MedTech

Continuing challenges, profound uncertainty, and dramatic opportunities ahead

The impact of COVID-19 on the medical imaging industry has been far-reaching and unprecedented.

The global COVID-19 pandemic has given an unprecedented setback to medical equipment and healthcare markets. Predicting the rate of recovery today is complex, given the nuances of regional lockdown restrictions, healthcare funding models, purchasing cycles, and predominant business model of each product sector.

Based on ongoing research, what are the key trends? What risks can be identified, and how much uncertainty lies ahead?

Indian scenario

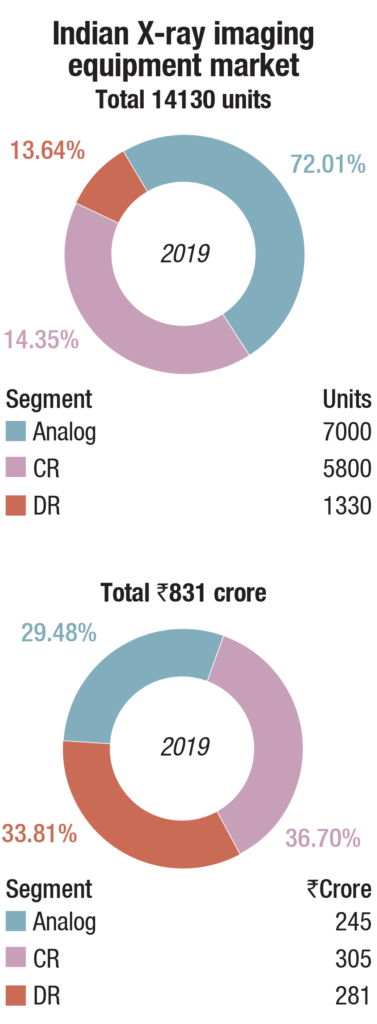

The Indian market in 2019 is estimated at 14,130 units, with value estimated as Rs. 831 crore.

The Indian market in 2019 is estimated at 14,130 units, with value estimated as Rs. 831 crore.

The dominance has moved from the CR machines to the DRs as the price differential is narrowing between the two. The analog machines are being phased out gradually, and are only bought for their competitive price points. Philips, Siemens, and GE have over the years discontinued their regular analog models. While Allengers’ focus is on the Tier-II and Tier-III markets, GE and Skanray find success with their mobile models. The local, unorganized players are deeply entrenched in this segment.

The CR machines segment is led by Fujifilm, with about 50-percent market share. Agfa and Carestream are in the second slot. Konica is also aggressive in this segment. This segment has not only lost a major share to the DR X-ray machines, but also has dropped prices over the last couple of years. The segment is steady at about 5800 units.

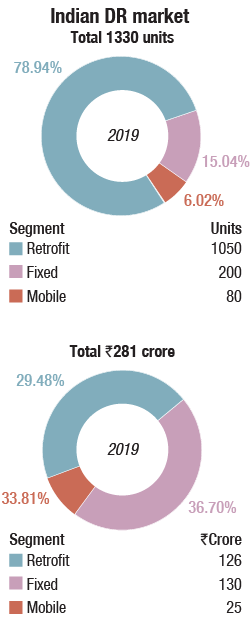

However, the realization of the machines in the DR segment has drastically dropped. Within the DR segment, the sales of fixed machines have declined in favor of the mobile and the retrofit, the latter being the major gainer. This is in spite of the high-end ceiling-suspended machines, unit priced in the Rs. 1.2 to Rs. 1.6 crore range, gaining preference in the government hospitals and a handful of the corporate chains. The mobile machines too, apart from the huge premium order that Samsung received from the Indian Army, are retailed in the vicinity of Rs. 20 lakh per unit. The retrofits have gained major share from 2018, from 800 units to 1050 units, but are now fetching approximately Rs. 12 lakh per unit. There is one added advantage: that of the machines being vendor neutral retrofits.

By brands, the DR segment may be segmented as those catering to the premium segment comprising mainly of the government, those to the corporate chains and those to the smaller private hospitals. Their product range and price points are in accordance with the customer they sell to.

