ECG Equipment

Innovation continues to drive the ECG industry

There has been a trend over the past decade toward smaller, more compact, mobile ECG monitoring systems. While the traditional 12-lead ECG system will remain a mainstay, the emergence of these devices will be one of the critical market trends in coming years.

The twenty-first century has seen the convergence of medicine and technology to bring once dedicated, cumbersome, single-function machines to a mobile, compact, and multifunction platform. There has been a trend over the past decade toward smaller, more compact, mobile ECG monitoring systems. These can be used either inside a hospital or clinic, or on the road with a visiting nurse, or on a cart for mobility between patient rooms. While the traditional 12-lead ECG system will remain a mainstay in cardiac diagnostics in the clinical or hospital setting, the future of cardiac assessment may shift to patients triaging themselves before requiring analysis by these more complex systems. There is a trend in the Holter monitoring and consumer market toward inexpensive wearable or smartphone-based ECG monitors. Unlike traditional Holter and cardiac event recorders, the new generation of devices are inexpensive or even disposable and are much easier to use – with the elimination of electrode wires, devices are simply stuck on the patient’s chest. Some new devices interface with cell phones to eliminate the need for an external base station hardwired in the patient’s home. These devices will likely result in widespread expansion of basic ECG monitoring, and represent a novel method for patient engagement in cardiology.

Indian market

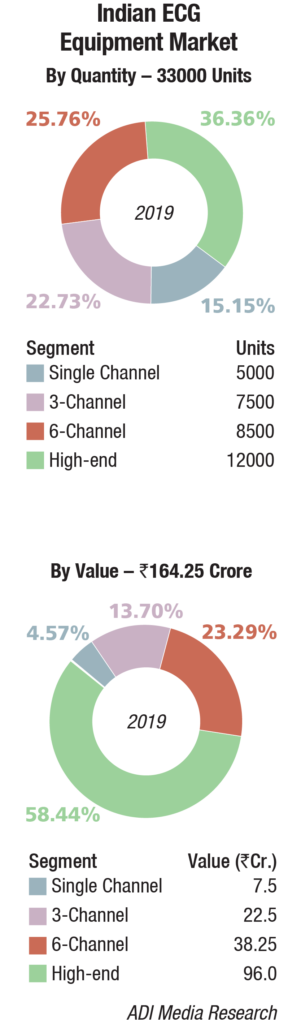

The Indian ECG equipment market in 2019 is estimated at Rs 164.25 crore. In value terms, the high-end machines account for a 58 percent share, and a 36 percent share by volume. The demand for single channel machine is declining ever year, as are the margins. By volume, the 3-channel systems contributed 23 percent by volume, and 14 percent by value. The 6-channel is gradually restricted for niche purposes, as the price differential between 6-channel and 12-channel has narrowed down. Also, with excellent algorithms, possible, the AI modeling of ECGs obtained in sinus rhythm which can identify patients with a history of or impending AF is gaining acceptance.

The Indian ECG equipment market in 2019 is estimated at Rs 164.25 crore. In value terms, the high-end machines account for a 58 percent share, and a 36 percent share by volume. The demand for single channel machine is declining ever year, as are the margins. By volume, the 3-channel systems contributed 23 percent by volume, and 14 percent by value. The 6-channel is gradually restricted for niche purposes, as the price differential between 6-channel and 12-channel has narrowed down. Also, with excellent algorithms, possible, the AI modeling of ECGs obtained in sinus rhythm which can identify patients with a history of or impending AF is gaining acceptance.

Connected ECG solutions, as part of the 12-channel devices are gaining popularity in the Indian market and the size of this segment is roughly estimated as Rs 35 crore in 2019. With telemedicine picking up at government levels and with voluntary organizations, this may just see a 15 percent growth y-o-y, at least for the next five years.

GE dominates the market and has presence in all the four segments, ECG, Holter, low-end stress, and high-end stress systems. Schiller is the only other company, which also has presence in all the four segments, albeit its contribution to the sector is lower than GE. BPL brings its strength of its vast dealer network across the country. Philips and Contec are the other aggressive brands in the ECG market. These five brands have a combined market share of 85 percent in 2019.

