MB Stories

Endoscopic devices market back on track in FY23

As Covid receded, endoscopes were back in demand, and FY23 may close at a 25 percent increase over FY22 in India.

Since the development of the flexible fiberoptic endoscope by Basil Hirschowitz in 1956, endoscopy has become an integral part of the discipline of gastroenterology. Subsequent innovations, such as the advent of ERCP (1968), snare polypectomy (1969), endoscopic sphincterotomy (1973), endoscopic mucosal resection (1977), band ligation (1985), and endoscopic submucosal dissection (1998), have transformed the field from a purely diagnostic into a therapeutic discipline.

Today, endoscopy continues to take off in a myriad of directions, both in diagnostics and increasingly in therapeutics, where it now offers minimally invasive alternatives to situations that have traditionally required surgical intervention. Owing to the central location of the gastrointestinal tract within the human body, it can be argued that within the field of medicine, there is no other subspecialty where creativity and imagination is as obvious, encouraged, and limitless as gastrointestinal endoscopy.

In the field of therapeutic endoscopy, the speed of development is breathtaking. In the endoscopy unit, in the recent years, market has introduced and established a wide variety of these new techniques.

A few examples are in the area of colonic neoplasia; full thickness resection using the techniques of endoscopic full thickness resection (e-FTR) and combined endoscopic and laparoscopic surgery (CELS), while in the area of bile drainage; lumen apposing metal stenting (LAMS).

In general, the aim of many new therapeutic endoscopic techniques has been toward replacing existing surgical techniques, examples of this have been – endoscopic fundoplication, endoscopic gastric sleeve, POEM to replace Hellers myotomy, gastroenteroanastomoses (GEA) with LAMS, just to name a few, the benefit being a lesser invasive procedure, often performed without general anesthesia, and thereby giving also more fragile patients a better option for treatment.

Looking into the crystal ball, on the future development within the field of endoscopy, the vision on improving image quality is toward 3D virtual-reality imaging, and increasing wider field of vision in order to visualize as much of a given intestinal surface as possible.

