IVD

Molecular diagnostics industry-A zero to a multi-billion market within a year

The sudden onset of SARS-CoV-2 and the resulting disease COVID-19 has put the world’s focus on molecular diagnostics in an unexpected way.

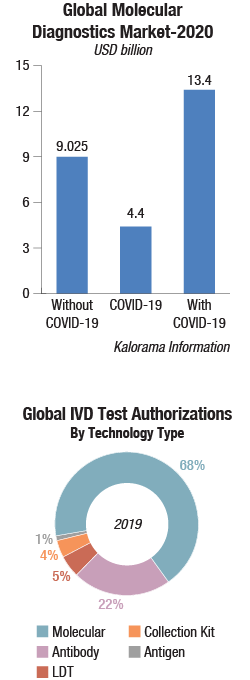

2020 was set to be a year of growth and innovations in molecular diagnostics (MDx) under any circumstances. New products, higher growth than other IVD categories, continued acceptance of next-generation sequencing methods was driving this segment. Liquid biopsy technologies and the increased use of predictive genetic tests were and still are areas of anticipated revenue growth. The sudden onset of SARS-CoV-2 and the resulting disease COVID-19 put the world’s focus on molecular diagnostics in an unexpected way.

In March 2020, as the COVID-19 crisis surfaced, molecular diagnostic manufacturers went to work with new RT-PCR testing kits. The worldwide demand for COVID tests materialized rapidly from zero and became a USD 1.3 billion market in the first half of 2020.

Indian Defibrillators Market |

|

|---|---|

Leading players-2019 |

|

| Segment | Brand |

| Monophasic | BPL, UNI-EM, and Schiller |

| Biphasic | Premium segment: Stryker (Physio-Control), Medtronic, and Zoll |

| Mid-end segment: Philips, Nihon Kohden, Schiller, Mindray, GE, Stryker, and Zoll; Mediana, Beijing M&B, and BPL | |

| AEDs | Stryker (Physio-Control), Cardiac Sciences, Schiller, Nihon Kohden, Philips, PRIMEDIC, Zoll, and Beijing M&B |

| ADI Media Research | |

There has also been a huge influx of product introductions from small, obscure companies. These have mostly targeted the low end of the price range and often had poor performance, while a small number of high-end automated systems are mostly limited to certain segments of the market, such as independent reference laboratories and centralized hospital laboratories. Low-quality products from fly-by-night companies are the predictable result of the shortages and the relatively basic resources needed to produce mediocre antibody test kits with a low level of quality control. A few major companies are seeing the most test runs.

COVID-19 testing has also been a bit of a double-edged sword for labs generally, for in vitro diagnostics and molecular tests. The news is not all positive from a revenue perspective. Molecular testing on COVID is paired with declines in more traditional molecular tests as patients avoided doctors and continue to reduce in person doctor visits during lockdown. Down but not out segments include cancer, histology, and inherited diseases which are expected to continue to grow, perhaps surge, later in the year and into 2021. Here volumes may be reduced by social distancing measures. But they are expected to continue to make progress converting laboratory customers. New technologies such as molecular near-patient and next-generation sequencing are increasingly part of the mix.

Prior to COVID-19, liquid biopsy was one of the stars of this segment. Favorable regulatory policies and promising studies will enhance companion testing. New LDT tests in inherited disease testing in particular, using IVD supplies which includes non-invasive prenatal testing (NIPT), is driven by the demand in China. Even though the demand is for laboratory test services and not for IVD products, the demand for instruments, kits, and consumables that are approved by regulatory agencies is driving the segment. However, the market opportunities may be challenging to access by foreign IVD companies due to the regulations promoting domestic companies.

Prior to COVID-19, liquid biopsy was one of the stars of this segment. Favorable regulatory policies and promising studies will enhance companion testing. New LDT tests in inherited disease testing in particular, using IVD supplies which includes non-invasive prenatal testing (NIPT), is driven by the demand in China. Even though the demand is for laboratory test services and not for IVD products, the demand for instruments, kits, and consumables that are approved by regulatory agencies is driving the segment. However, the market opportunities may be challenging to access by foreign IVD companies due to the regulations promoting domestic companies.

