Reports

Life sciences industry outlook

As COVID-19 moves from a pandemic crisis to an endemic fact of life, governments, economies and communities have to define what the new normal is going to look like. Communities will need to make affirmative decisions as to how the world and their specific social, political, and economic ecosystems will function post-pandemic. For life sciences companies, that will involve consideration of new technologies, business models, and consumer preferences.

Two pandemic-induced shifts that will have a broad influence on the future of life sciences include the rapid acceptance of digital health and the sharing of personal health information, and a business environment that is more productive remotely and geographically disbursed than experts had previously thought possible.

On top of that, new phase of national and global politics are emerging, which will affect regulations, supply chains, drug pricing and social systems.

To put this in perspective, the last 12 months have resulted in unprecedented government stimulus; cooperation between traditionally competitive business interests, governments and regulators; and capital markets that have brought record returns and investment dollars, all while the global economy went into lockdown and advanced the move to virtual by a decade.

Access to capital, improved public sentiment, and an increased ability to leverage external expertise will allow middle market companies to play an increasing role in rapid innovation and development of new drugs and therapies. The industry will also need to consider how best to maneuver in a changing national and geopolitical landscape as the economy emerges from the recession.

Overall, experts believe that year to date performance of the industry is indicative of continued expansion throughout the year with a focus on drug discovery and emerging therapies in biotechnology.

CHALLENGES/OPPORTUNITIES

New challenges, but opportunities and promise, too

The unprecedented focus on vaccine and therapeutic development for COVID-19 has shifted from development in 2020 to production in 2021, with Moderna, Pfizer-BioNTech, and Johnson and Johnson hoping to produce billions of doses this year. The rest of the life sciences industry can now begin to reset their focus to new challenges and opportunities in 2021.

First, an enormous amount of hard work remains to stop the pandemic and safely control the likely long-term endemic nature of COVID-19. The most obvious is the continued effort to produce sufficient vaccines to inoculate the world, and the public health effort to get those shots into

arms.

Reducing infection in just the United States and other wealthy countries risks both the lives of people in poorer countries and our own self-interest. Wherever there are populations still suffering from the impact of this virus, there is also the risk that a new variant arises that can elude vaccines.

Second, the vaccines are not 100 percent effective and there will be populations of people that are unable or unwilling to be vaccinated. This makes the development of additional therapies critically important as we adapt to life with this pathogen. With more than a dozen vaccines approved around the globe, there is a new wave of research into antivirals and promising new clinical trials for drugs like Merck’s molnupiravir.

