Endoscopy Equipment

It’s been a bumpy ride, but now time to move on

Endoscopy saw a rollercoaster year in 2021, with ebbing and flowing waves of Covid-19 and elective surgeries alternately on and off the table – punctuated near year’s end by the discovery of the Omicron variant.

The arena of endoscopy and related devices has perceived a diversity of revolution since past few years. Over the past numerous years, technological developments and product enhancements have made gastrointestinal endoscopes more operative in performing GI procedures. At present, HD format and HD+ including cutting-edge magnification abilities, which entered the GI endoscope market, have resulted in a better revealing rate for polyps. Further, better-quality designs have allowed flexible GI endoscopes easy to use, and smaller instrumentation has permitted for more dedicated devices.

Since previous decade, the request for flexible endoscopes has augmented remarkably, mostly due to patients’ inclination toward minimally-invasive procedures. Commonly, endoscopic processes are low-risk actions and are effortlessly covered under health insurance policies. Currently, upsurge in the number of aged population with high risk of orthopedic, gastrointestinal, and ophthalmic diseases, and different kinds of cancer, are driving the growth of endoscopes market across the world. As per WHO, during 2000 to 2050, the proportion of the world’s population that is aged 60 years will be twice from around 11 percent to 22 percent. This elderly population is the leading end-user of bariatric surgeries, colonoscopy procedures, knee-hip implants, and gastrointestinal endoscopy, among others.

As the marketplace advances, there will be a strong distinction of endoscopic systems on account of necessities of image-quality procedures and reprocessing. Such developments are already noticeable from costly optical high-end endoscopes to optimized visualization systems that incorporate a camera and an endoscope. Noteworthy changes like this in numerous minimally-invasive applications endeavor to deliver new-fangled openings for all system suppliers, and need competent partners to cultivate innovative products.

