Hematology Instruments and Reagents

Hematology – Fostering a Spirit of Innovation

Automation will continue to grow in the hematology laboratory as the number of technologists continues to decrease. The need for today is to have sophisticated systems, where one can put samples on and only be available to look at those truly abnormal samples.

During the first half of the 20th century, the complete blood count (CBC) was performed using exclusively manual techniques. From a simple automated blood cell count, to the first seven-parameter CBC, experts saw hematology changing before their eyes. More reliable automated platelet counts were added in the 1970s. In the 1980s the industry saw the first hematology analyzers that could perform automated differentials and the first automated reticulocyte analyzers. In the late 1990s, the advent of digital cell images and automated manual differentials were witnessed. Today, modern automated cell counters sample blood, and quantify, classify, and describe cell populations. Progressive improvement in these instruments has allowed the enumeration and evaluation of blood cells with great accuracy, precision, and speed, at a very low cost per test. Nowadays, analyzers can accomplish more and more routine diagnostics, and the role of the hematology technologist continues to evolve and expand.

Nevertheless, a number of technological solutions have been developed for laboratory hematology in recent times. These basically include commercialization of modular, high-throughput, and versatile analyzers, which can be easily interconnected by means of sample conveyers, and can fit the organization of small, medium, and large facilities; integration of preanalytical workstations, which can be identical to those included in models of total laboratory automation, or can be specifically designed to suit hematological testing; connection with automated slide strainers, which help improving the entire slide-making process (i.e., less manual activities and lower biological risk, improved standardization of slide preparation and staining, customization of staining protocols, reduction of TAT); and integration of automated image analysis systems.

Automation will continue to grow in the hematology laboratory as the number of technologists continues to decrease. The need for today is to have sophisticated systems, where one can put samples on and only be available to look at those truly abnormal samples. The ability to automate for walk-away systems to improve productivity is a big area. However, hematology is becoming a very competitive market, and sometimes pricing rather than best-available technology influences the purchasing of the analyzers.

Indian market

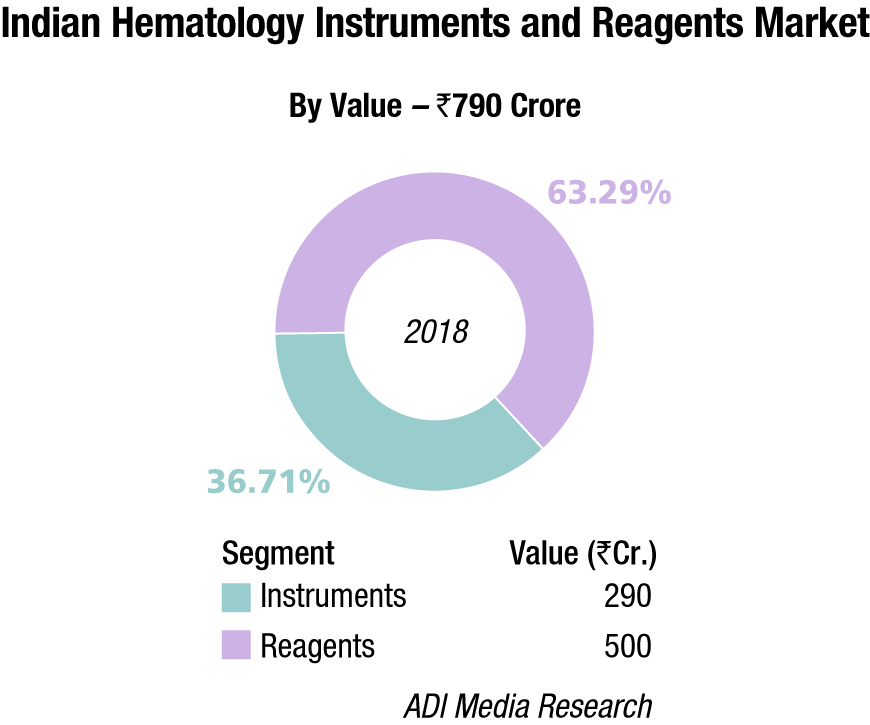

The Indian hematology instruments and reagents market in 2018 is estimated as Rs 790 crore. Reagents constitute 63.3 percent of the market at Rs 500 crore, and instruments the balance at Rs 290 crore.

The hematology instruments market may be segmented as 5-part and 3-part analyzers. By quantity, in 2018, the 3-part analyzers dominated with an estimated 85 percent market share, albeit the margins continued to come from the 5-part analyzers. Within the 3-part analyzer segment, the single-chamber is a dying breed and the laboratories are opting for its double-chamber counterpart. Within the 5-part analyzers, the entry-level analyzers are more popular. The maximum growth is being seen by the 5-part entry-level analyzers.

