Defibrilators

Biphasic defibrillation the shape of resuscitation

In India, biphasic defibrillators dominate since for monophasic models neither is there much demand, nor are there too many reliable vendors.

Defibrillators have come a long way since they were first implanted in humans in 1980, firmly cementing their place in preventing SCD. Despite four decades of continuous design updates, defibrillators are always evolving, and research is still being done to better the ever-expanding indications for their usage. Defibrillation is anticipated to improve with time in terms of both cost-effectiveness and safety.

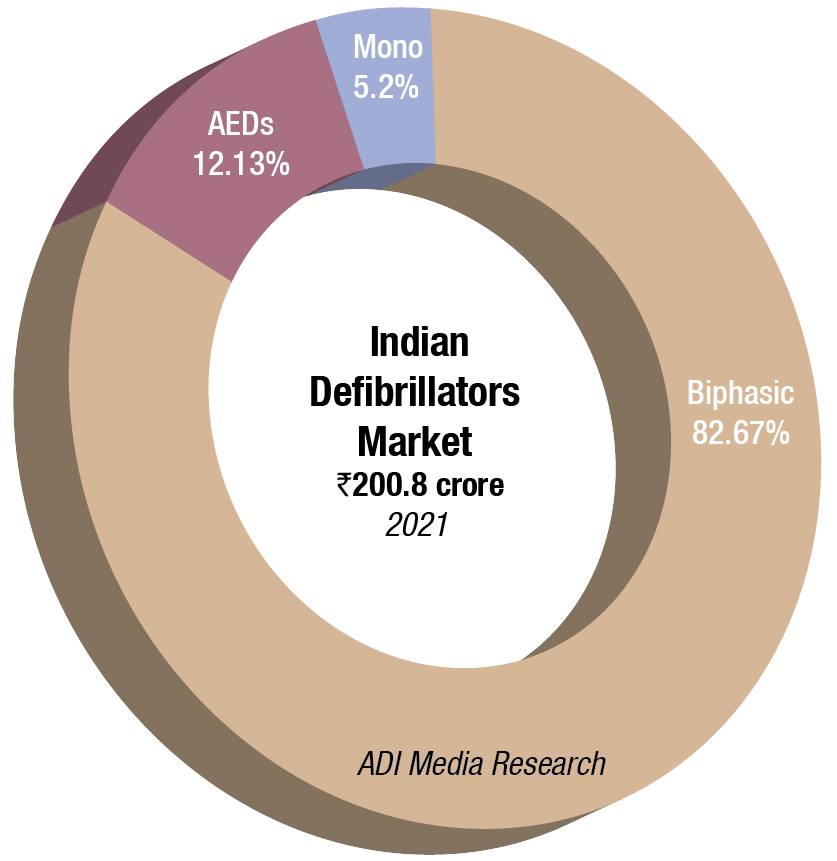

The Indian defibrillators market in 2021 is estimated at ₹200.8 crore, and 14,325 units. In India, biphasic defibrillators dominate since for monophasic models neither is there much demand, nor are there too many reliable vendors. Also, during the two Covid years, as more ICUs were being set up, and hospitals were adding more beds, the biphasic market received an impetus.

Brands reported good sales. For instance, Nihon Kohden found success with Government of Delhi NCT, Indian Army Hospitals, Odisha State Medical Corporation Limited (OSMCL), Government of Punjab, and Kalyana Karnataka Region Development Board (KKRDB) for its high-end biphasic models.

|

Indian defibrillators market |

|

|

Leading players – 2021 |

|

| Segment | Some leading companies |

| Monophasic | BPL, UNI-EM, and Schiller and regional, local brands |

| Biphasic | Philips, Nihon Kohden, Schiller, Mindray, BPL, Comen, Zoll, Mediana, and Beijing M&B |

| Automatic external | Philips, Schiller, Nihon Kohden, Zoll, Beijing M&B, Cardiac Sciences, Primedic, and Defibtech |

| ADI Media Research | |

The AED segment has lost ground over the last two years, as people stayed away from public places where the AEDs are generally installed. Also, unlike in the Western countries, there is no national requirement that employers provide AEDs in the workplace. Till the Indian authorities make AEDs mandatory and address their availability in public buildings, this segment shall continue to be a laggard.

