Hematology Instruments and Reagents

PoC hematology analyzers-Gaining momentum

In laboratory hematology testing, CBC tests account for about 40 percent of total revenues, compared with hemoglobin at 20 percent and other tests (e.g., hemostasis and coagulation) combined at the remaining 40 percent. Improved cost efficiency of benchtop analyzers is among the factors that have been driving this development, which is seen further accelerated by the Covid-19 pandemic.

Another practice that has gained increased popularity during the Covid-19 pandemic is telemedicine, with the opportunity to provide patients access to medical experts at a lower cost. However, telemedicine does not allow diagnostic testing. Patients monitored for disease recovery or adjustment of medication dosage for chronic diseases would greatly benefit from having access to nearby testing services to prevent prolonging the time to a new diagnosis. Applicable diagnostics should be readily deployable, easy to use, portable, and accurate so that they fit mobile laboratories, pop-up treatment centers, field hospitals, secluded wards within hospitals, or remote regions, and can be operated by staff with minimal training.

In hematology, point-of-care testing (POCT) is generally limited to hemoglobin and hematocrit testing by blood gas devices and POC coagulation monitoring, such as prothrombin time and INR for patients on warfarin.

Some studies have investigated portable instruments using newer technology, such as single-sample cuvettes and image analysis, microfluidic cartridges, and the lab-on-a-chip/micro total analysis system platform, which provides complete blood cell count tests, including 3-part differential white blood cells, red blood cells, platelet count, and hemoglobin for rapid diagnosis in resource-poor environments. A rapid complete blood cell count and differential blood panel can help clinicians determine whether a patient is suffering from a viral or bacterial infection and whether he or she requires admission and antibiotics.

The use of POC INR testing has become popular for at-home testing and allows patients to easily use a device to monitor their INR and report their results to a clinician (either in person or via telephone), who can then adjust anticoagulant dose, if necessary. The most common symptom of patients with venous thromboembolism is chest pain or dyspnea, but patients may also present with leg problems, arm pain, or chest tightness, or be asymptomatic. In a systematic review and meta-analysis of 11 trials with data for 6417 participants and 12,800 person-years of follow-up, there was a significant reduction in thromboembolic events in the self-monitoring INR group (hazard ratio, 0.51; 95% CI, 0.31–0.85) on oral anticoagulation. Participants younger than 55 years showed a striking reduction in thrombotic events (hazard ratio, 0.33; 95% CI, 0.17–0.66), as did participants with mechanical heart valves (hazard ratio, 0.52; 95% CI, 0.35–0.77), so the authors suggested that patients should be offered the option to self-manage their disease with suitable healthcare support.

POCT is likely to play an increasing role in healthcare delivery in the future. It will improve access to healthcare and increase the efficacy of service provided to patients. Although POCT provides laboratory results faster than the traditional central laboratory, process improvement is needed to optimize the accuracy of laboratory results.

Molecular POCT for common pathogens in select populations, such as in intensive care or other common illness presentations, needs to be evaluated to further improve patient care and effectively manage healthcare resources. Despite several advantages of POCT, limitations include cost, imprecision and inaccuracy, requirement for an interdisciplinary approach, and human error. Although the use of POCT is expanding in many areas, the limitations must be understood and improvements in analytical performance achieved to properly interpret POCT results.

