Reports

Global M&A mid-year update

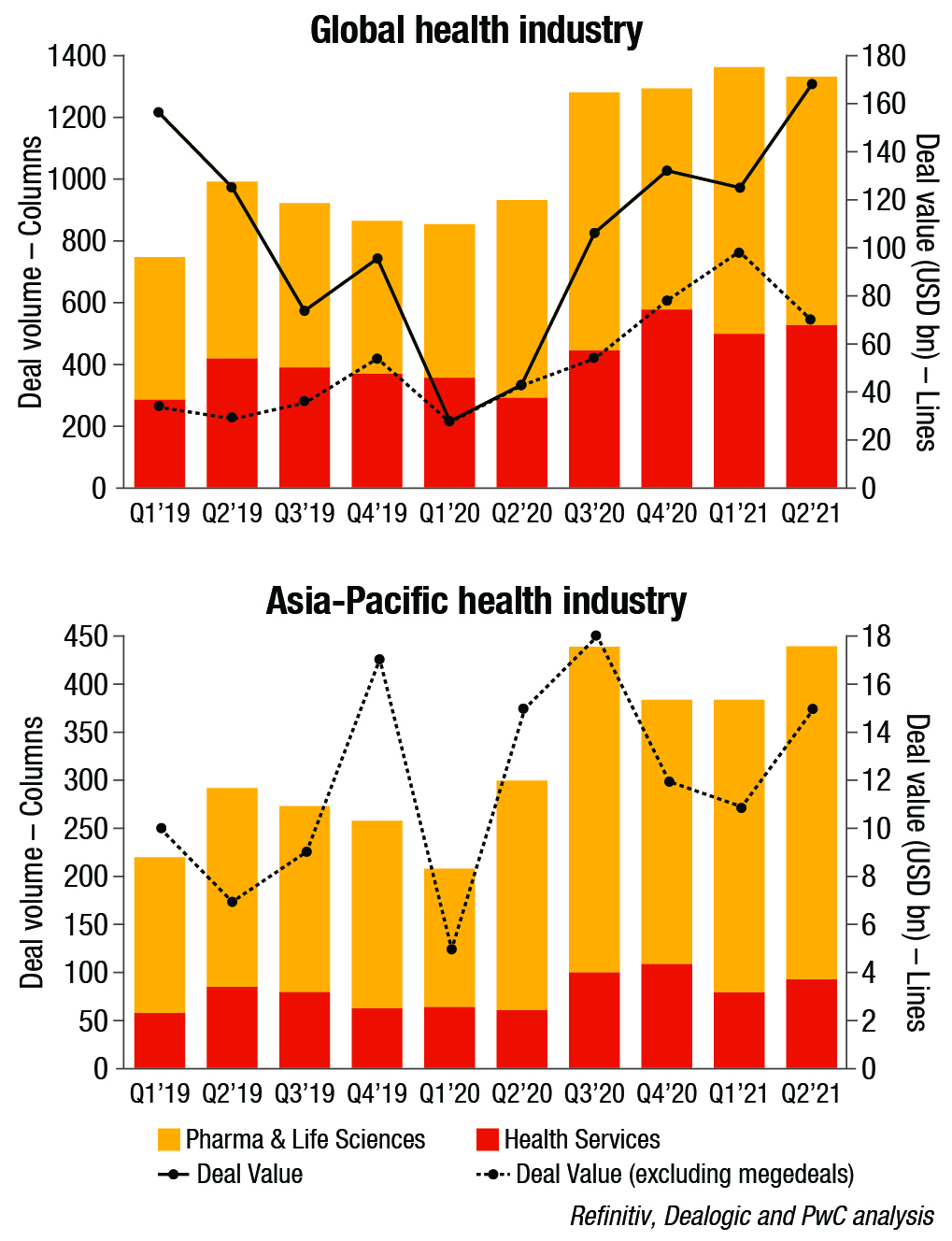

Pharmaceuticals and life sciences (PLS) and healthcare services (HCS) continued to attract high levels of investor interest in the first half of 2021, even as the COVID-19 pandemic has begun to ease in some regions. Despite growing economic optimism in developed economies, many investors continue to see the sector in terms of its historical position as an attractive sector, as it has proven to be structurally stable, and offers very good prospects across the economic cycle. M&A deal activity and valuations are running high, and PwC expects this trend to continue for the next 12 to 18 months.