Global scenario

Across the market, a swoosh-shaped recovery (sharp decline followed by a gradual recovery) is anticipated for imaging equipment. The speed of recovery will be closely tied to the recovery of imaging volumes, and how each health system reacts to substantial budgetary pressures in the wake of the pandemic.

Equipment sales take hit in 2020

The COVID-19 pandemic has resulted in a 17.7-percent decline in the market for medical imaging equipment, according to a recent report by Business Research Company. The medical imaging equipment market will produce revenues of USD 36.5 billion in 2020, a sharp drop compared with sales of USD 44.3 billion in 2019. The decline is primarily due to the COVID-19 outbreak and measures designed to contain it.

While few, if any, imaging equipment orders have been canceled so far, many will be delayed, putting significant pressure on vendor margins throughout 2020 at least.

Governments are prioritizing screening for the SARS-CoV-2 virus, and medical imaging is not routinely used to screen for COVID-19, the disease caused by the novel coronavirus. What is more, factories that make imaging equipment like X-ray systems, CT, and MRI scanners have been idled to protect staff.

There is, however, a more positive outlook into 2021, as market expects to see a recovery of imaging volumes as healthcare systems move toward normal levels of elective imaging and screening programs restart. The green shoots of this recovery have already been identified in the last few weeks of May from a number of European and US healthcare providers, though it is not expected to see a return to global market growth until the latter part of 2021 or 2022.

Major players* in Indian X-ray imaging market–2019 |

||

|---|---|---|

| Analog | DR | CR |

| Allengers; GE & Skanray (mostly mobile); local and regional brands | Philips, Siemens, GE, Carestream, Shimadzu, Allengers, Fujifilm, Canon, Konica & Agfa, many Chinese and Korean brands | Fujifilm, Agfa, Carestream, and Konica |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian X-ray imaging market. | ||

| ADI Media Research | ||

Software and service markets have seen less drastic near-term impact, with a substantial proportion of the market tied to recurring revenue from software licenses and maintenance for imaging IT platforms. However, COVID-19 is likely to affect the market over a longer period in comparison to medical imaging hardware owing to the lag between the implementation of contracts signed pre-pandemic and the refilling of new deal pipelines.

Large IT PACS or enterprise imaging regional tenders in Europe and major imaging IT acute hospital deals in the US have also slowed, with healthcare provider executives shifting resources and focus toward COVID-19 response and tackling new initiatives like telehealth adoption in the near term. This could also lead to further delays or downgrading of more complex enterprise imaging platform deals as budgets tighten and other initiatives take precedence.

The pandemic has also spurred some bright-spots for imaging informatics, with strong demand for home-reporting workstations, operational workflow tools (triage, case-load balancing), and specific advanced visualization toolsets for COVID-19 analysis.

Midterm order books remain healthy

Recent financial guidance from healthcare technology vendors has made it very clear a drastic market decline is not expected midterm, with orders merely delayed rather than canceled. This is something echoed across all healthcare markets to some extent from analysis of recent financial investor calls, with vendors reporting healthy order books.

Will a second peak affect the market?

A further unknown on the horizon for most healthcare providers and vendors is the possibility of a second peak of COVID-19 cases. How much of an impact would a second peak have on the market?

There would be only a limited impact for general radiography equipment. System demand for mobile imaging has already been addressed through emergency tenders. Vendors are also prepared for the pandemic to roll on throughout 2020.

Markets are, therefore, only likely to be affected in the case of reverting to more stringent lockdowns, limiting access to hospital sites for installation of equipment, further delaying revenue. However, assuming imaging volumes will return to pre-pandemic levels in the interim, and reserves of critical care equipment will have been met, the impact of a second peak in most markets should be less pronounced than the first wave.