The global defibrillators market size is valued at USD 11.35 billion in 2021, and is expected to expand at a compound annual growth rate (CAGR) of 7 percent from 2022 to 2030. Increasing product developments, rising incidence of sudden cardiac arrest, growing awareness among the general public, and supportive initiatives by governments and healthcare organizations are some of the key factors fueling the growth of this market. In May 2021, an Australian company – Rapid Response Revival Research Ltd. – received a CE mark for its CellAED, the world’s first personal AED for home use. This supported the company’s growth strategy. There have been several recent advancements in implantable cardioverter defibrillator (ICD) technology, including improved patient monitoring to prevent unnecessary shocks; the introduction of quadripolar lead devices to improve device programming and therapy effectiveness; and the development of MRI-safe ICDs.

Implantable cardioverter defibrillators dominated the market with a share of over 70 percent in 2021. The key factors driving this segment include the growing adoption of these devices due to the high prevalence of cardiovascular diseases, the high geriatric population in key markets, and growing product improvements by major companies. Medtronic, for instance, reported continued acceptance and expansion of its MRI-compatible Claria CRT-D devices in 2020. This was in addition to strong growth recorded for its Crome and Cobalt portfolio of CRT-Ds and ICDs.

The external defibrillators segment is anticipated to register the fastest growth rate of 9.3 percent. This is due to the technological advancements and initiatives promoting access to AEDs in public places. A bill to enhance availability and access to AEDs (public access) in the UK is in the pipeline. If the bill is cleared, it will become mandatory to install defibrillators at public places, thus boosting the demand for AEDs. Favorable regulatory policies and initiatives by public and private health organizations to promote public access to defibrillators already exist in several key markets, including the US, Canada, Italy, Japan, Australia, and China.

However, AEDs in public places are occasionally prone to failure due to issues with the battery, software, or hardware. Failure to defibrillate can result in treatment delays or even death. A number of defibrillators have been recalled in the past few years due to technical errors in the device’s operation, including shock delivery, electrical issues, and hardware configuration. In some cases, these flaws can result in poor product performance and even death of the patient.

When bulky, complex hospital defibrillators were converted into portable automated external defibrillators, it was a life-saving breakthrough, allowing people with no medical or first-aid training to save lives. So, where is this technology heading and what buyers can expect from innovations in the future?

While current AEDs are not very heavy or bulky, one can see them becoming much smaller units in the future. This will help in several ways, making them more portable (one could slip it into their backpack on a hike, keep it in the reception of small business or store in car first-aid kit, for example), easier to store and easier to place throughout a building.

Current AEDs are designed to be used by anyone, even children, to safely restart a heartbeat, but the user interface and instructions have not changed much over the years. We live in a time where technology has changed every facet of our lives, creating home assistants, smart appliances, apps, and smartphones that are connected and offer innovative user-friendly interfaces and features. It would be exciting to see some of that spill into the world of AEDs, where people can be empowered more effectively to save lives. Imagine an AED that you could ask questions of and get accurate answers as you treat a person that connects to emergency services and GPS automatically, and actively supports your lifesaving efforts. This would make bystanders more confident to act, especially in circumstances involving strangers, small children, or unusual environments.

For doctors to treat patients as effectively as possible, especially in a time-sensitive situation like SCA, they need patient data. Some new AED technology records patient data from the moment treatment starts – when the AED is attached to the patient – and makes it transmittable to emergency services and hospitals, ensuring the doctors waiting for the patient’s arrival have the most current and most accurate medical data on which to act. This allows doctors, surgical teams, and medical teams to provide more accurate, more insightful patient care, something that can directly impact on patient outcomes, survival rates, and long-term-care requirements.

One of the most significant challenges when it comes to public access and private AEDs is maintenance. Without regular maintenance, which includes running testing procedures, updating software, and replacing key components like electrode pads and batteries (which have a finite lifespan), an AED is unreliable at best during a cardiac emergency. It is up to the staff and the AED owners to keep their unit in good working order.

One of the new technologies on the horizon that may challenge this issue is a single-use, multi-shock AED. Buyers will not have to worry about time-consuming maintenance because they only use the unit once, then they will send it to be recycled. This option was highly cost-prohibitive in the past, but MedTech innovators are seeing promising results for affordable single-use AEDs that run self-checks and are simple to maintain. Every advancement that makes it easier to have an on-site AED makes it just a little bit easier to save lives.

Defibrillators continue to evolve despite four decades of iterative development advancements and updates, and current research is underway to enhance the ever-expanding indications for their usage.

With more advanced technology, the potential integration with leadless pacing, and the possibility to serve as a remote monitoring device to recognize atrial fibrillation, acute ischemia, or electrolyte imbalance, the application of defibrillators is rapidly evolving. These devices are expected to become more cost-effective and safer in coming years.