HPLC Systems

New HPLC techtniques push the limits of chromatography

Thanks to modern LC solutions, forward-thinking laboratories are streamlining the movement of both analysts and samples to achieve substantial gains in capacity and efficiency.

Chromatography may have been around for decades, but by no means has the technique and its applications stopped evolving. The method will continue to be adapted to meet novel challenging applications in 2022. High-performance liquid chromatography (HPLC) has witnessed technological advancements in every aspect since its inception, including detector refinements, advancements in column and pump technology, accuracy, and automation. These advancements have assisted in conducting high-quality analysis that provide more accurate results in less time while enhancing the overall convenience for the users.

Pharmaceutical firms are shifting their attention toward innovative biologic therapies as the business evolves. Advances in columns, stationary phases, detectors, injection devices, and chromatography methods have resulted in an unprecedented variety of applications, notably in the pharmaceutical and biopharmaceutical industries. This has boosted the use of ultra-high-performance liquid chromatography (UHPLC) in bioprocessing applications, especially for monoclonal antibody characterization, antibody-drug conjugates, quality control, and analytical technologies. These systems were created to meet the demands of drug development processes, which can be time-consuming and involve substantial data collecting, organization, analysis, precise findings, and quick separation.

Recent years have also seen the development of HPLC instruments that can monitor operational readiness through routine and automated system health checks. As a result, the early tell-tale signs of poor performance can be flagged in good time, ensuring any potential issues are resolved early, and significantly reducing unscheduled downtime or the need to re-run samples. Some of the most advanced LC instruments also incorporate intuitive diagnostic tools to quickly identify and troubleshoot issues. These systems can even display step-by-step maintenance videos on intuitive touch-screen displays, helping analysts quickly remedy issues and get workflows back online and running again faster.

As scientists’ analytical demands for working with challenging analytes in complex sample matrices evolve, advanced instrumentation and innovations will play an increasingly important role in meeting those needs and ensuring scientists can conduct their work without being hampered by their instrument capability and capacity.

With wide range of applications of HPLC tests and techniques, the global HPLC market is projected to reach USD 5.7 billion by 2025 from USD 4.5 billion in 2020, at a CAGR of 4.6 percent. The chromatography consumables market is expected to grow at a CAGR of 6 percent from 2020 to 2027 to reach USD 3.64 billion by 2027. Adoption of HPLC will continue to grow, owing to their higher accuracy and sensitivity in contrast to conventional chromatographic techniques. Collectively, diagnostic laboratories and pharmaceutical and biotechnology remain key end-users of HPLC. Demand from these two channels is likely to grow at 6 percent through 2030.

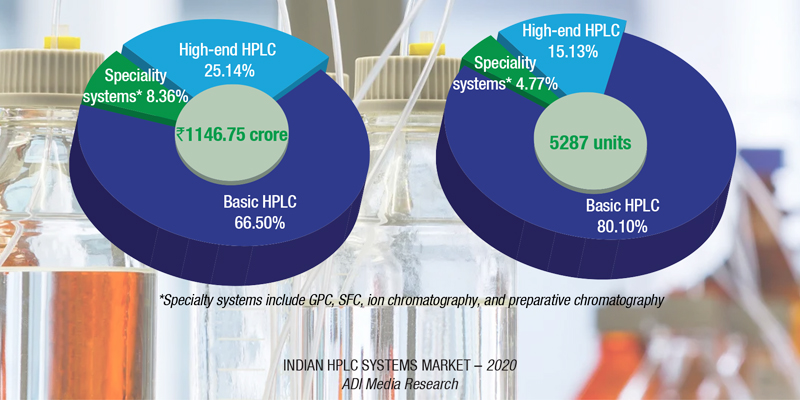

The Indian market growth over the last couple of years has declined from 12 percent per annum to 5–6 percent per annum. This may be largely attributed to the FDA approvals that are pending for most vendors.

COVID-19 did not have much impact on the HPLC market. As expected, the AMJ 2020 quarter was a complete write-off, as far as instruments are concerned. Subsequently, sales in OND 2020 saw a partial recovery. The pharma manufacturers restricted to buying equipment for COVID-related activities.

The high-end HPLC segment is dominated by Waters. Other players include Shimadzu, Thermo Fisher, Agilent, and PerkinElmer. These systems find applications primarily with mass spectrometry (MS) and front-end separations. Leading pharma companies as Pfizer and Glaxo also buy this product; their investment did not show much decline in 2020.

The basic HPLC systems saw a 5-percent decline in 2020 over last year. Shimadzu, Waters, and Agilent are the main players. Agilent has had a good innings in this segment for about 15 years in India. However, the company has had quality issues with the pharma industry since 2008 and is now not so popular. Its share is being captured by Thermo Fisher and Shimadzu.

Specialty systems are more niche-products and did not see much traction in 2020. They may be segmented into:

- GPC: Dominated by Waters;

- SFC: Leading players are Shimadzu, Waters (Thar); Knauer and Novasep also have some presence;

- Ion chromatography: Leading players are Thermo Dynex, and Metrohm;

- Preparative chromatography: Leading players are Gilson, and Shimadzu; Novacep, Knauer, Waters, and Agilent also have presence.

The industry is looking for cost-effective solutions now that have less operating cost, and yet are robust. Cost of ownership has become a major consideration. With COVID-19 in play, remote-controlled serviceable products are being sought, so that dependence on service engineers is minimum. This has impacted the smaller companies as there has been a pressure on margins.

Dual systems are gaining preference, as they offer higher productivity. The dual LC system contains a dual-gradient pump and also a dual-injection autosampler. When this is combined with two detectors, then essentially there are two UHPLC systems in one, and both flow paths are completely independent of each other, so two things can be done at once.

Prospects are good, and outlook is bright, yet how the second COVID-19 wave impacts demand is uncertain. JFM 2021 quarter was brisk, and AMJ seems to be promising too.

Continuing advancements in the methodology and technology used for chromatography has helped to establish the process as a standard laboratory technique across sectors, allowing it to remain relevant and useful, meeting analytical demands in a range of scientific scenarios.

With productivity now a key focus point for analysis laboratories across all sectors, instrument vendors have responded by developing HPLC technologies designed to overcome these challenges.

Modern instruments now offer a wide range of customizable features to facilitate the precise replication of existing methods. Highly flexible platforms allow gradient-delay volumes to be seamlessly adjusted to match the analyte retention time and separation profiles of other instruments. Other innovations, such as a choice of still-air and forced-air thermostating techniques within the same instrument, can help analysts more easily mimic legacy HPLC systems to achieve the desired results faster.

Another key issue associated with method-transfer relates to system dispersion effects. While lower system dispersion benefits overall separation power, it can lead to undesirable peak shapes when samples with high organic content are injected. Flexible systems that use custom injection programs to perform in-needle dilutions have enabled analysts to inject high organic samples, while maintaining exceptional chromatographic efficiency.

As such, custom injection programs are increasingly seen as a powerful tool when it comes to rapidly transferring methods between systems. Innovative productivity tools are also being built into instruments themselves. These simple yet effective features are designed to ensure instruments never run dry, and waste will not run over, enabling laboratories to minimize the potential for human error, avoid lost time and, ultimately, run large sample sets with confidence.

Analytical laboratories in a variety of industries are turning to the newest liquid chromatography technology to boost efficiency as workloads rise and firms strive to expand. Forward-thinking laboratories are expediting the mobility of both analysts and samples, thanks to modern liquid chromatography systems, resulting in significant capacity and efficiency advantages.