MB Stories

Embracing technology to remain competitive

During the COVID-19 pandemic, the IVD market received major impetus. The pandemic dramatically shaped the market, driving growth for some IVD tests, while suppressing demand for others. IVD tests for cancer and infectious disease detection, transplant success, and pharmaceutical selection have added value to healthcare and improved clinical outcomes. Genetic tests for rare diseases and prenatal assessment are increasingly being resorted to. COVID-19 pandemic has brought to the fore how important in vitro testing is, in a way that could not be imagined a year back.

The outbreak of the pandemic impelled the diagnostics industry into action, with a race to develop novel and rapid diagnostics kits for the detection of coronavirus. A majority of the tests have been approved under Emergency Use Authorization (EUA) by federal agencies. Major assays used for COVID-19 detection employ the RT-PCR technique. Although the conventional test takes 5 to 6 hours for result output, PoC assays have reduced the duration significantly.

The pace of innovation in medical science is accelerating but are the labs ready to keep up with the rapid transformation? The need of the hour is digitally empowering the labs to use state-of-the-art research to make them globally connected powerhouses capable of breakthrough innovation at scale.

Life sciences companies are applying digital to R&D or quality control labs. Around 60 percent companies are deploying digital, as 37 percent are piloting, 13 percent are scaling up, and 10 percent already have digital technologies in widespread use, according to an Accenture study.

The modern lab will dramatically transform how tests are conducted and biopharma products are created. With a broad focus on validation, knowledge management, new assay development, contract research, new technology evaluation, and R&D services in the field of genomics and proteomics, these labs will bring latest innovations, advanced concepts, and technologies for the benefit of clinicians and patients. In R&D, it will make previously inaccessible, miniaturized, and complex assays routine and fully automated. Further, quality control wise, the use of extended reality (XR) will become commonplace to ensure tech transfer, train and provide technical support on new methods.

As technology continues to revolutionize life and work, there is an escalating need to provide a modern, quality driven digital approach to laboratory operations that offer consumers unprecedented convenience, impactful innovations, and reliability. The future is at home diagnostics which would allow phlebotomists to conduct testing and deliver results instantly. The purpose is to enable a new generation of medicine where the operations can extend into peoples’ homes and the diagnostic continuum can empower a truly connected, accessible, and omnipresent vision of health.

One shall foresee state-of-the-art, harmonized system for clinical diagnostics that facilitates testing ability for immunoassay, serology, clinical chemistry, point of care, clinical microbiology, clinical microscopy, haematology, cytopathology, transfusion, and molecular diagnostics. A series of advancements are poised to change the industry’s testing paradigm through speed, quality, efficiency, and scalability to help guide care for patients. Healthcare system is increasingly recognizing the added value the laboratories can play in becoming more of a clinical decision engine, helping patients perform tests at home, and physicians interpret results and diagnose and monitor patients accurately and faster.

Technology trends

Automation has contributed to revolutionizing many human activities, thus providing unquestionable benefits on system performance. The abundant and multifaceted advancements of automation technologies have also generated a profound impact on the organization of clinical laboratories, where many manual tasks have now been partially or completely replaced by automated and labor-saving instrumentation.

Chemistry analyzers. When it comes to test menus for clinical chemistry and related areas, several new assays and new biomarkers are in development. Certainly, there are new tests that are innovating in terms of the core laboratory. For example, high-sensitivity troponin assays for diagnosing myocardial infarction are now becoming available to laboratories. New biomarkers may soon be available for diagnosing and monitoring traumatic brain injury, and encouraging research is emerging for tests for Alzheimer’s disease. Developments in multi-analyte markers to screen for cancer, and the use of artificial intelligence and machine learning to find combinations of physiological markers that correlate with disease states. For example, multi-analyte markers related to immune response to infection, perhaps in conjunction with molecular techniques, could help diagnose and predict the severity of infectious diseases, such as the outcome of a patient presenting with the early signs of sepsis. Promising research also is underway involving biomarkers for ischemic stroke and for kidney disease.

In addition to new assays, innovations are leading to improved performance of existing assays and in core laboratory instruments. Automated platforms are being designed to handle a wider variety of sample types and smaller sample volumes. Radioactive and toxic components of many assays are being replaced with safer materials, and there are innovations in electrical technologies and biosensors.

