Industry

Staying relevant in the face of competition

The Indian IVD industry in 2019 saw a 16.7-percent increase over 2018, albeit 2020 will be an absolutely different ball game, thanks to COVID.

In vitro diagnostic testing costs little to the healthcare system but contributes much to clinical practice. For some time, this has been stated as an educated conjecture; a recent study of US and German physicians offers proof.  The study found that 66 percent of clinical decisions made were based on a diagnostic test, while the costs of those tests were just 2.3 percent of healthcare expenditure. When the cost-effectiveness in vitro diagnostic testing is considered, along with beneficial effects on treatment outcomes, therapy choices, and hospital management there should be little surprise about the amount of interest in IVDs and the amount of activity in the market for them.

The study found that 66 percent of clinical decisions made were based on a diagnostic test, while the costs of those tests were just 2.3 percent of healthcare expenditure. When the cost-effectiveness in vitro diagnostic testing is considered, along with beneficial effects on treatment outcomes, therapy choices, and hospital management there should be little surprise about the amount of interest in IVDs and the amount of activity in the market for them.

The Indian IVD industry

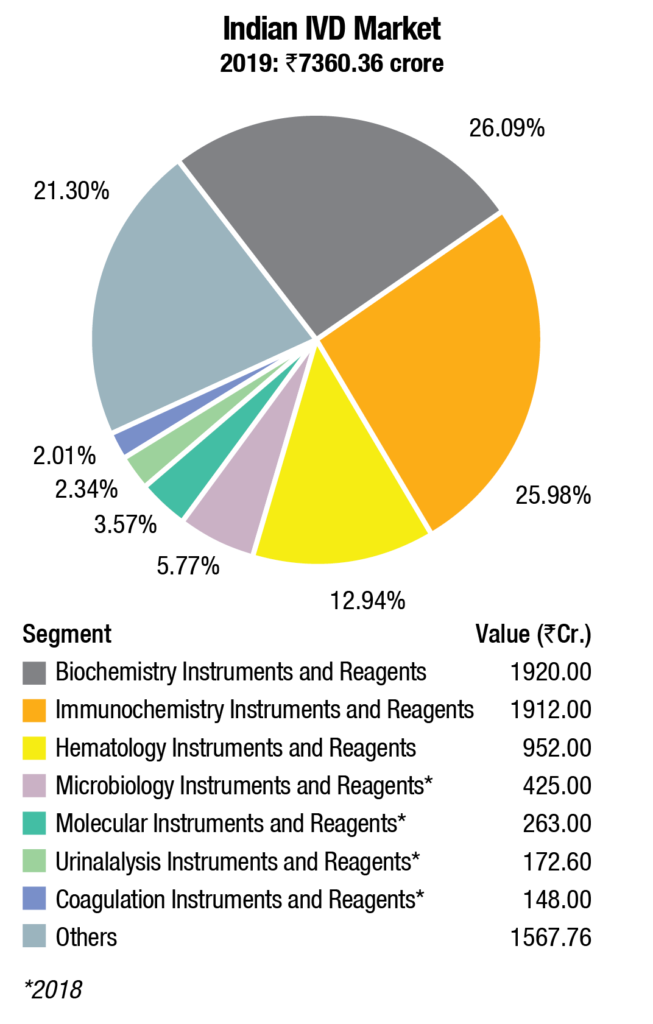

The Indian IVD industry has been estimated at Rs 7360.36 crore in 2019. The biochemistry instruments & reagents and immunochemistry instruments & reagents contribute about 26 percent share each. Hematology instruments & reagents constitute 13 percent of the market. The balance share is contributed by other segments.

This calculation does not include ELISA and rapid test kits. The market for microbiology instruments & reagents, molecular instruments & reagents, urinalysis instruments & reagents, and coagulation instruments & reagents market, which contribute a combined 14 percent is for 2018, as the research for 2019 market is scheduled for 2H2020.

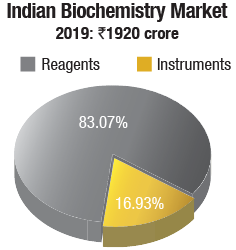

Biochemistry instruments & reagents. In 2019, the Indian biochemistry instruments & reagents market is estimated at Rs 1920 crore, with reagents continuing to dominate at Rs 1595 crore, at an 83-percent market share.

Biochemistry instruments & reagents. In 2019, the Indian biochemistry instruments & reagents market is estimated at Rs 1920 crore, with reagents continuing to dominate at Rs 1595 crore, at an 83-percent market share.

The floor-standing analyzers are estimated at Rs 93.41 crore and 670 units; benchtop analyzers at Rs 92.44 crore and 1767 units; and semi-automated analyzers at Rs 139.15 crore and 16,765 units. Almost 80 percent of floor instruments are on rentals; this figure is much smaller for bench-top. Semi-automated instruments are all procured, with almost none on rentals. The size of the market in 2019 has been calculated on assigning a monetary value to all the instruments installed, whether placed or sold.

The brands present in this segment include Transasia, Roche, Mindray, Bio-rad, CPC, Randox, Agappe, Tulip, Sysmex, Trivitron, Biosystem, Beacon, Rapid, Biosys, Vector, and Biotek.

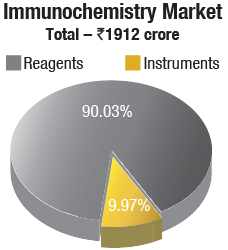

Immunochemistry instruments & reagents. The Indian immunochemistry instruments & reagents market, in 2019, is estimated at Rs 1912 crore, with reagents dominating the market, with a 90-percent share at Rs 1721 crore. Roche dominates the market, followed by Abbott, bioMérieux, Beckman Coulter, and Siemens, each with sales in the Rs 200 crore to Rs 250 crore slab. OCD and Mindray are the other aggressive brands. In 2019, the market saw two new entrants Fujirebio from Japan, now a part of Miraca group, and Mindray from China. In 2019, bioMérieux strengthened its presence with the inclusion of the products from its two acquisitions in 2018. Transasia, Bio-Rad, Maglumi (Immunoshop), Agappe, Snibe, CPC, Tulip, Compact Diagnostics, Randox, Sysmex, Trivitron, Horiba, IRIS, and SD Biosensors also have presence in this segment.

The Elisa kits & rapid tests segments, dominated by J Mitra and Transasia, are combined estimated at Rs 760 crore in 2019. These segments hold promise as there is an increase in tropical diseases, and cancer testing. Affordability is no longer a major issue as a huge Indian middle class is inclined to go ahead with diagnostic testing and allergy testing. The health aggregators are consolidating and focusing on building volume as the sample lasts for a longer time, once frozen. The year 2019 saw an attempt by a handful of vendors for partial placement through their distributors, i.e., placing the machine at a certain service revenue.

Equipment that perform both biochemistry and immunochemistry assays on the same system have proved to be the most economical in the last decade. Further development of the already-established equipment allows facilitated handling and increased capacity for blood samples, reagents, and consumables. An extra leap taken today will help the laboratories in investing more for upgradation in the near future as the emergence and rapid adoption of robotics is increasing day by day. R&D-based Indian manufacturers have come up with automated analyzers that can upgrade laboratories to perform more tests per reagent pack and more samples per run. These benefits are derived by incorporating the latest techniques in photometry, low-volume reagents’ consumption, and optimization of onboard facilities for reagents, samples, and consumables.

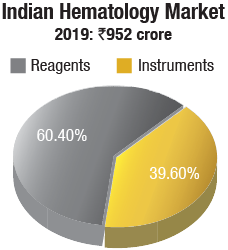

Hematology instruments & reagents. The Indian hematology instruments & reagents market in 2019 is estimated as Rs 952 crore. Reagents constitute 60 percent of the market at Rs 575 crore and instruments, all fully automated, the balance at Rs 377 crore.

