Hematology Instruments and Reagents

Expanding horizons

With the advent of automation, IoT, AI, and ML, hematology analyzers are poised for major upgrades. Healthcare professionals would receive reports and updates promptly on a regular basis. And the introduction of new technologies would make hematology analyzers safer, more accurate, and much easier to handle.

The need for laboratory testing in disease diagnosis and management has exponentially increased, causing an exemplary rise in laboratory testing demands. Complete blood count (CBC) and leukocyte differential are among the most frequently requested laboratory tests. These analyses are highly automated, and the evolution of automation in the hematology laboratory has enabled not only high throughput, greater reliability, and accuracy in the results but the systems have also become more sophisticated with the introduction of new physical principles for cellular analysis, also a generation of new parameters to characterize blood cells in more detail. Several parameters have been introduced to CBC, such as nucleated red blood cells, immature granulocytes, immature platelet fraction, as well as new parameters for the detection of ineffective erythropoiesis (reticulocyte hemoglobin, red cell subsets). Leucocyte morphometric parameters (cell population data) aid in the preliminary diagnosis of diseases, and could be useful to ascertain infection and sepsis, and discrimination of the etiology.

To meet the needs of an overworked and increasingly generalized workforce, today’s products not only must deliver more clinical data than ever before, but also must be easier to operate, relieving overburdened laboratory staff members of cumbersome tasks. Innovators have answered these needs with technological evolutions in the areas of new product commercialization, clinic workflow, analytical advancements, and clinical information management. In the past two years, several new products and technologies have emerged on the market, all of which promise to change the traditional understanding of laboratory hematology workflow and standards. New automated systems broaden capabilities beyond traditional methodologies that include cellular analysis combined with manual review. Globally, due to fast-moving product development, small entrepreneurial niche manufacturers and large multinational companies have launched products on the scene to provide unique solutions to evolving customer needs.

As the market becomes more competitive and technology advances, new tools and parameters will emerge. As a result, laboratory hematology, as we know it, will change – to one that uses a range of orthogonal techniques to deliver deeper clinical insights faster and at a lower cost than ever before. Indeed, this is an exciting time in the sector, with seismic changes expected over the next five years that will improve patient care and provide more opportunities for laboratory personnel.

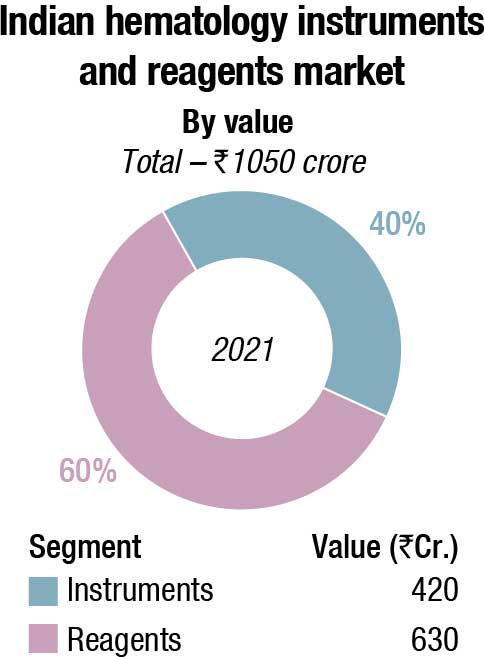

The Indian hematology instruments and reagents market in 2021 is estimated at ₹1050 crore. Reagents constitute 60 percent of the market at ₹630 crore and instruments ₹420 crore.

While 2020 had seen a decline with funds diverted for Covid-19-related activities, particularly from the decline in procurement by the government, 2021 saw a slight revival. There has been a spike in purchases by the government in 2022, with January–May seeing healthy demand. However, the CAGR over the next five years is expected to decline from 12 percent to 8–9 percent.

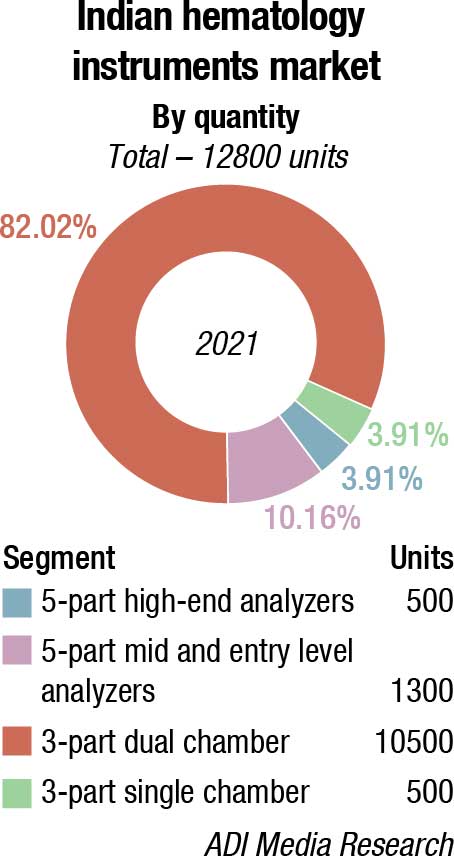

With the Make in India initiative getting a major push from the government, the 3-part analyzers have potential, since 5-part are not being manufactured in large numbers. The demand for 3-part single chamber, however, continues to decline. The price gap between 3-part dual chamber and 5-part entry models continues to narrow, hence a distinct shift in preference for 5-part entry level is observed.

