Coagulation Instruments and Reagents

Perfecting technology to unveil new opportunities

Recent developments in the coagulation analyzers are promising, yet there remains a high potential for developing novel monitoring and therapeutic technology in the future.

The Indian coagulation industry is a significantly growing segment in the IVD market. Majority of the coagulation testing is performed in hospitals and attached laboratories, rather than in standalone labs.

The significant rise in cardiac diseases and blood disorders has created the need for improved coagulation analyzers across the globe. Over the past decade, rapid advancements in technology and the introduction of new coagulation analyzer tests have led to an increase in the quality and efficiency of hemostasis laboratories. Some of the modern complex coagulators possess amazingly high throughput, flexibility, and reliability. Other than this, they provide improved accuracy and precision, and easy-to-use advanced software with in-built graphs and calibration curves.

Requisite impetus is provided by the increasing number of hospitals, diagnostic centers, and research institutes established nationwide.

The Indian market is at a two-way junction–one is the shift toward automation and on the other hand, a paradigm shift is also perceived toward a next-generation miniaturized point-of-care (PoC) coagulation testing device. The automation segment is dominated by multinational companies with their fully automated systems, which are placed as rentals in high-workload laboratories. Though rapid coagulation is gaining traction, the reliability of test results is still debatable.

In the semi-automated segment, the market is dominated by European and Japanese brands. Low-cost Chinese instruments find it difficult to gain market share. More safety is preferred when it comes to coagulation reagents as the need is that the reagents should be more hygienic. Lyophilized coagulation reagents prove to be hygienic for testing as their use reduces chances of contamination. Some coagulation testing devices comprise test-specific packs, containing the necessary reagents to perform the test. These kinds of closed systems are easy to use and inexpensive.