In April 2019, Sysmex reinforced direct sales and support network in India to expand its hematology business. By offering direct sales and support, the company aims to foster direct customer communications, enabling it to provide solutions to the diverse issues customers face. This approach should also allow Sysmex to step up its activities involving scientific seminars – an area of strength – as part of its aim to be a comprehensive supplier in India.

Since Sysmex selected Transasia Bio-Medicals Ltd. as its Indian distributor in 1993, the two companies have worked together to expand sales and support networks in India. In 1998, Sysmex established a joint venture with Transasia Bio-Medicals (now, Sysmex India) and began manufacturing reagents. In 2007, the company established a reagent factory in Baddi, and in 2008 Sysmex converted the company to a wholly owned subsidiary. In this manner, Sysmex established a business base in India, centered on the field of hematology, and promoted sales and support through local distributors.

Sysmex plans to work with its current distributor to ensure a smooth transition for all its customers in India. Going forward, Sysmex aims to strengthen its sales and support network and provide Sysmex support services as it strives to contribute to the development of healthcare.

Just recently, Transasia has introduced its latest range of 3- and 5-part fully automated hematology analyzers, which have been developed at Erba Europe, the global R&D facility of Transasia. These instruments are set to provide affordable diagnosis to cater to the masses.

2018* |

|||

|---|---|---|---|

| Tier I | Tier II | Tier III | Others |

| Transasia (Sysmex) | Beckman Coulter, Mindray, and Horiba | Abbot, Siemens, and Nihon Kohden | Roche, Dirui, Meril Diagnostics, Shenzhen Prokan, URIT, Labindia, and many small importers |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian hematology instruments and reagents market. | |||

| ADI Media Research | |||

At the buyer end, consolidation is inevitable. A case study of Neuberg Diagnostics sets the trend. Neuberg, which has 60 diagnostic labs and close to 500 collection centers in India, is planning to set up 40 more labs across the country with an investment of Rs 200 crore. Most of the investment will be done through internal accruals, and by its partners. The company wants to decentralize its reference lab model and have localized presence for advanced tests in proteomics, metabolomics, and genomics. The five labs that are now under Neuberg are Anand Diagnostic Laboratory, Supratech Micropath, Ehrlich Lab, Global Labs, and Minerva Labs, present in Karnataka, Gujarat, Tamil Nadu, South Africa, and UAE respectively. Neuberg has three global reference laboratories located in Bangalore, Ahmedabad, and Durban (South Africa).

Key players active in the hematology analyzer market are introducing new and innovative products to maintain or increase their market share. In addition, several companies are manufacturing and marketing miniature instruments with high accuracy. Analyzers are converging multi-parameter tests into single platforms through these miniaturized instruments, thereby helping labs and hospitals to save on heavy investments.

In March 2019, the Everstone Group, via its healthcare platform Everlife, acquired a stake in Chennai-based CPC Diagnostics to include core in vitro diagnostic segments in its portfolio of medical devices and extend its geographical presence to India, with this first investment in the country. Everlife also has investments in Malaysia-based Chemopharm Group, a leading provider of products and solutions to laboratory, research and medical facilities in South-East Asia; DV Medika Group, manufacturer and distributor of one of Indonesia’s top brands of hospital furniture and other imported medical equipment and supplies; and Singapore-based Bio-REV Pte. Ltd., which specializes in distribution of reagents, media, and consumables to the life sciences industry.

In March 2019, DxH 520 hematology analyzer from Beckman Coulter received 510(k) clearance from the US Food and Drug Administration (FDA). Designed for low-volume laboratories, including clinics and physician offices, the DxH 520 features unique technology that improves sample flagging by 40 percent, ensuring better first-pass yield and accurate differentials with as little as 17 microliters of blood.

In February, 2019, Horiba Medical introduced malaria screening and routine hematology. Based on the innovative data mining techniques combined with full blood count, the malaria-suspicion flag is optionally available on both the ABX Pentra XL 80 and Pentra XLR.

Industry Speak

Affordable Hematology Testing is the Need of the Hour

Dr Avi Nahar

Business Unit Head – Hematology

Transasia Bio-Medicals Ltd.

The increasing prevalence of blood diseases and disorders pose a global health challenge and are associated with high morbidity and mortality. From the patients’ perspective, this has led to increasing awareness of diseases and shift from sickness to wellness.

