Reports

Digital pathology investment matures, VCs get selective, Signify Research

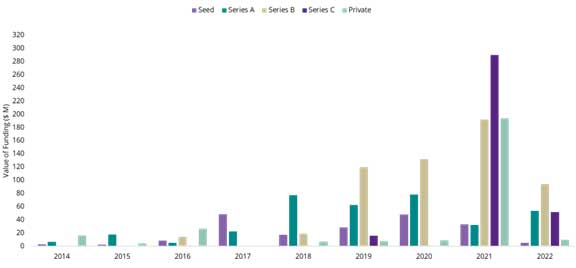

Investment for companies developing digital pathology solutions has spiked to more than $1.7B since 2014, with 42.4% of this total funding ($741.8M) raised during 2021. Only 12.3% was contributed the following year, signalling a marked slowdown and potential tough times ahead. Investors have not completely turned off the taps however, instead turning their focus towards mean-tested software companies with demonstrated commercial traction.

This analysis covers the period 2014-2022 and offers insights into:

- The total funding and number of deals for digital pathology vendors by quarter.

- The type of investments raised.

- The average amount raised per round.

- The distribution of funding regionally and by individual company.

- The total investment vendor type (target market, product type).

In brief

Funding for digital pathology companies has reached over $1,755.6M since 2014, however the majority (42.4% of this) was raised during 2021. This post-pandemic period reflected a time of renewed interest and adoption in the market, for both clinical and research use-cases. Positive developments from both regulatory bodies and key institutions framed digital pathology as a rapidly growing market that had finally started to mature – an easy win.

However, sentiment from investors rapidly shifted as economic and political conditions saw backers pivot strategies to a much more conservative approach in 2022. Consequently, funding reached only 29.0% of the previous year’s total (see Figure 1).

Figure 1: The digital pathology VC funding market 2014-2022 by stage

Impact on the wider market

Moving forward, we expect this conservative strategy to remain, and for there to be some consolidation as AI-start-ups in particular struggle to achieve financial targets. Since the beginning of the year, two companies have already been cannibalised by larger competitors, as Clarapath announced it had acquired Crossscope this month, and Tribun Health also quietly acquiring Keeneye in January.

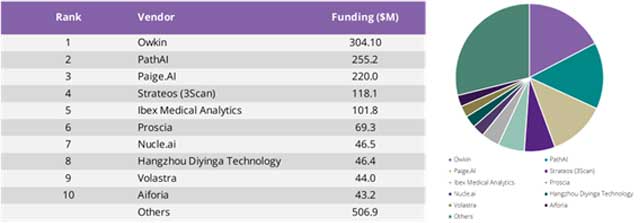

It should also be noted that although 2021 was a fantastic year for investment, most digital pathology funding remains heavily consolidated around three companies: Owkin, PathAI and Paige.ai. These three account for 44.4%% of the total, see Figure 2.

Figure 2: VC funding for digital pathology 2014-2022 by vendor

Spotlight on 2022

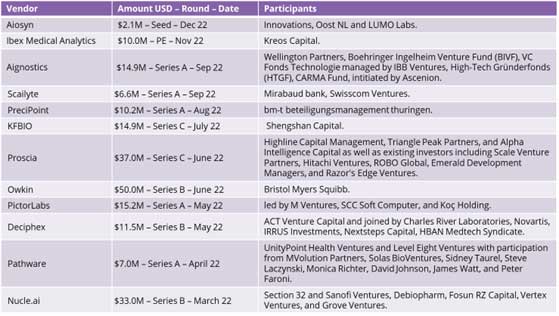

Of the fewer public rounds in 2022, vendors like Aignostics, Deciphex, Nucle.ai and Owkin certainly standout as having secured notable pharmaceutical investments, signalling proficiency in research and companion diagnostics development. This is particularly impressive for Aignostics, which was one of the few below to be raising a Series A.

Table 1: Digital pathology funding rounds during 2022

Proscia was another vendor able to secure funding, after first raising eyebrows through its partnership with healthcare giant Siemens Healthineers in early 2022. Its series C round of investment, worth $37.0M, will enable the company to scale its business globally.

The relatively lesser known PictorLabs was also able to scale to Series A investment in 2022. Most notably, some of this investment originated from SCC Soft Computers, a clinical Laboratory Information Systems (LIS) vendor operating based in the US. Investment and activity in digital pathology from LIS was relatively overshadowed last year as enterprise imaging partnerships took centre stage though this recent move indicates that LIS still has some influence to exert on digital pathology adoption.

Positively, since the beginning of 2023, investment has not slowed to a halt, with vendors like Qritive announcing completed rounds in January.

Paige.ai’s most recent round, although not included in the analysis as financial details were not publicly disclosed, also recently secured investment from Microsoft. The round was notable not just because of the technology giant’s name, but also because Microsoft has also arguably been quieter in this area than in other sectors such as medical imaging; this also pitches Microsoft as competition to vendors like Dell, which play an active part in shaping digital pathology thought leadership.

In conclusion, after an abundance of capital was made available for digital pathology start-ups throughout 2021, investment went on to drop dramatically in 2022 – lack of venture capital does not mean that the market is not progressing however.

As our analysis shows, investment is now beginning to turn towards more mature and “market-tested” solutions, with a preference for AI orientated businesses that can help the digital pathology market take the next leap in adoption.

Whilst the year ahead is expected to be tough, with a number of new entrants from aligning technology markets with bigger budgets also expected to shake up competitive dynamics, prospects for the future of digital pathology adoption remain as high as ever. CPT codes, FDA approvals and continued RFPs in the digital pathology domain means that it’s not a case of if, but when. Signify Research