Industry

Promising opportunities for the industry in the next decade

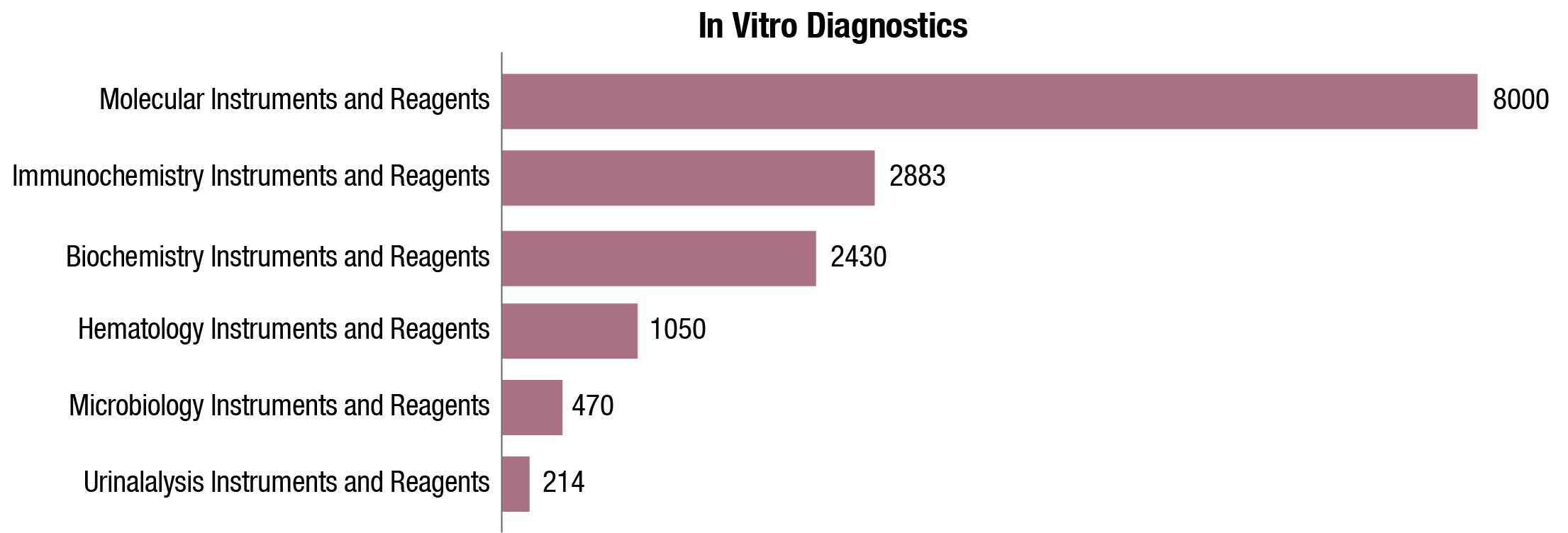

In vitro diagnostics (IVDs) form a significant and indispensable part of the patient journey in the current healthcare systems. Over the last two decades, they have significantly advanced from being just screening tools. They are not only enabling better healthcare efficiency but also better economics of treatment as well. This has become possible by, them being part of screening, diagnosis, determining prognosis, stratification of patients, as well as monitoring during the treatment cycles.

The Indian IVD market is estimated at ₹67,830 crore in 2021. The market growth has been propelled by rapid technological advancements as swift growth in diagnostic imaging, emergence of hub-and-spoke model, higher medical focus on evidence-based treatment, rise in non-communicable diseases and lifestyle-related diseases, increasing penetration of insurance and demand for preventive diagnostics. Diagnostics is closely linked to delivering superior outcomes for patients as the world and especially India moves toward evidence-based medicine.

