CT Scanners

CT Technology Continues To See Advancements

CT technology will continue to see advancements that quantify and make sense of the data, using them to bring value back to the radiologist, the provider, and the patient.

The healthcare industry has always been prosperous and substantially dependent on product innovation. The CT scanners market is no different, and has tremendous potential across the globe, especially for those vendors who can stay in sync with the latest technologies. According to Transparency Market Research, the global demand for CT scanners is projected to increase at a CAGR of 5.9 percent from 2019 to 2022 to reach a value of USD 6429.8 million by 2022, gaining traction from a number of factors, including increasing preference for minimally invasive diagnostic procedures, improved healthcare infrastructure in various emerging economies, recent product improvements including the advent of portable CT scanners, and escalating geriatric population who require bedside imaging and home healthcare.

The O-arm segment held 60.4 percent revenue share in 2018 and is estimated to dominate the CT scanners market owing to its extensive usage in diagnosis of several chronic conditions. It is widely preferred for assessing pedicle screw position in spine surgeries and kyphoplasty procedures. Moreover, O-arm is a cone-beam imaging system that is highly preferred in minimally invasive vascular surgeries.

The stationary CT scanners market is expected to have 5.4 percent growth during 2019 to 2025 with the adoption of stationary CT scanners in hospitals that carry out large numbers of scans every year. Well-established hospitals find it convenient to assemble stationary CT scanners that have exceptional capacity and efficiency though they occupy larger space. Also, in the developed countries, public hospitals are forced by the regional government authorities to adopt stationary CT scanners as results generated by these scanners are more reliable as compared to portable CT scanners.

| Tier I | Tier II | Others |

|---|---|---|

| GE and Siemens | Phillips | Aarvam, Accuray Incorporated, Anita Medical, Bhram Systems, Blue Star Limited (representing Hitachi), Carestream Health, Electromedicals, Erbis (Toshiba), First Medical, Ives Medical, Komega, Koning Corporation, Neusoft Corporation, Planmed Oy, Samsung Electronics Co., Ltd., Med Rad, Medirays, Medtronic, Naissent Technologies, Sanrad Medical, Schiller, Shimadzu Corporation, Soma Technology, Suzi Medi Equipp, and Trivitron |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian CT scanners market. | ||

| ADI Media Research | ||

Mid-slice segment was globally valued at USD 1.4 billion in 2018, and it is expected to grow considerably with systems that deliver mid-slice assortment of images, enabling efficient surgical treatment. Mid-slice technology includes scanners with 16–40 slices that possess considerable diagnostic accuracy with minimum exposure to radiation that substantially boosts its adoption. Moreover, frequent launch and approval of advanced CT scanners that deliver mid-slice range fuel segment growth.