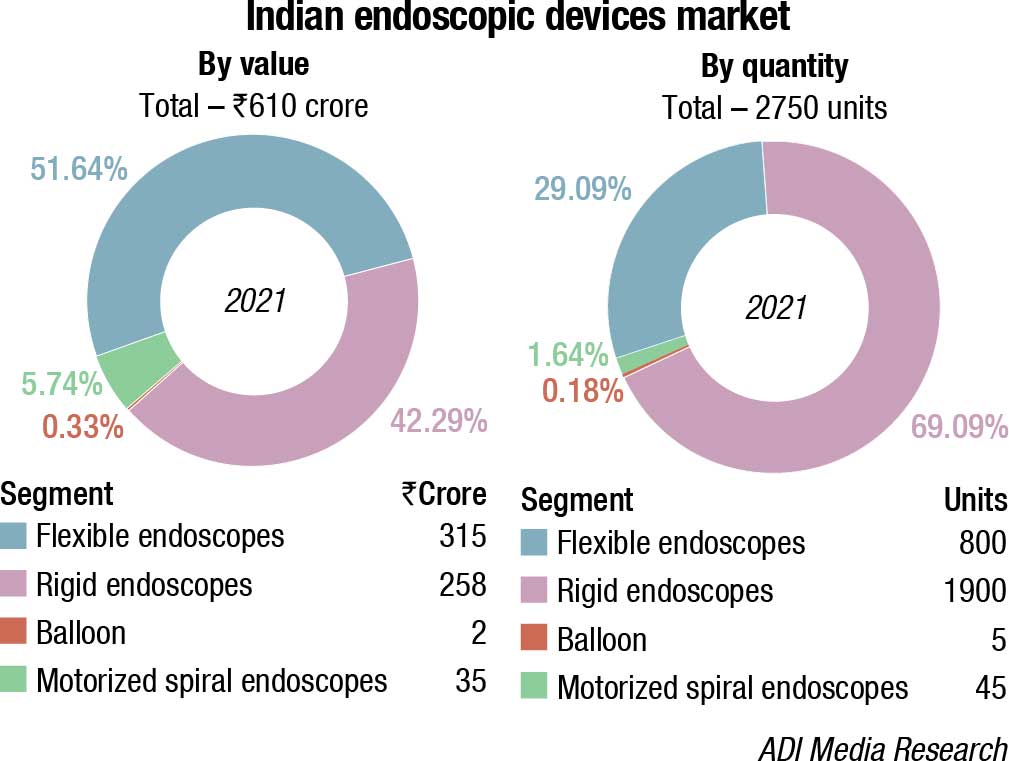

The setback from Covid-19 pandemic continued to impact the Indian endoscopic devices market in 2021-22. The demand continued to be slow. However, the market in FY22 increased by 17 percent over FY21, by value, not because the size of the market increased, but because a shift toward motorized spiral endoscopy is seen, in preference to the lower-priced balloon endoscopes, and the year saw a 275-percent increase over the last year, while balloon endoscopes were stagnant at five units. Flexible endoscopes saw no growth, at 800 units, whereas rigid endoscopes saw a decline of 24 percent. The drop is attributed to erratic supplies, and not to the decline in demand; vendors report that their supplies are behind schedule by about three months. Prices remained steady. The total endoscopic device market in 2021-22 is valued at ₹610 crore, with 2750 units, a 17-percent decline, by units, over the last fiscal.

FY23 is expected to see a 25-percent growth over FY22. The demand is emanating from government, corporate, and individual buyers. H1 FY23 has seen a 30-percent increase over the same period last year. And in H2, orders for the bids that have been opened by the public sector this year are expected to be finalized. The buyer is back and keen to improve clinical outcomes demanding technologically advanced models.

|

Indian endoscopic devices market |

||

|

Major players – 2021 |

||

| Flexible | Olympus, Fujifilm, and Pentax | Karl Storz, Richard Wolf, J Mitra, and other regional brands |

| Rigid | Olympus, Stryker, and Karl Storz | Refurbished, regional, and Chinese brands |

| Motorized spiral endoscopy | Olympus | |

| Balloon | Olympus (single ) and Fujifilm (double) | |

| Capsule | Medtronics | |

| ADI Media Research | ||

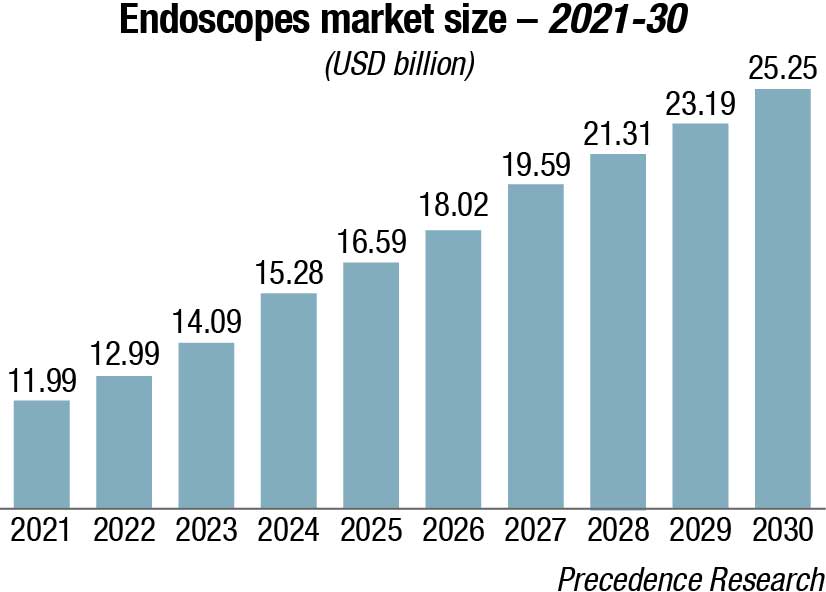

The global endoscopes market is estimated at USD 11.99 billion in 2021, and is predicted to hit around USD 25.25 billion by 2030 – foreseen to register a compound annual growth rate (CAGR) of around 8.62 percent during 2022 to 2030. The rise in prevalence of chronic disorders, and the growing awareness of early detection of diseases through minimally-invasive surgical procedures, are some of the major factors anticipated to drive the market growth over the forecast years. In addition, favorable reimbursement policies, and the increasing FDA approvals for endoscopic devices are also expected to boost the growth of the market over the years.