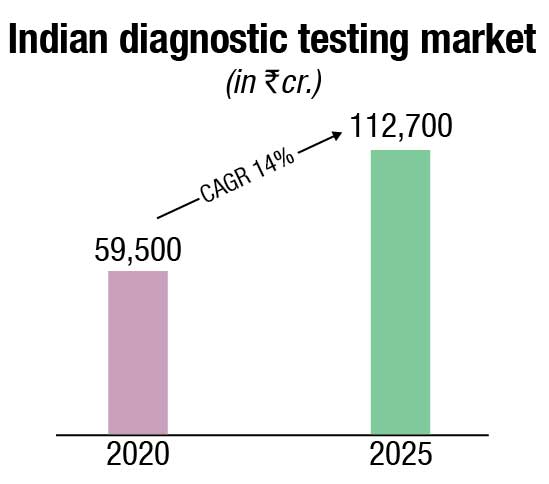

The non-critical visits to diagnostic labs declined due to the pandemic in 2020. However, high demand for Covid-related tests, such as RT-PCR, antigen, antibody, and CT scans offset the fall in non-critical tests and resulted in a 13 percent net drop in the diagnostics market in 2020. Effectively the diagnostics market dropped to ₹59,500 crore in 2020.

A considerable 46 percent of the diagnostics market is unorganized, led by stand-alone labs. The remaining 54 percent organized channel is further segmented into hospital-based labs, diagnostics chains, and online. Hospital-based labs cover 37 percent of the market, wherein most of the major hospitals have their own diagnostic arms, and the smaller hospitals partner with third-party labs to manage their diagnostics facilities. Diagnostics chains cover 16 percent of the market and have grown at a 15-percent CAGR. 60–65 percent of the diagnostics chain segment is led by regional chains, and the remaining 30–35 percent market is led by providers having pan-India presence. Online diagnostics accounts for 0.6 percent of the market as of 2020 but has emerged as a promising channel in the last couple of years, providing the convenience of home sample collection and advanced test booking. The organized sub-channels and players focus heavily on quality, accreditation, and offer complex tests, which are not offered by standalone labs – this made them better placed to serve the rising demand for Covid-19 tests.

Preventive diagnostics has emerged as a promising use-case in recent years, led by growing consciousness about staying healthy, especially among the GenZ and millennial consumers. The preventive use-case has also received a push from the employee health-tracking initiatives implemented by corporates. Hence, while the preventive segment is relatively small in size (just over 10 percent of the diagnostics market), it has grown at a 27-percent CAGR – more than 2x growth of the curative segment. While the demand for preventive tests dropped in the short term due to the pandemic in 2020 (as curative tests took precedence), it is projected to get back to rapid growth levels as the pandemic recedes within the next couple of years.

By 2025, the diagnostics market is projected to reach ₹112,700 crore, growing at a 14-percent CAGR in the period 2020–2025. The key growth factors are the continued shift from curative to preventive care (will contribute to the rise in the higher ticket size preventive segment), projected rise in India’s population above 65 years of age (who have a greater need for medical diagnostics), emphasis on evidence-based treatment, conducive government policies (such as AB PMJAY, free essential diagnostics under NHM, promotion of preventive diagnostics via tax benefits), and the growth in lifestyle diseases requiring regular need for diagnostic tests (e.g., blood sugar monitoring).

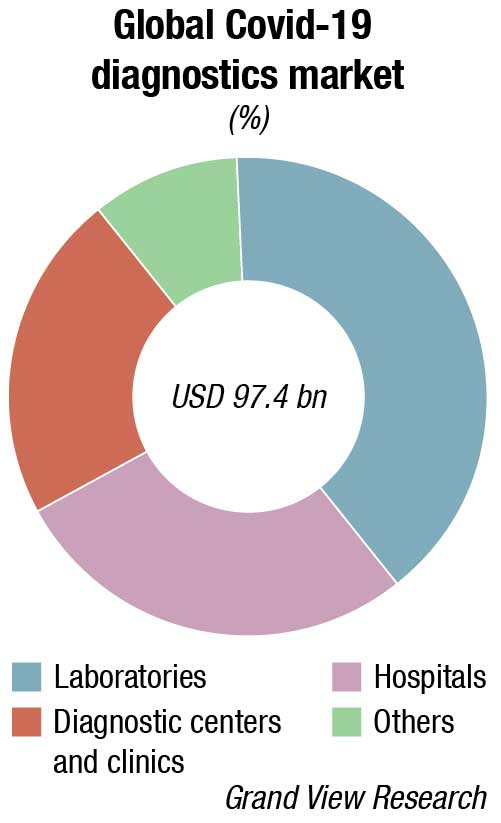

The world IVD market is expected to reach USD 127.4 billion in 2022, as per a recent Kalorama’s market research report. Covid-19 testing will contribute USD 32.6 billion to the market but the bulk of the market revenues, USD 94.8 billion, will be generated by non-Covid-19 IVD tests. The IVD market continues to expand and will exceed USD 140 billion by 2027, due not only to increased sales of existing products but also new product development. In the past, it would not have been tough to imagine the use of IVDs for diagnosis of potential head trauma in sports or to use tests to aid in diagnosing depression. This is now a reality.

