OR Equipment

The COVID impact

Demand in 2021 continues to be slow, albeit higher than in 2020. The vendors expect some normalcy to return in 2022, when the stalled projects make progress and expansion is once again undertaken.

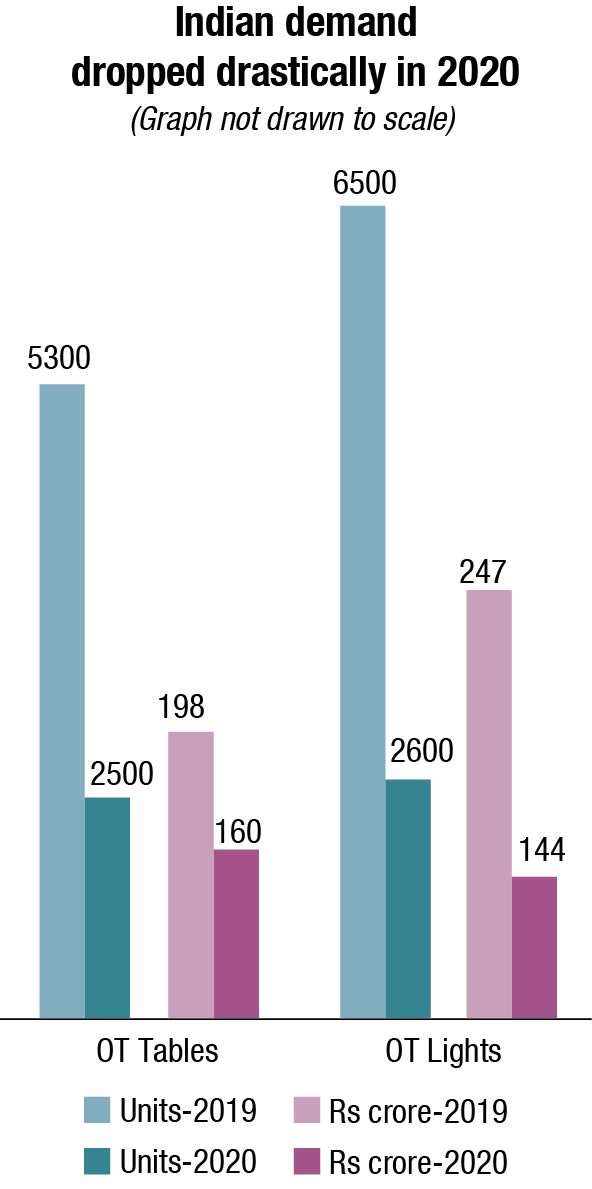

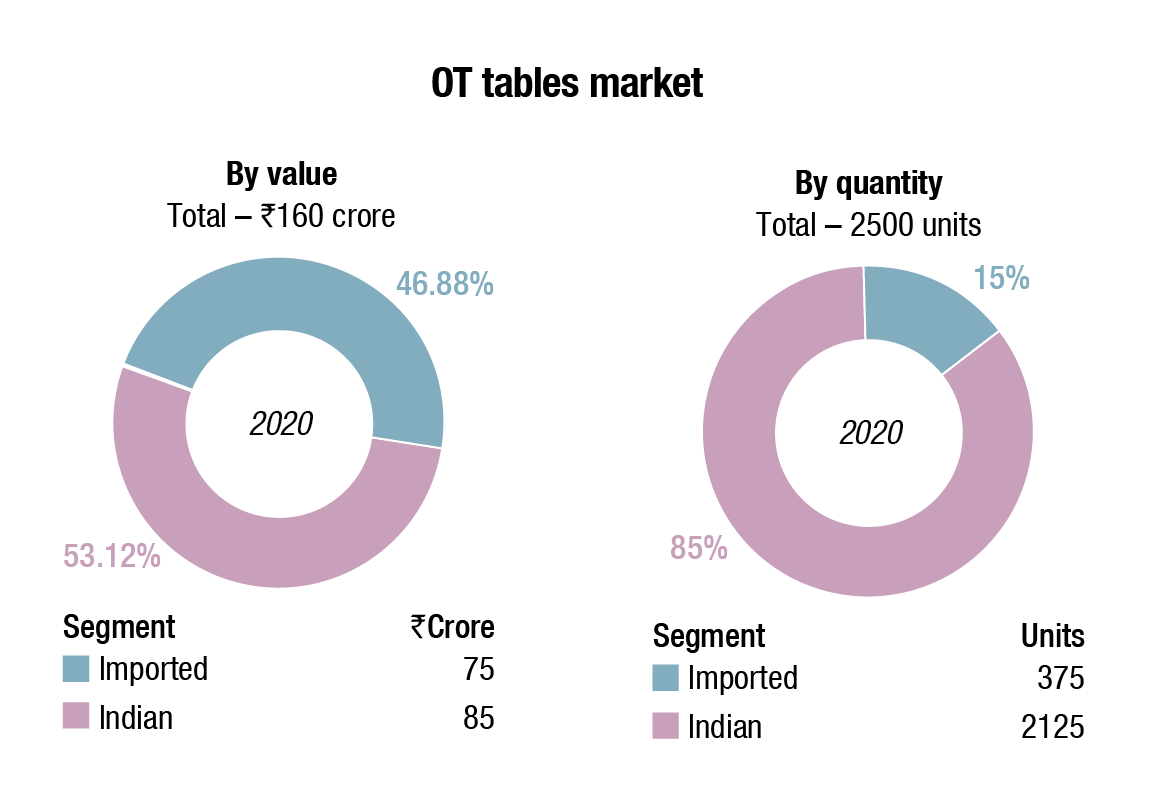

COVID-19 has changed the very face of the Indian OT tables and lights market. Priorities shifted since April 2020 and, with elective surgeries on the backburner, these two products saw demand plummet. There were just not enough funds available when it came to buying this product. And the customers that did buy, found the Indian products at more competitive prices and enhanced quality adequate to meet their needs. The Make in India thrust also favored the indigenous vendors. As a result, the imported brands lost major market share, particularly for OT tables.

