Hematology Instruments and Reagents

Brighter future ahead for hematology

New tools and parameters will continue to emerge as market competition increases, and technology evolves. These are exciting times, and the next five years promise to bring better patient care and more options for laboratory professionals.

The role of the laboratory in disease diagnosis and management has expanded in recent years and this has resulted in an overwhelming rise in testing demands. The availability of skilled technologists and specialists has also been a challenge across the country, more severe in Tier-II and Tier-III cities. To meet the needs of an overworked and mostly multitasking workforce, today’s hematology analyzers not only must deliver more clinical data than ever before, but also should be easier to operate, relieving overburdened laboratory staff members of cumbersome tasks.

The persistent growth of the hematology market is attributed to the increasing incidences of blood disorders and increased prevalence of other diseases and infections. Rapid technological advances in hematology analysis and the emergence of high-throughput hematology analyzers with novel parameters have also contributed to rapid growth.

Hematology analyzer manufacturers have responded to these needs with technological evolution in the areas of new product developments, workflow improvisation, analytical advancements, and clinical-information management. Further revolutionary advancements in computing, along with AI enabled algorithmic tools, electronics and manufacturing, along with continuous innovation in the areas of biotechnology, fluidics, and mechanics, have led to a reduction in the size of analyzers and increase in the speed of analysis. Many of the technologies like innovative flow-cytometry analysis, genomics testing, advanced automated imaging processing, and microfluidics are at the early stages of development and exist outside the routine core workflow, but it will not be long before they become standard hematology workflow.

All these developments have resulted in accelerated overall treatment regimen, with improved accuracy and elimination of human error. This evolution is providing the clinicians a plethora of information that was not available earlier. Technological advances are also allowing pathologists access to additional parameters and more cellular information and minimizing unnecessary manual reviews. Additional parameters have a great potential to identify changes in cell morphology that typically occurs in several acute medical conditions. As a result, hematology analyzers are gaining trust as a powerful tool for the management of any medical condition and assisting pathologists in clinical decision-making.

New tools and parameters will continue to emerge as the market competition increases and technology evolves. Indeed, this is an exciting time to be in the field, and the next five years should promise to bring better patient care and more options for laboratory professionals.

The ability of a hematology test to effectively measure several blood components has made it an essential screening tool to diagnose a wide range of blood-related disorders, including anemia, blood cancer, hemorrhagic conditions, and blood infections, among others that affect millions of people each year across all age groups. Increasing incidences of hematology disorders and growing awareness related to the availability of a wide range of diagnostic options to treat these targeted disorders are the primary factors driving the growth of the hematology instruments market.

The global hematology analyzers and reagents market is expected to grow from USD 3.93 billion in 2020 to USD 4.31 billion in 2021 at a compound annual growth rate (CAGR) of 9.7 percent. The growth is mainly due to companies resuming their operations and adapting to the new normal while dealing with the COVID-19 impact, which had earlier led to restrictive containment measures, involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The hematology analyzers and reagents market is expected to reach USD 5.69 billion in 2025 at a CAGR of 7.2 percent.

Dominance of hematology analyzers can be attributed to the presence of fully automated analyzers, which are objective, have high throughput, and are cost-effective. Furthermore, these hematology analyzers can also detect atypical results and can improve measurable parameters, such as red-cell distribution width, platelet distribution, reticulocyte (RET) counts, and nucleated red-cell counts.

The advent of point-of-care (PoC) hematology testing devices has led to improved diagnostic and patient outcomes. These devices are user-friendly and are available for use outside the hospital settings. This is anticipated to increase the acceptability and accessibility of hematology testing which, in turn, is anticipated to propel the market growth.

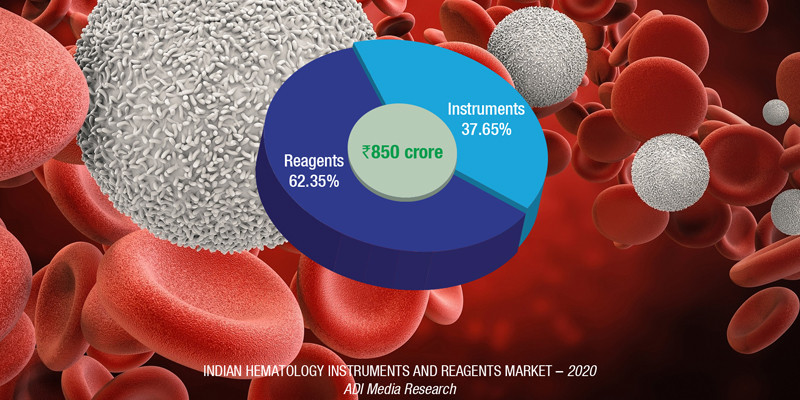

The Indian hematology instruments and reagents market in 2020 is estimated as ₹850 crore. Reagents constitute 62 percent of the market at ₹530 crore, and instruments, all fully automated.

The hematology instruments market may be segmented as 3-part and 5-part analyzers. Within the 5-part analyzers, the entry-level or standalone analyzers have been the preferred ones.

However, as COVID-19 pandemic raged through the country, buyers preferred the 5-part high-end analyzers, and the 3-part dual chamber analyzers to the single chamber models. It has all become a function of affordability. Stringent manufacturing protocols are finally finding their place in the industry. Customers want to keep intervention of service technicians as minimum as possible.

There are five dominant players in this market – Transasia, Horiba, Mindray, Sysmex, and Beckman Coulter, with the latter having restricted their offerings to the high-end range. Boule is gradually cementing its presence in the 3-part dual chamber segment. Abbott, Trivitron, Nihon Kohden, and Siemens give serious competition to these players. Many other players including Agappe, Beacon, CPC, Urit, and Meril are active in this segment.

|

Indian hematology instruments and reagents market |

|||

|

Leading vendors* – 2020 |

|||

| Tier I | Tier II | Tier III | Others |

| Transasia, Horiba, Mindray, Beckman Coulter, and Sysmex | Abbott and Nihon Kohden | Trivitron, Boule, Dymind, and Siemens | Agappe, CPC, Roche, Dirui, Meril, Beacon, Diatron, Shenzhen Prokan, Urit,

LabIndia, and many small importers |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian hematology instruments and reagents market. | |||

| ADI Media Research | |||

COVID-19 hurt the hematology market considerably. The routine CBC tests have been on the backburner since March 2020. It is the in-patients that kept this industry going, as they had to be often tested twice a day, which gave impetus to the capillary testing procedure. It is estimated that the number of CBC tests done in 2020 were down to 110 million from 330 million tests in 2019. A back-of-the-envelope calculation indicates that about 27 percent tests done are on 5-part analyzers; 65 percent are on 3-part dual chamber; and 8 percent on 3-part single chamber.

As far as the market for instruments is concerned, the high cost and stringent regulatory policies for hematology analyzers limiting growth will need to be addressed.

Although the laboratory diagnostics of anemia remains a rather simple enterprise, accurate disease characterization has emerged as a mainstay in the era of precision (laboratory) medicine, even for RBC disorders. The many technological advances occurred in laboratory medicine over recent times have enabled the introduction of a vast array of innovations, which have led the way to more efficient patient care and more convenient organization of resources and workflows within the laboratory.

In the foreseeable future, the better understanding of phenotypic heterogeneity of RBC disorders, also supported by IT tools, such as expert diagnostic systems or artificial neural networks, will predictably enable to improve the global management of these disorders at multiple levels. No doubt, some additional issues will need to be addressed, the main one being the current lack of harmonization in laboratory medicine.