MB Stories

MedTech 2022 – The story so far

The MedTech sector is beginning to return to what we might call, if we could bear to, the new normal after a few years of Covid-driven development. That is, growth and investment across the majority of market segments have returned to steady levels.

Amid the challenges of a global pandemic, parts of the MedTech sector were positioned to reap some of the spoils enjoyed by the big pharma players. Huge demand for Covid assays boosted revenues to previously unanticipated heights, and each new wave and variant provided new opportunities for innovation.

As the pandemic recedes, albeit by fits and starts, the demand for these assays – which were often available free of charge to the general public – has inevitably crashed, leaving some players blinking in the sunlight, wondering if it was all a dream. For others, though, the return to a more normal market is a welcome relief as treatments and surgeries that were halted due to Covid begin to ramp up again.

The Covid-19 pandemic has tested even the world’s most advanced healthcare systems, which has inevitably rattled India’s healthcare system as well. From USD 10.36 billion in 2020, the Indian market for medical equipment is expected to reach USD 11.86 billion in 2022, and is expected to increase at a 37-percent compound annual growth rate (CAGR) to reach USD 50 billion in 2025.

Massive expansion of medical facilities factored in and the introduction of the Medical Devices (Amendment) Rules 2020 is there to boost the demand for medical devices in the market. On the policy front, the Indian government is undertaking deep structural and sustained reforms to strengthen the healthcare sector. Recently, the Department of Pharmaceuticals, Ministry of Chemicals and Fertilizers, Government of India, has presented an Approach Paper on Draft National Medical Devices Policy 2022 for consultation. In order to drive the growth of the sector, the paper has been prepared with the aim to facilitate an orderly growth and provide a clear direction to meet the underlying objectives of accessibility, safety, and quality, while ensuring focus on self-sustainability and innovation.

The sector requires special coordination and communication among industry and stakeholders because of its diversified nature, continuous innovation, and variation. The Department of Pharmaceuticals (DoP), Ministry of Chemicals and Fertilizers, through various programmatic and schematic interventions, such as the PLI scheme for promoting domestic manufacturing of medical devices and the promotion of medical devices parks, intends to encourage the domestic manufacturing of medical devices. Realizing that the sector demands a high level of coordination between the regulators, who have a specific legal function but are spread over various departments, such as DoHFW, Consumer Affairs, Atomic Energy Regulation Board, National Institute of Biologicals, MoEF&CC, the DoP attempts to resolve many of the issues through institutional arrangements, viz., standing forums and regulatory round tables.

The proposed policy strives to put in place a comprehensive set of measures for ensuring sustained growth and development of the MedTech sector and address the further challenges of the sector, such as regulatory streamlining, skilling of human resources, lack of technology for high-end equipment, and lack of appropriate infrastructure, through a coherent policy framework.

In addition, the marketing practices of the medical devices sector are currently being voluntarily regulated by the Uniform Code for Pharmaceuticals Marketing Practices (UCPMP). Based on the request of the MedTech industry to have a separate uniform code, and having realized such needs, the Department of Pharmaceuticals (DoP) has prepared a separate Uniform Code for Medical Devices Marketing Practices (UCMDMP) in consultation with the industry.

A parliamentary panel has also recommended framing a new price-control regime, specific for medicines and medical devices for Covid-19 management, and putting them under price control, with no annual increase in prices allowed till the pandemic is entirely over in the country.

The Parliamentary Standing Committee on Chemicals and Fertilizers recommended covering medical devices for Covid-19 treatment under the National List of Essential Medicines for effective price control, while also suggesting exemption of basic customs duty and GST on medicines and medical devices for fighting the pandemic. The Committee, therefore, recommends that all medical devices critical to Covid-19 treatment, like ventilators and oxygen concentrators, should be covered under the National List of Essential Medicines for effective price control.

Arguing that the price range of oxygen concentrators is still on the higher side even after trade margin rationalization (TMR), the panel recommended that the DoP and the National Pharmaceutical Pricing Authority (NPPA) should consider capping of the prices of various types of oxygen concentrators so as to make them affordable to common man.

In the year 2020, in an effort to boost local manufacturing, the government took a policy decision to stipulate no global tender enquiry (GTR) will be invited for tenders up to `200 crore.

Accordingly, an amendment was made in General Financial Rules (GFR). However, it was also said that relaxation can be given in special cases. The government has also announced conducive policies for encouraging foreign direct investment (FDI). In fact, India’s FDI regime has been liberalized extensively. Currently, FDI is permitted up to 100 percent under the automatic route (i.e., a non-resident investor or an Indian company does not require approval from the Government of India for the investment) in the hospital sector, and in the manufacture of medical devices. In the pharmaceutical sector, FDI is permitted up to 100 percent in greenfield projects and 74 percent in brownfield projects under the automatic route. In the AYUSH sector as well, 100 percent FDI is permitted for the wellness and medical tourism segment.