Hopes for extremely wide usage of genetic tests have not always panned out, yet this segment is seeing test revenue growth even as medical societies and governments are weighing in with caution on these tests.

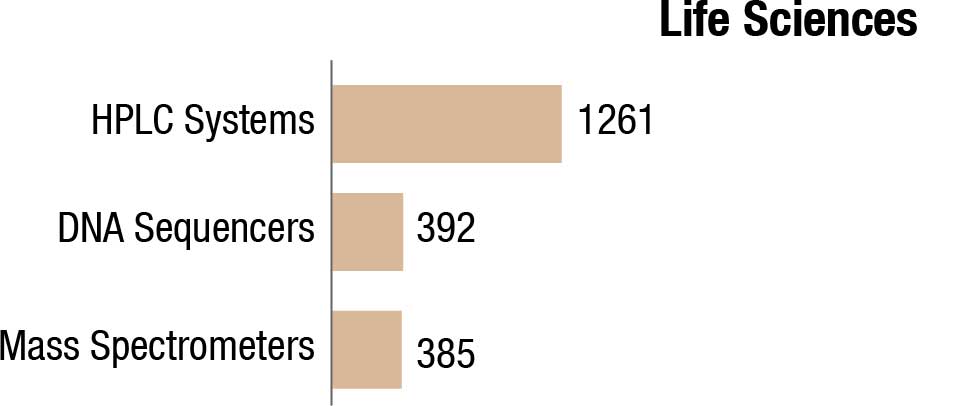

Mass spectrometry was once a novel technology used for diagnostics at a few university hospitals. It expanded into advanced microbiology systems, and now it is being used for diabetes testing and vitamin C tests.

The Covid-19 pandemic took focus and publicity away from cancer testing, but testing continued nonetheless. The markets for cancer testing will thrive – in 2022, revenue segments related to cancer testing are among the fastest growing; these include in situ hybridization tissue DNA tests, blood tests for molecular cancer markers, immunohistochemistry, and HPV molecular tests.

But it is not just cancer diagnostic testing that will find demand – drug-of-abuse tests (the IVD terminology for tests outside of criminal or employment testing), cardiac markers, fecal occult blood tests, and glucose tests will show greater than average growth. Inherited disease tests and molecular tests for organ transplants are areas of high market growth.