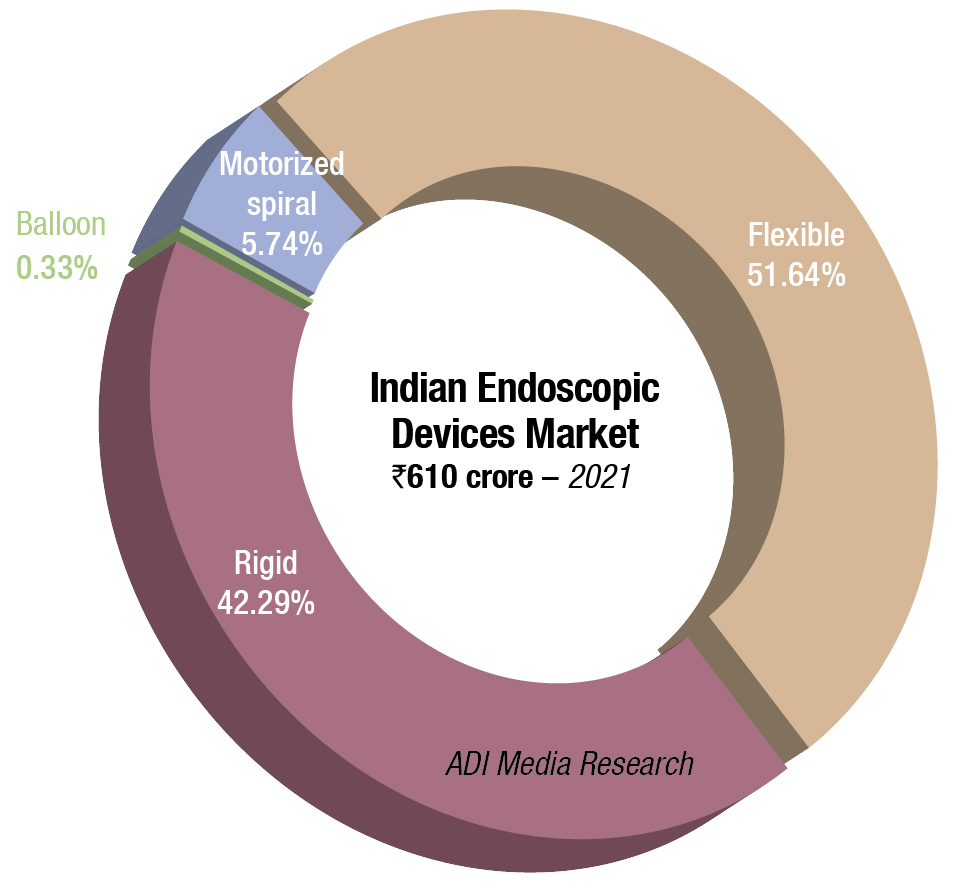

The setback from Covid-19 pandemic continued to impact the Indian endoscopic devices market in 2021-22. The demand continued to be slow. However, the market in FY22 increased by 17 percent over FY21, by value, not because the size of the market increased, but because a shift toward motorized spiral endoscopy was seen, in preference to the lower-priced balloon endoscopes, and the year saw a 275-percent increase over the last year, while balloon endoscopes were stagnant at five units. Flexible endoscopes saw no growth, at 800 units, whereas rigid endoscopes saw a decline of 24 percent. The drop is attributed to erratic supplies, and not to the decline in demand; vendors report that their supplies are behind schedule by about three months. Prices remained steady. The total endoscopic device market in 2021-22 is valued at ₹610 crore, with 2750 units, a 17-percent decline, by units, over the last fiscal.

FY23 is expected to see a 25-percent growth over FY22. The demand is emanating from government, corporate, and individual buyers. H1 FY23 has seen a 30-percent increase over the same period last year. And in H2, orders for the bids that have been opened by the public sector this year are expected to be finalized. The buyer is back and keen to improve clinical outcomes, demanding technologically advanced models.

|

Indian endoscopic devices market |

||

|

Major players |

||

|

Segment |

Leading brands |

Others |

| Flexible | Olympus, Fujifilm, and Pentax | Karl Storz, Richard Wolf, J Mitra, and other regional brands |

| Rigid | Olympus, Stryker, and Karl Storz | Refurbished, regional, and Chinese brands |

| Motorized spiral endoscopy |

Olympus | |

| Balloon | Olympus (single ) and Fujifilm (double) | |

| Capsule | Medtronics | |

|

ADI Media Research |

||

The global endoscopic devices market is estimated at USD 11.99 billion in 2021, and is predicted to hit around USD 25.25 billion by 2030 – foreseen to register a compound annual growth rate (CAGR) of around 8.62 percent during 2022 to 2030.

The flexible product segment accounted for the highest revenue share of more than 46.5 percent of the global market in 2021. It is attributed to its increasing preference by healthcare professionals for the first-line therapeutic option as it can be performed under sedation.

The disposable endoscopes segment is anticipated to register the fastest growth rate during 2022 to 2030. The emerging market for disposable endoscopes is rapidly growing, with new types of disposable endoscopes, and manufacturers entering the market every year.

Thanks to new technologies, the world of classic endoscopy is seeing significant changes, opening the doors for related medical devices and system providers to step into the market.

Until a few years back, the majority of minimally invasive surgical procedures used rigid endoscopes, such as laparoscopes and arthroscopes, with a rod-lens-based optical system. These optical systems are usually expensive and fragile, which is why the users of such devices, reprocesses included, are trained to handle them with extreme care and caution. But a number of technological developments have significantly pushed forward improvements in endoscopy to the benefit of doctors and patients alike.

Trends, such as the combining and merging of different imaging and visualization methods – like MRI or CT with endoscopic images – or the connection and integration of medical devices in the operating theater, as well as combining endoscopic visualization with instruments, lasers, and other devices and technologies, will push further developments in this area.

Chip-in-scope and LED-in-scope, together with full-HD image sensors, offer new possibilities in the endoscopic field. In addition to making the instrument a lightweight hand-piece with a single cable, the system does not require any additional or separate light sources or cables.

One of the challenges of using the LED-in-tip system is the high temperature generated at the distal tip. However, such a system would have the distinctive advantage of avoiding any additional fibers for light transmission, such as from the hand piece.

Similarly, to the consumer market, 4K resolution (horizontal resolution of approximately 4000 pixels) is also offered in medical endoscopy, although it is yet to be discussed whether this expensive technology offers any real advantage. Today, endoscopic towers are usually equipped with a 27–32 in monitor, and for the human eye to see 4K resolution in a 32 in monitor, the distance between eye and monitor should be around 60 cm. This distance is generally not practical, due to the fact that the display has to be positioned in the sterile field above the patient.

Additionally, 4K only makes sense when the full chain – from the endoscope and its sensor in the camera head to the video on the monitor – is realized in 4K. At the moment, therefore, 4K will be strictly a high-end solution for customers that can afford a 50-in-plus monitor in the operating theater.

Together with 4K, an extended color space (BT2020, as opposed to BT709) will be introduced. Fortunately, this extended color space will also be offered shortly with full HD monitors. Modern full-HD cameras will also be able to offer this extended wide-range color space for endoscopic procedures at minimal extended cost for 27–32 in monitors.

Due to the demands of reprocessing and image-quality procedures, there will be a clear differentiation of endoscopic systems as the market develops. Trends away from expensive optical high-end endoscopes and toward improved visualization systems that combine an endoscope and a camera are already apparent.

All system providers continue to benefit from these significant changes in a variety of minimally invasive applications, which call for qualified partners to create new products.