ECG Equipment

The new ECG devices are revolutionizing remote cardiac healthcare

The integrated ECG management systems provide a complete picture of the patient’s cardiac history. It promotes affordable care for various user sections, from patients at home to large hospital settings.

Cardiovascular disease seems no less than an epidemic when placed with the worldwide statistics of almost 18 million deaths.

Thousands of people die every day from heart diseases. One of the major problems in management of cardiac conditions is the delay in timely diagnosis. The ECG and echocardiograms are currently the routinely used systems for diagnosis, but they are not regularly done unless the patient presents with the symptoms. ECG machines produce electrocardiographs, the records of the heart’s electrical activity, through a set of wire electrodes placed in the chest and back. The electrical impulses are caused by heart muscle depolarizing during each heartbeat. The biggest advancement in ECG systems in recent years has been the shift toward greater interoperability and digital formats. In addition, other technologies has also been integrated into ECG systems, such as artificial intelligence, aids to place leads properly and ways to extract additional information from ECG devices to increase their diagnostic value.

Indian Market

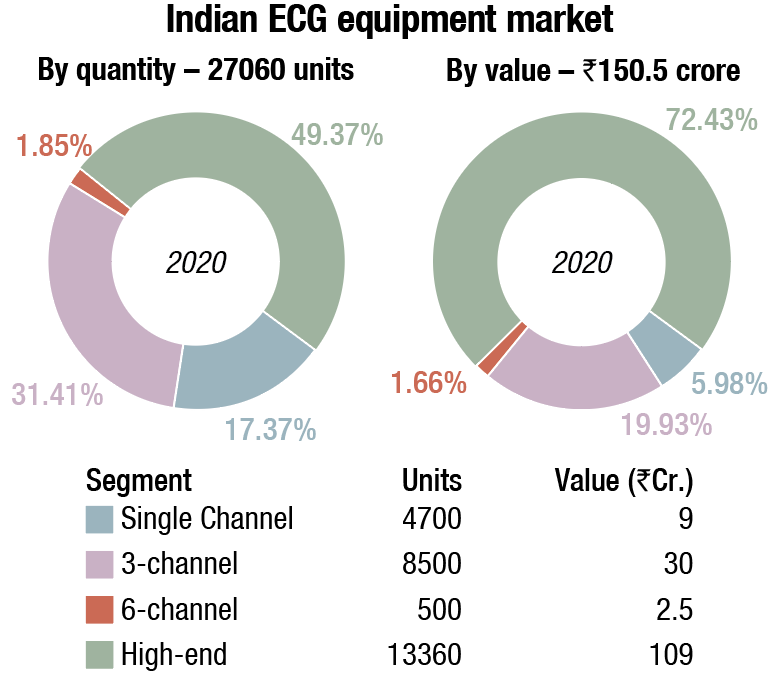

The Indian ECG equipment market in 2020 is estimated at ₹50.5 crore, at 27060 units. The market had slowed down in Q2 2020, with the hospitals barely functioning as a result of the nation-wide lockdown, but demand started picking up from Q3 onward, and in H2 2020 the market grew in double digits.

| Tier I | BPL and GE | |||

| Tier II | Schiller, Philips, and Contec | |||

| Tier III | Mindray and Edan | |||

| Tier IV | Nidek, Bionet, Mortara, Allengers, and RMS | |||

| Others | Skanray, Nasan, Medikit, Forest, Silverline Meditech, Nihon Kohden, and local brands | |||

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian ECG equipment market. | ||||

| ADI Media Research | ||||

In value terms, the high-end machines account for a 72 percent share, and a 49 percent share by volume. The demand for single channel machine is declining ever year, as are the margins. So is the 6-channel segment, though for a different reason. Its application is niche, and the reducing price differential between 6-channel and 12-channel is tilting the buyer toward the superior product.

