Industry

Navigating COVID-19 and beyond

The year 2020 has been both devastating and energizing for the medical device and diagnostics industry.

The COVID-19 pandemic’s impact first shut down and then curtailed routine medical, hospital, and surgical care around the world.

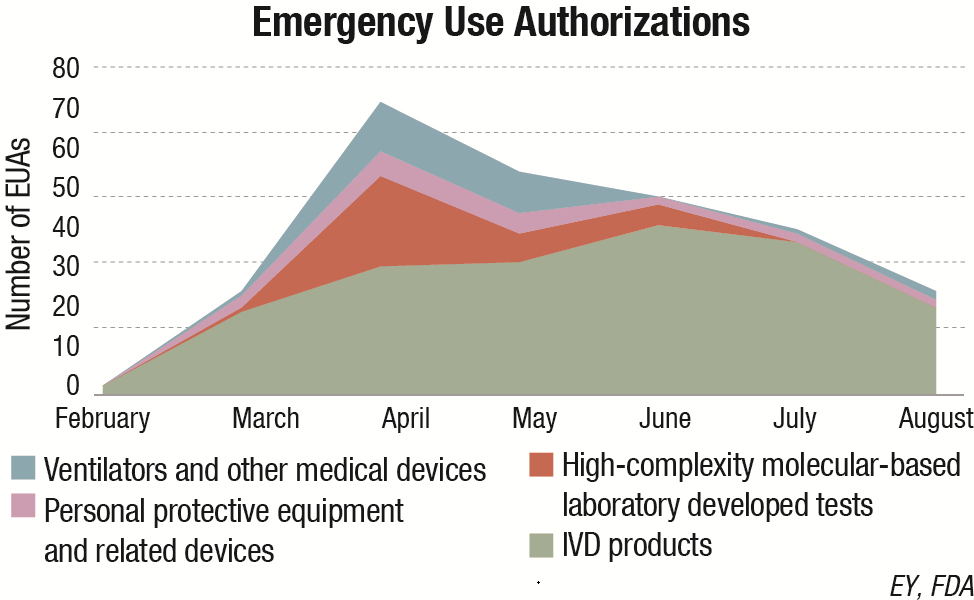

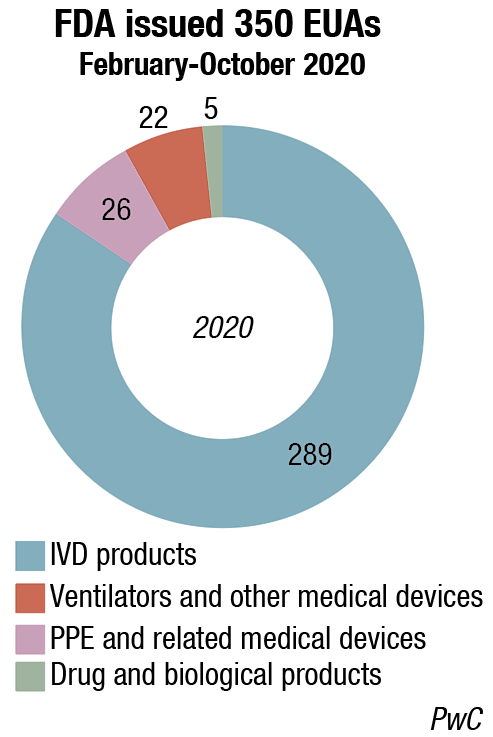

On the other hand, developers of IVD tests that diagnose the SARS-CoV-2 virus and manufacturers of infection control disposables, critical care, and respiratory products have seen their revenues skyrocket as the key players responded through quick launch of new testing kits for COVID-19. However, some were unable to keep up with demand. Furthermore, some in vitro diagnostics services were affected in a negative manner due to the lockdowns. The global in vitro diagnostics market was valued at USD 67 billion in 2019, and is expected to register a CAGR of 4.8 percent over the next five years. The overall impact on in vitro diagnostics market was low as the new demand for testing kits compensated for the losses due to fall in demand of other services and product.

The result has been a roller coaster but mostly disappointing year for the industry, although medical device and diagnostics companies can take comfort in the knowledge that they have not faced these hardships by themselves and, as an industry, have actually responded to the pandemic with great competence, ingenuity and care for their employees, patients, clinicians and stockholders.

Those betting on a large number of global tenders for many of their products found that the tenders delayed. Manufacturing operations and supply chains were also hit with infection rate on campus often climbing, making it necessary to shut down for a short while.

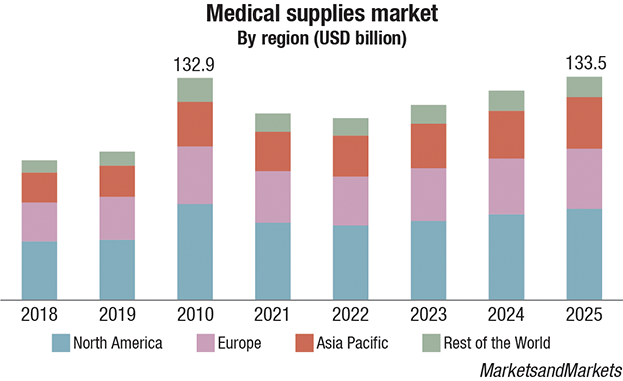

The impact on the global medical supplies market is expected to reach USD 100 billion by 2021 from an estimated value of USD 78 billion in 2019, growing at a CAGR of 13.4 percent. The market for medical supplies is driven primarily by the growing awareness on environmental and personal hygiene leading to rising demand for disinfectants, expansion of healthcare settings owing to increasing COVID-19 patients, increased requirement of PPE kits and N95 masks globally, rising demand for ventilators, and increasing demand for diagnostic supplies. In addition, repurposing liquor production lines to manufacture sanitizers offers an opportunity for players in this market. However, delays in non-urgent treatment and surgical procedures and impact on supply chain and logistics due to lockdown restrain the growth of this market.