INDIAN MARKET

In a country where the healthcare spend has been grossly underscored by the government, the pandemic has taught many things and among them is the awareness of infectious diseases, especially viral, which is the biggest threat in the coming years and decades. There are numerous viral diseases, which can be diagnosed very early, if we have cost-effective and rapid molecular testing machines and kits, which even small and medium laboratories can afford. What is needed is early diagnosis and treatment and that requires molecular testing and antigen detection, followed by antibody detection.

Since the onslaught of COVID-19, India has been calibrating its testing strategy as per the changing paradigm, and taking into account the scope, need, and capacity to rapidly scale-up tests performed each day across the country. The testing rate has been ramped up significantly over the last few months with the introduction of the rapid antigen detection test in addition to the molecular tests, which remain the mainstay of diagnosis.

Technology landscaping, leveraging resources, and optimizing the processes to increase efficiency are the key approaches of the Indian Council of Medical Research (ICMR), Ministry of Health & Family Welfare (MoHFW), and Government of India.

In the current scenario, technology has come in the form of growing adoption of RT-PCR testing on account of its high specificity and sensitivity. RT-PCR tests are highly recommended by regulatory organizations owing to their rapid detection and efficacy. The method continues to be the most accurate method available for the detection of the COVID-19 virus. India has a strong RT-PCR network, which contributed to the effective treatment of HIV/AIDS over the last several years.

In the current scenario, technology has come in the form of growing adoption of RT-PCR testing on account of its high specificity and sensitivity. RT-PCR tests are highly recommended by regulatory organizations owing to their rapid detection and efficacy. The method continues to be the most accurate method available for the detection of the COVID-19 virus. India has a strong RT-PCR network, which contributed to the effective treatment of HIV/AIDS over the last several years.

The surge in COVID-19 infections has pushed the government to change its testing strategy. While ramping up testing was, rightly, seen as an important part of the strategy to contain the virus, rapid antigen tests have not met the expectations. Hence, on the back of increased demand, manufacturers have significantly scaled up the production of their RT-PCR assay kits. The central government and state governments are working toward continually evolve its testing strategy and pushing RT-PCR testing on a larger scale.

Local authorities across the country, for instance the Delhi government and the Brihanmumbai Municipal Corporation authorities in Mumbai are working out modalities to ramp up RT-PCR testing in their respective regions.

During the initial phase of the pandemic, approximately 60 percent of RT-PCR kits procured were from foreign manufacturers and the remaining 40 percent were from Indian manufacturers. However, currently, increasing procurement of RT-PCR combo kits is from Indian manufacturers, whereas the COBAS and CBNAAT kits are still being imported.

Indian manufacturers now produce around 34.8 million RT-PCR combo kits per month, which gives the country a capacity to conduct around 1.135 million RT-PCR COVID-19 tests daily. The Central Drugs Standard Control Organization has granted manufacturing licenses for RT-PCR kits to 30 companies and import licenses to 119 firms.

Some recent developments

CoViDx One, the COVID-19 RT-PCR test kits developed by Pune-based GenePath Diagnostics, has received approval for manufacture and sale in India from the Central Drugs Standard Control Organization (CDSCO). The CDSCO has given approval to the Bengaluru-based Achira Labs to manufacture the kits.

RT-PCR testing kits jointly developed by iGenetic Diagnostics and Biogenomics have received approval from the Indian Council of Medical Research (ICMR) and the National Institute of Virology (NIV).

Equine Biotech, a startup incubated at the Indian Institute of Science (IISc), has developed an indigenous RT-PCR diagnostic kit called GlobalTM diagnostic kit for accurate and affordable diagnosis of COVID-19. It has been approved for use in authorized COVID-19 diagnostic labs by the ICMR.

Total operational labs reporting to ICMR for COVID-19 |

|||

|---|---|---|---|

September 2020 |

|||

| Segment | Government | Private | Total |

| Real-time PCR | 479 | 455 | 934 |

| TruNat tests | 576 | 202 | 778 |

| CBNAAT tests | 34 | 93 | 127 |

| Total | 1089 | 750 | 1839 |

| ADI Media Research | |||

The Department of Science and Technology (DST) has funded two companies, FastSense Diagnostics (FD) and Module Innovations (MI), to develop antibody kits as well as a quicker version of the rapid RT-PCR.