The hematology instruments market may be segmented as 3-part and 5-part analyzers. Within the 3-part analyzer segment, the single-chamber is a dying breed, and the laboratories are opting for its double-chamber counterpart, which contributes 86 percent to the total instruments market by volume.

Within the 5-part analyzers, the entry-level or standalone analyzers are the preferred ones and are largely purchased. Within the high-level 5-part analyzer category, the basic model with an auto loader is more popular. However, the discerning customer opts for the high-end analyzer, with a throughput of 200–300 samples per hour that can create four to twelve slides from a single sample aspiration; and 140 slides can be prepared per hour. A handful of buyers also opt for a series of connected hematology work cells so that the lab can now streamline workflow with smart workload balancing and advanced analytics, providing relevant and thoughtful workflow efficiency, while delivering comprehensive and accurate patient results. The 5-part high-level analyzers are almost all placements and are in a very few cases partially placed.

Transasia continues its journey, getting its earlier installations serviced by Sysmex engineers, and making inroads into Tier-II and Tier-III cities, with its competitively priced models. Mindray and Horiba are regularly introducing new products and gradually transitioning to premium customers, with a changed basket of fewer standalone systems. Beckman Coulter continues to deliver greater sensitivity through its advanced technology, and has a couple of very-high-performance models to its credit. Having parted ways with Transasia, Sysmex continues to strengthen its sales and support network. Siemens, Abbott, and Nihon Kohden are also aggressive in this segment. Trivitron, Agappe, and CPC provide a complete solution for hematology diagnosis. Roche, Sysmex, Trivitron, Agappe, CPC, Beacon, Medica Corp, Compact Diagnostics, Diasys, and EKF also have presence in this segment. And many other brands thrive in this segment, catering to regional labs, municipal corporation labs, and mohalla clinics, and mostly on rental basis.

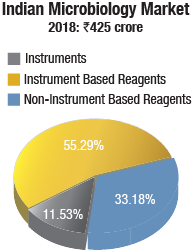

Microbiology instruments & reagents. The Indian market for microbiology instruments & reagents in 2018 is estimated at Rs 425 crore. bioMérieux and BD India continue to dominate the market, with BD dominating the reagents market and bioMérieux the instruments segment. Hi-Media is aggressive in non-instruments-based reagents. Thermo Fisher (Oxoid), Bio-Rad, Microxpress (Tulip Diagnostics), and Beckman Coulter (Siemens products) also have presence in this segment.

The instruments-based reagents were at Rs 235 crore in 2018, a 55.29-percent share of the total market, non-instruments reagents at Rs 141 crore, at a 33.18-percent share, and the instruments at Rs 49 crore, at 11.53 percent with 610 instruments sold in 2018. The market was dominated by identification and antibiotic susceptibility analyzers with a 57.37 percent share.

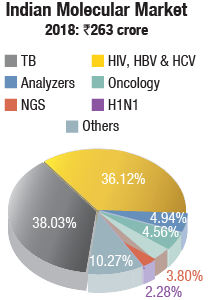

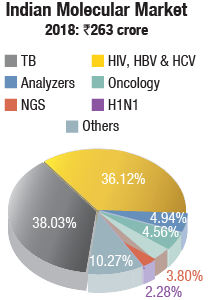

Molecular instruments & reagents. The Indian molecular diagnostics market is estimated at Rs 263 crore in 2018. Analyzers contributed Rs 13 crore, and most were placed. Roche, Abbott, and Qiagen continue to be the three dominant vendors. Bio-rad, HiMedia, Perkin Elmer, bioMérieux, Tulip Diagnostics, CPC, and Trivitron also have presence in this segment.

In the reagents segment, TB at Rs 100 crore and HIV, HBV (hepatitis B virus), & HCV at Rs 95 crore had a combined contribution of 78 percent.

Urinalysis analyzers & reagents. The Indian market for urinalysis analyzers & reagents in 2018 is estimated at Rs 172.6 crore. Reagents continued to dominate with an 81-percent share, valued at Rs 139 crore. The reagents may be further segmented as 75.5 percent being used by semi-automated instruments, catered to largely by Dirui and Transasia, and also by Roche and Siemens, and 24.5 percent by fully automated ones catered to largely by Sysmex, Iris, and Dirui (Rapid).

The brands present in this segment include Sysmex, Iris, Transasia, Horiba, Agappe, Abbott (Alere), and DiaSys.

The overall market has seen an increase in all segments, albeit there is a very slow transition to fully automatic analyzers, which are almost 95 percent placed. The semi-automatic instruments are also now increasingly being placed, with major revenue anticipated from reagents. The urinalysis market continues to be dominated by semi-automated instruments with a 97-percent share, by volume. However, the customers opt for high-throughput instruments.

The fully automated analyzers segment is estimated at Rs 15.6 crore, with integrated analyzers seeing maximum growth. The urine sediments fully automated instruments and urine chemistry instruments each contribute about 16 percent to the market, by value. By quantity, urine chemistry instruments have a 28.5 percent share, and urine sediments instrument a 21.43 percent. The integrated fully automated instruments are most popular with a 50-percent share by quantity, albeit the share by value is 67.3 percent.

The fully automated analyzers segment is estimated at Rs 15.6 crore, with integrated analyzers seeing maximum growth. The urine sediments fully automated instruments and urine chemistry instruments each contribute about 16 percent to the market, by value. By quantity, urine chemistry instruments have a 28.5 percent share, and urine sediments instrument a 21.43 percent. The integrated fully automated instruments are most popular with a 50-percent share by quantity, albeit the share by value is 67.3 percent.

Coagulation instruments & reagents. The Indian coagulation instruments & reagents market in 2018 is estimated at Rs 148 crore. The year showed a 9-percent growth over 2017. The installed base in 2018 is estimated at 4965 instruments, with semi-automated instruments at 4350 units, and fully automated ones at 615 units.

In the Rs 130-crore reagents market, although 80 percent of tests conducted are for routine parameters (PT and APTT) and remaining 20 percent are for specialized coagulation parameters, the revenue accruing from routine tests is 60 percent, and 40 percent is from specialized parameter tests.

The brands present in this segment include Stago, Werfen India, Sysmex, Agappe, Abbot Diagnostics, Compact Diagnostics, Tulip, Transasia, bioMérieux, CPC Diagnostics, Meril Diagnostics, and Roche.

The changing landscape

As is the trend for hospitals, laboratories are also seeing consolidation, thus impacting demand. Price erosion has been a major setback for the vendors, and although volume may have increased in some segments, the margins were compromised greatly. While newer assays are being introduced by the vendors, the absence of insurance reimbursement is keeping away the consumer.

The year 2019 saw an attempt by a handful of vendors for partial placement through their distributors, i.e., placing the machine at a certain service revenue. Competition continues to be cut-throat; margins are under pressure; and attempts are being made, not always with success at imposing penalties for not meeting commercial commitments of number of tests run by the laboratories to the vendors in a specific period.

As testing demand surges, laboratory administrators also face budgetary pressures and staffing shortages.

With the weakening of the rupee, there is a huge impact on the price of hardware and consumables, which are eluding the rural laboratories. Local manufacturing is the key success factor in this segment, and there are a few manufacturers in India who have envisioned this.

GLOBAL IVD MARKET

The world market for diagnostics is estimated at USD 69.2 billion in 2019 and is expected to grow 4 percent annually to USD 85.2 billion by 2024, predicts Kalorama Information. This includes all laboratory- and hospital-based products, and OTC product sales. This is against a 6 percent growth in the last couple of years. Faster growth is possible; if the potential of sequencing and personalized medicine testing is fully realized, such rates might return. For the next five years, slowdowns in instrument purchasing decisions, the effects of PAMA legislation in the United States, cold markets in Europe, decreasing reimbursement for glucose and low-cost competition (in an essential IVD market), as well as the migration of previously low-volume tests to integrated analyzers (that decrease the cost per test) must be weighed against the positives of an aging population, increasing procedures, and test improvements. The consolidation of lab customers is also a concern.