Coagulation analyzers. In recent years, blood-coagulation monitoring has become crucial to diagnosing causes of hemorrhages, developing anticoagulant drugs, assessing bleeding risk in extensive surgery procedures and dialysis, and investigating the efficacy of hemostatic therapies. In this regard, advanced technologies, such as microfluidics, fluorescent microscopy, electrochemical sensing, photoacoustic detection, and micro/nano electromechanical systems (MEMS/NEMS) have been employed to develop highly accurate, robust, and cost-effective point-of-care (PoC) devices. These devices measure electrochemical, optical, and mechanical parameters of clotting blood, which can be correlated to light transmission/scattering, electrical impedance, and viscoelastic properties.

Although recent developments in blood-coagulation analyzers are promising, there remain a high potential for developing novel monitoring and therapeutic technology in the future, based on photoacoustic detection and nanotechnology.

Hematology analyzers. Over the past decades, hematology analyzers have experienced great technical advancements, featuring low turnaround time, enhanced precision, and accuracy. The challenges associated with manual methods like immature cells, reliability on results, distribution error, and statistical error are being replaced with precise, safe, and dependable automated hematology systems. Recently, AI has also been employed in the analysis of hematopathology data for better-informed diagnosis, prognosis, and treatment planning. The foundation knowledge related to benign and malignant hematology is also evolving with the application of AI in hematology. Even the most skilled hematology specialist can overlook the patterns, deviations, and relations among the vast number of blood parameter measures by modern analyzers. In contrast, the AI algorithm can easily analyze hundreds of attributes (parameters) simultaneously with correlation, and recognize a pattern or fingerprint of certain hematological abnormalities. The AI algorithms of modern hematology analyzers are trained on sufficiently large datasets of clinical cases that include laboratory blood tests, performed and confirmed by hematology specialist using various confirmatory tests.

Other recent technological advances have led to the development and commercialization of innovative automated image analysis systems, which are suited for automation and can hence be directly connected (in series) with hematologic analyzers. The images can be transmitted to, and displayed on, computer screens, which can be even placed at long distances from the scanner, for analysis and potential reclassification of blood elements. The operator can also increase the size of the images, or expand single sections of the scan, so obtaining a more accurate view. The operator can then accept and conserve the automatic classification or can move elements from one cell category to another, thus improving the final reclassification.

Immunochemistry analyzers. Regardless of its current optimal analytical performance, CLIA technology is destined for further development. The new flow-injection chemiluminescent immunoassay (FI-CLIA) technology, which is based on the fast injection of micro-bubbles into the reaction system with the aim of ensuring a more efficient reagent mixture and of reducing incubation times and increasing temperature control, is able to improve the immunoreaction kinetics and, therefore, significantly reduce analysis time.

Current chemiluminescent immunoassay consists of discrete tests, i.e., measures one autoantibody at a time. However, the need is emerging for multi-parametric tests that can identify all the components of a complex immunological picture in a single analytical step, efficiently and at reasonable cost. Use of the two-dimensional resolution for CL multiplex immunoassay could open doors for the setting up of multi-parametric CLIA tests. The technique is based on a multichannel sampling strategy, in combination with the use of various enzyme labels.

Microbiology analyzers. The field of clinical microbiology nowadays is rapidly evolving because of several recent technological advances. From walk-away multiplex PCR assays to total laboratory automation, microbiologists are able to produce faster results of higher quality than ever before. Perhaps the most revolutionary advancement over the last decade has been the application of matrix-assisted laser desorption ionization time-of-flight mass spectrometry (MALDI-TOF MS) for the identification of organism. Not only is MALDI-TOF MS organism identification more accurate than growth-based systems, but identifications are produced more rapidly and at significantly lower cost. This technology can identify gram-positive, gram-negative, aerobic, anaerobic bacteria as well as mycobacteria, yeast, and molds, typically at the species level, with good accuracy and often better than traditional methods when compared to sequencing.