The pandemic has accelerated the pace of digitization across many aspects of our lives, and healthcare is no exception. The ongoing adoption of digital technologies is affecting everything from patient-care delivery to practice management to the development of advanced precision therapeutics. In PLS, this is causing large pharma to refocus on innovation-led value creation, and away from consumer-oriented businesses. For HCS, the whole operating model is shifting to focus more on delivering consumer-driven health and well-being services.

Along with high valuations, the sector has seen a multitude of deals involving complex deal structures, from special-purpose acquisition companies (SPACs) in the US to public-to-private transactions. As anticipated in our January edition, the prolonged impact of the pandemic has varied among different health industry businesses. Those that mitigate the effects of the pandemic with significant excess cash on their balance sheets are likely to have a significant impact on the M&A market for some years to come.

M&A hotspots

Following areas are expected to be M&A activity hotspots during the next 6 to 12 months:

Pharmaceuticals and life sciences. Traditional big pharma players have ample dry powder for M&A – and they are likely to continue to be interested in acquiring biotech companies at the frontier of science, such as cell and gene therapy or next-generation therapeutics. Due to a surge in valuations for some biotech companies, big pharma is increasingly looking at more creative approaches to deal-structuring and partnerships.

Contract development and manufacturing organizations (CDMOs) can command higher valuations with a differentiated offering or specialized capability, such as in mRNA technology or cell and gene therapy.

Apart from vaccination, rapid and increasingly sophisticated point-of-care diagnostics will play a central role in managing the pandemic. This is likely to attract further investment and M&A as innovative technologies emerge from disruptors.

As the pandemic is likely to remain front of mind in many countries, the market for consumer health products that can improve overall health and well-being (e.g., vitamins, minerals, and supplements) should continue to grow and is likely to make this sector increasingly attractive for investors.

Healthcare services. Specialty care and elderly care continue to attract investor interest. Automation and implementation of digital solutions continue to present value-creation opportunities across the care journey.

Cross-border transactions will remain at elevated levels as private equity (PE) groups and strategic players alike continue to build regional growth platforms and/or enter new markets.

Private healthcare providers and medical devices companies that are focused on elective surgery may become more attractive acquisition targets as healthcare systems work through the considerable backlog of procedures delayed during the pandemic. Businesses focused on cosmetic surgery and discretionary medical procedures, such as laser eye surgery, should also see additional demand due to levels of household savings and pent-up consumer demand as countries emerge from the pandemic.

