OR Equipment

OR integration – Technology that benefits all

One major trend in the market for operating room equipment is integration. Even though this concept has already been launched, it will continue to evolve over the next few years, if not a decade.

The world has witnessed a substantial increase in the incidence of chronic and infectious diseases over the past few years, and this has resulted in an increased focus on healthcare and a high rate of hospitalization. The number of surgeries being performed to treat these diseases has also increased, resulting in high demand for operating room equipment. The growing popularity of minimally invasive surgeries, and rising patient preference for such surgeries, is also expected to favor operating room equipment demand till 2032.

Indian market dynamics

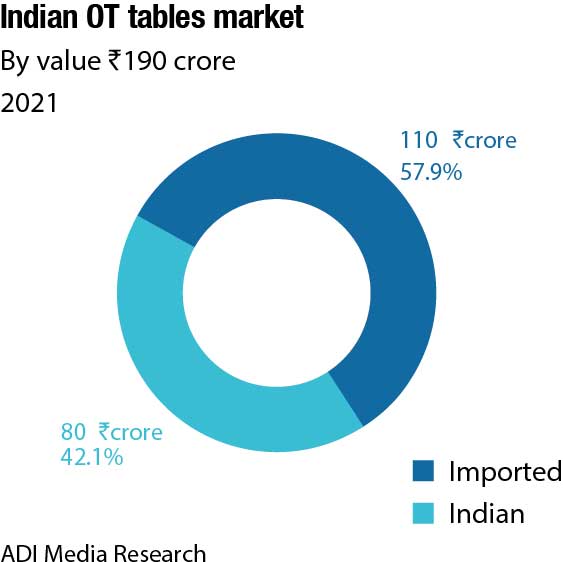

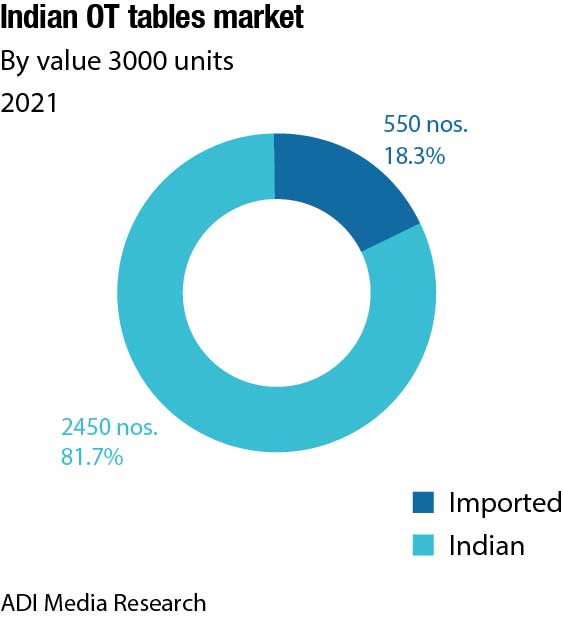

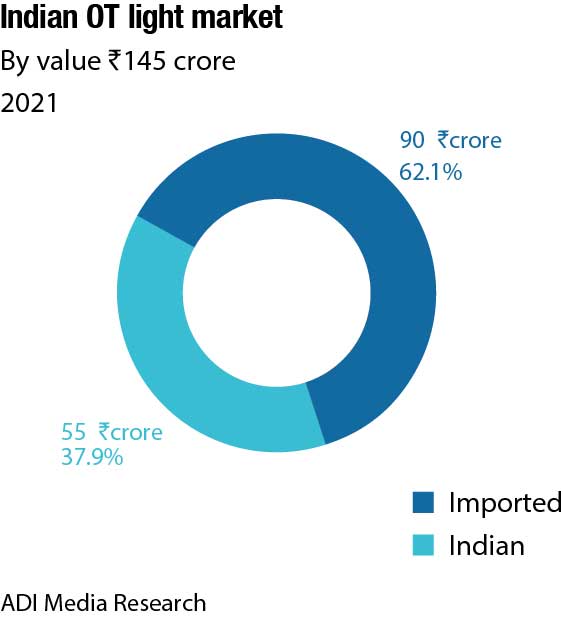

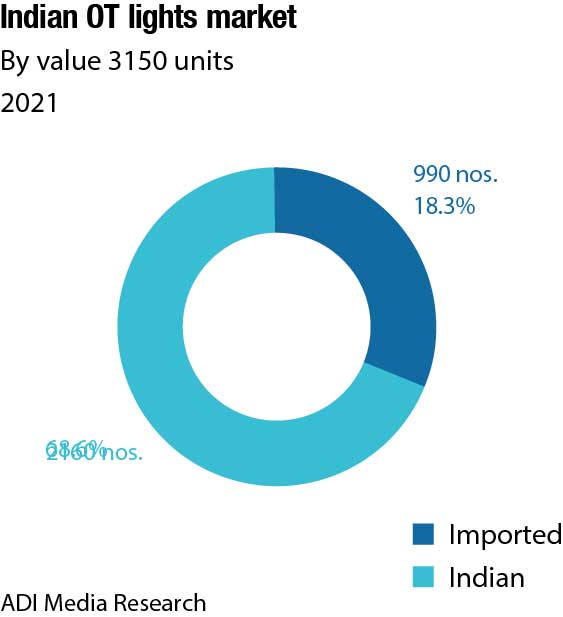

2021 was a very good year for OT tables and lights. The market picked up hugely after June 2021, and then the briskness in demand stayed. Stalled projects made progress and expansion was once again undertaken.

There was shortage of electronic components, including chips, ICs, and semiconductors. Vendors switched their component suppliers, based on availability. Logistics also posed a challenge, especially from Germany, and components were sourced more from Taiwan and China. Some vendors had major quality problems and observed that perhaps the components were being recycled. Most vendors were not able to meet the requirement made by the hospitals and nursing homes, resulting in price no longer being the only consideration for customers.

The Indian vendors asked for longer lead times. Those with deeper pockets started building up inventory up to three times their normal, albeit impacting profit margins. The local vendors that were able to procure material were now running factories at 100-percent capacity. The imported brands that did not have supply and logistics constraints did very well. And the very small manufacturers that did not have clout with their suppliers found preference being given to larger vendors and their deliveries being juggled.