|

Indian hematology instruments and reagents market |

|||

|

Leading vendors* – 2021 |

|||

|

Tier I |

Tier II | Tier III |

Others |

| Sysmex, Horiba, and Mindray | Beckman Coulter and Transasia | Abbott, Nihon Kohden, and Siemens | Trivitron, Boule, Agappe, CPC, Roche, Dirui, Meril, Beacon, Peerless Biotech, Diatron, Shenzhen Prokan, Urit and many small importers |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian hematology instruments and reagents market. | |||

| ADI Media Research | |||

The market continues to be dominated by three players, Horiba, Mindray, and Sysmex. Beckman Coulter has success with the replacement market. Transasia is gradually cementing its presence, as is Boule. Abbott, Trivitron, Nihon Kohden, and Siemens are also aggressive. Many other players including Beacon, CPC, Urit, and Meril are active in this segment.

With customers now more inclined to go for preventive diagnostic tests, the path labs at large are investing in automated cell counters, and there is a distinct decline in manual microscopy solutions. Having said that, the smaller diagnostic centers, having lost money in the last couple of years, with regular testing almost nil, consolidation has given negotiating pricing power to the larger labs, with the vendors. This is manifested in a steady increase in procurement of 5-part high-end analyzers.

The PPP model is also finding popularity, Some large players like Manipal Group, through its group entity Manipal Healthmap Medall, SRL, and Krsnaa Diagnostics have focused their energies on this collaborative mode of delivery system. Over the last couple of years, the state governments invited tenders for private players to set up diagnostic centers to be run under public-private partnership (PPP) mode. The diagnostic centers use hospital facilities and conduct tests for patients at the rate fixed by the government.

Under this plan, private partners are establishing as many collection centers at hospitals in the district as possible and providing services. For services not available at the district hospital, the partner procures machines from the market to carry out tests.

The respective health departments have planned that the service provider is responsible for investing in the equipment and manpower as per the terms of reference of operating the center, providing the service and adhering to the laws and regulation that govern the process.

Focus on healthcare has bolstered in recent years in India and this has created many opportunities for healthcare diagnostic providers. The nation is also experiencing a surge in instances of blood disorders and incidence of blood cancer, which is also a factor that promotes demand for hematology diagnostics. Hematology diagnostic providers can focus on India and gain from the untapped potential that the market has to offer, and increase their global revenue potential.

Emerging trends in hematology

YS Prabhakara

YS Prabhakara

Senior Advisor,

Agappe Diagnostics Ltd.

Hematology segment contributes 8-10 percent of Indian IVD market.

The origins

From common fever to carcinoma – the cell counter is critical for diagnose. Application of electrical impedance for cell counting by Wallace Coulter paved way for automation in hematology. It revolutionized hematological testing. Automation caused drastic drop-in review rates. Consequently, laboratory throughput, accuracy, speed of cell counting all leaped. It reduced the manual workload.

Analyzers decreased in size with revolutionary advances in computing, electronics and manufacturing, quantum jumps in biotechnology, fluidics, and mechanics.

Current market and what’s next?

India’s hematology analyzer market is expected to grow at over 12 percent CAGR in the coming years. Growing incidences of blood disorders, cancers, affordability, and patient awareness are contributing to this growth. Precision, repeatability, Image, trouble-free service and affordability determine the selection of suppliers and brands.

New generation hematology equipment smartly combine impedance technology with unique algorithms. Machines became compact but throughputs rose. Technological advances in haematology analysers are allowing the labs to access more cellular information than was ever available before through routine CBC with differential. It is possible through -innovative flow cytometry analysis, genomics testing, advanced image processing, microfluidics, usage of multiple scatters, high speed signal acquisition mechanisms, high resolution cameras, artificial intelligence and machine learning techniques for accurate morphological view of different cell characteristics.

Innovation in the area of clinical information also promises to save laboratory time and labour, while enhancing patient care. As measurement and analytical tools improve – in particular- optics, electronics, computing algorithms and reagent systems. Hematology analysis is undergoing tremendous changes with the use of AI and 3-D printing technology. In the place of flow-based counting, a combination platform with digital morphology analysis, cell sorting and counting is picking up. This will be more helpful in the cancer diagnosis and other blood disorders where cell morphology is a crucial factor. These developments will also reflect in the reagent kits as the focus will shift to more specific stains and dyes which help in differentiating specific cellular types.

Mispa Count X, the first indigenously designed and developed 3-part hematology auto analyzer Agappe’s proud contribution to the Make in India campaign. Affordable and accurate – this will be a game changer in Indian hematology, dominated by 3-PDAs.

The global hematology analyzer market size was valued at USD 1984 million in 2021 and is projected to reach USD 3941.10 million by 2030, registering a CAGR of 7.30 percent from 2022 to 2030. Reagents and consumables segment dominated the global market in 2021 and is expected to remain dominant throughout the period 2021–2023 owing to factors, such as increase in adoption of reagents and consumables in clinical laboratories for blood cell count, coagulation testing, other hematology tests, control, and calibration.