Look at it from the perspective of the IVD industry: hematology has grown to be recognized as a distinct steam of laboratory medicine. Technological advancements, increasing adoption of automated hematology instruments, integration of basic flow-cytometry techniques, usage of microfluidics technology, introduction of digital imaging for cell morphology, rising demand for high-throughput hematology analyzers, and development of high-sensitivity point-of-care (POC) hematology testing are all factors contributing to the growth of this segment.

Asia-Pacific is estimated to be the fastest-growing market due to the rapidly developing healthcare infrastructure and increased funding. Speaking of India, the hematology market has yielded close to Rs. 1300 crore for FY 2018-19.

Technological advancements in this segment have led to reporting of advanced parameters even by the most basic automated analyzers. These parameters provide detailed clinical insights for the differential diagnosis of various blood disorders. Particularly relevant in India, these parameters help in detection of anemia and other hemoglobinopathies. Ironically, there is still a large section of the society, which is devoid of basic laboratory investigations.

To add to that, factors such as high cost of instruments, regulatory constraints, and strong competition act as roadblocks.

Limited access to quality medical infrastructure, including skilled manpower and technologies, has been the pain points of over 70 percent of Indians who live in smaller towns and rural areas. The need of the hour is for Indian manufacturers to cater to this 70 percent. This can be done by providing latest technological advancements at affordable rates.

Transasia Bio-Medicals Ltd., one of the India’s leading IVD company, has been providing Make in India products with an aim to provide affordable diagnostic solutions. Recently, Transasia introduced its latest range of 3- and 5-part fully automated hematology analyzers, which have been developed at Erba Europe, the global R&D facility of Transasia. These instruments are set to provide affordable diagnosis to cater to the masses.

Industry Speak

CBC+CRP is the Right Approach

Dr Prakash Suvasia

Head- Marketing and Scientific

Horiba India Pvt Ltd.

Both erythrocyte sedimentation rate (ESR) and C-reactive protein (CRP) are used as inflammation markers, but in many ways CRP is a more useful test. CRP is made exclusively in the liver and can rise and fall within hours of an acute inflammatory stimulus. In contrast, ESR is more reflective of the concentration of fibrinogen and various non-inflammatory immunoglobulins that have half-lives of days to weeks, resulting in a significant lag time in the rise and fall of the ESR. This difference in specificity and rapidity of response makes CRP as more dependable marker test. The figure, acute phase reactants rise in tissue injury.

Results of ESR are highly dependent on the factors, such as, gender, age, drugs, and smoking, which may lead to wrong diagnosis. With changing lifestyles and time, now TAT for patient report is becoming a challenge. For the laboratories with critical samples and near-patient testing, immediate report and rapid diagnosis plays vital role. Horiba Medical has designed world’s exclusive concept for infection differentiation.

Microsemi CRP point-of-care analyzer helps users in rapid clinical decision making, saving time and reducing costs in emergency pediatric units, which could result in net annual cost savings due to reduced staff time, as well as faster decisions on antibiotic use. Results are available from the Microsemi CRP within 4 minutes for CBC+CRP and for CBC in 1 minute.

Industry Speak

Emerging Trends in Hematology Analyzers

Nitin Srivastava

National Sales Manager, IVD,

Nihon Kohden India Pvt. Ltd.

The cellular and morphological analysis is an integral part of any hematology laboratory. The hematology analyzers are being used predominantly for cell counts and differential leukocyte analysis, but in addition, these analyzers are capable of reporting many additional parameters and can provide much more information than what they are intended to provide, but unfortunately, due to lack of knowledge and propagation, they are not being optimally utilized to their full potential. The new information available with these additional parameters may help the laboratory physician in the screening and diagnosis of many disease states.

At the highest level of hematology laboratory automation are scalable, configurable automation systems that are useful in following analytic determinations like CBC, 6-part white blood count (WBC) differential, nucleated red blood cell (NRBC), reticulocyte count (RET) and immature retic fraction (IRF), automated immature platelet fraction (IPF), and automated smear preparation and staining. These on-demand tests are standardized assays that meet performance goals, decrease the technologist’s hands-on time, eliminate batch testing, and provide results faster to physicians.