All of the major IVD companies reported double-digit increases in their sales in China with growth in the other top emerging markets–Brazil, Turkey, Korea, India, Saudi Arabia, and Mexico. Other emerging markets of interest for IVD vendors were Colombia, UAE, South Africa, and the Eastern Europe region. These countries continue to invest in healthcare infrastructure and insurance coverage for a growing more affluent middle class.

The market continues to grow, but the market trend is changing. Twenty years ago, clinical chemistry and immunoassays were most of testing. Still today, the traditional core lab test segments–chemistry/immunoassay, hematology and coagulation–make up 34 percent of the value of the IVD market in 2019, while they are over sixty percent of tests run. As molecular, infectious disease, and cancer tests increase in importance, the market share of these core tests will decrease to 29 percent in 2024.

Testing trends

The industry continues to push issues and develop solutions for diseases that fall into the paradigm of early testing benefiting outcomes. It can even claim that some known healthcare problems in some way are the result of a lack of testing. Anti-microbial resistance continues to be an area where IVD shines; there is a growing realization that blind prescribing of antibiotics could be reduced with faster and more targeted testing.

Despite great attention and much action, the opioid crisis continues to plague most countries of the world. There is a need for increased collaboration between clinical laboratories and other stakeholders. Early detection of cancer and the popularity of consumer genetic tests are also likely contributors to increased recognition of IVD testing.

While this is happening, various worldwide payor schemes are pressuring prices. The response is consolidation of lab operations and facilities. Same with IVD vendors. Consolidation remains the rule in the industry among both customers and vendors. Top-tier IVD companies accounted for some USD 55 billion of IVD product sales last year. Part of this development is related to organic company growth, but also to strategic acquisitions that add revenue streams and product innovations.

Indeed, the top-tier plus next-tier companies, numbering less than 40, account for a majority of the world market for IVDs. The remainder is held by hundreds of companies, some of which specialize in specific test segments and others that serve their local markets.

That should foretell no lack of dynamism in the industry. Beyond the market numbers, the pace of mergers and acquisitions is brisk. There are also IVD startups and ventures. According to an August 2019 estimate from EY Parthenon, there were USD 3 billion invested in IVD-related businesses, and more than 170 investment rounds between May 2018 and April 2019. There were also over nine IPOs worldwide, raising USD 500 million for diagnostic-related ventures. These new ventures create technology that may fail, or may create the next Foundation Medicines, Alere, or Pacific Biosciences that will be consumed by a larger player in the future. Or like Illumina, they may yet grow to become technology leaders and dominant in their own right.

This technology innovation produced by these companies and ventures will run up against another trend–value-based testing. The EU IVDR directives insert clinical validity into requirements directly into permission-to-market a product in Europe, with staggering processes and paperwork requirements, and an upshifting of classification where contagious conditions or expensive treatments are involved. In the United States and other nations, expect these trends to enter in the payment process, if not the regulatory one. Because in vitro diagnostics are so integral to patient care, particularly for oncology, developers must be aware of how quality and efficacy data pertaining to their device will be used.

The diagnostics industry spends a fair amount on research and development compared to other industries. (Roche spent USD 1.4 billion on diagnostics R&D in 2018, bioMérieux USD 326 million, and Sysmex USD 158 million.) These investments and technology-driven M&A activity pay off. The industry now uses technologies that would not have been thought of when the first edition appeared two decades ago. Their influence is felt in personalized medicine, inherited diseases, pathogen detection, antibiotic-resistance testing, blood banking, and much more to come. Yet innovation has come with challenges, and the industry is also subject to regulation, price scrutiny, and value-proving as much as any part of the healthcare system and perhaps more.

Market highlights

Cancer and infectious diseases drive IVD sales. Tissue-based testing for cancer and molecular tests for both cancer and infectious diseases are the growth engine among larger segments–growing at 50 percent higher than the overall market. Concern over sepsis and respiratory conditions should ensure that infectious diseases will remain in the fast-growth categories. Specialty immunoassays, continuous glucose tests, mass spectrometry, and inherited diseases are other large and high-growth segments.

Second Opinion

Impact of COVID-19 on laboratories

Dr Babli Dhaliwal

CTO,

Trident Diagnostics and Healthcare Services Pvt Ltd.

Let me start with the idiom every dark cloud has a silver lining–the dark cloud of course being the COVID-19 pandemic. Now let me elaborate on the silver lining.

For years and decades, the department of laboratory medicine in the medical field specially in the hospital setup has been seen mainly as a source of revenue generation, and less for the enormous role it plays in healthcare, both in diagnosis and prognosis. COVID-19 changed this. The confirmation of diagnosis is solely based on the PCR test performed by the laboratory. The technician and the technologist have at last started getting their due attention/recognition. Sadly, there is a long way to go; very few even consider them as corona warriors although they are directly exposed to the virus while testing and sampling. The laboratory will soon have a different definition and recognition in healthcare.

Secondly, the speed with which the government machinery has started functioning is something we all have been dreaming for. Right from the government, politician, bureaucrat, and judiciary to the nodal national medical agency (ICMR), all are on fast track in decision making, licensing, or issuing guidelines. Never before have we seen so much confidence and self-belief in Indians to the extent that even WHO directives were overruled when it was felt necessary.

Within a few months, the scientific and manufacturing community has made great strides, be it in manufacturing of PPEs to drugs, instrumentation, or robots. In a short span of time, Indian companies have made PCR instruments, the antibody testing kits, collaborations in finding a vaccine, and much more. The approval and validation has been done in record time to boost the manufacturing ability.

Indians, who have never before reposed trust in indigenous products, are willingly putting Indian products to good use and that too at a highly affordable cost. This trend should last beyond the pandemic and should see manufacturing of all other biomedical testing equipment too. Given the right impetus, India can rise to any occasion. This thinking will give a big boost to the Indian biomedical industry.

The PCR test is not the only highly used test in this pandemic, but other tests like arterial blood gas, electrolytes, and cell counts, among others, have also been used in large volumes. This has brought the laboratory and the personnel manning it and authenticating the results in the forefront, and at last they will no longer remain the unsung heroes of healthcare.

In the early 1980s, when I started my career in laboratory medicine, WHO had the slogan which fascinated and impressed me a lot, Health for all by 2000. Ironically, it has now become All for health in 2020.

No matter how dark and big is the cloud of COVID, the silver lining is equally big and widespread.

Market by geographic regions. Developed markets (N. America/Europe/Japan) still make up the bulk of IVD sales, with USA accounting for 42 percent of the market. But growth is dependent on developing-nations IVD markets. Among these markets are China, India, Korea, Turkey, and Brazil but IVD vendors are finding new emergent nations, like the Philippines at 9 percent revenue growth, or Malaysia with 8 percent growth. There are others. Both Colombia and Romania are charting better-than-world growth rates with 6 percent CAGR. There is also an IVD market recovery in Europe, and growth in Japan.

Mass spectrometry has arrived. Mass spectrometry (MS) is a significant category in the market, especially in developed markets, for the identification of bacteria, fungi, and mycobacteria. The MALDI-TOF market has exploded in recent years in microbiology labs, thanks largely to the IVD regulatory approval of the VITEK MS and MALDI biotyper histopathology, which is a new area of interest–Bruker Corp. is developing technology to make MALDI imaging viable in histopathology. Throughput and operational complexity are limits despite this fast growth in usage.

