Industry

Device makers buy big

Whether sitting on a pile of cash or guarding against growing pressures, acquisitions are the answer.

After a pause, device makers are buyers again, mostly thanks to either stockpiles of Covid cash or, among the less fortunate, a pressing need to build scale during a difficult time. Acquisitions of MedTech companies worth a total of USD 67.2 billion were closed in the medical device sector last year, the highest figure since 2017.

And while the sector saw only 10 acquisitions worth more than USD 1 billion – three fewer than in pre-pandemic 2019 – the relatively low number of deals closed last year means the average price paid is higher than ever, at USD 1.12 billion.

Since this analysis tracks the closing of deals rather than their announcement, many date from 2020 and the height of the first wave of the pandemic, underlining the remarkable nature of this resurgence. The dataset encompasses MedTechs buying other MedTechs; it does not include deals done by drug developers or blank-check companies.

Siemens Healthineers, which closed the biggest deal of 2021, is these days in the Covid cash category, having done extraordinarily well thanks to its pioneering tests for the coronavirus. But its USD 16-billion bid for the imaging company Varian predates this success; when the deal was announced in the summer of 2020 the German group was hurt from the cancellation and postponement of non-urgent imaging procedures.

The deal was, therefore, a defensive move to shore up revenues by buying a group whose cancer-treatment tech was used in procedures not so easily deferred.

Another strong trend across 2020 and 2021 was a clear shift into digital and remote technologies. Baxter spent USD 11 billion on Hillrom, largely for the latter’s connected care systems, which include electronic health records, communication systems, and wireless patient monitors, as well as the software to link them.

Philips bought Biotelemetry for very similar capabilities. The group not only made arrhythmia-detecting wearable heart monitors and the software that connects them, but also a wider platform to integrate data from other sources and oversee data analytics and billing for healthcare services.

Another major issue, and possibly a worrying one, was the dearth of smaller deals. Just 18 acquisitions worth less than USD 100 million were closed last year, fewer even than in sluggish 2020. Start-ups rely on the prospect of takeovers to lure venture investors; if MedTechs in this size bracket are not being bought, the knock-on effects for younger groups in need of growth capital could be severe.

For deals that exemplify the spending of Covid testing revenues look no further than Hologic. The diagnostics group made around USD 2.4 billion from its Covid assays, instruments, and collection kits across its fiscal 2021, which ended on September 25. It was able to use this windfall to close five acquisitions in 2021, the largest of which was that of Mobidiag for USD 795 million.

Plenty of other groups whose coffers have been swollen with coronavirus-related revenues have signed deals, of course – those deals simply have not closed yet, and so will feature in future analyses. Roche’s USD 1.8 billion-acquisition of Genmark Diagnostics is one, as is Quidel’s recently announced USD 6 billion takeover of Ortho Clinical Diagnostics. This trend is not even close to finished.

And the wave of spin-outs, sweeping the industry, will also free up capital and create smaller, more adroit groups, capable of more focused deal making. Expect to see purchases by the newly independent GE Healthcare and Zimvie, the spine and dental company soon to emerge from Zimmer Biomet, in the coming year.

With mergers worth more than USD 22 billion currently awaiting close, and plenty of big MedTechs sitting on Covid-based fortunes, the sector could make another very strong showing in 2022.

|

Top 5 M&A deals closed in 2021 |

||||

| Completion date | Acquirer | Target | Value (USD bn) |

M&A focus |

| Apr 15 | Siemens Healthineers | Varian Medical Systems | 16.4 | Radiotherapy |

| Dec 13 | Baxter International | Hillrom | 10.5 | General hospital & healthcare supply, in vitro diagnostics, patient monitoring |

| Aug 18 | Illumina | Grail | 8.0 | In vitro diagnostics |

| Jun 2 | Steris | Cantel Medical | 4.6 | Endoscopy, general & plastic surgery, nephrology |