The global COVID-19 diagnostics market size is estimated at USD 84.4 billion in 2020 and is expected to expand at a CAGR of 3.1 percent from 2021 to 2027. Increased traction gained by mobile testing market space is expected to open new avenues for market expansion. Transitioning focus of new entrants toward at-home testing and integration of advanced software has been witnessed in the past few months. Despite the gradual decline expected in the number of positive patients in 2021, integration of COVID-19 tests in routine diagnostic protocols is expected to maintain the market growth.

Moreover, these testing programs are set to pave way for the travel industry, that have been most affected during this pandemic outbreak, to gear up, creating a favorable environment for the entities operating in the market.

Complex and pure reagents, such as probes, enzymes, and primers, are crucial in conducting tests in clinical laboratories. A number of factors like a sudden increase in demand, export bans, and stockpiling have led to the shortage of these reagents. Additionally, these reagents are manufactured by limited companies, therefore leading to a shortage of supply due to insufficient production capacity. The inadequate demand-to-supply ratio of reagents worldwide is anticipated to negatively impact the overall diagnosis rate and hinder the market growth.

The services segment is estimated to dominate the market with a revenue share of 48.34 percent in 2020. Service providers are boosting their testing capabilities by expanding technological footprints in existing labs and diagnostic centers as well as by launching new, high-capacity laboratories, which has contributed to the segment growth. Collaborations between governments, test developers, public health organizations, and private laboratories accelerate the expansion of testing capacities.

The reagents and kits segment is expected to register the fastest CAGR of 3.8 percent from 2021 to 2027. The accelerated approval process is a major factor contributing to the significant growth of this segment. In response to the pandemic, companies are implementing various strategic initiatives, such as new product development and collaborations. For instance, in September 2020, Veredus Laboratories Pte Ltd. launched an extraction-free RT-PCR suite that includes VereRT COVID-19 PCR kit for direct use either from a swab or human saliva.

The nasopharyngeal swabs segment is estimated to account for the largest revenue share of 43.88 percent in 2020. Nasopharyngeal swabs have been observed to exhibit a significantly higher SARS-CoV-2 sensitivity, detection rate, and viral load than other swab types. In addition, the majority of molecular diagnostic tests utilized for the detection of infection use nasopharyngeal swabs specimen.

The blood sample type segment is estimated to register the highest growth rate of 3.6 percent from 2021 to 2027. This is attributed to the steep elevation in the introduction of blood-based serology tests/antibody detection tests for the detection of SARS-CoV-2 infection. The major advantage of serology tests is their ability to detect asymptomatic symptoms of SARS-CoV-2 infection. Owing to this benefit, the demand for blood-based antibody detection testing has increased significantly in the market.

Oropharyngeal swab samples are observed to be less sensitive than nasopharyngeal samples; however, using multiple types of samples help attain maximum sensitivity during infection screening. This has accelerated the use of OP swabs for COVID-19 diagnosis. The use of an OP swab sample alongside a nasopharyngeal swab increases the detection of viral illnesses in clinical settings or enables a thorough study of the etiology of lower respiratory tract infection.

Molecular (PCR) testing is projected to dominate the market in 2020 with a revenue share of over 60.0 . Currently, the PCR technique is considered to be the most accurate for the detection of COVID-19, thereby leading to a tremendous increase in the adoption of PCR testing kits. Owing to the advantages of the PCR technique in detection, laboratories, hospitals, diagnostic centers and clinics, and research institutes are preferring this technique over others.

As the number of COVID-19 cases is rapidly increasing across the globe, many companies have started developing PCR-based diagnostic tests for efficient diagnosis. As of May 2020, more than 100 PCR-based diagnostic tests were either approved or in the development phase for clinical use. Such a high number indicates the dominance of this technology in the market, resulting in a large revenue share of this segment throughout the forecast period.

The antigen-based testing is expected to expand at the highest CAGR of 5.1 percent from 2021 to 2027. Antigen- and antibody-based tests are observed to be considerably more stable than RNA samples, which makes them less hazard-vulnerable during storage and transportation, thus minimizing the chances of false-negative results. Moreover, antigens and antibodies are more uniformly available in sputum and blood samples, thus improving testing accuracy. However, the most significant advantage of immunoassays is their capability in the detection of past infections.

The non-POC (centralized) testing segment is expected to dominate the market in 2020 with over 60 percent share. Currently, most of the COVID-19 tests are carried out in the laboratory environment, thus centralized or laboratory testing is currently the key testing mode in the market. Incorporation of automated high throughput systems facilitates efficient processing of a high number of samples at a given point of time without hampering the quality and integrity of the result. These factors are making centralized testing a critical element in a viable COVID-19-response strategy to circumvent the spread.

As a result, hospitals have centralized their lab operations into one core facility, rather than sending specimens to multiple places. Several companies are launching products suitable for lab-based COVID-testing.

The laboratories segment is estimated to account for the largest revenue share of 39.91 percent in 2020. The increasing numbers of laboratories are leveraging high-throughput technologies to process COVID-19 tests rapidly and effectively on a large scale. This is driven by the effective implementation of favorable reimbursement policies in developed economies.