Reshaping of imaging services

The threat of a second wave of COVID-19, pent-up demand for imaging services, and severe budgetary pressure on health systems will reshape how imaging is delivered to patients. While it is too soon to accurately predict how each provider and region will tackle the substantial challenge of returning to pre-pandemic levels, three key areas of change are evident:

Stronger focus on system utilization. With high demand, radiology practices and departments will be pushed to deliver more scans while juggling operational challenges like equipment sterilization between exams. This could lead to the following:

- Review and potential revision of imaging protocols for advanced imaging equipment to lower scan time, potential restriction of specific advanced scan types in order entry;

- Adoption of radiology department analytics and real-time operational tracking software;

- Use of remote fleet-management command center tools, enabling remote administration of modality fleets with fewer or more junior staff;

- Use of virtual waiting rooms limiting patient potential exposure in departments and clinics; and

- Increased use of mobile advanced scanners (e.g., in the back of a truck) to support short-term spikes in demand.

- Imaging service location will be challenged. Patient sentiment over attending routine imaging will be closely tied to the rate of imaging volume recovery. For many, the risks associated with attending imaging at acute hospital sites, while still dealing with patients who have COVID-19, could lead to substantial patient no-shows. To counter this, many healthcare providers will increasingly look to use outpatient imaging centers or near-term mobile imaging solutions, wherever possible. After the substantial drop in imaging volumes, the outpatient imaging sector could also be very different, with rapid consolidation and clustering of imaging facilities and reading groups.

Growing use of different models of teleradiology. Increased comfort with remote working practices, and the need for additional reading capacity, should lead to healthcare providers more aggressively exploring and implementing the use of teleradiology services. While it is early in this progression, the use of teleradiology outsourcing for out-of-hours reading, for specialist consultations, and for periods of internal reading overspill should become more widespread. However, imaging service providers will need to overcome the additional workflow challenges presented by teleradiology use to maximize the efficiency and potential cost savings. Radiologist home-reporting practices are also quite likely to become the new normal, raising long-term questions over healthcare provider bandwidth, security, and virtual peer and patient consultation.

Rohit Sathe

Rohit Sathe

VP, Health Systems,

Philips Indian Subcontinent

The digital transformation wave, which started taking shape in India in 2019, took a major leap in 2020, with the COVID-19 pandemic and subsequent lockdowns enabling further innovation using digital technologies. The same wave also swept across the healthcare industry, particularly the X-ray market with approximately 25 percent dedicated to digitized X-ray segment.

With the increasing burden on healthcare facilities requiring faster and more efficient ways of diagnosis, especially in X-rays, the industry saw a swift move to the digital X-ray technologies, marking a radical transformation from conventional X-ray imaging based on analog and computed technologies. This shift also came in because of the various hygiene protocols adopted by healthcare workers while imaging during the COVID crisis. With digitized X-ray systems in place, the number of sanitization steps are reduced, especially for mobile systems kept in isolation wards.

The X-ray market is also witnessing some path-breaking innovations in the field of artificial intelligence, where several algorithms and programs are being designed to aid the healthcare workers. These technological innovations in X-ray system has helped in streamlining processes at the healthcare institutions with reduction in time (as compared to analog technology, which takes 2 hours to complete and generate a finalized film, the digital scan takes under 10 seconds), quality output, and enhanced patient experience.

As a leading healthcare company, Philips has continuously worked in order to adopt a value-based approach, and providing customers with more seamless and integrated solutions. With solutions like the MobileDiagnost wDR system, Philips is helping radiology departments get one step closer to achieving the quadruple aim – improved outcomes, enhanced patient experience, increased staff satisfaction, and the lowered cost of care delivery.

Double-edged sword for AI adoption

In general, the fundamental drivers of artificial intelligence (AI) adoption look set to remain robust despite the impact of the pandemic; while some deals will have been delayed, we expect the impact to only be short-term. Reduced budgets for AI projects, especially those that are not directly related to COVID-19, such as neurology, liver, prostate, and musculoskeletal applications could likely be felt in 2021, as 2020 revenues will be somewhat supported by projects that were initiated pre-COVID.

Several vendors have rushed to the market with AI-based clinical applications for the triage and diagnosis of COVID-19.

For instance, in June 2020, GE Healthcare, in partnership with South Korean medical AI company Lunit, has released its Thoracic Care Suite, an AI suite designed to ease the workload associated with COVID-19. This eight-algorithm AI suite is designed to quickly analyze chest X-ray findings and flags any abnormalities, such as pneumonia, for further radiologist review. The suite can also pinpoint tuberculosis, lung nodules, atelectasis, calcification, cardiomegaly, fibrosis, mediastinal widening, and pleural effusion detection.

