Immunochemistry Instruments and Reagents

Reaping the benefits of immunoassay advances

In the coming years, advances in microfluidics, POC platforms, novel biosensors, lab-on-a-chip, new wash-free immunoassay formats, and smart technologies will lead to much enhanced multiplex immunoassays. The cost-effectiveness, simplicity, robustness, analytical performance, ease of manufacture, and clinical utility will play a key role in the market acceptance and penetration.

The pandemic has sparked a fresh demand for quick, low-cost diagnostics. Immunochemistry is becoming ever more popular. Direct detection of SARS-CoV-2 viral proteins (antigens) in nasal swabs and other respiratory secretions, using lateral flow immunoassays (also known as rapid diagnostic tests, RDTs) is a faster and less expensive method of testing for SARS-CoV-2 than nucleic acid amplification tests, which are the standard method (NAATs). Immunoassay is finding new markets, thanks to advances in genetic knowledge. Rapid diagnostics, point-of-care (POC), biomarkers, and consumer sectors are all rising, while traditional immunoassay remains a prominent player in the clinical diagnostics business. Chemiluminescence immunoassay (CLIA) systems are gaining traction, which leads to a decrease in enzyme-linked immunoassay (ELISA) testing.

Though the latest emerging technology, i.e., the multiplex proteomic array platform is rapidly replacing ELISA, its market continues to grow since it is being preferred as a secondary validation tool to confirm the results of multiplex proteomic platform.

With the development of signal-generation methods, the attention has shifted to the development of immunochemical methods and instruments to provide convenient, high-performance systems. Important advances have been made in the design of immunochemical approaches that allow small molecules, such as metabolites and toxins, to substitute dynamic format assays with non-competitive formats, bringing advantages previously seen only with large molecular analytes. Further, the continuous development of new biomarkers, cost-benefit, and growing adoption of automated platforms for ELISA are expected to increase this technology’s adoption.

Technological advancements and emerging trends

Thomas John

Thomas John

Managing Director,

Agappe Diagnostics Ltd.

Immunochemical methods are testing processes utilizing the highly specific affinity of an antibody for its antigen. Immunochemistry instruments support to test immune system functions by detecting the nature of the specific protein, antibodies, antigen, and their interaction. It is used to identify various diseases, such as cancer, heart disease, infectious diseases, drug development, endocrinology, and drug-abuse testing. It detects the distribution of a given protein or antigen in tissues or cells. Covid prognosis testing market in immunochemistry is expected to reach USD 150 million in 2022.

Major factors that are driving the growth of the Indian in-vitro diagnostics market are the high prevalence of chronic diseases, increasing use of point-of-care (POC) diagnostics, and raising awareness and acceptance of personalized medicine and companion diagnostics. Of course, Covid pandemic has made a paradigm shift in the IVD testing sector in molecular diagnostics, immunochemistry, and POC testing solutions.

During Covid, immuno-segment has gained mammoth momentum in testing Covid prognostic tests, where the severity of chest infection, blood clotting, etc., were critical parameters to assess the patient’s severity and criticality. D-Dimer, Ferritin, iL6, and CRP tests have been conducted in millions. During the second wave, Agappe served with more than 6 million tests, say 70 percent of nation’s demand at that time in this series, when all the then imports were obstructed due to extreme supply chain disruptions worldwide.

Pertaining to immunochem-equipment, entry-level automation machines of 80 tests/hour, are in vogue. The sale of these machines also increased multi-fold due to higher growth in the test numbers, post-Covid. Further, increased application of cancer and other infectious markers have created a surge in the demand for lower-level, 80–100T, and automated machines.

Another market behaviour on the immunochemistry is the increased demand for POC instruments by clinicians and clinics where tests results can be obtained within a short time before the patients leave the clinic. POC segment is the next biggest opportunity for immunofluorescence POC systems, with 20 percent share in IVD segment coming years, serving ICUs, ER, mobile units, small clinics, as well as rural area satellite labs.

