MB Stories

Analog systems and mobile machines drove the market in 2020

From 2021 onwards, pent-up demand for both interventional and surgical x-ray systems is expected to push revenues. With the postponement of non-essential elective surgeries and medical procedures to conserve medical resources for COVID-19 patients, cardiovascular procedures were severely impacted in 2020.

In the wake of COVID-19, markets across healthcare have changed dramatically. In particular, the market for general radiography and fluoroscopy systems has experienced a significant shift, with chest x-ray examinations identified as a key tool to diagnose and track the progression of late-stage COVID-19.

COVID-19 has diverted stimulus funds to diagnostic x-ray systems to help facilitate much needed diagnostic imaging facilities, resulting in a higher than anticipated uplift in the radiography market in 2020.

The digital transformation wave, which started taking shape in India in 2019, took a major leap in 2020, with the COVID-19 pandemic and subsequent lockdowns enabling further innovation using digital technologies. With the increasing burden on healthcare facilities requiring faster and more efficient ways of diagnosis, especially in x-rays, the industry saw a swift move to digital x-ray technologies, marking a radical transformation from conventional x-ray imaging based on analog and computed technologies. This shift also came in because of the various hygiene protocols adopted by healthcare workers while imaging during the COVID crisis. With digitized x-ray systems in place, the numbers of sanitization steps are reduced, especially for mobile systems kept in isolation wards.

The x-ray market is also witnessing some path-breaking innovations in the field of Artificial Intelligence (AI), where several algorithms and programs are being designed to aid the healthcare workers. These technological innovations in x-ray system has helped in streamlining processes at the healthcare institutions with reduction in time (as compared to analog technology, which takes 2 hours to complete and generate a finalized film, the digital scan takes under 10 seconds), quality output, and enhanced patient experience.

Aggressive technology partnerships with AI vendors in x-ray specificities highlight India’s willingness to embrace AI-led chest x-ray scanning for effective diagnosis and triaging of COVID-19 cases. The current crisis has given rise to several partnerships in India, including Behold.ai’s partnership with Apollo Hospitals to implement AI-based chest x-ray technology, and the joint initiative by NTT Data Corporation and DeepTekInc to use AI technology to analyze patient’s images from x-ray and CT and enhance the efficacy of triaging. Though the AI-led technology partnerships with hospitals continue to rise, the National Informatics Centre (NIC) of India is still awaiting a diverse pool of sampling of chest x-rays to use the data to create a prototype for COVID-19 detection throughout the country.

In addition, DRDO Centre for Artificial Intelligence and Robotics, with the support of 5C Network & HCG Academics has developed ATMAN AI, an AI algorithm that can detect the presence of COVID-19 disease in chest x-rays. The ATMAN AI is an Artificial Intelligence tool for chest x-ray screening as triaging tool in COVID-19 diagnosis, which is a method for rapid identification and assessment of lung involvement. This will be utilized by 5C Network, India’s largest digital network of radiologists, with support of HCG Academics across India.

Triaging COVID suspect patients using x-ray is fast, cost effective, and efficient. It can be a very useful tool especially in smaller towns in India owing to lack of easy access to CT scans. This will also reduce the existing burden on radiologists and make CT machines which are being used for COVID be used for other diseases and illness owing to overload for CT scans. The novel feature namely Believable AI along with existing ResNet models have improved the accuracy of the software and being a machine learning tool, the accuracy will improve continually. Chest x-rays of RT-PCR positive hospitalized patients in various stages of disease involvement were retrospectively analyzed using AI (deep learning and convolutional neural network) models by an indigenously developed deep learning application by CAIR-DRDO for COVID-19 screening using digital chest x-rays. The algorithm showed an accuracy of 96.73 percent.

Speaking about the initiative Dr UK Singh, director, CAIR, DRDO said, “The development of ATMAN, an Artificial Intelligence based diagnostic tool for chest x-ray screening is a part of DRDO’s effort to help clinicians and partners on the front line to have the tools they need to rapidly diagnose and effectively treat COVID-19 patients. Given the limited testing facilities for coronavirus, there is a rush to develop AI tools for quick analysis using x-rays. The tool will help in automatically detecting radiological findings indicative of COVID-19 in seconds, enabling physicians and radiologists to more effectively triage the cases, especially in an emergency environment.”