Migration, customer protection in the core laboratory. Major chemistry vendors are developing improved models, selling their existing customers on staying with them–to preserve and expand revenue, as well as create barrier entry against other vendors in a shrinking lab environment. Footprint improvements, IT enhancements, EMR, automation, and expanded menus are part of this change. While this is not part of traditional IVD commercialization, web-based and TV marketing has helped in a few categories and usage of such mechanisms would boost this category.

Companies buy to grow. No one company owns all the technology to compete in an increasingly complex world. Over 60 recent mergers and acquisitions related to IVD have taken place. Last year, Abbott brought PoC leader Alere into its operations, completing an acquisition finalized in 2017. Beckman Coulter Life Sciences acquired Cytobank in June 2019, a privately held, single-cell data analysis, software-as-a-service (SaaS) company. Beckman Coulter Life Sciences recently acquired Labcyte, best known for its Echo acoustic droplet ejection technology. In June 2019, Meridian Bioscience completed its purchase of GenePoC, with an eye toward a syndromic testing strategy. Thermo Fisher Scientific acquired Slovakia-based mass spectrometry software developer HighChem Ltd. in June 2019.

Hospitals driving point of care. It is a mistake to think that point of care is only used by physicians or self-testing. Hospitals are by far the biggest users of rapid IVD tests and decentralizing certain tests for improved outcomes can boost the right system, if the cost case can be made. The direct-to-consumer trend, recently successful in genomic type tests, is one to watch. OTC HIV, cholesterol, and colon cancer tests are available alongside well-established pregnancy and glucose tests. Individuals can purchase lab tests in retail outlets or via the Internet.

Trends to watch

These long-term trends will tend to inform what the future IVD market size in various segments will reach.

China and top emerging-nations IVD markets. China is the world’s largest, and one of the fastest-growing, IVD markets. Thus, it is a target by all major IVD vendors for replacing some revenue lost to slower growth in developed healthcare markets. The global industry has increased activities in China in the past decade, and companies not only sell IVDs, but also manufacture and distribute in China as well. In 2019, the Chinese market for IVD reagents was estimated at approximately USD 3.8 billion and is expected to show annual growth of 8 percent over the next five years.

Expanding beyond the top seven emerging markets is essential for growth in the global IVD industry. Eastern Europe, LATAM (outside of Brazil), and Eastern Europe represent next-tier emerging regions. With a longer-term focus, Africa must be part of 5- and 10-year business plans for companies not already in the region. There are already global companies in the region. More than half of global population growth between now and 2050 is expected to occur in Africa, according to the U.N.

Next-generation sequencing and IVD markets. Next-generation sequencing, accompanied by data analysis algorithms, can allow clinicians and researchers to uncover the hidden aspects of antibiotic resistance, cancer pathways, and rare and chronic diseases. This could mean precision medicine is beginning to put one-size-fits-all medicine in the archives of therapeutics. Their usage will be a large factor in the future growth of diagnostics.

The numbers of genetic testing units (GTUs) entering the commercial market daily are increasing at a faster pace. Most disease processes involve a number of genes and cell pathways. New multi-gene diagnostic tests by whole genome and next-generation sequencing that examine thousands of specific gene sequences might one day hold the key to assessing disease risk, diagnosing diseases, and guiding precision-medicine treatment decisions. However, artificial intelligence algorithms are needed to interpret the mass of test data produced by these tests.

The testing of cell-free and tumor DNA (liquid biopsy) is becoming an important tool for early and metastatic cancer detection. The technology is also playing a part in pathogen epidemiology. Established and new molecular techniques are being developed to realize the dream of unequivocal near-patient and point-of-care testing for infectious diseases and acute care analytes. This is important for resource-poor situations worldwide.

And then, there is the emerging science of linkages between the human microbiome and the manifestation of a whole host of diseases. This phenomenon is creating a new approach to disease detection and therapeutics. Molecular tests, especially for inherited diseases and some FISH analyses, are extremely complex. The tests provide raw data, the interpretation of which sometimes baffles even the most experienced molecular biologists. New sequencing technologies are expanding the number of causative genes known for genetic disorders. Gene identification is a first step for future development of a targeted therapeutic, especially for cancer and rare diseases. Exosomes carry nucleic acids and proteins from their host cells and are widely considered to be essential for biomarker discovery for personalized healthcare diagnostics. Tumor cells, for instance, release exosomes which contain tumor specific RNAs that can be isolated easier from biofluids, such as blood and urine than from biopsies. It is expected that exosome-based tests in routine genomic diagnostics will provide an alternative to tissue biopsies, and create new opportunities in molecular testing, especially for cancer liquid biopsy analysis.

Direct-to-consumer IVD markets. There has been an explosion of genetic test services that aim to predict a person’s risk of developing various chronic diseases, such as diabetes, cardiovascular conditions, arthritis, Alzheimer’s, breast cancer, celiac disease and psychological syndromes.

For a long time, these test services flew under the radar, but with increased consumer demand, the USFDA leaped into action. The most advanced company is 23andMe (Mountainview, CA). Although the FDA approval for 23andMe services may have surprised some, the company has fastidiously conducted studies to prove the utility of its human genome direct-to-consumer test services. The company’s over-the-counter use tests are intended for genomic DNA, isolated from human specimens collected by the user.

Yet, despite the well-known benefits of genomics to improve patient outcomes, access to genomic information in healthcare remains limited. It is generally accepted that a critical step in the commercialization of a test modality is the availability of quality-control standards.

Information technology and AI. Laboratory IT and clinical scoring systems and algorithms have been used in medical practice for some time; recently there has been an increase in the application of machine learning (artificial intelligence) to improve these tools. While traditional algorithms require all calculations to be pre-programmed, machine-learning algorithms deduce the optimal set of calculations by searching for patterns in large collections of patient data.

There have been extraordinary advances in artificial intelligence, the end-game for information technology. Similar to the product-commercialization process that is evident in the liquid biopsy market, IVD companies’ efforts have been supported by USFDA to give products expedited review. This helps patients to have more timely access to devices and technology that provide more effective treatment or diagnosis for life-threatening diseases.

More products have been cleared for clinical use and more new research-use-only applications have come to the market and many more are in development–companies are collaborating to improve the power of data analysis for patient care. Over the past several years, healthcare has witnessed a transformation, with a shift from paper-based record systems to electronic records and incorporation of digital health-monitoring devices and advanced patient screening systems. These advances have resulted in a data explosion, which can best be manipulated and analyzed, using artificial intelligence (AI) technology.

Evidence to support AI’s use in diagnostics is building. An August 2019 JAMA Network Open found that a novel artificial intelligence algorithm outperformed pathologists in differentiating ductal carcinoma in situ (DCIS) from atypical hyperplasia, a job that is “considered the most diagnostically difficult task in clinical practice,” researchers wrote in the paper published online. The researchers compared the performance of machine learning with the interpretation of digitized images by 87 practicing pathologists. A machine-learning algorithm that analyzed two features (tissue distribution and structure) had lower sensitivity than the pathologists, when it came to distinguish between invasive and non-invasive cancer.

New venues–Urgent and retail care, microhospitals. IVD marketers cannot ignore the trend of healthcare following the patient. Urgent-care centers are not new but have taken on new importance as convenient healthcare options. New urgent-care centers are being set up rapidly. Some of these will compete for patients with existing locations, and all may not survive.

There is a new opportunity opening for clinical laboratories–microhospitals. Microhospitals feature 8 to 10 inpatient beds (but can have as many as 50 beds), and range from 15,000 to 50,000 square feet, whereas full-service hospitals are 100,000 square feet or more. Microhospitals are significantly less expensive than large hospitals to bring to market. For patients, microhospitals offer the 24-hour care that cannot be found at healthcare clinics located inside drugstores or urgent-care clinics.