Indian market

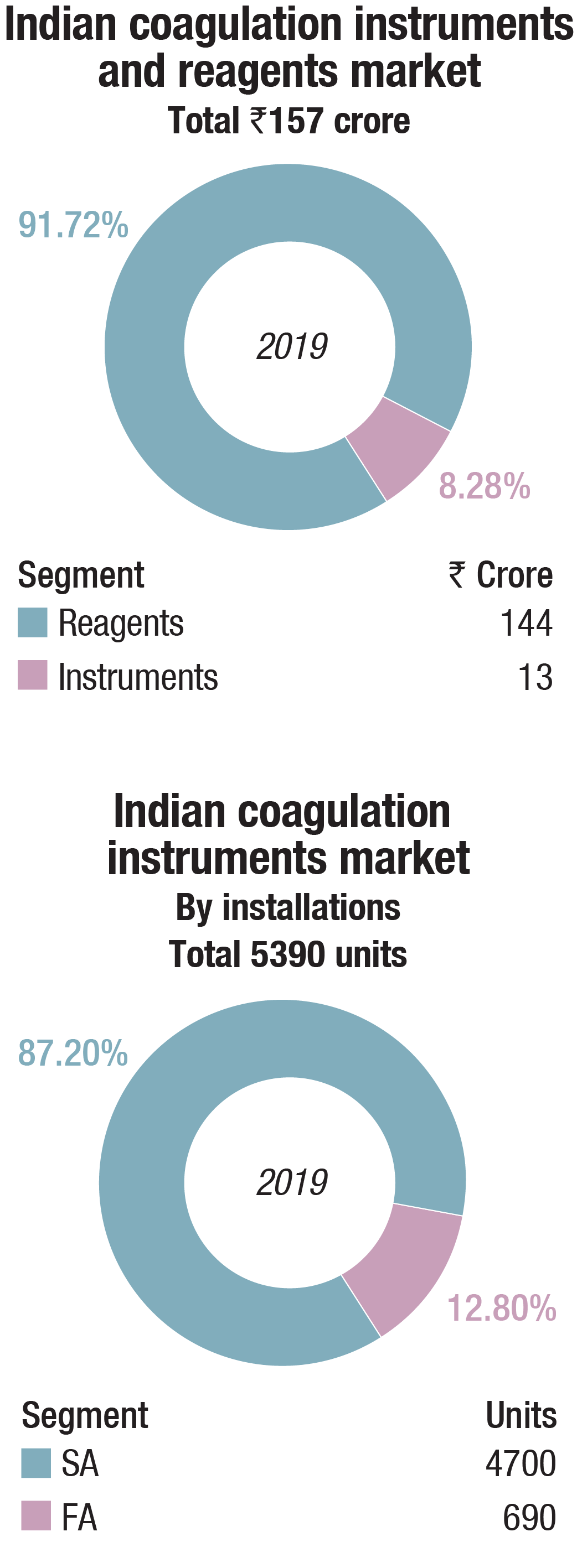

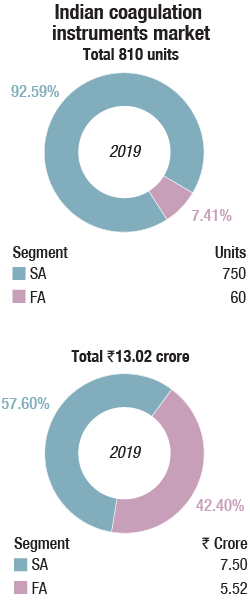

The Indian coagulation instruments and reagents market in 2019 is estimated at Rs. 157 crore. While reagents are estimated at Rs. 144 crore, semi-automated instruments 750 units valued at Rs. 7.5 crore, the fully automated instruments at Rs. 5.52, crore is merely a value estimated on 60 units of placed instruments. Almost all the fully automated instruments are now on reagent rentals, including the government procurement. A couple of high-workload laboratories in government hospitals have gone one step further and negotiated CPRT (cost per reportable tests) terms. Many instruments are replacements, while others may be change in brand or for new set ups, including hospitals, primary healthcare centers, diagnostic centers, and research institutes.

The Indian coagulation instruments and reagents market in 2019 is estimated at Rs. 157 crore. While reagents are estimated at Rs. 144 crore, semi-automated instruments 750 units valued at Rs. 7.5 crore, the fully automated instruments at Rs. 5.52, crore is merely a value estimated on 60 units of placed instruments. Almost all the fully automated instruments are now on reagent rentals, including the government procurement. A couple of high-workload laboratories in government hospitals have gone one step further and negotiated CPRT (cost per reportable tests) terms. Many instruments are replacements, while others may be change in brand or for new set ups, including hospitals, primary healthcare centers, diagnostic centers, and research institutes.

While the PT, aPTT, and TT tests continue to be the mainstay, this year the high-value D-dimer parameter testing, albeit constituting a small percentage, has been the saving grace in this segment. Blood banks are assessing the viability of fresh frozen plasma with the fibrinogen (Fbg) and factor VIII tests.

Quality control is a major area of concern. Most semi-automated analyzers in India lack IQC analysis modules. Many single-channel analyzers not only lack storage capacity of quality-control data, but also access to data because of the absence of wider displays or inbuilt printers. And though fully automated systems have quality-control modules, they are often rudimentary. More safety and hygiene is sought in the reagents too. Lyophilized reagents prove to be more hygienic. Closed systems are opted for as they minimize the possibility of contamination and reduce the cost of consumables. The amount of pre-analytics involved in hemostasis is seen as a major restraint, as testing still requires specific technical and clinical expertise, not only in terms of measurement but also for interpreting and then appropriately utilizing the derived information.

Global market

The global coagulation analyzers market is projected to reach USD 5 billion by 2025 from USD 3.8 billion in 2020, at a CAGR of 5.7 percent between 2020 and 2025, estimates MarketsAndMarkets. The market is largely driven by the increasing cardiovascular diseases and blood disorders, technological advancements in coagulation analyzers, and the rising geriatric population. The increasing development of automated coagulation systems with faster turnaround times, compact size, and expanded capabilities provides the requisite impetus. Emerging economies and the growing number of reagent rental agreements are expected to offer growth opportunities to market players in the coming years.