For many smaller hospitals and health systems, as they managed the aftermath and aftershocks of the Covid-19 crisis, it had become increasingly difficult to remain financially viable. All of this had occurred against the backdrop of deepening workforce shortages, broken supply chains, and historic levels of inflation that increased the costs of caring for patients. This issue continued into 2022, and that impacted buying for them. Some relief had come from the loans under the special RBI liquidity window for the healthcare sector at 6 percent, as against the average borrowing cost of 9.8 percent. Banks were incentivized for quick delivery of credit under the scheme through extension of priority-sector classification to such lending up to March 31, 2022, later extended till June 2022. However, this benefit was availed more by the large corporate chains than the smaller facilities.

Global market dynamics

The global operating room (OR) equipment market grew from USD 14.39 billion in 2021 to USD 15.66 billion in 2022 at a compound annual growth rate (CAGR) of 8.8 percent. The Russia-Ukraine war disrupted the chances of global economic recovery from the Covid-19 pandemic, at least in the short term. The war between these two countries has led to economic sanctions on multiple countries, surge in commodity prices, and supply chain disruptions, affecting many markets across the globe. The operating room equipment market is expected to grow to USD 19.23 billion in 2026 at a CAGR of 5.3 percent. The market is predicted to rise owing to increased demand for hybrid operating rooms, product innovations driven by technological advancements, and an increase in the number of ambulatory surgical centers.

| Major players in OT tables market* | ||

| Tier 1 | Tier 2 | Others |

| Imported | ||

| BenQ (Bet Medical) and Getinge | Steris, Stryker, Trumpf, Magnatek, Mediland, and Mindray | Mizuho, Scharer, Takeuchi, Schmitz, and Medifa |

| Indigenous | ||

| Cognate, Galaxy, Magnatek, Midmark, Pallakad, Staan, and many other regional players | ||

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indigenous and imported OT tables market.