Advanced imaging modalities – A step further

Advanced imaging modalities – A step further

Satyaki Banerjee

CEO – Medical Imaging,

Trivitron Healthcare

“Medical imaging represents the visual modalities to view interior of human body for diagnostic and treatment purpose. Two major applications of medical imaging are diagnos-tic imaging and surgical imaging. Radiography, mammography, computed tomography, sonography, MRI and endoscopy encompass the diagnostic imaging modality while C-arms and catheter labs constitute for surgical imaging modality.

Digital radiology solutions have brought in a radical transfor-mation over the last three decades in the field of medical imaging. X-ray imaging plays a vital role in providing accuracy of diagnosis and thus enhancing diagnostic confidence at large.

The overall impact of medical imaging in India is enormously high. As opposed to previous trends, with the ongoing technological advancements and the significant reduction in price, digital radiography is rapidly becoming the preferred choice over computed radiography.

Kiran Medical Systems, the radiology division of Trivitron Healthcare, has been a frontrunner in research and development of advanced imaging modalities. With an advanced product portfolio that comprises of floor mounted, ceiling suspended and mobile digital radiography, flat panel and completely motorized C-arm, the imaging portfolio of Kiran is furthermore enhanced suiting different global imaging market needs.

The manufacturing facilities of Kiran comply with the most stringent quality standards and are registered with US-FDA, SGS-UK, Health Canada and PMDA-Japan, amongst others.

With the company’s inherent Make in India philosophy, Kiran’s range of radiology equipment is made cost-effective to the Indian market. The development of the equipment has been significantly reduced in cost, allowing the company to provide the products at a more affordable price. This also aids in leveraging indigenous technical expertise and entrepreneurial mind-set to the global market, pushing Indian goods and solutions that enhance efficiency at lower prices on a global scale.

Kiran is committed to the field of medical imaging and has been offering research-oriented world class products for four decades. The introduction of a full portfolio of medical imaging solutions is in line with our strategy of providing incremental as well as breakthrough innovations in advanced imaging modalities that will have a major influence on care delivery. Kiran is also focusing in a major way to create products and applications with the power of Artificial Intelligence and Deep Learning. We anticipate a breakthrough in the delivery of total patient care, and Kiran is gearing up for major launches in radiology and imaging with these technological advances in 2022.”

Considering the current COVID-19 scenario in India, the Ministry of Healthcare will look to devise structural strategies for technology partnerships. But there will be a cautious approach when it comes to embracing AI in x-ray, even though it will curb the ongoing operational changes when handled effectively. Further, there will be an uptick in the adoption of cloud implementation, picture archiving and communication systems (PACS), and vendor-neutral archive (VNA) channels among healthcare providers as healthcare companies facilitate a seamless adoption of the technology-enabled models to engage patients, and for remote engagement strategies.

| Tier 1 | Allengers | |

| Tier 2 | Skanray | |

| Others | BPL and regional fragmented brands |

| Imported | Agfa, Carestream, Fuji, Philips, Siemens, and Samsung | |

| Indian | Allengers, Fuji, and Prognosis |

ImportedIndian

| Tier 1 | Samsung | Allengers |

| Tier 2 | Carestream | BPL |

| Others | Agfa | Skanray |

| Tier 1 | Konica | |

| Tier 2 | Carestream, Fuji, and Agfa | |

| Others | Regional brands | |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian x-ray imaging market. |

||

| ADI Media Research | ||

In general, the fundamental drivers of AI adoption look set to remain robust despite the impact of the pandemic; while some deals will have been delayed, it is expected that the impact will be only be short-term. Reduced budgets for AI projects, especially those that are not directly related to COVID-19, such as neurology, liver, prostate, and musculoskeletal applications could likely be felt in 2021, as 2020 revenues will be somewhat supported by projects that were initiated pre-COVID.