In March 2021, the government also announced a new PLI 2.0 scheme for promotion of the in-vitro diagnostics market.

In September 2021, the union government notified a scheme to promote medical devices parks at a financial outlay of `400 crore till financial year 2024-25. The financial assistance for a selected medical devices park would be 90 percent of the project cost of common infrastructure facilities for the northeastern and hilly states. For the rest, it would be 70 percent. However, maximum assistance under the scheme for one such park will be `100 crore.

To sum up, Indian MedTech industry has been growing at double-digit rates, and has evolved significantly in the last decade. However, a number of challenges need to be addressed in providing access to quality, affordable healthcare, and making this sector self-sustainable.

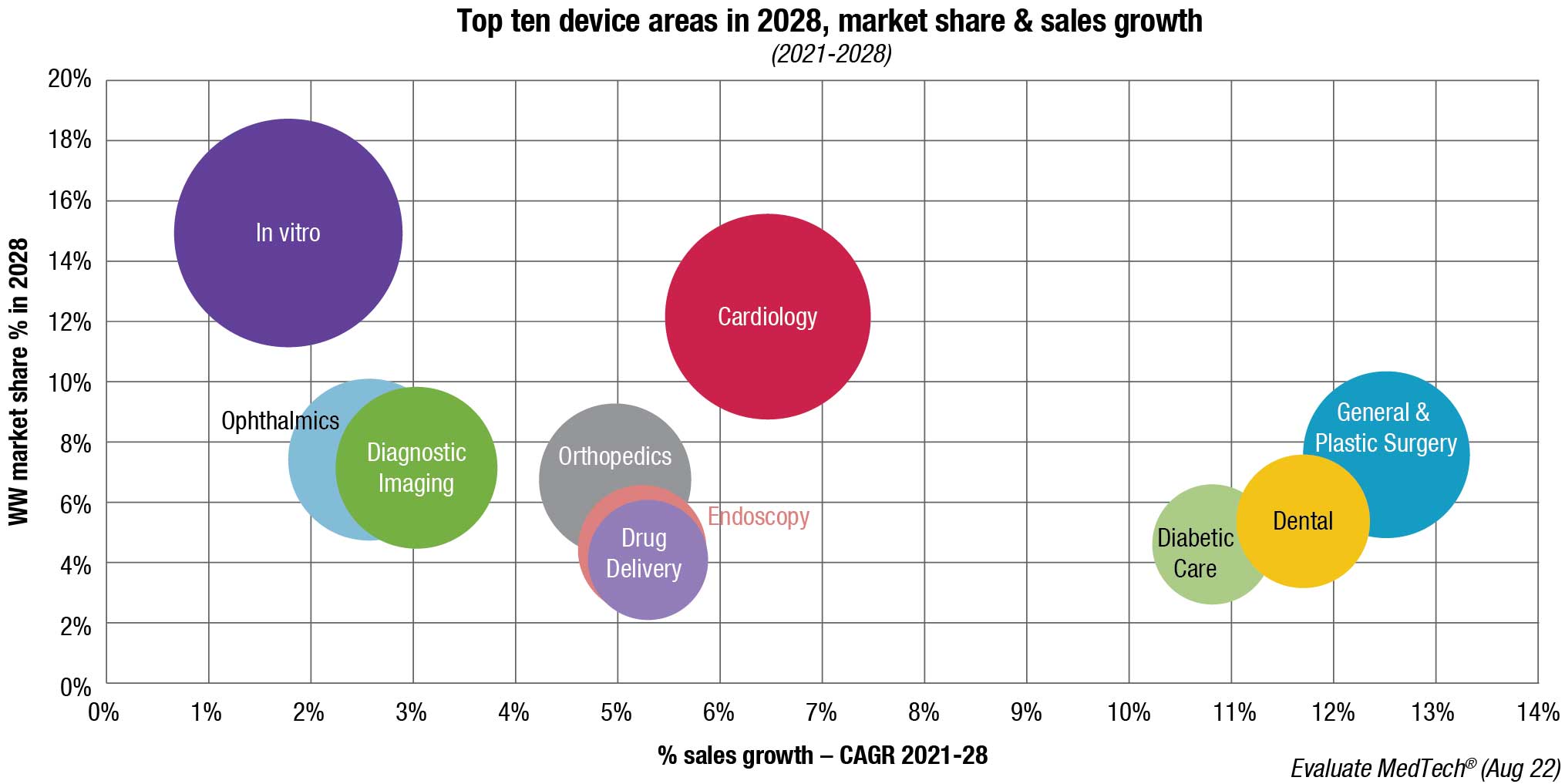

At the end of 2022, the state of the MedTech market has little to recommend it, with share prices falling and a stagnant deal-making situation. But the medium-term future remains strong, if not spectacular. The MedTech market will achieve sales of USD 753.8 billion by 2028, growing at a rate of 4.7 percent per year (CAGR) between 2021 and 2028.