ADI Media Research |

||

In addition, the OR equipment market is driven globally by the increase in ambulatory surgical centers (ASCs) across the world. All ASCs require an OR to undertake the surgeries; therefore, the growing number of ASCs all over the world is a key factor facilitating the growth of the market for OR equipment.

The high cost associated with the operating room equipment will restrain the operating room equipment market growth. Hospital costs are important to understanding value-based care and are even more critical when analyzing cost-saving interventions during surgery. The costs associated with the operating room equipment depend on the country, the surgical procedure, and the equipment used for the surgical procedure. The average cost per hospital stay was USD 11,700, making hospitalization one of the most important types of healthcare utilization. Higher prices remain documented for stays by patients with an expected payer of Medicare associated with stays with other expected payers (USD 13,600 for Medicare vs. USD 9300–USD 12,600 for other payers).

One major trend in the global market for operating room equipment is integration. Fully integrated operating rooms are predominantly profit centers for hospitals. Increasing the workflow and efficiency not only benefits the patient but also the hospital and staff. Numerous newer functions, such as archiving, streaming, video conferencing, and workflow enhancement, have become standard facets of integration in recent years. The ability of these operating rooms to reduce the total healthcare expenditure, enhance patient safety, and minimize the time taken to perform surgeries will lead to its increased popularity in the fields of neurosurgery, cardiology, and orthopedics.

Due to the Covid-19 pandemic, healthcare organizations have been stressing on the importance of operating room management. Healthcare companies in the operating room equipment market have been ensuring robust operation theater supplies across facilities to maintain patient quality of life.

Operating room theater personnel are taking precautions, such as utilizing personal protective equipment (PPE), pre-operative planning, and assessing negative pressure ventilation in operating theaters (OTs). Healthcare facilities are ensuring limited personnel in operating rooms and deployment of single-use equipment to avoid hospital-acquired infections (HAIs) and dedicated Covid-19 theaters to reduce the spread of the novel infection. Moreover, healthcare practitioners are making the use of regional anesthesia to minimize the duration of surgery.

Companies in the operating room equipment market are providing leading-edge patient-monitoring equipment, such as surgical imaging displays and vital signs monitoring devices in hospitals. 3D (3-dimensional) endoscopes are storming operating theaters, where in the near future, surgeons will be seen wearing 3D glasses that hold potential to solve limited-depth perception in endoscopic surgeries.

Although 3D surgical imaging is anticipated to become more commonplace in OTs, there is a need for investment to build a robust healthcare infrastructure in developing countries, such as India, Bangladesh, Vietnam, and the Philippines. Hence, companies in the operating room equipment market should collaborate with the governments in these countries and invest in building healthcare facilities to improve overall public health in emerging economies.

Modern-era surgical lights have much more to experience than just illumination

Manju Goyal

Manju Goyal

Deputy Director – PMLS and SU,

Mindray Medical India Pvt. Ltd.

When we think about an operating room, we assume that a surgical light is needed to illuminate the cavity so that the surgeon can perform the surgery effectively. A few years ago, it was true to much extent with halogen lights giving required illumination and maneuvering. Since LED lights entered surgical lights, we have entered a different era of infinite possibilities and a new level of thinking. The development has happened in all areas from aesthetics to designing for laminar flow compatibility. A lot of parameters are helping buyers to choose the best-fit light, depending on their specialization of operation, and not compromising on their actual requirement. For instance, high illumination may not be the most important parameter required for deep cavity surgery but depth of illumination may be the first and basic parameter you will need to perform that surgery. For a teaching institute, the live data stream of surgery outside OR may be the differentiator, and so on.

