Devices & Utilities

Technological advances to boost coronary stents market

New-generation DES have shown to be safer and more efficacious than older generations. A wide variety of new-generation DES is currently available on the market, each with its advantages and disadvantages.

Implantation of cardiovascular stents is an important therapeutic method to treat coronary artery diseases. Bare-metal stents (BMS) and drug-eluting stents (DES) show promising clinical outcomes; however, their permanent presence may create complications. In recent years, numerous preclinical and clinical trials have evaluated the properties of bioresorbable stents, including polymer and magnesium-based stents. Three-dimensional (3D) printed-shape-memory polymeric materials enable the self-deployment of stents and provide a novel approach for individualized treatment. Novel bioresorbable metallic stents, such as iron- and zinc-based stents have also been investigated and refined. However, the development of novel bioresorbable stents, accompanied by clinical translation, remains time-consuming and challenging.

The introduction of the concept of bioresorbable stent (BRS) brings both opportunities and challenges to the field of coronary interventions. DES dominates the coronary stent market; however, it has several deficiencies, including inhibition of normal coronary vasomotion at a late stage and provoking long-term inflammatory responses. The transient BRS is expected to overcome the limitations of DES. During degradation, the absorption of BRS potentially helps improve the positive remodeling of coronary arteries, preserve vasoreactivity, reduce the incidence of late stent thrombosis due to the absence of foreign materials, and inhibit edge vascular response. Based on completed clinical trial results, BRS shows great potential as the next-generation stents; however, there are also some limitations to BRS in clinical applications. Although the mechanical properties of BRS are close to those of BMS/DES in vitro, evidence from in vivo and human studies demonstrates a decreased focal radial expansion of BRS, especially without routine post-dilatation. The radial strength of BRS has been a problem, especially for polymeric ones.

Designing BRS with a thicker strut to compensate for insufficient mechanical strength is not a final solution. High strut thickness may inhibit the healing process and increase the incidence of stent malapposition due to fracture in its integrity during degradation. Therefore, further studies are needed to better balance the strut thickness and radial strength. Based on the clinical trials that have been completed thus far, the incidence of clinical events for patients treated with BRS is similar to those treated with DES, except for a worse late lumen loss in BRS. This suggests that the restoration of vascular physiological function may partially counterbalance some of the drawbacks of BRS.

Through advanced manufacturing techniques, especially the development of shape-memory polymers, 3D printing, and biosensors, BRS is expected to possess unprecedented features, including remote self-monitoring, precise adaptation to blood vessels, and shape change. Applying 3D printing into shape-memory materials implements adaptive functionality, thus allowing for the physical transformation of 3D-printed stents over time to perform programmed tasks. Additionally, advancements in intracoronary imaging guidance are also needed to improve clinical outcomes.

With the exciting and continual advancements in technologies, developing a next-generation BRS may improve the efficacy of treatments for coronary artery diseases in the future.

Global market dynamics

The global coronary stents market size is estimated at USD 8.8 billion in 2021 and is expected to witness a compound annual growth rate (CAGR) of 3.3 percent from 2022 to 2030. An aging population and a rising prevalence of risk factors, such as cardiovascular diseases (CVDs), complex lesions, diabetes, obesity, and others are expected to drive demand for coronary stents over the next 8 years.