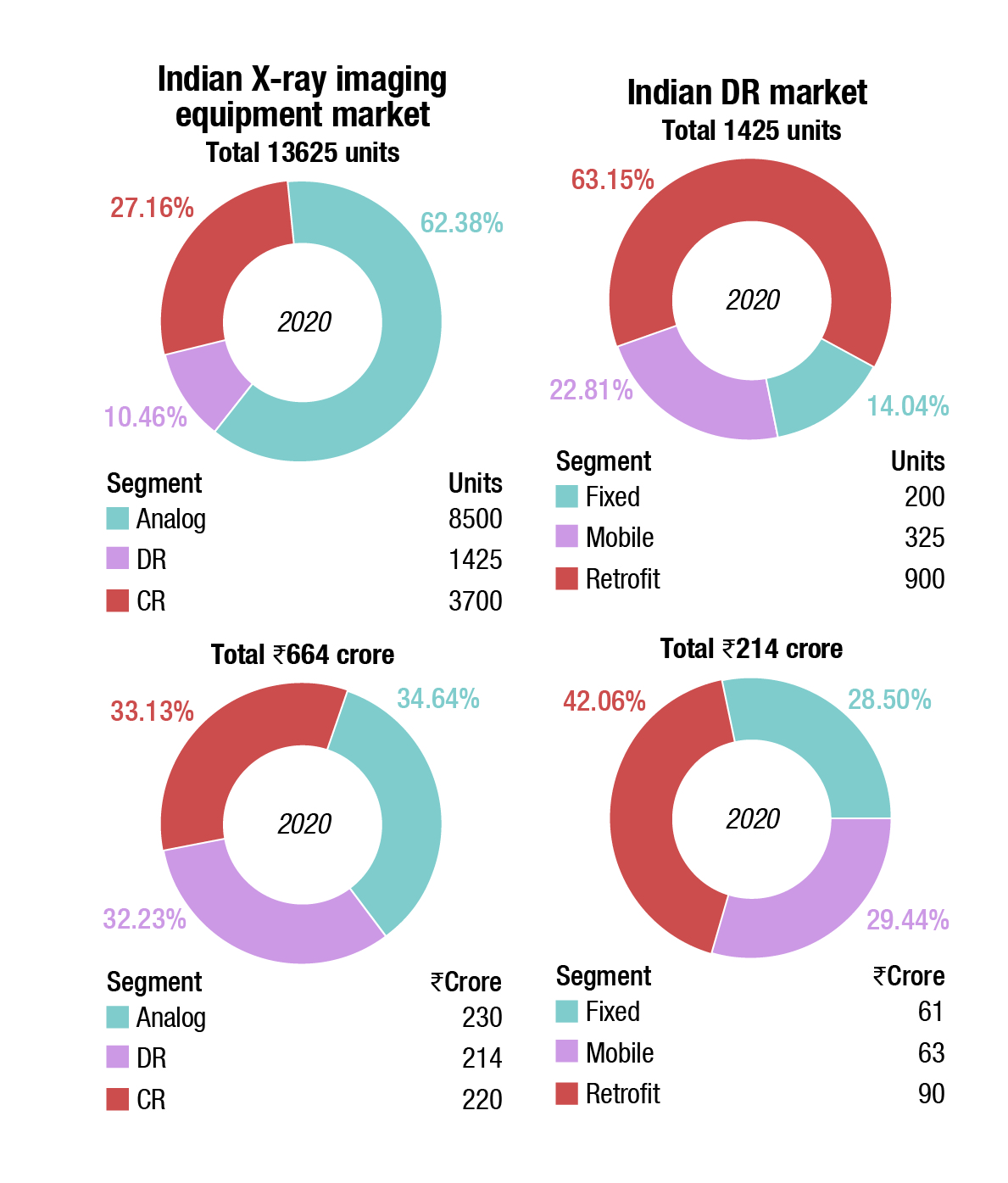

The Indian market in 2020 is estimated at 13625 units, a 3.57 percent drop from 14130 units in 2019. By value this translates to a 20 percent drop from ₹831 crore in 2019 to ₹664 crore in 2020. This change may be attributed to the increase in contribution of the analog machines, from a 29.5 percent share in 2019 to a 34.6 percent share in 2020 by value, and the average analog prices having taken a dip in 2020 too.

Of the 8500 units market in 2020, within the analog segment, Allengers leads the pack, with Skanray a close second. BPL is also visible in this segment. The HF machines have seen an increase in share from 60 percent in 2019 to 70 percent in 2020. While there was no change in prices, the systems when combined with the fluoroscopy configuration are retailed at a unit price ranging from ₹2 lakhs to 17 lakhs. These typically have a capacity of 1000MA. The 600MA LF systems are marketed by the regional brands scattered all over the country.