The modern-day analyzers are providing 5- to 7-parts differential white-cell analysis, based on different technologies, such as, electrical impedance, radiofrequency conductivity, light scatter, fluorescent scatter, cytochemistry, etc. In addition to these, they also provide additional information in the form cell population data (CPD) and lymph index, large unstained cell population, and hemoparasites, which can be utilized in the screening of benign and malignant hematological conditions. Majority of hematology analyzers are now available with an integrated reticulocyte count analysis with the routine complete blood count analysis, which not only provides the reticulocyte percent and absolute reticulocyte counts but also provides additional data in the form of reticulocyte hemoglobin content (CHr), percent hypochromic cells, percent microcytic cell or microcytic anemia factor, immature reticulocyte fraction, etc. Laboratories that have incorporated HbA1c testing on high-speed hematology lines are performing >90 percent of assays from lavender-top tubes with minimal technologist intervention.

From the point of view of analysis, the ability to analyze and report immature forms of three cell lines (WBC, RBC, and PLT) enables the hematology laboratory to fully automate parameters that can aid physicians in their therapeutic decision-making processes.

The user must identify the abilities and the limitations of these analyzers for better optimization in the laboratory; hence, it is the need of the hour to propagate this useful information acquired from hematology analyzers, both to the clinician and the laboratory physician as it may help the patients by reducing the cost to the diagnosis by avoiding other unnecessary tests and may also help in timely management of the disease states.

Global market

The global hematology analyzers and reagents market was valued at USD 3.23 billion in 2018 and is expected to generate revenue of around USD 5.09 billion by the end of 2024, growing at a CAGR of 7.90 percent, projects Zion Market Research. Improvements in analytical capabilities, rise in demand for analyzers with lesser operator intervention, increase in demand for point-of-care (PoC) analyzers, growing compatibility with electronic medical record system, and rising innovation are anticipated to propel the global market. Moreover, rapidly increasing number of hospitals and diagnostic laboratories due to surging prevalence of chronic diseases, cancer, vector-borne diseases, and blood disorders have been driving the market growth. In addition, rising geriatric population, increasing global healthcare expenditure, and technological advancements in medical research

have been contributing in the market growth of hematology analyzers, and this trend is expected to continue in the years to come.

The rising demand for blood banks is one of the critical reasons that will drive hematology analyzers and reagents market growth. Blood banks are witnessing a huge outflow of blood units to hospitals and other end users and inflow of blood units from blood donations on a daily basis. Hematology analyzers are extensively used in several screening tests. This results in an increased need for hematology analyzers and reagents for blood quantification.

Additionally, the rising usage of automated systems, such as automated hematology analyzer systems, will also drive hematology analyzers and reagents market growth. The use of automated hematology analyzers improves laboratory productivity by minimizing human error. It also generates precise results and offers faster turnaround time with superior performance optimization, resulting in reduced overall cost of diagnostic tests. As a result, there is a rising demand for these automated systems, especially in conducting reticulocyte analysis and coagulation tests. The advent of PoC hematology testing devices has led to improved diagnostics and patient outcomes. These devices are user friendly and are available for use outside the hospital settings. This is anticipated to increase the acceptability and accessibility of hematology testing which, in turn, is anticipated to propel market growth.

Product recall and intense market competition, leading to price wars, hinder market growth. In 2018, Becton Dickinson (BD) and Company recalled Vacutainer EDTA blood collection tubes owing to chemical interference with certain tests. This recall was classified as Class-I recall, the most serious type of recall, by the US Food and Drug Administration (FDA), thereby indicating that the use of these devices may cause serious injuries or death. Such product recalls negatively affect market growth.

The instruments segment held a major share of the hematology analyzers and reagents market owing to the growing demand for these instruments from the end users. The increasing adoption rate of the automated hematology instruments, along with the growing demand for highly sensitive hematology testing, is likely to drive the market for instruments segment in the coming years. Also, rising developments in high-end technology, like the introduction of basic cytometry techniques analyzers and the expansion of high throughput hematology analyzers, have been propelling industry growth.

The hospitals and diagnostic centers segment will account for the highest hematology analyzers and reagents market share. The growing demand for hematology analyzers and reagents in hospitals and outpatient transfusion centers, because of the prevalence of certain conditions, such as hemophilia and cancer that necessitate regular blood transfusions through transfusion therapy, will drive market growth in this end-user segment.

Regionally, North America will account for the largest hematology analyzers and reagents market. Increasing investments in healthcare research and testing in hematology in the US, rising healthcare awareness among the population, and increase in a number of highly advanced diagnostic clinics are some of the major reasons for the high growth of the market in this region. Asia-Pacific is projected to witness swift growth during 2019–2024 owing to the rising healthcare expenditure, coupled with focus on quality healthcare infrastructure.

Some of the leading players in the global market include Abbott Diagnostics, Bio-Rad Laboratories, Drew Scientific, Sysmex Corporation, F. Hoffmann-La Roche, Siemens, Bayer Healthcare, Beckman Coulter, Mindray Medical International, Heska Corporation, Danaher Corporation, and Cholestech Corporation.