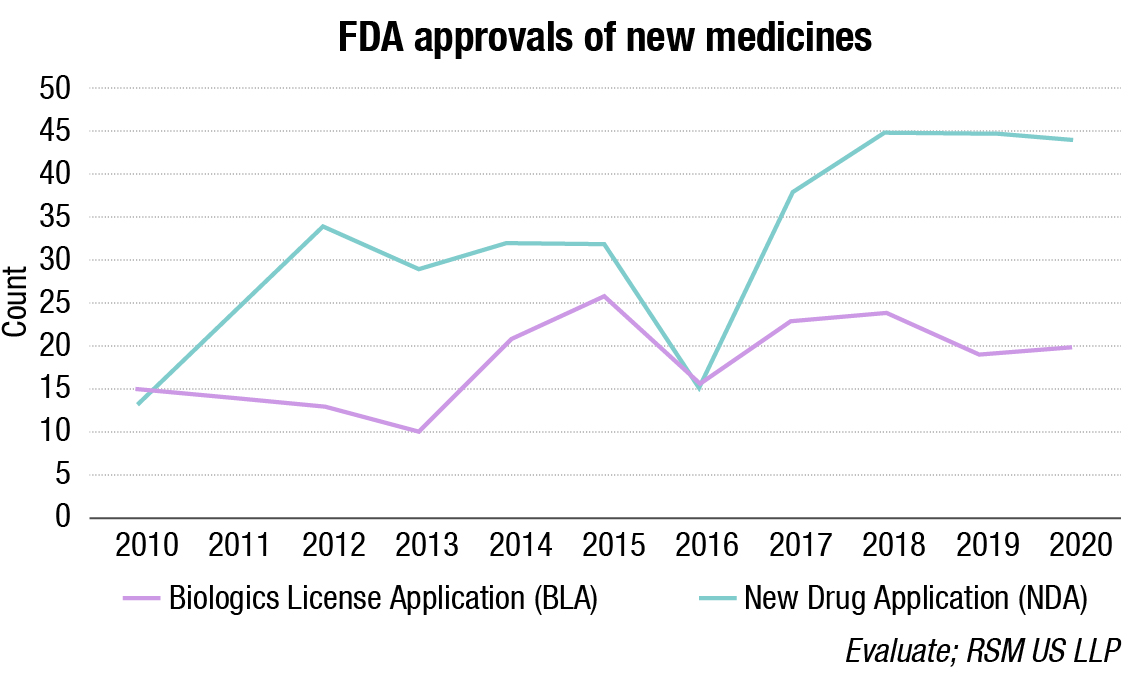

These drugs offer hope not just for future COVID-19 patients, but will also provide new treatment options for other viral infections that are not well treated today or that have yet to emerge into human populations. Despite the Food and Drug Administration’s focus on COVID-19-related applications during 2020, they were able to approve 64 new medicines.

Third, the industry faces a significantly different regulatory environment than they did a year ago. Starting with the Federal Trade Commission’s changes and heightened merger scrutiny (expanded upon later in our outlook), the new administration of President Biden will also include new leadership and priorities at the Food and Drug Administration, Department of Health and Human Services and Centers for Disease Control. The new leadership at these agencies has indicated they are committed to expanding access to health care and reigning in prescription costs.

Fourth, pandemic-induced adoption of remote work, virtual health, and digital clinical trials has likely moved the healthcare and life sciences ecosystem years forward in terms of its digital evolution. However, similar changes are happening across the economy, and as the US is poised for a major expansion in 2021, the competition for highly skilled employees with technical and scientific backgrounds will be fierce.

In some cases, companies may need to evaluate outsourcing opportunities as well as adopt labor-saving or labor-enhancing technologies in an effort to do more with less.

Finally, and perhaps most importantly, the pharmaceuticals industry has seen a major improvement in its public perception according to The Harris Poll. In January 2020 only 32 percent of respondents had a positive opinion of the industry compared to 62 percent in January of this year. This improved public opinion will be critical as the industry works to minimize the impact of drug pricing reforms and increased regulatory oversight, and continues to tap into public and private markets to fund drug development.

CAPITAL MARKETS

Strong capital markets continue to propel life sciences growth

Even with the pandemic weighing on the global economy, the life sciences ecosystem continues to drive forward with significant momentum coming out of 2020. Private investment (private equity and venture capital) in Q1 2021 outperformed the same time frame in 2020, and was on par with the second half of 2020 which were the two strongest quarters the industry has ever had. Generally life sciences is discussed in the three main sectors of biotechnology, pharmaceuticals, and medical devices, but the surging subsector of drug discovery warrants specific consideration.

Between 2017 and 2019 investment in companies specifically focused on the discovery, screening and efficacy testing of new drugs, represented approximately 28 percent of all capital raised and 22 percent of deals. Since the start of 2020, even before the pandemic, the share of investment increased to 43 percent of capital and 28 percent of deals.

While there is likely a COVID-19 induced bump in the growth of drug discovery, downside risk to the long-term is limited because of a structural shift in the market’s focus from broadly distrusted blockbuster drugs to personalized medicine.

As the focus on COVID-19 vaccines and therapies wanes, development efforts will shift back to cutting edge therapies in immune-oncology and cell and gene therapy. Companies that can help bring drugs to market in an efficient and cost effective way will be in high demand.

PUBLIC MARKETS

Public markets reflect long-term growth opportunity

In the last outlook it was discussed the 2020 surge of initial public offerings for life sciences companies, which marked a record for capital raised. 2021 has brought much of the same velocity of deal flow, as well as a consistent focus on biotechnology.

The overall proportion of life sciences companies going public in comparison to other industries also continues to rise, and over the last 12 months, 45 percent of all non-special purpose acquisition company (SPAC) IPOs were life sciences. With that said, the prevalence of SPACs has spiked since the beginning of the pandemic and there is an extraordinary amount of capital being raised by these blank check companies.

