Microbiology Instruments and Reagents

Automation, a paradigm shift in clinical microbiology

The automation monolith is evolving laboratory practice to where one can imagine the microbiology lab of the future.

With testing volumes going through the roof, automation is needed more than ever, particularly for small- and mid-sized labs that are in underserved geographic areas. Demand for laboratory testing is increasing. Overall testing volumes are expected to increase 10 to 15 percent per year for the next 20 years, due in part to an aging population that will require more healthcare. The global clinical microbiology market offers significant growth potential for prominent as well as emerging product manufacturers. The global clinical microbiology market size is projected to reach USD 5.3 billion by 2025 from USD 3.9 billion in 2020, at a CAGR of 6.5 percent. Technological advancements, rising incidence of infectious diseases and growing outbreak of epidemics, and increased funding and public-private investments, are some of the key factors driving the growth of the clinical microbiology market.

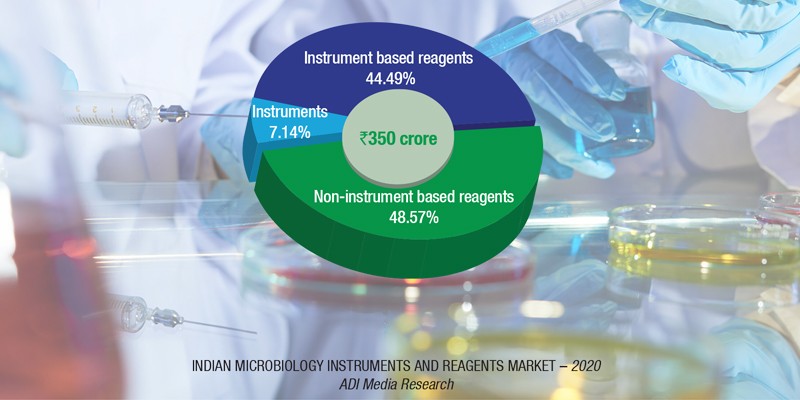

The Indian market for microbiology instruments and reagents in 2020 is estimated at ₹350 crore. The instruments-based segment constitutes 51.43 percent of the market, with the analyzers at ₹25 crore and the reagents at ₹155 crore. The non-instruments-based reagents contribute the balance 48.57 percent to the market at ₹170 crore.

bioMérieux is a clear leader in the instruments and instruments-based reagents segments, and BD is in the second place. In the non-instruments-based reagents segment, Hi-Media dominates with an estimated 58-percent share. This includes ready-to-use plates, antibiotic disks, MICs, etc. Titan Biotech (Microexpress) and Tulip are the other aggressive players.

|

Microbiology instruments & reagents market |

||

|

Major players – 2020 |

||

| Tier I | Tier II | Others |

| bioMérieux | BD | Thermo Fisher & Trivitron |

| bioMérieux & BD | Rapid & DL Biotech, China | – |

| BD | Midget & bioMérieux | – |

In 2020, the COVID-19 pandemic raged through the country, and impacted microbiology testing that had to be on the backburner. The six-month period from March to September was an almost complete write-off; regular testing only started in October 2020.

When an increasing number of patients with COVID-19-associated mucormycosis were reported, then the microbiology testing received some impetus. Specimens to test the disease vary according to the type of infection and clinical presentations. Most commonly used samples include skin scrapings from cutaneous lesions, nasal discharges, scrapings and aspirates from sinuses in patients with rhinocerebral lesions, bronchoalevolar lavages and needle biopsies from pulmonary lesions, and biopsy tissue from patients with gastrointestinal and/or disseminated disease. From pre-COVID era, prevalence of mucormycosis was at least 70 times higher in India as compared to other countries.

|

Microbiology non-instruments & reagents market |

||

|

Major players – 2020 |

||

| Tier I | Tier II | Others |

| HiMedia | Tulip & Titan (Microexpress) | Thermo Scientific (Oxoid), bioMérieux, BD India, Bio-Rad, Beckman Coulter (Siemens), Merck Millipore. Additionally, regional players have a combined 14% market share |

| ADI Media Research | ||

Growth resumed for blood-culture reagents and culture media during the last quarter too, but overall performance remained impacted by the decline in demand in other products and in equipment sales.

Clinical laboratories have played a critical role in response to the COVID-19 pandemic, drawing attention to the work laboratory professionals do, as never before. In addition to fulfilling the current testing needs, laboratories have an unprecedented responsibility to prepare for the pandemic’s aftermath.

The pandemic has also put enormous pressure on clinical laboratories – from increased testing volumes and turnaround time to biosafety, workforce planning, and social distancing within the lab.

The problems, such as shortage of laboratory technologists and technicians, historic financial pressures on hospitals and health systems, and physically and mentally exhausted laboratory professionals — which existed before the pandemic — have only been exacerbated. The shortage of staff is considerable at regional labs, staffed with smaller teams. These labs have fewer resources than larger labs, but continue to test at two to three times their average volumes as they secure more local employer and provider COVID-19 testing contracts, while the larger labs often capture the major testing contracts for situations, such as student body testing at higher education institutions.

Workflow automation, an important breakthrough in the recent history of laboratory diagnostics, integrates multiple diagnostic specialties to one single track to improve efficiency, organization, standardization, quality, and safety of laboratory testing.

Automation in microbiology is not simply automating the traditional practices of processing specimens and incubating cultures – that would not be transformative. Automation should be viewed as an all-encompassing approach to processing samples and communicating information that enable laboratory technologists to perform skilled tasks in ways not historically possible. This is why automation was recently described as a paradigm shift in clinical microbiology, representing the beginning of the future.

The major economic revenue of workflow automation, resulting from merging many diagnostic platforms within a consolidated system, not only encompasses a reduction of manual workforce (especially auxiliary and technical staff) needed for managing high-volume testing, but is also attributable to lower pre-analytical and post-analytical expenditures.

Automation plays a key role in addressing staff shortages while enabling precious resources to focus on high-value clinical tasks.

Even though molecular testing, which is the gold standard for diagnosing COVID-19, is not included in current workflow automation solutions, automating manual processes for routine tests free up lab resources to do more COVID-19 or other dedicated scientific work.

The lab automation that caters to labs processing high volumes of samples is out of reach for smaller-volume labs due to space requirements and infrastructure constraints.

The right fit for these labs is a solution that offers comprehensive workflow automation that reduces manual steps through pre-analytical, analytical, and post-analytical automation, conserving precious human resources to do higher-value clinical tasks while fitting within the space constraints; adapts to meet a mid-volume lab’s space requirements and infrastructure needs with a flexible design; and dynamically calculates route scheduling for rapid and consistent turnaround time (TAT), with short turnaround times (STATs) always prioritized to deliver results faster with intelligent routing.

Just because a lab is not processing a large number of samples should not mean it has to sacrifice the benefits of intelligent laboratory automation and settle for a marginally automated work cell-plus solution. The market is ready for workflow automation that can help small- and medium-sized labs meet the testing needs of their community.

Ten years ago, the majority of microbiologists would have agreed that the workflows in a microbiology laboratory could not be automated in a fashion as they know automation from clinical chemistry. Apart from the complexity of samples and workflows, not one microbiology laboratory works as another! However, today several systems are available which automate the workflow from incubation until reporting. Microbiologists should appreciate and perceive the occasion to rethink microbiology and get rid of some unnecessary longstanding and settled habits in a controlled, reflected, and evidence-based manner. It is time for microbiology to advance to the 21st century.