Patient Monitoring Equipment

Patient monitoring shifts to RPM and low-end models

2022 saw a slump in the first quarter. The second quarter was better, since many new greenfield projects came up, with some sophisticated hospitals set up in smaller cities. Many pending tenders are in the pipeline for 3Q & 4Q.

Remote patient monitoring has made it possible to give more medical treatment digitally than ever before.

The field of remote patient monitoring, or RPM, has grown significantly in recent years, as a result of major investment and quick technological advancements. With anything from connected inhalers that can predict the likelihood of an asthma flare-up to smart watches that can detect cardiac problems, medical devices veterans, healthcare startups, and IT giants alike have entered the market.

The Covid-19 pandemic has expedited the shift toward RPM and given businesses an unheard-of opportunity to demonstrate that their products can improve treatment by making it more accessible, affordable, and effective. Additionally, it has made it possible for RPM to take on a new and more important role in clinical trials as researchers try to keep track of patients’ symptoms or advancement virtually.

Now that RPM has moved to the forefront, the next step is to provide reliable, accurate, and full patient visibility to support patients living with chronic conditions. This means that in parallel to continuous disease management, tech leaders will need to put efforts into disease-burden monitoring, and strive to bring FDA-cleared medical-grade solutions to market that are premised on multiple biomarkers and supported with relevant research and patents for their innovative technologies and processes.

Moving forward, as the population grapples with an array of chronic conditions, the market will expect more companies to join the arena of innovators, tackling single and multiple chronic conditions and providing full data visibility to doctors.

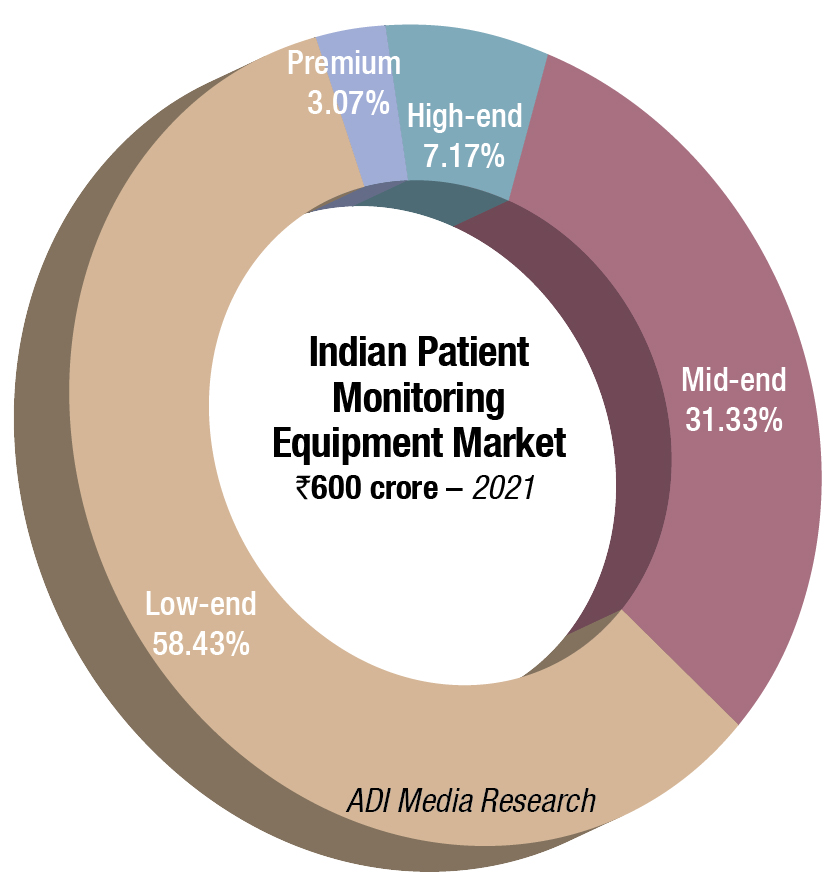

The Indian market for patient monitoring equipment in 2021 is estimated at ₹600 crore, and 94,450 units. The market had recovered from the 2020 drop, albeit the prices went south. Buyers opted for the mid-end and low-end models, which were now offered at lower price points. High-end systems constituted 3 percent in 2021, in contrast to 4.6 percent share in value terms (it was 15.9-percent share in 2019, and 100 units of super-premium sold in 2019, which seemed to be missing this year) and 0.6 percent in volume terms (it was 7 percent in 2019). The belly of the segment continues to be the mid-end and low-end systems, and it further gained share in 2021; it has progressively been increasing since 2018. The two segments dominated with a combined share of 89.7 percent by value and 96.5 percent by volume.