Watch point-of-care. Point-of-care (PoC) testing attracts heavy venture capital and company interest. PoC testing blends clinical and traditional medical engineering with telecommunications, information, and computer science opening niche markets for PoC testing and devices.

Diagnostics and patient monitoring will play a larger role in PoC testing. Newer technologies entering developing countries, such as smartphone-linked diagnostic devices, can make huge difference.

PoC testing’s past success hinged on developing tests that employed user-friendly techniques and alternative samples. Future success for PoC testing depends on value-added dimensions to PoC tests, already in progress. Currently, all high-end glucose monitoring devices offer software and connectivity that allows diabetics to better manage their health. Test services for HbA1c, paternity, coagulation, and other tests provide physician-consultation apps.

IVD mergers and acquisitions on the increase

As companies in in vitro diagnostics seek to reach additional markets, new partners and technologies are needed. There were more than 60 recent mergers and acquisitions in IVD in the past year, and there have been hundreds in the last five years.

Roche remains the world’s largest biotech company, with truly differentiated medicines in oncology, immunology, infectious diseases, ophthalmology, and diseases of the central nervous system. Roche is also the world leader in in vitro diagnostics and tissue-based cancer diagnostics, and a frontrunner in diabetes management. One of the ways Roche drives business growth is through mergers and acquisitions (M&A), so the company seems perpetually active in this area.

Roche’s recent acquisitions include the following:

- In June 2018, Roche took complete control in Foundation Medicine for USD 2.4 billion; Roche had already owned a majority stake in the company, valued at USD 5.3 billion.

- Roche in April 2018, for USD 1.9 billion, completed the acquisition of Flatiron Health, a maker of oncology-focused electronic health records.

- Roche completed in February 2018 the acquisition of biotech Ignyta for USD 1.7 billion, giving Roche rights to a drug, entrectinib, currently in testing for cancers that contain specific types of genetic mutations–NTRK or ROS1 fusions.

- Roche acquired Viewics, Inc. in November 2017, allowing Roche to expand its leading position in the integrated core laboratory with business analytics capabilities.

Abbott. The acquisition of Alere was finally completed in October 2017, after the deal went through many ups and downs since the initial announcement was made in February 2016. After the USD 5.3-billion acquisition, Alere became a subsidiary of Abbott. In 2017 Alere generated revenues of approximately USD 2.3 billion, of which the divested cardiovascular and toxicology product sales were approximately USD 1200 million. Therefore, Abbott inherited potential Alere revenues of approximately USD 1100 million, and reported Alere revenue of USD 540 million in 4Q2017.

Some large acquisitions in the period, April to June 2019, include Eurofin’s acquisition of Transplant Genomics Inc., Invita’s acquisition of Singular Bio for USD 55 million, Meridian Bioscience’s acquisition of GenePoC, Thermo Fisher’s acquisition of HighChem, Beckman Coulter Life Sciences acquisition of Cytobank, Bio-Rad’s acquisition to expand its genomic reagents product portfolio, Caris Life Sciences’ acquisition of Pharmatech, Ginkgo Bioworks’ acquisition of Warp Drive Bio’s bioinformatics platform, Thermo Fisher’s acquisition of Brammer Bio, Qiagen, and Health Innovation Manchester’s launch of Apis Assay Technologies, and PerkinElmer’s acquisition of Cisbio Bioassays.

Core lab’s expansion

Routine laboratory tests in chemistry, immunoassays, urinalysis, microbiology, coagulation, and HPV cytology are consolidating into the core lab. More analytes, previously found only on dedicated immunoanalyzers, have migrated to consolidated work stations, including D-dimer (coagulation), Vitamin D, HgA1c (diabetes), BNP, NGAL, anti-CCP, hsCRP, cystatin, HIV, HCV, procalcitonin, HE4 cancer marker, and markers for Graves’ disease.

Routine laboratory tests in chemistry, immunoassays, urinalysis, microbiology, coagulation, and HPV cytology are consolidating into the core lab. More analytes, previously found only on dedicated immunoanalyzers, have migrated to consolidated work stations, including D-dimer (coagulation), Vitamin D, HgA1c (diabetes), BNP, NGAL, anti-CCP, hsCRP, cystatin, HIV, HCV, procalcitonin, HE4 cancer marker, and markers for Graves’ disease.

Traditional specialization barriers, including microbiology, hematology, blood banking, immunology, and anatomical pathology are fading, making the core laboratory a lab medicine hub. Economic pressures, labor shortages, and continual additions of new diagnostic tests to lab menus are expanding the core laboratory. At least 80 immunoassays are currently available in clinical workstations. Automation is likely in the core lab’s future.

Smaller hospitals are amalgamating routine tests from different disciplines into one core laboratory. New tabletop diagnostic instruments for small labs are multianalyte workstations, running chemistries and many immunoassays. Current diagnostic instruments for clinical chemistry, immunoassays, hematology, coagulation, urinalysis, and microbiology can link to laboratory information systems and central lab tracks.

Potential IVD market disruptors

More walk-In clinic testing, more DTC testing. A growing segment in clinical laboratory testing is provided by walk-in style clinics in pharmacies and retail food outlets, more common in developed countries.

Skipping the pathogen–syndromic testing. Infectious disease tests most companies produce detect a single pathogen, or an antibiotic-resistance gene. However, if a patient presents with general symptoms of a respiratory infection, or with symptoms of a gastrointestinal infection or some other type of infection, there are several different pathogens that may have caused the infection. This has led to the development of syndromic panels that include a panel of pathogens, and often also resistance genes, commonly found with the targeted type of syndromic infection.

Immunoassay PoC pushes back. With all the attention on molecular PoC systems, it is worthwhile noting that there are also improvements in immunoassays. Few technologies in the PoC diagnostics market pit molecular against immunoassays in an interesting way.

The sensitivity and specificity of nucleic acid analytes provide molecular diagnostics key advantages in clinical practice, particularly in critical health situations. Nucleic acid amplification, or molecular tests, are now open to routine and distributed use in healthcare, thanks to advancements in microfluidics and molecular reagents.

Emerging microbiome diagnostic companies. The human microbiome consists of trillions of microbes (bacteria, fungi, archaea, and viruses) that exist symbiotically within the human body. These organisms are important, as they perform essential functions that human cells cannot do. There is growing interest and research activity in the microbiome. Many diagnostic companies have traditionally not shown interest in the microbiome, and diagnostic companies in this field have primarily been small. Some therapeutic companies have developed the diagnostic tests that are needed for use with their therapies since the diagnostic industry has not met their needs.

Many diagnostic companies have traditionally not shown interest in the microbiome, and diagnostic companies in this field have primarily been small. Some therapeutic companies have developed the diagnostic tests that are needed for use with their therapies since the diagnostic industry has not met their needs.

The microbiome in vitro diagnostics market is likely to continue to emerge. Meanwhile, consumer-focused microbiome testing companies are also continuing to attract investments.

Multiple target liquid biopsy. Interest is high in non-invasive methods to screen for cancer. While much of this interest is focused on blood-based cancer screening tests, other types of non-invasive screening tests are also attracting attention.

Rare diseases testing. Though a large amount of testing occurs, there are many conditions undetectable by current testing and, therefore, a need for further diagnostic products. A consortium of researchers called Solve-RD, funded with USD 18.8 million from an EU healthcare medical research booster, plans to use clinical knowledge and genomics to assist patients with unsolved rare diseases obtain a molecular diagnosis. Solve-RD also plans to move beyond sequencing and employ other omics technologies, depending on the availability of affected tissue samples from patients.

For example, the consortium has muscle biopsies for some patients with neuromuscular disease phenotypes that will be analyzed by RNA-seq, using mostly short-read, but in selected cases, long-read technologies. For other groups of patients, the consortium wants to employ mass spectrometry-based proteomics, metabolomics, or epigenomics.