Indian market dynamics

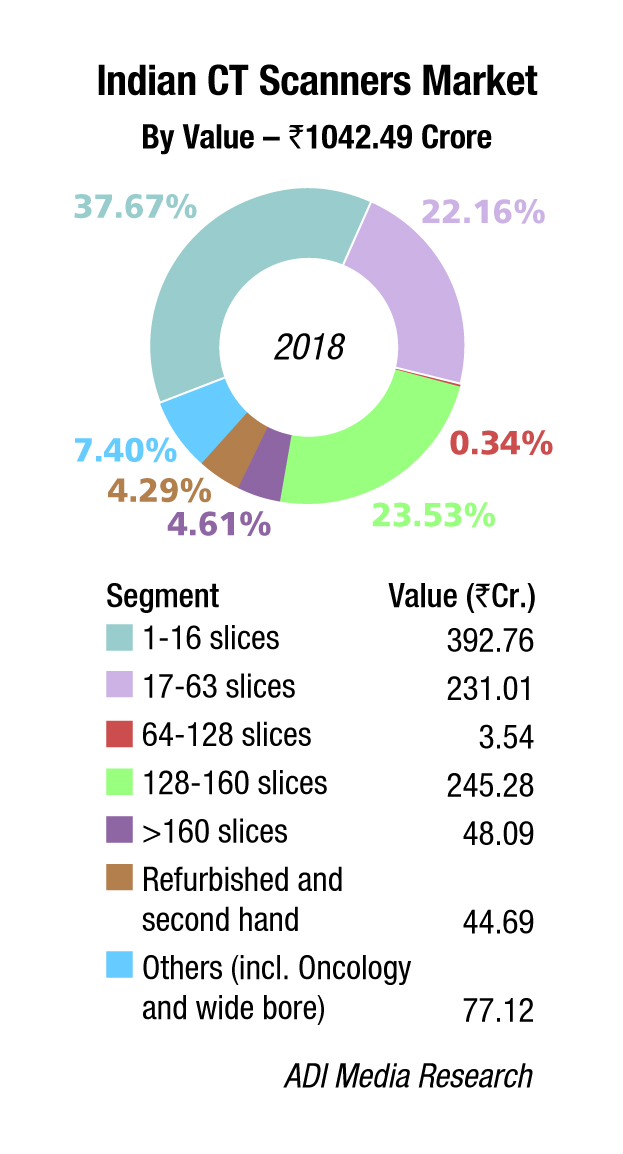

The Indian CT scanners market in 2018 is estimated at Rs 1042.49 crore, translating to 755 units in quantity terms. The 1–16 slices category dominated with a 38-percent market share. The other popular categories were 17–63 slices and 128–160 slices at a 23-percent share each. Refurbished machines continued to take a hit and were a mere 4-percent share in 2018. A large vendor as Cura is no longer aggressive. Sanrad too faced a major decline in demand. With the government directive that machines older than ten years will have to be retired has impacted sales. The market is dominated by GE and Siemens, with Philips a close third. The year 2019 may show a de-growth. 1H2019 had sales of 295 units, valued at Rs 369.34 crore as against 755 units, valued at Rs 524.29 crore in 1H2018, a 37-percent decline in value terms. One of the major contributors in 2018 had been a 22 units order received by GE from HLL. The government procurement was low as it was an election year, and buying decisions were in limbo in some states. The creeping in of recession, and MRI gradually being the preferred modality, may have contributed to the downward trend too.

The year 2019 may show a de-growth. 1H2019 had sales of 295 units, valued at Rs 369.34 crore as against 755 units, valued at Rs 524.29 crore in 1H2018, a 37-percent decline in value terms. One of the major contributors in 2018 had been a 22 units order received by GE from HLL. The government procurement was low as it was an election year, and buying decisions were in limbo in some states. The creeping in of recession, and MRI gradually being the preferred modality, may have contributed to the downward trend too.

Research Update

Machine learning has the potential to vastly advance medical imaging, particularly CT scanning, by reducing radiation exposure and improving image quality. The research findings were recently published in Nature Machine Intelligence by engineers at Rensselaer Polytechnic Institute and radiologists at Massachusetts General Hospital and at Harvard Medical School.

According to the research team, the results published in the journal make a strong case for harnessing the power of artificial intelligence (AI) to improve low-dose CT scans. Low-dose CT imaging techniques have been a significant focus over the past several years in an effort to alleviate concerns about patient exposure to X-ray radiation associated with widely used CT scans. However, decreasing radiation can decrease image quality. To solve that, engineers worldwide have designed iterative reconstruction techniques to help sift through and remove interferences from CT images. The problem is that those algorithms sometimes remove useful information or falsely alter the image.

Researchers found that their deep learning method is also much quicker and allows the radiologists to fine-tune the images according to clinical requirements. These positive results were realized without access to the original, or raw, data from all the CT scanners. And if original CT data is made available, a more specialized deep learning algorithm should perform even better.

Outlook

Looking forward to the future of CT, radiologists should expect to see faster, more automated, and easier-to-use scanners. The technology will transition from a good interpretation tool to a machine with more quantification and a speedy and direct diagnosis.

One of the biggest changes will be driven by AI/computer-aided design and expanded analytics. Healthcare is in a place where there is an influx of data, but its power has yet to be harnessed. CT technology will continue to see advancements that quantify and make sense of these data – using them to bring value back to the radiologist, the provider, and the patient.