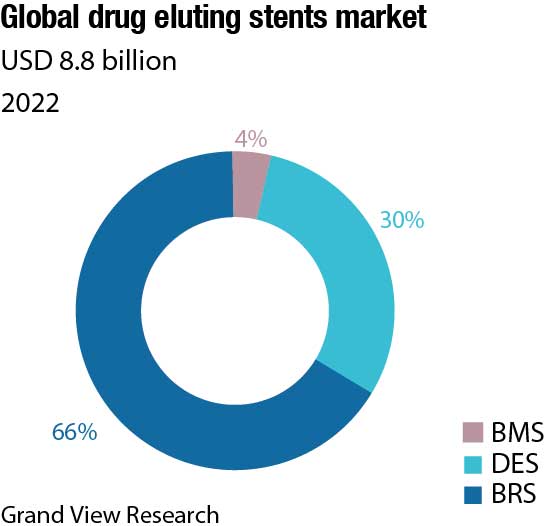

DES segment dominated the market for coronary stents and held the largest revenue share of over 66 percent in 2021. The continued advancement and launch of the new devices are important factors in strengthening DES’s dominance as the preferred device for PCI procedures. The competitors in the market continue to develop and launch technologically advanced DES, such as some of the notable launches are Abbott Laboratories’ XIENCE Skypoint, Medtronic’s Resolute Onyx, and Boston Scientific’s Synergy. In comparison to the previous-generation devices, these newer-generation DES provide greater stent integrity, higher deliverability, and lower complication rates.

Despite initial disappointments, such as overcoming the clinical shortcomings associated with the Absorb BRS, representing a technological challenge, and then Boston Scientific’s decision to discontinue its Renuvia BRS entire project in 2017, BRS technology has been an interesting technology for physicians as well as market competitors. This is primarily due to the ability of BRS technology to lower the risk of in-stent thrombosis, associated with metal stents or most existing old-generation stents. Several BRS devices are available in the European region, including Biotronik’s Marmaris, Elixir Medical’s DESolve, and Reva Medical’s Fantom – all of which have favorable trial results.

BMS held a substantial share in the market as of 2021. Though the advancement in DES is replacing the usage of BMS, still it is being used in many PCI procedures due to its low cost and low hospitalization rates.

Considering growing competition for the BRS and DES device types, the BMS has become less appealing to competitors due to low technological barriers to entry and clinical evidence demonstrating BMS’s inferiority to DES. However, the BMS stent type managed to maintain its foothold in the market in 2021, owing to factors, such as its low device cost.

BRS is the newest technology introduced in the market after DES. BRS technology has been called the fourth revolution in interventional cardiology due to its potential advantages. Abbott launched the first bioresorbable vascular scaffold system, Absorb in 2016. Companies are investing to develop newer-generation BRS with better patient compliance.

Hospital segment accounted for about 74.2 percent market share in 2021. Hospitals are noted to have developed infrastructure with technologically equipped medical devices required for effective stent procedures. Stents are commonly used in minimally invasive surgical procedures and are considered essential medical equipment. Hospitals offer better care owing to the availability of skilled medical professionals and nursing staff that offer effective care treatment post-surgery. Furthermore, increasing sedentary lifestyle, improper diet and unhealth habits such as smoking, alcohol, and tobacco consumption is expected increasing number of stenting procedures. Additionally, increasing focus on upgrading the healthcare infrastructure, including hospitals, is expected to fuel the stents market revenue.

Impact of COVID-19

According to the WHO, in 2019, CVDs were among the major causes of mortality worldwide. In 2019, an estimated 17.9 million people died from CVDs, responsible for 32 percent of all worldwide mortalities.