As the technology has evolved, the expansion of the databases containing spectra of known organisms has allowed the identification of species with similar phenotypic, genotypic, and biochemical properties that was not previously possible. This has resulted in improvements in clinical care including the diagnosis of infections caused by relatively rare species and decreasing the time to diagnosis. Overtime, the platforms have gotten progressively better, with significant improvements in the software, interpretive rules, and databases. MALDI-TOF MS can be used for various purposes like, microbial identification, strain typing, epidemiological studies, detection of biological warfare agents, detection of water- and food-borne pathogens, detection of antibiotic resistance and detection of blood and urinary tract pathogens etc. The provision for integrating in-built databases in the public databases of MALDI, as well as development of inexpensive and user friendly software for comparison and analyses would further increase the credibility of MALDI-TOF in future.

The adoption of MALDI-TOF in clinical microbiology has revolutionized the infectious disease diagnosis and clinical care due to timely and accurate identification of microorganisms. This has further lead to appropriate therapy resulting in reduced hospital stay of the patients.

Molecular diagnostics. Without question, the future of rapid, random-access molecular testing is moving closer and closer to the bedside or clinic room. Currently, there are a number of clinical laboratory improvement amendments (CLIA)-waived molecular tests for influenza virus, some paired with respiratory syncytial virus, group A Streptococcal pharyngitis and for Chlamydia trachomatis and Neisseria gonorrhoeae (CT/NG) with excellent analytical sensitivity and specificity. CLIA-waived means that these tests can be performed outside of a laboratory and by non-laboratory staff such as nurses. Studies of these platforms have shown clinical impact for influenza detection in both the inpatient and ambulatory settings. Group A S. pharyngitis (GAS) POC molecular tests are now CLIA-waved, without the need for confirmatory culture of negative results.

Bringing molecular testing outside of the clinical laboratory comes with appropriate concern. First, these assays produce millions to trillions of copies of pathogen nucleic acid. While they are closed systems, there is always the possibility of amplicon contamination from a defective product, and one laboratory accrediting agency has recently added new requirements to this point. To investigate potential contamination, researchers performed weekly swabs of the surface of an actively used POC molecular GAS test and surrounding environment at two different urgent care clinics. They were not able to detect any contamination that amplified via the same test across the 13-week period of the study. Second, as more molecular assays become CLIA-waved for POC use, especially those with multiple targets, the ability to provide diagnostic stewardship becomes increasingly challenging. For example, one of the large syndromic respiratory panels is now CLIA-waved. More data are needed on how these panels are used and interpreted in outpatient and urgent care settings.

Molecular diagnostics in true sense is a transformative technology with revolutionary offerings; however, it faces certain challenges like lack of proper regulatory policies, data archiving tools, high costs, data secrecy, and others. However, a multitude of molecular techniques are now being utilized in the clinical field, hence making it an integral part of clinical practice. Agreed, there are a few challenges, but with the day-by-day advancement in technology, those challenges can surely be overcome.

Urinalysis analyzers. Over the past 25 years, new automated technologies and informatics have greatly reduced the labor intensity of urinalysis, and have created new technical possibilities. Although dry-chemistry technology for urinary test strips has made limited progress, advances in electronic detection have considerably improved. An interesting recent evolution is the use of smart phones for reading and interpreting urine test strip results. According to the reflectance theory, the reciprocal value of reflectance readings is proportional to the concentration of the measured analyte.

Major improvement in the test strip technology has been made in recent years. Not only are highly sensitive test strips being introduced, but also, now one can find strips, which give quantitative results for urinary proteins. The financial aspect is also of great importance, especially in the Third World and developing countries; inexpensive test strips for various diagnostic reasons, such as the diagnosis of diabetes from urine sample are available. Test strip method also shows promising results in antibiotic susceptibility tests; if optimum diagnostic requirement is reached, it can reduce the test time significantly from 2 to 3 days to a few hours.

Urine microscopy is one of the most important diagnostic methods for UTIs and other kidney diseases. Manual microscopy is time-consuming and can be labor-intensive. Furthermore, with centrifugation, decantation and re-suspension always lead to cell loss and cellular lysis. With the currently available digital microscopy technologies, a significant time reduction can be archived with much more sample being processed in a significantly shorter time in comparison to manual microscopy. In addition, with the ability to process uncentrifuged urine sample, issues like cell loss and lysis are of no more concern. Many automated analyzers are now available in the market with different kinds of technologies like laminar-flow digital-imaging technology and pattern-recognition technology.