Based on type, fully-automated hematology analyzer segment dominated the global market in 2021 and is anticipated to continue this trend over the next 9 years. 5-part hematology analyzers are expected to be the most prominently used type of analyzers across the world, holding over three-fourths of the market share in 2021. The usage of 5-part hematology analyzers is increasing because there is a huge demand for automated analyzers, which provide readymade results for various programmed parameters required in the lab.

Routine hematology tests performed are increasing over time. The parameters checked in routine hematology tests are used for various health conditions. Development in technological advancements has led to an understanding of the relationship between routine tests and various disease indications. This has increased the number of routine tests performed in the world.

With point-of-care (POC) testing on the rise, POC hematology analyzers are expected to grow at a rapid pace compared to standalone devices during 2022-23.

The rise in prevalence of blood disorders, such as anemia, blood cancers, hemorrhagic conditions, and infections in the blood, is a major factor that drives the growth of the market. In addition, technological advancements in hematology analyzers, and growth in demand for automated hematology analyzers, coupled with rising preference toward high-sensitivity hematology analyzers, further fuel the growth of the hematology analyzer market.

Novel diagnostic procedures are costly and are on the expensive side of the spectrum, which makes it difficult for people with low income to afford. High costs of hematology diagnostic procedures are a major restraining factor for the global hematology diagnostics market. Other factors, such as lack of awareness and coverage exclusion from healthcare insurance, are also anticipated to negatively impact the hematology diagnostics market. In contrast, growth opportunities in the emerging economies are expected to offer lucrative opportunities for players in the hematology analyzer market.

North America is expected to witness significant growth in the hematology market in the coming years due to factors, such as the increasing incidence of blood disorders, technological advancements, and increasing product launches in the region. According to the American Cancer Society’s Ket Statistics for Chronic Lymphocytic Leukemia, 2021, nearly 61,090 new cases of leukemia and approximately 23,660 deaths from leukemia of all kinds were estimated in the United States in 2021, with nearly 21,250 new cases of chronic lymphocytic leukemia (CLL) and about 4320 deaths from CLL in the United States in 2021. The growing burden of blood disorders, such as leukemia, is expected to surge the demand for hematology instruments and reagents, thus driving the market growth in the region.

Growth drivers for the Indian hematology market

Archana Ravindranath

Archana Ravindranath

Group Product Manager Hematology SBU,

Transasia Bio-Medicals Ltd.

The last few years have witnessed an incremental rise in the prevalence of blood disorders, such as anemia, thalassemia, cancers, hemorrhagic conditions, and blood infections. This has led to greater focus on newer technologies in hematology to deliver enhanced clinical data, streamline workflow, and relieve lab professionals for performing in-depth analysis.

Hematology market in India

As of 2020, the hematology market in India was estimated at ₹850 crore, with reagents constituting 60 percent.

Hematology analyzers are used predominantly for cell counts and differential leukocyte analysis. Based on the requirement, they are also used to report additional clinical parameters for an early orientation of patients’ clinical conditions.

The emergence of new instruments, with advanced technological advancements and upgraded software, have the potential of transforming the workflow beyond traditional methodologies that include cellular analysis, combined with manual review.However, in India, these analyzers are not being utilized to their full potential. Lack of expertise for a clinical approach or shortage of trained lab professionals are the possible reasons.

The relevance of clinical parameters

Several parameters have been introduced to CBC, such as NRBC, IG, IPF, and new parameters for detection of ineffective erythropoiesis, clinical markers to differentiate iron deficiency, beta thalassemia and leucocyte morphometric parameters in the preliminary diagnosis of diseases.

All these parameters improve the accuracy of the automated WBC differential count and enable further classification of atypical or immature cells. They could thus be beneficial to ascertain infection, sepsis, and discrimination of the etiology.

Technologies that are driving the sector

Different technologies are deployed to enumerate platelets, RBCs, and derived indices relating to morphology, size, or cytoplasm complexity. Revolutionary advancements in computing, along with innovation in fluidics, mechanics, cellular and morphological analysis, combined with adaption of AI, are enhancing the accuracy of reporting.

Large institutes, with a high workload, have already deployed integrated high-end systems with automated stainer and digital morphology for efficient data management and reporting.

Automation has proven to be effective in improving efficiency of re-run and reflex testing, standardization, and TAT. Additionally, it aids in lowering the risk of errors and allows efficient integration of results.

Asia-Pacific offers profitable opportunities for key players operating in the hematology analyzer market, thereby registering the fastest growth rate during 2022–2030, owing to growing healthcare infrastructure, increasing prevalence of blood diseases, rising disposable incomes, well-established presence of domestic companies, and aging population in the region. In addition, factors, such as increase in population and growth in the economies of developing countries like India and China, are also supporting the growth of the hematology analyzer market in Asia. Technological advancements, coupled with supportive investments and funds by the government, especially in developing countries, are also expected to contribute to market growth.

Companies largely gain their competitive advantage and economic benefits from innovation. Innovation is advantageous and helps in acquiring new markets, generates revenues, and creates customer-value propositions. Innovation contributes to higher productivity, lower costs, increased profits, and improves existing product lines and processes. Firms that innovate have a higher global market share, higher penetration rates, and higher profitability. Innovative products also attract more customers. The hematology analyzers market has also seen a similar trend since the past decade.

