Cath Labs

The Impending Paradigm Shift In Cath Labs

Cutting-edge programs will embrace the new and rejuvenated complexion of the cath lab, and look forward to the next clinically proven solution.

Recent years have seen a variety of new procedures performed in the cardiac cath lab and in a variety of similar interventional suites in other areas of the hospital – valve repairs and replacement, closure of a number of congenital heart defects, peripheral vascular interventions for limb and cerebral vascular obstruction, mechanical approaches seeking to prevent arterial embolism from the heart, or dissolving thrombi already present in the peripheral and cerebral arterial circulation. Other catheter interventions include a variety of approaches for managing venous disease as well as cardiac electrophysiology procedures seeking to control atrial and ventricular arrhythmias. The volume of these procedures is increasing every year, resulting in a lessened need for so-called open operations for many individuals with cardiovascular disease. Practitioners are no longer cardiologists alone. Indeed, a considerable number of radiologists, vascular surgeons, and cardiothoracic surgeons are now performing interventional procedures in the cath lab and in specially designed interventional suites. Indeed, the cardiac cath lab has now metastasized and is found in radiology departments and in operating rooms. It is anticipated that this trend will continue in the future, leading to shorter hospitalizations, less morbid interventions, and shorter times for patients to recover from procedures.

Indian market dynamics

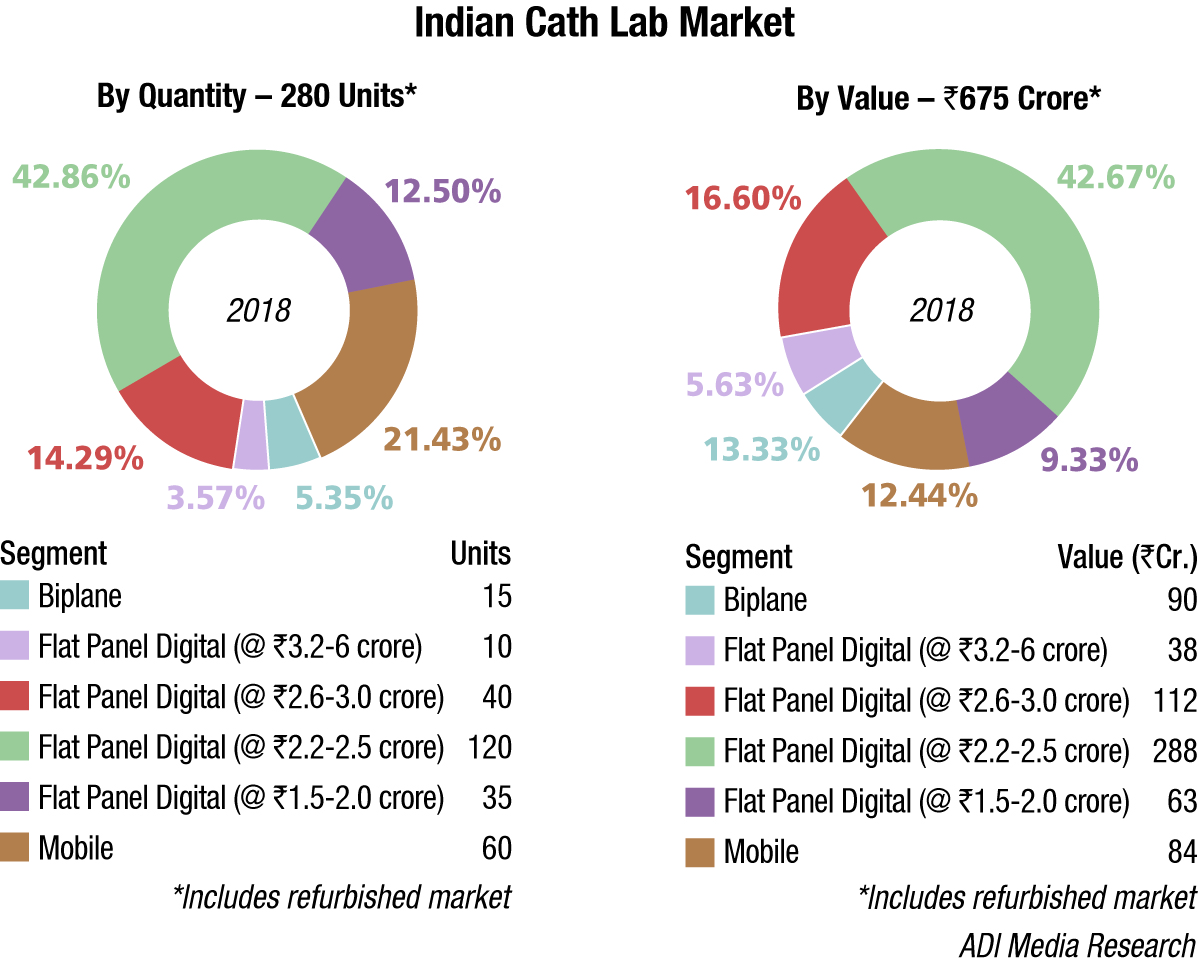

In 2018, the Indian cath labs market is estimated as Rs 675 crore, at 280 units. The biplane segment continues to be a premium segment, procured only by a handful of institutions. In the flat-panel digital segment, the systems with unit price in the vicinity of RS 2.5 crore dominate with an approximate 43 percent market share. The refurbished segment, estimated to have a 10 percent share, is largely catered to by Philips, Siemens, and Agfa, and each company has one model which is extremely popular. The mobile segment is catered to primarily by Allengers, GE, Philips, Zhiem, and Schiller.

2018* |

||

|---|---|---|

| Tier I | Tier II | Tier III |

| Philips, GE, and Siemens | Allengers and Toshiba | Shimadzu, Schiller, Zhiem, Skanray, and Alfa |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian Indian cath lab market. | ||

| ADI Media Research | ||