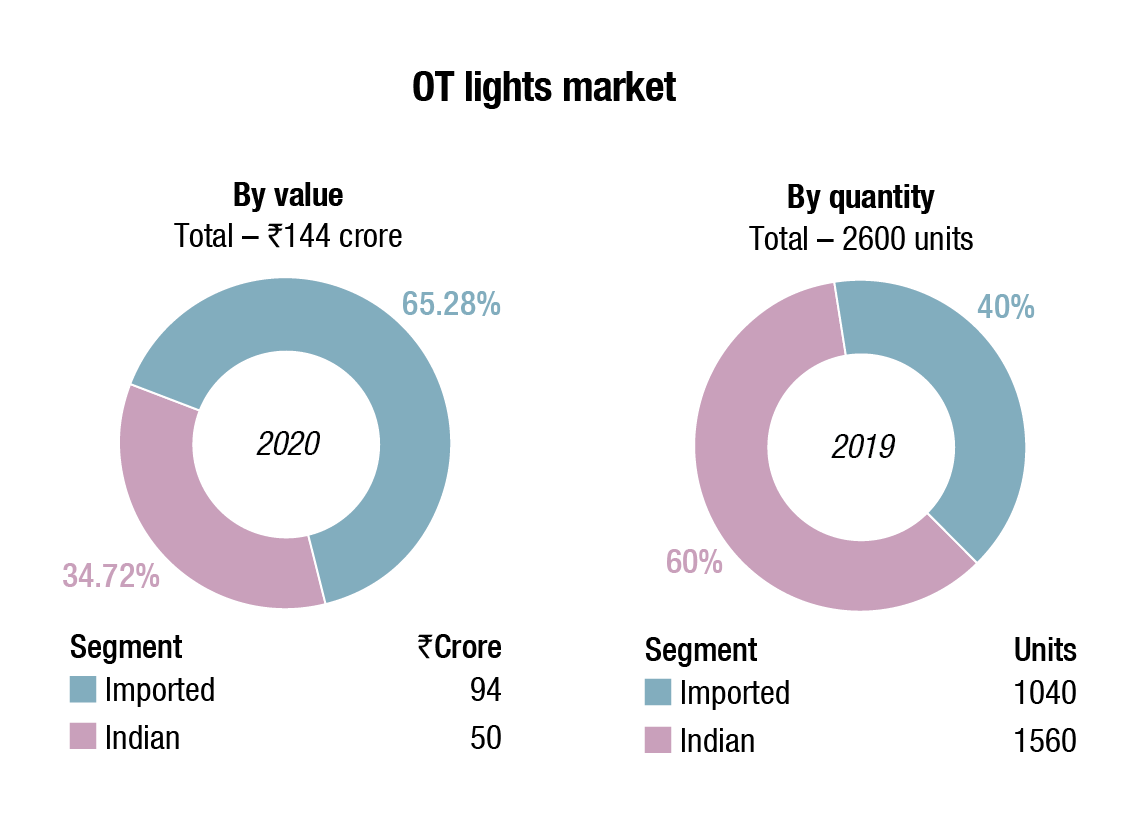

The OT lights are also being bought from Indian players, albeit these are assembled here with imported components. Within this segment, 70 percent of the market constitutes the high-end Indian lights and 30 percent the value models. A handful of discerning customers shifted to the Indian lights, opting for the high-end models. The imported ones in any case attracted higher freights too. With somewhat changed market conditions, and erratic supply chain, the post-COVID era found the imported brands offloading their stock. Government procurement was at an all-time low.

With the customers having switched almost completely to the more superior LED lights, the quantities of tables and lights now bought are almost the same in numbers procured. This has translated into a major hit for the OT lights segment that has dropped by quantity and by value in 2020.

Demand in 2021 continues to be slow, albeit higher than in 2020. The vendors expect some normalcy to return in 2022, when the stalled projects make progress and expansion is once again undertaken.

The pandemic has had ramifications for ways of working of various surgical procedures. There are strict guidelines specific to each specialty that have to be implemented and followed for surgeons to be able to continue to provide safe and effective care to their patients during the COVID-19 pandemic. The volume of surgeries has significantly declined during the pandemic, owing to the stringent guidelines by the regulatory authorities to avoid all non-emergent surgeries. This is going to impact the procurement of OR equipment for these surgical centers.

As COVID-19 restrictions have loosened in most parts of the country, elective and non-essential surgeries have been allowed to resume at many hospitals and ambulatory surgery centers. While this is obviously good news for patients and healthcare facilities, the reopening process has been fraught with challenges.

When the recovery begins, it could be accompanied by a resurgence of demand for both elective and delayed essential procedures, straining business models and financial resilience.