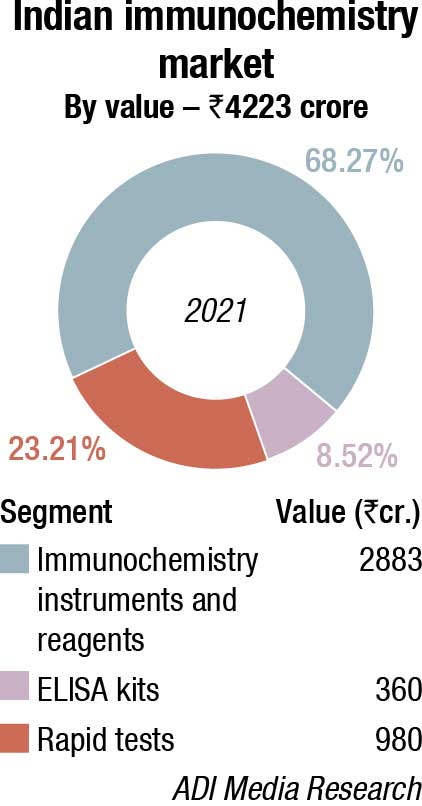

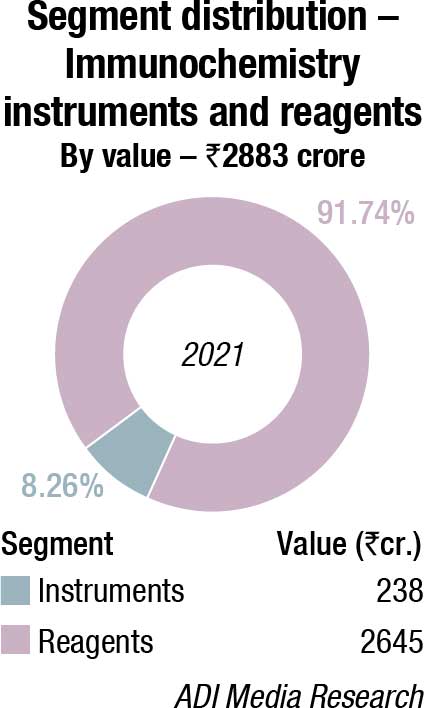

The Indian immunochemistry instruments and reagents market in 2021 is estimated at ₹2883 crore. Reagents continue to dominate the segment at ₹2645 crore. Additionally, the rapid tests’ market clocked ₹980 crore, with dengue and Covid assays being the major ones. The ELISA market is estimated at ₹360 crore. With blood banks being closed for a long time, and fewer blood camps held, these tests received a setback.

While routine immunochemistry and infectious disease testing declined, laboratory biomarkers, serum C-reactive protein (CRP), procalcitonin (PCT), D-dimer, and serum ferritin became essential to forecast the severity of the pandemic. Serosurveys, considered an important tool to map the trajectory of the pandemic, conducted at public hospitals, resulted in huge tenders and bulk buying.

A serosurvey is a population-wide sampling test done over a fixed period of time. It is traditionally done by taking blood samples from a random selection of people across ages and regions, to look for antibodies against SARS-CoV-2 – the virus that causes Covid-19. The results, which indicate how much of the population is/was likely infected and how many have recovered, can help shape strategic decisions around the pandemic.

Technological advancements and emerging trends

Dr Suresh Thakur

Dr Suresh Thakur

President – IVD, India,

Trivitron Healthcare

Immunochemistry is a biochemical field of science that involves the clinical study of the components and functions of the immune system with the help of rapid, simple, robust yet sensitive automated methods.

It has been used to identify prognostic markers in cancer, check for possible infectious diseases including neurodegenerative and muscular disorders, develop drugs by researching antibodies, and predict response to therapy.

In today’s time, immunochemistry is rapidly emerging as a reliable field to aid in the diagnosis of neoplastic (giving rise to tumor cells) and infectious processes and even act as a guide to appropriate therapy. Some of the global trends that have been found to emerge in the immunohistochemistry market include implementation of nanotechnology, use of multiplex immunological assays to provide unparalleled insights about the diseased states by studying the cell-cell interactions in the original tissue and the detailed tissue architecture, digital pathology, and the high use of automation in sample preparation.

