Mass Spectrometers

The fascinating role of mass spectrometry

Mass Spectrometry plays a fascinating role with a myriad of different applications in biology, chemistry, and physics and also in clinical bio-medicine and even in space technology.

Mass spectrometry (MS) is potentially the most important analytical spectroscopic tool of modern times. It performs the analysis of the sample, making mass spec equipment an essential part of the analytical instrumentation market. A recent shift in the laboratory landscape, though, is forcing a change in the size and functionality of mass spec equipment. Laboratories are requiring shorter testing times with faster throughput in a smaller footprint, and these new demands are driving the market to develop smaller, higher performance systems.

Traditionally, MS systems have been used for routine testing in biotechnology, pharmaceuticals, food safety, petrochemicals, and environmental analysis. MS equipment, which usually consists of a large box with a footprint that can easily take up a 6-ft laboratory benchtop, typically performs one task slowly with a retention time ranging from five minutes to 10 hours, depending on the type of test and molecules analyzed.

The MS market is an intensely competitive climate, and companies are looking to distinguish their product offerings with features that not only enhance the performance of routine functions such as clinical diagnostic testing, but that will also facilitate more demanding processes, such as analysis of biomarkers and biologic drugs.

Indian market

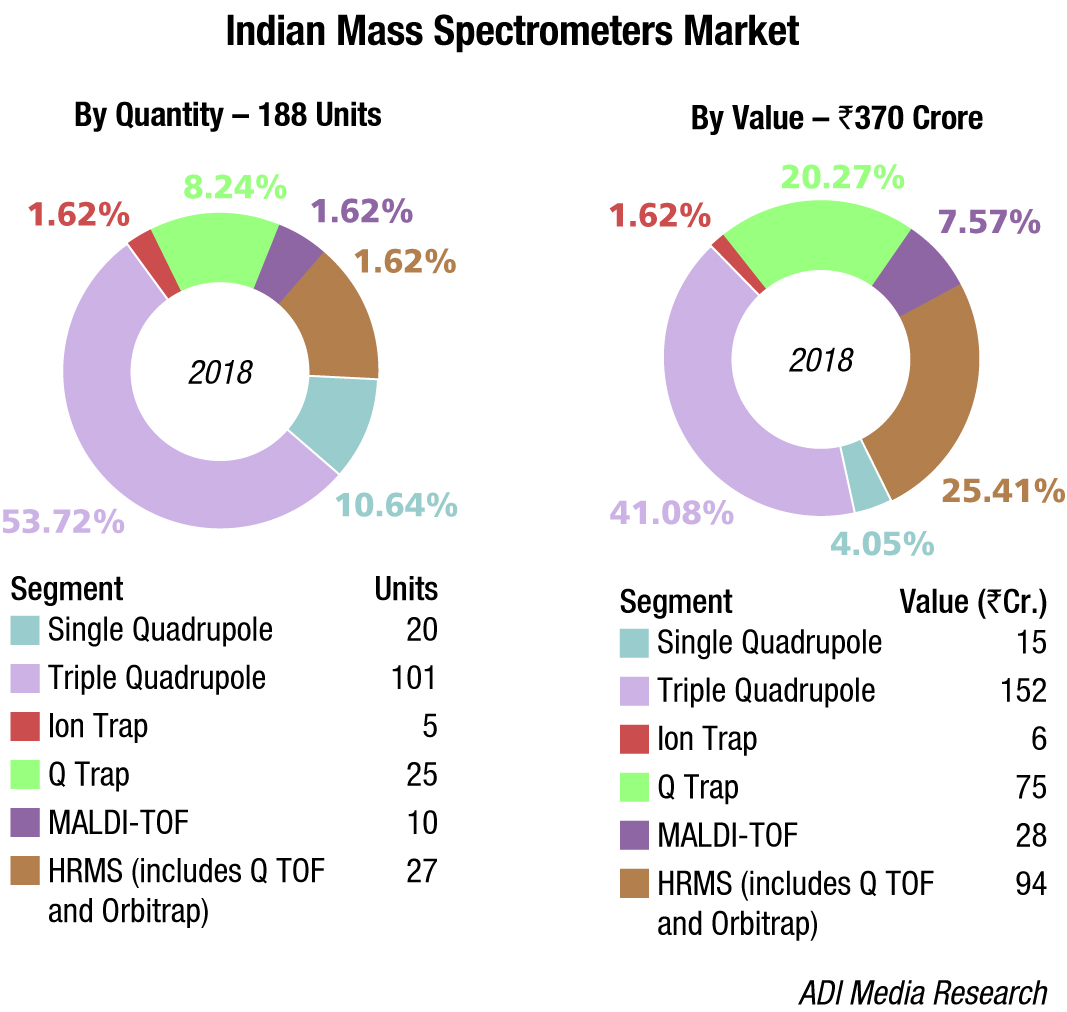

The Indian mass spectrometers market is estimated at Rs 295 crore, a 10 percent increase over the 2017 market of Rs 268 crore. In 2018 estimates, we have also included Q trap, catered solely by Sciex, thus taking the total market to Rs 370 crore. The triple quadrupole segment saw the fastest growth and dominated the market with 41 percent share, by value and 54 percent share, by volume, driven largely by the pharmaceuticals and food safety segment.

| Tier I | Tier II | Tier III | Others |

|---|---|---|---|

| Sciex Shimadzu | Waters, and Agilent | Thermo Fisher | Bruker and Perkin Elmer |

| *Vendors are placed in different tiers on the basis of their sales contribution to overall revenues of the Indian mass spectrometers market. | |||

| Segment | Major Players |

|---|---|

| Single Quadrupole | Shimadzu, Waters, and Agilent |

| Triple Quadrupole | Sciex, Waters, Shimadzu, and Agilent |

| Ion Trap | Thermo Fisher |

| Q Trap | SCIEX |

| MALDI -TOF & Maldi Top TOF | Bruker and Shimadzu |

| HRMS (includes Q TOF and Orbitrap) | Sciex, Waters, Shimadzu, Agilent, and Thermo Fisher |

| ADI Media Research | |