In 2020, the global operating room equipment market size was valued at USD 4.4 billion. The total market size is expected to increase at a compound annual growth rate (CAGR) of 4 percent to exceed USD 5.7 billion in 2027.

| Major players in OT tables market-2020* | ||||

| Tier I | Tier II | |||

| Indigenous Magnatek, Palakkad, and Staan |

Cognate and Technomed | |||

| Imported Getinge (Maquet) |

Steris | |||

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the indigenous and imported OT tables market. | ||||

| ADI Media Research | ||||

COVID-19 caused the operating room equipment market to experience a substantial drop in sales in the first half of 2020. However, most of the sales in these markets are made years before and, therefore, unit sales have not been influenced significantly.

Due to the situation in most hospitals, replacing capital equipment was not a high priority throughout the pandemic, as long as the original equipment was functioning. Furthermore, sales representatives from many manufacturers had limited travel and access to hospitals and other care sites.

The global operating tables market was valued at USD 840 million in 2020, and it is expected to reach USD 1025 million by 2026, registering a CAGR of 3.2 percent.

Globally, there are close to 35,000 surgical tables sold every year, with the US having the highest product demand. This number is expected to show single-digit growth over the next 7 years.

The total global market for surgical tables has been increasing at rates slower than the overall growth of the OR market, as this market has been largely commoditized for many years. As the mean population age continues to change, a shift in the types of procedures performed will occur, resulting in growth in the surgical table market. New tables that incorporate technological improvements and provide new economic advantages will be the main drivers of growth in this market.

One major trend in the global market for operating room equipment is integration. Fully integrated operating rooms are predominantly profit centers for hospitals. Increasing the workflow and efficiency not only benefits the patient, but also the hospital and staff. Numerous newer functions, such as archiving, streaming, video conferencing, and workflow enhancement have become standard facets of integration in recent years.