It has been even emphasized in many research studies that in the coming years, genomic immunohistochemistry would be used in targeted therapy to develop improved recombinant monoclonal antibodies and to identify proteins.

Immunochemistry has also played a major role during the pandemic in the detection of novel coronavirus and in the development of vaccines. Trivitron Healthcare takes another leap in providing cost-effective diagnostic solutions for providing SARS-CoV-2 neutralizing antibody on chemiluminescence testing platform in India to address the urgent need for assessing immunity during the Covid-19 pandemic.

MAGLUMI® SARS-CoV-2 neutralizing antibody assay kit is a fully automatic quantitative CLIA test for the determination of SARS-CoV-2 neutralizing antibody in human serum or plasma samples. The assay kit is highly sensitive (100%) and specific (100%) for detection of SARS-COV-2 neutralizing antibodies and is in 100 percent positive agreement with the gold standard virus neutralization test (VNT), which ensures accurate results. The assay is used as an aid in identifying individuals with an adaptive immune response to SARS-CoV-2, indicating recent or prior infection.

Each of Trivitron’s product offerings are at par with international regulations. SARS-CoV-2 neutralizing antibody assay and SARS-CoV-2 RBD (receptor binding domain) IgG testing kits are highly specific, sensitive, accurate, and easy to use in the Maglumi Chemiluminescence platform, which makes them ideal for testing laboratories.

Four rounds of Covid-19 national serosurveys have been conducted by the ICMR (Indian Council of Medical Research) so far, the first one between May 11 and June 4, 2020 and the fourth one between June 14 and July 6, 2021.

It is only from the fourth quarter, Oct 2021 onwards that normalcy returned. Since there was no shortage of kits, the organized segment, the MNCs, saw 20 percent increased sales in 2021, over 2020. And April 2022 onwards, it is expected that serology testing will once again take a backseat. 2022 is expected to see the segment back on a 10–12 percent growth, per annum.

The global market for immunochemistry instruments and reagents is expected to reach USD 39 billion by 2026, up from USD 28.4 billion in 2021, at a CAGR of 6.6 percent. Growth in the immunochemistry market is primarily driven by the rising incidence of chronic and infectious diseases. The advancing technology of immunoassay and the increasing adoption of immunoassay products are driving the growth of the market.

Biotechnology and pharmaceutical companies are investing heavily in R&D for the development of innovative products to remain competitive in the industry. Growth in R&D projects is propelling the demand for consumables, including reagents and accessories. Thus, the consumables segment dominated the industry with the largest market share of around 71 percent in 2021. With a CAGR of 5.5 percent, this segment is expected to lead the industry. Significant growth in the consumables segment is mainly attributed to repeat purchases, resulting in revenue generation for the segment. Advancement in the sector with the introduction of improved and user-friendly products, such as portable kits and paper-based electrochemical devices is supporting the growth of the segment.

Rapid diagnostic tests are witnessing wide acceptability

Aditya Patil

Aditya Patil

Asst. Product Manager – Immunology,

Transasia Bio-Medicals Ltd.

Rapid diagnostic tests are often preferred by laboratories, especially in low-resource settings, owing to various benefits, such as ease-of-use, quick diagnosis, and affordability. These tests are being employed effectively for vector-borne diseases, such as malaria, dengue, and infectious diseases, such as transfusion-transmitted infections, diagnosis of Covid-19, etc.

Principle of testing

Rapid diagnostic tests are devised on immunochromatography technique (ICT) or flow-through technique. ICT is based on the principle of affinity chromatography. The sample containing the analyte of interest along with the buffer flows through a nitrocellulose membrane, coated with the corresponding antigen/antibody. The use of colloidal gold conjugate makes the reaction visible to the naked eye in the form of a band. A control band is also coated, which acts as a procedural control.

ICT-based rapid tests are most commonly preferred due to their advantages, such as flexibility of detecting multiple analyte and use of samples, i.e., serum/plasma, whole blood, and urine. The technique is particularly beneficial for simultaneous detection of multiple analytes. For example, differential diagnosis of HIV 1 and HIV 2 is possible on a single device.