However, April has brought a slowdown in SPAC IPO activity and an SEC warning that some special purpose acquisition companies may have improperly accounted for warrants issued or sold to their investors.

As SPACs have only a limited amount of time to invest their capital, it is not surprising that life sciences companies continue to focus on more traditional market approaches.

The majority of SPAC investments are focused on the technology and financial sectors that have established products and consumer bases, and can leverage a capital infusion to penetrate the market more quickly.

| April 2020–March 2021 | April 2018–March | |||

|---|---|---|---|---|

| Capital | Count | Capital | Count | |

| Biotech | 17.5% | 31.7% | 10.5% | 24.1% |

| Pharma | 3.1% | 6.0% | 4.1% | 7.1% |

| Medical devices | 2.6% | 7.2% | 7.1% | 4.8% |

| All other industries | 76.8% | 55.1% | 78.3% | 63.9% |

| Total | USD 107B | 265 | USD 98B | 352 |

| Bloomberg; RSM US LLP | ||||

Life sciences companies in comparison have historically long development cycles, high rates of scientific failure, significant long-term needs for research and development and clinical trials, and are faced with FDA approval that can take a year or more.

These barriers to entry result in a slower rate of play, but with very high upside in the long run for successful firms.

It is quantitatively difficult to identify when a structural shift is taking place in an ecosystem, but that life sciences—particularly biopharma—is poised for just such a transition. This is the transition of development and distribution of drugs for the masses to the targeted development of therapies.

According to EvaluatePharma’s analysis of worldwide drug sales, the market share gap between biotech drugs and conventional pharmaceuticals is expected to close significantly by the middle of the decade. In 2012, biotech’s share of sales revenue from the top 100 products was 39 percent, and by 2026 it is expected to represent 55 percent of sales of the top 100 products.