In 2018, Instromedix and Mindray received an order from HLL, the latter’s order was for 500 units. In 2019, Bionet received an order for 650 units, at a unit price of Rs 80,000 from APIMDC. The order for 950 units is awaited from DGFMS through GeM. Motara is also successful in the tenders invited by the government.

Segment Players |

|

| Regular ECG systems | GE, BPL, Schiller, and Philips |

| Holter | Schiller, GE, Philips, and Motara |

| Stress low-end | Schiller, RMS, Allengers, GE, Nasan, Medikit, and Forest |

| Stress high-end | GE, Schiller, and Motara (Hillrom) |

Major Vendors* in Indian ECG Equipment Market – 2019 |

||||

| Tier I | Tier II | Tier III | Tier IV | Others |

| GE | Schiller and BPL | Contec and Philips | Motara, RMS, Allengers, and Bionet | Mindray, Skanray, Nasan, Medikit, Forest, Silverline Meditech, Nihon Kohden, Edan, Nidek Medical, and others |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian ECG equipment market. | ||||

| ADI Media Research | ||||

2019 saw a major slowdown, as the procurement of private hospitals fell drastically. Faced with mounting regulatory and operational challenges, Indian private hospital promoters looked to either merge or offload their businesses. Some leading instances are when Max India sold to Radiant Life Care, IHH Healthcare got into a deal with the Fortis group, and Medanta Medicity scouted for a buyer. For the smaller-sized hospitals too, the situation got tough. Many found it difficult to survive in the face of cut-throat competition from large chains. In this backdrop, procurement plans took a backseat.

Global market

The global diagnostic ECG equipment market is expected to reach USD 10.3 billion by 2024 from USD 7.5 billion in 2019, at a CAGR of 6.4 percent, predicts Markets and Markets. Increase in prevalence of heart diseases worldwide is the primary factor driving the ECG market globally. According to the WHO, cardiovascular disease (CVD) is one of the leading causes of death worldwide. It is estimated that CVD takes the lives of 17.9 million people every year, 31 percent of all global deaths. In addition, an increase in demand for the invasive techniques and lifestyle changes is bolstering the ECG market.

In many of the developing countries, owing to the cost-effective factor, physicians are forced to use traditional ECG devices instead of the latest high-end devices. Hence, high cost for buying and maintaining, and lack of technical skills are hindering the growth of the market in developing regions. In developed regions, because of already well-established infrastructure, the new sales are almost equal to the replacement rate.

Technological advancements in sensors have enabled the development of wearable devices that can monitor and record cardiac impulses for long durations. Such devices can be used in the absence of conventional ECG machines in out-of-hospital settings, such as households and public places. The emergence of handheld, wireless, and remote monitoring ECG devices will be one of the critical ECG devices market trends responsible for the growth of the market in coming years.

The ECG devices market has witnessed several technological advancements, which have reduced the size, enhanced portability, and simplified the use of ECG devices. The new-generation ECG devices incorporate advanced algorithms and various workflow improvement features, such as simplified step-by-step operation, touchscreen systems, and better connectivity with CVIS, EMRs, and ECG management systems. ECG electrodes have also undergone significant improvements in terms of design and interference during patient-monitoring procedures. The use of conductive textile has made ECG electrodes soft, flexible, and breathable. Moreover, textile electrodes do not cause any irritation or discomfort to the patient and provide a higher skin-electrode impedance. Such technological advances are expected to fuel the growth of the ECG devices market at a CAGR of over 6 percent during 2019–2023.

The resting ECG devices segment will account for the highest ECG devices market share, by product. The increasing focus on early diagnosis and disease prevention, the rising number of resting ECG procedures, and technological advances are driving the growth of this market segment.

The key players operating in the global ECG devices market include GE Healthcare, Philips Healthcare, Nihon Kohden Corporation, Schiller AG, Opto Circuits Limited, OSI Systems Fukuda Denshi Co. Ltd., Johnson and Johnson, Mindray Medical International Limited, Mortara Instrument, Inc., and Medtronic. The other key players in the value chain include Spacelabs Healthcare Inc., Welch Allyn, Compumed Inc., Cardionet Inc., Bionet, Cardiac Science, Midmark Corporation, Amedtec Medizintechnik, and BPL Medical Technologies.