New technology and process development have ensured advancements in the operating tables’ market landscape. With development and innovation in the medical industry, operating tables are being designed according to patients’ need and usage. As the surgical methodology is turning out to be more specialized, it has become the centerpiece of the operating room.

Surgeons who work in poor light settings, and with limited resources at the operation, complain of insufficient surgical lighting a threat to patient’s life and well-being. Often many of the surgeries have been called off due to poor lighting at the operation theater. Considering such light arrangements in many of the operation theaters, development, and allocation of high-quality, economical and sound surgical headlights are the need of the hour. It could provide perfect solution for such important issues during surgery.

With the growing demand for a balance between shadow management and luminance of light, the demand for surgical lights is likely to rise in years to come, which will subsequently propel the growth of the surgical lights market.

The global surgical lighting and surgical boom market sizes are estimated at USD 492.3 million in 2021 and it is expected to reach USD 533 million by 2027.

The majority of the global surgical lighting market share was controlled by Stryker, Skytron, and Getinge. On the other hand, the global surgical boom market share was controlled by Stryker, Dräger, and STERIS. This global market research spans over 70 countries and includes the equipment boom, anesthesia/nursing boom, and utility boom markets.

For surgical lighting, a strong, renovated ceiling is required to be able to withstand the weight and blueprint of the new lighting system when installed. For surgical booms, a ceiling support structure, which is costly to install and prolongs the time necessary to install a surgical boom system, must be added.

Over the last 5 years, the number of integrated operating rooms has grown steadily. OR integration often comes bundled with surgical lights. As a larger portion of ORs become integrated, this is expected to drive the growth of the surgical lighting market. New OR construction will continue to be the primary driving force of the surgical lighting market, in addition to continual product innovations, including software connectivity and constant obstacle-independent illumination. However, COVID-19 has delayed construction and as a result, has impacted this market.

Growth in the surgical boom market is closely correlated with growth in the integrated and hybrid OR markets. Booms and lighting are often purchased together from the same manufacturer, resulting in a similar competitive landscape within these two markets. The proliferation of specialty OR suites and hybrid OR suites, both of which require more surgical booms than a typical OR, has also induced growth in the number of units sold. Similar to the surgical lighting market, the surgical boom market was impacted by COVID-19 due to construction delays.

What to consider before installing surgical lighting systems? Surgical lighting is a crucial part of every operating room. While the technology is straightforward, surgical lighting can become tricky when it comes to purchasing and successfully installing a new system in your facility.

When choosing surgical lights, there are three major configuration choices – ceiling mount, wall mount, or portable mount. These are often available in configurations with multiple light heads, allowing users to customize the system so it meets their facility’s illumination requirements.

| Major players in OT lights market – 2020* | ||||

| Tier I | Tier II | |||

| Indigenous | ||||

| Magnatek, United Surgicals, and Bharat Surgicals | Matrix, Cognate, Staan, Confident Dental, Technomed, and Galaxy | |||

| Imported | ||||

| Getinge and Dr Mach | Mindray, Mediland, KLS Martin, Stryker, Steris, Brandon, Merivaara, and Eclipse | |||

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the indigenous and imported OT tables market. | ||||

| ADI Media Research | ||||

Importance of proper surgical light installation. Once users have chosen the correct lighting system configuration for their facility, they get to the most important part – installation. In order to get the full use out of lighting system, not to mention avoid costly building repairs or damage to equipment, surgical lights must be installed properly.

One of the most common results of improper light installation is when light heads drift from their intended location. Not only are the lights incapable of maintaining steady illumination of the operative area, but dual configurations can also knock into one another and cause damage to the light heads. Without adequate planning, lights can also sit too low in the operating room and restrict movement. In absolutely worst-case scenarios, faulty lights can cause electrical shock or fall from their ceiling mounts.

Avoid the pitfalls of improper light implementation by purchasing surgical lights from a reputed supplier that also offers installation services. Find a company that has skilled technicians who have developed processes to ensure safe and effective installation. Though this may mean a substantial price increase upfront, the benefits and peace of mind are worth the investment.