Buyers’ perspective

While procuring a hematology analyzer, buyers take into consideration:

- Sample size and micro-sampling the facility will be handling;

- Range of tests to be carried out;

- Kind of reagents that will be required and where to source them;

- The accuracy, precision, and linearity of the device;

- Degree of automation of the analyzer and its processes;

- Total time per analysis;

- Enquire about maintenance, calibration, and quality control;

- Check how to analyze results analysis and store samples; and

- Ask if there will be any footprint (digital/radioactive).

Technology trends

Innovative erythrocyte parameters. Irrespective of the fact that the diagnosis of anemia is relatively simple and straightforward (by measuring total hemoglobin in whole blood), the newer generation of hematologic analyzers is now equipped with many analytical and technical innovations, which enable obtaining other information than that reported with the traditional complete blood cell count, and which may ultimately provide a substantial improvement for the differential diagnosis of anemias. These innovative parameters most typically include automated reticulocyte and nucleated RBC counts, hemoglobinization of reticulocytes and RBC, reticulocyte hemoglobin content (occasionally defined as CHr and RET-He according to the technology used for its assessment), reticulocyte maturation, automatic analysis, and calculation of microcytic and hypochromic RBC. The various combinations of these different parameters not only may be useful to complement clinical history, physical examination and results of more conventional laboratory investigations (i.e., CBC, ferritin, transferrin, iron, haptoglobin, folic acid, and vitamin B12, among others) for troubleshooting the underlying cause(s) of anemia, but may also be clinically useful for diagnosing, prognosticating, and monitoring other non-RBC disorders. The generation of complex scattergrams, which is now almost commonplace in the vast majority of hematologic analyzers, is also helpful for more accurately identifying abnormal RBC populations and other atypical elements.

Disruptive technologies. Regardless of consolidated laboratory techniques, which have just recently made their way through phenotypic diagnostics of anemia (i.e., capillary electrophoresis), a major innovation has been represented by the application of mass spectrometry and molecular biology in the diagnostics of hemoglobinopathies. The former approach allows a better characterization of hemoglobin variants preliminarily identified by screening techniques, such as high-pressure liquid chromatography or capillary electrophoresis, whilst molecular diagnostic techniques enable to unravel specific molecular abnormalities characterizing many congenital RBC disorders.

Unlike screening tests, the selection of the most appropriate molecular diagnostic approach in patients with inherited hemoglobinopathies or RBC enzymopathies should take into account the prevalence and penetrance of the different mutations in the ethnic populations, across different geographical locations. Therefore, the first step may be represented by polymerase chain reaction (PCR)-based techniques [e.g., restriction-endonuclease PCR (RE-PCR), amplification refractory mutation system (ARMS), resolution melting analysis (HRMA), and denaturing gradient gel electrophoresis (DGGE)]. Allele-specific methodologies, such as allele-specific PCR and reverse dot-blot, are especially useful for thalassemia diagnostics in target populations, enable processing a high volume of samples, and are relatively inexpensive, permitting to screen some prevalent hemoglobin genes mutations at the same time. Array comparative genomic hybridization (array CGH) can then be used for detecting additional mutations, which cannot be identified with first-line DNA analysis. Regarding thalassemia, gap-PCR (gap-PCR) and multiplex ligation-dependent probe amplification (MLPA) are perhaps the best options for screening and also for detecting large deletions or duplications of globin genes, which cannot be identified with conventional DNA sequencing. Sanger or next-generation sequencing (NGS) techniques may then be particularly suited for detecting all known point-mutations, but may also enable identifying novel or rare mutations, thus helping to uncover new mechanisms of disease. A reliable guidance for the cost-effective integration of these different molecular techniques has recently been published by the European Molecular Genetics Quality Network (EMQN). Notably, emerging evidence also suggests that molecular genetic testing has a pivotal role in patients with diseases characterized by clonal hematopoiesis, thus supporting the diagnostic workout of hematologic malignancies and/or myelodysplastic syndromes.