The global coagulation analyzers market is projected to reach USD 5 billion by 2025 from USD 3.8 billion in 2020, at a CAGR of 5.7 percent between 2020 and 2025, estimates MarketsAndMarkets. The market is largely driven by the increasing cardiovascular diseases and blood disorders, technological advancements in coagulation analyzers, and the rising geriatric population. The increasing development of automated coagulation systems with faster turnaround times, compact size, and expanded capabilities provides the requisite impetus. Emerging economies and the growing number of reagent rental agreements are expected to offer growth opportunities to market players in the coming years.

The coagulation analyzers available in the market are based on three major technologies–optical technology, mechanical technology, and electrochemical technology. Coagulation analyzers can also be based on other technologies like nephelometric, immunogenic, chromogenic, advanced biosensor, and thromboelastometry. The most widely used technology in the coagulation analyzers market is the optical technology. Clinical laboratory segment held the largest share in 2020. Clinical laboratory analyzers are predominantly used in hospitals for hematological analysis of patients on a daily basis.

Consumables held over 65 percent of the share and are further segmented into reagents and stains. All tests require the presence of reagents; hence, large inventory or repeated orders of these products are placed by hospitals, leading to higher demand. Increasing volume of testing and development of new assays is expected to boost sales of these consumables.

In terms of test type, prothrombin segment was estimated to account for the largest share in the region, followed by APTT test based in 2020.

North America accounted for the largest share of the global blood coagulation analyzer market in 2015 and will continue to lead the market during 2019–2024. The North American market is being driven by increased awareness of blood-related diseases among its people, rising prevalence of CVD and growing usage of coagulation analyzers. The key players contributing to the robust growth of the blood coagulation analyzers market are entering into partnerships, mergers and acquisitions, and joint ventures in order to boost the inorganic growth of the industry.

Major players* in Indian coagulation instruments market–2019 |

|||

| Tier I | Tier II | Tier III | Others |

| Stago (including Trinity) | Werfen India and Sysmex | Tulip and Transasia | Agappe, bioMérieux, Compact Diagnostics, CPC Diagnostics, HUMAN, Meril Diagnostics, and Roche |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian coagulation instruments and reagents market. | |||

| ADI Media Research | |||

Players are mostly present in the international space, and due to easy global accessibility, they are competing directly to gain bigger share. The new vendor entrants in the market are finding it hard to compete with the international vendors based on quality, reliability, and innovations in technology. Key players in the coagulation analyzers market include Siemens AG, Thermo Fisher Scientific Inc., Roche Diagnostics, Alere Inc., Sysmex Corporation, Diagnostica Stago, Helena Laboratories, Instrumentation Laboratory, International Technidyne Corporation, Beckman Coulter Inc., and Nihon Kohden Corporation.

Technology trends

In recent years, blood-coagulation monitoring has become crucial to diagnosing causes of hemorrhages, developing anticoagulant drugs, assessing bleeding risk in extensive surgery procedures and dialysis, and investigating the efficacy of hemostatic therapies. In this regard, advanced technologies, such as microfluidics, fluorescent microscopy, electrochemical sensing, photoacoustic detection, and micro/nano electromechanical systems (MEMS/NEMS) have been employed to develop highly accurate, robust, and cost-effect ive point-of-care (PoC) devices. These devices measure electrochemical, optical, and mechanical parameters of clotting blood, which can be correlated to light transmission/scattering, electrical impedance, and viscoelastic properties.

Nanomaterials monitoring

Growing field of nanomedicine in recent decades has created a need for the investigation of nanomaterials’ biocompatibility, including their anticoagulation properties. Anticoagulation properties of these nano materials, such as metal nano particles (gold, silver, and platinum), metal oxide nano particles of titanium oxide and zinc oxide, carbon nano materials of graphene oxide and carbon nanowires, and modified polymeric nano materials have been studied and they were shown to be used successfully in the treatment and detection of hemostasis diseases. Nano particles can specifically interact with the coagulation system. Generally, this interaction can be in two different ways–contact with plasma coagulation factors or interaction with cells, such as epithelial cells, monocytes, and platelets.

