Biomedical Refrigerators and Freezers

Refrigerators and freezers – The curve has shifted

While the Covid-19 pandemic created an unprecedented demand for ultra-low temperature freezers and other medical refrigeration, it appears that much of the acute need has been satisfied. The same techniques promise new research investments.

The Covid-19 epidemic has altered our way of life, in more ways than one. Although it resulted in several fatalities, widespread anxiety, and global economic collapse, it also propelled technological upheavals and advances across industries.

Rapid digitization and tech adoption have become widespread among multiple industrial sectors, and the medical and pharmaceutical industries are no different. Tech-enabled solutions have improved the efficiency, with which the medical supply chain operated, and ensured the quality and safety of the therapeutics administered.

The Indian medical and pharmaceutical supply chain sector is expanding at an incredible rate. By 2025, JLL projects that the Indian cold chain logistics market would expand at a CAGR of 20 percent. This is due to many new trends emerging in the sector, usually tied to the employment of new technologies.

From bust to boom. When the Covid-19 pandemic was moved into the mainstream of global society, the research and scale-up of mRNA vaccines illustrated an impressive response, based on an existing infrastructure throughout the life science community. Directing this response were major international health organizations marshaling the resources of a robust pharmaceutical industry already at work on a new generation of vaccines.

Vaccine storage has always been a matter of temperature uniformity and stability in commercial refrigeration systems. As new mRNA vaccines requiring non-traditional low temperatures for vaccines were placed onto the market at the height of the pandemic, the demand for ultra-low temperature (ULT) freezers set off a struggle between supply and demand that continues somewhat to this day. In the ULT freezer industry, it was chaos. The pandemic triggered a strong and immediate reaction from the industry’s primary collective organization.

The long-term implications on the ULT market are emerging. Trends in the ULT industry are measured in terms of unit sales, product type, and orientation (upright versus chest), operating temperature range, and price. It is clear that the demand for ULT hit the industry with a blow that stressed resources in raw materials, manufacturing throughput, labor, logistics, transportation, and last-mile delivery to facilities unfamiliar with the nuances of ultra-low temperature storage. There are, however, no reliable estimates for the worldwide demand for ULT freezers. Most companies prefer to keep their projections under wraps.

The pandemic set the ULT freezer industry into a mild panic as demand exploded. Many customers had no idea what a −80°C freezer was in the first place. Moderna and Pfizer were pushing buyers. Logistic companies were ordering 500 to 1000 ULT freezers at a time, all to be delivered ASAP. There was also confusion about storage temperatures, so manufacturers had to educate new customers.

While the market evolves as pharmaceutical manufacturers seek to develop vaccines that may not require extreme storage temperatures, the need for long-term ultra-low temperature storage of clinical samples from extraordinarily large populations will certainly expand. Scientific research, reaching into the past from millions of frozen stored samples, and connecting these original specimens to current conditions, has always provided another data point that can help triangulate investigations into chronic illnesses. Thus, the need for ULT freezers will remain. But the vaccine market has expanded the envelope as far as required temperature storage points.

While the Covid-19 pandemic created an unprecedented demand for ULT freezers and other medical refrigeration, it appears that much of the acute need has been satisfied. But, the curve has shifted. The same mRNA techniques that accelerated the development of Covid-19 vaccines promise new research investments into molecular biology and associated disciplines that may yield better treatments for a range of disorders, such as Parkinson’s, MS, ALS, and others. More clinical specimens will require even more biorepository space for long-term storage.

Coincident with this demand, too, facility managers will replace older freezers with Energy Star-certified products developed to reduce operating costs and lower the carbon footprint in compliance with corporate mandates and environmental policies.

Since some types of Covid-19 vaccines require an average temperature of −70 °C to maintain their efficacy, there was an impending need for superior medical-grade freezers and refrigeration techniques. However, the use of hydrofluorocarbons (HFCs) and other medical-grade refrigerants with high global-warming potential (GWP) in the past has triggered regulations, such as the US SNAP and EU F-Gas programs, prompting several manufacturers in the medical cold-chain field to switch to green gases and natural refrigeration models that minimize the environmental impact of their products and reduce emissions.

The introduction of software temperature-monitoring solutions at all levels in the clinical and research fields allows to reach levels of extensive security that was not possible in previous years. These innovative devices and programs enable healthcare workers to remotely monitor the internal and ambient temperatures of each cold-chain equipment they use. This way, they can check the condition of the thermosensitive biologicals stored, and ensure none of them is at risk of degradation. Moreover, the software allows for the monitoring of the opening of the units’ lids or doors and the observing of the geographical position of the equipment via real-time GPS positioning.