The diagnostic centers and clinics segment is expected to expand at the fastest growth rate of 4 percent from 2021 to 2027. This is encouraging many individuals to opt for diagnostics centers over hospitals for COVID-19 testing, which is a major factor contributing to revenue generation for this segment. Thus, the need to eliminate the risk of acquiring COVID-19 in hospitals is boosting the growth of the diagnostic centers and clinics segment.

In 2020, the consumables segment constituted over 74 percent of the global COVID-19 diagnostics market share. The demand for consumables, including biomarkers and reagents, including substrates, enzymes, electrolytes, specific proteins, lipids, and point-of-care test kits, is growing as they obtain quick and accurate results for diagnosing diseases, including COVID-19. The need to perform rapid testing to detect coronavirus spread across the world is driving the demand for consumables. The COVID-19 detection kits market size is projected to surpass USD 8.5 billion through 2026, growing at a CAGR of 17.3 percent for the period spanning from 2020 to 2026.

New forces at play

The high demand for in vitro diagnostics could seed structural shifts that will have long-term implications for diagnostic-test manufacturers, says a McKinsey study.

With high technological and regulatory barriers to entry, in vitro diagnostics has been a relatively high-margin industry, with molecular diagnostics being one of its fastest-growing segments. In 2019, before the COVID-19 crisis, it was estimated that the North American molecular-diagnostic market would grow an average of 6.6 percent a year over the next five years. As COVID-19 spread, the demand for molecular testing, regarded as the gold standard for diagnosing infectious disease exploded. In United States alone, molecular-diagnostic demand rose 20-fold between March and October 2020. While the disease remains uncontained, such demand is likely to keep growing. Meanwhile, the rush to meet it has already driven four main developments in the IVD industry.

Broader adoption of diagnostics based on RT-PCR. Molecular assays, particularly those involving reverse- polymerase chain reaction (RT-PCR), are regarded as the optimal confirmatory tests for viral infections. However, in certain regions of the world, immunoassays have dominated because of a shortage of laboratory capacity for molecular assays.

In India, for example, only one laboratory was performing molecular assays for COVID-19 in January 2020. The COVID-19 pandemic has shifted that balance. By May, some 600 Indian RT-PCR laboratories had been set up in an effort to help manage the pandemic, increasing testing capacity 1000-fold. The additional capacity will likely remain in place as the pandemic subsides, leaving the RT-PCR assay as the dominant method for diagnosing most viral infections in India in the future. Similar developments are afoot elsewhere, suggesting a much broader adoption of RT-PCR globally as testing capacity and the installed-equipment base expand.

More point-of-care molecular testing. The volume of point-of-care (POC) testing has risen during the COVID-19 pandemic in response to demand for faster on-site screening. The Rockefeller Foundation estimated that around 70 million POC tests a month were conducted in the United States by October 2020, with the number increasing to as many as 200 million a month by January. Such tests can be conducted in physicians’ offices or outside of traditional healthcare settings. Drive-through centers were set up in Massachusetts, in the United States, for example, giving on-the-spot results. Laboratory-based RT-PCR tests typically take at least 24 hours to show results once the samples reach the laboratory. Point-of-care (PoC) COVID-19 tests are expected to gain immense traction in the near future, thus estimated to expand at the highest CAGR of 3.9 percent from 2021 to 2027. The development of point-of-care technology for the detection of COVID-19 infection is aimed at reducing the assay duration and scaling up the testing capacity to prevent further transmission of the disease, which has led to the segment’s highest growth rate.

Accelerated development and adoption of new technologies. As the COVID-19 pandemic gathered force, demand grew for not only faster testing but also testing in much higher volumes. That demand was a struggle to meet when it came to RT-PCR testing, as a result of laboratories’ turnaround times and a shortage of reagents.

The response to that struggle has been the accelerated development of new diagnostic technologies, such as next-generation sequencing (NGS) and CRISPR. Those technologies could come to challenge the leading position of the current RT-PCR systems for viral COVID-19 tests, particularly if regulators further facilitate their fast introduction. As of November 2020, the US Food and Drug Administration had granted emergency approval for two CRISPR-based diagnostic tests for COVID-19 from early-stage companies Sherlock Biosciences and Mammoth Biosciences. Approval of the former company’s test represented the first time a CRISPR- based product had been authorized for use in healthcare.

NGS has benefited from similar regulatory support. After decades of development in precision medicine, NGS could potentially become a platform for large- scale diagnostics, meaning that it would be suitable for testing entire communities or for conducting epidemiology studies. Authorities in China and the United States have already approved some NGS- based COVID-19 diagnostics for emergency use. Others are in development, with throughput as high as 100,000 samples per run. The companies pioneering such diagnostic techniques could well remain in the market in the future thanks to their technological expertise, manufacturing capabilities, and market acceptance established during the pandemic.

Manufacturing-capacity expansion in Asia and shift of supply. As demand for components used in molecular assays has soared, leading manufacturers, particularly those in China, have hurried to increase capacity for them. As a result, China now accounts for between 70 and 90 percent of global capacity for major molecular-assay components. That could eventually make China the leading global supplier for the diagnostics, too.

To be clear, China’s capacity for manufacturing molecular assays was growing rapidly, in line with demand, before the COVID-19 pandemic. Between 2014 and 2019, its domestic market for the tests grew an average of 16 percent a year to reach USD 1.5 billion, with manufacturers large and small producing a wide range of related products, including equipment and reagents. For example, the number of nucleic-acid-isolation manufacturers expanded tenfold (from around 30 to 330) in that six-year period. When the pandemic broke out in Wuhan, Chinese manufacturers expanded their capacity still further, quickly responding to the government’s efforts to control the outbreak. The molecular-assay manufacturers received extensive financial, operational, and regulatory support from the Chinese authorities.

