Reports

MedTech 2020 in review

The pandemic ensured that 2020 was unlike any other year for MedTech companies. But, while this sector turned their collective attentions to vanquishing the novel coronavirus, the usual business of drug and device development continued alongside.

In many ways COVID-19 turbocharged an industry that was already riding fairly high. The financing climate had been strong for a few years, but 2020 saw records broken in the venture and IPO worlds. With the spotlight on biopharma, which made remarkably swift progress on a pipeline of pandemic therapies, investors rushed to inject money into the sector.

This also resulted in ballooning stock market valuations, with many companies ending the year worth substantially more than at the beginning. Those developing COVID-19 vaccines and treatments drove those gains, with several small developers transformed into multi-billion-dollar enterprises. The vaccine developers Moderna, Biontech, and Novavax especially stand out.

Similar dynamics were seen in the MedTech arena, with diagnostics companies benefiting in particular – both those developing tests for COVID-19 and those working on liquid biopsy cancer tests. Such work appealed hugely to investors in publicly traded companies and to venture backers alike. M&A also held up remarkably well across the board, considering that for much of the year global travel was not possible. But the world quickly adapted to virtual meetings, and a number of big transactions emerged, culminating in Astrazeneca’s USD 39 billion move on Alexion in December.

The pandemic also provided the impetus for the biggest deal in MedTech last year – the USD 18.5 billion merger of the telehealth groups Teladoc and Livongo. Heady valuations have not noticeably curtailed deal-making, although this remains a concern heading into 2021. When preclinical companies can easily achieve the sort of market cap more typically associated with later-stage developers, some big and expensive disappointments seem inevitable.

When it comes to MedTech M&A, however, 2021 has kicked off in spectacular fashion with deals worth more than USD 10 billion already arranged. Liquid biopsy and remote patient monitoring have already emerged as major trends to watch in the coming year. The main COVID-19 focus this year is set to switch from tests for the disease to the progress of vaccines and therapeutics against the pandemic. 2021 is shaping up to be another wild ride.

Covid-19 tests and devices

Alongside biopharma the coronavirus pandemic has profoundly affected the MedTech industry – and the greatest impact has been on the diagnostics sector. Giants such as Roche, Danaher, and Abbott have developed multiple tests, and even diagnostics groups that specialize in other types of testing, such as the cancer-focused Exact Sciences and Guardant Health, have obtained authorization for COVID-19 assays.

Overall, the FDA has granted emergency use authorization for nearly 300 tests for COVID-19 infection and related technologies, such as sample collection kits.

With treatments arriving, the emphasis at the agency has quite rightly switched to evaluating and approving vaccines. But new tests were still reaching the market right up to the end of 2020, with Nirmidas Biotech’s MidaSpot COVID-19 antibody test winning authorization on New Year’s Eve.

While the first half of 2020 was all about RNA and antibody tests, for current and previous infections respectively, the latter half of the year saw growing emphasis on new testing modalities. Lateral flow antigen testing holds great promise for testing large numbers of people quickly and cheaply, but since these tests are less sensitive than molecular assays they must be used repeatedly within a stable population if they are to keep infections under control. The cost of repeated testing mounts up quickly, and the logistical challenges, including of the subsequent contact tracing, are considerable. T-cell-mediated immunity is, alongside antibody testing, a potentially highly useful technique for assessing immunity to the coronavirus, both in people previously infected, and those who have received a vaccine. Data backing this approach are early but encouraging, and T-cell testing could yet become a part of efforts to assess the effectiveness of vaccination regimens, and identify patients who need a booster.

The pace of test authorizations undeniably slackened during the autumn, however. As the vaccine rollout continues, and hopefully accelerates under the new administration, demand for COVID-19 assays ought to shrink.

As well as tests, the FDA also granted EUAs to hundreds of other medical devices including ventilators and personal protective equipment. From face shields to dialysis machines, hundreds of devices able to help prevent the disease’s spread or treat those suffering from its effects were ushered into hospitals and other critical settings. Many people will be hoping that this level of COVID-19-related regulatory activity will not be required in 2021, and FDA personnel will surely be among them.