Furthermore, endoscopic procedures have been largely adopted to diagnose and treat functional gastrointestinal disorders. Functional gastrointestinal disorders can affect any part of the gastrointestinal tract, including the stomach, esophagus, and intestines. The growing prevalence of functional gastrointestinal disorders, such as irritable bowel syndrome (IBS), functional constipation, or functional dyspepsia, is also expected to accelerate the adoption of endoscopy devices and boost the market growth over the forecast years. For instance, in 2021, a multinational study published in the Gastroenterology journal on 33 countries reported that globally, over 40 percent of persons have functional gastrointestinal disorders.

In addition, obesity is a growing serious health problem globally due to unhealthy lifestyles and diets. It is associated with several gastrointestinal disorders, such as esophageal adenocarcinoma, erosive esophagitis, gastroesophageal reflux disease, colorectal polyps, and cancer. As per the Organization for Economic Co-operation and Development (OECD) data, the obesity rate is expected to grow significantly by 2030. Nearly 47 percent, 39 percent, and 35 percent of the population in the US, Mexico, and England, respectively, are expected to be obese by 2030. Bariatric surgery is the most effective treatment option resulting in significant weight loss. However, the emergence of minimally-invasive endoscopic sleeve gastroplasty procedures significantly reduces stomach volume.

It is performed through the patient’s mouth unlike traditional bariatric surgery using a flexible endoscope. Hence, the increase in demand for minimally-invasive endoscopic bariatric procedures is further anticipated to drive market growth over the years. Furthermore, the growing global burden of cancer all over the world is also driving the demand for endoscopes for early diagnosis and treatment. According to Globocan 2020 report, the estimated number of new cancer cases was 19.3 million in 2020, and the number of deaths that occurred due to cancer was about 10 million. Thus, increasing demand for endoscopic biopsy to diagnose cancer is anticipated to drive the market growth during the forecast years.

A decrease in the number of endoscopic procedures during the Covid-19 pandemic hampered the market growth in 2020. Due to the risk of cross-contamination and the chance of SARS-CoV-2 transmission, several endoscopic facilities canceled or postponed the elective and semi-urgent procedures, which restrained the market growth during this period. Furthermore, supply chain disruption and changing regulations to curtail the infection are also some of the major factors that hindered the growth of the market in 2020. A study on the endoscopy unit of the Cancer Institute of the State of São Paulo (ICESP), published in Clinics (Sao Paulo) journal in 2021, stated that there was a 55-percent reduction in the endoscopic procedures during the pandemic, and that colonoscopy was the most affected modality (−79%).

The flexible product segment accounted for the highest revenue share of more than 46.5 percent of the global market in 2021. It is attributed to its increasing preference by healthcare professionals for the first-line therapeutic option as it can be performed under sedation. The cost-effectiveness, safety, and high-efficiency properties of flexible endoscopes also boost their adoption. In addition, flexible endoscopes are used in several surgical applications, such as gastrointestinal endoscopy, laparoscopy, arthroscopy, urology endoscopy, obstetrics/gynecological endoscopy, bronchoscopy, otoscopy, mediastinoscopy, and laryngoscopy. This increases their adoption, thereby fueling the segment growth.

The disposable endoscopes segment is anticipated to register the fastest growth rate during 2022 to 2030. The emerging market for disposable endoscopes is rapidly growing, with new types of disposable endoscopes, and manufacturers entering the market every year. Some, like disposable bronchoscopes, have been available on the market for over 10 years, while others, such as disposable duodenoscopes, have only been approved for use since late 2019. Given its emerging nature with high interest among healthcare professionals seeking to minimize cross-contamination of their reusable endoscopes, the initial few years of this market growth have experienced double-digit and even triple-digit growth. Currently, this market is dominated by just a few manufacturers; however, as this market matures over time, large, diversified medical device manufacturers are expected to enter this market and increase its competitiveness.