In another development toward doubling the testing capacity, Indigenization of Diagnostics (InDx) has been recently launched in Bengaluru and anchored at Centre for Cellular and Molecular Platforms (C-CAMP). The project plans to manufacture all reagents needed for RT-qPCR-based and other molecular methods of diagnostics of COVID-19 in bulk quantities and at much lower costs. The project aims to build a robust supply-chain network of Indian MSMEs capable of producing reagents for testing kits, and manufacture testing kits. According to C-CAMP, the project involves identifying bottlenecks in the supply-chain network, short-falls in quality levels and gaps in the ability of these MSMEs to scale-up.

Rising competition and amendments by the state governments are bringing down the prices as well, making a distinction between kits, raw materials, and the services component of testing. The April order on pricing of the test has been amended by several states.

For instance, the Uttar Pradesh government has reduced the charge for conducting COVID-19 test to Rs 1600 from Rs 2500 by all labs including those privately owned. This is the second time that the price of COVID-19 test had been reduced. When private labs were first allowed testing via RT-PCR, the fee for each test was Rs 4500 which was then reduced to Rs 2500 in April. According to the Maharashtra government, the charges for picking test samples from collection sites have been reduced to Rs 1200 from Rs 1900. On the contrary, the use of rapid point-of-care antigen tests for diagnosis has risen.

Industry Speak

SARS-CoV-2 (COVID-19) – SARS, MERS, and coronavirus composition

Martin Conway

Marketing Executive,

Randox

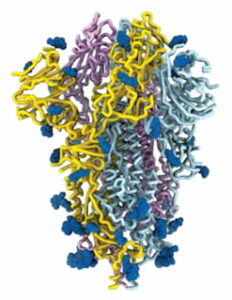

The coronavirus study group (CSG) of the international committee of taxonomy of viruses concluded that after viral genome analysis that SARS-CoV-2 shares 88 percent of its genetic code with two bat- derived severe acute respiratory syndrome (SARS-Like) coronaviruses, however concluded the sequence was more distant from SARS-CoV than MERS-CoV. The composition of coronavirus is enveloped with single-stranded ribonucleic acid, formally named for its solar corona like appearance to 9-12 nm-long surface spikes. The spikes crowning the new coronavirus that causes COVID-19 are typical of pneumonia.

derived severe acute respiratory syndrome (SARS-Like) coronaviruses, however concluded the sequence was more distant from SARS-CoV than MERS-CoV. The composition of coronavirus is enveloped with single-stranded ribonucleic acid, formally named for its solar corona like appearance to 9-12 nm-long surface spikes. The spikes crowning the new coronavirus that causes COVID-19 are typical of pneumonia.

Analysis of the spike architecture reveals other information that could prompt the discovery of counter measures against this virus. Researchers across the globe are currently trying to determine the infectivity mechanism, structure and function of the SARS-CoV-2 spike protein and its chemical binding affinities.

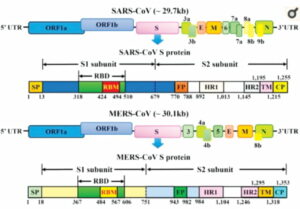

Genome sequence of SARS-CoV-2 also shows some similarities to that of MERS-CoV as both SARS-CoV and MERS-CoV, cause severe respiratory syndrome in humans. However, greater emphasis has been placed on SARS-CoV, which is essentially what SAR-CoV-2 has evolved from. Similarities of both SARS-CoV and MERS-CoV display similar pathogenesis that contributes to nosocomial transmission, preferential viral replication in the lower respiratory tract, and viral immunopathology.

Similarly, their genomic organization is typical of coronaviruses, having an enveloped, single, positive-stranded RNA genome that encodes four major viral structural proteins, namely spike (S), envelope (E), membrane (M), and nucleocapsid (N) proteins 3–5, that follow the characteristic gene order [5′-replicase (rep gene), spike (S), envelope (E), membrane (M), nucleocapsid (N)-3′] with short untranslated regions at both termini.