| Feb 9 | Philips | Biotelemetry | 2.8 | Patient monitoring |

MedTech scores its biggest-ever venture haul

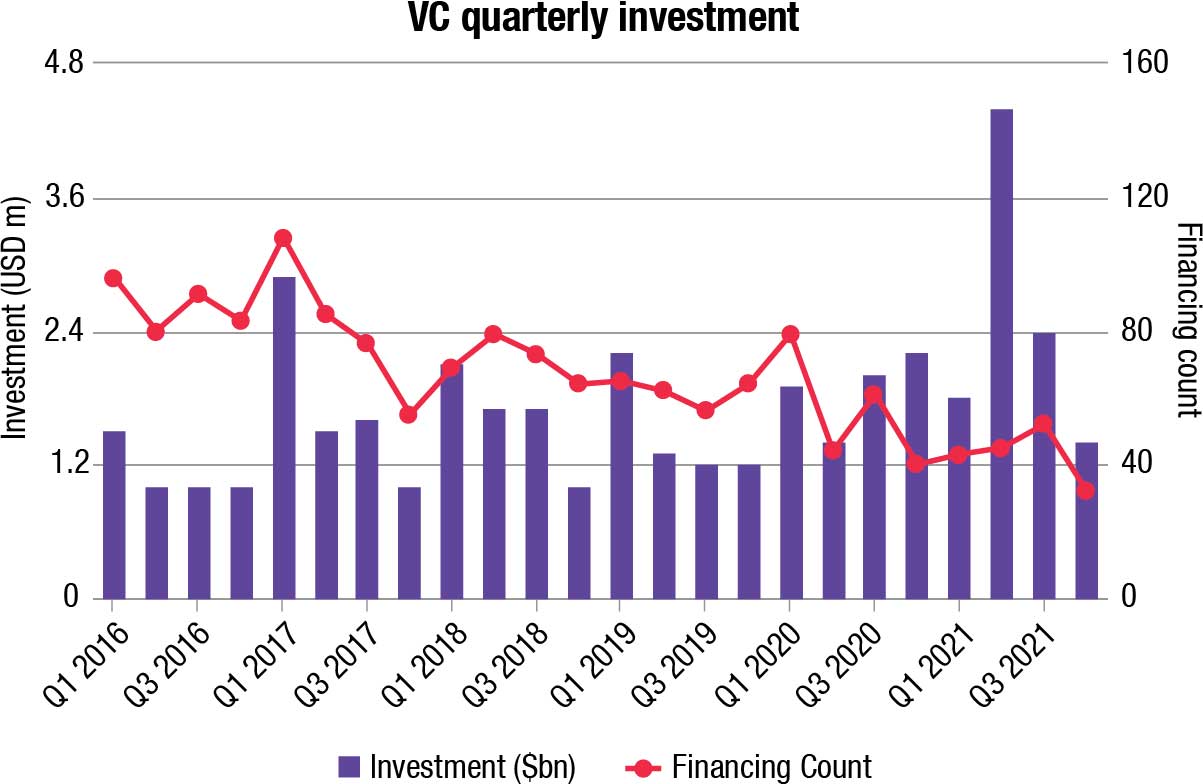

Medical device companies have just concluded a storming year for both acquisitions and flotations, and that means venture backers felt justified in ploughing their cash into the sector. They have done so in a big way – MedTech has had its strongest-ever year for venture financing, with a total haul of USD 9.9 billion.

Diagnostics developers have done best over the year, with liquid biopsy and Covid test makers represented in the top 10. The cancer-testing company Caris Life Sciences, which employs the investor catnip of artificial intelligence (AI) in its technology, raised the greatest single deal of the year with a USD 830-million infusion in May. Unusually, the second spot is taken by a UK company. The robotic surgery group CMR Surgical closed a USD 600 million series D round in June, and this in combination with Caris’s deal helped the second quarter of 2021 to a new record.

The second quarter of 2021 was the largest since Evaluate MedTech’s records began, its USD 4.4 billion total smashing the USD 2.9 billion taken in the first period of 2017.

Diagnostics companies are also strongly represented among the top 10 – and many are liquid biopsy developers, with Caris, Freenome, and Intervenn all working in this area. The others offer Covid tests or testing services.

It seems that nearly two years after the coronavirus emerged, VCs still see test makers as promising investment prospects. Those that backed Cue Health were arguably correct – the group went public in September, though its stock has done poorly since.

The pandemic is also a likely driver of the funding rounds closed by Kry and Quanta. Kry, which operates in the UK and France under the name of Livi, provides video-consultation technology to connect patients with healthcare professionals, and Quanta makes home-based dialysis machines.

In some ways, there are encouraging signs that cash is being spread around to a greater degree than in prior years. The top 10 rounds made up just 31 percent of the total VC haul, a relatively low proportion, and the year’s largest round is smaller than in either 2019 or 2020.