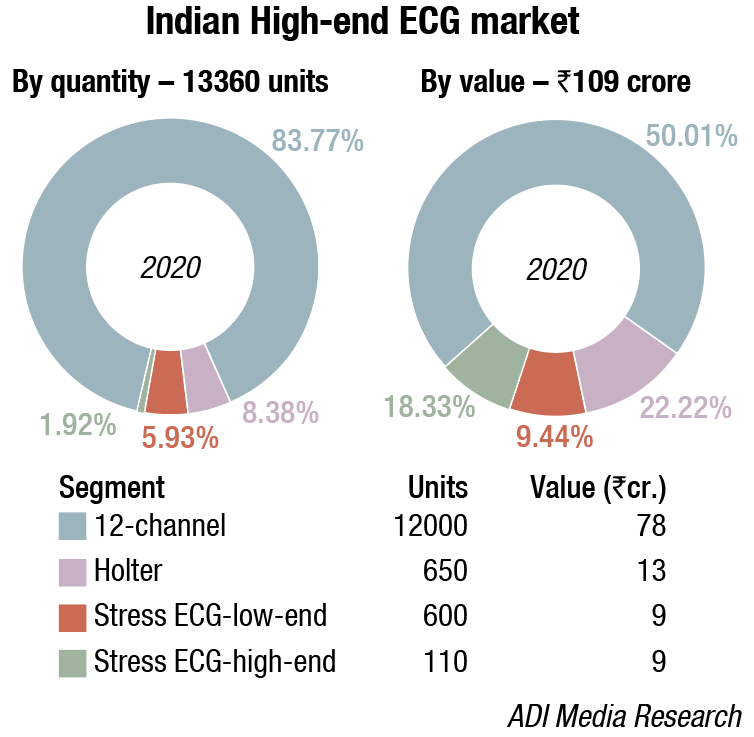

The 12-channel segment is seeing steady growth and this trend shall continue. By volume, the segment has an 89 percent share in the high-end systems and a 44 percent in the overall ECG market. By value, the shares are 71 percent and 52 percent respectively.

In the high-end segment, the holter machines are gaining popularity and strengthening their position. The ratio between stress/holter/ambulatory and resting systems in 2020 is estimated as 85:15.

2020 saw BPL gain ground. The brand came neck-to-neck with GE, and now GE shares the tier-1 position with BPL. It has increased its national distribution network to 110 dealers, and has the advantage of dominating the single channel and 3-channel segments.

The unorganised and local brands continue to hold sway in this segment, and increased their share from about 20 percent in 2019 to 34 percent share in 2020.

Global market

The global ECG equipment and management systems market size is expected to reach USD 8.9 billion by 2027, estimates Grand View Research, Inc. The market is expected to expand at a CAGR of 6.1 percent from 2020 to 2027. The growing prevalence of cardiac arrhythmia and increasing demand for ambulatory monitoring devices are expected to drive the market. The rising geriatric population, technological advancements, and advancements in ECG equipment and management systems are expected to boost market growth in coming years.

Resting ECG system dominated the type segment in 2020. The market growth is characterized by improved clinical accuracy due to new product launches, advanced data analysis tools, and several technological advancements for better care and accurate diagnosis

Development of algorithms that can remove motion artifacts in ambulatory ECGs is expected to offer lucrative growth opportunities for players in the market. For instance, in February 2020, researchers at University of Electronic Science and Technology of China developed an adaptive cancellation algorithm based on multi-inertial sensors to suppress motion artifacts in ambulatory ECGs.

Linear inflation iNIBP measurement technology

Dr Amit Bhushan Sharma

Dr Amit Bhushan Sharma

Associate Director and Unit Head Cardiology

Paras Hospitals

“ECG equipment has evolved a lot over a period of time. Now, remote-monitoring ECG devices can be attached like loop recorders in the patient’s body either in the form of a belt or chip. Loop recorders are of two kinds—external loop recorder and internal loop recorder. ELRs, which can be worn as a belt towards the waist for 24 hours, 5 days, 9 days or a month and the ECG details directly comes to the doctor’s computer or laptop. ELR can also be used to a diagnose stroke cases. It helps to locate the area like block artery which resulted in stroke. In, ILR a chip is inserted inside a patient’s body and doctor can monitor all his ECG records.

Moreover, increasing the efficacy of portable ECGs is also expected to aid in growth of the market. Recently, researchers at Electronics and Telecommunications Research Institute, South Korea, reported use of two kinds of first-order derivative filters and a max filter for an efficient real-time and QRS detection method to analyze ECG signals measured from wearable ECG devices in real-time.

Recent technologies in the market include ECG chip, which can be inserted in the body to record heart rhythms for a long duration; ECG data management solutions; and telemetry. Initiatives such as the Door-to-Balloon (D2B) time by the American College of Cardiology and Mission: Lifeline by AHA are expected to drive demand for wireless solutions and 12-lead ECG devices. Different technologies are being launched by players, either through innovation or partnerships. Some of these devices are HeartCheck ECG pen by CardioComm, online interface by emsCharts, and ZioPatch by iRhythm Technologies. For instance, in March 2020, Glanum Diagnostics developed a Holter ECG patch for the detection of arrhythmia, which records a patient’s heart data and timely transfers it to the virtual diagnostic center. The company’s plan is supported by EU funding under the HeartService project and CE certification is awaited.