IoT has been particularly impactful in powering the storage and supply of plasma vaccines and mRNA vaccines for Covid-19. One of the high points has been avoiding financial losses due to damage of products caused by delays and temperature inaccuracies. Web-based and data-driven interfaces and the remote temperature monitoring devices ensure effortless, remote, and real-time temperature monitoring.

Inventory management and remote temperature control systems ensure better visibility of the products and their conditions. Moreover, if the data could then be used, as it is already happening, to understand customer behaviors and prepare against problems through precise predictive analytics via AI and machine learning, it would improve the overall efficiency of the supply chain and ensure the well-being of patients around the world.

While along with the tech factors, the global pandemic has played a significant role in driving the progression of the Indian biomedical refrigerators and freezers industry, it is, however, the constant push for domestic manufacturing and vocal for local initiatives that is expected to keep this growth continuing even in the post-Covid era.

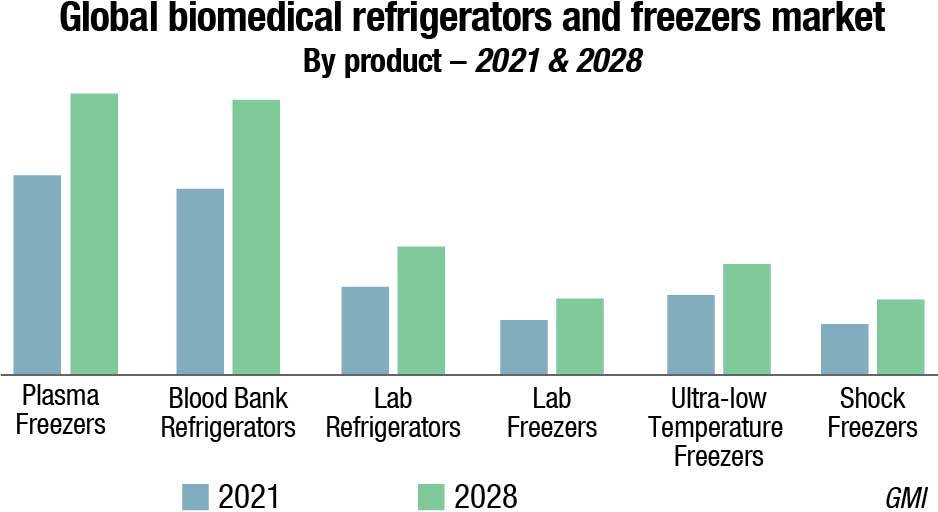

The global biomedical refrigerators and freezers market size surpassed USD 3.3 billion in 2021, and is expected to witness 5.5 percent CAGR from 2022 to 2028. Increasing government support for research and development activities and clinical trials in emerging countries will positively impact the market expansion. The growth in this market is driven by increasing demand for blood and blood components for transfusion and for support in cancer therapy. Technological advancements in lab freezers also drive the growth of this market.

The laboratory freezers market has shown a significant rise in demand in 2020 and 2021 due to the utility of these products for appropriate temperature-controlled storage of Covid-19 vaccines. The growing use of refurbished laboratory freezers and refrigerators could restrain the growth of this market.

In the optimistic scenario, the Covid-19 pandemic has had a significantly positive long-term impact on the laboratory freezers market. Initially, as a result of lockdowns and quarantine measures, there was a dip in the lab freezers/refrigerators market in early 2020.

However, as the disease progressed throughout the world, there was an exponential rise in the number of laboratories, Covid-19 testing sites, and processing facilities managing SARS-CoV-2 samples, reagents, and vaccines. This, in turn, led to growth in the demand for laboratory refrigerators, freezers, and ULT freezers to support sample processing, testing, and vaccine development labs.

This increase in demand for lab freezers and lab refrigerators can be expected to continue for the next 3–5 years, as Covid-19 vaccination continues to mitigate new emerging variants of the virus and provide booster doses to the population.

Similarly, in early-mid 2021, health officials from Thailand, Bahrain, and the United Arab Emirates decided to offer booster shots of Covid-19 vaccine to people already inoculated with vaccines from Sinovac Biotech Ltd., Sinopharm, and AstraZeneca. This could indicate an increase in the demand for ultra-low-temperature freezers in developing countries as well.

In such a scenario, if booster doses for Covid-19 continue over the coming years, it can be considered that the pandemic would have a significantly positive long-term impact on the laboratory freezers market.

In a pessimistic scenario, it could be assumed that the Covid-19 pandemic has resulted only in a temporary positive impact on the laboratory freezers market. Due to deferred medical procedures like organ transplantations and lower blood donations overall globally, the demand for lab freezers and refrigerators in blood banks and hospitals would have reduced considerably.

It may also be presumed that in the pessimistic scenario, the pandemic will subside globally within six months to one year without requiring additional booster doses or further vaccination rollout. In this scenario, the laboratory freezers market growth would return to pre-pandemic conditions.