ICT in Covid-19 testing

ICT-based rapid antigen tests (RAT) are being commonly deployed for Covid-19 testing. A nasopharyngeal swab is used for the detection wherein the SARS-CoV-2 virus is lysed using an extraction buffer to allow detection of nucleocapsid proteins.

Nucleocapsid proteins of SARS-CoV-2 are important markers for Covid-19 testing, since they are multi-domain, RNA-binding proteins that play a critical role in multiple steps of the viral lifecycle.

These tests have proven high specificity and significant sensitivity in SARS-CoV-2 diagnosis in the early phase of infection. They have been approved by ICMR for home testing in addition to professional use.

Transasia’s portfolio of rapid diagnostic tests

Transasia Bio-Medicals Ltd. offers a wide portfolio of ErbaQik range of rapids for malaria, dengue, and critical infections (HIV, HCV, Hepatitis B and C, Syphilis) with high sensitivity and specificity. The recently introduced ErbaQik Covid-19 Ag test detects all Covid-19 variants including Omicron, Delta+, and Deltacron.

Enzyme-linked immunoassay (ELISA) accounted for the second-largest market share after consumables. However, the introduction of high throughput techniques and automation of screening processes is driving the demand for chemiluminescence assays. As a result, the segment is expected to grow at a significant growth rate from 2021 to 2026. Some of the major advantages of this method over immunoelectrophoresis and immunodiffusion are reduced assay time, quantitative results, and the requirement of limited amounts of antisera for analysis.

Despite the long history of immunoassay IVD kits and reagents and maturity of the field, companies continue to develop new immunoassays and instrument platforms to improve assay sensitivity. New developments expanding the future potential of immunoassays include making multiplexing possible, miniaturizing platforms for POC testing, and identifying and developing assays for novel biomarkers.

The overall market for immunochemistry is highly competitive and growing slowly, but has specific areas of opportunity that will be maximized. Many of the market’s tests are mature and have been available for years or decades. Significant growth opportunities in the immunoassay market may be possible through further innovations. This includes both new platforms and novel biomarkers. The attractive opportunities these innovations may make possible have attracted many diagnostics companies.

Leading names in the immunoassays market will not surprise, and leading companies often lead in IVD as well.

The immunoassay market is large and, in some areas, locked up by large IVD companies, but there is plenty of opportunity for innovators and for niche players developing antibody or antigen-based tests.

|

Major vendors* in immunochemistry |

|

| Tier I | Roche |

| Tier II | Abbott |

| Tier III | Beckman Coulter, and OCD |

| Tier IV | bioMérieux, Transasia, Mindray, and Agappe |

| Others | Tosho, Bio-Rad, Maglumi ( SNIBE and Immunoshop), and CPC |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian immunochemistry instruments and reagents market. | |

| ADI Media Research | |

In recent years, Roche Diagnostics has been very aggressive and has emerged as the immunoassay market leader. Roche excels in infectious disease and testing for women’s health, sepsis, Vitamin D, and a number of cancer markers.

Abbott, active in immunoassays since the 1980s, has secured the second market-share position of the total global immunoassay market. Abbott generated most of its IVD sales outside the US, but is slowly regaining ground in its home country through an effort to issue more FDA-cleared immunoassays. Alere, now merged with Abbott, participates in nearly all immunoassay POC test segments but has a dominating position in rapid cardiac markers, drugs of abuse, infectious disease, pregnancy, and fertility testing.

Beckman Coulter’s Access and Synchron systems provide a wide menu that is continuously enhanced with new tests. The company’s immunoassay menu consists of more than 60 tests for cancer detection, cardiac disease, thyroid function, reproductive endocrinology, and women’s health.

Other immunoassay leaders include bioMérieux, Bio-Rad, Thermo Fisher Scientific, Sysmex Corporation, Siemens Healthineers, Radiometer, DiaSorin, Fujirebio, and Ortho Clinical. More than 100 other companies compete for market share in immunoassays, while smaller players with ELISA tests serve local markets.

