MB Stories

Sales for CT scanners saw a huge 86 percent increase in 2021

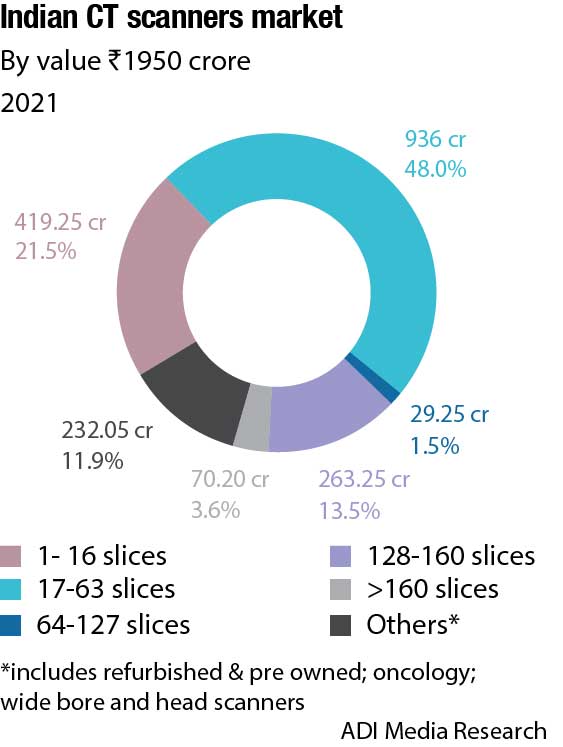

The Indian market for CT scanners increased from ₹1050 crore in 2020 to ₹1950 crore in 2021. Moving forward, it is set to grow at a steady 7-10 percent per annum.

CT scans have been around for decades. The basic principles of CT imaging have not changed much since the 1950s, but there have been improvements to the technology to increase safety and reduce radiation exposure. Today’s CT scans are able to detect more types of diseases and conditions than ever before. CT scans have revolutionized the medical industry, and have become a common diagnostic tool used by doctors around the world.

Indian market dynamics

The Indian market for CT scanners in 2021 is estimated at ₹1950 crore, an almost 86 percent increase over 2020. Spurred by the pandemic, 2021 saw huge sales for CT scanners, very similar to the ventilator segment. 2022 seems to be poised to close at a 7−10-percent increase over 2021, and a 30-percent increase over 2019. After June 2022, sales declined as huge procurement had been made in 2021. The enhanced value in 2022 will be contributed by the premium 256-slice scanners being procured by AIIMS − six are expected to be ordered in 2022 and remaining three in 2023 − as the building for some centers is still under construction. The tender for nine units is expected to be announced by HLL soon. The minimum unit price of these scanners is ₹15 crore. Large corporate chains are also expected to buy these high-end scanners in 2023. With the pandemic behind us, the CT scanner market is expected to settle down at 7 percent increase per annum.

Naeotom Alpha is a first-of-its-kind photon-counting CT diagnostic imaging device, developed by Siemens Healthineers based in Germany. Launched at RSNA last year, in November 2021, the vendor has about 50 installations globally, no machine has yet been installed in India. The machine is three times more expensive than the premium CT scanners available. Unlike conventional CT scanners that use detectors to measure the total energy from several X-rays at once, the new diagnostic imaging system utilizes CT technology of photon-counting detectors to measure the X-ray passed through a patient’s body and converts them into a detailed three-dimensional (3D) image.

| Indian CT Scanners Market | ||

| Leading Players* | ||

| Tier I | Tier 2 | Others |

| Siemens & GE |

Canon & Philips |

United Imaging, Hitachi and a miniscule share with some Chinese brands |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian CT scanners market.

ADI Media Research |

||

The images provided by the system are utilized by a trained healthcare professional for oncological procedures, cardiac diagnostics, follow-up examinations of lungs for respiratory disorders, and radiation therapy planning preparation.

The hospitals in India are going in for major expansions; new hospitals are being set up and investors are finding India attractive. At least 10 large hospital chains across India are currently negotiating with private equity and venture capital firms. These include Gurugram-headquartered Paras Healthcare, Maharashtra’s Sahyadri Hospitals, and Kauvery Hospital in the southern city of Tiruchirappalli.

Other big transactions have also been reported. In April 2021, National Investment and Infrastructure Fund (NIIFL) had invested ₹2100 crore in Manipal Hospitals, through Strategic Opportunities Fund. In February 2022, Asia Healthcare Holdings (AHH), an investment platform for the healthcare sector, announced it had raised USD 170 million in funding from Singapore’s sovereign wealth fund GIC. AHH invests in and operates various single-specialty healthcare companies under one enterprise.

