Defibrilators

Biphasics continue to reign supreme

In India, biphasic defibrillators continue to hold sway over both, the monophasic defibrillators and the AEDs.

Modern-day defibrillators are not only defibrillation/cardioverter/pacemaker boxes but they are also equipped with an increasingly sophisticated array of features, some of which include capability for monitoring temperature, blood pressure, pulse oximetry, end-tidal CO2, and the ECG based on 3-, 5-, 7-, and 12-lead configurations. Most defibrillators also have capability for data recording and retrieval featuring electronic storing devices and protocols for data transfer to a PC or directly to a printer.

Advanced monitoring capability of manual defibrillator/monitors is usually available in acute care areas (intensive care, operating rooms, and emergency departments), and integrated to clinical information systems. However, the advanced features become exceedingly useful when defibrillators are used outside monitored areas. Such is the case when defibrillators/monitors are used while transporting high-risk patients, or when responding to a cardiac arrest elsewhere than in the hospital. Measurement of end-tidal CO2 in the setting of cardiac arrest enables verification of proper placement of an endotracheal tube and also serves to assess the amount of systemic blood flow being generated during cardiac resuscitation. Pulse oximetry allows continuous assessment of arterial oxygenation, obviating the need for repetitive blood gas analysis. Blood pressure monitoring may help identify needs for additional hemodynamic interventions. The light weight of most available devices facilitates their transport to the scene of cardiac arrest and other emergencies.

With regard to defibrillation waveforms and energy levels, new automated external defibrillators (AEDs) and most manual defibrillators are engineered to deliver biphasic waveform shocks. Some manual defibrillators still feature monophasic waveform shocks, and some have both waveforms available. With monophasic waveforms the current delivered flows in one direction. With biphasic waveforms the current reverses polarity through the shock enabling successful defibrillation with less peak current and less energy than with monophasic shocks, possibly causing less post-resuscitation myocardial dysfunction. Manufacturers continue to develop variations around the basic waveform configuration; however, substantive clinical differences have not yet been demonstrated beyond today’s consensus favoring biphasic waveforms. The lower energy requirement of biphasic waveforms has enabled the construction of lighter and more portable units. With regard to the energy levels, most defibrillators present a wide range starting from 1 or 2 Joules and ending with 200 or 360 Joules, with 200 Joules being the recommended maximum for biphasic shocks, and 360 Joules for monophasic shocks. The wide range of energies allows defibrillation in patients of all ages (neonates, infants, children, and adults) and internal and external defibrillation.

When deciding which defibrillator/monitor to purchase, cost is not likely to be a deciding factor among brands, because prices of basic units (defibrillator/monitor) are similar. However, cost increases in proportion to added features. A purchasing decision should consider the intended use of the defibrillator/monitor, identifying the specific features required. Ideally such decisions should be part of a hospital-wide initiative, in which issues related to training, compatibility, service contracts, bargaining power, data integration, and track record of specific manufacturers are also considered. The solution for many hospitals has been to devise systems, in which crash carts are equipped only with AEDs and code teams carry more advanced manual defibrillators/monitors stationed in acute care areas.

The Indian defibrillators market in 2021 is estimated at ₹200.8 crore, and 14,325 units. In India, biphasic defibrillators dominate since for monophasic models neither is there much demand, nor are there too many reliable vendors. Also, during the two Covid years, as more ICUs were being set up, and hospitals were adding more beds, the biphasic market received an impetus.

Brands reported good sales. For instance, Nihon Kohden found success with Government of Delhi NCT, Indian Army Hospitals, Odisha State Medical Corporation Limited (OSMCL), Government of Punjab, and Kalyana Karnataka Region Development Board (KKRDB) for its high-end biphasic models.

| Indian defibrillators market | |

| Leading players – 2021 | |

| Segment | Some leading companies |

| Monophasic | BPL, UNI-EM, and Schiller and regional, local brands |

| Biphasic | Philips, Nihon Kohden, Schiller, Mindray, BPL, Comen, Zoll, Mediana, and Beijing M&B |

| Automatic external | Philips, Schiller, Nihon Kohden, Zoll, Beijing M&B, Cardiac Sciences, Primedic, and Defibtech |

| ADI Media Research | |

The AED segment has lost ground over the last two years, as people stayed away from public places where the AEDs are generally installed. Also, unlike in the western countries, there is no national requirement that employers provide AEDs in the workplace. Till the Indian authorities make AEDs mandatory and address their availability in public buildings, this segment shall continue to be a laggard.

A smart defibrillator-cum-monitor connecting the clinical expert and patient on wheels

Manju Goyal

Manju Goyal

National Marketing Manager-PMLS & SU,

Mindray Medical India Pvt. Ltd.