Within the DR segment, the mobile systems gained majorly, from an 8.9 percent share in 2019 to 29.4 percent share in 2020, by value. These were at the expense of the more expensive fixed systems that dropped from a 46.3 percent share in 2019 to 28.5 percent share in 2020, by value. The retrofit systems continued to be in the 43 percent share vicinity (constituted 44.8 percent in 2019 and 42 percent in 2020, by value). This explains the decrease in value of the total DR market by 23 percent in 2020, from ₹281 crore to ₹214 crore, in spite of a 7.14 percent increase by quantity, from 1330 units to 1425 units.

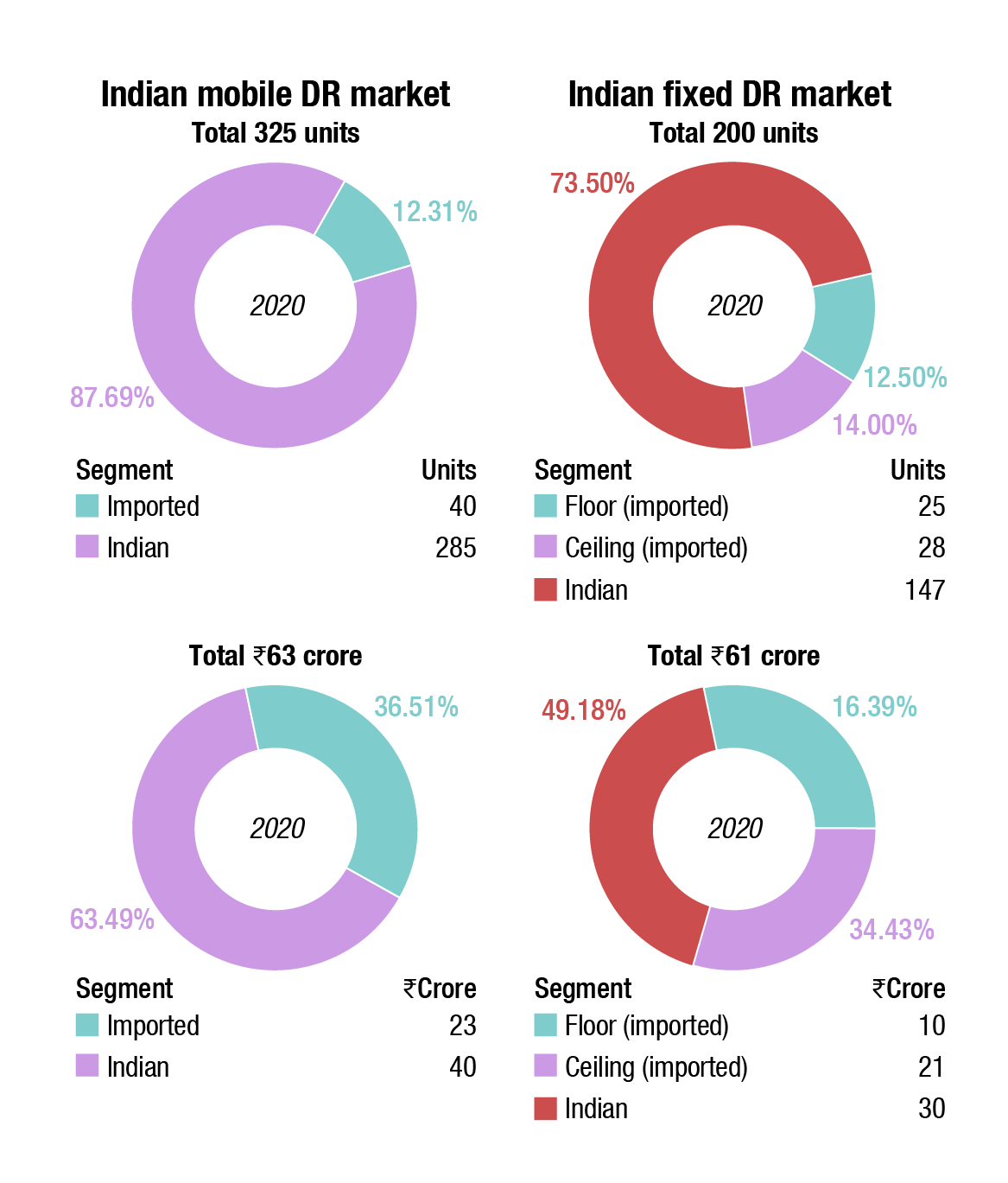

Within the mobile systems, the Indian machines constituted 87.7 percent by quantity and 63.49 percent by value. The imported segment is catered to by Samsung, Carestream and Agfa and the Indian ones by Allengers, BPL and Skanray.

The fixed DR market may be further segmented as imported and indigenous systems, and as ceiling and floor models. The Indian machines dominated with 73.5 percent by units, albeit a 49 percent share by value. Within the imported segment, the ceiling systems in spite of being higher priced sold slightly more than the floor models, by quantity; thereby contributing 67.7 percent to the imported DR fixed systems segment, by value. In the imported machines segment, the aggressive brands are Agfa, Carestream and Fuji; and Allengers dominates the Indian segment.

The Department of Pharmaceuticals (DoP) has prepared a phased manufacturing program (PMP) in consultation with department of revenue (DoR) to promote domestic manufacturing of medical x-ray machines and specified sub-assemblies/parts/sub-parts thereof by notifying enhanced basic customs duty (BCD) for financial years 2021-22 to 2024-25.

PMP has been prepared keeping in view the present status of manufacturing ecosystem in the country, whereby appropriate tariff changes shall be carried out in phases on the medical x-ray machines and specified sub-assemblies/parts/sub-parts thereof. The PMP shall enable the medical x-ray machines and related sub-assembly/parts/sub-parts industry to plan their investment in the sector.

For x-ray diagnostic table the current tariff rate is 10 percent and applicable basic customs duty (BCD) is 2.5 percent and proposed BCD for 2021-22, 2022-23, 2023-24, and 2024-25 is 10 percent. For vertical bucky current tariff rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22, 2022-23, 2023-24, and 2024-25 is 10 percent.