When choosing any surgical lights, one more aspect can be looked at which is the surgeon’s eye comfort as working for long hours on such a high illumination causes eye fatigue, which is inevitable as illumination is also mandatory to visualize the surgical site. Now the industry has brought such technologies to reduce the contrast between the surgical site and near surroundings so that while working for long hours, eye stress is reduced. It improves the efficiency of surgeons.

One more situation we need to consider while choosing surgical lights for complex surgeries where a group of surgeons and nurses work simultaneously to perform surgery. In such cases, the light’s illumination at the site gets compromised too much as light is blocked by their heads. In such cases, surgeons used to adjust OT light head frequently to find the best possible illumination. But this issue has also been addressed with much efficacy by synchronizing the satellite light dome illumination with the main dome to provide the required illumination at the actual site without increasing the temperature at the surgeon’s head. This technology has evolved over many years and has been established as a perfect solution to surgeon needs in these kinds of surgeries.

These modern-era lights bring the utmost comfort to surgeons and further establish that technology is meant for helping them to work with more efficiency without compromising on their basic needs.

North America dominated the global operating room equipment market in 2021. The market in the region is anticipated to expand at a CAGR of 6 percent from 2022 to 2031. Growth of the market in the region is attributed to factors, such as presence of leading players, high prevalence of chronic diseases, and established healthcare infrastructure. Favorable government initiatives and increase in the number of ambulatory surgical centers are the other drivers expected to propel the market in the region. The US held the largest share of the market in North America in 2021. This is attributed to increase in the geriatric population and rise in prevalence of diseases in the country.

Europe is likely to be the fastest-growing market for operating room equipment from 2022 to 2031 owing to strong research and development activities and support for the development of new medical devices.

The versatile portable x-rays

Lavanya U

Lavanya U

Director,

Iatome Electric (I) Pvt. Ltd.

Portable x-rays, by definition, are X-ray equipment intended to be moved from one location to another while used, or between periods of use, while being carried by persons. The weight of the portable x-ray shall not exceed 12 kg. Portable x-rays find application in outside of the hospital settings, such as primary healthcare services, medical camps, natural disaster sites, emergency and trauma care units, military field hospitals, and other such scenario where power availability and terrain do not permit regular x-ray equipment. x-ray screening is an important tool in tuberculosis (TB) prevention and care. Government programs, such as the National Strategic Plan for TB Elimination, provide guidelines on screening for TB and recommend use of digital x-ray. Portable x-rays could add value to such initiatives by extending the reach to a larger population.

| Parameters | Compact mobile x-rays | Portable x-rays | Ultra-portable x-rays |

| Overall weight | <80 kg | <12 kg+stand | <4 kg+stand |

| Mobility | Wheeled trolley | Hand carry | Hand carry |

| kV range | 40–120 kV | 40–100 kV | 40–90 kV |

| mA range | >60 mA | >20 mA | >5 mA |

| mAs range | >100 mAs | >20 mAs | >5 mAs |

| Generator power | >2.6 kW | >1 kW | >0.3 kW |

| Tube focal spot | 1.5 mm–2.0 mm | 0.8 mm–1.2 mm | 0.4 mm–0.8 mm |

| Power Source | Mains input | Mains/battery | Battery |

Advances in engineering have made the x-ray machines compact. x-ray images of sufficient quality to provide meaningful and useful diagnosis is now possible with these compact units. However, it should be understood that the image quality from a portable x-ray cannot exceed that from a mobile or fixed x-ray unit. The power and usability of portable x-rays fall in between that of mobile x-rays and the newer ultra-portable x-rays. The below table provides a generalized comparison between the three types.

Typical features of the portable x-rays are its smaller weight and size. Some models have in-built battery power source. LED light collimator and laser indicators for x-ray field indication are other features. Wireless exposure control is an advantage. A sturdy carry case, site deployable stands, battery-powered DR panels and laptop, complete the bundle for a portable digital x-ray system. Portable and ultra-portable x-ray machines from several brands are available in the market. Most of the Indian brands are line-frequency units. There are a few Indian brands with high-frequency portable units that offer the true advantages of portable units. The advances in performance and design of the portable x-ray systems are considerable, and it can be economically, safely, and effectively used for x-ray imaging applications and extend the reach of healthcare to a wider proportion of the population.