Time is the most crucial factor in the recovery of patients, especially for those suffering from cardiac diseases. Normally, from the moment a patient is transported to the hospital in an ambulance, valuable time passes on the road itself, and after reaching the hospital the patient is examined, diagnosed, and finally, the treatment is started. If the hospital is not equipped with all facilities required, the situation is more difficult as the patient needs to be transferred to some other hospital. That delay in diagnosis and treatment decreases the probability of a positive outcome and, in certain cases, it is too late to recover the patient. This issue can be sorted out if the devices inside the ambulance are smart enough to provide required patient information like all vital parameters including ECG, SPO2, NIBP, and 12-lead ECG with interpretation and defibrillator history, etc., before the patient reaches the hospital so that the available technician in an ambulance can be supported, and upon arrival of the ambulance in the hospital, crucial time is saved and treatment can be started without any delay.

Remote monitoring of patient data has extended its wings towards patients in the ambulance to help in this issue. For patients suffering from more complex pathologies, such as STEMI, this technology is a boon. IT is playing a major role in providing an effective communication solution for emergency care that features real-time data sharing between ambulances and hospitals with available 4G/3G communication networks. This real-time transmission of critical parameters allows involving all stakeholders to start the rescue process right from the beginning, thereby saving valuable time and lives. This concept is already established in many countries and is now slowly picking up in India too. As the patient need is linked to this concept so we can see a positive trend in coming years for this kind of technology.

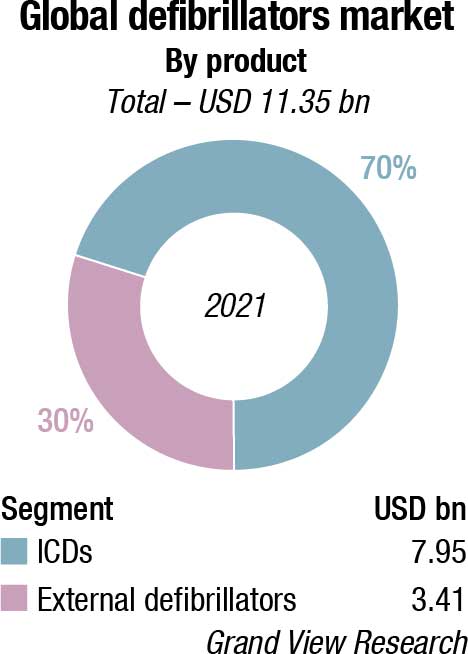

The global defibrillators market size is valued at USD 11.35 billion in 2021, and is expected to expand at a compound annual growth rate (CAGR) of 7 percent from 2022 to 2030. Increasing product developments, rising incidence of sudden cardiac arrest, growing awareness among the general public, and supportive initiatives by governments and healthcare organizations are some of the key factors fueling the growth of this market. In May 2021, an Australian company – Rapid Response Revival Research Ltd. – received a CE mark for its CellAED, the world’s first personal AED for home use. This supported the company’s growth strategy. There have been several recent advancements in implantable cardioverter defibrillator (ICD) technology, including improved patient monitoring to prevent unnecessary shocks; the introduction of quadripolar lead devices to improve device programming and therapy effectiveness; and the development of MRI-safe ICDs.

The Covid-19 pandemic adversely impacted the market, in particular the ICDs market, with dampened demand and sales during 2020. The sales improved as the hospitals resumed elective surgeries. However, the progression of Covid-19 in several key markets continued to create uncertainty during the year. Abbott, for instance, reported improvement in its hospital-based businesses during Q2 and Q3 2020. However, the improving trends flattened or were negatively impacted during Q4 2020 due to a sudden increase in Covid-19 cases and hospitalizations in many countries. Nihon Kohden, on the other hand, reported strong sales growth of defibrillators in 2020, despite inhibited sales activity due to the pandemic. Microport, a leader in the cardiac rhythm management market in China, registered 95-percent growth in revenue during H1 2021 in the Chinese market owing to a wide portfolio and robust product pipeline.

The rising number of homecare settings due to the coronavirus pandemic has also created alternative revenue streams for MedTech companies in the defibrillator market. Although ICDs are linked with advantages for patients who have suffered a heart failure, risks of these devices, such as tearing of heart muscle and collapsed lung, are affecting their adoption. Hence, MedTech companies in the defibrillator market and healthcare practitioners should increase awareness about consent forms and precautions for implantation to avoid adverse events in individuals and prevent unnecessary healthcare burdens. Companies in the defibrillator market should diversify their product portfolio in automated external defibrillators and wearable cardioverters/defibrillators to accurately analyze a person’s heart rhythm and deliver an electric shock to save the person from irregular heart function.

