Defibrilators

Defibrillators on an ongoing refinement path

Despite four decades of continual design improvements and upgrades, defibrillators continue to evolve and current research is ongoing to refine the ever expanding indications for their use. With time these devices will become even more cost effective and safer.

As technology continues to advance and accelerate, defibrillator technology is heading to a new level. Based upon the incredibly short lifespan of the technology as a whole and the rapid advancements the world has already seen, the possibilities are endless.

Indian market dynamics

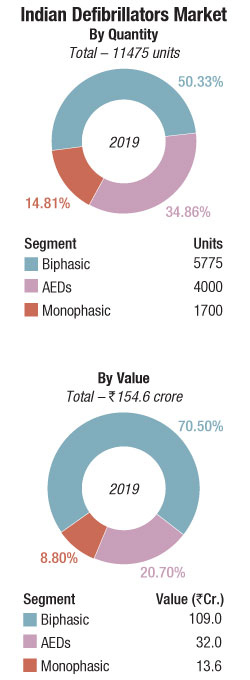

The Indian defibrillators market in 2019 is estimated at Rs 154.56 crore, and 11475 units. Biphasic defibrillators, at a 70 percent market share by value are the mainstay. Monophasic at best are a stagnant segment, bought mainly by small nursing homes and in smaller cities. The AEDs are not yet taken as seriously as must be in a 1.4 billion population size. Accessories to record some parameters as ECG, SpO2, CO2, and NIBP may be added on to the system, as may CPRs, that are accessorised with biphasic models, often for the ambulances, and are retailed in the vicinity of Rs 60,000-100,000 per unit.

In 2019, both biphasic and AEDs saw a 5-7 percent growth each with HLL, state hospitals, and DGMS being the main buyers. With the lockdown announced mid-March 2020, and most public places as cinema halls, restaurants, airports, railway stations shut, there was barely any demand for AEDs.

Some hospitals have bought defibrillators for their COVID wards, including AIIMS at Nagpur and Rishikesh and a couple of them in the West Bengal state.

The Chinese imports have also suffered this year, with the China-India border clash followed by the revival of the Quadrilateral Security Dialogue, when the four democracies, India, Australia, US, and Japan originally got together to check China’s ambitions in the Indo-Pacific region and beyond. It gained strength with the US banning Chinese suppliers, for instance Huawei in the telecom segment, and the Atmanirbhar Bharat initiative being pushed by the government.

Since the pandemic, the CPRs are being preferred as a major form of resuscitation, a technology that allows chest compressions to continue during ECG analysis, helping to increase hands-on time and reduce the longest pauses in CPR, which can improve survival outcomes. A child mode button reduces defibrillation energy for paediatric patients using the same electrodes, and an optional bilingual feature enables the rescuer to toggle to a second pre-set language. Using Wi-Fi connectivity, the self-monitoring CPR connects to an AED program manager to enable an organization’s AED manager to remotely monitor and manage device readiness issues such as low battery or expired electrodes. This helps ensure the device is always ready to use when needed. When connected to Wi-Fi, the machine also reports when a device is being used and pads have been placed on the victim by transmitting near real-time email alerts. One of the most popular models in this segment is the Lifepak CR2 from Stryker.

Global market

The global defibrillators market is projected to reach USD 11.7 billion by 2025 from USD 9.6 billion in 2019, at a CAGR of 3.4 percent, predicts ResearchAndMarkets. Growing focus toward public access defibrillator (PAD) by the public and private organizations has fueled market growth.

Indian Defibrillators Market |

|

|---|---|

Leading players-2019 |

|

| Segment | Brand |

| Monophasic | BPL, UNI-EM, and Schiller |

| Biphasic | Premium segment: Stryker (Physio-Control), Medtronic, and Zoll |

| Mid-end segment: Philips, Nihon Kohden, Schiller, Mindray, GE, Stryker, and Zoll; Mediana, Beijing M&B, and BPL | |

| AEDs | Stryker (Physio-Control), Cardiac Sciences, Schiller, Nihon Kohden, Philips, PRIMEDIC, Zoll, and Beijing M&B |

| ADI Media Research | |

Moreover, advanced defibrillator devices, rapidly growing geriatric population with elevated risk of targeted diseases, and increasing incidence of cardiac diseases among all ages are further driving the market growth.

However, product failures and recalls, increasing pricing pressure on players and lack of awareness about sudden cardiac arrest (SCA) are restraining the growth of this market.

The implantable cardioverter defibrillators (ICDs) shared the largest part of the global defibrillators market in the year 2019. Factors such as the development of technologically advanced devices with extended longevity, rapid growth in the number of implant procedures, and increasing adoption of cardiac resynchronization therapy defibrillators (CRT-Ds) and S-ICD systems across the globe are contributing to the large share of this segment.

Promoting the innovation of the next-generation external defibrillators to improve safety and effectiveness, enhancing the ability of industry, identifying and addressing problems associated with devices by the FDA, and focusing on the SCA are anticipated to create lucrative opportunities. SCA is the leading cause of death globally, which is a life-threatening condition. It can be treated successfully by early intervention of the disease with defibrillation at the right time.

Promoting the innovation of the next-generation external defibrillators to improve safety and effectiveness, enhancing the ability of industry, identifying and addressing problems associated with devices by the FDA, and focusing on the SCA are anticipated to create lucrative opportunities. SCA is the leading cause of death globally, which is a life-threatening condition. It can be treated successfully by early intervention of the disease with defibrillation at the right time.

The global external defibrillators market is dominated by automated external defibrillators (AEDs) and expected to grow with highest rate in future with increase in adoption by heart failure patients across the globe. The growing incidence of cardiovascular diseases and growing awareness regarding the lifesaving potential of AEDs have fueled the market growth. The second-largest market of external defibrillators is covered by manual external defibrillators followed by wearable external defibrillators.