Watch DNA sequencing move into in vitro diagnostics (IVD) and toward more FDA clearances/approvals. At this time, there are only two FDA-cleared next-generation sequencing (NGS)-based in vitro diagnostic tests, the Illumina MiSeqDx Cystic Fibrosis Clinical Sequencing Assay and the Illumina MiSeqDx Cystic Fibrosis 139-Variant Assay.

In addition, in the US, the FDA has approved the ViroSeq HIV-1 Genotyping System, which is performed on the 3700 Genetic Analyzer and is marketed by Abbott. Outside of the US, Abbott also offers the CE-IVD-marked Abbott HBV Sequencing Assay.

Nutrigenomics. Expect to hear more talk of nutrigenomics and testing aimed at consumers with the purpose of a diet plan. While not an area that traditional IVD companies are creating products in at the current time, the use of DNA sequencing-based tests to codevelop diet plans is one to take note of. While scientific evidence is not clear on these tests, that would not stop companies of various persuasions from cropping up to sell such products. Some companies test for genes which have no statistically significant association as published in meta-analyses. It is not out of the question that IVD companies would enter nutrigenomic testing.

COVID-19 takes center stage

As the COVID-19 pandemic continues to grow, attention has been focused on how to effectively scale up the diagnostic testing that is needed to correctly handle patients and track the disease’s spread. Countries have been trying to apply the lessons learned in the regions that were hit first. China appears to have dramatically slowed the disease, and one of the key aspects of that effort has been large-scale diagnostic testing. In the United States, there had been regulatory hiccups as well as problems with the initial CDC test kits sent out, which resulted in delays and significant concern about the ability to scale up in the necessary timeframe. In addition, there have been shortages of associated products needed to run the tests, such as controls and RNA extraction kits. Gradually the companies and labs have been addressing these needs.

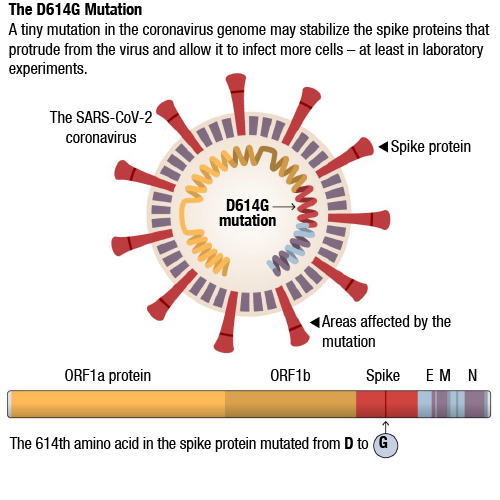

That SARS 2.0 spreads asymptomatically has been established now in several studies, and this is a factor for the rapid spread of the disease, and also is driving new policies. This means that a patient can be infected with the virus and not know it, and that makes it difficult to control. SARS-CoV-2 behaves like a typical respiratory coronavirus in the basic mechanisms of infection and replication. But several mutations allow it to bind tighter to its host receptor, and increase its transmissibility, which is thought to make it more infectious.

For months, scientists have debated why one genetic variation of the coronavirus became dominant in many parts of the world. Many scientists argue that the variation spread widely by chance, multiplying outward from explosive outbreaks in Europe. Others have proposed the possibility that a mutation gave it some kind of biological edge, and have been urgently investigating the effect of that mutation.

Now, scientists have shown–at least in the tightly controlled environment of a laboratory cell culture–that viruses carrying that particular mutation infect more cells and are more resilient than those without it.

The new study, which has not yet been peer reviewed, does show that this mutation appears to change the biological function of the virus. Researchers at Scripps Research, Florida, found that the mutation, known as D614G, stabilized the virus’s spike proteins, which protrude from the viral surface and give the coronavirus its name. The number of functional and intact spikes on each viral particle was about five times higher because of this mutation, they found.

These spike proteins must attach to a cell for a virus to infect it. As a result, the viruses with D614G were far more likely to infect a cell than viruses without that mutation, according to the scientists who led the study, Hyeryun Choe and Michael Farzan.

A tiny mutation in the coronavirus genome may stabilize the spike proteins that protrude from the virus and allow it to infect more cells–at least in laboratory experiments.

According to warnings from Chinese researchers, individuals infected with the earlier SARS-CoV-2 coronavirus strains could be defenseless against the more aggressive European strains with D614G mutations. This would have implications for countries like Japan, South Korea, most of the South-East Asian countries, and even China itself as most of the individuals infected in the early parts of the crisis were infected with the middle strains.

The Chinese researchers say that the antibodies found in blood of individuals, who have fought disease previously, failed to stop D614G strain. Also worrisome is that the new strain could actually be worse the second time round in patients who were previously infected with the milder strains and had recovered, but there is no clinical proof of this yet.

The strain with the D614G mutation began spreading in Europe in early February, and by May was the dominant strain around the world, presenting in 70 percent of sequenced samples in Europe and North America. It is now present in India, Iran, Middle-East, and Brazil as well. The Chinese researchers say antibodies found in patients, who had been infected with earlier forms of the pathogen, failed to neutralize the mutant strain.

Most significantly, one of the concerns now is whether the prevailing D614G strain will have a detrimental impact on vaccine development. Many Chinese vaccine candidates have entered the final phase of clinical trials, but they are based like those under development in the United States and Europe on the earliest strains of the coronavirus, detected and sequenced in Wuhan. A detailed study by IBM’s AI medical team in April warned that the D614G mutation could reduce the effectiveness of vaccine programs that target the virus’ spike protein. A separate study by a team of researchers in Serbia last month came to a similar conclusion.

Given the evolving nature of the SARS-CoV-2 RNA genome, antibody treatment and vaccine design might require further consideration to accommodate the D614G and other mutations that may affect the immunogenicity of the virus. Here are also other strains with mutations on them being discovered and studied, with another two more that might be even more potent!

IVD manufacturers have not escaped the pandemic’s impact

Similar to pharmaceutical companies, IVD manufacturers rely heavily on healthcare facilities for their clinical trial data collection. Most medical device products must undergo clinical trials both pre- and post-market before manufacturers can obtain certificates for market approval. As the COVID-19 pandemic continues to unfold, IVD companies are finding it difficult to make informed decisions about their products, supply chains, and regulatory obligations in the midst of uncertainty. IVD professionals have the unenviable task of asking for a pause amid the panic. No matter how bad it is or how bad it might get, here is the truth–heedless action will make it worse. Despite the adrenaline telling to produce as fast as possible, this is the moment when quality matters more than anything else.

With a strategy that leverages exemptions, production procedures that innovate to fill needs and a communication plan that works across public and private entities, one can navigate the chaos and support public health. Announcements from governing bodies and conversations with key decision makers and regulatory experts hold the key to the success of the IVD industry.

Overall, the implementation of several new regulations may be postponed, allowing both companies and regulatory agencies time to react to the crisis. However, there is no evidence this will alter reporting deadlines for established legislation.

The key, however, will be for companies to focus on how they can make the most effective contributions to control the spread of the virus and save lives.

Short term that might mean ramping up production to new levels; long term that might mean sticking closely to regulatory guidance to ensure that speed does not destroy quality, creating even more problems in the future. No matter what, IVD professionals will have an essential role to play in the fight against COVID-19!

Second Opinion

Doctors and AI–Friends or foes?

Dr Mukesh Sanklecha

Consultant Pediatrician,

Bombay Hospital

We doctor friends were all out for dinner, and the topic of discussion veered toward whether artificial intelligence (AI) would replace doctors and make them redundant in the near future. While many of my friends did feel that way, some begged to differ.

The proponents of this theory put forth several arguments. After having analyzed many plan X-rays, AI was able to diagnose pathologies in the images far more accurately and consistently than the human mind.