Strong niche competitors, such as Thermo Fisher Scientific, bioMérieux, Sysmex Corporation, DiaSorin, Wako, and other international companies market their products worldwide. Other smaller companies have experienced remarkable growth, but their total revenues only contribute a small portion of the total market. As the average cost per test decreases with the migration of a number of immunoassays to integrated analyzers, the market’s capacity for growth becomes constrained.

Chemiluminescence immunoassay on an upward trajectory

Dharampal Sharma

Dharampal Sharma

Product Manager – Immunoassay,

Mindray Medical India Private Limited

Diagnostic technology is rapidly evolving, and over the last decade, substantial progress has been made even for the identification of antibodies, diagnostic characteristics of chemiluminescence technology in its strength, and in its applicability for a more rapid and wide dynamic range, greater than that of immunoenzymatic methods, the high sensitivity and specificity of the results expressed in quantitative form, the high degree of automation and the clinical implications related to the reduction in the turnaround time, and the ability to run a large number of antibody tests (even of different isotypes), directed toward large antigenic panels in random access mode, make this technology the most advanced in the clinical laboratory.

For many years, immunoassay (IA) had a narrow role in the clinical laboratory and was performed by tedious manual methods in a specialized section of the laboratory. That situation has changed dramatically. The tremendous versatility of IA, together with its increasing automation, has thrust it into a leading role in almost all areas of the laboratory. This in turn leads to continuous technical upgradation in immunoassay platforms or assays. Factors, such as rising incidences of infectious diseases, coupled with persistent product modifications, contribute toward the market growth. In addition, increasing incidences of endocrine disorders (diabetes, thyroid dysfunction), enhanced discovery of biomarkers (cancer and cardiovascular), and introduction of novel drugs are leading further augmentation of the market.

Mindray is a leading high-tech medical device manufacturer, and one of the global leaders in medical innovation. The company’s business covers patient monitor and life support, in-vitro diagnostics, and medical imaging system. Mindray is committed to create customer value with comprehensive solutions through cutting-edge technological innovation to meet the market needs and requirements to strengthen the immunoassay portfolio. Mindray has acquired the global provider of antigen and antibodies, HyTest. HyTest is a global leading provider of antibodies and antigens focused on IVD market. The company has extensive expertise in antibody and antigen design, innovation, and production. The company has gained market-leading position in several key segments, including cardiac markers, inflammation, tumor markers, infectious diseases, etc. The acquisition of HyTest will further enable Mindray to have top-notch raw material R&D and innovation capabilities. Self-research and self-production of raw materials for testing reagents is an important guarantee of the reagents’ quality, Mindray will be among very few companies to have in-house core material.

A wide range of multiplex immunoassay (MIA) formats has been demonstrated during the last decade. The need for multiplex analyte detection has also been substantiated as it could critically improve diagnosis, monitoring, and management of complex diseases. MIAs would lead to better health outcomes by enabling early and accurate diagnosis of complex diseases. It would provide the desired opportunity to healthcare professionals as they could start the treatment of patients at the earliest possible time, thereby preventing costly late-stage complications and mortality. Rapid clinical diagnosis and prompt treatment are critical in intensive care units and emergencies, where immediate clinical decisions must be taken. Further, complex diseases, such as sepsis, require quantitative analysis of many biomarkers and an advanced clinical scoring algorithm. The recent advances in MIAs have demonstrated tremendous utility for clinical IVD and POCT, although they would also be useful for veterinary sciences, food safety, and environmental testing.

Most MIA formats could perform multiplex detection of a limited number of analytes and require expensive and bulky benchtop readers. Therefore, there is a need to develop rapid and cost-effective POC MIAs and portable handheld multiplex readers, which could be used at any place and time by users who have basic operator skills. In addition, the emerging trend toward smart digital healthcare, where the diagnostic devices are equipped with mobile healthcare and other smart features, would pave the way to personalized healthcare monitoring and management.

Technology and market trends

Dinesh Wagh

Dinesh Wagh

National Sales Manager,

Vector Biotek Pvt. Ltd.

(A Beacon Group Company)

Compared to the conventional techniques, immunoassays provide highly accurate results, using very less sample volume and having much better sensitivity. These tests are based on immunologic reactions, which are very specific as they can occur only in the presence of proper immunologic agents. Thus, higher sensitivity, specificity, and cost-saving has made immunoassay as one of the key segments in IVD market.