Digital hematology. Recent technological advances have led to development and commercialization of innovative automated image-analysis systems, which are suited for automation and can hence be directly connected (in series) with hematologic analyzers. These innovative platforms scan the slides (usually at a picture of ×100 objective), and store digitized images of blood smears at high magnification. The images are analyzed by artificial neural networks, based on a preexisting database of blood elements (thus including RBC), which can be locally customized or updated by the users. The images can be transmitted to, and displayed on, computer screens, which can be even placed at long distances from the scanner (i.e., in hospital wards or in remote laboratories), for analysis and potential reclassification of blood elements. The operator can also increase the size of the images, or expand single sections of the scan, so obtaining a more accurate view. The operator can then accept and conserve the automatic classification, or can move elements from one cell category to another, thus improving the final reclassification. Albeit these automated image-analysis systems have been originally developed for analysis of white blood cells (WBC), specific information can also be garnered on erythrocyte morphology, thus including the presence of anysocytosis, hypochromia, microcytosis or macrocytosis, spherocytosis, elliptocytosis, ovalocytosis, stomatocytosis, acanthocytosis, echinocytosis, polychromasia, poikilocytosis and abnormal erythrocytes (i.e., sickle cells and schizocytes, helmet and teardrop cells). Recent data showed that the diagnostic sensitivity of these systems for identifying some critical categories of abnormal erythrocytes is excellent, typically higher than 80 percent, thus making the use of digital image analysis a highly valuable, and probably more accurate and reproducible, alternative to optical microscopy. Notably, the use of these systems may also enable an efficient recognition of parasitoid infections, such as malaria, as well as the reliable identification of intravascular and spurious hemolysis, which would be otherwise undetectable on whole blood specimens. Interestingly, most of these automated image-analysis systems are also capable of optimizing the identification of rare RBC abnormalities, since morphological erythrocyte alterations can be more efficiently visualized on the computer screen. Finally, the creation of a large personalized database of images of suggestive RBC abnormalities represents a valuable resource for education and training of students and laboratory professionals.

Way forward

The International Council for Standardization in Hematology (ICSH) has proposed a new reference method for the leukocyte differential based on the use of monoclonal antibodies (mAbs) and multicolor flow cytometry. This would provide manufacturers with accurate and reproducible WBC classification for the development and improvement of automated technologies. Another opportunity for improvement is the incorporation of additional light scatter measurements in the characterization of blood cells, with the aim of more accurate classification of WBC subpopulations and potential identification of immature or pathological cell types. For example, advanced MAPSS technology can enable the differentiation of seven subpopulations of nucleated cells including neutrophils, lymphocytes, monocytes, eosinophils, basophils, IGs (including metamyelocytes, myelomyelocytes and promyelocytes), and NRBCs (if present), by utilizing seven light scatter detectors and fluorescent flow cytometry.

Industry Speak

Hematology Analysis, Technological Advancements and Emerging Trends in India

Dr Vijay Parekh

Scientific Advisor- R&D Equipment

Agappe Diagnostics Ltd.

Indian healthcare has undergone rapid transformation toward global sophistication and is already a preferred medical destination for patients from neighbouring countries. As an important part of Indian in-vitro diagnostic (IVD) sector, hematology analysis has also grown. Though large number of blood samples are analysed on automated hematology analyzers, many times more are still tested using microscope. What has still not changed, however, is Why blood counts are performed?

With evolving technologies, hematology analyzer data has become highly precise, objective and reliable. It has removed drudgery of microscopic techniques. Today more doctors ask What is wrong with the patient? instead of wondering What is wrong with the result?

Technologies that ushered such paradigm shift are electrical impedance, optical cell counting, laser light scatter, fluorescent staining, flow cytometry using monoclonal antibodies etc. However, detecting all WBC abnormalities is arguably the last bastion still to be conquered, primarily because new technologies can still not match the accuracy of expert morphologists, which is a fast decreasing tribe. This has led to development of automated image analysers which capture high resolution images, use high speed computing and sophisticated self-learning algorithms to reduce reliance on traditional morphology based white cell differentials. This trend will continue till alternate means are established for reliable diagnosis.

Though Indian IVD has moved closer to global sophistication. almost 80 percent of hematology analyzer installations in India are 3-part WBC differential analyzers (3-PDA) and imported, without exception. Over last two decades, several Indian IVD manufacturers began producing diluents and lysing reagents ensuring lower costs and easy availability. Continued reliance on imports prevents penetration of automated hematology analyzers to rural patients, discourages even high volume urban end-users from regularly using blood controls and calibrators as they are perishable with uncertain availability and high costs. Obviously this can not continue in India which boasts global capabilities in many technology areas. Several Indian IVD manufactures have progressed rapidly towards indigenous manufacture of equipment and reagents and by acquiring IVD companies abroad.

Though it is more difficult to miss an abnormal result today than ever, it is also true that effective use of data from hematology analyzers has still not reached majority of patients and rural populations remain underserved. To address this, Agappe Diagnostics Ltd. seized initiative over other IVD manufactures by launching the first indigenously developed automated 3-PDA hematology analyzer along with required consumables.