Hospitals held the largest revenue share of over 80 percent in 2021. This is owing to the higher number of cardiac patients received in hospitals, and surgeries performed in hospital settings. Both ICDs and external defibrillators are increasingly used in hospitals to deliver treatment to patients of sudden cardiac arrest and for other indications. Boston Scientific, for example, reported a distribution of around 659,000 ICDs globally as of January 2021. This number notably increased by 59,000 when compared to the 600,000 ICDs distributed by January 2020 indicating a high demand.

Emerging need for connected ambulance defibrillators

Tarun Gupta

Tarun Gupta

Assistant Manager- Product and Marketing, Medical Equipment,

Nihon Kohden India Private Limited

Cardiovascular disease (CVD) is the leading cause of death and disability worldwide. The incidence of CVD is increasing with 17.6 million deaths occurring each year and by 2030, this number is expected to rise to 23.61 million. It is estimated that 50 percent of all CVD deaths result from out-of-hospital cardiac arrest (OHCA), with survival rates varying from 2 to 22 percent across different countries. As a result, the demand for defibrillators has increased as these devices can save the lives of cardiac-arrest patients.

The worldwide defibrillators market was valued at USD 12.87 billion in 2021 and is expected to grow at a CAGR of 5.76 percent during 2021 to 2027. However, the advanced life support (ALS) and emergency medical services (EMS) defibrillator markets are expected to grow at a CAGR of 4 percent and 9.6 percent respectively.

There are several challenges faced by clinicians/paramedics during resuscitation management of OHCA patients, which include continuous CPR, early defibrillation, return of spontaneous circulation management, respiratory management, and decision support for cardiac arrest care. Nihon Kohden’s advanced technologies and unique features enable effective resuscitation management at all levels, out-of-hospital, in the ambulance, and in hospitals.

When an every-moment-counts situation occurs in emergency treatment, it is vital to do everything possible to save the patient’s life. Nihon Kohden’s cardiolife EMS is a lightweight and compact ambulance defibrillator. It enables EMS professionals to deliver a quick response and better care to the patient on-site and in an ambulance, with advanced technologies like CPR Assist for effective management of CPR to the patient, continuous VF/VT analysis for a faster shock to the patient in AED mode, non-invasive cardiac out for fluid management, mainstream CO2 sensor for non-intubated patients and Audible cue for better respiration management, iNIBP for faster and painless NIBP measurement, and many more.

It can continuously transmit vital data, waveforms of the parameters measured, and the 12-lead ECG test report automatically from the ambulance to the hospital. With advanced synthesized 18-lead ECG technology, the defibrillator can transmit 18-lead ECG to the hospital.

Nihon Kohden India continues to strive to provide Indian healthcare with advanced technologies for better patient care and highly reliable medical devices. We have been distinguished by our customers for high-quality products and after-sales service support.

The public access market segment is anticipated to register the fastest growth rate of 9.6 percent over the next 8 years with the rising initiatives to increase the availability of public access AEDs, train personnel, and improve response to sudden cardiac arrest events. In January 2020, Global Times reported that several tourist cities, first-tier cities, and coastal provinces across China have initiated accelerated AED deployment since 2019. Hangzhou also became the first city in China to mandate the dissemination of AEDs at airports, metro stations, law-enforcement vehicles, ships, and other public places.

Implantable cardioverter defibrillators dominated the market with a share of over 70 percent in 2021. The key factors driving this segment include the growing adoption of these devices due to the high prevalence of cardiovascular diseases, the high geriatric population in key markets, and growing product improvements by major companies. Medtronic, for instance, reported continued acceptance and expansion of its MRI-compatible Claria CRT-D devices in 2020. This was in addition to strong growth recorded for its Crome and Cobalt portfolio of CRT-Ds and ICDs.

The external defibrillators segment is anticipated to register the fastest growth rate of 9.3 percent. This is due to the technological advancements and initiatives promoting access to AEDs in public places. A bill to enhance availability and access to AEDs (public access) in the UK is in the pipeline. If the bill is cleared, it will become mandatory to install defibrillators at public places, thus boosting the demand for AEDs. Favorable regulatory policies and initiatives by public and private health organizations to promote public access to defibrillators already exist in several key markets, including the US, Canada, Italy, Japan, Australia, and China.

However, AEDs in public places are occasionally prone to failure due to issues with the battery, software, or hardware. Failure to defibrillate can result in treatment delays or even death. A number of defibrillators have been recalled in the past few years due to technical errors in the device’s operation, including shock delivery, electrical issues, and hardware configuration. In some cases, these flaws can result in poor product performance and even death of the patient.