In June 2020, Fujifilm showcased three work-in-progress AI technologies at RSNA 2019. The first automatically identifies pneumothorax, nodules or consolidations in the lung, and generates a heat map overlay showing areas an attending physician or radiologist should look at immediately. This lung-detection app, developed by AI vendor Lunit, will be used on the Fujifilm Aqro system.

As the year progresses, the anticipated backlog of imaging studies will put additional pressure on radiology departments, and this will drive increased interest in AI tools that help to maximize productivity and to prioritize cases. However, the robustness of some of these solutions is questionable. If health providers have a poor experience with these tools, it may set back the more widespread adoption of AI-based clinical applications. This could have a substantial impact on healthcare provider trust in AI solutions and willingness to further invest in innovative AI-based systems in the midterm future.

Greatest risk–emerging growth markets

The rate of imaging market recovery will also occur very differently by geography, creating a further logistical and operational challenge for vendors. For example, markets in Oceania and China are already returning to normal as the pandemic has been contained and restrictions are lifted. The largest markets of North America and Europe are also moving in the right direction, with the initial signs of market recovery apparent in recent weeks. However, given the unprecedented level of financial stimulus, recession, and near-term economic uncertainty facing markets, it is highly unlikely healthcare budgets will emerge unscathed over the next two years. Also, the ongoing risk of a second peak of the pandemic remains an underlying risk.

Most concerning for global market recovery, though, are emerging markets such as Brazil, Mexico, India, and Russia. These countries have become substantial contributors to overall market growth for imaging equipment and services in the last decade, behind only China in terms of growth trajectory, but they are also four of the five worst-affected regions by COVID-19 (along with the US) and have yet to reach the peak of the pandemic. Further, their health systems are generally inadequate to handle the unprecedented stress that COVID-19 places on resources. Experts see the highest risk and volatility in terms of market recovery for these regions, with a real risk of demand plummeting in the second half of 2020 and 2021 as the full force of the pandemic hits.

The impact of COVID-19 on the medical imaging industry has been far-reaching and unprecedented. It is also fraught with further uncertainty and risk. These predictions are based on evidence and research from the initial spread of the virus across global markets. It is almost impossible to forecast even the near-term market impact with any great confidence, such is the volatility and complexity of the global market response to COVID-19.

One thing is for sure though–the market will never be quite the same again.

Outlook

The recent loss of revenue from decreased demand could lead toward more interest in value-priced solutions and retrofit equipment to manage capital outlay. A general trend toward floor-mounted systems, which are priced more cost-effectively than ceiling-mounted systems, could also be accelerated. With increased patient demand, upside scenario would also see substantial investment in replacing aging radiography equipment in the outpatient setting for systems supporting higher patient throughput.

Although market predictions currently come with a higher-than-usual sense of uncertainty in the current climate, the midterm outlook for general radiography market is still promising. General radiography equipment is one of the most-used imaging modalities worldwide; with easing of pandemic measures expected over the next few months, a broad market recovery in the next two years can be expected.

However, with some leading emerging growth markets struggling to contain the pandemic and the threat of a second wave of COVID-19 a possibility, several risks to market recovery still exist.

Second Opinion

The revival, exponential demand, and impact of DR

Dr Mona Bhatia

Director and HOD, Radiodiagnosis & Imaging,

Fortis Escorts Heart Institute, New Delhi

Radiography was losing its shine to more advanced imaging techniques as CT and MRI, but the current pandemic has resulted in a complete reversal of demand and impact. Lungs being the most frequently affected organ in COVID-19, a chest X-ray is currently the most wanted, easily performed, and repeatable study in any hospital/COVID setting. On account of the high infectivity and risk related to COVID-19, there is the parallel demand to prevent cross infection between and among patients and healthcare workers, by ensuring stringent infection control methods, including equipment sanitization, social distancing, personal protective equipment, and strict SOPs to safeguard both patients, personnel, and healthcare workers.