Similarly, their genomic organization is typical of coronaviruses, having an enveloped, single, positive-stranded RNA genome that encodes four major viral structural proteins, namely spike (S), envelope (E), membrane (M), and nucleocapsid (N) proteins 3–5, that follow the characteristic gene order [5′-replicase (rep gene), spike (S), envelope (E), membrane (M), nucleocapsid (N)-3′] with short untranslated regions at both termini.

The single-stranded RNA genomes of SARS-CoV and MERS-CoV encode two large genes, the ORF1a and ORF1b genes, which encode 16 non-structural proteins (nsp1–nsp16) that are highly conserved throughout coronaviruses. These structural genes encode the structural proteins, which are common features to all known coronaviruses.

Market dynamics

The molecular diagnostics reagents market is expected to close 2020 in the vicinity of Rs 4920 crore for COVID tests alone. COVID tests constitute 50 percent RT-PCR tests, 40 percent antigen tests, and 10 percent TRueNAT and CB-NAAT, the latter two being TB tests with kits validated for COVID. The reagents market in the period, March-Sept 2020 is estimated at Rs 2220 crore for 74.1 million tests conducted, and for October-December at Rs 2700 crore with a conservative estimate of 90 million tests in that period. This amounts to the reagents market in 2020 for COVID tests at Rs 4900 crore, a new segment altogether. The leading players for reagents in this segment are Roche, Thermo Fisher, and Qiagen.

The reagents required for routine tests have taken a major dip as the industry lost about six months, hugely. The quarter, JFM 2020 was normal, and by September 2020 the demand for routine tests in laboratories started to trickle in.

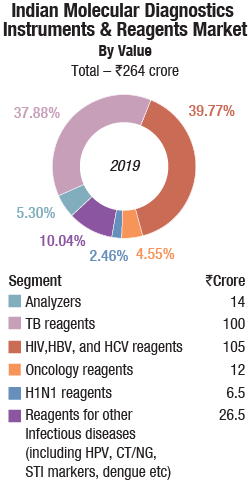

The Indian molecular diagnostics and reagents market is estimated at Rs 264 crore in 2019. Analyzers contributed Rs 14 crore, and most were placed, on rentals. Roche, Abbott, Qiagen, and Randox continue to be the dominant vendors.

In the reagents segment, TB at Rs 100 crore and HIV, HBV (hepatitis B virus), and HCV (hepatitis B virus) reagents estimated at Rs 105 crore continue to have a combined contribution of 78 percent. India is on its way to eradicating tuberculosis by 2025. It is estimated that in 2019, the Indian market for oncology reagents was Rs 12 crore, H1N1 reagents Rs 6.5 crore, and reagents for other infectious diseases as HPV, CT/NG, STI, and dengue, that are also increasingly being diagnosed by molecular methods Rs 26.5 crore. The percentage contribution remains more or less the same since the last few years.

Challenges and limitations

To curb the spread of COVID-19 pandemic, the world needs diagnostic systems capable of rapid detection and quantification of the novel coronavirus (SARS-CoV-2). Many biomedical companies are rising to the challenge and developing COVID-19 diagnostics. In the last few months, some of these diagnostics have become commercially available for healthcare workers and clinical laboratories. However, the diagnostic technologies have specific limitations and reported several false-positive and false-negative cases, especially during the early stages of infection. Currently, more sophisticated and reliable molecular diagnostics are being developed to improve the COVID-19 diagnosis.