Top risers and fallers in 2020 |

||||

|---|---|---|---|---|

| Share price 12-month change |

Market cap at Dec 31 (USD bn) |

Market cap 12-month change (USD bn |

||

| Top 5 risers | ||||

| Teladoc Health (USD) | 139% | 29 | 23 | |

| Novocure (USD) | 105% | 17.6 | 9.2 | |

| Align Technology (USD) | 92% | 42.1 | 20.1 | |

| Abiomed (USD) | 90% | 14.7 | 6.9 | |

| West Pharmaceutical Services (USD) | 88% | 20.9 | 9.8 | |

| Top 5 fallers | ||||

| Boston Scientific (USD) | -20% | 51.5 | -11.6 | |

| Becton Dickinson (USD) | -13% | 68.6 | -5 | |

| Smith & Nephew (USD) | -12% | 18.5 | -2.5 | |

| Hitachi (¥) | -12% | 37.4 | -4 | |

| Dentsply Sirona (USD) | -7% | 11.4 | -1.1 | |

The striking preponderance of liquid biopsy companies as both recipients of venture cash and as acquisition targets might also have been influenced by COVID-19. Since liquid biopsies can be conducted much more quickly and simply than tissue biopsies, and often at the patient’s own home, the pandemic has boosted uptake.

Even after successful vaccination programs COVID-19 could become a seasonal virus much like flu, and since cancer patients are often immunocompromised there could be an ongoing argument for a form of cancer testing that does not require doctor or hospital visits.

A tale of two COVIDs for device makers

A look at MedTech stocks’ performance at the half-year point revealed a stark delineation between those companies whose devices were of use in treating or diagnosing COVID-19 and those whose businesses had suffered from the pandemic and its associated lockdowns.

Six months on and the picture is blurrier, though COVID-19 was still a huge influence on device makers. Overall, the more established end of the sector is in a better position than it was in the summer, with the most successful big-cap companies seeing their share prices more than double. Even greater gains were seen among smaller companies – but so were greater losses. Indices of medical device stocks point to the broader recoveries occurring across stock markets. They do not show the sorts of gains MedTech companies saw in pre-pandemic 2019, but the second half of 2020 allowed a palpable improvement from the first.

Of all the big-cap companies, Teladoc saw its share price increase the most – indeed, it was not even in the big cap cohort at the start of 2020. The various quarantine measures put in place starting from the spring of 2020 ensured that demand soared for the remote health consultation services that Teladoc provides.

The acquisition of Livongo in August – at USD 18.5 billion, last year’s largest MedTech deal – prompted Teladoc’s stock to fall slightly. But the group soon recovered as investors digested the possibilities of adding a company whose business model signs up entire companies at a swoop. Livongo’s own share price had grown by 200 percent across the first half of 2020.

Align Technology’s stock jumped 35 percent when its third-quarter earnings came in more than four times higher than analysts had been expecting. The COVID-19 angle here, Align’s chief executive Joseph Hogan explained, was the Zoom effect.

People working remotely, staring at their own image in videoconference software, took more notice of their dental imperfections – and, because these white-collar workers had hung on to their jobs but spent less on holidays, commuting and socializing, they had the cash to do something about it.

The fate of small and medium-sized MedTech players last year largely hinged on their ability to avoid the worst of the fallout from the pandemic. Two of the risers, Seegene and Meridian Bioscience, are developers of COVID-19 diagnostics or reagents. Meanwhile, the Swedish group Sedana was buoyed by an increase in demand for its anesthetic delivery technology.

Irhythm might be the only mid-size company whose share price change had nothing to do with COVID-19. In early August its stock leapt 33 percent after the Centers for Medicare and Medicaid proposed new reimbursement codes for long-term electrocardiogram monitoring. Irhythm’s Zio, a wearable heart monitor for detecting arrhythmias, would be covered by these, and the decision was expected to drive sales growth. Four months later the CMS reversed its decision, deciding not to finalize the new pricing, and Irhythm dropped a quarter of its value.

Fortunately it had an ace up its sleeve, announcing the appointment of Mike Coyle as chief executive, following the retirement of Kevin King. Coyle was formerly the leader of Medtronic’s highly successful cardiovascular division, and investors’ collective delight permitted Irhythm to exit 2020 at close to a record high.