Leave it to the professionals. The most crucial part of surgical light installation is being able to assess the existing support structure, also known as the superstructure, and make needed adjustments. The superstructure will ultimately support the entire lighting system, so it is vital that the construction is up to the task. Depending on the state of the existing superstructure, installation could encompass just a few minor updates or a complete retrofitting process. All of this must be completed while negotiating around rigid vent ducting, electrical conduits and wires, air handlers, and gas and water piping.

Modern era surgical lights has much more to experience than just illumination

Manju Goyal

Manju Goyal

National Sales Manager,

Life Support,

Mindray Medical India Pvt. Ltd.

When we think about an OR room we assume that a surgical light is required to give required illumination to visualize the cavity properly so that surgeon can perform surgery well. A few years ago it was true to much extent with halogen lights giving required illumination and maneuvering. But after LED lights entered into surgical lights we are into different era of endless possibilities and thinking much beyond basic need. The development has happened in all areas from aesthetics to designing for laminar flow compatibility. A lot of parameters are helping buyers to choose the best fit light depending on their specialization of operation and not compromising on their actual requirement.

For instance, high illumination may not be the most important parameter required for deep cavity surgery but depth of illumination may be first and basic parameter you will need to perform that surgery. For a teaching institute the live data stream of surgery outside OR may be the differentiator and so on.

While choosing any surgical lights one more aspect can be looked at which is surgeon eye comfort as working for long hours on such a high illumination cause eye fatigue which is inevitable as illumination is also mandatory to visualize the surgical site. Now industry has brought such technologies to reduce the contrast between surgical site and near surroundings so that while working for long hours eye stress is reduced. It definitely improves the efficiency of surgeons.

One more situation we need to consider while choosing surgical lights for complex surgeries where group of surgeons and nurses work simultaneously to perform surgery. In such cases the lights illumination at site get compromised to much extent as light is blocked by their heads .In such cases surgeons used to adjust OT light head frequently to find the best possible illumination. But this issue has also been addressed with much efficacy by synchronizing the satellite light dome illumination with main dome to provide required illumination at actual site without increasing temperature at surgeon head. This technology has evolved over many years and has been established as perfect solution to surgeon needs in these kinds of surgeries.

These modern era lights brings utmost comfort to surgeons and further stablishes that technology is meant for helping them to work with more efficiency without compromising on their basic needs.

In addition to evaluating and reinforcing the lighting superstructure and handling the electrical installation, professional surgical light installers also use proper techniques and hardware to ensure that the light heads achieve their full range of motion and do not drift during use. Professional installers also adhere to medical facility standards from infection control risk assessment best practices and interim life safety measures.

How to make the installation process easier? To make the surgical light installation go as smoothly as possible, some preliminary steps are recommended. These set up clear communication and expectations between facility’s staff and the light installers and help to make sure everything goes according to plan.

First, assign a point of contact who will act as the liaison between the team and the surgical light installers. The point of contact can help to establish a timeline for construction and determine what kinds of paperwork and facility access permissions are needed to begin the installation process. If an on-site evaluation is needed before construction begins, the point of contact would be present to help answer any questions.

Before installation begins, it is helpful for the installation team to have a good idea of the operating room’s size and specifications. This information is typically found in building blueprints, and should include: Facility specifications, electrical or otherwise; building structure type; wall and/or ceiling material type; distance from the finished floor to the finished ceiling; distance from the finished floor to the existing superstructure; and distance between ceiling trusses.

In addition to these preliminary measurements, photos of the existing support structure and related interstitial space can help light installers to determine implementation strategies.

Before installation begins, the electrical drop for connection should be established. The electrical drop will also need to be on a dedicated circuit. All equipment should be cleared out of the operating room, if possible, allowing the installation team full space to work without navigating around valuable surgical equipment. The established point of contact for the facility should be present for the beginning of the installation process and should be easy to connect with for the duration of the project.