For x-ray tube suspension current tariff rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22, 2022-23, 2023-24, and 2024-25 is 10 percent.

For high frequency x-ray generator (>25 KHz) current tariff rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22, 2022-23, and 2023-24 is 2.5 percent and for 2024-25 is 10 percent.

For medical grade monitor current tariff rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22, 2022-23 is 2.5 percent and for 2023-24 and 2024-25 is 10 percent.

For x-ray grid current tariff rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22 is 5 percent and for 2022-23 and 2024-25 is 10 percent. For multi leaf collimator/iris current tariff rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22 is 5 percent and for 2022-23, 2023-24, and 2024-25 is 10 percent.

For flat panel detector including scinitillators, current tariff rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22 and 2022-23 is 2.5 percent, for 2023-24 is 10 percent and for 2024-25 is 15 percent. For x-ray tube current rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22 and 2022-23 is 2.5 percent, for 2023-24 is 10 percent and for 2024-25 is 15 percent.

For static user interface current rate is 10 percent and applicable basic customs duty is 2.5 percent and proposed BCD for 2021-22 is 5 percent and for 2022-23, 2023-24 and 2024-25 is 10 percent. For x-ray machine current rate is 10 percent and applicable basic customs duty is 7.5 percent and proposed BCD for 2021-22 is 7.5, for 2022-23 is 10 percent and for 2023-24 and 2024-25 is 15 percent.

The global medical x-ray equipment market is valued at USD 13 billion in 2020 and is expected to witness 5.7 percent CAGR from 2021 to 2027, by Global Market Insight. The analog medical x-ray market value was more than USD 5.2 billion in 2020. The direct radiography (DR) segment held around 42 percent market share in 2020. The mammography segment size was over USD 2 billion in 2020 owing to increasing number of breast cancer cases along with advents in technology. The portable medical x-ray market is estimated to showcase around 6 percent growth rate over the next 6 years.

Digital radiography – Welcoming the future

Digital radiography – Welcoming the future

Karan Shrama

Director-Sales,

Allengers Medical Systems Ltd.