But the first half of 2021 could be another difficult period for MedTechs. Despite the promise of newly approved vaccines, the coronavirus continues to spread at a horrifying rate in many areas. Quarantine measures are once more being instituted, and hospitals and doctors’ offices, close to capacity, are putting off less urgent surgeries and appointments.

MedTech deal-making stands firm in difficult times

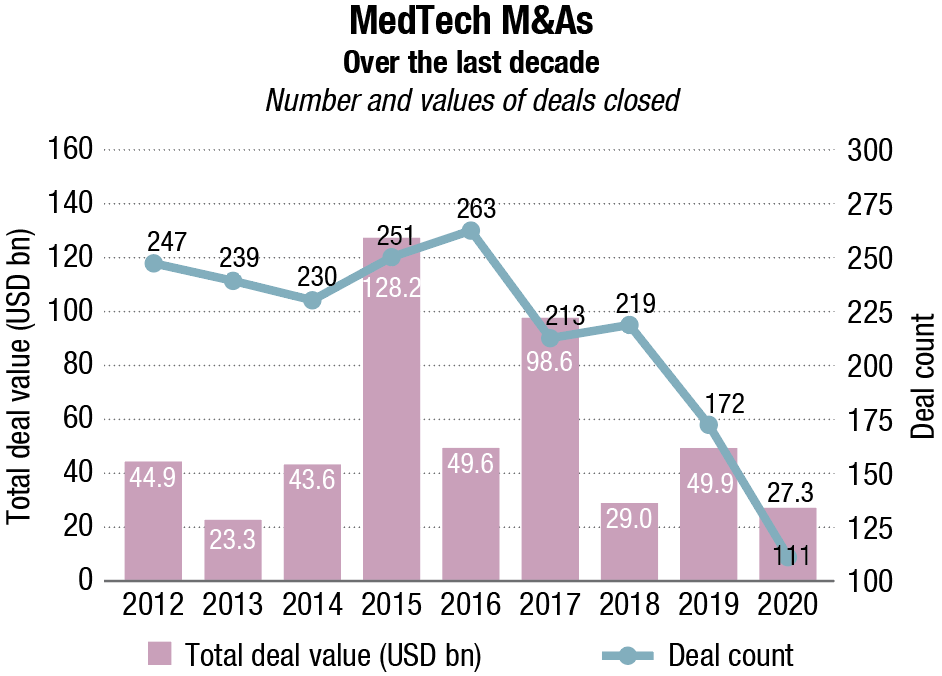

The remarkable thing about MedTech business development trends across 2020 is how resilient deal values have been under truly extraordinary circumstances. Transactions worth a total of USD 27.3 billion were completed last year – a highly respectable total, scarcely behind the USD 29 billion figure for 2018.

| Top 5 deals closed in 2020 | Acquirer | Target | Value (USD bn | M&A focus | Evaluate Vantage coverage |

|---|---|---|---|---|---|

| Oct-30 | Teladoc Health | Livongo | 18,500 | Diabetic care, healthcare IT and patient monitoring | Teladoc bets USD 18.5 bn that Covid-19 will change the world for good |

| Nov-11 | Stryker | Wright Medical Group | 5,400 | Orthopedics | Wright and Stryker embark on a joints venture |

| Oct-02 | Invitae | Archer DX | 1,400 | In vitro diagnostics | Invitae ends MedTech merger drought with ArcherDX deal |

| Dec-31 | Dentsply Sirona | Byte | 1,040 | Dental | Dentsply sees clear advantages to USD 1 bn Byte deal |

| Nov-18 | Steris | Key Surgical | 850 | General hospital & healthcare supply | Steris turns the Key on 2020’s fifth biggest buy |