That expansion has allowed some Chinese companies to gain bigger footholds in major markets, such as the European Union and the United States—markets that have experienced a shortage of tests and testing components and that were previously dominated by Western companies. For example, Chinese company BGI, a major player in the IVD industry, has not only exported millions of tests but also supplied equipment and the operating model for more than 70 diagnostics laboratories globally, including in Europe and the United States. By November 2020, that amounted to a total estimated capacity of about 430,000 tests per day.

In such a way, BGI and other Chinese companies have been able to build partnerships and alliances with new customers in new markets—facilitated, in some instances, by accelerated regulatory-approval processes. Regulations may well be tightened again once the pandemic abates. However, the new laboratory capacity, as well as the new customer relationships for players like BGI, will likely endure.

Positioning for the future. Diagnostic-test manufacturers are playing a critical role in government efforts to respond to the COVID-19 pandemic. Yet their work to increase the IVD supply is also initiating changes in the industry that could lead not only to greater adoption but also to greater competition. Much more than the course of the pandemic is uncertain.

Mergers and acquisitions

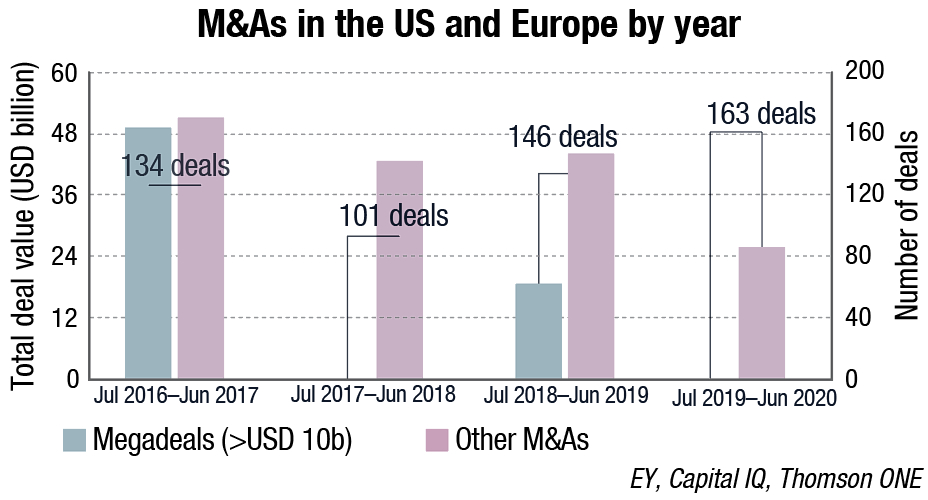

The COVID-19 pandemic also challenged life sciences mergers and acquisitions (M&As). Ernst & Young in its recently conducted research concluded that although no-one expected a repeat of 2019’s high level of M&A activity – with an annual deal total of USD 306 billion and four mega-deals – 2020 was a year like no other. The challenges of doing due diligence and closing deals virtually, as well as high valuations creating a seller’s market, created major barriers to deals.

The value of M&A activity across the life sciences industry in 2020 totalled USD 159 billion and there was only one mega-deal: AstraZeneca’s USD 39 billion December acquisition of Alexion. Despite a broadly unfavourable deal-making environment, life sciences companies were able to continue signing deals, even if they were of lower value than in 2019.

The volume of biopharma deals signed in 2020 was similar to the 2017, 2018 and 2019 figures. This was because the pharma industry pivoted from signing large M&As to focus on smaller collaborations and bolt-on deals in priority therapeutic areas. Bolt-on deals are small to medium-size acquisitions that represent around 25 percent of the buyer’s market capitalisation in a certain area. In terms of bolt-ons, EY’s analysis suggests that this type of deal accounted for 82 percent of biopharma M&A in 2020, while the mega-deal accounted for 2 percent.

In terms of alliances, biopharmas spent USD 17.8 billion on these types of deals, which were used to hedge risk and add new capabilities to their portfolio. The trend toward alliances has been building since 2013, and reached an all-time high in 2020. Through to the end of November, there were 261 partnerships worth up to USD 140 billion in upfront and milestone payments. One of the most important alliances signed in 2020 was Pfizer’s expansion of a 2018 partnership with BioNTech to develop the world’s first Covid-19 vaccine authorised for emergency use.

Deal-making activity is likely to pick up once vaccines become increasingly available and there is a return to some form of normality.

The road ahead

The year 2020 has been a year unlike any other year in our history. It has impacted the fabric of our society and life – but most importantly it has changed the healthcare industry forever.

Frost and Sullivan expects global healthcare to define new ways of rethinking business and growth opportunities in 2021, that will help determine the future direction of the industry. From vaccines to virtual care, enterprise imaging to precision medicine, these are the growth areas that will shape the direction of healthcare, this year and beyond, says Reenita Das, partner and senior vice president for transformational health, Frost & Sullivan. Along with Chandni Mathur, senior industry analyst, Frost & Sullivan, her expectations for 2021 are:

By the end of 2021, about 4 billion COVID-19 vaccine doses will be delivered globally. These will be prioritized to immunize three target groups: the healthcare workforce, consisting of service providers, management & support workers in hospitals and social care; adults above 65; and about 45 percent of adults with comorbidities

More than 50 percent of the expected production capacities of the vaccine candidates, which are in Phase III and are getting emergency approval, have been pre-booked by developed economies, such as the U.S., the E.U., Japan, Canada, and the U.K

Developing low- and middle-income countries are relying primarily on COVAX, the vaccines pillar of the Access to COVID-19 Tools Accelerator, which is co-led by the Coalition for Epidemic Preparedness Innovations, GAVI, the Vaccine Alliance, and the World Health Organization. These organizations aim to deliver two billion doses by the end of 2021 equitably among all the 172 participating countries, which would result in around 25 percent of the global population getting vaccinated.