The global immunoassay market is expected to reach USD 39 billion by 2026 with CAGR of 6.6 percent during 2021 to 2026. Rising incidences of chronic and infectious diseases, advancing technologies, and faster adaptation are thrusting the growth of Immunoassay market. Market is segmented based on products, technologies, specimen, applications, users, and regions. Amongst the regions, emerging markets of Asia, including India, are expected to offer strong opportunities in immunoassay market.

In absence of vaccine or specific therapy, diagnosis is the only way to control and manage the wide spreading of infectious disease, and immunoassay played this role significantly in curbing the spread of recent global pandemic condition of Covid-19. The massive research, validations, and approvals of several immunoassay consumables and analyzers have alleviated the issue of SARS CoV2 detection. There has been a surge in use of immunoassay, such as chemiluminescence, ELISA, and lateral flow base POCT rapid test.

Chronic diseases like cardiovascular, diabetes, and cancer are alarmingly rising across the world. Other infectious diseases are also on the rise worldwide. Due to expedited results, efficacy, detection limits, and cost-effectiveness, immunoassays have become instrumental part of diagnostic regime for these diseases. Over the past decade, development and applications of immunoassays have continued to grow exponentially. Novel technologies, based on new classes of biofunctional nanocrystals, consisting of releasable fluorophores or aggregation-induced emission (AIE), can improve the sensitivity and the detection limits of immunoassays.

Immunoassay segment is also offering higher growth opportunities in India due to improved healthcare facilities, growing awareness, and demand and availability of modern-day technologies. Current major players of this market are offering advanced technologies, receiving regulatory approvals, and launching new products to stay competitive in this fast-growing market.

A prospective MIA format uses spot microarray on a solid substrate, which can simultaneously detect several analytes in a sample. It has been used by Scienion, R-Biopharma, Biovendor, TestLine, and some other companies. The preparation of microarray spots on a substrate requires complex preparation and expensive microarray spotters with precise control of spotted volume in nL-pL. However, most spot-microarray-based MIAs employ a conventional manual ELISA procedure that takes a lot of time and involves multiple steps. Further, there is a significant risk of misinterpretation due to the non-specific background signal when nitrocellulose or nylon membranes are used. Additionally, most such MIAs are only qualitative that do not address the clinical need for quantitative results. Moreover, there is a need for a fully automated MIA where all the assay components of the MIA are integrated into a plug-and-play cartridge and all operations are performed by a benchtop analyzer, thereby obviating any manual handling by the users. However, it should be noted that it is not always possible to multiplex all analytes into the same well of 96-well microtiter plate (MTP) as the sample dilutions required for various analytes are very different. Moreover, it is possible that the assay formats for different analytes may also vary as competitive immunoassay is used for small analytes while sandwich IA is employed for big analytes. Therefore, spot microarray-based MIA format has limited applications in IVD and as most such MIAs have a total IA duration of more than an hour, they are not ideal for POCT.

Another MIA format involves the electrochemical detection of multiple analytes using a microelectrode array. An example is the ElectraSense platform from Custom Array Inc., USA, which detects multiple analytes on a CMOS-based chip with platinum microelectrodes via electrochemical detection. A handheld reader measures the signal in less than a minute.

The chip can be reused up to four times, which might be useful for research but inappropriate for clinical diagnostics. The main limitation is that it is expensive and involves complex fabrication procedures, making it inappropriate for clinical IVD applications.

The xMAP technology by Luminex Corp., widely used to develop bead-based MIAs, can detect up to 100 analytes in a single well of 96-well MTP using numerous distinctly colored bead sets. The xMAP-based MIA detects the analytes in a sample by binding to capture antibody-bound color-coded micron-sized polystyrene beads known as microspheres, followed by subsequent detection via binding to biotinylated detection Ab and streptavidin-labeled fluorescent dye. The readout is performed by an analyzer comprising multiple lasers or LEDs and high-speed digital-signal processors. A laser or LED identifies the specific microsphere set by exciting the microsphere’s internal dyes, while a second laser or LED excites the fluorescent dye bound to the detection Ab. The high-speed digital signal processors enable quantitative analysis of multiple analytes by measuring the fluorescent signals from each microsphere. There is a possibility to employ magnetic beads that might be of interest to many IVD companies to develop automated IAs. However, the limitations of this format are the need for expensive instruments and prolonged IA duration.

