Devices & Utilities

Incessant tech developments drive the OT tables and lights industry

Advances will continue as lighting choices, illumination, and surgical tables become smarter in the ORs and medical field. Each step forward makes for a safe environment for both the patient and the surgical team.

The operating room (OR) is getting smarter, more effective – and a lot less risky for patients. Hospitals are investing in new devices, designs, and digital technologies that promise a new era of innovation for surgery. The moves are part of a growing shift away from traditional open procedures that involve big incisions, lots of blood loss, and long hospitalizations.

Improved design of ORs and more efficient logistics are being developed using a multidisciplinary approach with close collaboration among clinicians, technologists, scientists, and industry. The OR is well-positioned to be one of the primary platforms for digitally enabled healthcare. These high-tech spaces have the potential to be more than the information-rich settings they already are. Because they integrate data from multiple sources and incorporate a range of equipment, including surgical tables and lights, future ORs will operate as distinct medical devices in their own right.

OT tables

The global OT tables market is estimated to reach a valuation in excess of USD 550 million by the end of 2025, estimates Markets and Markets. The non-powered/manual operating tables segment is projected to be the most attractive in the global market, with an attractiveness index of 1.4 over the next 8 years. Powered operating tables is the second largest segment by technology in the global operating tables market, with a market valuation of over USD 470 million by the end of 2025. However, the hybrid operating tables segment is projected to be the fastest growing segment in the global market, and is expected to exhibit the highest segmental CAGR of 4.6 percent during the period 2019–2025.

The growing demand for bariatric surgeries is one of the key factors likely to drive this market over the coming years. Also, with the worldwide prevalence of obesity constantly rising, it has led to physicians adopting minimally invasive techniques to carry out various weight loss surgical procedures and thus it is expected that this factor will further contribute to the growth of the market in the next few years.

Key players are focusing on the development of OT tables with better efficacy. These are likely to fuel the global market in the near future. However, high prices of OT tables are likely to influence demand.

Indian market dynamics

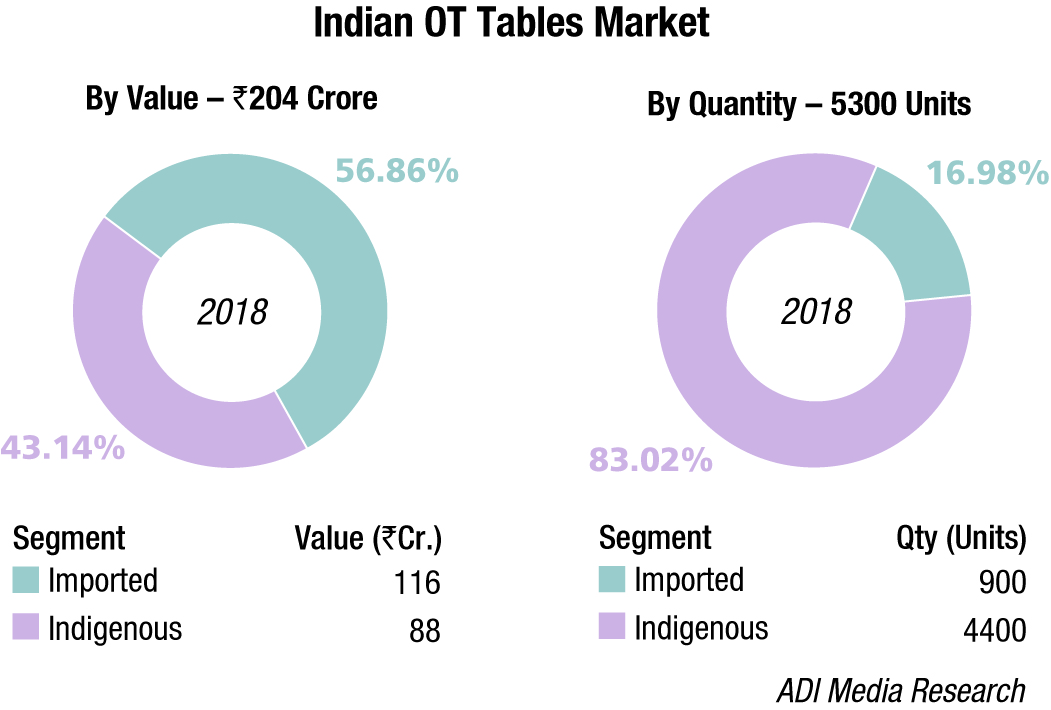

In 2018, the Indian OT tables market is estimated at Rs 204 crore with sales at 5330 units. The indigenous segment with 4400 units continues to dominate with 83 percent of the total market, and in value terms is estimated at Rs 88 crore, share being 43 percent of the market. The Indian segment is dominated by Cognate, Staan, and Galaxy; closely followed by Magnatek Enterprises and Palakkad Surgical. Other aggressive players include Surgdent, Midmark, and many local players. The indigenous manufacturers have improved the quality and features of the surgery tables. Features as patient-centered transfer system, extreme-positioning possibilities, lifting range from 535 to 1235 mm, patient weight capability up to 250kg and carbon fiber tabletops are not uncommon.

