MB Stories

MRI market bounces back

MRI, so far a great way to detect internal injuries, heart diseases, and cancer, with research is offering new advances expanding access to severely obese patients, those who are claustrophobic and more.

The Covid-19 pandemic accelerated the trend toward distributed imaging in diagnostic radiology. One of the best examples of this could be seen in the preference for performing portable chest radiography in the emergency department during the pandemic rather than PA and lateral chest radiographs in radiology. Similarly, VLFS MRI scanners, located in clinical areas, such as the ICU and ED, offer the ability to minimize flow through a medical center of potentially infectious patients or those vulnerable to infection.

Companies that previously spearheaded the high-field MR revolution are now exploring lower-field strength technology. In many ways, analogous to the emergence of ultra-portable ultrasound systems, portable and distributed MRI systems will challenge our current thinking on MRI scan reimbursement, accreditation, utilization and appropriateness criteria, turf issues, and credentialing issues.

There will be ongoing questions about whether the studies should be acquired by non-MRI, sub-specialty technologists, and whether they will be interpreted by radiologists, as well as the potential for substantial over-utilization and the potential for a falsely negative study, resulting in a more comprehensive, higher field strength MRI scan not being performed. On the other hand, the potential for a major expansion of MRI into new hospitals and outpatient locations, and even onto emergency vehicles for point-of-care service, into new indications for cost-effective yet higher accuracy patient evaluation, and as a more sensitive indicator of disease than CT or ultrasound or conventional radiography is exciting.

Radiologists have demonstrated incredible creativity and innovation in the application of MRI to an extraordinary number of anatomic, vascular, functional, and interventional applications. Portable, ultra-low field MRI will undoubtedly add a whole new dimension to this potpourri of patient-care options, and will eventually bring MRI to that 90 percent of the world’s population that has been waiting for it to finally arrive.

The market bounced back in 2021, with government back in action after the drastic decline in 2020, attributed to the lower procurement by the private sector, almost no buying by the government hospitals in the pandemic, accompanied by the health cess introduced in the Union Budget 2020. For the first time, in 2021-22, CT as a modality overtook MRI; it will be interesting to see how the market has behaved in 2022-23.

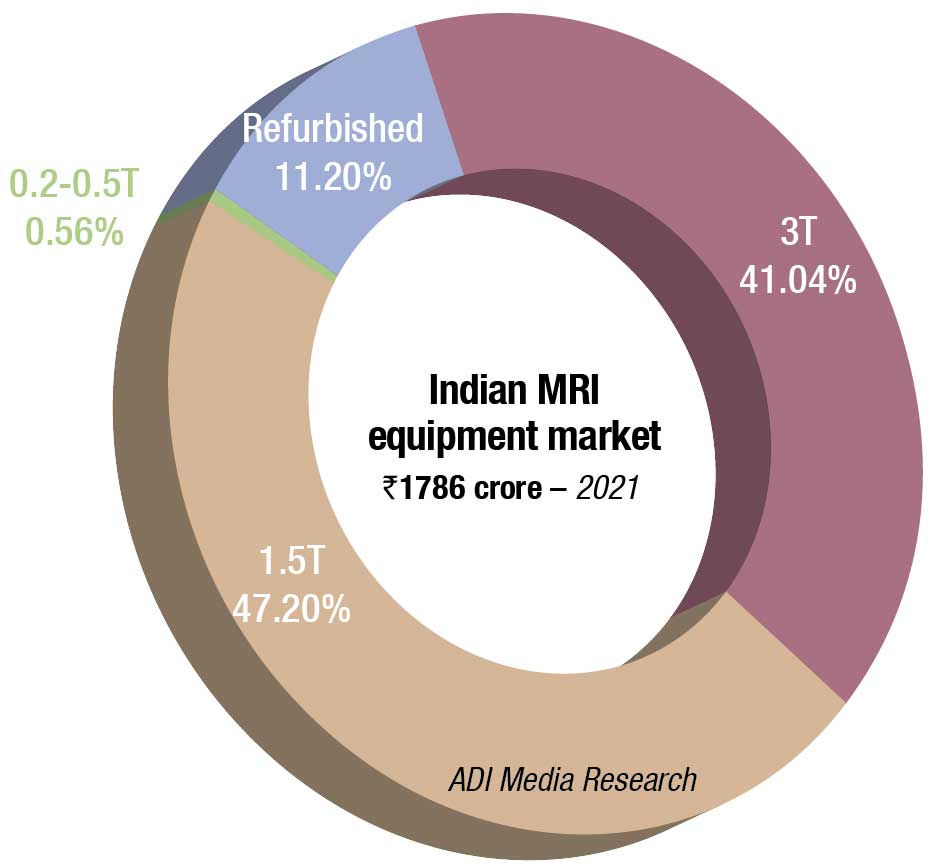

The Indian MRI equipment market for 2021 is estimated at ₹1786 crore, and 291 units, by quantity. It is projected to witness a CAGR of 9.34 percent to grow to ₹3320 crore by 2026. The two premium segments, 3T and 1.5T systems, dominate the market with a combined 88-percent share by value, and 80-percent share by numbers. Within these two segments, in 2021, 3T scanners have been the more popular machines, with a 52.5-percent share by value, while 1.5T contributes 47.2 percent. The refurbished systems continue to have an 11-percent share, by value. The 0.2T–0.5T machines are gradually losing out, only seven units were sold in 2021, with Hitachi being the preferred brand.