Polymeric nanoparticles, metallic nanoparticles, zinc oxide Nps, Nanocreia, and electrospun nanofibers have been used to stop bleeding and wound healing. For instance, electrospun N-Alkylated chitosan (NACS) fibers have been studied as an effective hemostasis agent. NACS can be used to stop bleeding by converting whole liquid blood into a gel immediately. The main mechanism of clotting by Ch-based hemostatic agent acts is by adhering and physically sealing the bleeding wound, based on mainly the electrostatic interaction between positive charge of protonated amine group of Ch and negative charge of erythrocytes cell membranes. These fibers have been shown to be in favor of the activation of coagulation factors and platelets.

Moreover, there are some of the nano hemostasis materials commercially available or in the phase of FDA approval, such as silver NPs (various FDA-approved silver-based formulations have been used for chronic wounds). For instance, Acticoat produces wound dressing consisting of silver nanoparticle, which can be released to the wound. Electrospun nanofibers, synthetic fibrin polymers, and nanocarriers for drug delivery are other nanostructured materials, which are in FDA-approval phase. In addition, thrombin nanoparticles, which have been used as a hemostatic agent in internal bleeding, PolySTAT, chitosan nanoparticles, and electrospun fibers are hemostasis materials approved by FDA. One commercial device for wound healing is SpinCare, which is a portable electrospinning device and can produce nanofibers containing drugs like antibiotics, as well as antibacterial compounds, collagen, silicon, and other substances that may facilitates healing a wound.

PoCT devices monitoring

Commercial point-of-care testing (PoCT) devices for blood-coagulation monitoring can be divided into two categories–devices for standard diagnostic blood clotting tests, such as PT/INR, and APTT tests and devices which measure directly the viscoelastic properties of clotting blood. Hand-held devices to conduct blood clotting tests include Xprecia Stride coagulation system and CoaguChek, which are working based on electrochemical sensing, optical coagulation analyzer (OCG-102), which is working based on optical technology, and COAGMAX is a MEMS device. This portable device allows monitoring of clotting status in homes, and also facilitates the rapid assessment of clotting status in all clinical scenarios, including operating and emergency rooms. On the other hand, the second category of devices provide more information and coagulation parameters similar to TEG/Rotem devices. For instance, TEG-6S is a miniaturized version of TEG system that consists of a microfluidic cartridge and piezoelectric resonators, Thrombodynamics analyzer provides thrombodynamics analysis (TD), based on the analysis of thrombin distribution with optical and fluorescent imaging, and Quantra hemostasis analyzer is a newly developed device for evaluation of hemostasis, providing clotting time, clot stiffness, platelet, and fibrinogen contributions to clot stiffness based on the ultrasonic technology.

Although recent developments in blood-coagulation analyzers are promising, there remain a high potential for developing novel monitoring and therapeutic technology in the future, based on photoacoustic detection and nanotechnology.

Novel anticoagulant therapies

Anticoagulants are used to treat blood clots during thromboembolic events, which do not have specific signs and consistent symptoms. For example, these agents are used to prevent and treat venous thromboembolism, for stroke prevention in atrial fibrillation, embolism prevention in heart failure, and in the management of atrial fibrillation. These new oral anticoagulants are in various phases of clinical development. Direct thrombin inhibitors (DTI) prevent thrombin activity in free plasma and at the thrombus. Lepirudin, bivalirudin, argatroban, and fondaparinux are in this category of anticoagulants. Consequently, they block conversion of fibrinogen into fibrin, decreasing thrombin generation, which affects the amplification and propagation of coagulation. On the other hand, direct factor Xa inhibitors (DFXaI) directly affect factor Xa without effects on other intrinsic/extrinsic coagulation pathways. Rivaroxaban, apixaban, edoxaban, and betrixaban are in this category of anticoagulants.

