Immunochemistry Instruments and Reagents

Technologies flipping traditional immunoassays

New assays are quicker, more sensitive, can be conducted high-throughput, and require minimal sample.

The diagnostics market is constantly evolving and companies that want to stay ahead of the curve need to be continually exploring new approaches and innovations to ensure the future of their product. Even a relatively traditional, well-established market like immunoassay is not immune to the quickening pace of change and developers in these areas need to be live to innovation to continue to attract consumers and stay relevant.

During the past two decades, a wide range of immunoassay analyzers has been developed to provide the quantitative, semi-quantitative, or qualitative detection of analytes. Tremendous advances in immunoassay formats, bioanalytical platforms, immunoanalytical systems, and complementary technologies have led to various emerging immunochemistry technologies. Initially, most of the analyzers, developed several decades ago, were based on radioimmunoassay (RIA) and enzyme-linked immunosorbent assay (ELISA). Owing to extremely high sensitivity, specificity, precision, and throughput of ELISA, this format has served as the gold standard for a plethora of analytes and the last two decades have seen tremendous innovation in ELISA technology. Automated assays are equipped with robotic workstations while the microtiter plate (MTP) readers have also improved drastically in terms of technology, features, and cost-effectiveness. Advanced bioengineering, microfluidic, and biosensor technologies have further led to the development of prominent immunoanalytical systems including surface plasmon resonance (SPR)-based instruments for label-free immunoassays. These systems have become the global standard for developing rapid analyzers for the detection of analytes and screening of immunological components based on the determination of biomolecular interactions.