Philips and Contec, with its many resellers, dominated the market in 2021, with a combined share of 42 percent, by value. However, the balance may shift away from the Chinese brands, with Central Drugs Standard Control Organization (CDSCO) making registration mandatory for medical devices from October 1, 2022, and while home country approval is not required, applicants will need to submit proof of a reference country’s approval.

|

Indian patient monitoring equipment market |

|

|

Leading players |

|

| Segment | Vendors |

| Tier I | Philips and Contec |

| Tier II | Mindray, Nihon Kohden, BPL, and Skanray |

| Tier III | Schiller, Comen, GE, Edan, and Drager |

| Others | Clarity, Creative, and GMI |

|

ADI Media Research |

|

As imports faced supply chain issues in 2021, and prices subsequently were also increased by some brands, indigenous brands as Skanray saw strong traction. This trend is expected to stay over the next couple of years, as the government’s thrust on Make in India initiative is not waning. Skanray has had success in 2021 with orders from almost all AIIMS centers; the vendor is active in both GeM and HLL Infra Tech Services Limited (HITES) portals.

2021 was a mixed year. The government largely stayed away, as the focus of the spend was more Covid-related. The private buying moved away from the high-end premium equipment to the value segment. The CSR-related buying that commenced April onwards was for mid-end equipment, with barely any negotiation being done on pricing. Some of the large donors included Tata Trust, Infosys Foundation, Aziz Premji Foundation, ICICI Foundation, Capgemini, and HDFC Bank.

During the Covid-19 pandemic, remote patient monitoring came of age. The medical fraternity revisited the feasibility and utility of remote monitoring, and it has gradually become a way of life.

2022 has seen a slump in the first quarter. The second quarter was better, since many new greenfield projects are coming up, with some sophisticated hospitals being set up in smaller cities. Price negotiation is also an important part of the deal. Many pending tenders are expected to be finalized and orders placed in the latter half of the year.

There has been a significant government push to enable healthcare for the underserved, making technology adoption imperative. With the release of telemedicine guidelines by the Ministry of Health & Family Welfare (MoHFW), the regulatory environment has become clearer.

The guidelines, prepared in collaboration with the NITI Aayog, allow consultations via multifarious communication channels, such as text, audio, and video, and crucially permit registered medical practitioners to prescribe medicines. Along with structured regulatory guidelines and technological advancement in terms of reconfiguration and statistical analysis of a vast-vivid database with the Government of India, India’s patient-monitoring market is predicted to have its market opportunities increased by up to 20 percent by 2030.

Industry trends. By all accounts, industry is at an inflection point as powerful trends are shaping the field.

In terms of current market interests, AI connected to data analytics is at its peak; yet, in fact, AI is still developing on a comprehensive and integrated market scale.

In the United States, the value of patient monitoring is recognized at the federal level. Centers for Medicare and Medicaid Services have called for expansion of reimbursement for remote care, seeking to make sure home health agencies can leverage innovation to provide state-of-the-art care.

There is a need for technology providers to take a solutions-focused approach. Instead of being a B2B provider of products, the industry is transitioning to become the service provider through strategic partnerships.

International benchmarking of performance is an increasingly sought-after capability. Health systems are also looking for opportunities to work with international groups to do collaborative research, and to help them pull together robust clinical data elements.

For future clinicians to use telemedicine effectively, a growing number of medical schools, and teaching hospitals are including telehealth in the classroom setting. Students learn how to monitor the flow of real-time data from a patient’s wearable device, for example.

Cybersecurity continues to be critical, especially as patient data flows beyond the hospital and into the home. The shift of healthcare and patient data from multiple physical devices into the cloud also brings a host of software and security challenges.

With monitoring technology increasingly being placed in the hands of the patient, design and well-tested, well-researched ideas are more important than ever.

Predictive analytics is enabling preventive health management on the population level, and the growing importance of care beyond the hospital increases demand for population health solutions. Remote monitoring technologies are continuing to play a critical role in home monitoring, potentially preventing readmissions.

Technological advancements in terms of accuracy and patient comfort, as well as connectivity and data analysis, will also be major growth drivers in this market in the foreseeable future. While the pandemic has presented challenges for some markets in the patient-monitoring space, others have grown. In either case, the market is set to stabilize and continue its trend of modest growth in coming years.