Validated RT-PCR Kits |

Validated RT-PCR Kits |

Validated RT-PCR Kits |

|---|---|---|

September 2020 |

September 2020 |

September 2020 |

| Medical and Biological Labs | ABI | DNA Xpert |

| Medsource Ozone Biomedicals | Accelerate Technologies | 1Drop Inc. |

| Meril Diagnostics | ADT | Equine Biotech |

| Micobiomed Co. | AMD | GCC Biotech |

| M.J.Biopharm | Affigenix Biosolutions | GeneMatrix |

| Mylab Discovery Solutions | Agappe Diagnostics | Gene Path Diagnostics |

| NeoDx Biotech Labs | Ajay Bio-Tech | Gene Proof |

| Ningbo Health Gene | AITbiotech | GeneReach Biotechnology |

| NovaTec Immunodiagnostica | Altona Diagnostics | General Biologicals Corp. |

| Nucleus Diagnosys LLP | Angstrom Biotec | Genes2me Pvt Ltd |

| OSANG Health Care | Aspen Laboratories | Genestore |

| Oscar Medicare | Athenese-Dx | Genetix Biotech Asia |

| PerkinElmer | Aura Biotechnologies | Genome Diagnostics |

| Pishtaz Teb Zaman Diagnostics | 3B Black Bio Biotech | Genores Biotech |

| POCT Services | BAG Diagnostics | Gland Pharma |

| Primer Design | BGI Genomics | Guangdong Ardent Biomed |

| Progenie Molecular | Bhat Biotech | HA Tech Biopharma |

| Promea Therapeutics | Biogenix Inc. | Helini Biomolecules |

| QuantuMdx | BioGenomics | Huwel Lifesciences |

| Reliance Industries Limited | Bioneer Corporation | iNtRON Biotechnology |

| Roche Diagnostics | BioSewoom | JITM Skills |

| Shambhav Medical | BioSystems Diagnostics | JN Medsys |

| Sansure Biotech Inc. | Cancer Rop | Karwa Enterprises |

| Seegene | Cepheid India | KILPEST |

| Sentinel Diagnostics | CoSara Diagnostics | Kogene Biotech |

| SD Biosensora | CPC Diagnostics | IIT |

| Shanghai ZJ Bio-Tech | Daan Gene | InnoDx Solutions |

| Shenzen Uni-Medica Tech | DiagSure | Intron Biotechnology |

| SNP Biotechnology R&D | DNA Technology Research | Lab Care Diagnostics |

| Stellence Pharmsciences | LabGenomics | |

| TranScience Inno. Tech | Lab Genomics | |

| Trivitron Healthcare | Siemens Healthcare | |

| uBio Biotechnology Systems | Lifespan Biotech | |

| Vitane Biologics | Lipomic Healthcare | |

| Vitro S.A. | LLC Art Biotech | |

| Wuhan Easy Diagnosis | Maccura Biotechnology | |

| YOUSEQ | Med Achievers | |

| ZyBio Inc. | ||

| ADI Media Research | ||

Molecular diagnostics can be developed rapidly and provide extremely sensitive, specific, and often quantitative detection of the SARS-CoV-2 RNA. However, they are complex, expensive, and slow to deliver. A single RT-PCR test kit may cost over 100 USD, while setting up a diagnostic/processing lab requires more than 15,000 USD, whereas the analysis time is 4–6 h, and sample-to-result turnaround time is more than 24 h. Furthermore, the molecular diagnostics are not deliverable to end-users and are intended only for qualified clinical laboratory personnel and medium- or high-complexity laboratories. Yet, some studies suggest a high false-negative rate of RT-PCR diagnostics for COVID-19. Erroneous RT-PCR results may be caused by inappropriate sample collection, storage, transfer, purification, and processing. The quality of the RNA extracted from the swabs also affects the results. Other factors such as degradation of purified RNA, the presence of RT-PCR inhibitors, or genomic mutations may cause false-negative results. On the other hand, cross-contamination of samples during collection, pipetting, and processing or technical errors may cause false-positive results. Notwithstanding the probability of these untoward instances, these diagnostics are currently the most accurate and the most sensitive available solutions for the earliest and large-scale detection of SARS-CoV-2.

On the research and development front, molecular assays are still being developed to optimize their clinical sensitivity, LoD, and ease-of-use. The molecular assays may fail to diagnose COVID-19 if they have low sensitivity (and high LoD), while the number of steps involved in handling and processing of biological samples increases the turnaround time and risk of technical errors and cross-contamination. The overall clinical performance of molecular diagnostics is determined by several factors.