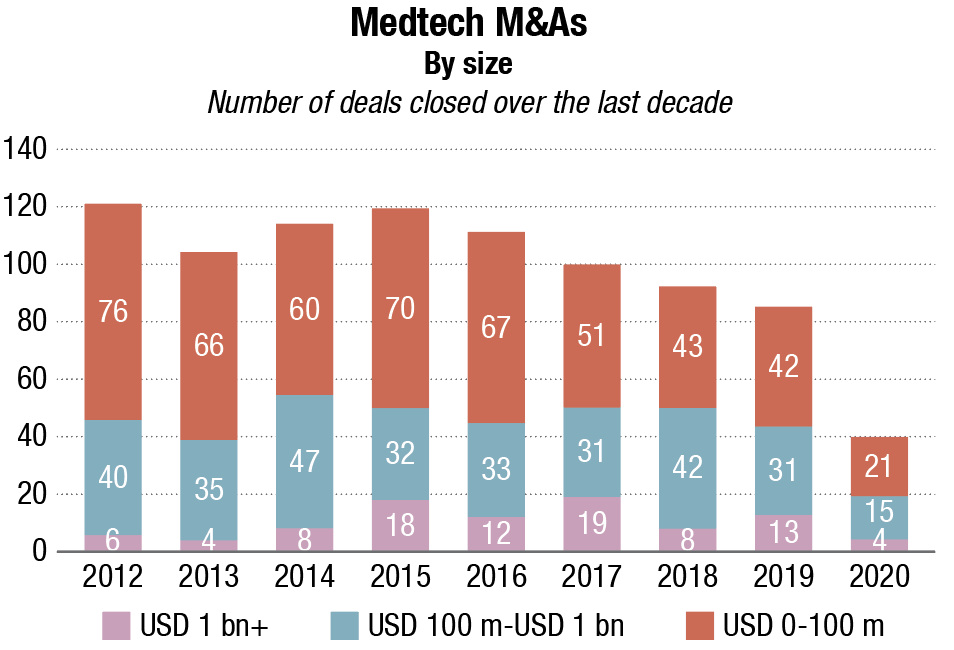

While COVID-19 appears to have had little effect on the overall sums spent, it has depressed deal-making activity in terms of the numbers of signatures on dotted lines. Just 111 acquisitions were closed in 2020. For the purposes of this report, the term encompasses business unit purchases and majority stakes as well as outright company purchases.

Public companies are enjoying persistently high valuations, and free-flowing capital in the venture markets means the same is true of private groups. This is likely putting some potential buyers off, cutting the numbers of deals, while also ensuring that when deals do go ahead the purchaser pays top dollar. And one of these will go down in the hall of fame. At USD 18.5 billion, Teladoc’s purchase of Livongo is the largest deal of 2020 and the sixth largest pure-play MedTech acquisition of all time. Acquisitions in the telehealth area were always on the cards, this being one of the fastest-growing forms of medical technology, but the lockdown and quarantine regimes necessitated by the pandemic provided the impetus for the tie-up.

The coming year ought to see a return to more M&A deal-making, should vaccine rollouts go as hoped. There will certainly be appetite for deals: the groups negatively affected by hospitals prioritizing COVID-19 patients, such as those active in the orthopedics and cardiology arenas, will be keen to catch up by buying high-growth businesses.

MedTechs rake in the venture cash

Looking at the cash raised by private medical device companies last year you would be hard pressed to find any evidence of a pandemic at all. Venture investors poured USD 6.4 billion into the sector, with the particularly strong performance in the second half putting the total markedly above 2019’s.

And some of the very biggest investments have already paid off handsomely. The liquid biopsy developers Grail and Thrive hooked nine-figure rounds and were promptly bought for billions of dollars each, by Illumina and Exact Sciences respectively. The VCs backing their fellow cancer blood test specialists Freenome and Caris Life Sciences doubtless also had takeovers in mind. In fact diagnostics companies dominate the top 10 rounds. In addition to the four liquid biopsy groups, Everlywell, Karius and Oxford Nanopore Technologies – two of which are working on tests for COVID-19 – also enjoyed sizeable cash injections. Diagnostics developers, with their relatively cheap and easily scalable technology, are always appealing to VCs, but 2020 was something special. The biggest round of 2020, however, did not go to a testing company. Nearly two years after the USD 1 billion investment that put it on top of 2019’s leaderboard, Verily obtained USD 700 million from current investors, including its majority owner, Alphabet, as well as Silver Lake, Temasek and the Ontario Teachers’ Pension Plan.