The government, which opts for top-of-the-line systems was aggressive in 2018. AIIMS procured 40 systems, Andhra Pradesh under PPP scheme 5 units, ESIC 10 units, Maharashtra and Kerala 4 units each, and Tamil Nadu 10 units.

With demand emanating from the Tier-III and Tier-IV cities, which do not have the budgets for setting up a Rs 6–7 crore center, the challenge for the vendors remains to cater to this segment.

Global market dynamics

The global cath labs market is likely to grow at a CAGR of 6.9 percent, resulting in global revenue of USD 21.88 billion by 2022. The development of advanced minimally invasive procedures and an increase in adoption of the same in interventional cardiology is likely to drive the global market in the future. Moreover, the development of hybrid procedures is another trend that is likely to gain acceptance across the industry in the coming years. An increasing number of people with heart diseases around the world, rise in population, and growth of pediatric heart diseases are some of the other factors that are expected to push the progress of the overall interventional cardiology market in a growth trajectory.

Despite the optimistic growth forecast of the interventional cardiology market, some restraining factors must be taken into consideration while analyzing the overall market scenario. Post-procedural complexities such as blood clotting or thrombosis, uneven drug release, and varying rates of degradation are some of the factors that may hinder the growth of the market.

Moreover, the market scenario of interventional cardiology is very dynamic. The intensity of competition among companies is reasonably high. Price cuts offered by small and medium players on their devices compel established players to reduce their profit margins, thereby leading to inhibiting of the research and development efforts owing to lack of funds. This may become a strong restraining factor in the extended long term.

Major players operating in the global market include GE Healthcare, Philips Healthcare, and Siemens. Other players include Toshiba, Shimadzu, Schiller, Zhiem, Medtronic, Boston Scientific Corporation, Terumo Corporation, Smith & Nephew, Johnson & Johnson, Cook Medical, Canon Medical, Edwards Life Sciences, B. Braun, CR Bard, and Teleflex Incorporated.

Technological trends

A totally equipped cath lab is an unmet dream of any interventional cardiologist. Advances in cath lab technology are so fast paced that any new state-of-the-art cath lab starts looking old in less than 5 years. A cath lab now means much more than a fluoroscopy unit. Vascular imaging has become an integral part of any cath lab setup.