HRMS, including Q TOF and Orbitrap, catered to by almost all the vendors, including SCIEX, Waters, Shimadzu, Agilent, and Thermo Fisher gained traction in 2018. Sales of ion trap, marketed solely by Thermo Fisher remained stagnant. The single quadrupole market continues to have a presence in the Indian market.

The market is forecast to grow at a CAGR of 20 percent over the next 4 years due to the increasing use of MS as the primary detection tool in the pharmaceutical industry for drug discovery pipeline and for quality assurance/quality control purposes. The Indian government, academia, R&D institutes, life sciences, and pharmaceutical industry are the biggest buyers of MS instruments. There is a steady increase in the number of contract research organizations in India, especially in clinical research management. With further technological advancements in instrumentation and software platforms, the R&D sector will grow. With GDP growth, these sectors are expected to pick up, causing increased demand for the MS instruments.

Many companies are constructing their manufacturing and research facilities in India. In addition, an increasing number of conferences and exhibitions by manufacturing companies to promote mass spectrometry technology is also contributing to the growth of the market.

Multinational companies such as Sciex, Shimadzu, Waters, Agilent, and Thermo Fisher Scientific dominate the Indian market. Indian companies are still lagging in terms of the technical expertise required for manufacturing these high-end devices. Instrument manufacturers are continuously focusing on new product design and development that are compact, multi-disciplined, offer high accuracy, and are low cost. Market leaders depend heavily on their channel partners for the sales and distribution of their instruments. The instruments are manufactured out of India and imported to India; however, manufacturers are themselves involved in creating brand awareness and marketing their products through Indian operations.

Indian equipment manufacturers provide cost-effective products, but the quality and standards are not at par with the global market leaders operating in the Indian market. However, this trend is changing and with sufficient government push, R&D facilities, and infrastructure, the Indian companies can create a brand name and a niche in the market. Lack of skilled workforce is another challenge that Indian instrument manufacturers face. Manufacturers not only need to keep in mind that their products need to be world-class but also need to cater to and address the Indian customers’ requirements and challenges. Such an innovative product design and cutting-edge technology would allow instruments manufacturers to grow in the market that offers immense growth opportunities in the medium and long term.