Emerging trends

Sunil Dhadkar

Sunil Dhadkar

Vice President – IVD India,

Trivitron Healthcare

Hematology analyzers are concerned with the detection, monitoring of diseases, prognosis, and subsequent screening, which are extensively used against various blood-related diseases, such as hemophilia, blood cancer, and blood clots. There are three main technologies used in hematology analyzers, which are electrical impedance, flow cytometry, and fluorescent flow cytometry. These are often used in combination with hematological reagents that alter blood cells to measure the relevant parameters.

Majorly screened parameters include complete blood count (CBC); white blood cell count (WBC); red blood cell count (RBC); platelet count; hematocrit red blood cell volume (HCT); hemoglobin concentration (HB); differential white blood count; red blood cell indices; prothrombin time (PT); reticulocyte count; partial thromboplastin time (PTT); and international normalized ratio (INR).

The global hematology analyzers and reagents market size is expected to grow from USD 3.68 billion in 2021 to USD 4.14 billion in 2022 at a compound annual growth rate (CAGR) of 12.4 percent. The global hematology analyzer and reagent market is expected to grow to USD 5.25 billion in 2026 at a CAGR of 6.1 percent.

Improving workflow efficiency with 5-part differential hematology analyzers. Laboratories with low volume rely on 3-part differential analyzers, and busy laboratories with 5-part differential are gaining interest. The throughput of the instrument and its speed will vary between machines and the sample size. The 5-part differential hematology instrument is based on the flow cytometry principle to differentiate WBCs into their five major sub-populations, such as monocytes, eosinophils, neutrophils, lymphocytes, and basophils, based on the cell size and granularity. A 5-part hematology instrument can provide a more detailed and targeted assessment of the blood status.

New tools and parameters will continue to emerge as the market competition increases and technology evolves. Thus, the traditional concept of laboratory hematology will evolve into leveraging a variety of orthogonal techniques to produce deeper clinical insights faster and at a lower cost than ever before. Indeed, this is an exciting time in the field, and the coming years should see seismic changes that promise to bring better patient care and more options for laboratory professionals.

The hematology market is moderately competitive. Some key industry players include Abbott Laboratories, Bio-Rad Laboratories Inc., Danaher Corporation, PerkinElmer Inc., and F. Hoffmann-La Roche Ltd., Nihon Kohden, Mindray, Boule Diagnostics, Horiba, among others. The companies are implementing certain strategic initiatives, including mergers, new product launches, acquisitions, partnerships, and investments in research and development activities, which help them in strengthening their market positions globally.

In August 2021, Danaher Corporation announced the completion of its acquisition of Aldevron. Aldevron will operate as a standalone operating company and brand within Danaher’s Life Sciences segment.

In February 2021, Siemens Healthineers and Sysmex Corporation extended a long-standing global distributor, supply, sales, and service agreement for a wide range of hemostasis products, including CN-Series automated blood coagulation analyzers, the CN-3000, and CN-6000 of Sysmex Corporation.

In February 2021, Beckman Coulter launched the DxH 560 AL, which is a tabletop hematology analyzer designed to reduce the time and resource constraints faced by small- to mid-sized laboratories as it only needs 17 μL of a blood sample and can deliver results in less than 60 seconds.

In January 2021, F. Hoffmann-La Roche AG signed a global business partnership agreement with Sysmex Corporation that allows Roche to distribute Sysmex hematology testing products, including instruments and reagents.

In September 2020, Cyient entered a manufacturing partnership with Agappe to manufacture certain key components of Mispa Count X at its ISO 13485-certified, state-of-the-art manufacturing facilities in India. The Mispa Count X is an indigenously designed and developed three-part hematology analyzer by Agappe.

In October 2021, Suburban Diagnostics announced the launch of its Centre of Excellence in hematology. The new establishment provides research support and training of diagnostic procedures for multiple common and uncommon hematological disorders. In November 2021, the company was acquired by Dr Lal Path Labs in an all-cash deal for an enterprise value of Rs 925 crore and a cap of Rs 1150 crore. Through this deal, Dr Lal Path Labs has access to over 150 collection centers, 44 laboratories and diagnostics centers of Suburban, out of which one is CAP-accredited and five are NABL-accredited.

CBC test during Covid-19 pandemic

Andrey Shanchev

Andrey Shanchev

Commercial Operations Director Russia Sales,

Boule Diagnostics AB

Fevers can be caused by a trivial infection, or be a manifestation of a rapidly progressive and lethal infection. A short time to diagnosis for early initiation of treatment can, therefore, be necessary to save a patient’s life.

Severe infections are one of the most common causes of intensive care unit admissions in tropical countries. As many infections share the same symptoms and clinical findings, a combination of a detailed patient anamnesis, physical examination, and laboratory data is a prerequisite for identification of the likely cause.

As different infections can have diverse effects on blood cells, whereas other causes of febrile illness may have little or no effect on the blood cells, a complete blood count (CBC) is often included in early fever investigations, together with other general infection biomarkers.

For example, CRP level and platelet count can be useful in discriminating between dengue and malaria, with a low CRP being indicative of dengue, whereas a low platelet count, together with an elevated CRP level, is more indicative of malaria. While neutropenia is a common feature in many tropical infections, leptospirosis is typically associated with leukocytosis. Many parasite infections are associated with eosinophilia; however, protozoan infections, such as malaria are typically not.