This is in the silver jubilee year and justifies Agappe’s commitment to use

Surging innovation, Serving mankind

Industry Speak

Cellular Analysis Line – Future of Hematology Testing

Priyank Dubey

Product Manager Hematology

Mindray

The laboratory testing is moving toward consolidation across different segments. Factors, such as acquisitions, better connectivity, centralized testing, wider ranges of tests, etc., have contributed to this phenomenon. Hence the challenges for the modern-age laboratory have also changed, and now involve processing very large volume of samples while lowering the turnaround time.

Hematology testing has also come of age, and has become the mainstay of laboratories across segments. Over the years, their roles have evolved from being used merely for counting cells to now assisting the pathologists in clinical decision making with enumeration and flagging of abnormal cells, and now enabling greater efficiency with middle ware, automated slide maker, workload optimization, and capability to share the results over web interface. These features enable these cell counters to meet the demands of the modern laboratories that expect accurate results, lower turnaround time, competitive cost per test, and seamless integration with their reporting infrastructure. Especially in the segment where the number of samples are very high, such as in corporate laboratories and hospitals, there is an eminent need for having a single integrated system, which can provide customized solution. Integration enables the laboratory to reduce the turnaround time, lower manual intervention, and increase the quality and consistency of the results. So, instead of having more number of standalone systems, these labs are now opting for integrated options, which enhance their overall efficiency.

Mindray’s Cellular Analysis Line (CAL) concept has been designed to help the customers in overcoming these challenges. The latest CAL 8000 and CAL 6000 systems provide very high processing speeds, 100-plus parameters, automated rules and decision capabilities, and slide making with flexible configurations, thus taking integration to the next level. In addition to that, the system equips the key decision makers to review the machine results and add further microscopic details on real-time basis, thus providing end-to-end integration and adding value to the laboratory’s workflow.

We are certain with the CAL system, we will be able to address the existing gaps and provide solutions which will revolutionize hematology testing, thus providing healthcare within reach.

Industry Speak

Technology Advancements and Emerging Trends in Hematology

Anil Prabhakaran

Managing Director

Sysmex India Pvt. Ltd.

The dynamic and complex challenges faced by the medical diagnostics laboratories have played a pivotal role in evolution of clinical hematology and blood cell counting methods. The modern-day hematology analyzers are well equipped to collect more information about the cell characteristics, and subsequently detecting the diseases more accurately. The advanced systems can classify multiple cell types, including five mature WBC types, and additionally the immature granulocytes (IG). Automated and accurate IG count has significantly reduced the manual review rates; the result including the presence and concentration of IGs is made available within a minute and can be reported along with the routine CBC and differential counts.

The modern hematology cell-counter systems can very well detect atypical parameters, which are of utmost importance in diagnosing or monitoring the progression of a blood disorder under investigation like NRBCs, reticulated RBCs/PLTs, fragmented RBCs, reticulated hemoglobin equivalent (RET-HE), immature reticulocyte fractions (IRFs), and immature platelet fractions (IRFs), neutrophil reactivity and granularity intensity (NEUT-RI and GI). Furthermore, these hematology analyzers can also detect atypical results, and can improve measurable parameters, such as red cell distribution width (RDW), platelet distribution, etc.

Data fusion is a diverse collection of techniques, which are used to combine multiple sensor measurements and/or information from related sources to improve accuracy, and draw more specific conclusions than would have been possible by using a single source. The data fusion technology has helped to recognize the presence of giant platelets using the information generated from PLT and NRBC modules. This clue can be used by the WBC algorithm to correlate with any interference detected, leading to the automated WBC count correction, if needed. Hence, it has established the bridge between the various measurement channels of the analyzer, leading to a highly dependable result and high-quality data interpretation.

Automation of hematology diagnostic process has reduced the turnaround time, and accelerated the overall treatment regimen with improved accuracy and elimination of human errors. It is evident that automation will shape the ultra-modern laboratories of the future and boost the growth of hematology testing market in the forthcoming years. To summarize, the technological advances integrated in modern hematology analyzers are providing the clinicians a plethora of information that was not available earlier with routine CBC differential counts. We all are advancing to such a future where the hematology cell counters have ability to identify and monitor clinically significant cellular transformations, and evolve as a powerful tool for management of any medical condition which impacts blood cells. It is evident and well accepted that the advanced and efficient systems are adding indispensable clinical value to modern laboratory practices. However, the value delivered by these systems demands a fair economical support for further advancements and sustainability!