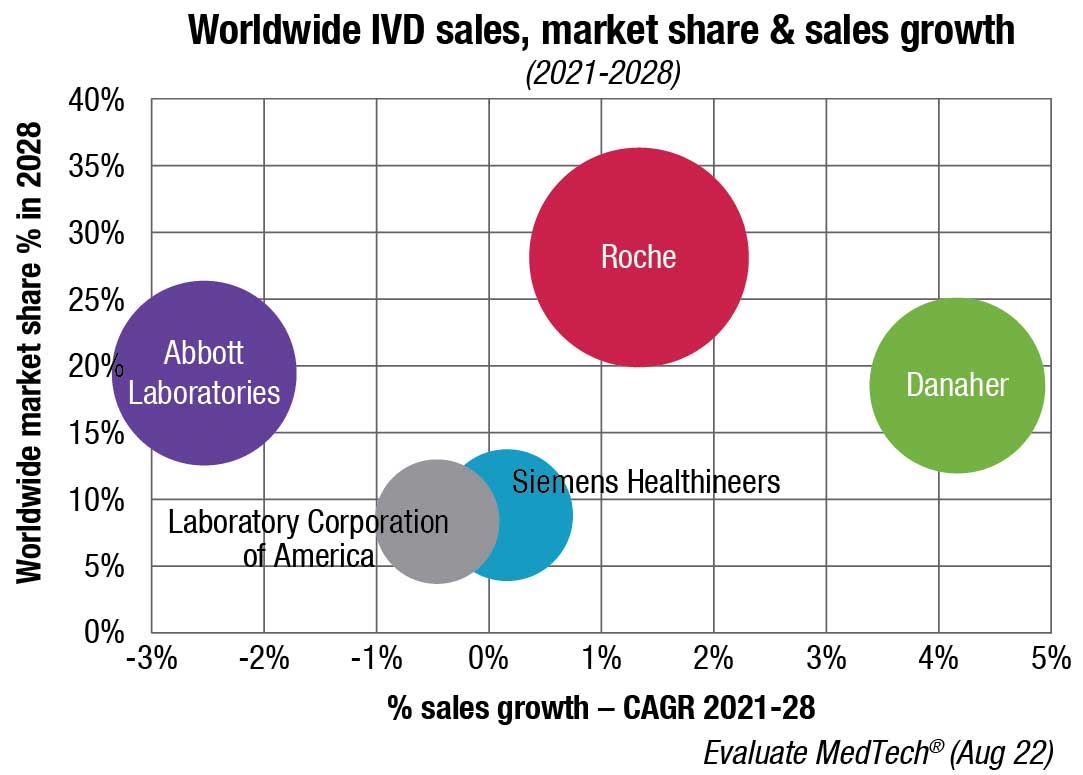

Who earns this revenue? Most of the revenues in the market are reported by about a dozen dominant companies.

The leading position of Abbott, one such dominant firm, is partly due to demand for its point-of-care products (stemming from its Alere acquisition in 2017), products developed for Covid-19 testing, and the continued presence of a testing market for infectious diseases. Abbott’s glucose test sales have also contributed.

Meanwhile, Roche’s presence in large hospital systems in the US and other areas, its partnerships with pharmaceutical companies, and its tissue diagnostics offerings keep it in a leading position.

bioMérieux, Bio-Rad, Sysmex, QuidelOrtho, Siemens Healthineers, Beckman Coulter, Cepheid, and Becton Dickinson are among other market leaders.

