MB Stories

Realising the promise of automation in biochemistry

Labs are expanding their business by expanding menu, opening new branches, and joining hands with existing market leaders, creating good demand for automation.

The healthcare industry is at the beginning of a new era of revolutionized practice in the clinical laboratory. There is currently a great shakeup in the history of pathology and laboratory medicine that will move pathologists and laboratory scientists into the center of patient care, and redefine their role from being diagnostic specialists into active participants in patient care through prediction of disease risk, assessment of prognosis, and guiding treatment decision in addition to patient follow up after treatment. This revolution is triggered by two distinct classes of innovations – sustaining and disruptive innovations. Sustaining innovations can be simply defined as improvements in the performance of currently existing technologies and methodologies that eventually lead to an improved product (e.g., a laboratory test) or a better function (e.g., making an existing technology more efficient or enhancing the capability of a current platform). There are plenty of examples of sustaining innovations in a laboratory setting. Disruptive innovation, on the other hand, is the introduction of a new concept/technology.

Disruptive technologies have their fingerprints in healthcare. Pathology and laboratory medicine are fertile soils for disruptive innovations because they are heavily reliant on technology. Disruptive innovations have resulted in a revolution of our diagnostic ability and will take laboratory medicine to the next level of patient care. There are several examples of disruptive innovations in the clinical laboratory. Digitizing pathology practice is an example of disruptive technology, with many advantages and an extended scope of applications. Next-generation sequencing can be disruptive in two ways.

The first is by replacing an array of laboratory tests, which each requires expensive and specialized instruments and expertise, with a single cost-effective technology. The second is by disrupting the current paradigm of the clinical laboratory as a diagnostic service by taking it into a new era of preventive or primary care pathology. Other disruptive innovations include the use of dry chemistry reagents in chemistry analyzers in the core laboratory and point-of-care testing (POCT).

The latter is defined as an investigation done close to the patient at the time of the consultation. These are usually performed by a nurse without the need for a laboratory technologist, with instant availability of results to make immediate informed decisions about patient care. There is a growing list of POCT, including pregnancy tests, measuring blood sugar level by glucometers, cardiac biomarker tests, and the list continues to grow. POCT has the typical features of a disruptive innovation, including being cheaper, quicker, and easier to perform, but with less accuracy compared to a standard laboratory test. Handheld analyzers for testing whole blood are another example of a disruptive technology that can be used for POCT, even at home.

The switch from manual labor-intensive laboratories into fully automated chemistry analyzers is another example of successful disruptive thinking. Manufacturers are now incorporating even more advanced technology in the chemistry core laboratory, including mobile general-purpose dual-arm robots that mark a new horizon for automations. These robots can perform certain repetitive tasks faster, cheaper, and more accurately than humans. They can be employed to perform sophisticated multiple-step tests like the enzyme-linked immunosorbent assay.

Disruptive innovations include the use of matrix-assisted laser desorption/ionization-time of flight (MALDI-TOF) mass spectrometry as a clinical tool for pathogen identification. Another emerging disruptive innovation, jointly developed by Google and Novartis, includes a glucose-sensing electrode with telemetry so that glucose levels are monitored from the tears of the eye and transmitted to remote devices. The use of disposable electronics is an interesting example of a disruptive innovation in POCT.