A pandemic, such as the Covid-19 outbreak, poses additional challenges to disease investigations. A large number of patients need to be screened to distinguish virus-infected patients from healthy individuals.

At the same time, vaccination and actual infection can both cause febrile illness, adding to the complexity. In such cases, a CBC test that includes also a white blood cell differential count can be both a rapid and cost-efficient tool for early identification of infected patients. A CBC can also be useful in monitoring of disease progression and treatment efficacy.

Compared with many more specific tests, a CBC is a cost-efficient analysis and, therefore, readily available in laboratories worldwide. On-site CBC testing can provide results within a minute, compared to more specific tests that can take days to results. CBC test results help suggest a likely diagnosis, while waiting for confirmatory test results to be available.

In laboratory hematology testing, CBC tests account for about 40 percent of total revenues, compared with hemoglobin at 20 percent and other tests (e.g., hemostasis and coagulation) combined at the remaining 40 percent. Improved cost-efficiency of benchtop analyzers is among the factors that have been driving this development, which is seen further accelerated by the Covid-19 pandemic.

Another practice that has gained increased popularity during the Covid-19 pandemic is telemedicine, with the opportunity to provide patients access to medical experts at a lower cost. However, telemedicine does not allow diagnostic testing. Patients monitored for disease recovery or adjustment of medication dosage for chronic diseases would greatly benefit from having access to nearby testing services to prevent prolonging the time to a new diagnosis. Applicable diagnostics should be readily deployable, easy to use, portable, and accurate so that they fit mobile laboratories, pop-up treatment centers, field hospitals, secluded wards within hospitals, or remote regions, and can be operated by staff with minimal training.

In hematology, point-of-care testing (POCT) is generally limited to hemoglobin and hematocrit testing by blood gas devices and POC coagulation monitoring, such as prothrombin time and INR for patients on warfarin.

Some studies have investigated portable instruments using newer technology, such as single-sample cuvettes and image analysis, microfluidic cartridges, and the lab-on-a-chip/micro total analysis system platform, which provides complete blood cell count tests including 3-part differential white blood cells, red blood cells, platelet count, and hemoglobin for rapid diagnosis in resource-poor environments. A rapid complete blood cell count and differential blood panel can help clinicians determine whether a patient is suffering from a viral or bacterial infection and whether he or she requires admission and antibiotics.

The use of POC INR testing has become popular for at-home testing and allows patients to easily use a device to monitor their INR and report their results to a clinician (either in person or via telephone), who can then adjust anticoagulant dose, if necessary. The most common symptom of patients with venous thromboembolism is chest pain or dyspnea, but patients may also present with leg problems, arm pain, or chest tightness, or be asymptomatic. In a systematic review and meta-analysis of 11 trials with data for 6417 participants and 12,800 person-years of follow-up, there was a significant reduction in thromboembolic events in the self-monitoring INR group (hazard ratio, 0.51; 95% CI, 0.31–0.85) on oral anticoagulation. Participants younger than 55 years showed a striking reduction in thrombotic events (hazard ratio, 0.33; 95% CI, 0.17–0.66), as did participants with mechanical heart valves (hazard ratio, 0.52; 95% CI, 0.35–0.77), so the authors suggested that patients should be offered the option to self-manage their disease with suitable healthcare support.

Exceeding the expectations

Varun Sharma

Varun Sharma

Product Manager, Hematology,

Mindray Medical India Pvt. Ltd.

Hematology analyzers have seen evolution, resulting in increasing clinical utility since 1956. However, for the first few decades, progress was slow and every two decades, there was a significant new technology. Like any other industry, hematology analyzers were also impacted by new developments in other areas, like introduction of laser, efficient pneumatic control, etc. This provided scope to manufacturers in reducing the size of analyzers and making them more efficient.

However, for a long time, focus was on making an efficient, robust, and user-friendly system. With new-age data informatics and science around algorithms, now focus is to also improve clinical utility, and exceed expectations.

Experience from hematology analyzers has also evolved greatly, and now the analyzer is helping in lot of morphology analyses than just being a cell counter. Aspirations have replaced expectations and the user is interested in what more can be achieved. Mindray, being a leader, has taken the challenge always head on. Our R&D has been efficient in bringing new products suiting to customer needs. And now Mindray has products for all customer segments.

In its quest to do more, Mindray has recently launched a new series of analyzers BC-700. It employs patented SF Cube technology and advanced algorithms, resulting in new features. BC-700 series offers high-end hematology parameters like IMG, NRBC, RET profile, body-fluid parameters, and reports ESR along with 5-part differential. This combination of CBC and ESR is helping labs in managing their TAT and platform optimization. With 40 t/h throughput for CBC+ESR in hematology analyzer, turnaround time for any sample would be greatly reduced. This will help the lab in optimizing its resources.

For long, microcytic RBCs and RBC fragments were nightmares in labs using impedance-based analyzers as small RBCs or fragmented RBCs would trigger use of floating discriminator, resulting in falsely reduced PLT counts. Now BC-700 series can solve this issue by reporting PLT-H (hybrid of impedance and optical PLT) from Diff channel, equipped with fluorescence dye. PLT-H will reduce the slide review rate to a great extent and user will have more time for other important tasks.

For a big laboratory, where TAT management is a key, Mindray has launched its digital morphology analyzer MC-80. This new addition in Mindray’s already vast product portfolio will complete its integrated system and help laboratory do more.