Significant revenue generated by developed Western European countries, such as the UK, Germany, France, and Italy, is attributed to Europe’s prominent share of the global market. Rise in base of the target patient population, i.e., geriatric population (over the age of 65 years), is projected to drive the operating room equipment market in Europe during the forecast period.

Asia-Pacific is one of the leading markets for operating room equipment due to rise in prevalence of chronic diseases, large patient pool, and increase in number of hospitals and healthcare facilities with improving infrastructure. The large population base with high unmet needs in Asia-Pacific attracts foreign investors to expand their business in emerging markets, such as China, India, and Singapore.

Major players in the OR equipment market are Steris Plc., Stryker Corporation, Getinge AB, Hill-Rom Holdings Inc., Mizuho OSI Inc., Koninklijke Philips N.V., Karl Storz GmbH & Co. KG, GE Healthcare, Dragerwerk AG & Co. KGaA, and Medtronic plc.

| Major players in OT lights market* | ||

| Tier I | Tier II | Others |

| Imported | ||

| Dr Mach, Getinge, Vivid (BenQ), and Draeger | Steris, KLS Martin, Simeon, Stryker, Magnataek, and Mindray. | Brandon among some small Chinese brands |

| Indigenous | ||

| Bharat Surgicals and United Surgicals | Matrix, Cognate, Staan, Confident Dental, Technomed, and Galaxy | Many small Indian unorganized manufactures mainly in Delhi, Bhiwani, and southern Indian states |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indigenous and imported OT lights market.

ADI Media Research |

||

Recent developments

In July 2022, Beyeonics, an Israeli start-up focused on bringing the heads-up-display technology from military aviation helmets to operating theaters. The company developed its first product Beyeonics One for ophthalmic surgeons and is expected to focus on the development of new helmets for other surgeries as well.

In May 2022, Zimmer Biomet launched its new artificial intelligence (AI) capabilities for its Omni Suite intelligent operating room. The suite is designed to optimize operational efficiency, and with the new AI features, it can record workflow milestones, such as door count, patient entry, and anesthesia administration.

In March 2022, Activ Surgical, a company focused on developing surgery technology with augmented reality (AR) and AI to reduce surgical errors, raised an additional USD 15 million for its Series B financing round. The company previously raised USD 45 million in the same financing round in September 2021.

In December 2021, Baxter acquired Hillrom for the deal of the USD 15 billion amount. This acquisition unites two leading MedTech organizations in a shared vision for transforming healthcare and advancing patient care worldwide.

Integrated OR transforming healthcare industry

Hybrid operating rooms, digital operating rooms, and integrated operating rooms are playing an instrumental role in improving patient outcomes. Hybrid OR is being publicized for use of mobile systems that offer advantages of flexibility in use of imaging systems during surgeries. Such innovations are fueling the demand for operating room supplies.

Digital OR, on the other hand, is gaining popularity for next-gen setup of software sources, images, and OR video integration, all at the same time. However, operating room integration system manufacturers are focused on automation of OR equipment, imaging devices, and patient-information systems.

The high prevalence of chronic diseases in patients worldwide is fueling the demand for equipment for operation theaters. Manufacturers in the global operating room equipment market are innovating in operating room lights, surgical lights, and hospital lights to ease healthcare services for surgeons, healthcare staff, and practitioners. Surgical lights help to illuminate the operative site on a patient for optimal visualization during a procedure.

Operating room lights, including luminance management device (LMD), are being developed by MedTech companies. Advantages of LMD include same luminance irrespective of the tissue, constant illumination during time-consuming surgeries, and automatic light adjustment to suit the surgeon’s ability and comfort.

The most commonly used operating room instruments are surgical instruments. Manufacturers are increasing output capacities for ratcheted forceps, babcock forceps, and gillies forceps, among others. An alarmingly high number of cardiovascular patients, diabetic patients, and obese patients are translating into revenue opportunities for surgical instrument manufacturers in the operating room equipment market.

