Infusion Pumps

From smart pumps to intelligent systems

The infusion industry is constantly evolving as our healthcare system shifts to meet new demands. It is incumbent upon the infusion industry to ensure that it not only advances but also focuses on the way in which care is delivered to provide better, safer, and more effective treatments.

The first programmable IV infusion pumps came into use more than 40 years ago. Being able to program a specific rate and volume made modern infusion therapy possible; but these dumb pumps could accept any infusion rate from 0.1 to 999 mL/hr or higher. Programming 54 instead of 5.4, 800 instead of 8, or entering the volume as the rate could each deliver a fatal dose. Compared to medications delivered via other routes, IV medication errors are twice as likely to cause patient harm. For the next three decades, the potential for pump mis-programming and other errors remained a critical issue.

The most significant advance in smart pump use came in 2003 with the introduction of wireless connectivity. The implementation of bidirectional wireless connectivity between hundreds of pumps and a single server allowed hospitals to upload software revisions and download infusion data much more easily. This greatly enhanced infusion safety and continuous quality improvement (CQI) efforts.

These newer infusion pumps are equipped with predetermined clinical guidelines, dose error reduction systems (DERSs), and drug libraries that provide a comprehensive list of medicines and fluids with dose, volume, and flow rate details. In addition, they are designed to address the programming errors that traditional pumps are susceptible to by notifying the user when there is a risk of an adverse drug interaction or when the pump’s parameters are set outside of specified safety limits for the medication being administered. Alerts generated by smart pumps include clinical advisories, soft stops, and hard stops.

However, smart pumps are still not smart enough to ensure the five rights of right drug, dose, route, patient, and time, much less right response and documentation. Barcode medication administration (BCMA) can help ensure these rights and works very well for tablets, unit-dose liquids, and injections for which the drug administration is a discrete event. Scanning the nurse, patient, and medication and administering the drug completes the event. However, many IV infusions are a continuing process involving initial programming and often subsequent changes with multiple nurses involved in the therapy. While smart pumps and BCMA coexist in many hospitals, except in a very small number where they are not integrated. Addressing the complexity of IV therapy requires an integrated approach.

A major limitation has been that even with connectivity, infusion pumps typically operate in insolation – not assigned to a particular patient, not aware of the intent of therapy, unaware of caregiver proximity, and unable to interact with other safety technologies. Wireless connectivity and direct communication with BCMA, the hospital information system (HIS), and other systems can overcome these shortcomings and elevate the current smart pumps to the new level of intelligent infusion system. Fully developing and implementing such systems will take time, but the impact will be dramatic.

Interoperability is a journey and not a destination. Hospitals can start anywhere in the spectrum of opportunities that will be coming along, based on need and HIT capabilities. However, a hospital chooses to begin, an ultimate goal is to connect and monitor all infusion-related systems with surveillance, patterned after the air traffic control systems. In much the same way as the air traffic controller works with pilots to help planes fly more safely, one can envision a future IV medication system that is fully integrated with other systems and would automatically flag any critical, infusion-related situation that requires immediate attention, adding a new dimension to IV infusion safety.

A hugely evolved infusion pumps product range offered now

Aditya Kohli

Aditya Kohli

Director-Marketing & Sales,

Allied Medical

Infusion pumps that control the administration of medication infusions at a set rate were introduced worldwide over 40 years ago. These have evolved vastly over time from manual control into sophisticated automated systems, with in-built safety features and ability to interface with other electronic systems. Safety features include a sensor for detecting air within the line; a battery fail-safe system, which is a backup power system, and ensures that the infusion pump continues administering medication in the event of an electricity outage; pressure sensors which can detect pressure changes within the lines caused by issues such as blocked lines or veins or empty bags of medication.

However, it is recognized that as with the introduction of any new technology, not all errors will be eliminated, and new errors may occur. A multisite study conducted revealed that using smart pumps could decrease errors caused by gravity infusions (i.e., not using any technology to limit the rate of infusion); however, new errors or unintended consequences could be introduced when using newer.

Infusion pumps are microprocessor-controlled, high-precision, intelligent drip-type, and syringe infusion pump, which is capable of accurately controlling the delivery rate of disposable IV set and syringes as well as monitoring the infusion course.

It is especially suitable for clinical treatments, which require continuous and precisely controlled infusion at a constant rate. It is widely used in internal medicine, surgical, pediatrics, obstetrics, ICU, CCU wards, operating rooms, and other clinical infusion treatments.

The daytime mode and night mode feature could be switched automatically, and it is not necessary to set one by one, and so the noise pollution would be decreased effectively. Specially designed docking station has Wi-Fi and network interface, which can work with dock as a bedside infusion workstation (docking station).

All data can be monitored in real time, data acquisition and transmission can be done automatically, suitable for mounting both syringe pumps as well as volumetric infusion pumps simultaneously in quantity three or more (in multiples of three). Syringe and infusion pumps apply the same operation panel, and every pump is an independent infusion module; all these are for the convenience of operation and user training.