The modern molecular diagnostics are not intended for point-of-care diagnosis of COVID-19 but provide a core diagnostic solution to conduct large numbers of tests in a reasonable timeframe. It has been estimated that 80 percent of the COVID-19 positive cases were initially transmitted by the undetected infections during the early stages of this pandemic. Therefore, accurate diagnosis of the disease is crucial to curb its spread. In the current pandemic situation, the SARS-CoV-2 tests were rapidly developed and approved for emergency use. Rationally, due to the lack of research and development time, the commercialized diagnostics were not validated or optimized with sufficient numbers of clinical samples, which might have led to inaccurate results. Furthermore, false-negative results may have been caused by inadequate diagnostic timing, low sensitivity, or low viral load. Therefore, it is plausible that infected individuals may have been missed by the real-time RT-PCR tests. Ideally, RT-PCR must be combined with clinical examination and computed tomography to medically judge the suspected individuals. Considering these deficiencies and limitations, continuous optimization of RT-PCR diagnostics is critical to meet the diagnostic standards. In this view, digital RT-PCR technology may enhance the accuracy, sensitivity, and lower detection limits thereby enabling accurate and early diagnosis of COVID-19.

Presently, molecular diagnostics combined with a comprehensive clinical examination of suspected asymptomatic or oligosymptomatic individuals may reduce the number of false-negative results. However, an independent and careful assessment of the commercial diagnostic tests should be conducted to identify diagnostic errors and determine the efficiency of approved tests. These approaches would lead to better understand and diagnose COVID-19 and improve the future epidemic readiness for emerging infectious diseases.

GLOBAL MARKET

MDx segment continues to be the fastest growing segment within the global IVD market. The global market is estimated to be USD 8,760 million in 2019.

Infectious disease testing segments are driven by the COVID-19 crisis (not only detection tests but related rule-out respiratory tests and HAIs). The demand will come from advanced markets such as North America and Europe, while blood screening, histology and inherited diseases testing are driven by additions to blood test protocols and emerging markets.

For the first time, molecular diagnostics will represent more than 15 percent of the market, double where the category fell in 2019. This reflects not only PCR tests for the virus, but also the continued use of molecular for new purposes such as prenatal testing and cancer marker detection.

Under any circumstances IVD was set to grow in 2020. Testing had been making headway over the last decade. New product introductions, investments, and mergers were brisk. Tests for cancer and infectious disease detection, transplant success, pharmaceutical selection have added healthcare value and improved outcomes. Genetic tests for rare diseases and prenatal assessment are increasingly utilized.

In addition, the integration of novel technologies and software solutions with COVID-19 testing is expected to open new avenues for market expansion. For instance, the market participants are inclined toward incorporating Artificial Intelligence (AI) algorithms in the COVID-19 tests for rapid and efficient diagnosis. In August 2020, BMC, an Indian civic body, announced to assess the efficacy of AI-based COVID-19 tests. Also, in July 2020, the University of Oxford published results of using AI algorithms for the screening of patients.

Robust funding and investments by the public as well as private agencies are expected to propel molecular diagnostic companies to develop COVID-19 diagnostic products, thereby driving the market. In June 2020, NIH has announced to release four funding opportunities to accelerate research on SARS-COV-2 screening for vulnerable and underserved populations to decipher and address the disparity gap.

The regulatory framework for approvals has always posed major restrictive factors on pharmaceutical, biotechnology, and medical technology industries. Faulty diagnostic kits could provide inaccurate results. Hence, the possibility of causing harm to the patients has driven the FDA to ensure compliance with premarketing regulations. The regulatory environment is already complicated, and the FDA is becoming increasingly careful owing to the growing dependency on molecular diagnostics for making critical medical decisions.

The US FDA also conducts a post-market investigation of in vitro diagnostic device products to ensure parity between performances and claims. For instance, a heavy penalty was imposed on Nichols Institute, a subsidiary of Quest Diagnostics, as its test kits produced results that were inaccurate and unreliable. Hence, the stringency of regulations associated with the approval process for molecular diagnostics is limiting the market growth.

COVID-19 has affected every diagnostic company. This had dominated the activities of players such as Roche and Abbott, specialists in respiratory testing such as BD and Quidel, and international testing companies such as Seegene, SD Biosensor, and DiaSorin. Life science companies with diagnostic offerings like Thermo Fisher Scientific and Illuminia have also developed test kits and have seen changes from the pandemic.

