DNA Sequencers

NGS to transform biomedical research

New applications of genetic testing will result in changes to current care teams and processes. It will reshape how pathologists, oncologists, geneticists, genetic counselors, biostatisticians, and bioinformaticians work together.

Gene sequencing has proved its usefulness as a diagnostic and prognostic tool. Its use in the identification of BRCA1 mutations is already a gold standard in cancer research. Thanks to personalized medicine trends and collaborations between the industry and the regulatory authorities, whole genome sequencing (WGS) is turning into a common practice faster than one could have originally expected. Indeed, it is now possible to get genome sequenced through the post by firms, such as Dante Labs and 24 Genetics in Europe and Veritas Genetics and Sure Genomics in the US.

However, there is more that is required. Through a collaborative effort between clinicians, pharma companies, scientists, and regulatory agencies, the industry is working on a new framework for genomics to be incorporated into standard care on a global basis.

Conservatively, the market entered the phase of moderate adoption of NGS-based analytics in the clinic about 10 years ago. The goal is to diagnose diseases better, predict their outcome, and choose the best possible care option for a patient. Currently, the industry is in the very midst of this adoption phase.

Many success factors are key to driving adoption in the moderate phase of the curve:

Regulatory environment. The regulators are paying increasing attention to how genetic information about individuals is handled. Already today, a growing number of drugs are approved with an accompanying test that leverages biomarkers.

Testing technology. Many experts believe that the usage of NGS data, including whole exomes and genomes, will ultimately give the insights needed to diagnose or predict diseases and select treatment options at the highest level possible. Increasing usage of whole exomes and genomes in testing labs is expected in coming years.

Reimbursement. The adoption of these tests in the clinic hinges on the ability of doctors to recover the expense associated with genetic tests. Payers are increasingly open to pay for NGS-based tests. Ultimately, for this industry, it is key that the tests become part of the routine for clinicians to diagnose disease. Payers are looking for price points to come down so that a global adoption is financially feasible.

Physician education and acceptance. The industry is facing the need to educate a wide range of healthcare specialists involved in designing, conducting, interpreting, and utilizing genetic tests – translational researchers, pathologists, geneticists, genetic counselors, biostatisticians, and so on.

Bioinformatics capability. There is a plethora of new tests in the development stage that require a massive computing resource to deal with the sheer amount of data. The storage requirements for a whole genome, depending on the coverage, range between 100 and 200 GB for a single person. Added to that are the results of the variant analysis and other datasets generated as part of the analysis. For a broader-scale usage, these datasets and their interpretation must be part of the patient record. This requires investment in an infrastructure to provide, gather, store, research, and clinically interpret this data on a large scale that is not currently in place.

Patient demand. All tests require patient consent. Because of this, a more global adoption of genetic tests is also dependent on patients agreeing to use their DNA for this purpose.

The genetic testing technology and infrastructure are evolving quickly. There are a few areas where adoption is expected first with significant testing volume – oncology, rare disease diagnosis, and pediatrics and newborn screening. Beyond these areas, there is definite potential in areas, such as obesity, diabetes, and cardiac disorders.

In addition to this, there is a considerable uptick in the adoption expected in the field of pharmacogenomics to determine safety, efficacy, and cost of care. New applications of genetic testing will result in changes to current care teams and processes. It will reshape how pathologists, oncologists, geneticists, genetic counselors, biostatisticians, and bioinformaticians work together.