Offering a complete cath lab solution. When a hospital installs a new interventional lab, many want a complete package, so they do not have to subcontract with multiple vendors. In the cath lab, the hemodynamic system is at the core of all procedures, including cardiac procedures, interventional radiology, vascular surgery, and electrophysiology. All the major angiography vendors now partner with other vendors to offer complete solutions with hemodynamics. Newer-generation hemodynamic monitoring systems have interfaces to help document all types of procedures. This may include charting, device usage, specific site identification, fractional flow reserve, sheath exchanges, and automatic timers to record balloon-inflation time and pressures applied. The data gathered by the system helps speed workflow by automatically generating reports and auto fills report fields and billing information.

New echo-fusion solutions for procedural navigation. Complex procedures, especially in the structural heart space, require visualization of the surrounding soft-tissue anatomy beyond what 2D angiography can offer. Ultrasound is usually employed for complementary imaging during procedures, usually with transesophageal echo (TEE). A couple of vendors have taken TEE a step further with integration with the live fluoro imaging to co-register the images and display them in one fused view. Specifically designed for use in the cath lab, the new systems streamline communication between the interventional cardiologist and the echocardiographer during complex interventional exams. Combining live ultrasound and X-ray information into one fused view, the system helps interventional cardiologists oversee procedures along with the location of key anatomical structures.

Integration of augmented reality in the cath lab. A new technology that is already on the horizon to aid procedural navigation in the cath lab is augmented reality. The technology enables operators to see true 3D images of anatomy in a heads-up display while they are looking at the patient or at the main screen in the lab. Manufacturers are showing a conceptual work-in-progress of this technology and some have already commercialized augmented reality technology to aid in advanced visualization of patient 3D datasets. AR allows physicians to view, measure, and manipulate real-time holographic images of the patient’s heart during procedures while still being able to clearly see around the room. Using real-time navigation-data feeds rather than MRI or CT, the solution provides clinicians with patient-specific anatomy in a holographic display, including catheter movement. The software is aimed at reducing operating time and radiation exposure to clinicians, and potentially improving outcomes for patients.

Advances to Lower Radiation Dose. As interventional procedures become more complex, imaging and procedural times naturally increase. To compensate for the higher imaging X-ray doses involved, vendors have developed a new generation of angiography systems that address the need to lower dose for both the operator and the patient. The current-generation systems all offer lower X-ray dose while preserving image quality. This has been accomplished with a combination of new X-ray tubes, more sensitive detectors, new image reconstruction software, image hold technologies, and by using better navigation and multimodality image-fusion software to guide procedures.

Use of AI to Aid Navigation. There will be an increased usage of artificial intelligence (AI) algorithms to speed automation on the backend of imaging systems and analysis software in the coming years. An example of this was shown at the 2018 Radiological Society of North America (RSNA) meeting. GE Healthcare showcased its new Liver Assist Virtual Injection (VI) technology it has developed for interventional radiology. It incorporates applied intelligence-enhanced software that identifies the feeder blood vessels for liver tumors and identifies the best locations to embolize the tumor. AI also can enhance the blood to look like a contrast injection in the interventional lab to help map the vessels for procedural pre-planning prior to having the patient on the table. The software can show the direction of flow in each vessel segment and can overlay a vessel map onto 3-D rotational angiography images created in the cath lab to aid procedural navigation.

Way forward

Cath labs have come a long way, but what is next on the horizon? Will cath labs as they exist today become obsolete as CT and MRI technologies advance? Will robot-assisted procedures in the cath lab become commonplace in all hospital settings? No one can predict for sure, but one thing is certain – the healthcare delivery of the future will require a willingness to think creatively and investigate out-of-the-box solutions. Care that provides value – high quality at the lowest cost – will require administrative and medical staff leadership support and collaboration in order to drive sustainable change.

Information that supports data-driven decision-making as a means to evaluate technology and any associated improvements in clinical outcomes will be a cornerstone for measuring and tracking progress. The need for reliable data cannot be understated, whether in terms of patient-volume potential for a new technology/technique or procedure, or for understanding the clinical, operational, and financial impact of an already-adopted advancement. Knowing the current situation in the cath lab and having the information readily available for determining the future impact of something new can make all the difference between success and failure.

Looking back to gain perspective on how far industry has come is always a worthwhile effort. Indeed, cutting-edge programs will embrace the new and rejuvenated complexion of the cath lab and look forward to the next clinically proven solution.