“Digital radiography represents the greatest technological advancement in medical X-ray imaging over the last decade. The field of radio-diagnosis continues to grow, both in clinical applications and technology and is simplifying patient diagnosis by providing accurate and faster test results.

Advantages like higher patient throughput due to less waiting time between exposures, improved diagnostic assistance due to better resolution, post processing for digitally enhanced images makes DR the most sought after technology.

Safety. Another major advantage lies in reduced radiation dose to patients leading to better patient safety with the option of multiple scans in a shorter time span.

Improved workflow. With digital radiography the workflow is now very simple and effective. Digital images can be shared with any location globally in a matter of seconds. Excellent image data with flexibility of post processing makes DR as the first choice for all the diagnostic centers. Images are compatible with EHR (electronic health records), DICOMized images confirm the integrity of patient image and patient data.

Artificial Intelligence. With technological innovations on an ever high, newer solutions are being introduced for enhancing workflow like DR systems integrated with AI which lends a helping hand to the ever increasing patient load a doctor has to manage.

Mobile DRs coupled with their ability to also provide immediate views, data storage, and onsite point of care imaging are further showing increase in demand making them very popular with maximum healthcare facilities.

The shift is primarily driven by the rise in adoption of FPDs, thus products like FFDM, DR systems, and mobile DRs in healthcare facilities are witnessing better overall outcomes.

Lately, technology advancements in breast imaging, rising incidence of breast cancer and increasing awareness for the early screening of breast cancer are some factors anticipated to drive the growth of oncology application segment in the global digital radiography market.

In conclusion today’s DR systems are achieving previously considered impossible diagnosis and the credit goes to the innovations being made by the medical equipment manufacturers under the able guidance of visionary doctors.”

The need for access to x-ray imaging within intensive care departments has skyrocketed, creating unprecedented demand for mobile x-ray systems, which are easy to clean and transport between wards.

Sales of fluoroscopy and fixed x-ray radiography rooms have dropped, as budgets are sequestered to focus on pandemic response. Site-access restrictions have prevented or delayed prescheduled installations.

The world market for interventional and surgical x-ray equipment is forecast to reach almost USD 3.9 billion by 2024, according to Signify Research. The world markets for interventional x-ray and surgical x-ray have declined by 17.4 percent and 16.3 percent, respectively, in 2020. Growth in this market is predicted to return from 2021 onward as the negative impact of the pandemic is expected to subside. Recovery is forecast to be gradual rather than V-shaped, with the steady return of elective procedures and as healthcare expenditure is restored following the diversion to COVID-related equipment.

In the surgical x-ray market, flat-panel detector (FPD) 2D mobile C-arms are forecast to have the fastest growth through to 2024, with a compound annual growth rate (CAGR) of 3.4 percent. In 2020, there was a shift toward low-end to mid-range FPD 2D systems as a result of stretched capital expenditure budgets.

Demand for image intensifier-based C-arms is slowing down, with emerging regions now key markets. However, in developed markets, such as the US, usage of imaging intensifier systems is still high in pain management clinics.

3D mobile C-arms are primarily used for imaging the joints, spinal fusion, and fractures, and the market is expected to start seeing signs of recovery from 2021 onward, following the return of elective spinal procedures to pre-pandemic levels. Countries with the highest adoption of 3D surgical x-ray imaging include China, Western Europe, and the US.

Within the interventional x-ray market, the interventional cardiology (IC) market was more negatively impacted by COVID-19 than interventional radiology (IR) due to heavier reliance on elective procedures. An increase in the number of structural heart procedures performed, in particular percutaneous coronary intervention (PCI), continues to be a factor maintaining clinical demand for the IC market. The interventional radiology market has experienced a continued expansion of clinical procedures being performed. An increased incidence of peripheral vascular disease is driving demand for general vascular angiography. Despite an estimated 26 percent drop in the hybrid operating room segment in 2020, the fastest growth is predicted for this product category through to 2024.

Dr Madhur Saxena

Dr Madhur Saxena

Consultant Radiologist,

Bhagwan Mahaveer Cancer Hospital & Research Centre

“Radiographic use of x-rays is effective and a conventional diagnostic tool. Advanced digital solutions providing better image quality, faster processing techniques, and dose reduction advantages have further positive effects on this imaging modality. Recent advances like 3-D color imaging technique can produce clearer and more accurate pictures for more accurate diagnoses.