Indian market dynamics

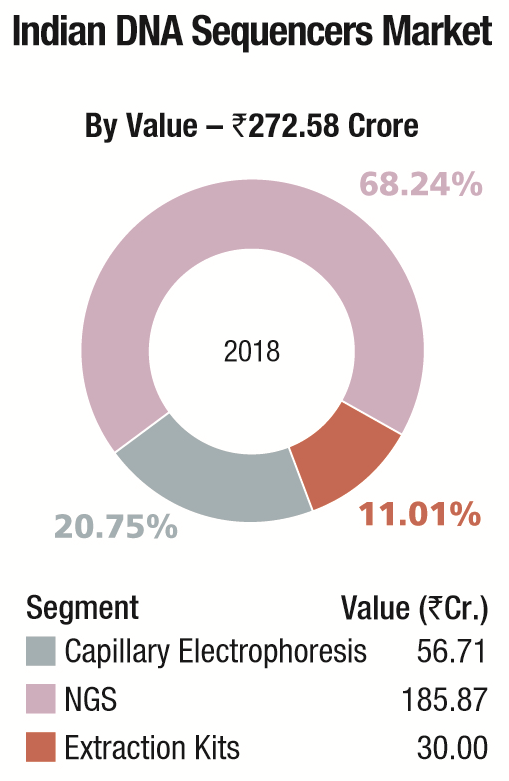

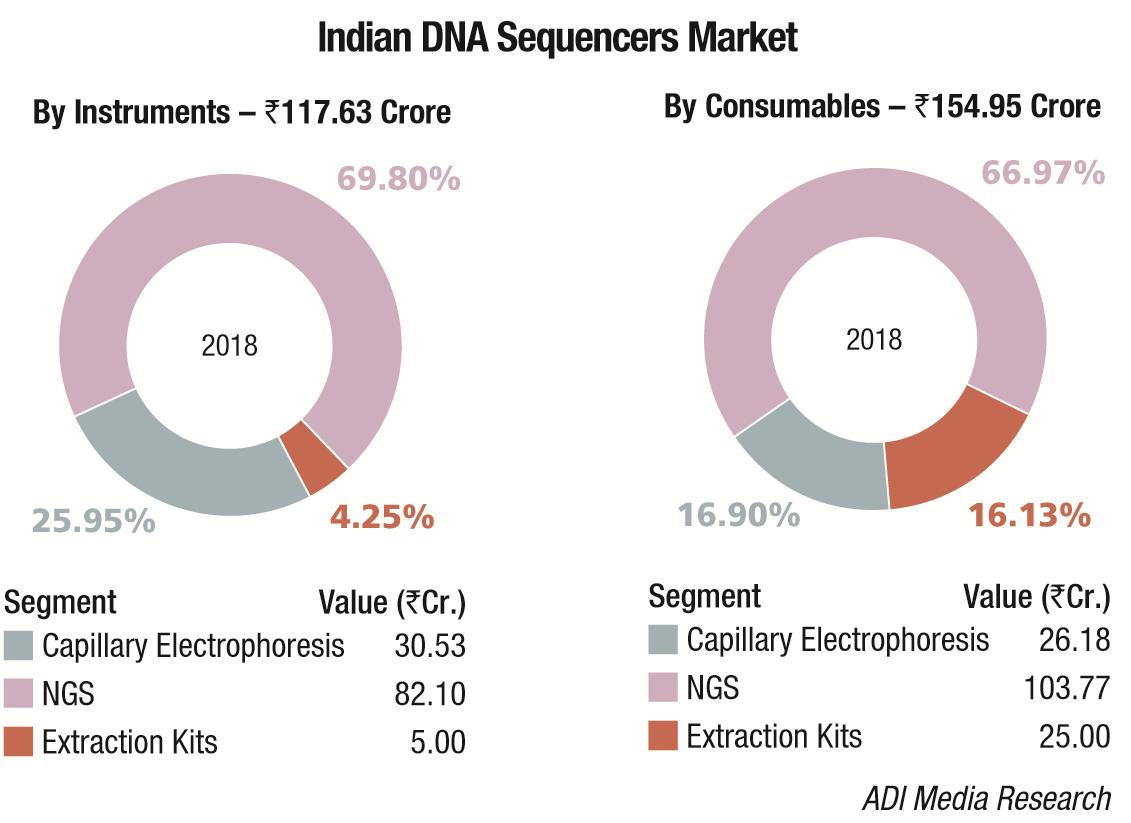

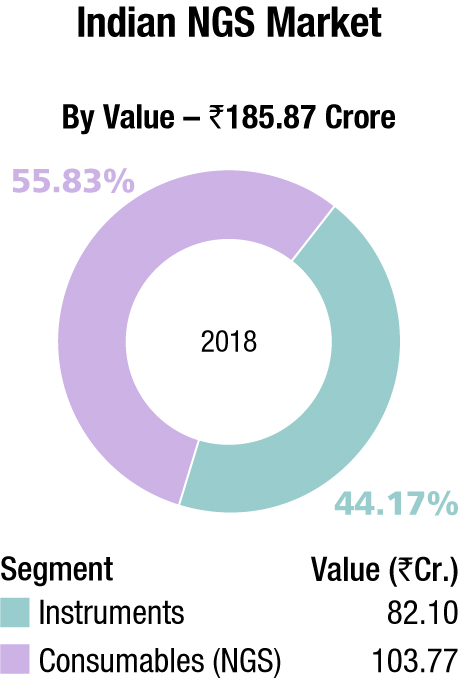

The Indian market in 2018 for DNA sequencers is estimated at Rs 272.58 crore. It may be segmented as capillary sequencers, NGS, and DNA-extraction kits for hospitals. NGS continues to dominate the segment with Illumina, marketed by Premas Life Sciences at a 68.24 percent share, leading the pack.

| Segment | Tier I | Tier II |

|---|---|---|

| Instruments | Thermo Fisher (brand Applied Biosys) | – |

| Consumables | Thermo Fisher | Promega |

| Segment | Tier I | Tier II |

|---|---|---|

| Instruments | Illumina (Premas Life Sciences) | Thermo Fisher and Pacific Biosciences (Imperial Life Sciences) |

| Consumables | Thermo Fisher, Agilent, and Illumina (Premas Life Sciences) | NER, Nimble Gene, and Pacific Biosciences |

| Segment | Tier I | Tier II |

|---|---|---|

| Instruments and Consumables | Qiagen, Thermo Fisher, and Promega | HiMedia, BioMérieux, and Perkin Elmer |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian DNA Sequencers market. | ||