The Eight Roads’ launch of USD 250 million fund reflects the confidence of the investor community in the evolution of the Indian healthcare and life sciences segment. This new fund is amongst the largest for the sector in India, bringing the total amount managed by Eight Roads in India to USD 1.6 billion. Tata Capital Healthcare Fund marked the final close of its second vehicle with commitments of USD 126 million in March.

In the first half of 2022, PE and VC firms invested USD 390 million in India’s private hospitals. The amount in 2021 and 2020 stood at USD 634 million and USD 216 million, respectively.

These provide a direct impetus to the Indian MedTech market.

Global market dynamics

The healthcare sector is hardly affected by the blow Covid-19 has caused to other businesses around the world. Healthcare has been a booming sector even in the testing times of the new coronavirus pandemic, and the CT scanners market is no exception. The CT market saw a major boost from the Covid-19 pandemic, during which many hospitals purchased additional systems. This was in part due to increasing their imaging capability during strict sterilization protocols of the CT room between patients, which limited the patient throughput. It was also because many hospitals, especially outside the US, used CT to diagnose Covid-19 and monitor patient progress. This led to CT market growth from about USD 4.1 billion in 2019 to USD 6.39 billion in 2021. The market is projected to grow from USD 6.70 billion in 2022 to USD 9.92 billion by 2029 at a CAGR of 5.8 percent.

Certain countries saw a much larger uptick in demand, such as China, Western Europe, and some parts of Asia. But other countries like the United States had an adequate install base to deal with the related Covid-19 demand.

One of the key technology advances was the introduction of the first commercial photon-counting CT scanner, and more are expected to follow over the next couple of years. Many expect this to be the way of the future in CT systems because it offers several advantages in improved image quality, lower radiation dose, and built-in spectral CT capabilities. Photon-counting technology greatly enhances image quality, improves tissue characterization, and reduces the amount of contrast and radiation doses needed. Photon-counting also bins the photons detected by different kV energies, making all scans inherently spectral CT scans. This allows the radiologist to view images at different kV levels to bring out different features in the images, rather than scanning patients multiple times with different protocols. Elements like iodine, calcium, metals, and the makeup of uric acid also can be enhanced or dialed out of images to reduce or eliminate calcium deposits inside vessels, bone removal, virtual removal of metal implants or their usually image artifacts, and creating non-contrast images from contrast CT exams. This also can help better visualize small kidney stones, or iodine perfusion in issues, such as cardiac ischemia, stroke, and pulmonary embolism.

Spectral CT, or dual-energy CT, systems have been around for more than a decade, but the extra costs and additional steps in workflow have not helped in wide adoption. All the primary CT vendors in the US now offer CT systems with built-in spectral capabilities, but if the market moves to photon-counting systems, the spectral benefits will be built into every scan.

Just over a decade ago, there was a big movement to adopt 64-slice CT systems as a standard work-horse system. Now that these systems are reaching replacement age, many are being replaced by higher-slice systems with improved image quality, larger fields of view, and new technologies to aid workflow and improve image quality. In developed markets, there is that shift to higher slice systems, such as 128 to 160 slices. In the US and Western Europe, even high-slice systems, 256 and above, are seeing more uptake.

Countries that are seeking mid-range 64-slice systems include Africa, Russia, Saudi Arabia, Vietnam, and Pakistan.

Developing markets, such as India, most of the Middle East, and Latin America, are still looking for 16-slice CT systems because they can be purchased at a lower price point.

The CT scanners market is experiencing a rise in the research and development activities for discovering the use of CT scans for diagnosing SARS-CoV-2. Technologies like artificial intelligence (AI) and cloud-based technologies can bring a paradigm shift in the Covid-19 testing landscape. A cloud-based system can help healthcare professionals assess data at minimal costs. Besides, it will help in detection and treatment, eventually leading to flattening of the curve. Security-enabled cloud-based technologies, such as AES encrypted images for complete privacy in terms of images, will also prove to be beneficial. Thus, these developments can help the CT scanners market to steer toward growth.

The CT market is also making inroads in the dentistry segment. CT scanners providing a true 3D visualization of the patients, and the compatibility with all DICOM format CT scans, is helping the CT scanners market to garner considerable momentum in terms of growth rate.

Recent advances in CT technology

CT has undergone substantial advances in technology in the past decades; it has significantly improved cancer diagnosis, reduced the length of hospitalization, and helped preparation for surgeries. The advances in the CT scan technology in recent years include reducing harmful radiation to patients, enabling faster scan speed, as well as improved image quality.

Lowering the dose. Lowering radiation emission has long been a challenge for the CT scanning scientists, as radiation doses for CT scans are significantly higher than conventional X-rays, and can cause serious long-term health risks to patients. These days, there are novel scanning techniques that dramatically reduce radiation during scanning. A CT scan technique that splits a full X-ray beam into thin beamlets can deliver the same quality of image at a much-reduced radiation dose. The use of beamlets enables a sharper image resolution, as the part of the scanner reading section is able to locate where the information is coming from more precisely. This CT scan technology can deliver the same quality of image at a much-reduced radiation dose.