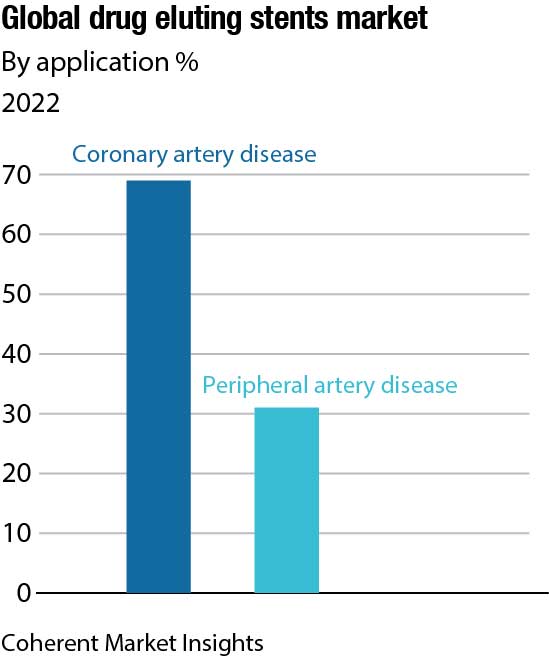

In addition, according to research published in the National Library of Medicine in June 2021, coronary artery disease (CAD) causes roughly 610,000 fatalities yearly (an estimated 1 in 4 deaths), and is the major cause of mortality in the US. As a result, the unprecedented rise in CAD incidences is predicted to boost demand for an effective coronary stent device for treatment. This factor is expected to bolster the demand. Since a coronary stent is used in the majority of percutaneous coronary intervention (PCI) procedures, the impact of Covid-19 on the market for coronary stents closely tracked the impact of Covid-19 on overall PCI procedures.

During the pandemic’s initial outbreak and periods of high local Covid-19 case counts, several states, towns, and nations issued orders to citizens to shelter in place or minimize the potential exposure to and transmission of illness, resulting in elective surgeries being postponed. As a result, total PCI procedure volumes and hence coronary stent unit sales and revenues went significantly lower in 2020. These revenues are expected to rise as facility capacity usage improves and resumes all the semi-elective to non-urgent procedures.

Furthermore, all notable competitors in the market for coronary stents announced revenue falls in their interventional cardiology portfolios, which include coronary stent devices, in 2020, owing mostly to the impact of the Covid-19 pandemic. Boston Scientific, for instance, reported a significant decrease in annual revenues in its interventional cardiology segment, which includes coronary stent devices, in 2020, but the company performed relatively well in 2021, reporting revenue growth of approximately ~7 percent globally compared to 2020. In contrast, Abbott Laboratories was the least affected, with less impact on its entire vascular segment in 2020, which includes coronary stent devices, in its 2020 annual results.

In addition, the rising preference for minimally invasive surgeries is another factor expected to boost the adoption of coronary stents in coming years. The advantages of these procedures include small incision wounds leading to higher patient satisfaction. These procedures also provide shorter hospital stays and facilitate quick recovery. Stenting technology is increasingly being preferred over the conventional balloon angioplasty owing to the introduction of advanced DES and evolving bioresorbable scaffolds. Technological advancements in coronary stents, such as the development of bifurcated stents and the use of biodegradable materials, have led to efficient and improved outcomes of CVD treatment. Companies are proactively involved in product developments and partnerships and strategic collaborations. The aforementioned factors are expected to propel the market growth in coming years.

Recent developments

Major players, operating in the global drug eluting stents market, include Boston Scientific Corporation, Medtronic, Abbott Laboratories, Biotronik, Lepu Medical Technology, Cook Medical, Shandong JW Medical Systems, Stentys, AlviMedica Medical Technologies Inc., Amaranth Medical, Inc., HangZhou HuaAn Biotechnology Co., Ltd., XTENT, Inc., Cardionovum GmbH, Cordis Corporation, and Kyoto Medical Planning Co., Ltd.

Abbott Laboratories, Boston Scientific, and Medtronic accounted for a significant presence in the overall market. These companies have gained a notable presence in the market due to good strong performances in the lucrative DES market and large product portfolios spanning numerous different IC device categories as well. Despite the dominance of the three major manufacturers, the market for coronary stents is a blend of numerous global and local players. Biotronik, for instance, has been able to establish a significant presence in the entire market by offering low pricing and new technologies that address unmet needs.

Terumo Corporation, Biosensors International, and Cardinal Health are a few additional significant competitors in this market.

In April 2022, Biosensors International Group, Ltd., a manufacturer of interventional cardiology devices, received a premarket approval for BioFreedom, a drug-coated coronary stent system, used for improving coronary luminal diameter in patients who are at high risk of bleeding due to de novo lesions. BioFreedom Ultra is the most relevant stent option for high-bleeding risk patients who cannot tolerate dual antiplatelet therapy.