Indian market dynamics

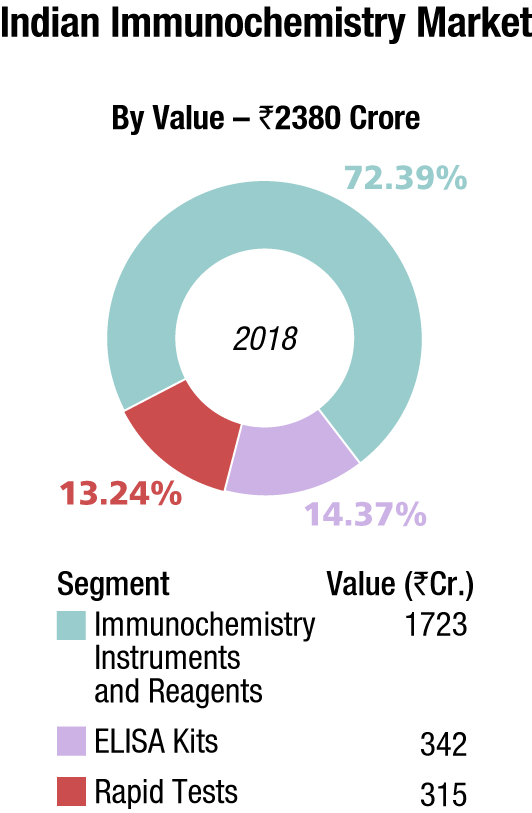

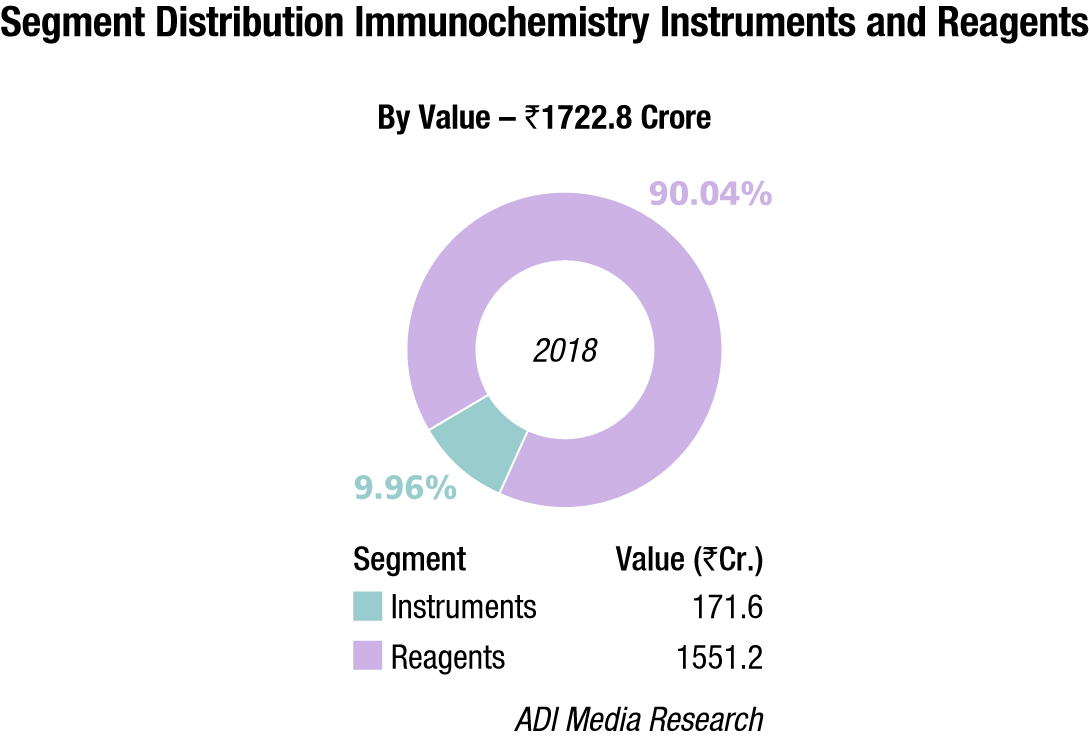

The Indian immunochemistry instruments and reagents market in 2018 is estimated at ₹1722.8 crore, with reagents dominating at ₹1551.2 crore. Roche, Abbott, Siemens, bioMérieux, Beckman Coulter and J Mitra are the players with a strong presence. OCD, Tosho, Transasia, and Bio-Rad are aggressive. Other popular brands in this segment are Mindray, Immunoshop, and Maglume. Elisa kits clocked an additional ₹342 crore and rapid tests, an additional ₹315 crore in 2018.

As GST implementation in 2017 gained momentum, it had a negative impact on the instruments market, which in turn translated to a slowing in demand in the reagents business in 2018.

Total lab automation has somewhat lost pace over the last couple of years, with a tussle for supremacy among the leading brands. The customers find the business requires too much space and with low ROIs perceive it to be an expensive proposition, not always worthwhile increasing investing in.

Having said that, the emerging trend of corporate players establishing diagnostic centers in small towns and rural areas tends to provide opportunities for the import of automated systems and reagents. For instance, Metropolis Healthcare has announced plans to add 800 collection centers, and 10 labs by end-FY19. Oncquest Laboratories also plans to add 18 more labs across India by 2020-end, mainly in Tier-II cities as the group already has a presence in the Tier-I cities. It is looking at cities such as Vijayawada, Jammu, Jalandhar, Kanpur, Jodhpur, Surat, Bhopal, Indore, Ranchi, Coimbatore, etc., for expansion. Also on the cards is a network of 500 more collection centers taking the total count to 1000 centers.

Global market

The global immunochemistry analyzers and reagents market is expected to increase from USD 1.69 billion in 2018 to USD 2.77 billion by 2025, with CAGR of 7.27 percent, predicts MarketInsightsReports. The increasing incidence of chronic and infectious diseases, technological advancements in immunochemistry instruments and introduction of novel automated systems, growth in the biotechnology and biopharmaceutical industries, increasing adoption of immunoassay-based point-of-care testing and rapid testing, and the vital role of immunoassays in drug and alcohol testing are the major factors driving the growth of this market. On the other hand, stringent regulatory requirements for the approval of the instruments and consumables and the implementation of excise duty by the US government are expected to restrain the growth of this market. Moreover, some other elements will also influence the growth of immunochemistry analyzers and reagents like market share, key geographical regions, and major key vendors of this industry. All the major immunochemistry analyzers and reagents market regions and their contribution to the global market share are also considered as one of the growth factors.

| Tier I | Tier II | Tier III | Tier IV | Others |

|---|---|---|---|---|

| Roche | Abbott, Siemens, bioMérieux, Beckman Coulter, and J Mitra | OCD, Tosho, Transasia, and Bio-Rad | Mindray, Maglumi (SNIBE and Immunoshop) | Agappe, CPC, and Meril |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian immunochemistry instruments and reagents market. | ||||

| ADI Media Research | ||||

The technological progressions in immunoassay instruments, essential function of immunoassays in drug and alcohol analysis, and advancements in the biotechnology and biopharmaceutical industries are the primary growth drivers for immunoassay market. Mounting occurrence of chronic and infectious diseases is also driving the growth of the market. Increasing significance of companion diagnostics in the immunoassays market, expansion of condition-specific biomarkers and tests, and incorporation of microfluidics technology in immunoassays are also facilitating the growth for the immunoassay market.