Over the past two decades, automated urinalysis has undergone remarkable technical progress. Both microscopy- and flow cytometric-based instruments generate reliable results that are clinically useful, and automated test strip reading provides added value. Additional integration of existing technologies may further reduce turn-around times.

Market dynamics

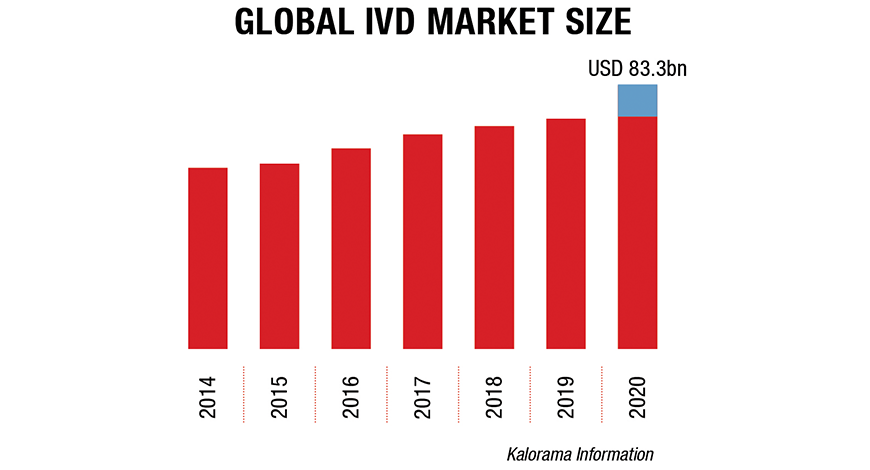

The global IVD market size was valued at USD 83.3 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.5 percent from 2021 to 2027, estimates Kalorama Information. The growth can be attributed to the increasing adoption of in vitro diagnostics (IVD) owing to a rise in testing due to the pandemic. The development of automated IVD systems for laboratories and hospitals to provide efficient, accurate, and error-free diagnosis is expected to fuel market growth. The rising number of IVD products being launched by key players is also fueling the lucrative growth rate of the market.

Globally, the elderly population is growing at a faster rate than the younger. In many countries, the growth of the older population can be attributed to declining fertility and low birth rate. According to United Nations, the number of individuals aged 80 years and above is projected to increase by threefold from 137 million in 2017 to 425 million in 2050. With age, the immune system is affected, which increases susceptibility to acquiring various diseases. Hence, a large geriatric population requires better healthcare, especially for chronic diseases.4

Product insights. The reagents segment dominated the market for IVD and accounted for the largest revenue share of 65.3 percent in 2020. The growth of this segment can be attributed to the increasing demand for rapid, accurate, and sensitive devices. Furthermore, their wide usage in in-vitro diagnostic testing, increase in demand for self-testing and point-of-care products, and rise in the number of R&D initiatives pertaining to reagents are expected to aid market growth.

Equipment and machines that assist in automating the process of diagnosis and bringing reagents and samples together are referred to as analytical instruments. Commercial kits and robots are used in polymerase chain reaction (PCR) laboratories to help detect and quantify infectious microorganisms, blood antigens, and viral load. In addition, the increasing use of these systems to develop new tests that can detect infectious diseases is expected to fuel the growth of the market. For instance, in February 2020, Sherlock Biosciences collaborated with Cepheid to develop a new CRISPR-based molecular test that can be used on the GeneXpert platform.

The services segment includes program interfaces used for operating diagnostic instruments, conducting analysis, and interpreting results. In vitro diagnostic software is used in many devices, such as point-of-care analyzers, laboratory-based analyzers, handheld personal in vitro diagnostics, and others. In addition, increasing adoption of in vitro diagnostic systems with analyzer software at diagnostic centers is anticipated to fuel market growth.

Applications insights. The infectious disease segment dominated the market and accounted for the largest revenue share of 41.8 percent in 2020, which is attributable to the increasing incidence of infectious diseases such as SARS-CoV-2, HIV, AIDS, tuberculosis, and pneumonia. Furthermore, an increase in the development of infectious disease detection assays by market players for in vitro diagnostics is expected to drive the segment.