While the yesteryears have seen conventional radiography with cassettes, films, development of images, and printing, the need today is efficient acquisition, automated image generation, fast image transfer, remote interpretation, and guidance to therapy with analysis of disease progression or regression. Digital radiography has made that dream come true, eliminating cassettes, film loading, development, printing, etc., each of which is strewn with potential risks of cross infection. Digital radiography today involves state-of-the-art detectors, electronic digital images, wireless transfer to digital platforms as PACS and hospital information systems, including e-mails to patients, doctors, smart phones, etc., within the gamut of HIPAA compliances, all of which have resulted in tremendous time efficiency. Artificial intelligence software linked to digital images is an added bonus.

The digital radiography machines today are high end in terms of X-ray generators, with improved tube anode heat storage, touchscreen display, and ability to automate exposure. Organ-specific program selection is available with wireless detectors, with high pixel resolution, motorized patient, table, SID, tube, detector tracking, auto alignment, and collimation. These equipment are also safer on account of reduced radiation dose. The workstations enable touchscreen display for stat image acquisition, processing, and viewing.

Digital radiography has the tremendous advantage of being doctor-friendly, with instant images amenable to teleradiology and artificial intelligence; environmentally friendly, with no processing chemicals; economically friendly, with reduced running costs of films, CR cassette replacement susceptible to scratches and tears; and patient-friendly with reduced radiation dosage, stat readouts, and increased patient acceptance to treatment options.

Digital radiography thus provides high-quality imaging, with faster acquisition, high-volume throughput, easy mobility, direct and fast image transfer, faster access of images to doctors and patients, ensuring effective and efficient readouts. Hence, it is safe to assume that the exponential growth digital radiography has seen in this decade will continue with increasing demand and impact.

Advancements, current technology, and trends

Dr Vinod Wadhwani

Sr. Consultant Radiologist,

Vishesh Hospital, Indore

Conventional radiology or X-ray radiography has been the basic mainstay of diagnostic imaging for over a century now, and is an integral part of the radiology department, emergency department, and intensive care units. Advances in imaging acquisition, resolution, transmission, and manipulation through progress in electronics, miniaturization, visualization, and computing power has resulted in making a move from expensive, large, stationary, and complex systems to smaller, easier-to-use, and more accessible devices with higher levels of accuracy, allowing information to be accessed efficiently, while providing higher throughput.

Beginning from the era of conventional film screen radiography to computed radiography (CR systems) and the current era of digital radiography (DR), the X-ray imaging has made a big leap, with digital image acquisition now being the standard for modern equipment, making filmless radiology a reality. The increased dynamic range and image contrast of digital radiography, compared with conventional X-rayfilm-screen combinations and the facility to manipulate signal intensity after image capture reduces the operator dependency and number of repeat exposures, thereby increasing radiographic efficiency and reducing the radiation dose received by patients. Also, providing the radiograph to the patient in digital format is more cost-effective, easy to reproduce in future, and store.

The big dilemma of prospective medical buyers is to opt for the CR versus DR system. The basic difference between a CR and DR system is that computed radiography (CR) cassettes use photo-stimulated luminescence screens to capture the X-ray image that goes into a reader to convert data into a digital image while the digital radiography (DR) systems use active matrix flat panels, consisting of a detection layer deposited over an active matrix array of thin film transistors and photodiodes, which convert the image to digital data in real time, and is available for review within seconds thus providing superior workflow throughput in a busy radiology department, allowing to handle more patients in a given period of time, thus becoming cost effective. The radiology setups and hospitals of metro and Tier-I cities have become the main buyers of DR systems as they have become more affordable and cost-effective through advancements of flat-panel detector technology and DR retrofit solutions. The option of CR system appears to be still viable for the Tier-II/III cities and the rural areas in terms of acceptable image quality, relatively lower price, and patient throughput with the option of upgrading to retrofit DR as and when needed, which offers similar performance to DR system at nearly one-third of the cost. The recent advances with wireless flat-panel detectors have further increased the portability and flexibility of DR systems.

Future panels enabling advanced applications like tomosynthesis and dual-energy imaging and incorporation of artificial intelligence with digital imaging will greatly improve patient care by maximizing imaging efficiency while minimizing radiation exposure and making DR an integral part of radiology departments.