Companies are focusing on major collaborations, mergers, and acquisitions in order to enhance their market share. Market players are also focusing on R&D to improve product quality and minimize manufacturing costs, and developing safer devices to improve patient compliance and safety.

Market trends

Market trends

In the last couple of years, many medical devices are widely available beyond hospitals and clinics. Sphygmomanometers and glucometers are two such devices, which have enabled individuals to obtain self-measured blood pressure (SMBP) and self-measured blood glucose (SMBG) measurements. This expansion has undoubtedly led to improved awareness, detection, and control of hypertension and diabetes. ECG could be another such device that in coming years could expand to non-hospital settings, and it can be debated if this change will indeed be useful. While SMBP and SMBG both have simple numeric outputs, ECG is a waveform based on a complex analysis of rate, rhythm, and patterns of these waveforms. While automated computerized interpretations of ECG are available in hospital-based devices, false-positives and need for a physician confirmation are invariably required. Further, a conventional ECG interpretation is made in light of symptoms and evaluation of multiple leads.

Single-lead devices have a potential utility among patients with a known episodic rhythm disorders, such as atrial fibrillation, supraventricular, and ventricular tachycardia. While symptoms such as palpitations, dyspnea, or syncope are useful to screen these conditions, availability of home-based rhythm-recognition devices can be useful in prioritizing visits to the emergency room. While prevalence of these episodic rhythm disturbances is low, early treatment has a high immediate impact in preventing mortality and morbidity. This is in contrast to hypertension or diabetes, which are high-prevalence but low immediate-impact situations. External auto-triggered loop recorder (ELR) is another option to screen patients with recurrence of syncope or palpitations.

Chest pain is common life-threatening cardiovascular symptom that requires emergency care. While ECG is a mainstay in diagnostic algorithm of chest pain, a single ECG has limited sensitivity. Often, serial ECGs with a cardiac biomarker study are required to make an accurate diagnosis. Utility of a single-lead ECG is highly questionable in this setting with a potential for false-negative test results. While false-positive result could cause more visits to the emergency room, a false-negative result is worse, as it may lead to potentially fatal missed diagnosis. Multiple-lead wearable devices are likely to be better than a single-lead device in this regard, but interpretation of the presence or absence of ischemia will still be uncertain as compared to a 12-lead ECG. Multiple chest-lead wearable devices, however, will have an unparalleled utility in diagnosis of stable angina, when individuals have chest pain or equivalent symptoms on exertion. There could be a potential to supplant exercise-electrocardiography in these situations.

Research update

Scientists have trained an artificial intelligence (AI) tool to predict sex and estimate age from electrocardiogram readouts. A recent paper in the journal Circulation: Arrhythmia and Electrophysiology, describes how the team developed an AI tool to predict sex and estimate age from ECG data.

The researchers, from the Mayo Clinic College of Medicine and Science, in Rochester, MN, trained the AI tool, which is of a type known as a convolutional neural network (CNN), using ECG readouts from nearly 500,000 individuals.

When they tested the CNN’s accuracy on a further 275,000 people, they found that it was very good at predicting sex but less good at predicting age. The AI tool got the sex right 90 percent of the time but got the age right only 72 percent of the time. The team then focused on 100 people in the test batch for whom they had at least 20 years of ECG readouts. This closer investigation revealed that the accuracy of the AI tool’s age estimates depended on whether the individuals had experienced heart conditions.

For individuals who had experienced heart conditions, the AI tool’s age estimates tended to be greater than their chronological ages. For those who had experienced few or no heart conditions, the AI tool’s age estimates were much closer to the participants’ chronological ages. The results showed that for people who had experienced low ejection fraction, high blood pressure, and heart disease, the AI tool estimated their ages to be at least 7 years greater than their chronological ages. Ejection fraction is a measure of how well the heart is pumping.

The researchers say that these results suggest that the tool appears to be estimating biological, or physiologic age, which, in contrast to chronological age, reflects a person’s overall health status and body function.

Even people with no medical training can see that different people appear to age differently. Scientists investigating aging research are increasingly turning to physiologic age as a way to measure progress of biological aging processes, as opposed to the simple passage of time. To this end, they have proposed a number of biomarkers, including those that measure substances in the blood, epigenetic alterations to DNA, and the level of frailty.