| ADI Media Research | ||

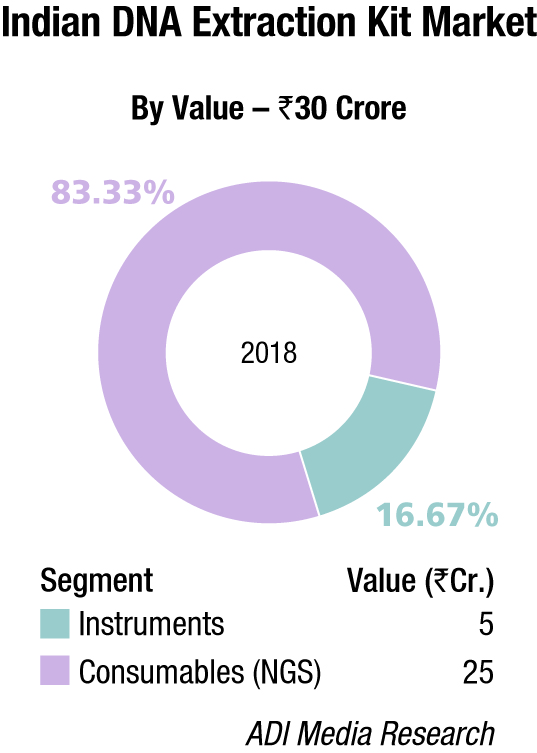

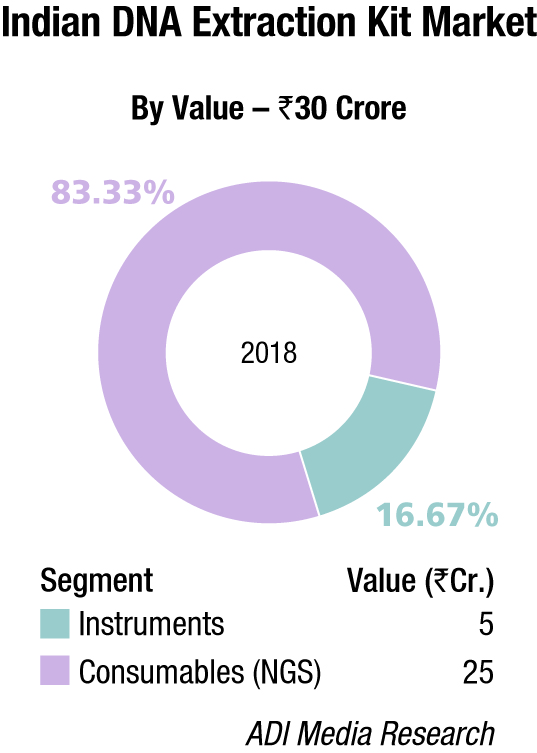

Thermo Fisher almost monopolizes the capillary electrophoresis segment, with instruments contributing a 53.84 percent share. The DNA-extraction-kit market for hospitals is estimated at Rs 30 crore and consumables are the main buy, constituting 83.3 percent share. Qiagen, Thermo Fisher, and Promega are the major players in this segment.

Global market

The global DNA sequencing market is projected to grow by USD 17.6 billion, with CAGR of 18.1 percent, predicts ResearchAndMarkets. There are many factors that are driving growth. These include increasing advancements in technology in DNA sequencing, rise in global genome mapping programs, growth in partnerships and collaborations, higher investment in research and development activities, growing demand for fast and easy clinical diagnosis, high-throughput technology, increasing activities in cancer research, and growing need of breeders both for plant production and animals. On the contrary, factors such as standardization and accuracy concerns, legal and ethical limitations, algorithmic challenges, expensive machinery, and repeat content may hinder the growth of the DNA sequencing market. The diagnostics segment displays the potential to grow at over 18.5 percent. The shifting dynamics supporting this growth makes it critical for businesses in this space to keep abreast of the changing pulse of the market. Poised to reach over USD 6.7 billion by the year 2025, diagnostics will bring in healthy gains, adding significant momentum to global growth.

The diagnostics segment displays the potential to grow at over 18.5 percent. The shifting dynamics supporting this growth makes it critical for businesses in this space to keep abreast of the changing pulse of the market. Poised to reach over USD 6.7 billion by the year 2025, diagnostics will bring in healthy gains, adding significant momentum to global growth.

Representing the developed world, the United States will maintain a 19.5 percent growth momentum. Within Europe, which continues to remain an important element in the world economy, Germany will add over USD 667.5 million to the region’s size and clout in the next 5 to 6 years. Over USD 840.9 million worth of projected demand in the region will come from Rest of Europe markets.

Leading global players in DNA sequencers market include Beckman Coulter, Bayer Corporation, Myriad Genetics, Siemens Healthineers GmbH, General Electric Company, Hamilton Thorne Biosciences, Thermo Scientific, Tecan, Eppendorf, Illumina, Life Technologies, Deep Genomics, Inc., Johnson & Johnson, Pacific Biosciences, Koninklijke Philips N.V., Oxford Nanopore technologies, Genia Corporation, Agilent Technologies Inc., Siemens AG, Illumina, Roche Holdings AG, and Perkin Elmer.

Way forward

Based on the current trajectories, it will take next 5 to 10 years to clear the hurdles characteristic of the moderate adoption phase. So, what are the top-level issues that need to be addressed once we reach a stage of full adoption? Here are some of the most pressing topics:

Automation. In 2017, there were 3,945,875 births just in the United States. Applying routine tests on every newborn will by itself require a massively scalable and highly automated infrastructure that surpasses everything we have established in hospitals and testing labs across the nation.

Population-scale sequencing. Genetically caused diseases increase with the statistical power of the underlying dataset. Once have a highly scalable infrastructure and testing operation installed on a nationwide basis, industry is in a position to generate massive datasets that can be mined for undiscovered associations. This will also allow to verify previous findings that were made using much smaller datasets.

Interdisciplinary collaboration. The diagnosis and treatment of disease ultimately require that one can integrate data from multiple platforms such as imaging, biosensors, and predictive analytics – just to name a few.

For thousands of years, the smallest thing humans could detect was about as wide as a human hair. This changed with the invention of compound microscope toward the end of the 1500s. Over time, the microscope became a cornerstone of clinical diagnosis. It has been only a little over 40 years since the invention of DNA sequencing and a little over 15 years since the completion of the Human Genome Project. However, NGS-based clinical testing is about to quickly transform both biomedical research as well as how experts apply this knowledge in the clinic.