The OR equipment market is undergoing a significant change with innovations in operating tables. Manufacturers are developing OR tables, such as orthopedic tables, general surgical tables, and radiolucent imaging tables to revolutionize healthcare facilities. Since the healthcare industry largely runs on faith among surgeons, doctors, and patients, robust operating room supplies have become the need of the hour in hospitals and ambulatory surgical centers.

Operating tables

The global operating tables market value is projected to exceed USD 1156.4 million by the year 2025 at a CAGR of 2.9 percent. Technological advancements in medical equipment and rising healthcare expenditure across developed and developing economies will complement the industry growth. Countries worldwide are investing in advanced healthcare technologies, software, and medical devices to strengthen surgical capabilities and improve overall patient care. The advent of next-generation technologies, such as artificial intelligence (AI), machine learning (ML), the internet of things (IoT), and robots has enabled the development of new medical systems that can help healthcare experts to improve surgery outcomes.

General surgical table segment is estimated to reach USD 820 million by 2030. General surgical tables are widely used at hospitals to help surgeons perform complex procedures more efficiently through increased accessibility, stability, and support. The equipment provides surgical versatility and allows the integration of advanced surgical accessories for different operations. Technological advancements, such as 3D printing and electrification have enabled the development of general surgical tables with superior capabilities. In July 2022, researchers from Michigan Technological University and Western University developed a 3D-printed surgical table. The equipment can be used in both general surgery as well as orthopedic procedures.

Surgical tables market share from the non-powered segment is anticipated to witness over 3-percent CAGR through 2030. Non-powered surgical tables, also known as manual operation tables (OTs), offer a wide range of benefits including suitable ergonomic features and accessories. The equipment can be deployed across multiple disciplines. Features like 360° rotation and hydraulic pneumatic system can cater to every surgical requirement. Manual surgical tables are used in gynecology, cardiovascular, plastic surgery, pediatric, and more.

Surgical tables market from hospitals and clinics end-use segment was valued at more than USD 870 million in 2021. A rise in surgical procedures performed in hospitals due to growing chronic illnesses and the Covid-19 pandemic-led backlog will accelerate product needs. British Columbia reported the completion of more than 337,000 surgeries between March 2021 and March 2022, the highest number of surgeries ever performed in a span of 12 months. Growing preference for inpatient hospital treatment due to access to innovative and superior surgical and post-surgical care will positively affect the industry outlook.

Market drivers. The developed countries are witnessing an altogether different scenario in terms of hospital infrastructure, and development. There is a gradual decline in the number of hospitals in the developed countries, such as Germany, France, etc., owing to consolidation of hospitals, and a shift of outpatient and patients suffering from chronic diseases toward homecare settings. However, this has not limited the demand for surgical tables from healthcare facilities in these countries, owing to existing facilities focusing on capacity expansion to cater to the growing inflow of patients for surgical procedures.

The scenario in developing countries portrays a contrasting image, where there is a marked and rapid development in the hospital infrastructure. Increasing investments by public and private sectors alike in the healthcare and hospital infrastructure, and the growing number of public-private partnerships in countries including Brazil, China, and other countries, has led to an exponential increase in the number of hospitals and other healthcare settings during the past 5–10 years. This has been instrumental in fueling the demand for new shipments of surgical tables, and boost the growth of the global surgical tables market.

Aging installed base. A typical lifetime of a surgical table is 10 to 15 years. This leads to a need for replacing the operating tables that have surpassed their lifecycle, creating a demand for new shipments of surgical tables. Also, rapid advancements in surgical tables by market players, and introduction of procedure-specific operating tables in the market, has led to some healthcare settings replacing their obsolete models with these advanced tables.

There is a large and aging installed base of traditional non-powered manual surgical tables in hospitals of developing countries, which, according to their lifecycle, are demanding replacement. This has created a large demand for these surgical tables being replaced by the advanced new modalities. This, coupled with development of new healthcare facilities, is further anticipated to drive the demand for these tables in the global operating tables market. Considering this, the surgical tables industry is expected to flourish in the forthcoming years.