Pharmaceutical companies will be collaborating extensively for manufacturing, supply chain requirements, post-surveillance studies, and storage. Digital enterprise vaccination management platforms will have to be built to inform the public, schedule vaccinations, automate mobile facilities, monitor outcomes and manage the supply chain for COVID-19 vaccines.

More than one in three patient interactions will go virtual globally – since the physician will no longer be the automatic first touchpoint. The pandemic has reinforced the power of digital platforms in communicating and guiding healthcare. Throughout the crisis, virtual visits, remote monitoring and patient-engagement tools have effectively reduced foot traffic at clinics and delivered a large portion of office visits virtually. Nearly 35 percent of patient interactions will be digital in 2021, compared to 20 percent currently as delivery paradigms change.

Up to 75 percent of hospitals’ capital equipment budgets will be diverted to other immediate needs, with flexible pricing models becoming the norm. Hospitals faced significant losses in 2020 due to COVID-19 since elective procedures were put on hold and outpatient department visits reduced dramatically. In 2021, as a continued trend from 2020, hospitals are expected to dedicate large portions of capital budgets toward digital transformation efforts – for virtual care, remote patient monitoring, analytics and other health IT capabilities.

Hence, the already reduced capital budgets due to lower revenues in 2020 will see an even smaller share dedicated to capital equipment procurement in 2021. In order to get new business, MedTech OEMs will be seen rolling out flexible pricing options and risk sharing models. As hospital CFOs are looking for ROIs in two-to-three years, instead of five-to-seven years, outreach messages will need to be customized.

The enterprise imaging IT space will drive up to USD 2 billion in investments toward imaging workflow efficiency, interoperability and analytics. Much like hospitals, imaging centers also suffered significant losses in 2020. Budgets will be focused on imaging-IT infrastructure upgrades and teleradiology to manage workflow optimization and reduction of unnecessary examinations.

Consolidation of traditional IT infrastructure picture archiving and communication systems and vendor neutral archives is expected to improve the efficiency and quality of outcomes without wasting resources. OEMs will be seen deploying subscription-based models instead of up-front purchases.

Molecular screening platforms, multi-gene panel tests, and NGS tests will re-imagine large population cancer treatment pathways – representing an opportunity of some USD 1.7 billion by the end of 2021. More than 1.2 million mutations in 350 genes in a human body causing cancer make every cancer case a unique one. In addition to benefiting from less invasive testing, simultaneous mapping of multiple biomarkers of genomic alterations, rather than one biomarker at a time, is expected to increase access to multi-gene panel and next-generation sequencing tests (comprehensive genomic profiling/testing).

By unlocking the potential of multi-gene panels and NGS tests, the in vitro diagnostic industry is accelerating efforts to transform cancer care by enabling precision oncology at all stages of the disease, regardless of specimen type.

As more guidelines get published in the future and possible label expansions are incorporated, real-word evidence and regulatory imperatives will drive the need to deliver the promise of precise therapies to patients and accelerate the adoption of these tests.

2020 witnessed the shift toward mapping multiple biomarkers of genomic alterations, thereby decreasing wait times for initiating treatment, and providing insight into possible resistance mechanisms. By 2021, 5 percent of the new cancer cases are estimated to adopt multi-gene panels and NGS treatment pathways for the most common cancer types, i.e. lung, colorectal and prostate cancer. As the market evolves, early cancer detection pathways will become mainstream, and synergistic CDx (companion diagnostic) tests will foster this new standard in cancer care.