With the introduction of novel anticoagulant therapies, the validity and applicability of current coagulation measurement techniques have been in question. The new generation of anticoagulant therapies, involving dabigatran, rivaroxaban, apixaban, edoxaban, and betrixaban were designed to minimize the requirement for monitoring or dose adjustment of the patient. However, while with these novel anticoagulants, the need for monitoring might be reduced, it will never go away for patients with special needs like kids, pregnant women, and senior people. New devices have been shown to be capable of measuring and studying effect of both types of DOACs–direct thrombin inhibitors and anti-Xa(s)–although these devices have not been employed in all clinical centers. Therefore, the applicability of already-established methods needs to be verified with these novel drugs and new methods and parameters, which will enable their monitoring need to be established.

The manufacturers are actively pursuing novel analyzers, which more specifically assess the role of platelets in human pathologies, including bleeding and thrombotic disorders, cancer, sickle-cell disease, stroke, ischemic heart disease, and others. There are several analyzers like acoustic waves that are already commercially available, and their ability to assess platelet contractile forces. These analyzers are utilized in a miniaturized PoC device, capable of using only a small amount of citrated whole-blood, measuring the time required for fluorescent microspheres to cease motion due to clot formation. The result provided is a clotting time in seconds. Also, this system may be useful for assessing anticoagulant effects.

The ongoing novel strategies, based on microfluidics and nanotechnology, may enable potential for self-testing, self-monitoring but a great reduction in sample volume is needed. There are important mechanical parameters that relate to coagulation but are not measured, and finally they do not evaluate, monitor, or mitigate acute bleeding or thrombosis risk. These drawbacks demand for the development/standardization of novel strategies that can improve the clinical diagnosis process. A continuous quest is ongoing to discover new methods of clot detection, or other novel types of coagulation analyzers are in development or will soon be ready for prime time for use in routine diagnostics of hemostasis disorders. However, these require more standardization and more clinical studies to assess and exploit their potential before they are made available in the market.

Multiplexed sensing

Electrochemical biosensors, embedded inside microfluidic chips, facilitate multiplexed sensing of different parameters like pH, oxygen, glucose, lactate, and chloride. In addition, microfluidic centrifugal technology has enabled miniaturization of typical laboratory processes, such as blood plasma separation and enzyme-linked immunosorbent assay. In this regard, combining these novel platforms with microfluidic viscometers lead to the development of multiplexed microfluidic chips for blood-coagulation monitoring and other blood tests. Moreover, different fluorescent probes provide monitoring of different blood-coagulation factors, such as thrombin and fibrin. Multiplexed sensing for both blood-coagulation analysis and other biochemical parameters is promising for developing low-cost and multiplexed blood assessments.

AI in diagnosis and monitoring

With the advancements in artificial intelligence (AI) and machine learning, algorithms that can track multiple parameters simultaneously throughout a treatment/diagnosis and find out patient-specific patterns that can aid in pinpointing proper treatment or underlying causes will become one of the biggest developments in coagulation-measurement technologies in the upcoming years. Especially with the challenges set by the novel anticoagulant technologies for the current measurement techniques and the validity and applicability of diagnostic parameters such as INR, simultaneous observation of multiple parameters or complicated patterns within them may be necessary for proper observation of patients with special needs. For these special cases, AI and machine learning-based algorithms may very likely find place within the future novel PoC blood-coagulation measurement technologies in the upcoming years.

Outlook

Blood-coagulation monitoring with high level of accuracy and reliability for anticoagulant drug dose adjustments, studying effects of the drugs, and checking the risks in surgeries for the patients is highly demanded. Viscoelastic assessments, optical, and electrical impedance measurement are frequently used for both evaluating pharmacological treatments and diagnosing the blood-coagulation abnormalities. Recent advances in microfluidic technology has enabled the researchers to simulate the blood-coagulation process in physiological conditions, and study the events in the molecular level.

Moreover, the fluorescent imaging and targeting different particles with fluorescent probes in microfluidic channels facilitate understanding of the interactions and origin of defects with a remote, accurate, and multiplexed manner.

Other platforms like centrifugal microfluidic devices can be used for future multiplexed analysis of blood as it facilitates the separation of different blood components.