The researchers call for more research to validate the use of the AI-enhanced ECG as a way to estimate physiologic age in healthy people. The data that they used came from people who had undergone ECGs for clinical reasons.

Outlook

The number of available devices that can record and analyze electric signals, emitting from the cardiac conduction system, is on the rise. Innovations in sensor technologies have made it possible to record electric impulses from heart in the absence of conventional ECG machines. A number of first-generation devices using a single lead to record cardiac rhythm have been manufactured, tested, and approved by regulatory agencies. These devices are best suited for a short-term rhythm analysis. Second-generation devices that can record multiple leads are available as both wearable and non-wearable devices. Wearable devices are better suitable as ambulatory cardiac rhythm analysis devices, and could be the future of Holter monitoring systems. This advancement has a potential to enhance utility of this technique in out-of-hospital settings, such as within households, endurance trainings, sports training, and public places. It is also possible to immediately transmit obtained waveforms for expert interpretation, in addition to already-available computerized reports.

Many such sensors are small in size and can be used to monitor rhythms and waveforms over weeks or months. Many handheld ECG devices give only limited information as compared to conventional 12-lead ECGs. Hence, concerns about their accuracy and reliability need to be examined. As information obtained by ECG invariably needs to be interpreted along with clinical inputs, it is debated if out-of-hospital use will really be beneficial. More visits to a hospital because of a false-positive test and missed opportunities because of false negatives will always be a concern as this technology expands.

Industry Speak

ECG market overview

Amit Tickoo

Amit Tickoo

GM – Cardiology and Respiratory Sales,

Schiller India

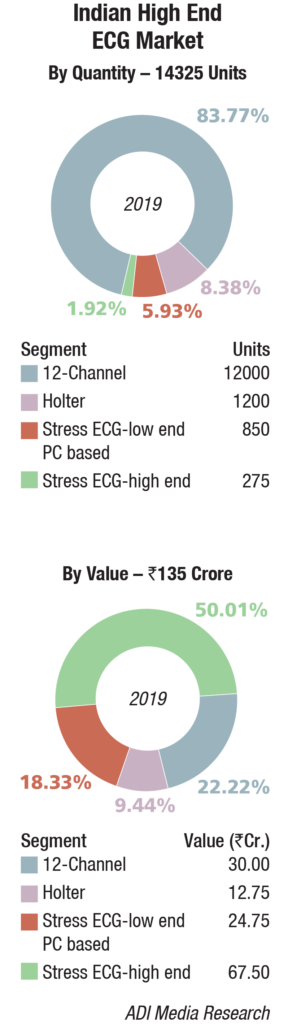

The market saw consistent growth in sales of the high-end ECG segment over the last couple of years. We saw similar trends in 2019 as well. The market was driven by the 12 channel ECG segment as compared to a 3 channel ECG.

Quite similar to 2018, the market saw an upsurge in innovation in technologies, which further accelerated the growth of the high-end ECG sales. Advancements in technology such as higher sampling frequency, better frequency response, and higher screen display size were some of the major highlights of 2019. New tools such as different ECG lead configuration, an advanced tool to detect occlusion site in the artery became the talk of the industry.

Apart from the growth in 12 channel ECG sales, interestingly, the market also witnessed significant growth in sales of the Holter segment. The trend moved toward enhanced technology, with lightweight Holters being introduced in the market. Another very important trend of the year was that the segment not only catered to the retail sector but the government as well. A significant number of tenders were published for the Holter system in 2019 which goes on to prove that the government sector in the coming years will be one of the largest buyers of Holters. Most of the existing manufacturers introduced Holters which were lightweight with a better sampling frequency, and recording facility up to 14 days, which attracted potential buyers.

I believe in coming years the ECG market trend will increasingly move toward new technology, which will be focused on higher sampling frequency for better results, improved wi-fi transmission from the device, quality display with more information. In coming times the ECG device will be handier, enabling the user to carry it from one place to another.

Industry Speak

Electrocardiograph – Market scenario

N. Manogaran

N. Manogaran

Vice President –Sales,

BPL Medical Technologies

Leading firms are increasingly focusing on India and emerging markets, where the markets are growing at an exponential rate due to low labor costs and increased medical tourism.ECG monitoring devices such as, resting ECG, stress ECG, and Holter monitors help identify and provide information about abnormal functioning of the heart.