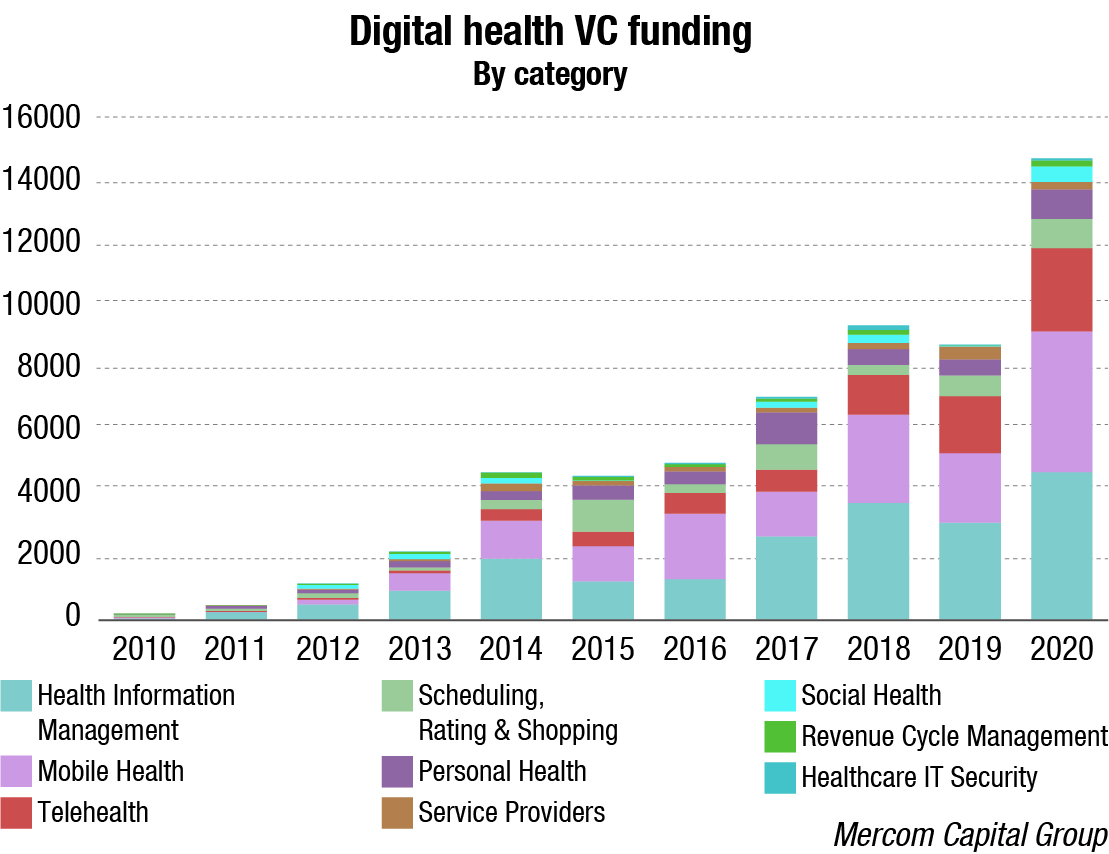

The global telehealth market will reach nearly USD 50 billion in 2021, and be embedded in virtual care. The pandemic has been a massive jolt to the healthcare industry and telehealth stood out as the silver lining. The second quarter of 2020 saw a surge in virtual consultations via telephone and video calls as lockdowns remained in different parts of the world. Remote monitoring tools and mobile health apps and services took center stage.

More than one in four interventional medical equipment-application support-specialist interactions with hospital surgical teams will happen remotely. Hybrid models of interaction (in-person and remote) will become more common. Several hospitals are limiting the presence of sales personnel in hospitals due to COVID-19, the majority of physicians believe these restrictions will continue.

MedTech OEMs will benefit from agile commercial models. Sales costs will be reduced dramatically with lower costs for travel. Best practices can be disseminated relatively more easily across the network with video training feeds to help improve patient outcomes and therefore brand value.

Behavioral health will drive 3X increased growth in the digital therapeutics market from 2021 to 2023. The impact of COVID-19 will have a profound influence on the behavioral health of citizens around the world. The collective mental anguish, the loss of cherished family members, personal economic disasters, and the pressure to social distance have already increased the incidences f deep depression, anxiety, PTSD and substance abuse.

The response to this trend will drive increased growth in the Digital Therapeutics market in developed regions. Further, the mental tele-health and digital therapeutics market participants will begin to merge into a new hybrid market. This development will also drive growth in virtual care.

Up to 50 new deals are expected to lead to USD 2 billion spent on imaging solutions via enterprise-customer partnership models. Reforms in national health policies and budget constraints will increase the appeal and appetite towards OpEx business models. Rapid technology turnover will necessitate an allocation of 20-30 percent of imaging department budgets on next-gen intelligent imaging equipment over the 8-15 year horizon.

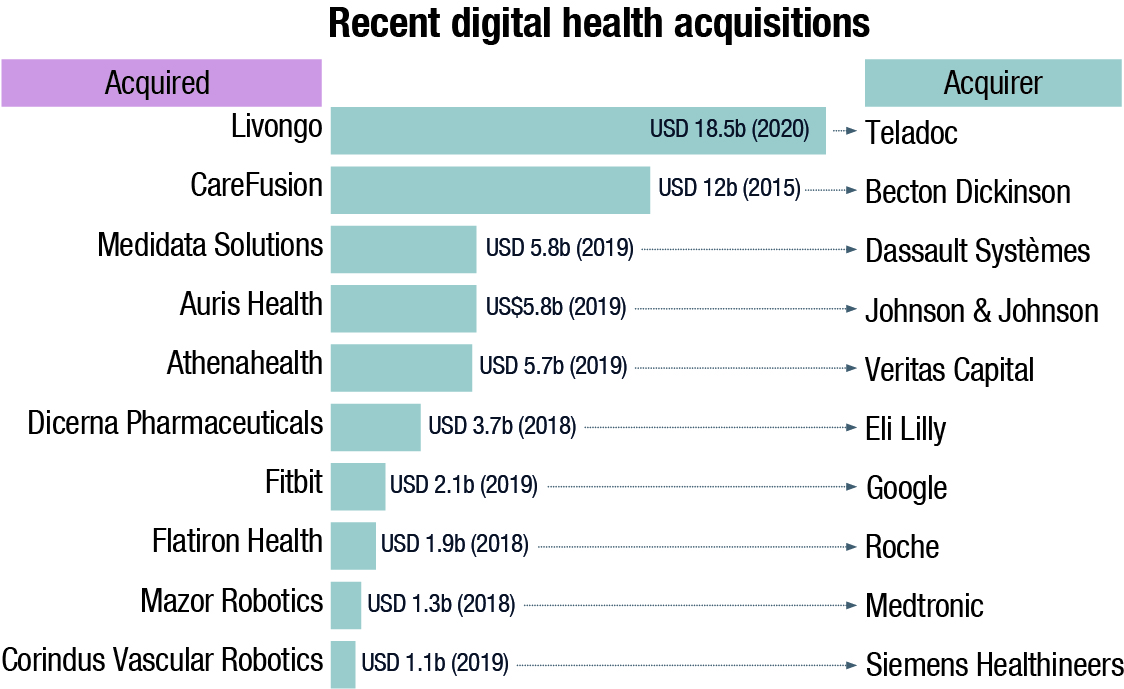

It is clear that the pandemic has accelerated the adoption of digital health and virtual care around the globe, and this will be seen through this decade. Healthcare providers will be seen embracing technology as never seen before. Healthcare delivery is no longer restricted to the four walls of hospitals.

