Reports

An overview of the Indian diagnostic sector

The diagnostic industry has emerged as an attractive play in India’s growing healthcare sector and is one of the fastest growing services in the country. The domestic diagnostics industry at USD 9 billion (around Rs. 675 billion) is expected to grow at a compounded annual growth rate (CAGR) of ~10 percent over the next 5 years. Growth will be primarily driven by change in demographics, increase in lifestyle diseases, and higher income levels across all strata of society, rise in preventive testing, deeper penetration with asset-light expansion, and spread of healthcare services and insurance. The diagnostic segment is a critical component of the healthcare sector. Globally, ~80 percent of physician diagnoses are a result of laboratory tests. There are mainly three types of tests routine, clinical lab, and specialty tests.

- Routine tests are common tests like sugar, cholesterol, HIV, pap, and pregnancy; Clinical lab tests monitor diseases and drug treatments; and

- Specialty tests are for genetics, immunology, oncology, endocrinology, and other critical segments

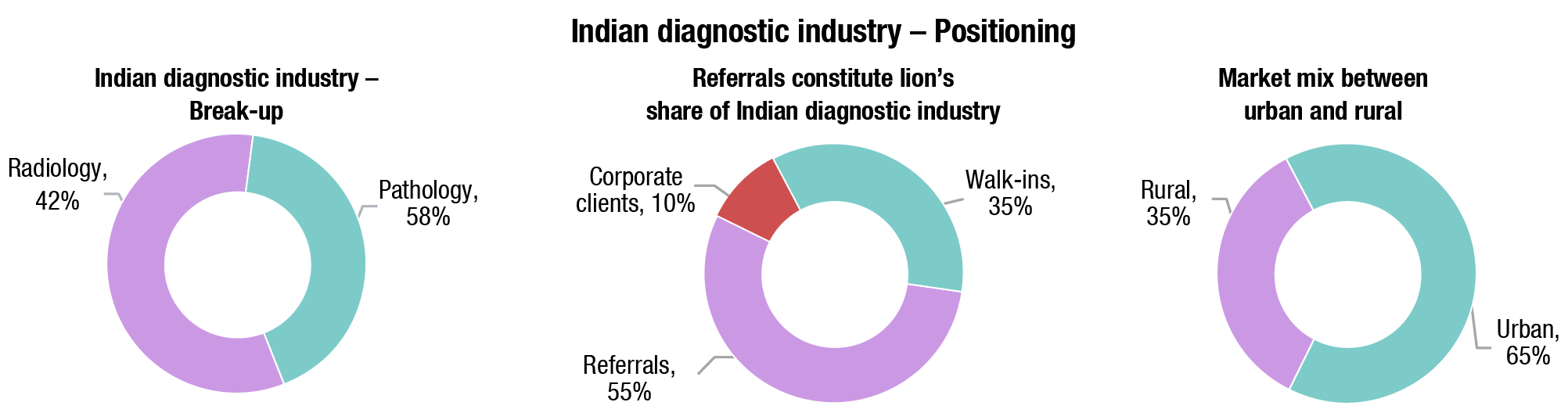

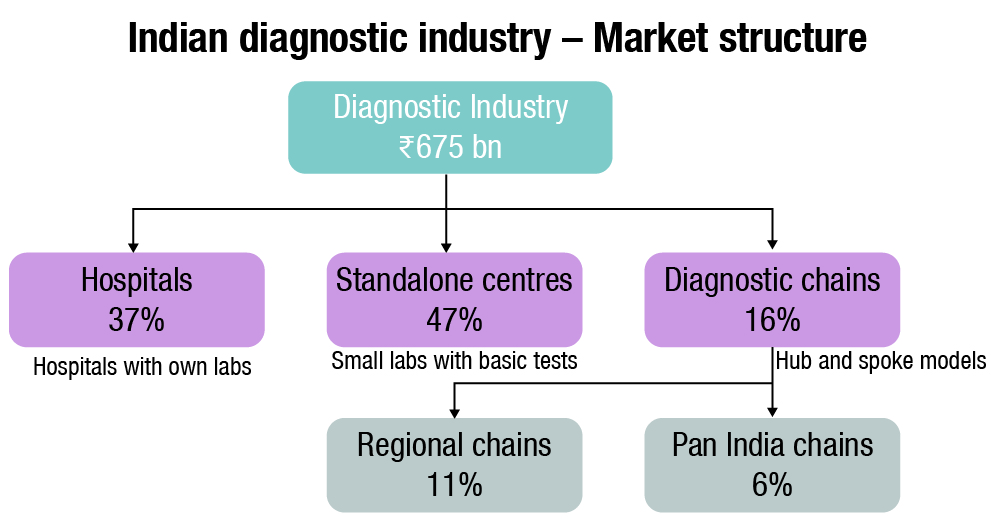

The Indian diagnostic industry is highly fragmented and under-penetrated despite the presence of over 100,000 labs. The diagnostic chains command ~16 percent market share. The four major players, Dr Lal PathLabs (DLPL), Metropolis Healthcare (METROHL), SRL Diagnostics (SRL), and Thyrocare Technologies have a share of ~6 percent. There thus exists a huge opportunity for national players to consolidate and expand organically. The industry may broadly be segregated into pathology testing and imaging diagnostic services. Pathology testing (in-vitro diagnosis) includes sample collection in the form of blood, urine, and stool. This is followed by the sample’s analyzation using laboratory equipment and technology to derive useful clinical information for assisting in patient treatment. The imaging diagnostic segment consist of more complex tests like computed tomography (CT) scans and magnetic resonance imaging (MRI) and other highly specialized tests like positron emission tomography (PET)-CT scans. The pathology segment is estimated to contribute ~58 percent to total market revenue.

With private diagnostic chains taking the lead with superior and quality services, highly accurate, and wider test menu – resulting in market share gains, going forward, consolidation in the sector is anticipated. Currently, only 1 percent of labs are National Accreditation Board of Laboratories (NABL) and/or College of American Pathologists (CAP) accredited. Only a few large national players, SRL, DLPL, METROHL, Thyrocare, Max Healthcare, and Apollo Clinic have accredited labs.

National players have majority of accredited labs in the country, focus on quality

National diagnostic players focus on quality through their accredited lab network has helped them establish a brand for themselves in their core market of operation. There are around 1216 NABL accredited labs, which is ~1 percent of total labs in India and works out to less than 1 lab per million. The top 4 players have the maximum number of NABL accredited labs. Though the number of accredited labs in India have been growing at 16 percent CAGR to 1216 in 2020 from 576 in 2015, there is still a long way to go to reach the numbers of peer nations such as the UK, US and Australia, which have more than 10 labs per million. Quality will be the key future growth driver for the diagnostic industry, where national players are ahead of sector peers.