With ever-changing industry environment, and increasing customer expectations, Mindray will always live up to its reputation as complete solution provider. Mindray is committed to ensure that high-end technology with more clinical value is accessible to all..

In one investigation, negative D-dimer test was valuable in ruling out acute pulmonary embolism in patients with a low pretest probability in hospital outpatient or accident and emergency settings. Combined with pretest probability scores, point-of-care D-dimer tests are a quick and safe way to rule out venous thromboembolism and improve patient experience. In addition, the D-dimer POC device was comparable with the laboratory device and was sufficiently accurate for use as a screening tool in the emergency department (ED) setting. In a prospective observational study of 104 patients, who underwent simultaneous D-dimer measurements using the two analyzers, the median time for D-dimer results from triage by VIDAS was 258 minutes (interquartile range, 173–360 minutes) and that by AQT90 Flex analyzer was 146 minutes (interquartile range, 55–280.5 minutes). Following implementation of the rapid whole-blood D-dimer test in the ED, there was a 13.8-percent decrease in patients admitted to the hospital, a 7.3-percent increase in patients discharged from the ED, and a 6.4-percent increase in patients admitted for observation only. General practitioners can safely exclude pulmonary embolism by using the Wells criteria in combination with either a qualitative POC D-dimer or a quantitative D-dimer test.

Point-of-care testing is likely to play an increasing role in healthcare delivery in the future. It will improve access to healthcare and increase the efficacy of service provided to patients.

POC testing is likely to play an increasing role in healthcare delivery in the future. It will improve access to healthcare and increase the efficacy of service provided to patients. Although POCT provides laboratory results faster than the traditional central laboratory, process improvement is needed to optimize the accuracy of laboratory results.

Existing hematology analyzers require labor-intensive work and a panel of expensive reagents. AIRFIHA can accurately classify subpopulations of leukocytes with minimal sample preparation.

Leukocyte differential test is a widely carried out clinical procedure for screening infectious diseases. Existing hematology analyzers require labor-intensive work and a panel of expensive reagents. Herein, an artificial-intelligence-enabled reagent-free imaging hematology analyzer (AIRFIHA) modality is reported that can accurately classify subpopulations of leukocytes with minimal sample preparation.

With recent developments in ML/AI, e.g., visual geometry group (VGG), inception, and residual neural network (ResNet), abundant training data are available to train a model to extract important image features to classify targeted objects. Compared with previous manual feature extraction analysis methods, the new approaches in ML/AI may offer features with statistically significant differences. Among the recent ML/AI methods, ResNet tackles the gradient-vanishing problem by creating shortcut paths to jump over layers. Conversion among different types of biomedical images and the segmentation of certain cell structures have been achieved using ResNet building blocks. With such exciting developments, ML/AI have also been applied to label-free imaging systems to tackle complicated cell analysis problems. For instance, machine learning for the differentiation of lymphocytes has been achieved on a bright-field and dark-field microscopy platform and a QPM platform using fixed pathology slides. To further improve the detection accuracy and specificity of leukocyte subtypes, the methods using 3D QPM technique have been proposed and demonstrated.

In a recent study, researchers have proposed a rapid, low-cost, AIRFIHA that can classify hierarchical leukocyte subtypes in human blood samples. AIRFIHA is based on leveraging the morphological attributes of phase images from a custom-built QPM system and a cascaded-ResNet for leukocyte classification. From this proof-of-principle study on six human donors, researchers have achieved a classification accuracy of 90.5 percent on average for monocytes, granulocytes, and B and T lymphocytes. The robustness and applicability of the proposed method have been confirmed by conducting cross-donor validation experiments. They further investigated the potential of AIRFIHA in discerning human CD4 and CD8 T cells. AIRFIHA demonstrated a much higher accuracy when compared with methods based on negative isolated leukocyte classification and a comparable or better accuracy when compared with methods based on positive isolated leukocyte classification. The study shows a promising perspective when applying AIRFIHA for automated clinical blood-testing applications, which is especially useful in resource-limited settings and during pandemic situations.

Hematology – Advancing new heights

Meenakshi Verma

Meenakshi Verma

Deputy Product Manager – High End Haematology & Systemization Marketing Department,

Sysmex India Pvt Ltd

Few decades back, when cell counter meant manual hand-tally differential counter to today, where a fully automated cell counter is a basic need of the lab, the technology has changed the way labs functioned. It has offered enhanced accuracy, and reliability with reduced turnaround time.

Reagents. Pioneer brands in hematology are competing to provide highly accurate results and advanced clinical parameters. For instance, platelet enumeration in an automated analyzer is performed, using impedance method (PLT-I), which has limitations inherent to size measurement. Today’s cell counter addresses this issue by providing multiple methods of platelet measurement like optical (PLT-O) and fluorescence (PLT-F). The fuorescent method uses a specific reagent dye that binds only to platelet granules, eliminating major interferences. The results obtained are highly accurate even for thrombocytopenic samples, and are comparable to flowcytometry CD41/61.

New-age reagents have made many advanced diagnostic parameters possible like RET-He, IPF, newer infection parameters like Neutrophile activation status (Neut-RI, Neut-GI), lymphocyte activation status (RE-LYMP, AS-LYMP), etc. These advanced parameters are no more a luxury of Tier-I city or a high-workload lab but are available and affordable to all. Hematology analyzer has indeed become the common man’s flow cytometer.