Global market

The mass spectrometry market is expected to grow from USD 4.6 billion in 2019 to USD 6.3 billion by 2024, at a CAGR of 6.7 percent, forecasts MarketsandMarkets. Growth in the market is primarily driven by factors such as government initiatives for pollution control and environmental testing, increasing spending on pharmaceutical R&D across the globe, government regulations on drug safety, growing focus on the quality of food products, increase in crude and shale gas production, and technological advancements in mass spectrometers.

The hybrid mass spectrometry segment is expected to witness the fastest growth during 2019-2024. Advantages offered by hybrid mass spectrometers, such as rapid and high-resolution testing abilities with more accurate and precise results, are increasing its adoption. Consequently, the demand for mass spectrometry devices for high throughput screening is also growing.

The pharmaceutical and biotechnology applications segment held the largest share of the market in 2019, a trend that is expected to continue during 2019-2024. The large share of this segment can be attributed to the rise in demand for pharmaceutical biosimilars, phytopharmaceuticals, and regenerative medicine.

North America held the largest share of the market in 2018 and is projected to continue to do so during 2019-2024. Factors such as the growing funding for research and government initiatives in the US, widespread usage of mass spectrometry in the metabolomics and petroleum sector, and CFI funding toward mass spectrometry projects in Canada are driving the North American market. Lately, the US has seen a significant increase in the shale gas and crude oil production with increasing oil fields and the subsequent increase in the employment of analytical tools such as mass spectrometers.

The major vendors in the mass spectrometry market include Thermo Fisher Scientific, Shimadzu Corporation, Agilent Technologies, Bio-Rad Laboratories, Waters Corporation, Bruker Corporation, PerkinElmer, Charles River Laboratories International, bioMérieux, and AB Sciex.

MS applications

In the last four years or so, new MS products have addressed the full scope of user requirements through an elevated level of functionality by offering a wide range of applications as well.

MS for laboratory tests. As a highly sensitive and specific technique, MS is ideal for quantifying small molecules from biofluids, such as steroids, illicit drugs, or abused and therapeutic prescription drugs. For instance, regulating the concentration of immunosuppressants (such as tacrolimus) is essential; if levels are too low, this increases the risk of tissue rejection, whereas if the levels are too high, it could lead to toxicity and damage to the transplanted organ. MS is also amenable for detecting and quantifying larger biomolecules, such as proteins. For example, it may be employed to monitor thyroid cancer patients post treatment by assaying for thyroglobulin, a glycoprotein produced by thyroid follicular cells and a biomarker of recurrent thyroid cancer.

MS for metabolites and inborn errors of metabolism (IEM). Targeted MS identification of specific small-molecule metabolites in biofluids enables diagnosis of some IEMs in neonates. For instance, defects in fatty acid oxidation can be identified through acylcarnitine profiling. Other IEMs that MS can help diagnose include cystinosis, glutaric aciduria type I, and lysosomal disorders, which themselves span a range of illnesses such as Fabry disease, Gaucher disease, Krabbe disease, Mucopolysaccharidoses types I and II, Niemann-Pick type A/B disease and C disease, and Pompe disease. A recent trend towards untargeted, systems biology utilizes metabolomics to detect alterations across the entire metabolome, which may be tied back to a mutation in a certain metabolic enzyme and hence to an IEM. This approach is not yet in clinical use but is an active area of research.

MS for cancer diagnostics and surgery. Matrix-assisted laser desorption/ionization imaging mass spectrometry (MALDI IMS) is a combination of MS with spatial information. The MS collects a spectrum across an entire histological sample, generating a spatial MS map. To date, it has been principally used to analyze cancer tissue, either for diagnostic purposes, i.e., differentiating tumor from healthy tissue, or for prognostic purposes, i.e., predicting patient survival. The method is not FDA-cleared but could be amenable to clinical use.

Way forward

MS equipment is no longer destined to be a big box, limited to routine analysis. As mass spectrometry OEMs seek to distinguish their products in performance and size, they will be considering different component technologies—such as canted coil springs—as a means to reduce the size of their equipment. They will also expect the next generation of MS equipment to perform more demanding applications in more markets than ever before.