| Tier I | Tier II | Others |

|---|---|---|

| Imported | ||

| Getinge, Dr. Mach, and Magnatek | Mindray, Steris, KLS Martin, Dräger, Stryker, Galaxy, Bet (Vivid), and Siemon | Chinese brands |

| Indigenous | ||

| Bharat Surgicals and United Surgicals | Matrix, Cognate, Staan, Confident Dental, Technomed, and Galaxy | Many small Indian unorganised manufacturers mainly in Delhi, Bhiwani, and Southern Indian states |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian OT lights market. | ||

| ADI Media Research | ||

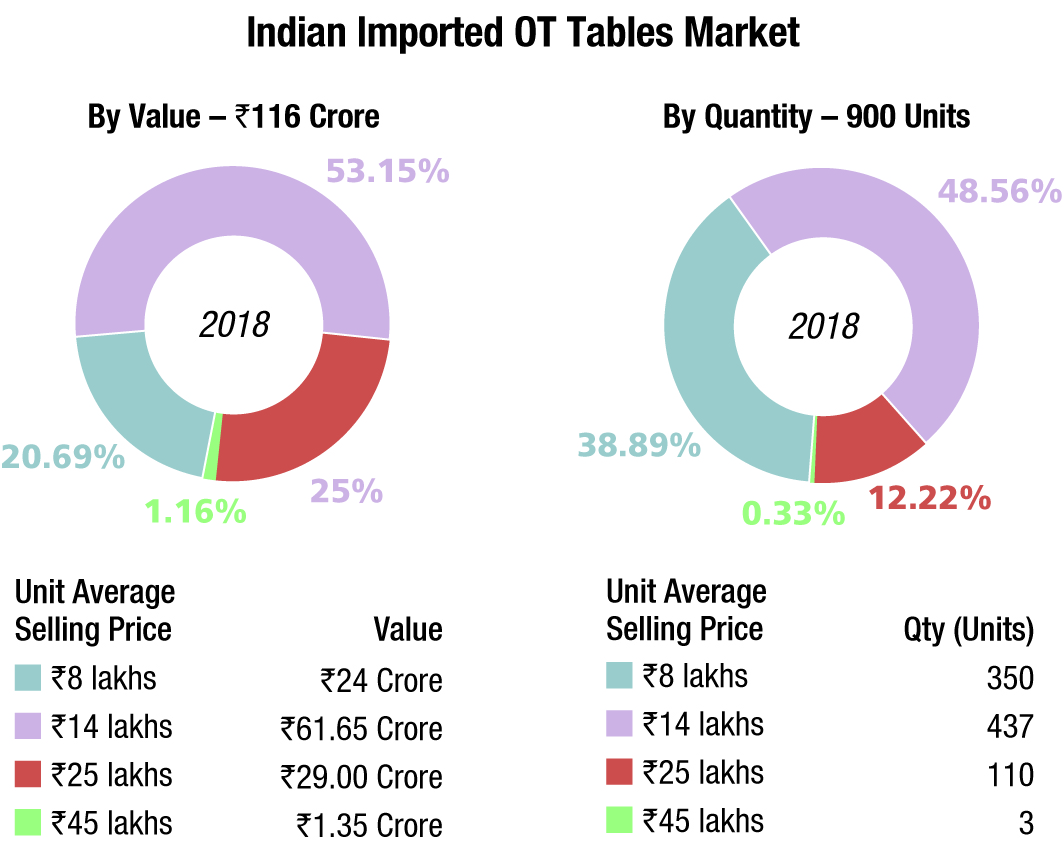

The market for imported OT tables in 2018 is estimated at 900 tables, valued at Rs 116 crore. This market for further analysis may be segmented by its average unit selling price. The high-end tables, in the unit price range between Rs 14 lakhs to Rs 45 lakhs is catered to by Getinge, Mindray, Stryker, and Steris. Other brands with some presence include Mediland, Mizuho, Schärer, Takeuchi, Schmitz, and Medifa. The OT tables, at a unit price in the vicinity of Rs 8 lakh are catered to by Magnatek and Bet Medical. These are Chinese models at competitive prices. Many small players continue to import in small quantities and supply the product.

2019 seems to be a more promising year than 2018. HLL had invited bids but not awarded orders in 2018, these are expected to be closed in 2H 2019, approximating to 182 OT tables and 216 OT lights. There was specific requirement expressed by the states of Rajasthan, Chhattisgarh, MP, Orissa, and Telangana too. Now that the election process is over, other states are also expected to award orders.

In the integrated ORs, intelligent sensor technology is gaining popularity and tables and lights are controlled by a single panel, enabling the team to concentrate on the patient rather than the surgical equipment. While the Indian market is moving toward the value segment, discerning customers including AIIMS, Delhi; PGI Chandigarh; Apollo Group; and Aster demand to cater for features required for IoT and robotics surgery. Increasingly some vendors are catering for modular OTs.

To encourage the Make in India initiative, a tender condition has been introduced recently. The bids being invited by HLL and state governments, in case where the lowest bidder (L1) is an overseas vendor, are awarding 25 percent of the orders to an Indian supplier, the second lowest bidder (L2), provided his quoted price is not more than 10 percent of L1, at L2 price. This seems to be setting a precedent for other non-life saving equipment.