Industry Speak

D-dimer plays an important role in screening COVID-19

Dr Omkar Kadhane

Dy. Product Manager–Coagulation,

Transasia Bio-Medicals Ltd.

While we wait for a vaccine for COVID-19, it is important to understand the pathophysiology and clinical manifestation of the infection for preventive and treatment strategies.

Role of D-dimer in COVID-19-associated coagulopathy. Coagulopathy in patients hospitalized with COVID-19 is characterized by elevations in fibrinogen and D-dimer levels. D-dimer is a protein fragment that is produced when a blood clot dissolves and its levels are elevated when large numbers of clots are breaking down. Recent IFCC guidelines recommend D-dimer testing in patients with COVID-19, since studies reveal a high correlation between severity and outcome of COVID-19 in patients with increased D-dimer levels. A D-dimer value >1000 ng/mL is alarming for a COVID-19 patient with venous thromboembolism (VTE) complications. This rarely referred parameter has now become a point of major concern for clinicians or pathologists combating the pandemic.

Methods for detecting D-dimer levels. Enzyme-linked immunosorbent assay (ELISA), chemiluminescence immunoassay (CLIA), immunofluorescence assay (IFA), point-of-care testing, and immunoturbidimetric assay are various methods for D-dimer detection. The automated latex-enhanced immunoturbidimetry assay on coagulometer is the most commonly used technology. This quantitative method provides valuable information about the prognosis of thromboembolic disease. These assays are faster, with higher sensitivity and specificity and easy to process on fully automated coagulation analyzers, thus making them a method of choice.

Variances in reporting. Depending on the method, results are reported as fibrinogen equivalent unit (FEU) or D-dimer unit (DDU). FEU is 1.7 times higher than DDU. This can lead to significant errors during method comparison. It is thus necessary for laboratories to comply with the reporting recommendations of the reagent manufacturer.

An early indicator for exclusion of DVT and PE monitoring. Transasia’s Erba D-dimer R reagents help in determining the change in D-dimer concentration, as an early indicator for exclusion of DVT and PE monitoring. The tests are pre-programmed and can easily be performed on Transasia’s ECL series analyzers.

At a nascent stage

Vikram Tandon

Executive Vice President,

Agappe

The Indian IVD market coagulation segment is still at a nascent stage, where instruments and reagents put together have a 2 percent market share. Reagents have the highest share, contributing more than 65 percent of the revenue. The market is dominated by the semi-automated systems but there is an increasing trend in automation. Prothrombin Time, Activated Partial thromboplastin time and fibrinogen are the major tests performed in this segment. The number of laboratories performing coagulation tests or profiles are considerably low in the market. One of the reasons for such low testing is the lack of automation and the high recurring cost. Unfortunately, there are few manufactures in India for the instruments (semi-automatic systems).

The coagulation market is expected to reach `170 crore by the end of March 2021. COVID-19 has created a shift in the market segment, and there is a huge demand for coagulation-associated parameters like D-dimer. D-dimer, one of the fibrin degradation products is useful for diagnosis of deep vein thrombosis. The recently published IFCC guidelines on COVID-19 strongly suggest D-dimer testing in patients with COVID-19 since studies on SARS-CoV-2 revealed a high correlation between severity and outcome of COVID-19 in patients with increased D-dimer levels. D-dimer levels are also a predictor of developing acute respiratory distress in COVID-19, mentioning the probability of micro pulmonary embolism especially in severe forms of COVID-19. With an increase in the number of COVID-19 cases in India, there is an increased demand for COVID-19 parameters like D-dimer, Ferritin, and CRP.

Fortunately, all these parameters are available to perform in our specific protein system Mispa i2, i3, and the newly launched Mispa CXL pro clinical chemistry automation platform. We at Agappe are committed to give the best product at affordable price to the labs and hospitals in India. To address the need for these parameters, we have increased our production cycle for the COVID-19 parameters and at present we are having more than 8500 Mispa-i series instruments performing these tests in India.If the parameter D-dimer is considered in coagulation segment, the market share of coagulation will become bigger than the expected by the end of March 2021.