Speed of CT scanning. When the 64-slice CT scanners were introduced in the early 2000’s, they were quickly purchased to replace the older 16-slice CT scanners, and became the new standard for CT technology. The current 32- or 64-slice scanning is up to 4 times faster than the original generations of scanners. OHSU Knight Cardiovascular Institute offers a 256-slice CT scan diagnostic imaging equipment, which takes super-fast pictures in milliseconds of a moving heart, using a three-dimensional tool format on a computer monitor. It also provides much more visual details about the heart’s functions and structures. The increased speed of scanning enables physicians to provide more accurate diagnosis and better treatment for early or advanced coronary artery disease.

Iterative reconstruction. Before the development of iterative reconstruction, CT systems images were created based on filtered back projection, which was relatively fast and could be created in a reasonable amount of time whilst using older technology. However, nowadays most major CT vendors include iterative image reconstruction. Image reconstruction (IR) in CT is a process that generates tomographic images from X-ray projection data acquired at many different angles around the patients, which in turns impact on image quality and reduce radiation as less-projection images are needed. The IR tool revises the image again and again with many iterations to clean the artifacts and offer even more clarified images down to the pixel. The dose-reduction strategies combine a decrease in the tube current or voltage while the IR algorithms provide the diagnostic image. This approach allows acquiring a reduced number of scans and reconstruct 2D and 3D images, which in turn provides an enhanced diagnosis tool for physicians.

Spectral imaging. Spectral CT technology (also called dual-source/dual-energy CT) is another trend that is becoming more and more integrated into major CT vendors’ technologies. Spectral CT breaks down X-ray photos by chemical elements, based on viewing one part of the body at two different kV energies, with a dual-source CT scanner. Instead of scanning a patient several times using different energies to focus on different tissues’ types, spectral CT technology provides different views from a single scan. This software can also highlight and remove chemical compounds, solely based on their atomic number, i.e., iodine, calcium, and metals. This can create contrast and non-contrast images created from one single scan. This technology is particularly useful in the treatment of gout and locating kidney stones; it also improves metal artifact reduction. The spectral CT imaging and detector systems have led to a reduction in dose by 70–82 percent over the last few years.

Portable CT scanners creating buzz in the market. Portable CT scanners are proving to be a boon for the CT scanners market due to the plethora of benefits they offer. Portable CT scanning is clinically and economically beneficial. Physicians can limit the risks associated with intra-hospital transport, such as the compromise of monitoring equipment, intravenous lines, or intubation tubes. Portable CT scanners offer fast CT deployment to hospitals and radiology units and have been especially beneficial for the treatment of head injuries, by reducing the risk to patients during transportation and increased risk during the treatment process. Portable CT scanners allow clinicians to maximize the availability of stationary CT equipment in a hospital as improving the workflow of standard scanners creates faster imaging for ICU and non-ICU patients. In addition, minimizing the need for extra transport contributes to economic benefits, as well as improves the use of other equipment, and enhances the overall quality of patient care.

Workflow, speed, and productivity drive CT trends

With increasing incidences of cancer and the persistence of Covid-19, the demand for CT scans continues to rise. To meet this demand, manufacturers are focusing on key functional and productivity issues to improve their systems. Some of the recent trends in technology seen this past year include:

AI technologies. Consistency and accuracy of patient imaging saves millions of lives each year, none of which would be possible without the adoption of advanced technologies that continue to revolutionize the medical imaging industry by improving workflows and process-related strains on radiology staff.

To improve patient care and drive operational efficiencies, there is an obvious shift from the use of standalone solutions and products to smart integrated systems that rely on data and intelligence. This had led to the adoption of AI embedded into everyday tools that radiology departments use to improve efficiencies, reduce operational costs, meet ambitious financial objectives, and ultimately improve patient experience and outcome.

One such intelligent technology is the CT 5100-Incisive platform with CT smart workflow, which was unveiled by Philips at the Radiological Society of North America (RSNA) annual meeting in 2021, and is the company’s latest addition to its CT portfolio. The system features a comprehensive suite of AI-enabled capabilities and applications, designed to accelerate CT workflows, enhance diagnostic confidence, and maximize equipment uptime by ensuring precision in dose, speed, and image quality, allowing radiologists to focus their expertise on the patient instead of the process. Smart imaging solutions are designed to improve efficiencies, operator consistency, and diagnostic confidence at the point of image acquisition by automating many of the time-consuming procedural tasks that radiologists, technicians, and staff traditionally had to perform manually. By empowering the radiology departments to streamline care and make the best decisions for each patient, healthcare providers can ensure operational excellence and the best patient outcome.