North America held the largest revenue share in the market in 2020. This is owing to the rising incidence of Atrial Fibrillation (AFib) in the region, aging population, technological advancements, shifting patient preference toward ambulatory ECG monitoring, the launch of next-generation wireless ECG monitoring devices, and technological collaborations between manufacturers.

Rising incidence of CVDs, growing geriatric population, and favorable regulatory conditions are expected to boost the growth of the market for ECG equipment and management systems in Europe.

In Asia-Pacific, the market is expected to grow fast during 2020-2027. The growth can be attributed to the rapidly growing geriatric population coupled with an increasing incidence of CVDs, rising disposable income, and developing healthcare infrastructure.

The industry is also witnessing dynamic mergers, acquisitions, and partnership and collaboration agreements. For instance in July 2020, BioTelemetry, Inc. acquired On.Demand remote patient monitoring and coaching system from one of the subsidiaries of Centene Subsidiary—Envolve People Care, Inc. The acquisition helped the company broaden its portfolio of acute care connected health products and services.

The key players are engaging in new product launches to strengthen market presence. For instance, in July 2020, Philips launched Tempus ALS, a remote monitor, and a defibrillator solution for Emergency Medical Responders (EMS) in the US.

Dr Keshava R

Dr Keshava R

Director Cardiology

Fortis Hospital

ECG has become ubiquitous in medical care. ECG machines have evolved significantly over last century from a strip based thermal paper ECG to A4 sized digital ECG. Current generation machines needs to be small, compact, portable, battery operated, and able to connect to any printer. Machines to be compatible with connection to current social media platform for ease of sharing on different platforms. Machines should have adequate memory to store the ECG and print later. Rugged portable and trolley version or standalone machines format needed to suit variety of hospital or clinic needs.

Major players operating in the global ECG equipment market include, Cardiac Insight Inc., Koninklijke Philips, GE Healthcare, CardioNet Inc., Mindray Medical International Limited, Spacelabs Healthcare (a subsidiary of OSI Systems Inc.), SCHILLER AG, Compumed Inc., Nihon Kohden Corporation, and Welch Allyn Inc.

Newer ECG technology trends

Full digital formats. ECG systems have been improved to overcome the older generation machines’ paper printout system. The today’s technology is based on an easy IT interface, which allows better vendor compatibility and digitally stored waveforms to suit the increasingly growing concept of paperless hospitals that use the electronic medical record (EMR) systems to access patient reports and data such as ECGs. The new ECG Management systems offer digital analysis of ECG waveforms and integration with the CVIS and EMR.

AI integrated ECG. Artificial Intelligence has infiltrated a number of healthcare platforms. AI is being to aid with ECG interpretation, by examining ECG waveforms to pinpoint patients at higher risk of developing a potentially dangerous abnormal heart rhythm or of dying within a year. The AI systems can take a vertical dive to extract more information out of the waveforms that may not be apparent for even an experienced reader.

Next generation interpretive AI-based personal electrocardiogram (ECG) algorithms are being used in the device and many companies have received the FDA clearance for their products. These devices are able to detect a wide range of cardiac conditions including atrial fibrillation and arrythmia.

Aid ECG lead placement. Improper placement of ECG lead in clinics and offices is one of the major reasons for poor electrocardiograms. Several new systems have been introduced and they offer a convenient solution to this issue. They are designed to allow 3-D rendering of a patient on the device’s screen, displaying where each lead needs to be placed. The technological updates enable rotated of images on the touch screen which helps indicate where the leads are to be placed. The systems can automatically alert about misplaced leads and aiding the expert to easily identify where the issue lies. This has led to improvement in speed and accuracy of ECGs, along with better visualization in comparison to the traditional black and white 2-D pictures.

Wavelet ECG may provide additional data for cardiac diagnostics. The Wavelet ECG waveform in development offer new information which may lead to better diagnosis of cardiac patients. A new type of ECG system called Myovista have shown a new way of analysing the heart. The standard ECG that has been using the basic electrical activity waveforms for a century. This Wavelet ECG system uses continuous wavelet transform (CWT) signal processing to provide new frequency and energy information. It uses AI-based algorithms to analyse the data from the transformed ECG signal using continuous wavelet signal processing. This low-cost electrocardiographic testing system aims to provide physicians new information that will help improve patient risk-assessment for heart diseases.