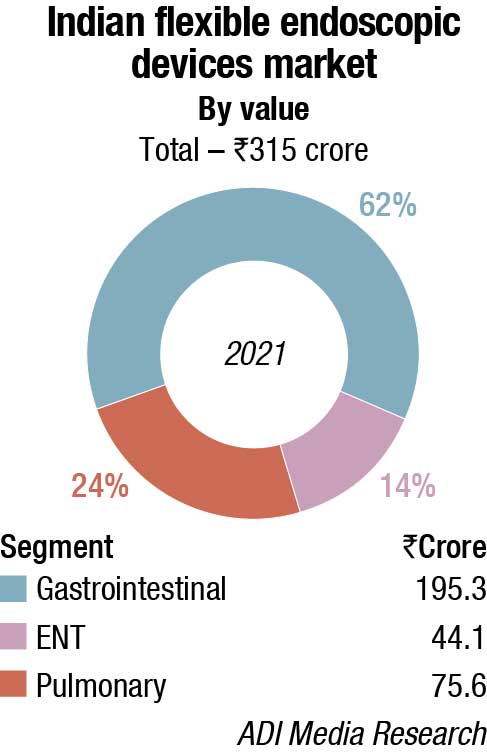

The gastrointestinal (GI) endoscopy application segment dominated the market and accounted for a share of more than 51.5 percent of the global revenue in 2021. The high share can be attributed to the increased burden of functional gastrointestinal diseases, and the rising geriatric population across the globe. In addition, an increase in the number of upper gastrointestinal procedures performed, and the growth in the adoption of endoscopes for the treatment and diagnosis of gastrointestinal diseases, are also among the key factors driving the segment growth.

The urology endoscopy-application segment is estimated to register the fastest growth rate over the next 8 years. This growth can be credited to the increasing prevalence of urologic cancers, and the growing volume of urology surgeries. In addition, the growing preference for endoscopic devices for the diagnosis and treatment of urologic disorders is also propelling the segment growth.

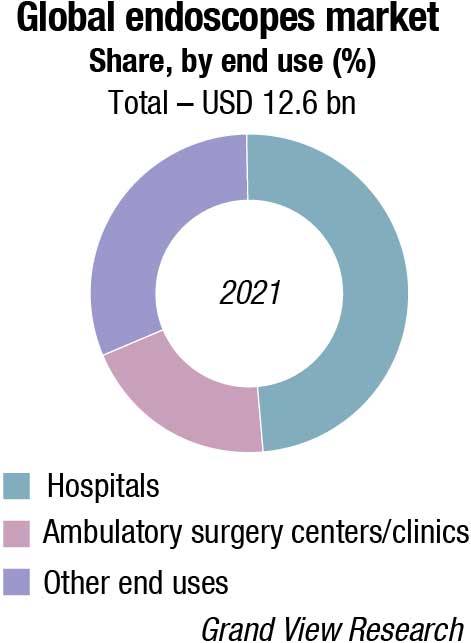

The hospital’s end-user segment dominated the market in 2021 with a revenue share of more than 48 percent. It is attributed to the increasing product preference among patients for chronic diseases treatment. In addition, favorable infrastructure and reimbursement policies also support the segment growth. Moreover, a large number of surgeries are performed in hospitals and it is considered the primary healthcare system in a majority of the countries.

The ambulatory surgical centers (ASCs)/clinics segment is anticipated to grow at the fastest CAGR. The increasing adoption of endoscopes in the ASCs/clinics for early diagnosis and detection of several life-threatening diseases is supporting the segment growth. In addition, the introduction of keyhole endoscopic surgeries with minimal discomfort and faster recovery time also boosts the segment growth.

The key manufacturers in the market are looking forward to investing more in the development of technologically advanced devices. The growing demand for a different type of endoscopes increases the competition among market players to expand their product portfolio and global presence. Moreover, key industrial strategies, such as collaborations, mergers, and acquisitions, have also been undertaken by the top market players to increase their market share.