The Indian infusion pumps market is expected to rise around 7.8 percent CAGR over the next 8 years. The Indian market is anticipated to develop at a considerable rate owing to the surging adoption of specialty infusion systems, growing private-sector and government funding, and improving healthcare expenditure. Rapid advancement in technology is expected to favor companies to launch more user-friendly and technologically smart infusion systems. Furthermore, reimbursement value increases for private payers, if infusion therapy is done at home rather than at a hospital, as associated charges are less. This is expected to promote revenue growth from the home infusion end-user segment.

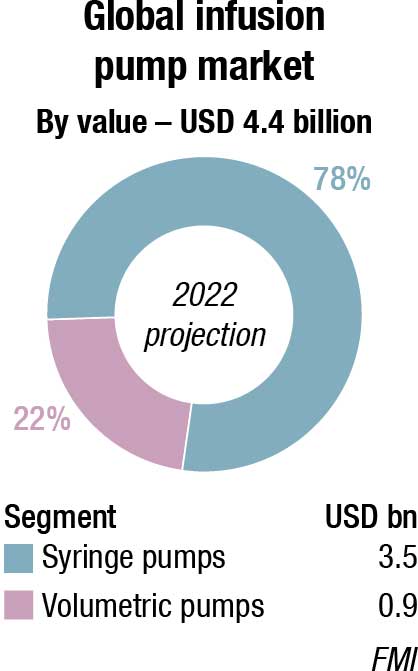

The global infusion pump market is projected at USD 4.4 billion in 2022, and is expected to reach USD 6.6 billion by 2030 at a CAGR of 5 percent, finds Future Market Insights (FMI). The growing incidence of chronic diseases, together with the rapid rise in the elderly population, increasing demand for ambulatory infusion pumps, and the rising volume of surgical procedures carried out around the world are the primary factors boosting the development of the infusion pump market. Moreover, the increasing adoption of specialty infusion systems, and growing demand for infusion pumps in the developing markets, offer high growth opportunities for several players in this market.

Infusion pump market holds nearly 32.4 percent market value share of the USD 13 billion intravenous therapy market in 2021. In addition, the rapid advancement of technology in healthcare has resulted in increased health awareness.

As a result, the use of infusion pumps is expected to rise. Technology, safety features, and equipment shapes and sizes all contribute to the market’s growth.

Volumetric pumps are anticipated to hold a share of 22 percent in 2022, by product type, expanding at a rate of nearly 4.8 percent. Volumetric pumps have a broad range of applications in parenteral nutrition and disease management, due to which the market share of volumetric pumps is the highest in comparison to other products. The simplicity, accuracy, and safety of these infusion pumps in the treatment of several therapeutic areas adds to the increasing demand for these pumps.

Presently, the volumetric pump segment is boosted by its advantages, broad applications, and growing use and increasing product launches in the emerging and developed countries.

Furthermore, the demand for volumetric pumps is anticipated to grow globally, specifically in the South American and Asia-Pacific countries, due to their growing popularity and the increasing focus of governments on healthcare facilities.

The US is estimated to account for around 88.5 percent of the North America infusion pump market in 2022. The dominant share of US can mainly be owing to the increased usage of specialty infusion pumps for the cure of chronic diseases, rising geriatric population, rising prevalence of chronic diseases, and the availability of several large hospitals in the country.

Germany is estimated to account for 15.4 percent of the European infusion pump market in 2022. Germany is expected to lead the market owing to the substantial rise in the prevalence of chronic diseases, such as gastrointestinal disorders and diabetes, growing popularity of infusion pumps in-home settings, and growing number of the up-coming players.

In addition, the development of the market is boosted by factors, such as growing usage of insulin injection pens over conventional vials and syringes due to the growing incidence of diabetes. Diabetes is a serious chronic disease with no particular cure. Occurrence and prevalence of diabetes is gradually growing in the country. As per the IDF (International Diabetes Federation), around 7.9 percent of the people in Germany suffer from diabetes – most of the patients have type-2 diabetes. The number of patients with diabetes is expected to grow considerably in the next two decades.

The infusion pump market in China is estimated to be worth USD 249.6 million in 2022 owing to rising disposable income, and increased patient awareness of infusion therapies. Additionally, the rising geriatric population and growing disease incidence are the major factors driving the market growth in the country. According to the latest report on the geriatric population, in 2020, around 264 million people are over 60 years of age and around 191 million people are over 65 years of age. The old-age population is frailer and more susceptible to diabetes, which is leading to the growth of the market in China. This can mean diabetes-associated complications are most common and difficult to manage, thus leading to growth of the market in China.

Companies operating in the infusion pumps market are consolidating, with the presence of a few players. These players are involved in a number of strategic alliances.

The product launch and acquisition accelerate the manufacturer’s strategy to capitalize on the market share and capture a significant share of the market.

Major players operating in the global infusion pump market include B. Braun Melsungen AG, CareFusion Corporation, Fresenius Kabi AG, Mindray Medical, Terumo Corporation, Medtronic Plc., Baxter International Inc., Smiths Medical, MOOG Inc., Johnson & Johnson Private Ltd., and Hospira, Inc.