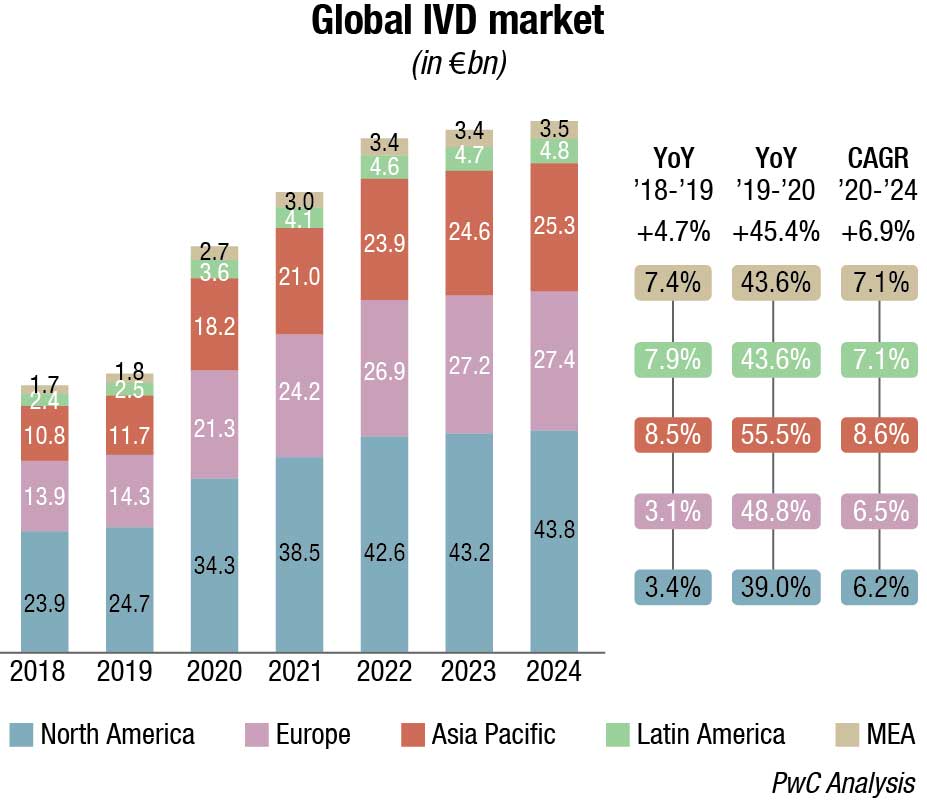

Many factors support a robust world market. China is the world’s largest and one of the fastest-growing IVD markets. Thus, it is a target by all major IVD vendors for replacing some revenue lost to slower growth in developed healthcare markets. The global industry has increased activities here in the past decade, and companies not only sell IVDs but manufacture and distribute here as well. In 2021, the Chinese market for IVD reagents was estimated at approximately USD 4.8 billion, and is expected to show annual growth of 8 percent over the next five years.

Expanding beyond the top seven emerging markets is essential for growth in the global IVD industry. Eastern Europe, LATAM (outside of Brazil), and Eastern Europe represent next-tier emerging regions.

Many companies are seeking out Eastern Europe as a place to make gains. The European Diagnostic Manufacturers Association (EDMA), for instance, reports that new members, generally Eastern European nations, allocate more than three times their healthcare spending to IVD than do their newer members, generally the Western European nations.

With a longer-term focus, Africa must be part of 5- and 10-year business plans for companies not already in the region. There are already global companies in the region. More than half of global population growth between now and 2050 is expected to occur in Africa, according to the UN. The American Association for Clinical Chemistry announced an expansion of their Global Lab Quality Initiative (GLQI) to Africa next year. The program circulates testing best practices, providing method verification workshops and other training and education. For 8 years, the GLQI has worked with partner associations in Latin America and the Pacific region.

Meanwhile, the IVD market in India is considered complex in its regulatory process, and has a fragmented system for device registration and geographical market penetration. Despite the challenges, the IVD market India is growing and showing a steady flow of foreign investments. India is highly dependent on medical imports, and that market continues to grow despite the increasing number of domestic medical equipment suppliers.

Despite great attention and much action, the opioid crisis continues to plague the United States and countries of the world. Total overdose numbers remain over 70,000, per CDC statistics, indicating that the problem is still severe. The American Association of Clinical Chemistry released a position statement at their recent convention, calling for increased collaboration between clinical laboratories and other stakeholders. Early detection of cancer and the popularity of consumer genetic tests are also likely contributors to the increased recognition of IVD testing. While this is happening, various worldwide payor schemes are pressuring prices. The response is consolidation of lab operations and facilities. Same with IVD vendors. Consolidation remains the rule in the industry among both customers and vendors. Top-tier IVD companies accounted for some USD 55 billion of IVD product sales last year. Part of this development is related to organic company growth and also to strategic acquisitions that add revenue streams and product innovations.

Indeed, the top-tier plus the next-tier companies – less than 40 companies – account for a majority of the world market for IVDs. The remainder is held by 100s of companies, some of which specialize in specific test segments and others that serve their local markets.

That should foretell no lack of dynamism in the industry. Beyond the market numbers, the pace of mergers and acquisitions is brisk. There are also IVD startups and ventures. These new ventures create technology that may fail or may create the next Foundation Medicines, Aleres, or Pacific Biosciences that will be consumed by a larger player in the future. Or like Illumina, they may yet grow to become technology leaders and dominant.

This technology innovation, produced by these companies and ventures, will run up against another trend – value-based testing. What clear benefit does a given new technology add to the status quo of practice? How does a discovered biomarker relate to the doctor and the patient? The EU IVDR directives insert clinical validity into requirements directly into permission to market a product in Europe, with staggering processes and paperwork requirements, and an upshifting of classification where contagious conditions or expensive treatments are involved. In the United States and other nations, expect these trends to enter in the payment process, if not the regulatory one. Because in vitro diagnostics are so integral to patient care, particularly for oncology, developers must be aware of how quality and efficacy data pertaining to their device will be used.

Due to Covid-19, diagnostics had come in the limelight, and public and private investors are watching how the pandemic may impact the IVD market in the future. As the sector receives an influx of investment, companies will be in strong positions to expand their portfolios.