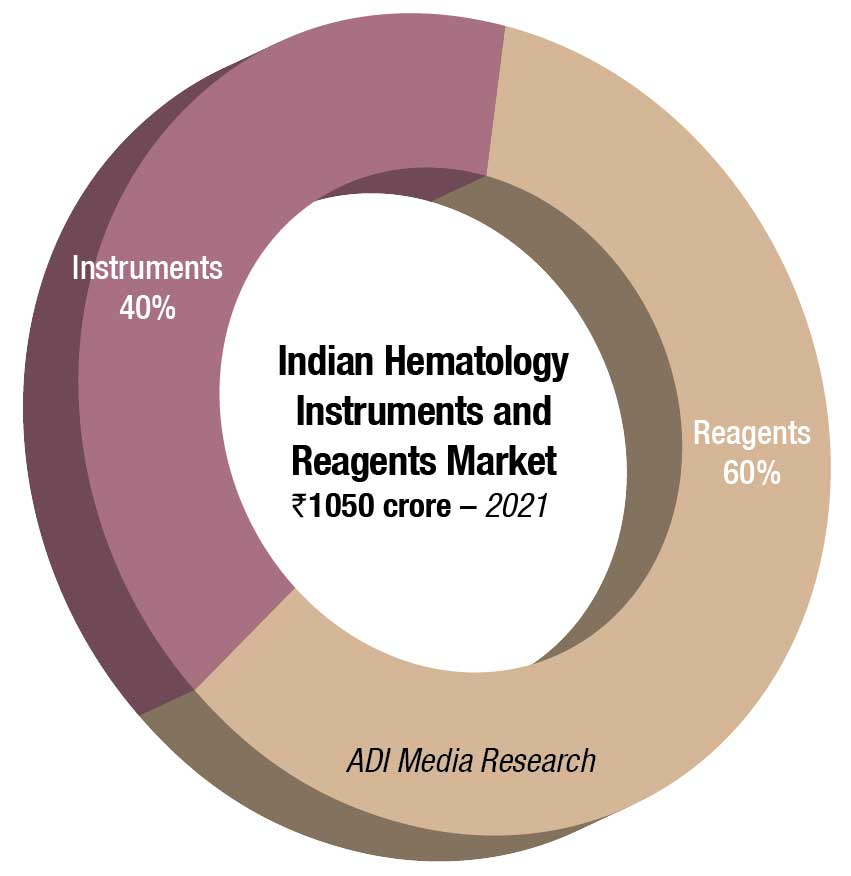

The Indian hematology instruments and reagents market in 2021 is estimated at ₹1050 crore. Reagents constitute 60 percent of the market at ₹630 crore and instruments ₹420 crore.

While 2020 had seen a decline with funds diverted for Covid-19-related activities, particularly from the decline in procurement by the government, 2021 saw a slight revival. There has been a spike in purchases by the government in 2022, with January–May seeing healthy demand. However, the CAGR over the next five years is expected to decline from 12 percent to 8–9 percent.

| Indian hematology instruments and reagents market | |||

| Leading vendors* | |||

| Tier I | Tier II | Tier III | Others |

| Sysmex, Horiba, and Mindray | Beckman Coulter and Transasia | Abbott, Nihon Kohden, and Siemens | Trivitron, Boule, Agappe, CPC, Roche, Dirui, Meril, Beacon, Peerless Biotech, Diatron, Shenzhen Prokan, Urit and many small importers |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian hematology instruments and reagents market. | |||

| ADI Media Research | |||

With the Make in India initiative getting a major push from the government, the 3-part analyzers have potential, since 5-part are not being manufactured in large numbers. The demand for 3-part single chamber, however, continues to decline. The price gap between 3-part dual chamber and 5-part entry models continues to narrow, hence a distinct shift in preference for 5-part entry level is observed.

The market continues to be dominated by three players, Horiba, Mindray, and Sysmex. Beckman Coulter has success with the replacement market. Transasia is gradually cementing its presence, as is Boule. Abbott, Trivitron, Nihon Kohden, and Siemens are also aggressive. Many other players, including Beacon, CPC, Urit, and Meril, are active in this segment.

With customers now more inclined to go for preventive diagnostic tests, the path labs at large are investing in automated cell counters, and there is a distinct decline in manual microscopy solutions. Having said that, the smaller diagnostic centers, having lost money in the last couple of years, with regular testing almost nil, consolidation has given negotiating pricing power to the larger labs, with the vendors. This is manifested in a steady increase in procurement of 5-part high-end analyzers.

The PPP model is also finding popularity, Some large players like Manipal Group, through its group entity Manipal Healthmap Medall, SRL, and Krsnaa Diagnostics have focused their energies on this collaborative mode of delivery system. Over the last couple of years, the state governments invited tenders for private players to set up diagnostic centers to be run under public-private partnership (PPP) mode. The diagnostic centers use hospital facilities and conduct tests for patients at the rates fixed by the government.

Under this plan, private partners are establishing as many collection centers at hospitals in the district as possible and providing services. For services not available at the district hospital, the partner procures machines from the market to carry out tests.

The respective health departments have planned that the service provider is responsible for investing in the equipment and manpower as per the terms of reference of operating the center, providing the service and adhering to the laws and regulations that govern the process.

Focus on healthcare has bolstered in recent years in India and this has created many opportunities for healthcare diagnostic providers. The nation is also experiencing a surge in instances of blood disorders and incidence of blood cancer, which is also a factor that promotes demand for hematology diagnostics. Hematology diagnostic providers can focus on India and gain from the untapped potential that the market has to offer, and increase their global revenue potential.

Analyzer, reagent, and software development need to be backed up by support from the supplier. The importance of good and ongoing training and support cannot be over-emphasized, both for the optimal operation of the instrument and for quality control and result interpretation.

POC diagnostics will make routine health testing more accessible, inexpensive, and actionable for connected consumers as the industry transitions toward a more patient-centered healthcare delivery system, guaranteeing that everyone who needs a test can get one.