We can expect significant growth in use of x-rays in healthcare industry due to its rapid, essentially painless, and non-invasive nature and current advancements in technology. With the advancement in Artificial Intelligence in this scenario, the future of x-ray machines is expected to be promising.

Further, in the developing countries like India increasing incomes, greater penetration of health insurance and easier access to healthcare facilities are the factors supporting the growth of the healthcare industry.

Hence, all the above mentioned factors are expected to help in the growth of the x-ray industry and better opportunity for x-ray machine manufacturing market.”

From 2021 onwards, there is expected to be pent-up demand for both interventional and surgical x-ray systems. With the postponement of nonessential elective surgeries and medical procedures to conserve medical resources for COVID-19 patients, cardiovascular procedures were severely impacted during 2020. However, the massive financial burden of COVID-19 on healthcare providers is expected to result in reduced capital expenditure budgets for imaging equipment, including interventional x-ray and mobile C-arm systems.

The pandemic is having a negative impact across all interventional markets (including IC and IR), due to a combination of reduced vendor sales activity (on-site demonstrations, new product launches, conferences) and plummeting elective procedure volumes during national lockdowns.

Demand for image intensifier mobile C-arms was less impacted than for FPD equivalents in 2020 due to COVID-19, as providers focused on cost-effective equipment due to reduced capital budgets.

Demand for mobile C-arm and mammography x-ray systems is forecast with gradual return in 2021 and 2022, with delayed or pending orders being processed.

Manufacturers have seen a rapid sale of mobile DR to hospitals in 2020. The maneuverability of the systems make them essential for early diagnosis of COVID-19 patients. Prior to COVID-19 the digital radiography (DR) segment (inclusive of fixed DR rooms and mobile DR systems) was forecast to increase by 9 percent in the number of unit shipments (base growth).

However, due to a surge of demand for diagnosis of COVID-19, the unit shipment of the systems is forecast to sharply rise.

According to Mordor Intelligence, portable x-ray systems are predicted to see significant growth and expected to make revenue of approximately USD 5.6 million by 2025. Major factors driving this growth include advanced technology, a rising number of patients with chronic diseases along with an increasing geriatric population, and rising awareness regarding the availability of portable systems. In addition, during the pandemic it was shown that mobile DR systems have the potential to overcome location barriers and benefit patients who are in need of on-the-spot diagnosis.

ItemApplicable BCD (%) vide Cus.N. No.50/20172021-222022-232023-242024-25

| X-ray diagnostic table | 2.5 | 10 | 10 | 10 | 10 |

| Vertical buck | 2.5 | 10 | 10 | 10 | 10 |

| X-ray tube suspension | 2.5 | 10 | 10 | 10 | 10 |

| High frequency x-ray generator (>25 KHz) |

2.5 | 10 | 10 | 10 | 10 |

| High frequency x-ray generator (<25 KHz) |

2.5 | 2.5 | 2.5 | 2.5 | 10 |

| Medical grade monitor | 2.5 | 2.5 | 2.5 | 10 | 10 |

| X-ray grid | 2.5 | 5 | 10 | 10 | 10 |

| High frequency x-ray generator (>25 KHz) |

2.5 | 10 | 10 | 10 | 10 |

| Multi leaf collimator/Iris | 2.5 | 5 | 10 | 10 | 10 |

| High frequency x-ray generator (>25 KHz) |

2.5 | 10 | 10 | 10 | 10 |

| Flat panel detector, including scintillators |

2.5 | 2.5 | 2.5 | 10 | 15 |

| X-ray tube | 2.5 | 2.5 | 2.5 | 10 | 15 |

| Static user interface | 2.5 | 5 | 10 | 10 | 10 |

| X-ray machine | 7.5 | 7.5 | 10 | 15 | 15 |

The existing installed analog mobile x-ray systems at hospital facilities have also seen an upgrade to digital mobile technology via retrofit solutions in another step towards increasing availability of mobile DR systems.