In January 2021, Olympus Corp. acquired Quest Photonic Devices to strengthen its presence in the surgical endoscopy market.

In 2021, Fujifilm Holdings Corporation announced the launch of the ELUXEO 7000X System, a novel video-imaging technology. This advanced imaging system is beneficial in enabling real-time visualization of the hemoglobin-oxygen saturation levels in the tissues during the endoluminal imaging and/or laparoscopic procedures.

In 2020, Pentax Medical announced the launch of its innovative J10 series of ultrasound video gastroscopes. This technologically advanced gastroscope with ergonomic design enhanced maneuverability, and better image quality will be beneficial in delivering both market and clinical needs.

The growing field of endoscopy. The single-use endoscopy market is expected to grow from USD 500 million in 2021 to USD 2.5 billion by 2025, based on three key catalysts – higher focus on infection control; significant benefits of workflow and efficiency; and rapid technological advancements that make single-use more competitive relative to reusable.

In another key trend, all major group purchasing organizations (GPOs) will have single-use endoscopy buying categories by next year, giving US hospitals access to these products. Ambu plans to launch its aScope 5 high-definition scope in 2022, propelling the company into the bronch suite. Ambu plans to bring 20 single-use flexible endoscopy products to market by 2022-23.

Fujifilm Medical Systems USA, Inc., has added artificial intelligence (AI), high-tech image capture, and advanced data processing to accelerate innovations in its endoscopy portfolio.

This past year saw the launch of the Olympus EVIS X1, which the company is describing as its most advanced endoscope system to date. It is designed to improve outcomes from disorders of the stomach, colon, and esophagus, along with bronchial diseases.

Boston Scientific reported 11.4 percent organic growth in the third quarter net sales for endoscopy, up from USD 475 million in 2020 to USD 533 million for the same period in 2021. The company is targeting more than USD 3 billion in revenue in its endoscopy division in 2025, according to a September investor day report.

Since the development of the flexible fiberoptic endoscope by Basil Hirschowitz in 1956, endoscopy has become an integral part of the discipline of gastroenterology. Subsequent innovations, such as the advent of ERCP (1968), snare polypectomy (1969), endoscopic sphincterotomy (1973), endoscopic mucosal resection (1977), band ligation (1985), and endoscopic submucosal dissection (1998), have transformed the field from a purely diagnostic into a therapeutic discipline. Today, endoscopy continues to take off in a myriad of directions, both in diagnostics and increasingly in therapeutics, where it now offers minimally-invasive alternatives to situations that have traditionally required surgical intervention. Owing to the central location of the gastrointestinal tract within the human body, it can be argued that within the field of medicine, there is no other subspecialty where creativity and imagination is as obvious, encouraged, and limitless as gastrointestinal endoscopy.

While originally developed as a diagnostic procedure, ERCP today is almost entirely therapeutic. This reflects advances in diagnostic radiological imaging with magnetic resonance cholangiopancreatography as well as diagnostic endoscopic ultrasound (EUS). Intraluminal diagnostics during ERCP have been enhanced with cholangioscopy and pancreatoscopy as well as adjunctive techniques, including confocal laser endomicroscopy. Difficult intraluminal stone disease may be managed with several lithotripsy techniques. Though strictures are managed with an armamentarium of stents ranging from plastic to numerous types of covered metal stents, more novel therapeutics for malignant strictures include photodynamic therapy, radiofrequency ablation, and brachytherapy.