But what does this mean in the longer term? While a post-Covid reset was inevitable, has the pandemic fundamentally changed the shape of the world of MedTech?

The short answer is no.

Given the bear market that the life sciences industry has endured throughout 2022, steady growth will be music to many ears. Of course, this growth varies by sector, with highlights coming from diabetic care, growing at 11 percent annually out to 2028; dental, growing at 12 percent; and general and plastic surgery, growing at 13 percent. In all cases, this largely stems from the ending of Covid lockdowns, so patients can see their doctors and dentists face to face and undergo necessary procedures.

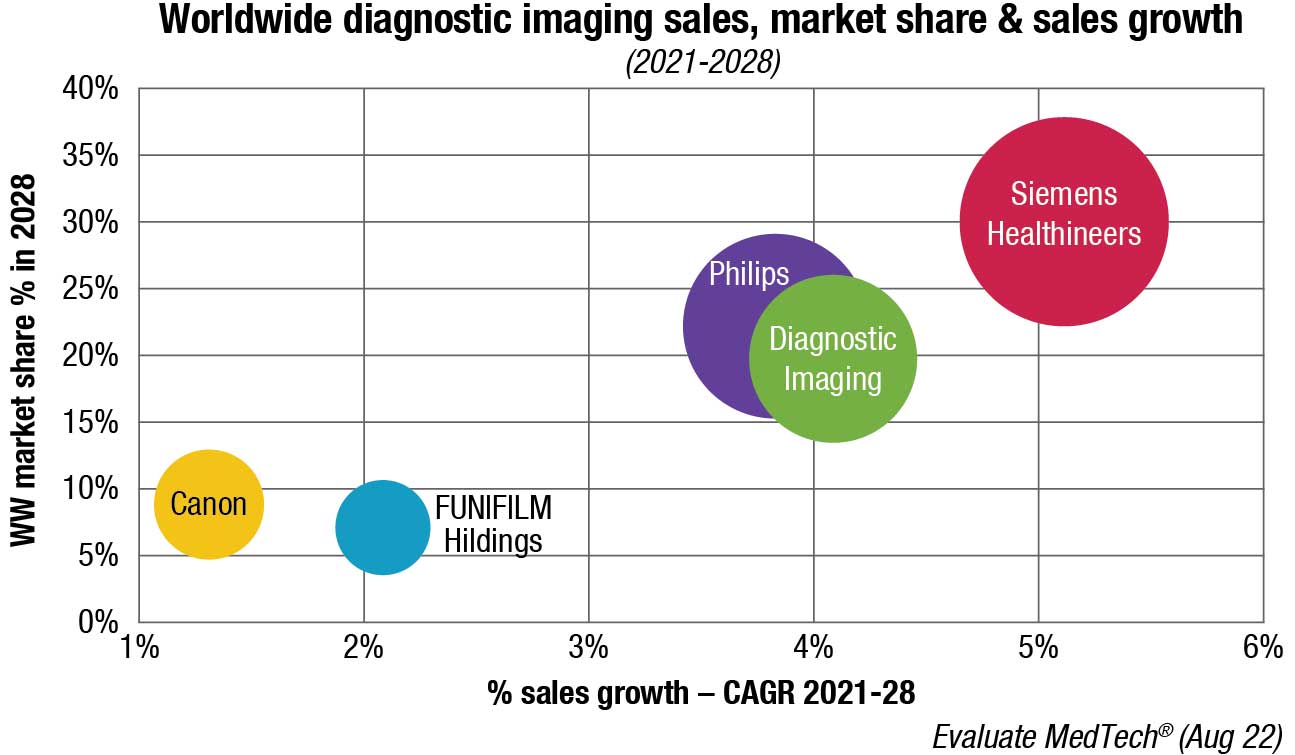

Diagnostic imaging will be one of the slower-growing devices areas, with an expected CAGR of only 3.0 percent between 2021 and 2028.

The diagnostic imaging market is set to grow from a global total of USD 44.6 billion in 2021 to USD 54.9 billion in 2028.