In a realistic scenario, it could be assumed that the effect of Covid-19 on the laboratory freezers market has been fairly positive and possibly long-term. In this scenario, even if the Covid-19 vaccination proves effective without requiring additional booster doses, the demand created for lab freezers/refrigerators would remain stable, following a trend similar to the pre-pandemic scenario. This could be attributed to the possible increase in the number of vaccine trials fueled by growing investments, the increasing number of surgical procedures conducted (such as organ transplants), and increasing blood donations globally.

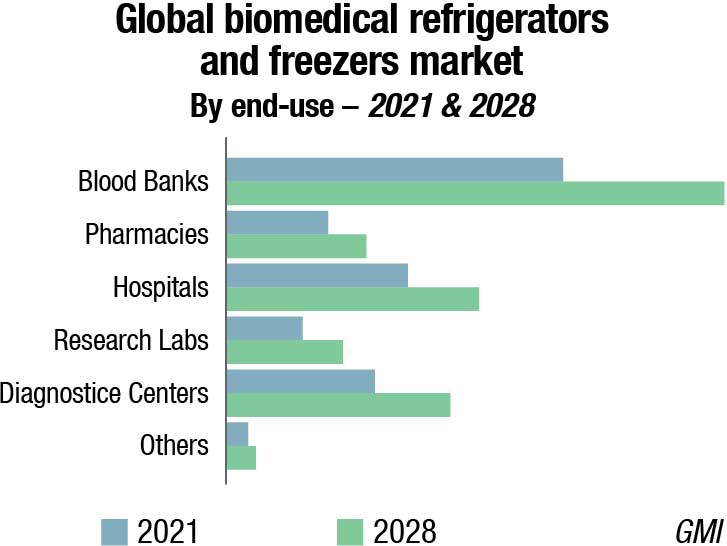

The global demand for blood and blood components is on the rise. According to the American National Red Cross, nearly 21 million blood components are transfused each year in the US alone.

According to the American Cancer Society, in 2021, an estimated 1.9 million new cancer cases were recorded in the US. The requirement of blood and blood components is high for cancer surgery patients as well as for patients suffering from blood cancers, such as leukemia and lymphoma.

Moreover, blood donation has increased globally, with the WHO reporting an increase of 7.8 million blood donations from voluntary unpaid donors from 2013 to 2018. This increase in the demand for blood and blood products and rise in blood collection globally will increase the demand for lab freezers and refrigerators in blood banks for their storage.

Capital investments in the cold storage of biomedical samples are very high for hospitals, laboratories, and blood banks. The average price of a ULT freezer ranges between USD 10,000 and USD 25,000, which is quite expensive for smaller blood banks, hospitals, and laboratories.

Refurbished medical devices are generally available at 50–60 percent lower prices than new instruments. The public healthcare expenditure for infrastructure improvement in many emerging and underdeveloped countries is inadequate; this restricts the adoption of technologically advanced medical devices in healthcare systems across these countries.

The high demand for refurbished lab freezers and refrigerators will hamper the growth of the global laboratory freezers market to a certain extent during 2022–2028.

Vaccine development for emerging infectious diseases has received greater attention due to the Covid-19 pandemic. This rising focus and investments in vaccine development would boost the growth of clinical research trials for vaccines in the coming years. This, in turn, would boost the growth of the lab freezers and refrigerators market, as most vaccines are required to be stored at low temperatures at the time of development and distribution.

Therefore, the increasing investments and focus on vaccine development for emerging infectious diseases present an opportunity for players in the laboratory freezers market in the coming years.

Lack of awareness of the utility of specialized lab freezers and refrigerators. In certain clinics, laboratories, blood banks, and pharmacies, there is a lack of awareness on the proper use of medical/lab refrigerators. Blood bank providers or small chemist shops may lack awareness of the benefits of using particular refrigerators to store specific specimens. Domestic refrigerators do not provide optimal temperature conditions for the storage of blood and blood components and DNA testing samples, among others. Domestic refrigerators are designed to keep efficiency in mind and sacrifice precision so that a degree of temperature variability is tolerated to reduce the amount of time and frequency that the compressor must run to cool the storage chamber.

However, lab freezers are designed with precise temperature control, reliability, and storage capacity as key considerations. If the samples are not stored in under-optimum conditions, they may get contaminated, and results may be distorted.

Laboratory freezers, especially ULT freezers, are sensitive lab equipment that require proper maintenance. The common sources of failure of ULT freezers include compressors, electronics, or HVAC malfunction.

Therefore, a lack of knowledge regarding the proper storage of medical specimens and maintenance of laboratory refrigerators and freezers could pose a challenge for the growth of this market.