| Date | Company | Investment (USD m) | Round | Focus |

|---|---|---|---|---|

| Dec-17 | Verily | 700 | Undisclosed | Diabetic care; ophthalmics; patient monitoring |

| May-06 | Grail | 390 | Series D | In vitro diagnostics – liquid biopsy |

| Aug-26 | Freenome | 270 | Series C | In vitro diagnostics – liquid biopsy |

| Jul-29 | Thrive Earlier Detection | 257 | Series B | In vitro diagnostics – liquid biopsy |

| Oct-27 | Caris Life Sciences | 235 | Undisclosed | In vitro diagnostics – liquid biopsy |

| Dec-03 | Everlywell | 175 | Series D | In vitro diagnostics – various, inc Covid-19 |

| Feb-24 | Karius | 165 | Series B | In vitro diagnostics – infectious disease |

| Mar-06 | Insightec | 150 | Series F | Diagnostic imaging |

| Jan-02 | Oxford Nanopore Technologies | 144.5 | Undisclosed | In vitro diagnostics – various, inc Covid-19 |

| Feb-04 | Outset Medical | 125 | Series E | Nephrology |

Verily’s history of vast fundraisings is emblematic of another trend that predates COVID-19: deals are getting bigger. 14 of the deals done last year were worth USD 100 million or more, equaling the record set in 2018. And syndicates can be vast: there were no fewer than 23 participants in Freenome’s USD 270 million series C. There is safety in numbers, of course, but it is to be hoped that VCs regain the ability to see the advantages of earlier, riskier investments as the pandemic winds down. That said, it is difficult to argue with the case studies provided by Grail and Thrive.

Astounding success greets newly public device makers

Medical device companies listing in 2020 raised a highly respectable total of USD 2.3 billion, an impressive figure for what was a difficult year. Intriguingly, the action coincided with the height of the COVID-19 pandemic, though none of the companies going public was specifically involved with diagnosing or treating the disease.

So keen were investors on healthcare stocks that not one of the 10 largest MedTech IPOs needed to price at a discount, and some managed double-digit premiums. Moreover, all but one have enjoyed valuation growth since, with six of the top 10 more than doubling their market cap by the end of the year.

Cutting the listings data by quarters shows a clear lull in offerings as 2019 turned into 2020. But after the first quarter of last year ended, just as it was becoming clear that COVID-19 had reached the West and was going to pose major problems, IPOs came roaring back. The graph above excludes IPOs that raised USD 1 billion or more, to reflect the environment for younger groups in search of growth capital.

Mega-floats are becoming an annual tradition in the device sphere. The select group that comprises Convatec, Siemens Healthineers and Smiledirectclub was expanded to include Sotera Health, whose USD 1.2 billion offering in November went out at a modest premium. Stock in the group, which is active in the areas of sterilization, lab testing and radioisotopes, has done acceptably since – though arguably somewhat disappointingly compared with its fellows.

The undisputed leader of the class of 2020, however, is Inari Medical. The company has two FDA-cleared products designed to remove large emboli and thrombi from the peripheral vasculature, and managed to achieve profitability within a year of entering the market. On its first day on Nasdaq the stock closed up 124 percent, and has done remarkably well since. Inari’s market cap currently sits at USD 4.7 billion.

| Date | Company | Focus | Amount raised (USD m) | Discount/ premium | Share price change to Dec 31 |

|---|---|---|---|---|---|

| Nov-21 | Sotera Health | General hospital and healthcare supply | 1,233 | 7% | 19% |

| Sep-16 | Outset Medical | Nephrology | 278 | 17% | 111% |

| Jun-19 | Genetron Holdings | In vitro diagnostics | 256 | 28% | -13% |

| Jun-12 | Burning Rock Biotech | In vitro diagnostics | 223 | 14% | 40% |

| Oct-02 | Pulmonx | Anesthesia & respiratory | 219 | 9% | 263% |

| Aug-07 | Acutus Medical | Cardiology | 183 | 6% | 60% |

| Aug-21 | Nano-X Imaging | Diagnostic imaging | 165 | 0% | 154% |

| Oct-16 | Eargo | Ear, nose, & throat | 163 | 20% | 149% |

| May-22 | Inari Medical | Cardiology | 156 | 9% | 359% |

| Sep-21 | Implantica | Gastroenterology; Urology | 152 | 0% | 114% |

| EvaluateMedTech classification | Number of PMAs | Average approval time (months) | Number of de novos |