Among life sciences subsectors, medical devices have been the most negatively disrupted by Covid-19. Some products have escaped the worst effects, such as devices used in less deferrable procedures that fall within trauma, cardiac, oncology, and TAVR, as well as dialysis and diabetes management. Although no elective-surgery categories have reached pre-Covid-19 utilization levels, those for which there are no comparable alternative treatments, such as breast surgery and hysterectomies, have come close. And the Delta surge in 2021 sustained demand for ventilators and other respiratory devices, as well as PPE, syringes, and other consumables.

In this unpredictable environment, deal makers in 2021 tended to focus on smaller-scale, strategic deals rather than transformative transactions. Such deals were used in 2021 to diversify or extend product lines, expand into new geographies, and add scale, while managing the risks of uncertain environment. For example, Boston Scientific announced that it is acquiring Baylis Medical Company for an upfront payment of USD 1.75 billion. The acquisition expands Boston Scientific’s portfolios of electrophysiology and structural heart products.

How medical devices fared in 2021. Despite the unpredictable environment, it was a good year for deal making. Deal volume rose by 13 percent, compared with 2020, and was strong in each quarter. The total deal value increased by 65 percent to USD 79 billion.

Three major themes drove M&A in medical devices in 2021 – portfolio shaping by established organizations to accelerate growth, deals aimed at innovation, and acquisitions of devices companies by diagnostics players:

Portfolio shaping. In February 2021, Zimmer Biomet announced that it is spinning off its spine and dental businesses to focus on its core orthopedics business – including hip, knee, and sports medicine, extremity, and trauma devices.36 In March, Cardinal Health announced the sale of Cordis, a cardiovascular devices manufacturer, to Hellman & Friedman, a private equity fund, for approximately USD 1 billion.

Innovation. Devices companies are pursuing innovation through traditional M&A and through investments in early-stage companies. For example, Olympus has created a venture fund to nurture partnerships with relevant and compelling entrepreneurial teams. Bayer has funded One Drop, which has developed an artificial-intelligence-powered platform, designed to help predict trends in an individual’s glucose levels and blood pressure. Connected devices for use in care settings, and for home monitoring, remain a focus of innovation and investment. In September 2021, Baxter International announced a USD 10.5-billion deal for Hillrom, a maker of smart beds and other connected devices, which Baxter says will accelerate expansion into digital and connected care solutions that are increasingly enabling patients with access to hospital-level care at home or in other care settings.

Multi-disciplined diagnostics players branching out. Diagnostics-test manufacturers, with a windfall of Covid-19-related revenues, are investing in medical devices. Hologic, for example, continued its acquisition program with the USD 160 million acquisition of Bolder Surgical, a maker of surgical tools. That deal was announced in October 2021.

Outlook and investment considerations. On balance, the outlook for investment in the medical devices subsector appears to be positive. Investors will be looking for manufacturers of medical devices that have solid underlying technology as well as tuck-ins to expand market share or share of wallet.

The two principal drivers of transactions will likely be portfolio reshaping and a resumption of normal demand. Established players are shedding non-core, non-complementary, or lower-performing businesses (which nonetheless have high valuations) and buying into new growth opportunities. Early-stage companies are ripe targets for investment by companies seeking access to innovation, with connected devices garnering a great deal of attention.

Divestitures by two major medical devices players are planned. GE has announced that it will divest GE Healthcare, which is in interventional imaging, as part of a major restructuring. Johnson & Johnson is keeping its medical devices and pharmaceutical businesses, but plans to spin off its consumer health business.

Investors will need to consider new variants and potential surges, as well as their impact on supply chains. Further, there are some areas where breakthrough innovations could eliminate the need for certain devices. Investors will need to stay abreast of regulatory developments as the Biden administration’s agenda comes more clearly into focus. There is some discussion in Washington around reshoring critical manufacturing processes, at least for sourcing of some critical components. However, it remains to be seen whether the Biden administration’s agenda will prioritize medical devices over other critical manufacturing-based industries.

Big MedTech’s share price bloodbath. The first half of 2022 has been nothing short of disastrous for the largest MedTech companies. All but one of the groups, with a market cap greater than USD 10 billion, saw their share prices decline over the past six months, with this cohort as a whole shedding an astonishing USD 450 billion in value.

While the wretched state of the markets in general is a major factor here, it is also clear that several of the big losers had been winners during the pandemic. The cosmetic dentistry specialist Align Technology, whose value soared as people became dissatisfied with their appearance on video calls, and Sysmex, which makes Covid tests, lead the fallers.