Virtual care will take steam and an immediate opportunity for growth aided by the integration of wearables and acquisitions by telehealth leaders to offer platforms and end-to-end solutions targeted for care at home and also high-acuity settings. Interoperability will be table stakes, because secure and efficient data exchanges are essential building blocks of the digital future of healthcare.

The end goal is to move closer to the quadruple aim of healthcare … but digitally.

Some obvious trends that will gain traction are:

IoMT (Internet of Medical Things) to modernize healthcare. Significant innovations in new technologies such as smart sensors, smart devices, and other lightweight communication devices are driving medical devices that generate data into care pathways, creating alliances with IoMT systems. These advancements that help aid in the monitoring of biomedical signals and the diagnoses of diseases without human intervention are aiding healthcare organizations to improve patient outcomes, lower costs, and improve efficiency. The role of MedTech is now even more important, serving as a value-based partner rather than just a developer and supplier of devices. The IoMT market is expected to grow USD 285.5 billion by 2029, which is a compound CAGR of 28 percent.

Remote patient monitoring. In the wake of the pandemic, remote patient monitoring tools saw a steady spike in demand on higher consumer adoption of digital healthcare options. It is a form of AI-powered technology, which can be utilized to assimilate patient data outside the traditional healthcare settings as well as monitor the patient health status cautiously. This was necessitated by the urgency to curtail the need for clinic and hospital visits, thereby minimizing the exposure to the deadly virus. The global remote patient monitoring market is projected to reach USD 117.1 billion by 2025 from USD 23.2 billion in 2020, seeing a CAGR of 38.2 percent between 2020 and 2025, predicts MarketsandMarkets.

Biotech stocks are poised for triple-digit profit potential. The biotech sector is projected to surge beyond USD 775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Health IT adoption skyrocketed. As hospitals, health systems and patients increasingly relied on digital health technologies for care delivery during the pandemic, the stage has been set for continued growth and innovation in 2021.

Organizations will continue accelerated digital transformation next year, and the CIO’s role will evolve to look more like that of a COO’s, overseeing the organization’s strategy and risk management. IT teams also are evolving to include more people with clinical backgrounds, data scientists, and senior security professionals.

A new age of cybersecurity. Hackers stepped up their efforts to attack healthcare providers in 2020 to go beyond phishing attacks and stealing information to sell on the dark web. Ransomware attacks, especially during the second half of the year, shut down IT systems and slowed operations at hospitals and healthcare facilities. IT teams will need to effectively communicate good cyber hygiene to staff members to prevent attacks and troubleshoot vulnerabilities as more work goes permanently remote and more health systems will be investing in cybersecurity technology and talent as a top priority.

EHRs evolving with new capabilities. As digital voice assistants like Amazon Alexa and Google Home have secured a place in consumers› living rooms, hospitals and health systems are inviting similar technologies into patient rooms. With tech developments increasingly focused on natural language processing and ambient listening capabilities, EHR are inking deals to integrate virtual assistants in their software this year.

Blossoming of Artificial Intelligence and machine learning in healthcare. AI is not new in healthcare. Organizations have used artificial intelligence and machine learning in hospital administration and operations for years, specifically in the revenue cycle process. Before the pandemic, researchers began testing AI models to read medical images, yielding mixed results and leaving some wondering whether AI and machine learning would live up to the hype.

But in the last year AI became crucial in developing predictive models for COVID-19 cases spreading across the country. Academic institutions and health systems have developed predictive tools and models to track the virus and estimate the risk of COVID-19 patients developing severe symptoms. The field will continue to evolve and become more integrated with clinical care in the coming years.

A combination of wearables and other biomedical devices, combined with machine learning and artificial intelligence will continue to transform clinical research, treatment protocols and increase the virtual care capabilities of health providers. This will challenge traditional healthcare organizations to compete with emerging retail and virtual providers in ways we have not experienced before. It will also enable healthcare delivery science and bring data scientists to the forefront of improving patient care outcomes.

Big data management becomes a need. The digital transformation among health systems was well underway when 2020 began, and the pandemic underscored the need for centralized and efficient data management. Data-gathering and reporting efforts sped up during the pandemic, and even small organizations are eyeing cloud implementations to securely store and coordinate data. Microsoft, Amazon, and Google all have healthcare-specific clouds.

For academic medical centers, the stakes are higher, as secure research becomes a larger priority. Investment in cloud-based research platforms around high performance computing, Artificial Intelligence and the machine learning toolkits and integrating them back into the EHR is key.

Predictive analytics moves to the forefront. The accelerated digital transformation in 2020 means more health systems now have the technical capabilities to practice precision medicine and inch closer to predictive analytics.

Digital front door and the digitization of the consumer experience. The pandemic ushered in a newfound era of social distancing, which has forced healthcare organizations to ramp up their digital presence and capabilities to stay connected to patients. With the digital front door, serving as the first impression potential patients have of a health system, online experience has become a critical component of their overall reputation.

Clinical IT advancements. Augmented reality, wearable technologies, and IoT devices in clinical care are steadily advancing within the hospital›s four walls. With COVID-19 limiting direct contact, health systems have turned to robotics for tasks from facilitating video chat communications for patients to virtual reality headsets that display a clinician›s first-person point of view from inside patient rooms remotely to the rest of the care team.