In 2019, North America accounted for the largest share of the market. The rising geriatric population, increasing incidence of cardiac diseases, and technological advancements are the major factors driving the growth of the market in North America.

Some of the major players operating in the defibrillator market, which are extensively involved in the development of AEDs, include Stryker Corporation, Zoll Medical Corporation, Koniklijke Philips N.V., and Nihon Kohden Corporation. Other players include Schiller AG, Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Mediana Co. Ltd., Opto Circuits Limited, and CU Medical System Inc.

Technology trends

There have been several recent advancements in implantable cardioverter defibrillator (ICD) technology to extend battery life, improvements in patient monitoring to avoid needless shocks, the introduction of quadripolar lead devices to improve device programming and to improve therapy effectiveness, and development of magnetic resonance imaging (MRI)-safe ICDs. Several newer ICDs offer pacing functions, and many vendors offer wireless remote monitoring/interrogation of the device data with bedside sending units so patients do not need to come in for regular office visits.

As major improvements over the early devices, the second generation ICDs were designed to detect ventricular arrhythmias (VA) using a probability density parameter based on the concept that, unlike sinus rhythm, ventricular fibrillation did not maintain an isoelectric baseline. This enabled bradycardia pacing ability and they were minimally programmable. This ended the need for separate pacemakers.

The second generation ICDs could do away with thoracotomy by the introduction of transvenous leads in 1988, which enabled the implantation procedure to be performed in an electrophysiology laboratory rather than open surgery. Furthermore, these devices possessed limited telemetry function to test battery strength, for which an external monitoring device was needed. Cylindrical aluminium electrolytic capacitors and silver vanadium pentoxide batteries of the first generation ICDs were replaced by lithium-silver vanadium manganese oxide batteries, which resulted in longer life of ICDs.

Amit Tickoo

General Manager-Cardiology/Respiratory Sales,

Schiller India

“COVID -19 has created many shifts in the way we perceive emergency care today. Given the current situation, the mechanical CPR device has emerged as one of the most important devices for rescuing a patient. During an emergency, when a patient requires CPR; a manual CPR may not be possible. This is where a mechanical CPR device can perform effective resuscitation consistently while maintaining distance from the patient”.

The first third generation ICDs were introduced in the early 1990s. Anti-tachycardia pacing (ATP), low energy shocks for terminating VTs, high level of programmability and telemetry functions were the key upgrades. To improve specificity in discriminating between VT or supraventricular tachycardia, various algorithms were developed. ICDs could be programmed into three different cycle length-related zones and the discriminative detection algorithms programmable in the two lowest zones. The highest programmable zone is meant for detection of fast VT or VF without any further discrimination to avoid unnecessary delay of delivery of therapy. Additionally, improvements were made in lead construction.

The coaxial lead design of the first and second generation ICDs was replaced with the multi-lumen lead design in third generation ICDs. The coaxial lead had a layered design comprising a tip conductor, ring conductor, defibrillation conductor and an insulation layer between each conductor. The multi-lumen lead construction is based on parallel running conductors through a single insulating body.

The key advantage of multi-lumen over coaxial leads is the fact that more conductors would fit into overall smaller leads. The tip and ring conductors are used for pacing and sensing, a defibrillation conductor for the coil located in the right ventricle and a defibrillation conductor for the coil located in the superior vena cava. The insulating body contains extra lumens to increase the lead’s resistance to compression forces.

ICDs of today or the fourth generation ICDs have progressively become smaller and more sophisticated. They weigh not more than 80–90 g and have a volume of 30 ml, measuring less than a centimeter in thickness. Newer lithium silver vanadium batteries now last up to 9 years. All modern ICDs carry the ability of overdrive pacing, i.e. ATP, which can often terminate VTs without resorting to shock therapy.

In addition, ICDs are also available with biventricular pacing (cardiac resynchronization therapy) to improve symptoms in patients with advanced cardiac failure.

ICDs will continue to evolve, become smaller, equipped with more advanced detection algorithms to treat life-threatening arrhythmias. In the future, the potential integration of S-ICDs with leadless pacing may make this therapy suitable for a larger target population at high risk of SCD. Moreover, if the leadless pacemaker is epicardial, left atrial and left ventricular pacing can be introduced and linked to S-ICD; alternatively application of a left ventricular seed would permit resynchronization. S-ICDs may also serve as a remote monitoring device to recognize atrial fibrillation, acute ischemia, or electrolyte imbalance.

New ICD and CRT-D devices such as Abbott’s Gallant have received the CE mark in February 2020. This system, for instance, pairs with the secure myMerlinPulse mobile app to help streamline communication and increase engagement between doctors and their patients. This sort of app-based ICD system, which would allow patients to engage more frequently with their healthcare team by providing access to transmission history and device performance and schedule their appointments could be the immediate future of ICDs.

Application and refinements of global positioning systems (GPS) may allow remote monitoring and programming of pacemakers wherever patients are on the planet. Furthermore, these developments are ideal in rural and inaccessible areas. Incorporation of advanced technologies such as artificial intelligence (AI) in CRM devices will further help patients monitor their cardiac health by notifying them and their physicians in case of abnormal activity. These cutting edge technologies come with cybersecurity threats and would therefore require the latest cybersecurity controls and partnering with industry cybersecurity experts to provide input into the design and testing of these controls to provide a seamless and a secure experience.

Way forward

Defibrillators have come a long way since their first implantation in humans in 1980, firmly cementing their place in preventing SCD. Despite four decades of continual design improvements and upgrades, defibrillators continue to evolve and current research is ongoing to refine the ever expanding indications for their use. With time, it is hoped that these devices will become more cost effective and safer.