When it came to dose calculation, and picking up which two drugs could or could not be used with one another, AI was way ahead in the race.

When it came to analyzing various signs, symptoms, and investigation findings, AI was far more consistent than the human mind when it came to a classical case with typical findings.

Was this the death bell for the medical profession? Certainly not!

The machine was not able to empathize at all. The human touch to healing has for long been underestimated.

When it came to borderline or doubtful cases, the experienced human mind immediately scored. When it came to choosing the right option based on judgement rather than mere facts, AI lost out.

What then does the future hold for this relation?

As I see it in the future, we must use AI for its best virtues. Let AI decide the correct dose, drug interactions, and let it do all the paper work and record keeping that has become so time-consuming and something that sometimes takes away from the joy of medical practice.

That will let the human mind concentrate more on important borderline decision-making, patient communication, and empathy that get compromised due to the doctor’s time getting taken up by menial tasks.

The future is of a beautiful symbiotic relationship between the man and the machine!!

DIAGNOSTIC SERVICES INDUSTRY

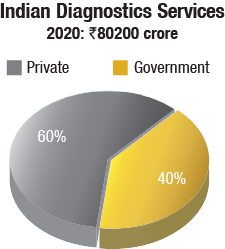

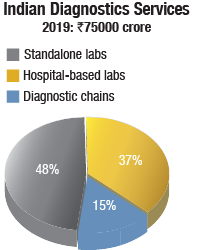

The diagnostic services market in India is pegged at Rs 80,200 crore in 2020, at a CAGR of 16 percent. There are 110,000 diagnostic labs, and 1076 centers are those accredited by the National Accreditation Board for Testing and Calibration Laboratories.

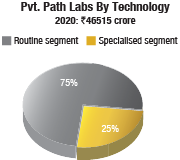

The pathology segment contributes 58 percent of the total market, by revenue, and radiology the balance 42 percent. Pathology business is the first step toward testing, and is highly scalable as blood samples can be easily shipped to a remote, centralized location, attaining economies of scale. However, despite being a relatively more cut-based practice, the margins involved in radiology are higher. Having said that, both go hand in hand, and one would not be able to survive without the other.

In technologies, if we limit to lab medicine in pathology, then 75 percent of the private pathology is in the routine segment, and specialized segment, which is growing, consists of almost 25 percent. The second is molecular pathology market–molecular biology which is more of genomic, genetic-based DNA, RNA segment sequencing, is growing at almost 35–40 percent every year. The two technologies, surgical pathology and molecular pathology, are definitely growing.

The standalone laboratories continue to constitute 48 percent, whereas those based in hospitals contribute 37 percent to the revenues of the diagnostics market. The unorganized players are mostly concentrated in Tier-II and Tier-III cities. These players are very often only focused on increasing their valuation so as to retain their presence in the market. In order to gain momentum, they strive to lower their costs. Introduction of new tests at a cheaper rate is a common strategy used. The unorganized and smaller labs offer a chance to the bigger players to expand their hub-and-spoke structures.

Reference labs are mostly concentrated in Tier-I cities, whereas Tier-II and Tier-III cities have collection labs or labs conducting routine testing. For high-end testing, the samples are couriered to their reference labs. However, with the introduction of digital pathology, the model has been changing. For instance, the reference labs are facing heavy loads of sample, and despite the large number of workforce, the sample size at times can be overwhelming. As a result, strategies are developed through digital pathology platforms to get the pathologists in other labs to report these cases. Slides can be scanned and images can be sent to other labs where the reporting can be performed.

There has been an emergence of a number of startups dealing in specialized testing, targeting only specific specialties and modalities.

A parallel network of unauthorized pathology labs continues to pose a huge risk. These are run by under-qualified technicians. Absence of qualified personnel, coupled with lack of quality procedures, may increase the possibility of erroneous reports, incorrect diagnosis, and an increased patient distrust in pathology.

Online aggregators, known to aggressively attract customers, are also expected to drive greater patient participation in using diagnostic offerings. The caveat, however, is that established chains offer a dedicated back-end testing infrastructure that cannot be replicated and matched at scale by the online aggregators.

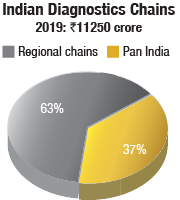

The diagnostic chains constitute 15 percent of the diagnostics market. These organized labs have flourished because they are supported by private equity investors and thus, capital to acquire existing labs that have good patient catchment, necessary processes, and protocols in place. And the hospital chains and corporate houses are seeding diagnostics ventures.

The top five in this segment are Dr Lal Pathlabs, SRL Diagnostics, Metropolis Healthcare, Neuberg Diagnostics, and Thyrocare. Mergers and acquisitions, as a strategy, have been extensively used by market leaders to grow their network and increase their market share.

Most of India’s top pathology chains are backed by private equity investors. Dr Lal PathLabs, for instance, counts WestBridge as a PE investor while Thyrocare is backed by Nalanda Capital, and Metropolis Healthcare Ltd. by buyout giant Carlyle. While Dr Lal PathLabs and Thyrocare went public in 2016, Metropolis Healthcare completed a Rs 1200 crore IPO in May 2019.

Other popular path lab chains include Medall Healthcare Pvt. Ltd., Medgenome, Oncquest Laboratories Limited, Core, iGenetics, Healthians, Hitech Diagnostic Centre, Suraksha, Suburban Diagnostics, Lucid Medical Diagnostics, and Vijaya Diagnostic Centre, some of which have raised huge funds for expansion. Bengaluru-based, AI startup, SigTuple, having raised USD 40 million is another story.

Top five chains. Dr Lal PathLabs, in existence for 70 years, contributed 34.3 percent to the Rs 3530.1 crore revenue pie of the top-five lab chains in 2018-19.

Dr Lal PathLabs, backed by WestBridge Capital and TA Associates, has made some acquisitions over the last couple of years. Shree Computerized Pathology Laboratory, operating in Maharashtra’s Yavatmal district, was acquired for Rs 4.1 crore; Modern Diagnostics & Modern Lab in the Sangli district for Rs 3.6 crore; a 70-percent stake in Amins Pathology Referral Laboratory, Vadodara, Gujarat; a 70-percent stake in a company housing the business of Central Lab, Indore, for not more than Rs 50 crore, housing the business of Central Lab, Indore; and Bawankar Pathology, a sole-proprietorship firm, based in Maharashtra’s Bhandara, acquired.

SRL Diagnostics, having been set up 24 years back contributed 20.5 percent to the Rs 3530.1-crore revenue pie of the top-five lab chains in 2018-19. SRL has changed hands many times. Passed around from Ranbaxy to Religare to Fortis Healthcare, SRL Diagnostics is a paradox that has been tainted with the promoters’ reputation. And now, it is scouting for a buyer again. The company has hired Kotak Mahindra Bank to get a PE exit.

The Metropolis chain, having been set up 39 years back, constituted 21.5 percent of the revenue share of the top-five lab chains in 2018-19. Metropolis has more than 240 centers in the country and offers diagnostic services in clinical chemistry, hematology, cytogenetics, etc. The company offers more than 4500 tests ranging from simple to super-specialized tests.

Neuberg Diagnostics is a two-year-old diagnostics venture. The chain gained a 12.75-percent revenue share in the top-five lab chains in 2018-19. It is an international alliance of five clinical labs. Dr GSK Velu, co-founder of Metropolis Healthcare, set it up by acquiring Anand Diagnostics Laboratory, Bengaluru; Supratech Micropath, Ahmedabad; Ehrlich Laboratory, Chennai; Global Labs, South Africa; and Minerva Diagnostics, Dubai. The success may largely be attributed to Velu’s formula not of acquire-and-merge the business but leveraging each of the individuals’ proficiencies and letting each thrive in its own strength. Also, this has resulted in the company not being a run-of-the-mill pathology chain but focusing on high-end diagnostics and genomics, proteomics, and metabolomics.