That said, the number of rounds closed has fallen once again. This number has been shrinking year-on-year since 2013, a downward trend that shows no signs of reversing.

|

Top 10 VC rounds of 2021 |

||||

| Date | Company |

Investment |

Round | Focus |

| May 11 | Caris Life Sciences | 830 | Undisclosed | In vitro diagnostics |

| Jun 27 | CMR Surgical | 600 | Series D | Robotic surgery |

| Apr 27 | Livi/Kry | 316 | Series D | Telehealth |

| Dec 07 | Freenome | 300 | Series D | In vitro diagnostics |

| Jun 29 | Element Biosciences | 276 | Series C | In vitro diagnostics |

| Jul 15 | Imperative Care | 260 | Series D | Cardiovascular |

| Jun 23 | Quanta | 245 | Series D | Home dialysis |

| May 13 | Cue Health | 235 | Series D | In vitro diagnostics |

| Jul 29 | Exo | 220 | Series C | Diagnostic imaging |

| Aug 02 | Intervenn Biosciences | 201 | Series C | In vitro diagnostics |

| Jan 04 | Color | 167 | Series D | In vitro diagnostics |

Medical device groups float, then sink

Last year was a tricky one on the public markets, but this did nothing to discourage private medical device developers from venturing into the choppy waters. In 2021, over USD 5.5 billion was raised across 28 deals, as companies sought capital from investors still eager to back healthcare – and particularly diagnostics – groups.

But there were limits to shareholders’ ardor. Many of the companies that went public last year had to accept lower valuations to get away, while more than two-thirds of them had seen their share price decline by the end of the year.

Despite these risks, this strategy paid off in spades for some groups. The most remarkable case was that of Ortho Clinical Diagnostics, whose listing by its private equity owners in January was 2021’s biggest at USD 1.5 billion. Ortho Clinical was public for less than a year, however, before being snapped up by Quidel for a startling USD 6 billion.

Apria, too, was bought less than a year after its IPO, by the hospital equipment supplier Owens & Minor for USD 1.5 billion. Its flotation in February raised USD 150 million, putting it just outside the top 10, and by the end of 2021 its stock was up 63 percent, the second highest rise of 2021.

The deal also shows that the vogue for buying developers of remote internet-enabled technologies is continuing into this year. The preponderance of diagnostics companies in the top 10 is a reflection of the broad popularity of this sub-segment with investors of all kinds. Six of the top 10 venture rounds last year went to test companies, for instance.

The other clear message to come out of 2021’s data is that the US is still seen as the land of opportunity. With two exceptions – Oxford Nanopore’s flotation in London and Affluent Medical’s €33-million (USD 30 million) listing on the Euronext Paris – all last year’s IPOs – occurred in New York.

Cutting the data by quarter shows the action reaching fever pitch in the third period, with 12 deals raising USD 1.9 billion. The graph above does not include IPOs worth more than USD 1 billion, since they tend to distort the picture of underlying market trends. Without these megadeals, 2021 was the strongest year for total dollars raised since Vantage began tracking MedTech IPOs in 2013.

Huge IPOs are still coming, however. In mid-January this year, eye care group Bausch & Lomb filed with the SEC for an offering to raise USD 100 million – but this is surely a placeholder amount for a deal some industry experts estimate could raise up to USD 3 billion. The company is being spun out by its owner, Bausch Health, and if a buyer does not emerge in the meantime, this seems likely to be the biggest IPO of 2022.

|

The 10 biggest MedTech IPOs of 2021 |

|||||

| Date | Company | Focus | Amount raised (USD m) | Premium/discount | Share price change to Dec 31 |

| Jan 28 | Ortho Clinical Diagnostics | In vitro diagnostics | 1,486 | (21%) | 26% |

| Feb 11 | Signify Health | Healthcare IT | 649 | 17% | (41%) |

| Sep 30 | Oxford Nanopore Technologies | In vitro diagnostics | 442 | 3% | 64% |

| May 27 | Singular Genomics Systems | In vitro diagnostics | 258 | 5% | (47%) |

| Feb 11 | Talis Biomedical | In vitro diagnostics | 254 | 7% | (9%) |

| Jul 15 | Sight Sciences | Ophthalmics | 240 | 2% | (27%) |

| Jul 23 | Sophia Genetics | Healthcare IT | 235 | 0% | (22%) |

| Sep 25 | Cue Health | In vitro diagnostics | 200 | 0% | (16%) |

| Feb 5 | Lucira Health | In vitro diagnostics | 176 | 6% | 10% |

| Sep 15 | Procept Biorobotics | Urology | 164 | 9% | 0% |

| Jul 15 | Rapid Micro Biosystems | In vitro diagnostics | 158 | 5% | (47%) |

| All listings on Nasdaq, except Signify on the NYSE and Oxford Nanopore on the LSE. | |||||

Device approval times lengthen

With 32 high-risk innovative medical devices approved in 2021, the picture for companies trying to bring new products to the US market is acceptable – by the end of the year, the overall number of approvals was only one shy of 2020’s total.

In terms of review times, however, the agency has slowed down. Compared with 2020, it took around a month longer, on average, to examine the submissions for the approved devices. This is perhaps understandable – in a blog post toward the end of December, Jeff Shuren and William Maisel of the FDA’s devices section said that a sustained high volume of filings was straining the center’s resources.