M&A trends in the first half of 2021

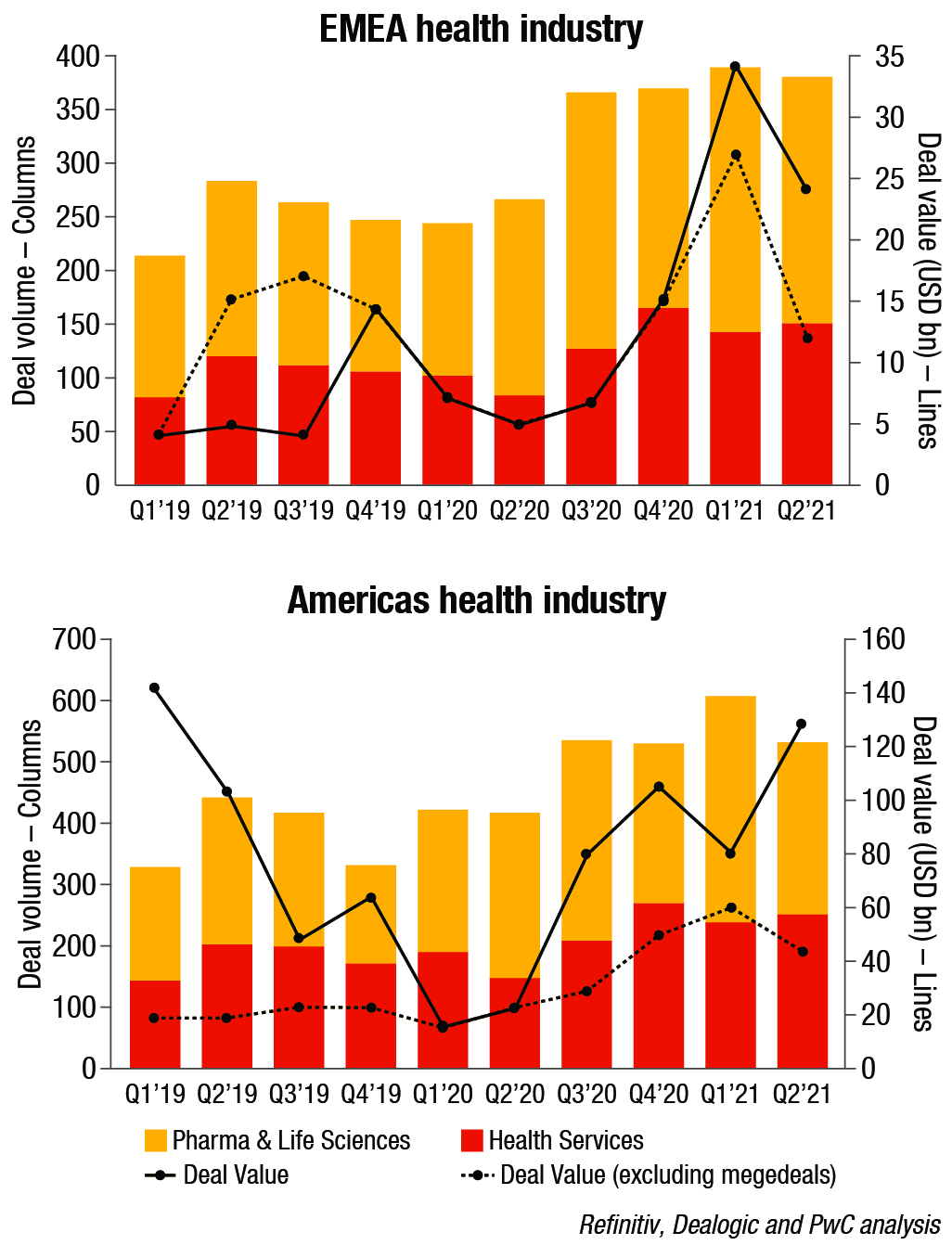

The significant uptick in M&A deal flow in the sector that began in the third quarter of 2020 continued into the first half of 2021, with deal activity remaining at elevated levels across all regions both in terms of deal volume and deal value. This is driven by particularly strong interest from PE funds in the health industry sector, which collectively accounted for approximately 47 percent of deal volume, a marked increase compared with a long-term average of around 35 percent.

Eleven megadeals were announced in the first half of 2021 with a total deal value of approximately USD 128 billion: a consortium of PE funds is to acquire a majority stake in Medline (USD 34 billion); Thermo Fisher announced that it will acquire PPD (USD 17.4 billion); Ginkgo Bioworks announced plans to go public in a SPAC deal (USD 16.9 billion); ICON announced plans to acquire PRA Health Sciences (USD 12 billion); Danaher announced plans to acquire Aldevron (USD 9.6 billion); Hapvida announced a takeover of Intermedica (USD 9.6 billion); Roivant announced plans to go public in a SPAC deal (USD 7.3 billion); Jazz Pharmaceuticals acquired GW Pharmaceuticals (USD 6.8 billion); Nestlé announced it plans to acquire core brands from The Bountiful Company (USD 5.8 billion); Humana announced it has agreed to purchase the remaining share of Kindred at Home (USD 5.7 billion); LumiraDx announced plans to go public in a SPAC deal (USD 5 billion).

Key M&A trends for each region include:

Asia-Pacific – Deal activity continues to be driven by PLS, as R&D and innovation from the region lead to increased licensing deals, partnerships and M&A.