Average approval time (months) |

|---|---|---|---|---|

| Cardiology | 9 | 14.9 | 3 | 12 |

| Diagnostic imaging | – | – | 1 | 5.4 |

| Dental | – | – | 1 | 12.9 |

| Gastroenterology | – | – | 1 | 6.9 |

| In vitro diagnostics | 23 | 12.2 | 7 | 9 |

| Nephrology | – | – | 2 | 15 |

| Neurology | 1 | 9.6 | 2 | 3.7 |

| Ophthalmics | 1 | 5.9 | 2 | 10 |

| Orthopaedics | 2 | 9.3 | 2 | 11.8 |

| Urology | 1l | 30 | 1 | 10.8 |

| Total | 37 | – | 22 | – |

| Average | 12.9 | 9.8 | ||

Focus on COVID-19 does not distract the FDA

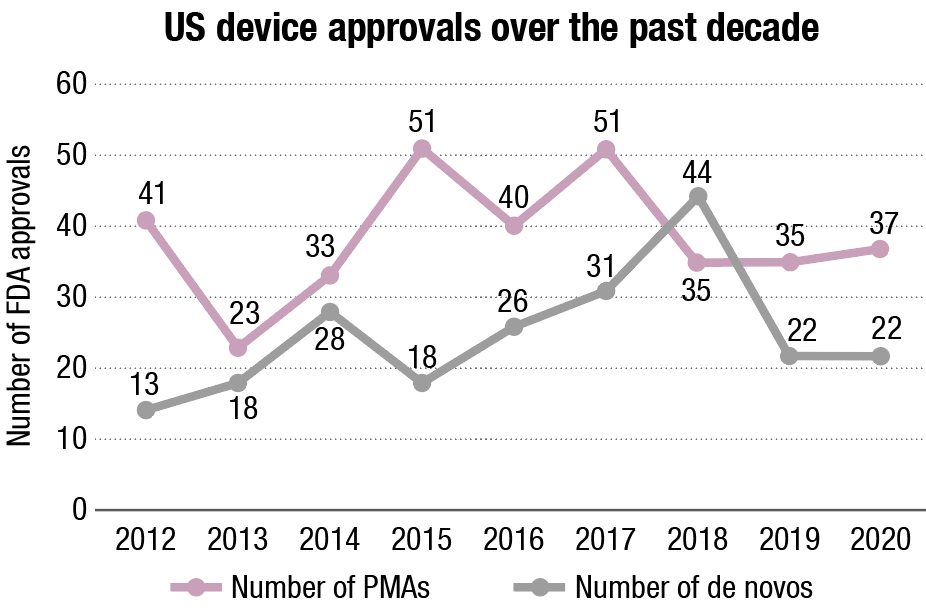

Not bad, considering. The number of innovative medical devices approved or cleared by the US FDA over the course of 2020 remained pretty steady from the year before, despite the COVID-19 pandemic putting huge pressure on the agency to get new products and diagnostics to market swiftly via a new regulatory path: the emergency use authorization.

At 37, the number of first-time premarket approvals, which are granted to high-risk innovative medical technologies, just pipped 2019’s figure of 35, and de novo 510(k) clearances, granted to low-risk products, held constant at 22.

But these approvals were clustered in particular therapeutic areas. Devices in just six different therapeutic classifications were granted PMAs in 2020, versus nine different areas in both 2019 and 2018. And diagnostics are way out in front. 23 different high-risk and seven low-risk assays were approved or cleared last year, 62 percent and 32 percent of the total PMAs and de novos respectively. None of these was for COVID-19 – the only route to market for coronavirus tests in 2020 was via emergency authorization.

Instead they were mostly for other sorts of infections. The Italian company Diasorin gained PMAs for a host of hepatitis B and C diagnostics, and tests for HIV and human papillomavirus were also represented. A breath test for H pylori developed by the Emirati group Arj Medical rounded out the infection diagnostics. The other seven diagnostics approved are designed to detect, or guide the treatment of, cancer. The most notable here were the two liquid biopsies, from Guardant Health and Roche, which gained their PMAs three weeks apart in the summer. More cancer test approvals should be expected in the coming year, too. Evaluate Vantage.