Cancer, a chronic disease, is one of the major causes of death globally. The most common types of cancers are colorectal, prostate, breast, and lung. The increasing prevalence of cancer is expected to accelerate the demand for in vitro diagnostic tests.

Alcohol abuse, smoking, unhealthy diet, decreased physical activity, and high blood pressure are expected to increase the risk for cardiovascular diseases. Furthermore, diabetes mellitus causes cardiac disorders, which leads to an increase in demand for in vitro diagnostics in cardiology. The introduction of PoC devices for quick and on-site diagnosis, especially in emergency cases, is expected to drive the market.

Technology insights. The immunoassay segment dominated the market and accounted for the largest revenue share of 29.8 percent in 2020. It is anticipated to grow at a lucrative rate in upcoming years owing to its use in the detection of infectious microbes, such as fungus, bacteria, and viruses, by detection of their toxins. The increasing prevalence of chronic diseases, such as HIV, and the introduction of instruments with higher accuracy can be attributed to the largest market share.

Clinical chemistry is the practical application of biochemistry and is used to analyze body fluids for diagnostic and therapeutic purposes. Serum, plasma, and urine are the most commonly tested samples in pathology. The increasing use of approved blood-gas analyzers to monitor respiratory conditions is expected to fuel the growth of the market for in vitro diagnostic.

The microbiology segment includes tests and assays for the identification of infectious microorganisms. An increase in initiatives by organizations to improve patient outcomes using cost-effective and rapid diagnostic techniques, to help fight antibiotic resistance, is expected to fuel market growth.

Regional insights. North America accounted for the largest revenue share of 41.1 percent in the IVD market in 2020 and is expected to continue its dominance in coming years. This is attributable to the local presence of major market players. In addition, rising disease prevalence and increased consumer awareness are propelling the need for improved diagnostic devices.

The IVD market is showing particularly strong growth in Asian countries with advanced healthcare systems. And that growth has been on steep trajectories since several years before the pandemic hit. In China, the IVD market is growing quickly as a result of a number of factors, including increased awareness of public health, an increase in the overall number of hospitals, more chronic Western diseases and an increased income in the middle class.

In Japan, the IVD market is growing due to an increase in chronic diseases that can be diagnosed and monitored more easily than in the past. Among the products showing the most growth are immunoassay and infectious disease IVDs, tumor markers, hematology, pathology, and genetic testing.

The South Korean market for IVD is projected to experience a CAGR of 5 percent until the end of 2025. IVD products used to diagnose infectious diseases account for the largest share, followed by oncology, which is the fastest growing segment owing to the increasing prevalence of cancer.

In Singapore, marked by an advanced healthcare system and high per capita spending, diagnostics has emerged as a way for earlier and better identification of diseases to control rising healthcare costs. Along with the country’s state-of-the-art infrastructure and high standards of medical practice, Singapore has become a natural choice for many global diagnostic companies to establish their regional business operations thanks to its strategic location and position as the most developed healthcare system in Southeast Asia.

Key players .The IVD market is price-sensitive and, therefore, players enter into intensive competition in terms of manufacturing cost-effective and efficient products. Companies are engaging in acquisitions, partnerships, and mergers, in order to strengthen their manufacturing capacities, product portfolio, and provide competitive differentiation. In addition, companies are focusing on gaining market approvals for innovative products to diagnose different infectious diseases. The prominent players in the global IVD market are Roche Diagnostics Limited, Abbott Laboratories, Thermo Fisher Scientific, Bio-Rad Laboratories, Siemens Healthineers, Danaher Corporation, Johnson & Johnson, Becton, Dickinson and Company, Sysmex Corporation, bioMérieux, Diasorin, Ortho-Clinical Diagnostics, and Qiagen.

Miles to go

There are still many opportunities to improve the modern lab. Over the years, lab staffs have transitioned from recording data with pens and notebooks to utilizing cloud-based technologies and ELNs. But now, another wave of innovations is taking hold.

The ways in which research is conducted, and even the physical lab environment, may look quite different in the coming decade as emerging technologies simplify processes and more features become automated. Armed with a variety of smart technologies, lab managers will be better equipped to make informed decisions and lead their teams.