What a year for deals in the IVD sector, for both buyouts and corporate mergers and acquisitions 2021 was! The number of deals nearly doubled to 34 in 2021 from 18 the prior year, with most of the growth in Asia-Pacific and Europe. Disclosed deal value soared to USD 11.1 billion from USD 2.4 billion. Indeed, there was so much life sciences activity that this year’s report breaks out the sector for the first time.

Traditionally, life sciences assets have been most attractive for corporate buyers, but as the industry evolved to focus more on treatment and detection of infectious diseases, private equity investors have been able to get their foot in the door. They have primarily targeted tools and technologies used for therapeutic research and diagnostics.

Diagnostic labs have proven to be reliable long-term investments, and in 2021 investors showed great interest in lab consolidators, particularly in Europe and Asia-Pacific, as well as companies that specialize in early disease detection. Covid-19 testing has provided significant cash flows; while testing volumes fluctuated as vaccinations rose, waves of Covid-19 variants are likely to require further interventions from these operators.

In this context, private equity firms have targeted clinical diagnostic providers. Two notable European deals were the EQT acquisition of Cerba HealthCare, a European lab and diagnostics provider, for USD 5.3 billion (an exit opportunity for Partners Group), and the Goldman Sachs, OMERS Infrastructure, and AXA purchase of Amedes Holding, a German-based operator of diagnostic laboratories. The Cerba and EQT partnership has already started playing out its strategy by announcing the add-on acquisition of Viroclinics–DDL. In Asia, notable activity included Catterton Management’s USD 181-million investment in the Japanese company PHC Holdings. Specialty diagnostics firms also stepped up their investments, such as ArchiMed’s acquisition of Zyto Group, a fully integrated cancer diagnostic test and equipment provider for clinical pathology labs.

As drug development and research advances, lab equipment has become more attractive for investors. Key deals in 2021 included Carlyle’s acquisition of Unchained Labs, a life sciences tool company and provider of biotechnology solutions, from Novo Holdings for USD 435 million; Altaris’s purchase of a majority stake in Solesis, specializing in biomaterials for life sciences companies; and the acquisition by Adelis Equity Partners of Nordic Biosite, a distributor of diagnostic and life sciences products.

Going forward, IVD investments will face a wide range of hazards in the future.

Trends to watch in the in vitro diagnostics market. The following long-term trends will tend to inform what the future IVD market size in various segments will reach.

Direct-to-consumer IVD markets. There has been an explosion of genetic test services that aim to predict a person’s risk of developing various chronic diseases, such as diabetes, cardiovascular conditions, arthritis, Alzheimer’s, breast cancer, celiac disease, and psychological syndromes. For a long time, these test services flew under the radar, but with increased consumer demand, the USFDA leaped into action. The most advanced company is 23andMe (Mountainview, CA). Although the FDA approval for 23andMe services may have surprised some, the company has fastidiously conducted studies to prove the utility of its human genome direct-to-consumer test services. The company’s over-the-counter use tests are intended for use on genomic DNA, isolated from human specimens collected by the user. March 2019, 23andMe began offering a new genetic health predisposition report that offers customers insight into their likelihood of developing Type-2 diabetes. 23andMe received FDA clearance for the BRCA1/BRCA2 (selected variants) genetic health risk report. This was the first-ever FDA authorization for a direct-to-consumer genetic test for cancer risk. Yet, despite the well-known benefits of genomics to improve patient outcomes, access to genomic information in healthcare remains limited. It is generally accepted that a critical step in the commercialization of a test modality is the availability of quality-control standards.

Next-generation sequencing and IVD markets. Next-generation sequencing, accompanied by data analysis algorithms, can allow clinicians and researchers to uncover the hidden aspects of antibiotic resistance, cancer pathways, and rare and chronic diseases. This could mean precision medicine is beginning to put one-size-fits-all medicine in the archives of therapeutics. Their usage will be a large factor in the future growth of diagnostics. On average, more than 14 genetic testing units (GTUs) per day are entering the commercial market, a pace faster than in the previous high-growth years. Most disease processes involve a number of genes and cell pathways. New multi-gene diagnostic tests by whole genome and next-generation sequencing that examine thousands of specific gene sequences might one day hold the key to assessing disease risk, diagnosing diseases, and guiding precision medicine treatment decisions. However, artificial intelligence algorithms are needed to interpret the mass of the test data produced by these tests.