North America held the largest revenue share of more than 35 percent in 2021. The growth of the North American market can be attributed to the initiatives taken by key players, favorable regulations, and technologically advanced healthcare facilities in the US and Canada. Boston Scientific, for instance, reported that it had distributed about 33,000 of its CRT-Ds line-up including Resonate, Autogen, Dynagen, Incepta, and Cognis devices worldwide in 2020. Out of these, 16,500 were registered in the US alone indicating a high adoption rate.

American Heart Association’s Heart & Stroke Statistics – 2020 Update claimed that over 356,000 out-of-hospital cardiac arrests occur in the United States each year, and nearly 90 percent of them are fatal. The estimated number of the incidences of out-of-hospital cardiac arrests (OHCA) among adults in the United States was 347,322. Less than half (45.7%) of cardiac arrest victims get immediate help before emergency responders arrive in part because emergency medical services take, on average, between four and ten minutes to reach someone in cardiac arrest.

However, if AEDs are available nearby, this high mortality from out-of-hospital cardiac arrests can be reduced, which may increase the demand for automated external defibrillators in the country, projecting the growth of the market studied.

Asia-Pacific is projected to expand at the fastest CAGR of 7.9 percent. This is owing to developing healthcare infrastructure, high patient population, and prevalence of cardiac diseases. The regional growth is spearheaded by the Japanese market owing to the high penetration of defibrillators and supportive policies. In fact, Nihon Kohden, a market leader in Japan, registered over USD 66,000 sales of manual external defibrillators in 2020.

Leading players operating in the global defibrillator market are Philips Healthcare, Zoll Medical, Nihon Kohden, Boston Scientific, Medtronic, Stryker, Asahi Kasei Corporation, Abbott, MicroPort, Biotronik, CU Medical Systems, METsis Medikal, Mediana Co., and Mindray Medical.

Key players in the global defibrillator market are engaged in regulatory approvals, technologically advanced products, launch of new products, and acquisition and collaborative agreements with other companies. These strategies are likely to fuel the growth of the global defibrillator market. A few growth strategies adopted by players operating in the global defibrillator market are:

In September 2021, Zoll Medical introduced three automated external defibrillator (AED) models to penetrate the Thai market. This estimated that demand for AEDs in Thailand would rise to 10,000 units.

In March 2021, as a part of the company’s three-year business plan, Nihon Kohden was expanding its US business by integrating and unifying six local subsidiaries, while also broadening its product lineup in neurology products and treatment equipment, such as next-generation automated chest-compression devices.

In February 2021, Navratna Defense PSU Bharat Electronics Limited (BEL) and BPL Medical Technologies Pvt. Ltd. together entered into an MoU for cooperation in the field of medical products and solutions to provide affordable healthcare for the country, and to leverage the policy initiatives of the Indian government, such as Make in India.

Lower pricing alone unlikely to win sales in the ICDs market. A typical penetration pricing approach used by many makers of medical devices is to cut the price to enter a market that is competitive and has well-established brand leaders. Nevertheless, GlobalData notes that despite the strategy’s appeal in terms of establishing a pricing floor with the ability to quickly overtake rivals in the market share, the ICDs market may not be a good fit for it.

The ICDs market is segmented into three categories; single chamber ICDs, dual chamber ICDs, and subcutaneous ICDs, which are used to monitor heart rhythms and deliver therapy to correct heart rates that are too fast, a condition that can lead to sudden cardiac arrest. Medtronic Plc. is the global market leader for single-chamber ICDs with a 41-percent market share, ahead of Biotronik with a 22 percent share and ahead of Abbott, and Boston Scientific.

The global average selling price of the single-chamber ICDs portfolio within Medtronic and Biotronik is over USD 14,000 and USD 12,500 respectively.

Medtronic launched its most recent product, Cobalt XT, in 2021. Cobalt XT is enabled with BlueSync technology to offer connected health, including the ability for clinicians to program the device through app-based remote monitoring, thereby reducing potential exposure to Covid-19. As a premium brand in the ICD market, Medtronics’ average selling price (ASP) for the Cobalt XT is 35 percent higher than the previous model Cobalt.

Tina Deng, principal medical devices analyst at GlobalData, commented, “As pricing in the ICD market is currently set at a premium level, this indicates that a pricing strategy alone may not be effective enough in persuading surgeons to move away from competitor products. Medtronic has years of experience in the field with a good reputation, offers a high-quality product, a diverse ICD portfolio, and continually invests in product improvement and new product lines. These factors will be reflected in their product pricing and are clearly important considerations alongside price in their clients’ decision making process.”