EMEA – An elevated level of M&A activity is being driven by healthcare services, diagnostics, and medical devices companies as the region recovers from the setback and subsequent backlog of elective medical procedures due to the pandemic.

Americas – Deal flow and valuations have benefitted from the buoyant capital markets and the strong interest in the healthcare value chain from PE funds and SPACs.

Key themes driving M&A activity

Industry-specific drivers. The PLS industry has two main drivers of value – innovation in treatments and enhancing the customer experience and ecosystem. Recent scientific and technological developments in cell and gene therapies, mRNA, and digital analytics capabilities are leading industry players to refocus primarily on treatment innovation.

In other words, the large strategic players will continue shedding non-core business units, focusing instead on building specialty platforms, and moving away from being pharma conglomerates. As a result, we expect to see accelerating deal activity from the divestment of consumer-focused businesses (such as over-the-counter products) and the acquisition of specialty pharma developers, contract development and manufacturing, and contract research organizations. We also expect that non-PLS players, such as fast-moving consumer goods (FMCG) companies are well positioned to unlock growth and value from these non-core business units with their direct-to-consumer and digital marketing expertise.

Players from across the PLS and HCS spectrum are leveraging digital solutions to modernize their business models, streamlining and enhancing how they interact with payers, providers, and consumers. As a result, PLS and HCS firms are increasingly acquiring or partnering with tech companies.

Geopolitical developments. While much of the world has been preoccupied with social inequalities and healthcare policies debates in the wake of the pandemic as well as national political uncertainties (including the upcoming elections in Japan, France, and Germany), China has ratified a new regional free trade agreement, the Regional Comprehensive Economic Partnership (RCEP). China has also published an economic plan for 2021–2025 and pushed further investment in its regional PLS industry champions (BioNTech’s first vaccine partnership, for example, was with the Shanghai-based multinational conglomerate Fosun). PwC expects to see additional Chinese cross-border M&A activity, particularly in biotech, over the next 6 to 12 months.

M&A outlook

Consumerization of healthcare. As the pandemic lingers in many countries, the market for consumer health products that can improve overall health and well-being – such as vitamins, minerals and supplements – should continue to grow. Armed with direct-to-consumer and digital marketing expertise, new entrants like FMCG companies have the potential to unleash growth in consumer healthcare brands by rewriting the sector’s marketing playbook.

Business model disruption. We expect continued growth in cross-sector deals as existing players and new entrants alike jostle for ecosystem strength throughout the healthcare value chain. Companies will need to remain agile and challenge themselves to reinvent business models and optimize corporate portfolios. The ability to identify, negotiate, and realize value from increasingly complex partnerships and alternative collaboration models will be an important competitive advantage.

Regulatory uncertainty and geopolitical tension. Geopolitical relations between China and certain other countries continue to create some uncertainties and may dampen some cross-border M&As. However, uncertainty surrounding potential political regime changes elsewhere, either from ordinary elections or in response to the pandemic, may result in additional M&A activity over the next 6 months. Those businesses that have been considering exits from certain regions may decide to expedite those plans in anticipation of governments making unfavorable tax, regulatory, or fiscal changes.

Healthcare services consolidation and digitization. Across the healthcare deals landscape, we see continued consolidation of private clinics and specialist care providers, which remain fragmented across different markets. Operators will need to embrace digitization and accelerate the adoption of digitized practice management and digital solutions to put patients at the center of the patient care journey in order to unlock further value.

Post-crisis, post-vaccine: Winners and losers. Analysts had previously anticipated an influx of cash for the industry from COVID vaccines, which are collectively poised to generate tens of billions of revenue. This could be a powerful catalyst for a disruption to the balance of market power across the pharma and life sciences landscape. M&A will be a priority for capital allocation among successful vaccine developers in the coming years. Apart from vaccines, rapid and increasingly sophisticated point-of-care diagnostics will likely play a central role in managing the pandemic going forward.

This article is based on a recent report Global M&A trends in health industry: 2021 mid-year update by PwC.