OT lights

The global surgical lights market is expected to grow at a CAGR of 4.53 percent during 2018–2023, estimates Market Research Future. The global market is driven by the extensive use of surgical lights for minor and major surgical procedures and increasing demand for new technologies in surgical lighting. Further, technological advancement in medical devices and increasing number of surgical light manufacturers also fuel the growth of the market.

Asia-Pacific’s surgical lights are driven by an increasing number of surgical procedures, and government initiatives have had a synergistic effect on the market. Additionally, focus on the quality of surgical lights, increasing demand for a LED lighting system in ORs, and rising demand for LED lighting systems also fuel the growth of the market.

Indian market dynamics

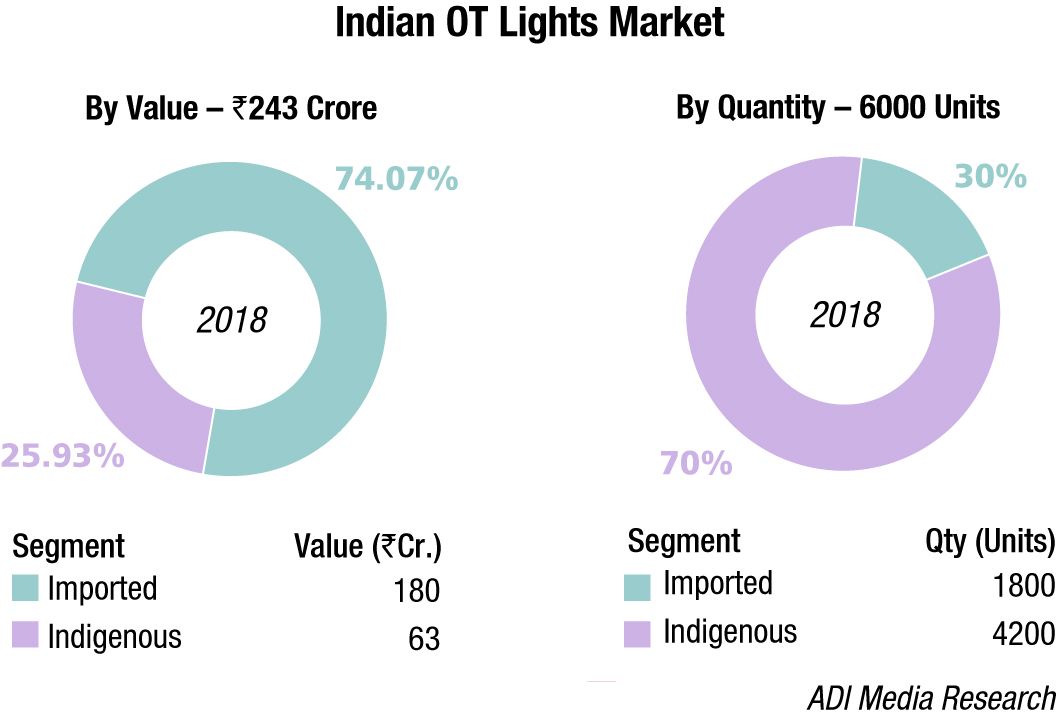

In 2018, the Indian OT lights market is estimated at Rs 243 crore, with 6000 units; with imported lights at 1800 units and indigenous brands at 4200 units. Value-wise the imported segment is estimated at Rs 180 crore and Indian at Rs 63 crore. The imported lights have a 30 percent share when compared to the imported OT table segment at 16 percent, in volume terms. This may be explained by the smaller price differential between imported and indigenous lights as compared to that of the OT tables.

The imported segment of OT lights is dominated by players as Dr. Mach, Maquet, and Magnatek. Other players also aggressive in this segment are Mindray, Steris, KLS Martin, Dräger, Stryker, Galaxy, Bet (Vivid), and Siemon. Companies are looking at importing the lights in CKD condition, which attracts duty of 2.5 percent as against 15 percent, and assembling the parts in India. The Chinese companies continue to have presence in this segment although increasingly the Indian players are seen to have an edge as their quality is perceived to be better than their Chinese counterparts. This may be attributed to the increasingly stringent conditions imposed by BIS in the last couple of years and insistence that manufacturers adhere to them in the bids invited by the tendering authorities.

The indigenous OT lights segment is dominated by Bharat Surgicals and United Surgicals. Aggressive presence is seen of Cognate, Matrix, Staan, Confident Dental, Technomed, and Galaxy. The unorganized segment and regional manufacturers located primarily in Delhi, Bhiwani, and southern states of India continue to cater to this market.

It is expected that with LED lights, with a longer life span, having replaced the halogens almost completely, the Indian market for OT tables and lights will become equal in numbers.

Way forward

OR is a demanding environment that requires precision, efficiency, communication, skilled surgeons and healthcare professionals, and quality lighting. Advances will continue as lighting choices, illumination, and surgical tables become smarter in the ORs and medical field. Each step forward will make for a safe environment for both the patient and the surgical team.