National diagnostic players poised to gain market share

Diagnostic players, with revenue above ₹100 crore, are profitable with better operating margins as the benefits of scale in test coverage and market penetration brings operating leverage.

Benefits of scale:

- Diagnostic companies procure their main raw material of chemicals/reagents from equipment manufacturers. Moreover, machines are supplied to them free of cost, lowering their upfront CapEx requirement for expansion. This arrangement is available to scale up players only as they can procure reagents in bulk.

- Large organized diagnostic chains are in a position to perform high revenue generating complex tests.

- Their strong brand visibility and widespread network of labs and patient service centers attracts more B2C revenue.

- Doctors’ associations play a crucial role in growth, which is driven by a strong brand.

- The hub and spoke model ushers cost efficiencies with bulk testing and increased penetration.

- Their efficient IT infrastructure, centralized operations, and streamlined pan India processes help them gain market share.

National players gain market share through the inorganic route

Global players like LabCorp and Quest Diagnostics in the US have also grown through acquisitions and this model is being followed by Indian diagnostic players. National players are driving growth through acquisitions, business mix, by offering high end complex tests and competitive pricing. This inorganic expansion is the result of competitive pricing, lower scale of business and slowdown in PE investments. This mode of growth is one of the major vectors of market share gains for national players in this fragmented market. National players are more focused on Tier II, III cities for inorganic

expansion.

Sector outlook

The diagnostic sector in India is highly fragmented with large chains, standalone centers, and hospital-based laboratories. The lack of regulatory framework and minimum standard requirements led to low-entry barriers. However, limited test menu/offerings by regional standalone laboratories and partial coverage of hospital-based laboratories have resulted in higher opportunities for diagnostic chain players.

Diagnostic chains have the advantage of years of experience, brand trust and recall, global quality standards and accreditations, brand experience, expansive test menu, patient touchpoints to service patients locally, value-added offerings for patients, and the ability to sustainably grow into newer markets. Pan India diagnostic players have been gaining market share continuously over the past few years on account of expanding collection centers and laboratory networks, which has helped them improve their asset utilization. National diagnostic players would gain market share in coming years, especially post the COVID-19 pandemic, which would further lead to industry growth.