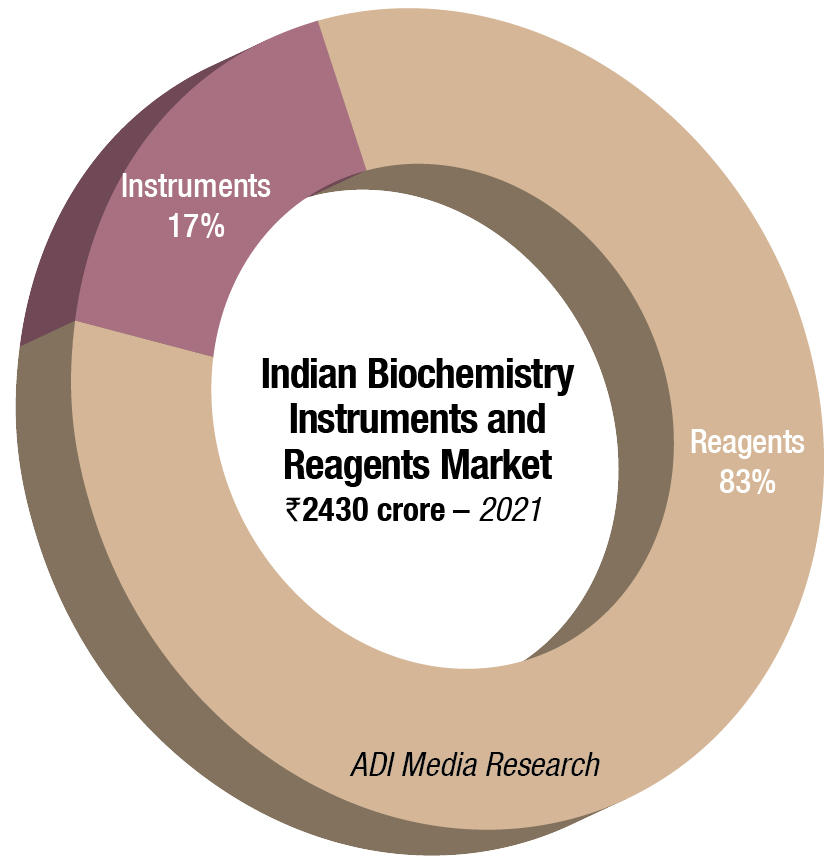

In 2021, the Indian biochemistry instruments and reagents market is estimated at ₹2430 crore, with reagents continuing to dominate at ₹2017 crore at 83-percent market share. This is a 22.08-percent increase by value and a 24.96-percent increase by quantity, over 2020.

The floor-standing analyzers are estimated at ₹129.34 crore and 925 units; benchtop analyzers at ₹121.84 crore and 2435 units; and semi-automated analyzers at ₹161.82 crore and 23,120 units. Almost 80–90 percent floor instruments are on rentals; this figure is much smaller for bench-top. Semi-automated instruments are all procured, with almost none on rentals. The size of the market has been calculated on assigning a monetary value to all the instruments installed, whether placed or sold.

|

Indian biochemistry instruments and reagents market |

|||

|

Major vendors* |

|||

|

|

FA | SA |

Reagents |

| Tier I | Transasia | Transasia | Transasia, Roche, Beckman Coulter, Siemens, OCD, and Abbott |

| Tier II | OCD and Roche | Mindray and Robonik |

Agappe, Randox, Accurex, DiaSys, Biosystems |

| Tier III | Mindray, Biosystems, Beckman, Abbott, Thermo Fisher, Siemens, Meril Diag, and CPC | Agappe, Eurit, CPC, Biosystems, Thermo Fisher, Accurex, Tulip, Microlab, Beacon, and regional brands |

Fuji, Mindray, Rapid, and local brands |

| Others | Trivitron, Sysmex, Tulip, Biosystems, and Accurex (Dirui) | ||

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian biochemistry instruments and reagents market. | |||

|

ADI Media Research |

|||

Transasia continues to be a clear leader in this segment. Roche, Beckman Coulter, Siemens, OCD, and Abbott are the other leading brands for reagents. It is estimated that ₹250 crore worth of reagents were consumed as a direct impact of Covid. The current pandemic increased the demand for special parameters like LDH/ferritin/D-Dimer/CRP. By 2022, this is expected to lose its momentum.

In the fully automated instruments segment, Mindray, OCD, and Roche have aggressive presence. Since Agappe represents Mindray, Canon (Toshiba), TokyoBoeki, Furono, and Dirui for fully automated instruments, the company has not been included in the tier table.

The global market for biochemistry analyzers, estimated at USD 12.3 billion in the year 2021, is projected to reach a revised size of USD 15.7 billion by 2026, growing at a CAGR of 4.5 percent. The exponential growth of the market is ascribed to the increasing advancements in technology and the rising healthcare industry requirements.

The introduction of robust software, and upgraded production methods are some of the other factors that are projected to drive the growth of the clinical chemistry analyzers market. The high capital investment required in this field and inadequately skilled laboratory technicians limit the overall market growth.

Reagents segment is projected to grow at a 4.9-percent CAGR to reach USD 10.6 billion by 2026. This is due to the presence of a vast collection of reagents in the market, serving various clinics’ requirements. Most importantly, the reagents are cost-beneficial, have optimal sensitivity, linearity, and accuracy, which as a result, ensure limited performance variations.

There are multiple reasons to encourage disruptive innovations in the clinical laboratory, including the escalating cost of healthcare, the need for better accessibility of diagnostic care, and the increased demand on the laboratory in the era of precision diagnostics. There are, however, a number of challenges that need to be overcome, such as the significant resistance to disruptive innovations by current technology providers and governmental regulatory bodies. The hesitance of healthcare providers and insurance companies must also be addressed.

Adoption of disruptive innovations requires a multifaceted approach that involves orchestrated solutions to key aspects of the process, including creating successful business models, multidisciplinary collaborations, and innovative accreditation and regulatory oversight. It also must be coupled with successful commercialization plans and modernization of healthcare structure. Fostering a culture of disruptive innovation requires establishing unique collaborative models between academia and industry. It also requires uncovering new sources of unconventional funding that are open to high-risk high-reward projects. It should also be matched with innovative thinking, including new approaches for delivery of care and identifying novel cohorts of patients who can benefit from disruptive technology.