Molecular Diagnostics

Subdued MDx market prompts repurposing or else selloffs

As the need for COVID-19 testing collapses to a fraction of its current demand, molecular diagnostics companies will be holding and maintaining facilities that can create immense supply. They will need to repurpose themselves or else face a mass selloff.

As the world rushes to become vaccinated against the coronavirus (COVID-19), strategy turns from infection mitigation to achieving herd immunity. The pandemic and the multiple lockdowns that followed have had a huge effect on the world’s markets, butchering some industries while allowing others to boom. The IVD field has been no exception, but different subsegments have been affected differently.

2020 saw the onset of the virus and the lockdowns and shutdowns that followed. This meant that the field of elective surgeries saw its sales numbers tank, as everyone was staying home and surgeries were postponed. Some companies saw as much as double-digit declines in their sales segments.

These same decisions, however, led to growth in the testing market. As COVID-19 tore across the world, correctly identifying who had the virus was of paramount importance to enforce quarantines and stay-at-home orders. Polymerase chain reaction (PCR), antigen, and antibody tests skyrocketed from their original workflows to having to produce hundreds of millions, if not billions, of tests very quickly. But this explosive growth will not continue forever.

Since the COVID-19 outbreak, India has been at the forefront of formulating COVID-19 testing protocols. This has been enabled by rapidly increasing testing infrastructure and capacity across the country. ICMR has been enhancing COVID-19 testing capability across the country by expanding and diversifying testing capacity by leveraging technology and facilitating innovation in affordable diagnostic kits. The testing strategy has been carefully calibrated to increase access and availability of testing.

The concerted efforts toward augmenting and diversifying testing prepared the infrastructure, which made it possible to deliver on India’s increased testing requirements in the wake of the second wave of COVID-19. COVID-19 testing capability across the country has been enhanced by leveraging technology and facilitating innovation in affordable diagnostic kits. Easy-at-home self-diagnostic kits have been developed and approved.

A specific testing platform is available, addressing general testing (RT-PCR), high-throughput testing (COBAS), testing at remotest places and PHCs (TrueNAT, CBNAAT), in containment areas (rapid antigen testing) and for large number of migrant population (pooled sample testing). The total number of COVID-19 diagnostic laboratories has reached 2876, of which dedicated government laboratories are 1322 and private laboratories’ number stands at 1554.

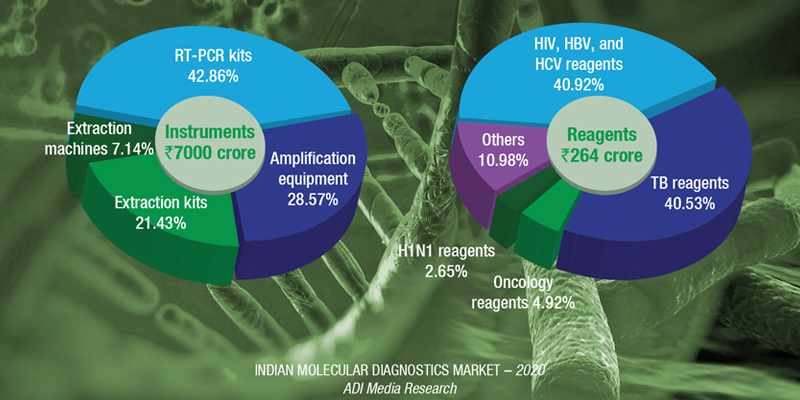

This has given a huge impetus to the molecular diagnostics market. Estimates indicate that the escalation in demand from extraction machines, extraction kits, amplification test equipment, and RT-PCR kits is ₹7000 crore in 2020, translating into a total Indian molecular diagnostic of ₹7264 crore.

And since now capacities have been created, and huge investments made, apart from the continuity in COVID-19 tests moving forward, molecular diagnostics is expected to start a new chapter, where tests for dengue, malaria, chikungunya, etc., will be conducted on the molecular diagnostic techniques.