Second Opinion

Developing Trends in Automation in Hematology

Dr Sarita Kumari

Director Lab

Delhi Heart and Lung Hospital

In this highly competitive world, each laboratory is doing its best to make sure that the results are of supreme quality. Assuring quality of test results depends on many factors, starting from pre-analytical to post-analytical variables. In analytical segment, advanced technology and fully automated hematology analyzers play revolutionary role in diagnostic sector.

The original hematology analyzers first appeared in 1950s but truly functional and automated versions became available in the market after 1970s. Before this time, the laboratory tests were based exclusively on manual techniques, blood cell counts by hemocytometer, hemoglobin concentration by cyanomethemoglobin method, hematocrit by Wintrobe method, reticulocyte count by supravital stain, and white blood cell differential counts by microscopic method. The pathologists were facing lots of difficulties because it was more laborious, more imprecise, more chances of distributional, statistical errors, and errors due to inter-observer variability.

The history of Coulter is very interesting. In 1956, Coulter impedance measurement particles suspended in a conductive electrolyte solution were drawn though a small aperture. During 1960s, multichannel instruments were able to do RBC and WBC counting by impedance method and hemoglobin determination using the cyanmethemoglobin method. But in 1970s, automated platelet counts were done by hydrodynamic focus method and cell counting by light-scattering method, introduced in analyzers. Five-part differential hematology analyzers were introduced in the year 1980. Now, the seven-part differential hematology analyzers are available in the market.

Currently, various analyzers available in the market are based on various techniques: impendence technology, optical system, fluorescence flow cytometry, double-hydrodynamic sequential system, high-fluorescence body-fluid technology, and digital cell morphology. The combination of these various technologies has increased the yield and productivity of test results.

Advantages of various automated hematology analyzers are excellent analytical performance, closed-tube analysis, no inter-observer variability, no slide distribution error, elimination of statistical variations, and availability of extra parameters, e.g., MCV and RWD.

What is next for the hematology laboratory?

Increasingly, manufacturers are incorporating additional tests into the routine hematology analyzer, e.g., CD61, CD3, CD4, and CD8 assays. These tests allow for increased analyzer utility and efficiency. Latest-generation analyzers are capable of giving detailed cellular information to the operator, such as blast cell differentials. Some are also able to give suggestive information regarding pathological conditions, e.g., iron deficiency anemia. The additional information available to hematology technology increases the efficiency and productivity of the laboratory, and ultimately when used correctly improves patient care.

Second Opinion

Hematology Instruments & Reagents – Global Market Trends

Dr Somika Sethi

Sr Consultant

NABL

The global market for hematology instruments and reagents is projected to increase rapidly, driven by the rising incidence of blood related disorders and robustly growing business of blood donation and collection. Complete blood count is one of the most commonly performed laboratory tests to characterize early disease detection.

Automation, a growing trend in the market, led to global increase in purchase of hematology instruments, which are indispensable diagnostic tools and still sustain a robust position within the world tending trade. They include flow cytometers, coagulation analyzers, and slide strainers. Specialty analyzers are computerized and are extremely specialized machines that confirm the presence, count, and kinds of cellular components in an exceedingly blood sample for sickness detection and follow up. Samples of blood are processed alone or in batches instantly in an exceedingly medical specialty analyzer.

The major driving factors of global hematology analyzers and reagents market are:

- Increasing adoption of machine-driven hematology instruments

- Rising technological advancements

- Integration of basic flow-cytometry techniques in trendy hematology analyzers

- High-throughput hematology analyzers; and

- Development of high-sensitivity point-of-care (POC) hematology testing

The restraining factors of this market are:

- Cost of the instruments is quite high.

- Low adoption of advanced hematology analyzers and reagents in rising.

- Product recall.

- High competitive market for entrance.

- Lot of time-consuming and stringent policies.

To sum up, the benefits of using automated instruments include ability to report additional parameters in samples, provide more complete information, more accurate measurement of cell morphology, multifocal single instrument that reduces the need for multiple samples, reduced turnaround time for tests and elimination of errors associated with manual cell counts, and faster, accurate, and reliable results. Asia-Pacific ranks as the fastest growing market led by higher risk of blood transfusion transmissible infection in emerging countries with poor health infrastructure and the resulting increased focus on blood donor screening and testing, rise in blood cancer in line with the epidemic spread of various types of cancers worldwide, developing blood banking infrastructure and rapid overall growth in healthcare infrastructure, and supportive diagnostic services as evidenced by the establishment of new high-volume laboratories that deal with difficult blood samples.