Thermo Fisher-Qiagen deal falls apart

On August 13, 2020 Thermo Fisher Scientific announced that its bid to acquire Qiagen had failed and the planned deal was terminated. The deal, which was made public a week before the World Health Organisation announced that the spread of COVID-19 had reached pandemic levels, had been on track for one of the largest deals in MedTech this year.

Thermo Fisher initially offered Qiagen €39 per share, which it later upped to €43 per share in July, increasing the value of the deal from $11.5bn to nearly $12.5bn. The offer was increased after several Qiagen shareholders insisted the firm was worth more than Thermo Fisher was offering, due to the increased demand for the kind of diagnostics products Qiagen sells stemming from the COVID-19 pandemic.

Qiagen went on to publish its Q2 results on 4 August. While its sales in the Americas actually fell during the quarter, it saw significant growth in European, Middle Eastern and African regions, as well as in Asia Pacific and other ex-US territories, leading to an overall global revenue rise of 16 percent.

As well as increasing the offer price, the new agreement reduced the minimum acceptance threshold of Qiagen’s issued and outstanding share capital from 75 percent to 66.67 percent. It also specified a $95m expense reimbursement payment from Qiagen to Thermo Fisher if the threshold of the deal was not met.

In the end, only 47.02 percent of Qiagen shares were tendered by the August 10, deadline, missing the threshold by a fairly significant margin. Qiagen will now pay Thermo Fisher the required reimbursement, and has plans to acquire COVID-19 and flu test developer NeuMoDx.

Shareholder opposition ultimately killed the deal. The opposition to the acquisition among Qiagen’s shareholders was spearheaded by investment firm Davidson Kempner, which in early July owned 3 percent of Qiagen. The firm published an open letter voicing its objection to the sale and said it would not tender its shares under the initial proposed deal. When Thermo Fisher upped its takeover price, Davidson Kempner proceeded to increase its stake in Qiagen to 8 percent and said it would still not tender its shares. Davidson Kempner put the standalone share value at Qiagen at €48 to €52 a share, around 18 percent above Thermo Fisher’s second offer.

As well as Davidson Kempner’s opposition, the deal was objected to by Swiss hedge fund PSquared, which owns over 4 percent of Qiagen. PSquared likewise said it would not tender its shares even after the improved offer from Thermo Fisher, claiming it undervalued Qiagen’s offering.

Despite the shareholder opposition, the Qiagen board was in full support of the deal. The Financial Times has questioned whether the board can now remain in place, being that it found itself in such significant opposition to its shareholders.

Vaccines may be more future-proof than diagnostics. It’s not especially common for a deal of this magnitude to fall apart because the COVID-19 pandemic has improved the fortunes of the companies involved, instead of weakened them. However, despite Qiagen’s significant growth, some analysts have argued that the company’s good fortunes might not last.

While 2021 is likely to see a continued demand for diagnostic products that can be used in COVID-19 testing, analysts from Evercore ISI believe this demand is unlikely to be sustained long-term.

Themo Fisher’s portfolio of over 200 COVID-19 vaccine and therapeutic candidates may indeed be more future-proof than Qiagen’s offering. While COVID-19 is still a very real threat, with looming fears about a second wave, the spread of the disease among the population has been declining over time as a result social distancing and other public health measures. It’s not unreasonable to assume, with many robust diagnostic products for the disease already on the market and case numbers dropping, that the general focus of the medical community will slowly shift from diagnostics to inoculation.

Way forward

Will MDx market continue into future years? Assuming, cancer tests are able to be completed in a surge of make-up healthcare visits and procedures later in the year and into 2021 it presages a strong momentum for growth. It is worthwhile noting that DNA-based testing technologies already represent nearly a USD 10 billion market without COVID-19. While it is possible COVID-19 tests will be panelized and added to larger menus and may not have the emergency system sales of 2020, its influence should last in other ways. It already has boosted the respiratory and healthcare infection testing market segments.

Continuous monitoring for emerging signs of a possible new world order post-COVID-19 crisis is a must for aspiring businesses and their astute leaders seeking to find success in the now changing molecular diagnostics market landscape.