Next-generation techniques have begun to make their way into the clinic in a range of diagnostic applications, including prenatal screening for genetic diseases, transplant typing, and risk assessment and treatment selection in oncology.

While traditional molecular diagnostic techniques, such as PCR (polymerase chain reaction) and ISH (in-situ hybridization) will remain relevant for years to come, many emerging applications require the rich information NGS can offer. New associations between the broad/deep genetic information NGS can provide and disease prognosis or treatment are being reported with increasing frequency. The next huge impetus is expected from these tests, albeit costs of NGS continue to plummet.

The global molecular diagnostics devices market size grew by a massive rate of 258.9 percent to USD 18.07 billion in 2020, and is expected to decline to USD 13.57 billion in 2021 at a rate of –24.9 percent, according to a recent report by The Business Research Company. The change in this growth trend is mainly due to companies stabilizing their output after catering to the demand that grew exponentially during the COVID-19 pandemic in 2020. However, the market size is still almost double that of what it was during pre-COVID levels at USD 6.98 billion in 2019. The molecular diagnostics equipment market is later expected to reach USD 19.01 billion in 2025 at a compound annual growth rate of 8.8 percent.

Molecular testing on COVID is paired with declines in more traditional molecular tests as patients avoided doctors, and continue to reduce in-person doctor visits during lockdown. Down-but-not-out segments include cancer, histology, and inherited diseases, which are expected to continue to grow, perhaps surge, in coming years. Prior to COVID-19, liquid biopsy was one of the stars of this segment. New LDT tests in inherited disease testing in particular, using IVD supplies, which includes non-invasive prenatal testing (NIPT), is driven by the demand in China. Even though the demand is for laboratory test services and not for IVD products, the demand for instruments, kits, and consumables that are approved by regulatory agencies is driving the segment. However, the market opportunities may be challenging to access by foreign IVD companies due to the regulations promoting domestic companies.

|

Indian molecular diagnostics |

|

|

Leading players – 2020 |

|

| Segment | Some leading companies |

| Analyzers | Roche, Abbott, Thermo Fisher, Qiagen, Danaher, and Randox |

| TB reagents | Danaher, Molbio, Qiagen, and Bio-Rad |

| HIV, HBV, and HCV reagents | Abbott, Qiagen, Roche, and Altona |

| Oncology reagents | Qiagen, 3B BlackBio Biotech, Roche, and Siemens (Fast Track) |

| H1N1 reagents | Siemens (Fast Track), Qiagen, and Hi-Media |

| Reagents for other Infectious diseases (including HPV, CT/NG, STI markers, dengue etc ) | Bio-Rad, PerkinElmer, Beckman Coulter, bioMérieux, Tulip Diagnostics, CPC, and Medsource Ozone |

| ADI Media Research | |

The molecular diagnostics field worldwide, up until recently, has been dominated by large firms, such as market leader, Roche, followed by Cepheid/Danaher, bioMérieux, Qiagen, Hologic, BD, Siemens, and Luminex. While many of these companies are focused on competitive strategies (e.g., sophisticated automation for molecular testing, test menu expansion) to maintain their position, emerging competitors are also entering the market by developing next-generation technologies.

The global COVID-19 pandemic has accelerated these and other new approaches for molecular diagnostics to enter the market, through substantially reduced regulatory hurdles, with many novel technologies coming out of research laboratories.

As the need for COVID-19 testing collapses to a fraction of its current demand, molecular diagnostics companies will be holding and maintaining facilities that can create immense supply. This mismatch between demand and supply will either lead to a collapse in prices of molecular diagnostic tests, as suppliers struggle to break even on their facilities maintenance costs, or a mass selloff or repurposing of these facilities.

Either way, the companies in the molecular diagnostics space will have to plan their next steps very carefully. They have made a lot of money in the boom of the COVID-19 pandemic, but they must be careful not to be saddled with large illiquid material assets for a market that is a fraction of its previous price.