The testing of cell free and tumor DNA (liquid biopsy) is becoming an important tool for early and metastatic cancer detection. The technology is also playing a part in pathogen epidemiology. Established and new molecular techniques are being developed to realize the dream of unequivocal near-patient and point-of-care testing for infectious diseases and acute care analytes. This is important for resource-poor situations worldwide.

And then there is the emerging science of linkages between the human microbiome and the manifestation of a whole host of diseases. This phenomenon is creating a new approach to disease detection and therapeutics. Molecular tests, especially for inherited diseases and some FISH analyses, are extremely complex. The tests provide raw data, the interpretation of which sometimes baffles even the most experienced molecular biologists. New sequencing technologies are expanding the number of causative genes known for genetic disorders. Gene identification is the first step for future development of a targeted therapeutic, especially for cancer and rare diseases. Exosomes carry nucleic acids and proteins from their host cells and are widely considered to be essential for biomarker discovery for personalized healthcare diagnostics.

Tumor cells, for instance, release exosomes, which contain tumor-specific RNAs that can be isolated easier from biofluids, such as blood and urine than from biopsies. It is expected that exosome-based tests in routine genomic diagnostics will provide an alternative to tissue biopsies and create new opportunities in molecular testing, especially for cancer liquid-biopsy analysis.

Information technology and AI. Laboratory IT and clinical scoring systems and algorithms have been used in medical practice for some time; recently, there has been an increase in the application of machine learning (artificial intelligence) to improve these tools. While traditional algorithms require all calculations to be pre-programmed, machine-learning algorithms deduce the optimal set of calculations by searching for patterns in large collections of patient data.

There have been extraordinary advances in AI, the end-game for information technology. Similar to the product commercialization process that is evident in the liquid biopsy market, IVD companies’ efforts have been supported by the USFDA’s efforts to give products expedited review. This helps patients have more timely access to devices and technology that provide more effective treatment or diagnosis for life-threatening diseases.

More products have been cleared for clinical use, more new research use-only applications have come to the market and many more are in development – companies are collaborating to improve the power of data analysis for patient care.

Over the past several years, healthcare has witnessed a transformation with a shift from paper-based records systems to electronic records and incorporation of digital health-monitoring devices and advanced patient-screening systems. These advances have resulted in a data explosion, which can best be manipulated and analyzed using AI technology.

There is a new opportunity opening for clinical laboratories – micro-hospitals. Micro-hospitals feature 8 to 10 inpatient beds (but can have as many as 50 beds), and range from 15,000 to 50,000 square feet, whereas full-service hospitals are 100,000 square feet or more. Micro-hospitals are significantly less expensive than large hospitals to bring to market. For patients, micro-hospitals offer 24-hour care that cannot be found at healthcare clinics, located inside drugstores or urgent care clinics.