While ORs are one of the most critical areas of a hospital, historically they have had a very low degree of technological savviness. The crucial components of an OR a decade ago were surgical lights, simple operating tables, and critical surgical devices. However, there has been a significant transition, thanks to technology adoption in modern hospitals. Some of the latest trends in operating rooms include:

Smart lighting design. The introduction of a wide array of medical imaging devices in the operating room poses a challenge with standard lighting designs. There is the risk of glare and eye strain for the surgical team. Similarly, there can be reduced visual acuity in the event of too much reflectance in a hybrid OR setting. Surgical lighting design has now shifted to dimmable mobile fixtures that can be moved in and out of the operating space. Modern OR lights also come with added features, such as built-in cameras with video recording abilities.

Where a third light is needed, most surgeons switch to surgical headlights. They have advantages, such as lower heat emission, easy mobility, and hands-free adjustment.

Powered surgical tables. The constant demand for advanced operating tables by healthcare facilities globally led to the introduction of powered surgical tables including electric and battery-powered tables. The powered tables have been instrumental in offering improved ergonomics to surgeons globally and have led to ever-increasing demand. Offering different modes including tilt, traverse, slide and other functional options for movement and positioning of the patients, is a major reason for the dominance of the segment in the global operating tables market in 2020. With development and innovation in the medical industry, operating tables are being designed according to patients’ need and usage. As the surgical methodology is turning out to be more specialized, it has become the centerpiece of the operating room. Robotic surgeries are on the rise, and the result is likely to lead to increased demand for specialty operating tables. Apart from developing specialty operating tables, the use of anti-microbial coating over mattresses is also a trend observed to carve a niche. Many manufacturers are focusing on the quality of operating tables, using an anti-bacterial and anti-rusted surface with ions of silver to ensure maximum hygiene and prevent cross-contamination over the surface.

Internet-connected devices. The internet is now a common feature in the operating room in order to support the aforementioned technologies. Faster internet connections have been introduced not only for video conferencing and teleconsultation but also for data exchange among devices.

The result is an improvement in collaboration and better patient outcomes. Standardized IP networks also help to eliminate cable entanglements and enable faster connection of medical devices.

Technological advancements have had several positive changes in the operating room, including increased surgical accuracy, safety, and better patient outcomes. Adopting these trends can also improve the overall performance of your healthcare organization.

Robotic surgery. Automation has taken over most operating rooms today, and hospital managers cannot afford to ignore this trend. The adoption of smart devices in the theater room can help improve workflows. Robot-assisted surgeries are popular in prostatectomies, gynecologic surgical procedures, and cardiac valve repair. Robotics helps to improve precision in minimally invasive surgeries. The result is less pain for the patient, minimal loss of blood, and faster healing time.

The future for this trend is uncertain, though, as there is still controversy over the safety, expenses, and the training needed for robot-assisted procedures.

Voice recognition OR programs. High-tech devices and monitors in the OR used to be touch-controlled, but that is quickly changing too. Most hospitals have moved to acquire voice-controlled surgical technology that works more efficiently – and it is also a safety improvement trend. ORs need to be sterile spaces, free of pathogens that otherwise may imperil patient safety. Controlling devices without touching them helps to reduce the risk of contamination. The surgical team can use speech to control lights, for instance, or zoom in and out on the imaging devices, and change the content on display.

Augmented reality. In the neurosurgical operating room, augmented reality (AR) currently comes into clinical effect together with the microscope. Tumors and other enriched objects are injected into the microscope’s ocular so that the surgeon can see what lies under the visible surface. This does not just apply to larger anatomical structures, but also to those that cannot be seen with the naked eye like fiber tracts that are near the treatment area. If the surgeon is using an exoscope, these views are visible to the entire team from its monitor. Augmented reality in the OR has the potential to positively change the way a surgeon consumes and experiences data.

Made-to-order instruments. Surgical procedures are not the only parts of the OR going digital. Rapid advances in 3D printing could soon change how surgeons get tools in their hands. Today, hospitals must order and stock surgical tools from distant manufacturers in a process that is often wasteful and inefficient, because specialized tools come in kits that can contain instruments the surgeon does not need. But researchers are pushing forward with ideas to 3D printed instruments on-demand with no stockpiling, shipping, or unwanted kit components.

Of course, many technologies are still in development, and others have yet to be widely adopted or fully evaluated for safety and cost effectiveness. As the landscape of medical technology evolves, hospitals have to be ready for whatever innovations may come.