The estimated number of MRI scanners installed across India is around 2800, of which the majority are 1.5T systems. 3T scanners are more common in metros and Tier-I cities, and account for approximately 50–65 percent of the MRI market in those regions. Although 1.5T scanners still have the largest market share, the 3T systems are the ones contributing to the market growth. On an average, the annual market across government hospitals and medical colleges amounts to 40–60 MRI scanners, and is cyclical. Private hospitals and diagnostic imaging centers account for about 230 new MRI scanners in a year. The volume of low-field-strength systems is stagnant at present.

|

Major vendors* in Indian MRI |

||

| Tier I | Tier II | Others |

| Siemens, Philips and GE | United Imaging | Hitachi & Toshiba |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian MRI equipment market. | ||

| ADI Media Research | ||

The prohibitive cost of MR scanners limits their accessibility for the general population in our resource-poor environment. A 12–18 percent GST and 18 percent customs duty, amounting to 30 percent, is making it a challenge to invest in medical capital equipment. The central government might want to take a cue from the Gujarat state government that, barring in its large cities, offers a 20 percent cashback on medical equipment to the hospitals, encouraging the setting up of medical facilities in the smaller cities of Gujarat. Most of the MR scanners are concentrated in the metros and Tier-I cities. Penetration in rural areas is negligible. Also, the stringent requirements regarding power supply, a trained workforce, service, and maintenance are difficult to address at the peripheral level.

On the positive side, in the last decade, there have been many government initiatives to equip teaching hospitals across India with high-end MR scanners. Also, many new tertiary-care teaching hospitals are being set up across the length and breadth of the country, and are being equipped with state-of-the-art imaging equipment. Several state governments in the country are also providing novel and advanced MRI solutions to their customers. In July 2021, the Punjab Government announced the launch of a novel project, under which CT and MRI centers will come up in around 25 government hospitals. The government will build novel diagnostic and monitoring centers and purchase novel MRI systems. The government has also been promoting a Make in India campaign to bring down costs, and adapt MRI to local requirements. As a result, a number of promising lightweight MRI scanners are in an advanced stage of development here. The corporate sector has also set up hospitals in Tier-II and Tier-III cities, which will help to improve accessibility for the rural population.

Major limiting factors in MRI are the prohibitive cost, the need for trained personnel, and the complex infrastructure requirement for MR scanners. A cheaper lower-field-strength scanner that requires simpler infrastructure and can leverage recent advances – such as automated study planning, compressed sensing, innovative k-space filling strategies, remote support for troubleshooting, and deep-learning-aided image generation – would go a long way to making MR available to the Indian population. It would reduce both the capital and the operational expenditure required for things, such as helium top-ups, and could be used in areas where trained personnel is scarce.

By utilizing the currently available technologies, it is possible to achieve good-quality diagnostic images with lower-field-strength scanners without a significant time penalty. There is a distinct need for low-cost MR scanners, which can use optimum technology and provide good-quality images. In countries like India, where trained personnel may not be available in small cities, it would further help if such scanners allowed the remote execution of MR protocols. This would be a major step toward making MR imaging more accessible in resource-poor regions of the world.

As far as the usage pattern is concerned, the bulk of the work at most sites is craniospinal imaging, followed by musculoskeletal imaging. Use of MR imaging for the evaluation of abdominal and chest diseases is generally confined to large tertiary-care and academic centers. In metro cities, there are many centers of excellence engaged in high-end research, including advanced applications like whole-body imaging, MR elastography, diffusion-weighted imaging (including intravoxel incoherent motion and diffusion kurtosis imaging), perfusion imaging, and texture analysis. These techniques have been used in India not only for traditional oncology applications but also for diseases endemic in India, such as tuberculosis.

As the demand for better diagnosis and non-invasive procedures is growing, people look forward to innovations that can enable faster contrast scans, and simplify imaging workflow. An increase in investment is expected to propel the growth of the MRI market size. It is expected that the rapid development of intraoperative MRI and its use in neurosurgery and other such applications will propel the growth of the market.

Advances in diagnostic techniques, such as open MRI, visualization software, and superconducting magnets, are predicted to further fuel the MRI market in coming years. In addition, the production of cardiac pacemaker-compatible MRI systems is expected to propel the cardiology segment demand.