The freezers segment holds the highest market share, by product. In 2021, the freezers segment accounted for the largest share of the market. The large share of this segment can be attributed to their utility in pharmaceutical and biotechnology companies and academic and research institutes to support vaccine development and in medical laboratories and hospitals for storing test samples.

The ULT freezers segment is poised to grow at the highest CAGR. Based on type, the freezers market is segmented into ULT freezers, laboratory freezers, plasma freezers, enzyme freezers, explosion-proof freezers, and flammable material freezers. Ultra-low-temperature freezers are growing at the highest CAGR, by type, in the freezers segment. The high growth of this segment can be attributed to the wide application of ULT freezers for biological and biotech storage in research universities, medical centers, and hospitals.

In 2020 and 2021, the laboratory refrigerators segment shows high growth due to the extensive use of laboratory refrigerators in the short-term storage of samples for Covid-19 testing in medical laboratories, hospitals, and clinics.

The blood bank segment accounted for around USD 1.3 billion in 2021, and the trend will continue to rise in the near future as well. This is owing to the growing need for definitive blood cold chain for blood storage, donated blood, and transportation of blood samples.

The increasing demand for plasma from biopharmaceutical companies for use in plasma fractionation procedures is also driving the demand for plasma freezers in blood banks.

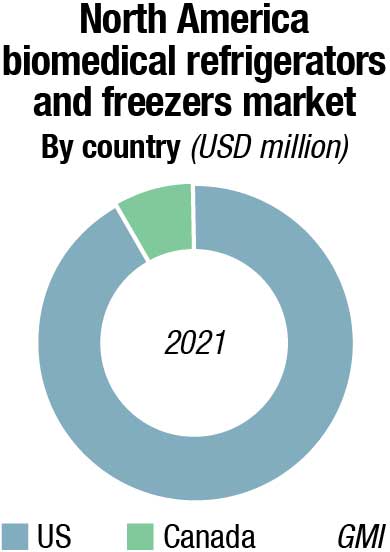

North America biomedical refrigerators and freezers market captured 42 percent market share in 2021, and is poised to grow substantially during the forthcoming years. High regional growth is attributed to increasing R&D expenditure, coupled with developments in pharmaceutical and biotechnology sectors.

In addition, rising prevalence of cancer in the US, coupled with increasing adoption of biomedical refrigerators and freezers, will accelerate the market growth. The presence of a large number of laboratory freezer and refrigerator manufacturers in the region also plays a pivotal role in boosting the market growth.

Furthermore, the surging number of blood banks, pharmacies, and laboratories in the US is leading to increasing adoption of biomedical refrigerators and freezers in the country. In addition, existence of major market players in the US favors the biomedical refrigerators and freezers market.

Some of the key industry players operating in the biomedical refrigerators and freezers industry include Aegis Scientific, Inc., Azbil Corporation, Binder, Eppendorf AG, Follett LLC, Haier Biomedical, Helmer Scientific, Liebherr-International AG, Migali Scientific, Power Scientific, Inc., Panasonic Healthcare Corporation of North America, and Thermo Fisher Scientific, among others. These market participants are formulating various growth strategies with continued innovations and technology improvements to sustain market competition in the biomedical refrigerators and freezers market.

In January 2022, B Medical Systems announced that it is opening a new manufacturing facility in India. The company’s huge investment and more production capacity of medical cold-chain products, such as freezers and vaccine refrigerators, scaled up the demand in the market.

The global market has witnessed rapid advances in technology, including vacuum insulation control technology, protection against explosions and accidents, and advanced temperature-control mechanisms for the significant adoption in biomedical refrigerator with freezer.

Technological advancements, coupled with the availability of improved compressor system, circulation system, and auto cascade cooling system, are likely to bolster the market growth over the forthcoming years.

The biggest challenge consumers face today is the availability and prevalence of misinformation. For example, look at the energy savings marketing – consumers do not often consider that saving 5 KW/24 H results only in a few hundred dollars per year, while their average sample value is about ten times that amount. They keep opting for a risky system that saves a bit of energy rather than making sure their samples are safely stored. If you do not have reliability and total sample security, no other benefits or features really matter.

The second challenge is the unpredictable timing of errors. Often, consumers have to call out of hours if they have samples at risk and no plan to move them to an alternate place. An unplanned failure is catastrophic to end-users and they always seem to happen in the middle of the night or on the weekend.

The third challenge is budget compression and the increased availability of poor-quality but truly affordable freezers. The cold storage industry is shifting from a capital equipment point to a consumable products standpoint.

The future of cold storage is likely to shift to new technologies, not considering compressor development. Instead, fusion technologies or most probably some derivations from Bose-Einstein condensate, using laser beams to take energy away from the atoms. These new laser-based approaches are going to drastically change the way manufacturers produce cold systems in general.