The transition of EUS from diagnostic to therapeutics has also occurred more recently although diagnosis and staging continues to be the bread-and-butter cornerstone of endosonography. Diagnostic EUS has been enhanced by new technologies, including elastography, contrast harmonic EUS, and needle-based confocal laser endomicroscopy, as well as serial refinements in EUS needles and tissue diagnostics. Nevertheless, the epicenter of advancements in EUS lies squarely within therapeutics, with the advent of innovative applications that have expanded the boundaries of the field. EUS-guided fine-needle injection, initially developed for celiac plexus block and neurolysis to manage chronic pancreatitis and pancreatic cancer-associated pain, has subsequently opened new possibilities including targeted therapy of pancreatic lesions with alcohol or chemotherapeutics, and ablative techniques including EUS-guided radiofrequency ablation and photodynamic therapy. EUS-guided angiotherapy was developed as an alternative to interventional radiology in the management of gastric variceal bleeding through injection of coils, glue, and other substances. EUS-guided pancreaticobiliary access can be performed in situations where ERCP is difficult or unsuccessful, with some even considering the possibility that EUS may one day supplant ERCP as first-line access to the bile duct. Finally, the advent of lumen-apposing metal stents (LAMS) has truly expanded the seemingly endless possibilities of EUS-guided therapeutics, including the drainage of most any collection in close proximity to the gastrointestinal lumen, including walled-off necrosis and pancreatic pseudocysts, gallbladders, post-surgical fluid collections, and abscesses, the creation of gastro-enteral bypasses in the management of gastric outlet obstruction, and to facilitate ERCP in post-surgical/post-gastric bypass patients.

There have also been astonishing advancements in the endoscopic management of luminal disorders. Radiofrequency ablation and other endoscopic ablation techniques have shifted the paradigm governing the management of dysplastic Barrett’s esophagus. Endoscopic resection techniques continue to advance and evolve with endoscopic submucosal dissection and endoscopic full-thickness resection, providing patients with minimally-invasive alternatives for lesions that historically required surgical management. This trend of endoscopic techniques supplanting more invasive surgical approaches is nowhere more obvious than in the advent of third-space endoscopy and peroral endoscopic myotomy (POEM) in the treatment of achalasia, with variations of this technique now also increasingly used to treat Zenker’s diverticulum and gastroparesis. Endoscopic therapy has evolved for GERD, one of the most common gastrointestinal diseases, with radiofrequency energy platforms and more complex suturing techniques or transoral incisionless fundoplication. Finally, capsule endoscopy and device-assisted enteroscopy techniques have revolutionized the ability to access the small bowel, a historically mysterious and inaccessible section of the GI tract.

Bleeding and strictures can affect any part of the GI luminal tract. Hemostatic spray, new types of over-the-scope clips, and radiofrequency ablation have provided new ways to manage difficult, recurrent, or refractory bleeding. Though luminal strictures have traditionally been managed with dilation and stent placement for malignant strictures, stent placement for benign diseases, needle-knife incision techniques, and lumen-apposing metal stents (LAMS) for anastomotic strictures, and injection of chemotherapeutics and biologics into inflammatory strictures now provide more options for the management of refractory luminal strictures.

Over the past decades, as a reflection of the exponential rise of obesity and metabolic syndrome in the Western society, gastroenterology has increasingly journeyed into obesity-related medicine. Bariatric-trained gastroenterologists are now becoming familiar with the medical management of obesity, offering novel endoscopic techniques, both for the primary therapy of obesity as well as for the management of complications following bariatric surgery. The increasing demand for bariatric endoscopy is reflected in the establishment of the Association for Bariatric Endoscopy within the ASGE. A wide array of endoscopic options now exists ranging from more straightforward techniques, including intragastric balloons and aspiration therapy to complex suturing and plication procedures, providing patients with more options for weight loss and management of the metabolic sequelae of obesity.

Finally, the latest frontier in gastroenterology is artificial intelligence (AI). Originally, an experimental curiosity, the recent FDA approval of the first colon polyp-detection device has brought AI squarely within the reach of everyday gastroenterological practice. Though this only represents the beginning of the wide-ranging impacts of AI in gastrointestinal endoscopy, AI technology can be expected to impact everything from how an endoscopy unit runs to how lesions throughout the GI tract are identified and managed.

It is humbling to reflect how far the field of endoscopy has come, and thrilling to witness the continued evolution of the field.

Looking ahead to 2023, AI, robotic-assisted endoscopy, and reimbursement options are sure to drive endoscopy conversations. Infection prevention will remain a hot topic, and new single-use endoscopes are poised to debut.