Thyrocare, having been set up 23 years back, almost at the same time as SRL Diagnostics, had an 11-percent revenue share in the top-five lab chains in 2018-19. The company’s focus is on preventive care, target being that preventive care packages contribute 75 percent of the company’s total revenues by 2020. In 2011, Thyrocare established Nuclear Healthcare, offering PET/CT imaging. Growing at 33 percent annually, NHL contributes 7 percent of Thyrocare’s overall revenue. Radiology is perceived as a long-term differentiator for the company.

The entry of Reliance Life Sciences into the diagnostics industry is being viewed with apprehension, as the group is expected to follow a disruptive pricing model like their telecom venture of Reliance Jio, thereby increasing the market size for the organized players. The group plans to set up pathology labs across the nation. RLS will partner with local players, doctors, pathology labs, and hospitals to establish its chain of diagnostic centers.

RLS has indicated that it will follow a hub-and-spoke model. A regional center will provide super-specialized tests, while the chain of network labs will provide routine tests, generally offered by diagnostic labs. On the lines of existing diagnostics centers, Reliance Life Sciences will set up the collection centers, from where the test-details could be sent to the regional hub or the network labs for processing.

With the recent raising of Rs 115,693.95 crore from leading global investors in about eight weeks, the activities of this company certainly need to be watched closely.

Established national brands have the advantage of robust compliances and better service levels, which will serve as distinguishing factors favoring the chains. The laboratories constantly evaluate introducing new technologies in customer acquisition and test delivery with the key objective of enhancing the customer experience.

Home collection is fast gaining popularity. Outsourcing is another area that large players are exploring. Outsourcing proves to be a better option, when testing volumes of a particular test do not justify volumes. This would also demarcate testing such that the high-end, complex tests are done by central labs.

With the large laboratories gaining strength, consolidation, integration, and automation too go hand in hand. And this leads to the adoption of ML and AI, the application of which makes complex testing in molecular diagnostics and genetic testing possible. This helps bring diagnostics closer to the masses.

Regulation. Despite their constant efforts, the industry is still predominantly unregulated. There is a lack of standardization throughout the rural and semi-urban areas. Even in molecular testing modalities like NGS, inter-lab variations are aplenty. The testing protocols, kits and technical SOP followed by Lab A may not be the same as followed by Lab B, resulting in discrepancies in the reports issued.

The lack of regulation leads to pricing pressure, deficiency in quality services, and proliferation of labs not following standard treatment protocols, which results not only in compromised patient safety, but also concerns accountability in healthcare costs.

For the general public, they would prefer a report from a well-established lab like SRL as these labs put in a lot of research into their testing and have the highest accreditations like CAP and NABL, ensuring most stringent quality practices. Also, the stakes for bigger labs are much higher and they cannot afford to have wrong results.

Some options for accreditation as adoption of the Clinical Establishment (Registration and Regulation) Act, 2010, and NABL exist, but there are not too many takers. Till now, only eleven states including Arunachal Pradesh, Himachal Pradesh, Rajasthan, Jharkhand, Mizoram, UP, and Uttarakhand have adopted the Act, and only 1 percent of the existing labs are accredited by NABL. However, the accredited labs in COVID times have had an advantage as the Union Health Ministry allowed only accredited private labs across the country to conduct the COVID-19 tests.

Another change is in reporting regulations. In 2018, the Medical Council of India came up with a rule and the Supreme Court made it a mandatory that all the lab reports, including those under the scope of genetics, will have to be signed by an MD doctor. This does help regularize the reporting and prevent unregulated practices.

Competition and pricing is a major concern. The intensity of competition in the diagnostics industry has somewhat abated in the past years; however, structurally, the sector lends itself to regular outreach initiatives from the established players both in the unorganized and organized space. The barriers to entry being low, there is also a constant influx of new outfits. When this happens in a market where the pricing already operates at the lower band, the established diagnostic chains have to fight for market share at the cost of margins. Trust and connect that the patient enjoys toward the brand is an effective antidote.

From time to time, both the central and the state governments mandate capped pricing for specified tests/panels. This is primarily done at times of epidemics when the intention is to improve access to testing. In the recent past, pricing caps have been imposed during instances of swine flu, dengue, chikungunya, and now COVID, which have been subsequently eased.

In keeping with the WHO’s list of essential diagnostics and priority areas for non-communicable diseases, and diseases prone to outbreaks, ICMR (Indian Council of Medical Research) has put out a national essential diagnostics list (EDL). The introduction of the EDL list will help regulate the sector and bring in a price cap, and ensure price standardization.

The margins in diagnostics are largely dependent on the scale of operations. The spending on materials for conducting each test is an important consideration because a lot of it expires and ends up in waste. Around 95 percent of the laboratories presently are working under-capacity, with machines lying idle. As more companies enter the organized sector, there would be an increasing emphasis on the hub-and-spoke model in order to bring in volumes required for a commercial entity to survive in the market.

Automation. As the labs are opting for automation, it is the pre-analytical and the post-analytical components, in reaching the sample to the lab and in reaching the report to the doctor, where cost competitiveness determines the margins. Of course, once the report has reached the doctor, the interpretation of the report, and how the interpretation is applied to the patient, is of paramount importance. Automation in the analytical component is determined by the investment made in the instruments and the competence of the technician.

The question frequently asked is, “Can labs afford it?” The rewards of automation on RoI and improved efficiency, quality, and timely more accurate results are so great that it ultimately boils down to, “Can lab afford not to automate?”

In spite of India being in the throes of a technological revolution, it is ironical that automation has not even touched the rural areas of the country. In the next ten years, the dynamics of the entire industry could change.

Navigating COVID-19

A FICCI EY study, released in March 2020, estimates that short-term operating losses for the diagnostic sector will be to the tune of Rs 200-800 crore for a month and Rs 600-2200 crore for a quarter (assuming 50-80 percent decline in revenue).

Testing update

ICMR, the apex body in charge of India’s COVID-19 strategy, has now validated 1000 testing laboratories. Out of these, 730 are in government setups and 270 laboratories are in the private sector. And 7.13 million RT-PCR tests for detection of the disease samples have been tested till June 22. The country is now testing over 0.19 million samples every day.

Funding these tests is a major issue, that is till the costs come down. The corporate sector, NGOs, and other innovative methods will need to be found to share the burden with the government.

Shortage of swabs, reagents, and PoC testing machines needs to be addressed. Reagents continue to be imported from Europe, the US, and China. Indian companies do not make them. The global companies make them at scale and offer optimal pricing. Stockpiling of reagents will begin now as the whole world is looking for reagents.

India will need to become self-reliant in producing diagnostic tests, and to bring the cost of testing within an affordable range. Currently, manufacturing kits locally is not an option for most manufacturers. There is little to no access to antigens and other chemicals required to do so. The Department of Biotechnology and its public sector undertakings, Biotechnology Industry Research Assistance Council; NITI Aayog’s new initiative Project CARD; Gujarat Biotechnology Research Centre, in partnership with Neuberg Supratech Reference Laboratories (NSRL), and many other efforts are underway.

Rapid testing could hold the key to testing millions. Most of these tests come from China, and can potentially be self-administered, like pregnancy test kits. Potentially, rapid tests, which are often pin-prick, point-of-care devices, provide the strategic advantage of screening people en masse. They provide a scientific way to quarantine people instead of blanket lockdowns.

Key to the testing strategy is the ground-level mapping of resources, with several districts without medical colleges and modern private laboratories, every possible public and private facility and infrastructure that can serve the purpose of testing effectively, has been deployed.

Private sector diagnostic chains are collaborating with each other to deliver high-quality testing services to assist the government in tackling the coronavirus crisis.