The market is likely to witness a stiff competition among the prominent players. The high development of the medical industry and the increasing investments by the players for research activities are projected to ensure the development of the market in the next few years. Moreover, the high number of collaborations and acquisitions is considered as another key factor that is predicted to ensure the market development in the coming years.

North America accounted for the major share in the immunoassay industry in 2018, globally as the players in the region are continuously investing capital for the research and development. Also, the increasing prevalence of chronic disease and infectious diseases, accessibility of government assets, mounting usage of immunoassays in clinical diagnostics, and improved healthcare infrastructure are driving the growth of the North American market.

Asia-Pacific is observed to witness the fastest growth in the market, due to large population base, increasing prevalence of chronic diseases, and technological advancements. In addition, increasing healthcare expenditure, developing healthcare infrastructure, and growing pharmaceutical and biotechnology industry in the region are supporting the growth of the Asia-Pacific immunoassay market.

Demand for immunochemistry analyzers is slowing in the US and Western and Eastern Europe. Europe’s challenges in this segment include laboratory consolidation in France and economically troubled Greece, Italy, Spain, and Portugal. China’s growing rural hospital market lacks basic diagnostics laboratory infrastructure and represents an untapped opportunity for affordable immunochemistry analyzers.

The leading players in the global market include Siemens Healthineers, Abbott Laboratories, Beckman Coulter, Ortho-clinical Diagnostics, Thermo Fisher Scientific, F. Hoffmann-La Roche, Becton, Dickinson and Company, Danaher Corporation, Sysmex Corporation, Mindray, bioMerieux, and DiaSorin.

Technology trends

New technologies are flipping traditional antibody-based assays on their heads. These assays are quicker, more sensitive, can be conducted high-throughput, and require minimal sample.

Mass cytometry (CyTOF). Instead of the traditional fluorescent probes used in flow cytometry, mass cytometry employs heavy-metal-labeled probes to significantly reduce signal overlap and increase the number of detectable parameters to over 100. The Helios mass cytometer by Fluidigm is currently the only platform on which mass cytometry can be performed and get the most detailed information from every sample.

ELISA. Enzyme-linked immunosorbent assay (ELISA) is a plate-based assay that uses antibodies to detect and quantify their ligands (often proteins) within a liquid sample. Traditional ELISAs can only detect a single analyte and have limited sensitivity, which makes the detection of low-abundance analytes difficult. The two new ELISA platforms are addressing these shortcomings.

Immuno-PCR. Immuno-PCR combines ELISA and real-time PCR (RT-PCR) by conjugating the detection antibody to an oligo. The antibody detects the analyte, and the amount of associated oligo can be quantified with RT-PCR. Immuno-PCR is extremely sensitive and can detect analytes in the pg-fg range, as well as being highly amenable to multiplexing with the use of multiple unique oligos. Multiple vendors now offer conjugation services and kits.

Immunofluorescence. In immunofluorescence (IF), fluorescently labeled antibodies are used to detect analytes in a sample that can be visualized with a fluorescence microscope. Traditionally, IF is conducted on a single layer of cells or a thin slice of tissue to determine the distribution of the biomolecule, and only a few analytes can be measured in each sample.

Way forward

The coming years are anticipated to witness continuous innovation and breakthroughs in immunoassay formats, bioanalytical platforms, biosensing concepts, detection devices, and complementary technologies. The next-generation immunoassays, based on highly simplified immunoassay formats, require only minimal process steps and critically reduced sample volumes without any washing steps. They will be fully automated, cost-effective, and equipped with smartphone- or gadget-based mobile healthcare capabilities. Therefore, they can be deployed at centralized, decentralized, remote, and personalized settings with minimal or no requirement for power supply and skilled analysts. The immunoassay trend is strongly inclined toward immunoassay formats to perform multiplex detection of biomarkers for a particular disease and offer clinical diagnosis and monitoring effectively via clinical score. The evolving trend toward smartphone-based immunoassay technologies can extensively extend the outreach of diagnostics by providing personalized mobile healthcare monitoring and management.