Similarly, GE Healthcare’s Revolution Ascend with Effortless Workflow offers clinicians a collection of AI technologies that automate and simplify time-consuming tasks to increase operational efficiency, and free up time for clinicians to deliver more personalized care for more patients. The system’s 75-cm wide gantry, 40-mm detector coverage, and lower table position are designed to accommodate high body mass index (BMI) patients, as well as trauma cases that would otherwise be too delicate to maneuver in a smaller size gantry. To help address workflow speed, the system incorporates Effortless Workflow, a suite of AI solutions that personalize scans accurately and automatically for each patient, and require significantly less effort from the CT technologist. They can use the system’s attached bar code reader to scan the patient’s chart or tag and personalize each exam. This automatically pulls up the patient’s information and suggests relevant protocols. The technologist can then initiate auto positioning, which uses real-time depth-sensing technology to generate a 3-D model of the patient’s body and uses a deep-learning algorithm to determine the correct table elevation and cradle movements to align the center of the scan range with the isocenter of the bore. Then, intelligent tools embedded in the Clarity Operator Environment provide optimal scan range settings, dose, and image quality for each patient, helping to deliver greater efficiency and more personalized medicine across clinical care areas.

Quality, dose, and workflow. Recent advances in imaging technology, such as the multi-energy Spectral CT 7500, recently introduced by Philips, are transforming patient care, providing physicians greater confidence in diagnoses and lowering unnecessary, suboptimal, and repeat imaging costs. The system has regulatory clearance in Europe and from the FDA. It uses intelligent software to deliver high-quality spectral images on every scan 100 percent of the time without the need for special protocols. Philips said the system aims to improve disease characterization, reduce rescans, and follow-ups while using the same dose levels as conventional CT scans. The time-saving workflow is fully integrated, enabling the technologist to get the patient on and off the table quickly. Spectral chest and head scans take less than one second, and a full upper-body spectral scan can be completed in under two seconds. The system features a fast-scanning table that can accommodate patients up to 727 lb., and offers an 80-cm bore.

Intelligent user interface. The FDA recently approved the Siemens Healthineers Somatom X.ceed, a premium single-source CT scanner that combines high-speed scanning capabilities and a level of resolution previously unseen in other single-source CT systems with a new hardware/software combination to simplify CT-guided interventions. The scanner, with an 82-cm bore, is designed for all diagnostic procedures. Key features include a fast rotation speed of 0.25 seconds to ensure a high native temporal resolution and reduce motion artifacts when scanning moving structures, such as the heart. Its scan speed at 262 mm/sec provides consistent image quality across the entire field of view, and the scanner’s small focal point, 0.4×0.5, enables increased spatial resolution to better detect deep-seated small and medium lesions. With its 1300 mA power reserves, it has high power, enabling a high level of image quality for larger patients while expanding the utilization of low-dose and low-contrast media techniques, such as low-kV imaging.

Accuracy, precision, and speed. Canon Medical Systems received FDA clearance for its Aquilion Exceed LB CT system, giving clinicians the opportunity to see more during radiation therapy planning for accuracy, precision, and speed. It supports fast and efficient radiation oncology workflows without compromising on patient position, image quality, or reproducibility. Features include a large bore opening (90 cm), edge-to-edge extended field-of-view (90 cm) reconstruction, and wide detector coverage (4 cm). AI powers its contouring, providing sharp, clear, and distinct images from Canon Medical’s Advanced intelligent Clear-IQ Engine (AiCE) Deep Learning Reconstruction (DLR) technology.

Capturing clear images of the heart. Fujifilm received FDA clearance for the Scenaria View Focus Edition in April 2022. It is a premium scanner with an advanced cardiac motion correction feature, called Cardio StillShot. The system is designed for routine and advanced clinical applications, including coronary computed tomography angiography, interventional CT, extended coverage shuttle scanning for perfusion exams, and dual-energy examinations. Cardio StillShot feature helps clinicians capture clear images of the heart – even on the most challenging heart rhythms by simultaneously acquiring two data sets in the scan. These data sets are then compared against each other to detect and correct motion. The final images have an effective temporal resolution of just 28 milliseconds, compared to 175 milliseconds without Cardio StillShot.

Shifting gears into the future

Function and productivity will drive many of the trends in CT imaging. One of the things that will continue to drive the industry forward will be the need for faster exam times. Faster exams can help reduce patient stress, improve physician efficiency, and increase a facility’s throughput.

The industry will likely see more manufacturers continue to implement and improve on existing workflow enhancements. Workflow enhancements can include faster gantry rotation, faster table speed, and faster reconstruction times to name a few. These enhancements are all focused on helping to drive exam times down.

The market will also see the adoption of more advanced software and hardware applications, such as CAD, virtual reality, and automated patient positioning. These applications will not only help to improve the workflow and patient experience but also to improve the final image quality.