Dr Gale Kathleen Edward

Lab Head,

Oncquest Laboratories, Bangalore,

Breast cancer appears to be the most prevalent cancer worldwide, as per the latest World Health Organization publication, prompting governments and health-policymakers to change their approach, and to focus more on prevention, diagnosis, and treatment.

Over the course of many decades and especially in the last 20 years, there has been a dramatic shift in the diagnostic criteria and management of breast cancers. From a histo-morphological-based classification in the early 2000s to a more refined combination of immunophenotyping and molecular aberrations, as added information, has resulted in specific targeted therapies that have been hugely beneficial to patient populations.

The discovery of receptors and oncogenes like estrogen receptor (ER), progesterone receptor (PR) and Her2neu oncogene have not only expanded the understanding of the pathogenesis of breast cancers, but also assisted in the development of targeted therapies for patients harboring these tumor receptors and genes, which have now become available widely.

Lateral flow IA (LFIA) are the most simple, rapid, and cost-effective IA formats for POCT at homes, remote settings, decentralized laboratories, and point-of-need settings. The tremendous utility and potential of such assays has already been witnessed by billions of coronavirus disease antigen tests that have been used worldwide during the current pandemic. Apart from the professional IVD use as Covid-19 antigen tests, they have also been approved for self-use. They are available in singleplex as well as multiplex format.

The MIAs would be useful for the clinical diagnosis of many complex diseases as they involve the detection of many biomarkers. The use of advanced diagnostic algorithm, based on a clinical score, which is determined by assigning specific weightage to each biomarker in the multiplex panel, would further improve the diagnosis and lead to differentiation of diseases. However, despite several MIAs developed by companies, the market penetration of MIAs is still negligible in comparison to automated IAs that occupy a predominant market share. This is mainly due to the limitations and pending concerns of MIAs. However, the continuous developments in microfluidic technologies, POC platforms, novel biosensors, lab-on-a-chip, new wash-free IA formats, and smart technologies are leading to critically improved MIAs in the coming years.

The cost-effectiveness, simplicity, robustness, analytical performance, ease of manufacture, and clinical utility will play a key role in the market acceptance and penetration of MIAs.

It is critical that the bioanalytical performances of immunoassays for various biomarkers in an MIA should correlate well with the results obtained from established predicate immunoassays for each biomarker. If a single biomarker in the MIA format does not meet the desired performance, the whole MIA would fail in terms of development.

Therefore, the development of MIA carries a high risk and is very costly in comparison to automated IAs that detect a single biomarker. On the other hand, there are several limitations, which make it very challenging for MIA formats to penetrate the market. One of the most predominant concerns is the reimbursement of MIAs. If the physicians prescribe only immunoassay for the determination of selected biomarkers instead of all the biomarkers in the MIA, the healthcare authorities cannot justify charging the costs of an entire MIA as this will not be approved by the reimbursement agencies.

Therefore, the MIA companies need to conduct a thorough due diligence and discuss it with the healthcare authorities and reimbursement agencies before they start developing a particular MIA. In some cases, it is better to go for different combinations of biomarkers in separate kits so that the clinical needs are addressed.

Presently, lateral flow immunoassay-based rapid multiplex test is the most prospective MIA format based on its rapid sample to provide a response in less than 20 min, and its ease of use, stability, and cost-effectiveness. It can be used both for professional IVD use and self-use, as evident during the current Covid-19 pandemic. However, there is an emerging trend toward POC, PADs, and MF-based MIAs. The MIA is still in its nascent stage, but it has tremendous utility for the clinical diagnosis of complex diseases. The continuous advances in complementary technologies and IA formats would lead to the development of critically improved MIAs in the coming years, which, in turn, would lead to better health outcomes.