Instruments. The journey from semi-automated analyzer to a complete walkaway total lab automation system has been worth witnessing. The hematology systemization is not only capable of handling CBC samples but can also be integrated with digital imaging, HPLC analyzer for HbA1c, and ESR analyzer making it a complete EDTA island. The cell counters are multitasking, capable of analyzing body fluids (BF-Mode), and blood bank samples (BB-Mode) like RBC/PLT pack, along with routine blood sample by just a simple change in mode.

Emerging trends. The digitization of data has transformed every aspect of healthcare. Artificial intelligence (AI) is now being utilized in hematopathology to make faster diagnosis and better-informed decisions. Machine learning (ML) algorithm can identify and uncover disease-related patterns in parameters and scattergrams that are beyond current knowledge, resulting in higher accuracy and better patient care.

New tools and parameters will continue to emerge as the competition increases and technology evolves. This is an exciting time in the field of hematology as we are at a turning point of technology boom. We are entering into a future where hematology cell counter, aided with AI, can lead to fundamental modification in diagnostic guidelines, and might result in complete disruption of how we see a hematology lab today.

In their proof-of-concept study, the capability of AIRFIHA for label-free classification of leukocyte subpopulations has been demonstrated on human blood donors. With a well-designed neural network model, high information-content quantitative phase images, and a considerable amount of data collected from human blood donors, AIRFIHA method has outperformed current reagent-free methods for the classification of granulocytes, monocytes, and B and T lymphocytes. Preliminary result also shows that the detection accuracy of our method is not severely affected by different donors, thus indicating a potential for use in clinical settings. Researchers further demonstrated that AIRFIHA can differentiate CD4 and CD8 cells that are normally difficult to distinguish with label-free methods.

With the capability to differentiate very complex leukocyte types, AIRFIHA can provide more comprehensive information for potential disease diagnoses with simplified testing procedures. There are still ways to improve the detection accuracy of system, such as improving the phase-imaging resolution through synthetic aperture phase-imaging method, deconvolution, and using 3D-resolved phase maps, preferably captured through a single-image acquisition to avoid taking a large amount of data (such method has been recently made possible; a manuscript is under preparation). The other way to improve accuracy is to expand the dataset and upgrade the neural network model.

Overall, results show the potential of AIRFIHA as a fully automated, reagent-free, and high-throughput modality for differential diagnosis of leukocytes at POC and in a clinical laboratory. Additional salient features of this platform include its single-shot measurement, small spatial footprint, and low cost. Of note, due to its facile and simpler set-up, this platform can be combined with other modalities for blood cell investigation. For example, by combining it with microfluidic devices, AIRFIHA can conduct blood testing and analysis in a fully automated way. Importantly, the need for isolation kits is obviated and the leucocytes separated from blood using a routine centrifugation process can be directly subjected to the AIRFIHA to provide percentage population of leukocyte subtypes. One other example could be its integration with Raman spectroscopy that has been proposed for B lymphocytes acute lymphoblastic leukemia identification and classification. While Raman spectroscopy provides biomolecular specificity, spontaneous Raman measurements are not feasible for clinical workflow requiring rapid diagnosis. Importantly, given the potential of the AIRFIHA platform in screening B cells from other leucocytes, QPM-based strategy can be used to screen B lymphocytes where Raman measurements can be carried out for B lymphocytes leukemia diagnosis. The combined QPM–Raman system obviates the need for any additional separation method to select B lymphocytes, either from the blood or from the leucocyte mixtures, for leukemia diagnosis in a label-free manner.

Moreover, as AIRFIHA involves a low-cost system that requires minimal sample preparation or chemical consumables, AIRFIHA has a great potential to be used in POC applications, resource-limited settings, or pandemic situations, like Covid-19 pandemic.

Evolution of automation in hematology

Sreekrishna Ramanathan

Sreekrishna Ramanathan

Sr. Product Manager,

Peerless Biotech Pvt. Ltd.

Hematology is a segment in the medical diagnostic spectrum, which deals with the treatment of blood disorders and malignancies, including types of hemophilia, leukemia, lymphoma, and sickle-cell anemia. The automation in hematology has evolved over a period of years, and plays an important role in the laboratory diagnostics.

While retrospecting the automation in hematology, we will be missing the wood for the tree, if we do not peep into the chronology in which automation in hematology has evolved over the years.

It was in the 1950s that the first cell counter, which works on electrical impedance principle, came into existence and revolutionized the way cell counting was done. In the 1970s, automated 3-part differential leukocyte counters (lymphocytes, monocytes, and granulocytes) entered the market, which has emerged as a viable alternative to manual WBC counting. In the 1980s, an instrument, which could churn out 10-parameter CBC (complete blood count), was developed. The 1990s brought further advancements in WBC differentials with the use of flow-cell techniques, based on either electrical impedance or light-scatter properties. Eventually, this process was upgraded even further when it became possible to obtain these results without uncapping the sample.

The three main technologies used in today’s hematology analyzers are electrical impedance, flow cytometry, and fluorescent flow cytometry. These are used in combination with chemical reagents that lyse or alter blood cells to extend the measurable parameters. Manufacturers combine these three technologies with innovative uses of reagents, hydrofluidics, and data analysis tools to produce proprietary methods, each of which has strengths in terms of accuracy, speed, or breadth of parameters.