In December 2021, the US Food and Drug Administration (FDA) approved Slender IDS fixed-wire and Direct RX rapid-exchange DES systems for the treatment of coronary artery disease by Svelte Medical, a healthcare company. Both the products, Slender IDS and Direct RX, are highly deliverable DES systems, which provide long-term clinical outcomes in the coronary artery patient population.

In October 2021, Medtronic Resolute Onyx drug-eluting stent was the first to receive one-month DAPT indication. The Resolute Onyx DES is the one and the only DES that is proven to be highly effective, safe, and reliable in the United States. Resolute Onyx DES, along with its biocompatible polymer and stent design, is highly effective for patients who are suffering from various cardiac diseases.

In August 2021, Sinomed declared the first commercial implantation of the HT Supreme DES at the University Hospital Galway, in collaboration with the National University of Ireland Galway, thereby marking the start of the European launch.

In June 2021, Abbott launched XIENCE, a type of stent used to open blood vessels and received the US FDA approval for one-month DAPT labeling for high-bleeding risk (HBR) patients.

North America dominated the market for coronary stents and accounted for the largest revenue share of over 32 percent in 2021 and is anticipated to witness the same trend over the foreseeable future. A sedentary lifestyle, resulting in obesity and other cardiovascular diseases, such as heart attack, stroke, and ischemic heart disease (IHD), are primarily driving the coronary stents market in North America. In addition, technological advancements in coronary stent technologies, such as drug-eluting stents and the use of biodegradable materials, have further augmented the market growth. The presence of mature market players, such as Medtronic, Abbott, and Boston Scientific is fueling market growth in this region.

In the Asia Pacific, the market for coronary stents is expected to exhibit the fastest growth rate in terms of revenue generation. This market is driven by some additional variables of enhanced screening for CAD, economic growth, regulatory updates, and notable beneficial reimbursement in some of the countries, such as Australia and South Korea. Furthermore, increased government investment in healthcare and conducting new initiatives to bring in devices at affordable prices in cost-constraint markets, such as India and China, are influencing this market as well.

For instance, in China, to address inflated pricing and other issues in the delivery of expensive medical supplies, the Chinese government launched a centralized procurement scheme for high-value medical consumables in January 2021. The government aims to use this initiative to skip the associated suppliers and buy the items straight from the manufacturers, lowering the inflated pricing. As a result, the cost of coronary stents has dropped dramatically in China. The average price of coronary stents has been reduced by 93 percent since 2019 to grab the national tender.

Looking to the future

Although considerable advances have been made, an ideal DES system has yet to be developed. The occurrence of stent thrombosis has accelerated technological evolution in interventional cardiology, and the eradication of this fatal outcome should be the focus of new DES.

Since the advent of DES, restenosis figures have dropped to a single digit, even for the most complex lesions. The most recent generation of DES is associated with a greater reduction in the risk of early and late thrombosis than BMS. However, target lesion-related events are still observed years after implantation due to neoatherosclerosis. Future DES designs will have to address this issue.

The safety and efficacy of contemporary stents are supported by evidence from clinical trials and registries; however, larger trials and longer follow-up are necessary to assess the effectiveness of novel devices. The risk of late thrombosis with first-generation metallic DES and the risk of early and very late thrombosis with BRS were not properly identified in the preclinical stages of research. Animal models’ ability to reveal the significant long-term limitations of devices implanted in diseased coronary arteries of humans is limited. The more complex the interplay between a device and arterial wall-plaque, the harder it is to predict the long-term effects in humans. From BMS to DES, and particularly to BRS, stents are increasing in complexity. Computational models based on finite element analysis could complement the animal data but new advances in animal models will be crucial.

In summary, it remains uncertain whether further changes in stent design will translate into improved outcomes since contemporary DES technologies have reached such high efficacy and safety standards that make it challenging to show the superiority of any new device. Future research in coronary stent technology will primarily focus on high-risk populations, imaging guidance for optimal stent deployment, and novel antithrombotic therapy strategies that minimize the bleeding risk.