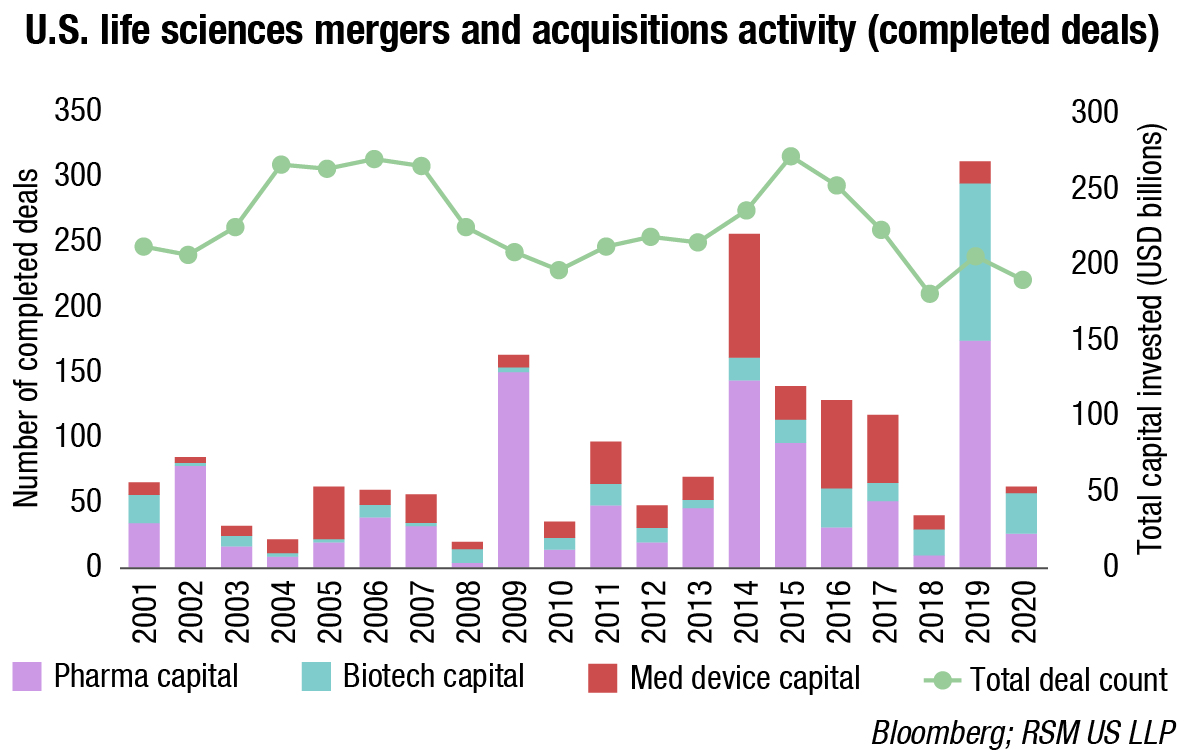

This technological shift is also believed visible through life sciences startups and how capital is being raised throughout their life cycle. Over the last two decades life sciences companies have been raising significantly more rounds of capital, and have chosen to go public as opposed to being acquired, as is illustrated by the private capital and IPO charts previously, and the following mergers and acquisitions chart.

In 2002, 66 percent of all private financing rounds were the first or second round (initial investments) that a company had received. In 2010 that dropped to 50 percent, and in 2020 only 40 percent of all investments were initial investments in life sciences companies. One could assume this was due to fewer new company starts, but as is seen in the following analysis of PitchBook deal data, the number of initial investments has been steadily rising for a decade, aside from a pandemic-induced decrease in 2020.

Considering additional financing, life sciences companies are going back to the well in increasing numbers and are also able to raise significantly more capital than is secured through initial rounds.

This should be looked at within the context of the number of life sciences companies going public, which represent 45 percent of all IPOs, and a 10-year CAGR of ~23 percent, and in relation to the amount of corporate M&A activity, which has been flat over the last two decades, but with increasing deal size.

This means that more life sciences companies are starting up with the intention of taking their own drug to market, and in the process are raising more rounds of capital at increased valuations, and are able to either enter the pubic markets on their own, or chose to be acquired.

However, given the increase in company starts and IPOs compared to flat M&A activity, it appears that middle market life sciences companies are increasingly successful in their own commercialization pursuits.

M&A

Taking stock of exogenous factors

Regardless of how much effort is put toward research, controls and planning, there are many factors outside the control of life sciences companies. 2021 has ushered in a unique operating environment in terms of societal attitudes toward life sciences, geopolitics, and domestic policy.

FTC strikes a more skeptical tone toward life sciences mergers

Traditionally, large pharma companies have used M&A as a key strategy for driving growth and filling gaps in their drug development pipelines. This strategy will continue, but the new leadership of the FTC will force the industry to consider more broadly the impact of proposed M&A on competition.

In January, Rebecca Slaughter was designated acting chair of the FTC. In March, the FTC sued to stop the acquisition of Grail Inc. by Illumina, Inc. Illumina manufactures systems used for analyzing genetic materials and functions. Grail focuses on tools for cancer screening. It is not uncommon for the FTC to challenge or request changes to a merger; but the commission’s 4 to 0 vote to prevent this specific deal represents only the second time in 40 years the commission sued to stop a merger that is primarily a vertical integration.

The FTC’s stated rationale for preventing the merger is that DNA sequencing tools that Illumina manufacturers are critical tools for both Grail and their competitors. They argue that if the merger proceeds, Illumina would be able to prevent competition and innovation in the space of multi-cancer early detection tests.

This move quickly followed the launch of a new FTC working group focused on pharmaceutical company mergers. While the FTC has traditionally focused on areas where the merging companies have similar pipelines and products, this working group’s goal is to look more broadly at the competitive implications of mergers and their impact on drug prices.

Looking at the data, drug spending—specifically for branded drugs—does continue to increase year over year, but that is not purely a result of price increases. In reality, a larger portion of the population has expanded access to health care, more prescriptions being written per person, and there is greater availability of a wider range of drug options (albeit some are no more effective than their generic or biosimilar peers).

The conversation on pricing is beyond the scope of this outlook, but if M&A is being considered a primary culprit, consideration should be given to the fact that the amount of life sciences M&A has been falling for several years, and has been flat in terms of the number of deals in comparison to the total amount of M&A throughout all industries.

Although the FTC often focuses on large pharma mergers, middle market life sciences companies that hope to be acquired rather than take their own pipeline commercial will need to pay close attention to the concerns of the FTC and their continued focus on the impact of mergers on drug pricing and competition.

The article is based on Life Sciences Industry Outlook by RMS.