The half-year change in indices of listed devices makers shows just how miserable the situation is. All were up across 2021, by between 18 percent and 23 percent. Now all are down. European companies do not appear to be suffering as badly as US groups, though whether this counts as a glimmer of hope is debatable.

Japan seems to be more resistant to wider market woes than US or even European stocks, judging by the sole group which managed to grow its valuation in the first half of 2022. Stock in Tokyo-listed Olympus has risen by 3 percent so far this year, which counts as a triumph in these dismal times.

The company’s shares rose sharply in mid-May after it posted strong results for its fiscal fourth quarter and projected record net profit for the coming fiscal year. Olympus’s profit more than doubled to ¥28.1 billion (USD 216 million) for the quarter that ended in March, thanks in part to a recovery from pandemic sales slumps. And it said it could achieve net profits a third higher than this in its fiscal 2022.

The rest of the big caps can only look on in envy. Align had the most torrid time of all, with its 64 percent fall in valuation, representing the only time a big-cap company has shed more than half of its worth stock since Vantage began tracking this cohort in 2013.

The reason for Align’s free fall is simple – sales of Invisalign, the transparent tooth-straightening system that is the company’s bread and butter, are falling. In the first quarter of 2022, the group shipped 598,835 Invisalign cases, down 5 percent from the final quarter of 2021. And the Q4 2021 figure was 4 percent below the quarter before that.

As a company, whose products are used electively and largely paid for out of pocket, Align is hugely exposed to the cost of living crisis bedeviling the Western world. The same factors are partly behind the fall in the shares in Straumann, which has an Invisalign competitor called ClearCorrect.

The drop in Dexcom’s market cap is more to do with competitive pressure. Abbott’s Freestyle Libre 3 continuous glucose monitors was approved by the FDA in late May. The device competes with Dexcom’s G7 in Europe, but G7 has yet to gain US approval.

One element that was not at play in Dexcom’s falling valuation was the bid it was said to be considering for the insulin pump maker Insulet in May. The company scotched these rumors after a week or so of fevered speculation, but its shares barely shifted during this period.

While the factors affecting individual companies are interesting, they are mostly outweighed by the macro issues hitting the sector. Makers of devices that patients pay for themselves are having a hard time and will likely continue to suffer in the months to come.

MedTech bleeds corporate venture cash. In the first three quarters of this year, only 15 percent of the total venture cash received by MedTech companies came from rounds with corporate VC participation. This proportion has shrunk fast; two years ago the figure sat at 30 percent.

The good news for the sector is that investment in private devices makers seems to be holding up nicely, at least at the half-year point, as this Vantage analysis found. Traditional VCs are very well funded at the moment, and since the Covid pandemic highlighted the importance of medical technology, they have been happy to back MedTechs.

So why are the strategics pulling back? The almost total shutdown of the IPO market, which has meant fewer crossover rounds – the big deals that precede a flotation – cannot be the explanation because corporates are not crossover investors. Of the 10 largest-ever VC deals with corporate participation, only one, Cue Health’s USD 235-million round in May 2021, could be regarded as a crossover.

In any case, IPOs of small devices companies have never played a huge role in the MedTech industry’s lifecycle.

Covid is perhaps responsible for some of this trend. The parent companies of some of the most prolific corporate investors were hammered by the pandemic. Johnson & Johnson, Boston Scientific, and Medtronic were hit hard by lockdowns, though they still feature in the top five most prolific corporate MedTech backers of the past five years.

Neither Boston nor Medtronic have made any venture investments since March 2020, however. Diagnostics specialists Roche and Illumina, both of which sold many millions of dollars-worth of Covid tests, have played more of a role since early 2020. In both cases their interest as investors has skewed heavily in favor of liquid biopsy developers, with Grail, Freenome, and Delfi Diagnostics, all benefiting.

Overall, it is not the number of corporate rounds that are shrinking. Of the 102 VC deals closed by MedTechs between January and September this year, 14 counted at least one corporate in their syndicate. This is very nearly the same proportion as in the past two years.

If it is not the number of corporate rounds that are declining, then, it must be the size. So far this year the rounds with the investment arm of one of the big strategics on board averaged under USD 50 million in size, for the first time since 2019. While rounds with corporate participation have always been, on average, bigger than those without, now this only just holds true. Perhaps next year, it will not be true at all.

The take-away. Low procedural volumes, supply chain disruptions, and delayed capital sales made 2021 a difficult year for many medical devices companies. The extent to which the environment will normalize remains an open question. To thrive amid the uncertainty, medical devices players will need to maintain their focus on innovation and diversification and emphasize risk management in structuring their deals.