New launches were also seen in the mobile DR market. In August at the virtual Association for Medical Imaging Management (AHRA) 2020 conference, Canon Medical launched its Soltus 500 Mobile Digital x-ray, giving facilities access to a system equipped with enhancements to streamline bedside exams to help improve workflow and productivity. The FDA 510(k)-cleared Soltus 500 has a compact design with advanced features that promote efficiency and patient safety, without compromising image quality.

The pandemic has turned the spotlight on diagnostic imaging, demanding a need for high-speed workflow and efficient patient management. DR systems provide this fast turnaround with less than one minute needed between exposure and image acquisition. Many companies released or revised their products in order to meet those growing needs. For example, during the virtual 106th Scientific Assembly and Annual Meeting of the Radiological Society of North America (RSNA), Agfa launched its new SmartXR Assistant. SmartXR uses a unique combination of hardware and Artificial Intelligence (AI)-powered software to lighten radiographers’ workloads and provide image acquisition support. This newest member of Agfa’s DR portfolio offers key assistance during the radiology routine, which has proven to be very important during the COVID-19 crisis, as well as beyond.

Also at RSNA 2020, Siemens Healthineers launched the Multix Impact C, a new ceiling-mounted DR system, in addition to the Multix Impact VA20, a new version of the established floor-mounted parent DR system. Both systems are affordably priced to expand access to high-quality imaging and enhance the patient experience. The Multix Impact C and the Multix Impact VA20 both have an intuitive operating system, versatile wireless detectors, motorized tube heads, and a free-floating, flat tabletop, which enables easy patient access.

Dhaval Modi

Dhaval Modi

Consultant, Head of Neuro-Radiology Dept. & Associate Professor,

Bombay Hospital

“The current research of x-ray technology focuses on methods of reduce radiation dose, improve image resolution, and enhance contrast materials and methods to reduce. Researches are committed to integrate physical and engineering sciences with life science to advance medical care. x-ray generator market was valued at USD 450.99 million in 2020 and is expected to reach USD 570.28 million by 2026. Pandemic like COVID-19 and other chronic diseases will demand manufacturing of high resolution systems. Multinational companies are integrating x-ray devices with AI technology for faster reporting. In India AERB is the major driver for diagnostic x-rays devices right from procurement stage till issue of license for operations. The manufacturer is made responsible for the same. Present x-ray generators use high frequency principle due to which generator size is reduced, decreased in input power, with controlled KV spikes, life of tube is increased, and hence overall product cost has reduced. Coupled with DR technology x-rays remain the most common major diagnostic tool. Latest development is OK Printer—medical grade True Dicom. Diagnostic quality positive printer saves 70 percent on films cost. Positive printout is easy to view (without viewers) and retains all diagnostic resolution.”

As a result of the COVID-19 pandemic, pending orders for x-ray systems for late 2020 and 2021-2022 had been carried forward to early 2020. Therefore, demand is forecast to retract in 2021. Spend has been diverted from image guided therapy x-ray systems to mobile diagnostic DR systems to increase and enable more diagnostic capabilities and treatment of COVID-19.

Due to demand plummeting for mammography, interventional, and mobile C-arms in countries most highly impacted by COVID-19, recovery is projected in late 2021 through to 2022.

However, the rate of imaging market recovery will also occur very differently by geography, creating a further logistical and operational challenge for vendors. For example, markets in Oceania and China are already returning to normal, as the pandemic has been contained and restrictions are lifted. The largest markets of North America and Europe are also moving in the right direction, with the initial signs of market recovery apparent in recent weeks. However, given the unprecedented level of financial stimulus, recession, and near-term economic uncertainty facing markets, it is highly unlikely healthcare budgets will emerge unscathed over the next 2 years. Also, the ongoing risk of a third peak of the pandemic remains an underlying risk.

Emerging markets like Brazil, Mexico, India, and Russia are the most concerning for global market recovery. These countries have become substantial contributors to overall market growth for imaging equipment and services in the last decade, behind only China in terms of growth trajectory, but they are also four of the five worst affected regions by COVID-19 (along with the US). Further, their health systems are generally inadequate to handle the unprecedented stress that COVID-19 places on resources.

To conclude, the impact of COVID-19 on the medical imaging industry has been far-reaching and unprecedented. It is also fraught with further uncertainty and risk. It is almost impossible to forecast even the near-term market impact with any great confidence; such is the volatility and complexity of the global market response to COVID-19.