MRI can now provide large volumes of functional and anatomical image datasets, which are important tools in various research fields. MRI systems are now combined with other modalities, such as positron emission tomography (PET) or therapeutic devices. These hybrid systems provide additional capabilities.

As the industry continues to digitize, users can expect more changes that will make MRIs more powerful and efficient.