Robotic surgery developments are expected to continue across the healthcare system, in areas including spine, cardiology, and oncology. By 2025, the global medical robots market is expected to reach USD 12.7 billion, up from about USD 5.9 billion in 2020.

MedTech’s recovery will have to wait for H12021

Technological advances are revolutionizing the medical device industry, not only increasing the number of connected medical devices available to market but strengthening their role in healthcare.

Wall Street expects declines in elective care to continue as coronavirus cases keep rising. However, a more widespread rollout of vaccines could spur a recovery later in the year. The challenges for the MedTech industry will not be easily escaped.

For the first half of 2021, the MedTech industry will have to manage another likely decline in elective care and lower general hospital admissions due to the ongoing rise of COVID-19 cases, with the risk of another surge after the holidays, J.P. Morgan analysts wrote in a report.

The recent climb in cases will certainly impact the first half of 2021, however, the second half of the year could provide some relief. MedTech should see organic revenue growth of 10.1 percent and earnings growth of about 24.8 percent next year, compared to declines of minus 0.5 percent and minus 12.7 percent expected in 2020, respectively, according to the report. The global medical devices market in 2020 was valued at USD 456.9 billion, which is an increase at a CAGR of 4.4 percent since 2015.

“While we won’t get back all the revenues lost in 2020 … we remain bullish on this reacceleration as underlying market fundamentals remain healthy and focused innovation into high-growth markets has continued through the pandemic,” the analysts wrote.

One of the lessons learned from 2020 is how exposed the MedTech industry is to the pandemic, particularly its reliance on elective procedures and emergency care, analysts noted. While some return to normalized volumes is expected throughout the first half of 2021, the analysts “don’t expect a meaningful bolus of catch-up volumes.”

The industry will also be hit by a decline in emergency care that cannot be easily recovered and hesitancy from patients to return to hospitals. Some procedures, however, are expected to return more quickly than others, such as orthopaedics, spine and neuromodulation.

SVB Leerink analysts outlined a similar near-term environment for the industry — vaccine availability will likely help elective volumes, but procedure comebacks are not expected until the second half of 2021 and even 2022. Even with recovery delayed to the back half of next year, the SVB Leerink analysts believe that MedTech’s fundamentals are relatively stable and 2021 sales for large-cap companies should beat 2019 levels. The analysts added that while 2020 brought a lot of pressure for the industry, new trends like the boom in telehealth could benefit “all MedTech subsectors.”

William Blair analysts also pointed to telehealth as a positive for the industry going forward while the traditional procedure decline continues. “We believe this could shift industry focus beyond just medical devices, but also to those with digital offerings that can improve both outcomes and efficiency (think artificial-intelligence-driven decisions),” the analysts wrote. “This dynamic could extend competitive advantages for medical device companies that have already invested meaningfully in these solutions.”

Increase in Indian government spend sought

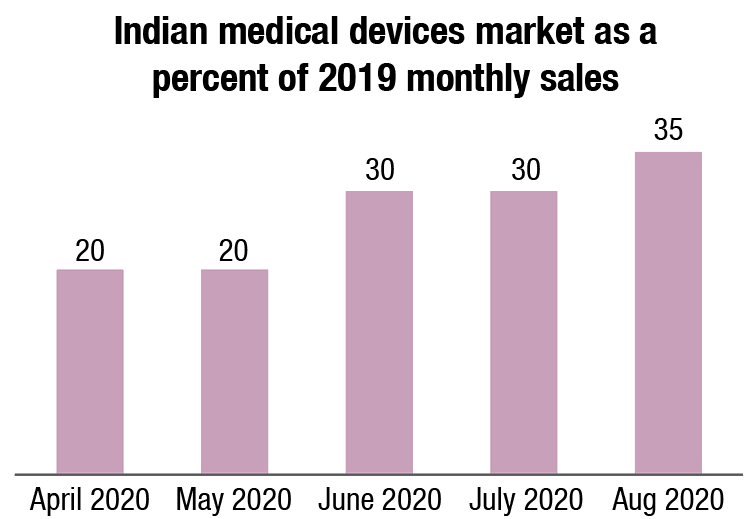

India’s healthcare industry is estimated to reach USD 193.83 billion in 2020 from USD 233.14 billion in 2019. Though this industry registered double-digit growth during 2015-2019, revenue is expected to witness a downturn once data of Q2 and Q3 of the calendar year 2020 is collated, due to international travel restrictions and nationwide lockdown restricting business from direct walk-ins, elective cases, and B2B channels. With an estimated downturn of 30-50 percent year over year (YoY) from 2020-2021, the healthcare delivery industry is expected to make a V shaped recovery with business as usual from 2022, predicts Frost and Sullivan.

The COVID-19 pandemic has raised concerns over the health infrastructure of the country and the government’s investments towards strengthening the sector. The government has time and again been urged at various industry forums to increase its investment in health to at least 2.5-3 percent of GDP by the year 2025 to ensure affordable healthcare for all.

Experts also believe that for the long-term, the government must increase the investment for R&D, equipment, and medical infrastructure to support scientific advancements, for developing a stronger healthcare system. The health insurance schemes also must be taken seriously by the government and come under five percent GST tax slab ambit from the current 18 percent, to make it more affordable for individuals.

The stakeholders including the government, MedTech players, hospitals, diagnostic centres, and the payers will need to collaborate with each other, be it on the regulatory, pricing, financing, innovations or any other fronts, and tread this challenging road to recovery.