By lead type, the diagnostic ECG market is divided into 12-lead, 5-lead, 3-lead, 6-lead, single-lead, and other lead types (15- and 18-lead). The 3-lead segment is expected to grow at the highest CAGR in coming years. This growth is due to the fact that these leads are used conjointly with various other cardiac diagnostic tests and during medical procedures. Electrocardiography market is dynamically moving towards 12 Channel ECG. This situation leading to 3 Channel ECG and 12 Channel ECG models as growth drivers in the ECG industry.

ECG measurement and analysis with interpretation features gaining demand and customers do prefer reliable interpretation algorithms like Glasgow. Glasgow has slowly become the widely accepted rest ECG algorithm. Cardiologists appreciate the analysis reporting QT dispersion and QTc apart from QT interval.

QT interval dispersion (QTd) over 80 ms is considered abnormally prolonged. Ideally, this is where the Cardiologist can catch an error in the heartbeat of the patient. Generally, QTd is preferred over QTc for better prediction analysis.

In the recent time, many hospital and institution customers have started looking for connectivity features like DICOM, HL7 as preferred features.

The industry also seen a massive increase on using ECG for telemedicine projects in the government and the private sector. Forwarding 12 lead ECG and getting cardiologists/experts opinion in case of patient symptoms has become a necessity in case of serious heart diseases or irregular heartbeats detected.

Stress ECG is an important for analysis and the market demand is consistently seeing an upward trajectory. Good treadmill and good software with user friendly Interface compels the user to choose from available models.

12 Channel Holter recorder is choice of many compared to 3 Channel Holter recorder. User friendly Holter SW support with various analysis reports make cardiologists to select their choice. Water proof Holter recorders are getting preference from users.

Also, the feature to have electronic memory over memory cards has turned out to be a better in terms of customer usage as because it can provide safe storage to data till it downloads to the Holter software for review and analysis. A buyer behavior to be noted for cardiologist is that they prefer buying based on review/analysis software and the size of the acquisition.

Second Opinion

ECG blockages are not the same as heart artery blockages

Dr KK Aggarwal

Dr KK Aggarwal

President,

CMAAO

The electrocardiogram (ECG) provides a graphic record of the electrical activity of the heart. The sequential movement of electrical current with each depolarization, from the sinus node to the entire ventricular myocardium, creates specific phases of the ECG – P wave, PR segment, QRS complex, ST segment, and T wave.

The electrical activity of the heart is captured by recording electrodes or leads placed on both arms and legs (called the limb leads), and six on the chest (called the precordial leads). The 12-lead ECG is created by simultaneously comparing electrical activity from two of these in the following manner: ECG is helpful in the evaluation of suspected structural and functional cardiac disease in people of all ages who have abnormalities on physical examination and/or a concerning clinical or family history. The routine use of ECG to screen for cardiac disease in asymptomatic people is generally not recommended.

The advancement in ECG has been a shift to miniature hand-held single-lead and 12-lead ECGs, smart watch with single-lead ECG for screening of atrial fibrillation and life-threatening irregularities in the heart, and smart phone-based ECG technology. Signal averaged ECG is another advancement for detecting high-risk patients, who have suffered a heart attack to detect proneness to sudden death.

24-hour ECG monitoring is called Holter monitoring, and single-lead 24-hour ECG is called event recorder. Event recorders that can measure recording for up to three weeks are now available.

Smart phones, for example, can also find the earliest signs of corona virus illness in the society by detecting high resting-heart rates of the community, which will be higher than the preceding day’s heart rates. So smart phone ECGs can detect a possible oncoming epidemic in the society. ECG can also predict chances of future sudden death, and the ECG signals are wide QRS, left bundle branch block, tri-fascicular blocks, symptomatic slow heart rates, and wide irregular heart betas. Remember ECG detects the electrical systems of the heart while angiography detects the plumbing systems of the heart. Echocardiography detects the structure of the heart with its functioning. They all are not a replacement to each other. Blockages seen in ECG are different from blockages seen on angiography. Both may coexist in a person.