A number of factors are restraining the demand for infusion pumps. The increasing number of product recalls and lack of skilled professionals and standard usage guidelines are the key factors restraining the market growth. Infusion pump is one of the most recalled medical devices owing to design deficiencies. Other errors linked with infusion pumps include alarm errors, software problems, insufficient user-interface design (human factor issues), battery failure, damaged components, fire, sparks, electric shocks, or charring. Faulty device design was accused for a large share of the recalls.

The impact of product recalls due to safety and efficacy issues on infusion pump sales is a major worry for device manufacturers. These recalls compel manufacturers to replace faulty infusion pumps with updated units and to compensate victims of significant injuries caused by mishaps. As a result, product recalls have an impact on the overall sustainability of the infusion pump market.

The lack of skilled professionals and standard usage guidelines is expected to hamper the market development. The lack of skilled professionals leads to errors while using the pumps, which in turn increases the risk of emergencies, thus, hampering the market growth.

In addition, infusion pumps are designed to deliver liquid medication and other solutions to a patient’s body, and are subject to rigorous standards and requirements to protect the health and safety of patients. The infusion pump market is regulated by various regulatory authorities, such as the US Food and Drug Administration (FDA), the Medicines and Healthcare Products Regulatory Agency (MHRA), and the European Medicines Agency (EMA), for the approval of new products.

In European countries, the CE mark certification is necessary to legally market and sell infusion pumps. Infusion pumps (non-implantable) are classified as Class-II b devices, and implantable infusion pumps are active implantable medical devices (AIMD). There are almost 300 UK-specific standards for medical devices.

The current process for developing new infusion pumps across several geographies is time-consuming and expensive. This is likely to hamper the growth of the infusion pump market in the coming years.

Homecare will become a common infusion setting. The trend to care at home was seen globally as a result of the pandemic. With emergency rooms overpopulated, doctors overwhelmed, and hospitals crushing under pressure, a shift to home hospitalization proved vital. Even before the pandemic, hospital-at-home (HaH) was being implemented in hospitals around the world with a clear benefit to patient’s mental and physical health by keeping them in familiar surroundings, with the dangers of hospital-acquired infections (HAI) far away.

In 2022, expect this shift to continue and strengthen with the expansion of remote patient-monitoring reimbursement codes. The new remote therapeutic monitoring codes may facilitate homecare in three main areas – by allowing the reporting of non-physiologic data; by allowing self-reporting when using FDA-defined medical devices; and the expansion of billing providers to include nurses and others.

Furthermore, many patients have, since the start of the pandemic, pushed off treatments within hospital settings for fear of contracting Covid-19, making care-from-home an appealing option. Indeed, with the increased use of telehealth technologies, also a result of Covid-19, patients are increasingly asking what may be possible to do from home in terms of their medical care.

Covid-19 has in many ways given the healthcare industry permission to finally implement the many technologies that will enable the home to become an extension of the hospital, including for infusion treatments, previously only delivered in hospitals and clinics.

As homecare treatments rise in importance in 2022, providers are going to need additional layers of support to ensure that their patients are receiving optimal care in the home environment. Increased home-administered infusion therapies will necessitate the implementation of connected infusion devices to help maintain the lines of communication between the patient and the provider.

Providers need to know if patients are receiving the infusions they need, and through smart pumps they will be able to determine infusion compliance and intervene, when necessary, rather than simply cold calling an entire patient list, providing a new efficiency in home-based patient management. Additionally, connected devices can alert attending medical personnel of any pump malfunctions, potentially improving the quality of care for infusion patients.

With the increase in home infusions through connected devices, device manufacturers may have greater insight into how these devices are used in the home, what the biggest challenges are for patients, and what could help improve patient compliance.

Additionally, data analytics may reveal hidden patterns otherwise inaccessible, potentially contributing to the entire health ecosystem. These data can be tapped into by both the infusion and pharma industries to better understand how treatments are tolerated in home environment.

For example, providers may find that patients taking parenteral infusions at home regularly receive less medication than prescribed. This may inform prescribing patterns and provide pharma with greater insight into certain patient groups.

Connectivity will be essential for fleet management. A challenge that healthcare providers may face as more infusion treatments are delivered in alternate care settings will be the ability to manage their fleet of infusion pumps. Locating and retrieving infusion pumps from patient homes can be both expensive and time-consuming. Lost pumps are a common and expensive problem for providers, which can be addressed with cellular and Bluetooth tracking capability.

Down-time due to annual maintenance requirements can require additional pumps, which can be a significant cost. Some smart pumps have automated rapid testing capabilities, which allow pumps to be serviced and tested and recertified in a few minutes, potentially improving fleet efficiency.

The infusion industry is constantly evolving as our healthcare system shifts to meet new demands. It is incumbent upon the infusion industry to ensure that it not only advances but also focuses on the way in which care is delivered to provide better, safer, and more effective treatments.