It was a life-saving innovation when bulky, complex hospital defibrillators were transformed into portable automated external defibrillators, allowing people with no medical or first aid training to save lives. So, where is this technology heading and what to expect from innovations in the future?

Smaller, more compact design and engineering. Modern technology is small enough to carry in a back pocket, and IT giants are increasingly being incorporated into smaller, more streamlined designs. AEDs now are not very large or heavy, but one may envision them evolving into much more compact devices in the future. This will be beneficial in a number of ways, including facilitating their portability, storage, and placement throughout a structure.

Easier to use. The user interface and instructions have not changed much over the years despite the fact that modern AEDs are made to be used by anybody, including children, to safely restart a heartbeat. Technology has completely transformed our world today, bringing us linked smartphones, smart appliances, applications, and home assistants with cutting-edge user interfaces and functionalities. It would be fascinating to see some of that permeate the world of AEDs, where individuals can be more effectively empowered to save lives. Imagine an AED that actively helps users’ attempts to save lives by connecting to emergency services and GPS automatically, answering questions and providing accurate answers while users treat a patient. This would make bystanders more confident to act, especially in circumstances involving strangers, small children, or unusual environments.

Improved patient care. For doctors to treat patients as effectively as possible, especially in a time-sensitive situation like SCA, they need patient data. Some new AED technology records patient data from the moment treatment starts – when the AED is attached to the patient – and makes it transmittable to emergency services and hospitals, ensuring the doctors waiting for the patient’s arrival have the most current and most accurate medical data on which to act. This allows doctors, surgical teams and medical teams to provide more accurate, more insightful patient care, something that can directly impact on patient outcomes, survival rates, and long-term care requirements.

Reduced maintenance. One of the most significant challenges, when it comes to public access and private AEDs, is maintenance. Without regular maintenance, which includes running testing procedures, updating software, and replacing key components like electrode pads and batteries (which have a finite lifespan) an AED is unreliable at best during a cardiac emergency. It is up to the staff and AED owners to keep their unit in good working order.

One of the new technologies on the horizon that may challenge this issue is a single-use, multi-shock AED. Given that the unit will only be used once before being sent for recycling, there is no need to worry about time-consuming maintenance in this situation. This option was highly cost-prohibitive in the past, but MedTech innovators are seeing promising results for affordable single-use AEDs that run self-checks and are simple to maintain. Every advancement that makes it easier to have an on-site AED makes it just a little bit easier to save lives.

Novel method to disrupt spiral waves offers new path to defibrillate hearts. Electrical waves enable the heart to contract and send blood throughout the body. When a wave becomes a spiral, its rotation is faster than the heart’s natural pacemaker and suppresses normal cardiac function. A spiral wave of electrical activity in the heart can cause catastrophic consequences. One spiral wave creates tachycardia – a heart rate that’s too fast – and multiple spirals cause a state of disorganized contraction known as fibrillation. For years, scientists and doctors have worked to find the best way to stop spiral waves before they get out of control. Yet, for over half a century, the best method has been a single strong electric shock. The 300 Joules of energy required for defibrillation excites not just the heart cells, but the entire body, making it very painful for the patient. Now, a new method to disrupt spiral waves uses less energy and may be less painful than traditional defibrillation.

The new method was developed by researchers from the Georgia Institute of Technology (Atlanta, GA, USA) who determined that because spiral waves develop in pairs, they must also be terminated in pairs. Every spiral wave is connected to another spiral wave going in the opposite direction. Bringing the spiral waves together through an electric shock instantly eliminates both waves. The researchers used a mathematical method to identify the key regions for electrical shock stimulation to target spiral waves. They determined that a stimulus delivered to the tissue area as a spiral wave just left and was able to sustain a new wave could defibrillate the heart.

In the process of terminating the spiral waves, the researchers were actually moving them, as well, through a concept they named teleportation. Spiral waves can be teleported anywhere in the heart using this approach. In particular, spiral waves can be moved so that they collide with their partners, which extinguishes them. For successful defibrillation to occur, all pairs of spiral waves must be eliminated in this manner. The researchers plan to further test this concept, using two-dimensional cultures of heart cells and develop methods that could be used clinically.

Defibrillators have come a long way since their first implantation in humans in 1980. The advances of ICD technology have made it safer and effective to prevent SCD and treat HF in both ICM and NICM. It has resulted in a striking global increase in the implantation of defibrillators and resynchronization devices with its indications continually being redefined and expanded by ongoing research. Subcutaneous ICD has provided a valuable alternative to the transvenous-type, which is implanted on an individualistic approach and continues to evolve to overcome its current shortcomings.