Cardiac monitoring is key. Given its newness and changing nature, the pandemic presents scientific limitations. As the science continues to develop and international practitioners share their findings and experiences, the data will undoubtedly change—as will recommendations for managing cardiac complications of COVID-19. While this new evidence unfolds, cardiac monitoring will continue to play a key role in treatment planning. Be diligent, watch for changes in ECG, refer to advanced imaging when it is needed, and stay on high alert for abnormalities that could indicate problems.

ECG-management system. While standard 12-lead ECG is the bread and butter of ECG assessments and the core of ECG-management system reporting, hospitals that use 15-lead pediatric ECG should make sure the systems can accommodate its reporting. With the rapidly expanding use of single-lead cardiac monitors and consumer-grade ECG devices and apps, reporting systems that can accommodate capture and report for these devices might be a consideration. For office-based practices and smaller clinics that do not require a standalone ECG-management system, some vendors offer cloud ECG-management service as an extension of their CVIS or picture archiving and communication system (PACS). This can help reduce the costs of implementing an ECG-management system.

Focus on vendor neutral interfaces. The lack of interoperability between ECG systems and ECG management systems has been one of the major concerns for larger hospitals or healthcare systems as many operated using proprietary programming. Over the last few years, many vendors have inched toward using open platform standards for easier interface with other vendors’ technology, such as DICOM format waveforms and HL7 IT interfaces.

Major players in ECG equipment market have introduced newer versions of their device to allow greater connectivity with other vendors’ ECG systems, including newer, adhesive-based wearable Holter and event monitors.

Recording and interpretation for consumer-grade ECGs. In the past few years, the wearable and handheld ECG enabled devices and smartphone apps have flooded the market. This has enabled the users to record a 1-6 lead ECG. The newer generation of implantable cardiac monitors are wearable, clinical-grade, stick-on cardiac monitors that offer interfaces with patients’ mobile devices and even mark events. This data can also be transmitted to a physician’s office or automated ECG remote monitoring system. The COVID-19 pandemic period is testament to the fact there is a steep need for efficient and consumer-grade remote healthcare systems. The newer ECG devices have made it much less cumbersome than the earlier used bulky device. Patients prefer these more comfortable systems and their wire-free form factor. Also, the quality is as good as, or even better, than the Holter.

Extended ECG monitoring duration with these devices is another important reason why consumers are transitioning to newer ECG wearables and compact body-worn devices. Longer term device wear time gives an extensive data as it allows more time to capture cardiac arrhythmia events that may not present with a one- or two-day test period. The new ECG wearables can be worn for a week or two, while some go as long as up to 30 days. Several studies are also corroborated that the peak diagnostic yield for arrhythmia detection occurs by about 8 days of device wear time. Therefore, wearing an ECG recording device for at least a week may significantly improve the diagnostic yield compared to the traditional Holter, which is usually worn for 24 to 48 hours.

Some intelligent all-in-one remote patient monitoring devices have been introduced for the home consumer. Although, for some FDA clearance is still awaited, they have been of much interest. The device integrates all the important parameters, such as 7-Lead ECG, intelligent stethoscopes, heart rate, pulse oximeter, temperature, blood pressure, and respiration rate. This will bring all the high-tech cardiac monitoring in the ICU in the hospital to the user’s pocket. It is a peek into the future of telehealth and home monitoring. The system is easy to use that is put on with four fingers to make contact with the skin, and that’s it. It requires no training and no wires.

Takeaway

Healthcare technology is on a high rise as every year a new and more advanced form of system is introduced in the market. The recent developments in cardiac monitoring systems can go a long to save lives by enabling timely diagnosis. The novel Coronavirus outbreak has promoted a more important perspective towards at-home monitoring devices. During COVID-19, wearable ECG systems have allowed effective telemedicine based care for patients with AFib or other major adverse cardiac effects, such as myocardial infarctions or heart failure.

One of the biggest expenses in the health systems is the readmissions within 30 days after a surgery. This can be significantly cut down by these cardiac devices monitoring at home. It not only helps save lives, but also greatly improves the quality of lives of the patients. As a game changer, it truly revolutionizes the delivery of home care for all age groups of patients.