While the number of premarket approvals – the regulatory path that must be taken by high-risk devices – fell slightly from 2020’s total, this was balanced by a year-on-year increase in the number of low-risk products cleared for sale via the de novo clearance route.

This analysis considers first-time premarket approvals, humanitarian device exemptions and de novo 510(k) clearances. Standard 510(k)s and supplemental approvals are not covered.

According to the FDA Voices blog post, the FDA’s Center for Devices and Radiological Health has issued emergency-use authorization to over 1900 medical devices for Covid, and continues to receive more than 100 EUA requests per month. On top of this, the number of conventional submissions – PMAs and 510(k)s, including de novos, supplemental approvals, and pre-submissions – increased for the second consecutive year, reaching almost 18,000 last year.

With all this going on, it is hardly surprising that the agency’s timelines have slipped slightly. It should be stressed that the timings listed are based solely on successful filings; the FDA does not make available the review times for rejected submissions.

One notable feature of last year’s approvals is the dearth of diagnostics, the result of a deliberate strategy by the agency to prioritize Covid tests, companion diagnostics, breakthrough devices, or assays with a significant public health impact.

From 2011 to 2019, an average of 28 percent of device approvals awarded by the FDA were for in vitro tests of one kind or another. In 2020, this ballooned to 49 percent, as tests for cancer and infectious diseases were prioritized. This figure did not include Covid tests, since all those that reached the US in 2020 did so under emergency authorization.

Last year, however, saw a sharp pullback, with just 11 assays approved or cleared – 18 percent of the total. Non-Covid IVD approval times also extended, to an average of more than 15 months last year, versus an average of 10.5 months for the prior decade.

A bad year to be an American MedTech

With better availability of rapid Covid tests, often free of charge, and more centralized healthcare systems overseeing vaccination efforts, European countries have arguably been better able to manage the effects of the pandemic than the US. Perhaps this is why nearly all the big-cap groups that enjoyed the biggest increases in valuation last year were listed in Europe, and nearly all the fallers listed in New York.

Better investor confidence in Europe seems the likeliest explanation for the Swedish group Getinge having more than doubled in value while Teleflex, a US company that plays in similar hospital supply and cardiology areas, experienced a 20-percent share price fall.

The medical device indices back this interpretation, the Stoxx Europe 600 healthcare index having outpaced the Dow Jones US medical equipment basket. That said, these do not track precisely with big-cap companies – the Dow Jones index, for example, tracks 65 US-listed groups with a median market cap of USD 4.3 billion.

As the Omicron variant threatens to overwhelm hospitals, despite its apparently milder symptoms, a hospital-equipment manufacturer rules the roost. Sweden’s Getinge, which sells acute care products used in the ICU, as well as cardiac, vascular, and pulmonary devices, more than doubled in value across last year. The remaining risers are in disparate sectors – dental, cardiovascular, diagnostics, and hearing – but all but Penumbra are hosted on European exchanges. The converse is seen with the fallers. Only one, Philips, has a European berth. This group had a disastrous year, and arguably did well to get away with a loss of just a quarter of its value.

Other fallers are US-based, and have perhaps suffered excessively harsh punishment. The digital health behemoth Teladoc led the risers at the end of 2020 as lock-down users flocked to its virtual healthcare tech. As restrictions eased in 2021, it has been unable to maintain the same growth, and skittish investors deserted.

The mid-caps – those whose market cap sits beneath USD 10 billion but above USD 2.5 billion – were led by diagnostics group Fulgent Genetics, which nearly doubled in value. Fulgent’s 93-percent growth came partly as a result of its Covid tests; its PCR assay was authorized in the US in May 2020, and the cash this generated enabled the company to triple in size across 2020.

Insulin pump developers did well, with Tandem and Ypsomed among the five biggest mid-cap risers. The former rose steadily across the year as sales of its insulin pumps picked up as lockdowns were lifted. It also benefited late in the year from the ongoing quality-control nightmare at Medtronic’s diabetes pump manufacturing site.

Another diabetes player, Senseonics, also rose significantly. The company makes Eversense, a tiny blood-glucose monitor that is implanted in a patient’s upper arm and works for either three or six months. Senseonics had a rotten 2019 and a lackluster 2020, but came roaring back in early 2021 as a distribution agreement with Ascensia began to bear fruit.

Overall, 2021 was a relatively staid year for small- and mid-cap device makers, with the huge gains of 2020 nowhere to be seen. Perhaps sentiment will pick up in 2022.

Evaluate Vantage.