Some of the leading companies in the surgical table industry include Stille, Getinge AG, Stryker Corporation, Steris PLC, Mizuho, Skytron, AMTAI Medical Equipment, Hill-Rom Holdings (Trumpf Medical), Schaerer Medical, and Narang Medical Limited. These industry players are focusing on strategic alliances and supply agreements to expand business reach.

Operating lights

Surgeons, who work in poor light settings and with limited resources at the operation theater, complain of insufficient surgical lighting a threat to patient’s life and well-being. Often many of the surgeries have been called off due to poor lighting at the operation theater. Considering such light arrangements in many of the operation theaters, development and allocation of high-quality, economical, and sound surgical headlights is the need of the hour. It could provide perfect solution for such important issues during surgery.

With the growing demand for a balance between shadow management and luminance of light, the demand for surgical lights is likely to rise in years to come, which will subsequently propel the growth of the global operating lights market. The global operating lights market was worth USD 1698.64 million in 2021. It is expected to reach USD 2568.15 million by 2030, growing at a CAGR of 4.7 percent. Over the last five years, the number of integrated operating rooms has grown steadily. OR integration often comes bundled with surgical lights. As a larger portion of ORs become integrated, this is expected to drive the growth of the surgical lighting market. New OR construction will continue to be the primary driving force of the surgical lighting market, in addition to continual product innovations, including software connectivity and constant obstacle-independent illumination.

Technological advancements in these devices have been a mainstay factor for growth in this market globally. The shift of technology from halogen lights to LED (light-emitting diode) technology has played a crucial role in fueling the demand for these devices in the operating lights market. The gradual shift of technology from halogen to LED is gaining pace, especially in emerging countries, such as China, India, and Brazil, where healthcare facilities are now focusing on replacement of halogen lights with LED lights. The overall cost benefits, combined with improved efficiency during the surgical procedure offered by LED lights, are propelling the growth of the global operating lights market in coming years.

The life cycle of a surgical light is measured in hours. Advanced LED lights offer a life cycle of an estimated 40,000 hours to 60,000 hours. The increasing number of cardiovascular, neurological, and dental surgical procedures are prominently responsible for the usage of lights for longer duration, which is leading to a comparatively faster replacement of these lights in operating rooms. The exponential increase in the prevalence of chronic conditions, coupled with rising per capita expenditure, is anticipated to boost the number of surgical procedures, resulting into the growth of the market by 2027.

In spite of the tremendous technological advancements in surgical lights, it has certain disadvantages, which are likely to hamper the market growth. Heat is formed from the light source in the form of infra-red that is harmful to any person in the contact of radiation. This is anticipated to offer an uncomfortable working environment not only for the patient but the whole surgical team, as well as the surgeon. Moreover, it is likely to obstruct the operation by affecting the wound tissue to dry out, particularly during longer procedures. This may also lead to burns to the patient as well as staff, when exposed directly. Some light sources, such as halogen lighting, are ineffective owing to the amount of energy consumed, which leads to heat. Thus, all the aforementioned factors are anticipated to hinder the market growth.

The market remuneration in Europe is estimated to grow at a robust pace due to the expanding geriatric population and rising number of surgical treatments in the region. The presence of some well-known product manufacturers and mounting healthcare awareness among the regional citizens is set to foster the industry dynamics in the coming years.

The majority of the global surgical lighting market share was controlled by Stryker, Skytron, and Getinge. On the other hand, the global surgical boom market share was controlled by Stryker, Dräger, and Steris.

Way forward

OR system integration with other devices will continue to play an increasing role, posing a challenge for sellers and buyers. At the moment, each manufacturer has its own operating philosophy that the OR team must comprehend. This is rapidly changing, with many technologies communicating with one another and equipment being used successfully. Even though these concepts have already been launched, they will continue to evolve over the next few years, if not a decade.