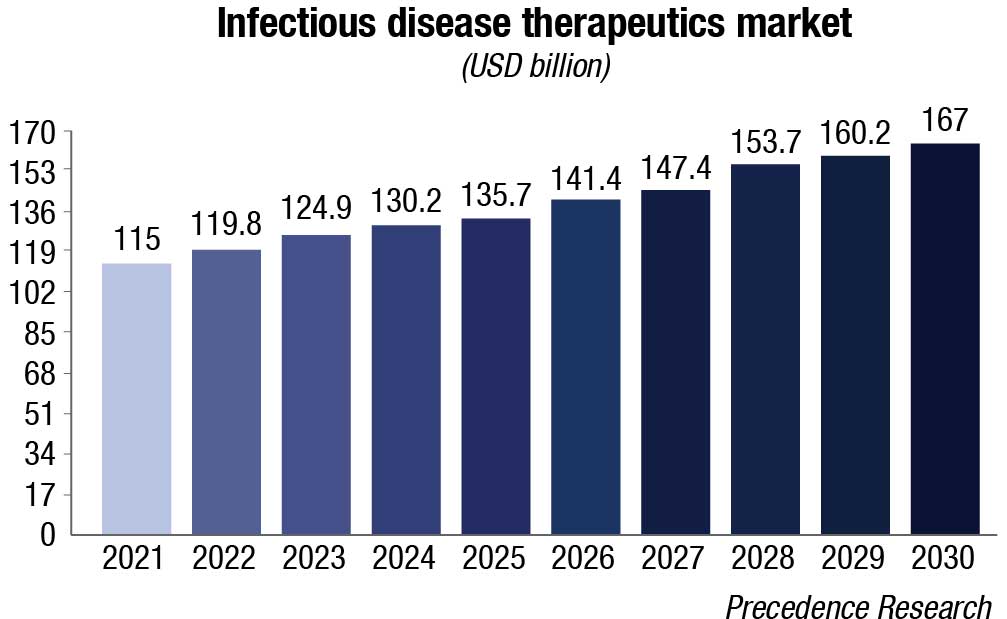

Cancer and infectious diseases drive IVD sales. Tissue-based testing for cancer and molecular tests for both cancer and infectious diseases are the growth engine among larger segments, growing at 50 percent higher than the overall market. Concern over sepsis and respiratory conditions should ensure that infectious diseases will remain in the fast-growth categories. Specialty immunoassays, continuous glucose tests, mass spectrometry, and inherited diseases are other large and high-growth segments.

Clear majority of market outside US. 58 percent of the market is now outside of US. Developed markets (N. America/Europe/Japan) still make up the bulk of IVD sales, but growth is dependent on the developing nations’ IVD markets. Among these markets are China, India, Korea, Turkey, and Brazil but IVD vendors are finding new emergent nations like the Philippines at 9-percent revenue growth or Malaysia with 8-percent growth. There are others. Both Colombia and Romania are charting better-than-world growth rates with 6-percent CAGR. There is also an IVD market recovery in Europe and growth in Japan.

Mass spectrometry (MS) has arrived. MS is a significant category in the market, especially in developed markets, for the identification of bacteria, fungi, and mycobacteria. The MALDI-TOF market has exploded in recent years in microbiology labs, thanks largely to the IVD regulatory approval of the VITEK MS and MALDI Biotyper histopathology is a new area of interest – Bruker Corp is developing technology to make MALDI imaging viable in histopathology. Throughput and operational complexity are limits, despite this fast growth in usage.

Migration, customer protection in the core laboratory. Major chemistry vendors are developing improved models, selling their existing customers on staying with them – to preserve and expand revenue, as well as create barrier entry against other vendors in a shrinking lab environment. Footprint improvements, IT enhancements, EMR, automation, and expanded menus are part of this change. While this is not part of traditional IVD commercialization, web-based and TV marketing has helped in a few categories and usage of such mechanisms would boost this category.

Hospitals driving point-of-care. It is a mistake to think that point-of-care is only used by physicians or self-testing. Hospitals are by far the biggest users of rapid IVD tests, and decentralizing certain tests for improved outcomes can boost the right system if the cost case can be made. The direct-to-consumer trend, recently successful in genomic-type tests, is one to watch. OTC HIV, cholesterol, and colon cancer tests are available alongside well-established pregnancy and glucose tests. Individuals can purchase lab tests in retail outlets or via the internet.

Decentralization in hematology is a trend to watch. In the US alone, there are approximately 35–40 million CBC tests run in physician offices. The market potential for decentralized hematology testing, worldwide, has led to the development of several tabletop and hand-held hematology analyzers, designed specifically for small labs and decentralized test sites, such as physician offices and clinics. Dedicated POC devices for hemoglobin/hematocrit have been available for many years. Hemoglobin test systems are used by office labs, hospitals, blood banks, dialysis centers, and public health agencies.

New drugs and coagulation testing’s future. In coagulation, patients with atrial fibrillation and artificial valves are beginning to switch from warfarin to next-generation drugs. This will affect routine screening clotting time assays – prothrombin time tests (PT) and activated thromboplastin time tests (aPTT) – that provide a gross assessment of coagulation capability. But this also provides another test opportunity in coagulation testing. Several companies have already commercialized tests for the monitoring of the new anticoagulant drugs.

The diagnostics and research tools fields are expanding in new directions. These developments have the potential to transform the industry and have ramifications across the value chain, touching patients, providers, insurers, scientists, laboratorians, and the biopharma industry. Diagnostics companies should consider their participation in these emerging fields as they build winning strategies.