Automation has gone to the next level wherein some models can determine nucleated red blood cells (NRBC), reticulocyte count (RET), immature reticulocyte fraction (IRF), and automated immature platelet fraction (IPF). The latest in the series can automate the process of smear preparation and staining.

Of late, artificial intelligence (AI) is playing an important role in all segments of the industry, including healthcare industry. In healthcare, an AI-based algorithmic platform is being developed for rapid point-of-care analysis, designed to capture, manage, analyze, and interpret cell counting and cell morphology, empowering the laboratories to produce quick results, enabling better turnaround time (TAT).

Manual methods of characterizing blood cells and blood components can be unreliable and labor-intensive. Re-processing samples and performing additional procedures, such as nucleated red blood cell and optical counting, are often necessary to collect the data required for disease detection and monitoring. In addition, qualified laboratory technicians are increasing in age and less experienced technologists replacing them are yet to have sufficient training in multiple specializations and complex manual analyses, in order to address the labor requirements in multi-discipline laboratories. In contrast, fully automated hematology analyzers can accommodate a wide range of analyses, significantly minimizing manual intervention and human error.

Hematology analyzers are capable of processing hundreds of samples simultaneously, making them ideal for high-throughput industrial, medical, and research applications. Sophisticated models with improved sensitivity can also detect not just blood cell and platelet count, but also the reticulocyte function and cell size.

Market trends

Harshal Kadu

Harshal Kadu

National Sales Manager,

Beacon Diagnostics Pvt. Ltd.

(A Beacon Group Company)

Hematology, which deals with the study of blood and its diseases, is a subspecialty of internal medicine and is concerned with nature and function of blood diseases. Hematology uses highly developed technology to make specific diagnoses and treat illnesses occurring in all organ systems. Blood disorders become a critical health issue, with different causes related to high mortality. Blood disorders, like anemia, blood cancer, hemorrhagic conditions, and blood infections affect many people every year across all age groups, accelerating the need of the market.

The global hematology reagents and instruments market is expected to grow from USD 3.93 billion in 2020 to USD 5.69 billion by 2025 with a CAGR of 7.2 percent.

The market can be segmented into hospital laboratories, commercial service providers, government reference laboratories, and research and academic institutes. Out of these, the hospital laboratories dominate the market, and they are expected to continue the dominance in the coming years. The use of high-quality equipment, which provides most accurate and reproducible results, is the main reason for this dominance.

The commercial service providers in this segment are projected to register high growth in coming years, which can be accredited to growing disease prevalence, coupled with shift from manual to automated testing. Moreover, several benefits offered by these providers like efficient turnaround time, affordable service costs, and efficient management for sample collection are further contributing to the growing trend.

Development of precise, flexible, and user-friendly technologies that are cost-effective has been a trend in hematology analyzers and reagents. Hematology analyzer manufacturers are increasingly investing in the research and development of analyzers with microfluidics technology that use low volumes of sample and reagent. Microfluidics deal with the flow of liquids inside channels as small as a few micrometers. Low reagent consumption by hematology analyzers with microfluidics technology helps reduce operating costs significantly.

As a traditional player in this most competitive hematology analyzer and reagent market, Beacon Group is constantly making dynamic developments by offering high-quality instruments and reagents, manufactured in state-of-the-art manufacturing facility, and meeting the challenging demands of customers across the globe.

Operated by advanced algorithms, modern hematology analyzers also implement data-fusion capabilities to integrate information from multiple separate modules and identify patterns, which cannot be determined by a singular module. This function leads to convenient detection and correction of interfering elements and lesser need for manual reviews.

Anjali Tewari

Anjali Tewari

Director, Lab Sciences & Medical Superintendent,

Regency Hospital

“Coagulation testing is a challenge as it is not foolproof, or an exact science. Operator expertise in performing quality testing and interpreting results is a key component. The advances and ongoing innovations have greatly improved laboratory analysis of coagulation, and attention must be paid to rapidly evolving literature and diagnostic validity of methodologies for choosing a test method or an equipment. Photo-optical clot end-point detection may give erroneous results due to icterus or lipemia. The commonly used technologies like mechanical or viscosity-based clot detection, which use steel ball and electromagnetic field, reduce interferences from lipemia or icterus. Chromogenic substrate assays are more specific than clot-based assays and are useful to evaluate specimens from patients who have circulating inhibitors or who are on anticoagulant treatment because the inhibitors do not interfere in the chromogenic assay. Other techniques include immunoturbidimetry, enzymatic, and chemiluminiscence. Coagulation testing can now even be performed by using small handheld, battery-operated devices (POCT).”

Currently, there are a few jobs where clinicians are mandatory such as transferring blood samples from the collecting tube to the instrument. However, in the future, hematology analyzers would limit human involvement as much as possible to eliminate the risk of aerosols released while collecting the tube. The device operator merely needs to place the capped collection tube in the sample carrier and it will automatically enter the device for analysis. With the advent of the Internet of Things (IoT), these devices will receive major upgrades. The healthcare professionals would receive reports and updates promptly on a regular basis.

The advent of new technologies would make hematology analyzers safer, more accurate, and much easier to handle.