Devices & Utilities

Today’s technology is catching up with yesterday’s in hospital beds

Technological developments in smart beds are converting hospitals into a comfortable place to stay.

The healthcare industry has entered a phase that will be characterized by unprecedented opportunities for growth for affordable healthcare services offerings. Digital and technological developments are occurring increasingly fast throughout the entire healthcare process, from research to diagnosis, treatment, and aftercare. The focus is no longer merely on tablets and data mining. Robots, artificial intelligence, and virtual and augmented reality are not science fiction anymore. With patients spending less time in hospitals and more time at home or in long-term care establishments, the future is bright for medical bed manufacturers, able to deliver the innovative solutions that are needed to successfully reshape healthcare delivery. If they get their strategy right, makers of smart medical/hospital beds – which collect and analyze patient data to provide actionable insights – can capitalize on the optimal market conditions being generated by the changing face of care.

There is the need to think modularity, cost-efficiency, and developing service-based value propositions in tune with the desire for getting patients out of the hospital more quickly. For the medical bed to deliver on its promise and become a key component of the new healthcare delivery universe, exponents need to put strong partnerships in place. Tie-ups with experts in digital solutions, algorithmic analysis, and digital security are all vital to a successful competitive strategy.

The number of hospital beds per capita in the developed world has been declining for 20 years, along with the average length of stay, according to Cambridge Consultants. Healthcare reforms have provoked a shift away from hospital-centric models in response to the dual challenge of a larger, older population with complex care needs and the greater availability of more expensive medical treatments. As hospitals evolve into highly specialized centers for the rapid treatment of serious and acute conditions, post-intervention and chronic care is being shifted elsewhere – to nursing and care homes, smaller specialist care centers, or the patient’s home.

There is a big push to get people out of hospitals because it is expensive to keep them there and in India particularly, there is a major risk of secondary infection for the patient.

On one hand, this trend could set warning bells ringing for bed manufacturers facing declining demand from their established customer base. But opportunities abound for those alive to the need for cost-efficient solutions that shorten stays in the hospital. High patient turnover presents an attractive growth opportunity for companies able to combine smart beds with reusable and disposable sensor technologies. Higher patient throughput means more sensors sold, which sits well with a service-based value proposition.

Smart beds currently sit in a niche, with limited market penetration caused by the restraining effect of the large installed base of traditional medical beds and the high price of fully integrated products. This challenge can be overcome by offering a value proposition, which enables institutions to upgrade their existing beds without the need for large investments.

The notion of adding modular, smart add-on solutions is key to a successful business strategy. Low-tech wearable, disposable sensors could be offered as part of a service-based value proposition. Unobtrusive sensing technologies such as optical, acoustic, and millimeter-wave for lidar, which can still deliver the necessary accuracy, are attractive to both patients and healthcare professionals.

A bed can be used for up to 20 years, thus limiting the opportunity for traditional capital expenditure sales of fully integrated beds. As the installed base is huge, a key success factor is the ability to de-couple the smart features from the bed. The industry is looking toward using wearables from the consumer market to harvest patient data.

The future, then, will belong to those who offer not beds per se, but the ability to upgrade an institution’s installed base with specific smart features.

Plans have been announced by various hospitals to procure beds. In November 2019, Aster DM Healthcare announced its plan to add over 1500 beds to its existing capacity within the next 3 years. In October 2019, Medicover Hospitals firmed up a Rs 400-crore expansion in India. The facility will see an addition of bed strength by 1000 and also an establishment of two new hospitals by the end of June 2020. In September 2019, the government-run hospitals in Delhi, planned to increase the existing capacity of 11,353 beds in 38 hospitals to 13,899 beds. Three hospitals, with a capacity of approximately 2800 beds, are also planned in the next 6 months.

Major Vendors in Indian Hospital Beds Market – 2019 |

||

|---|---|---|

| High-end | Mid-end | Low-end |

| Arjohuntleigh | Paramount | Midmark |

| Stryker | Arjohuntleigh | United Surgical |

| Paramount | Midmark | Medimec |

| Hill-Rom | Godrej | Visco |

| Linet | Meditek | Unorganized |

| Midmark | Stryker | — |

| ADI Media Research | ||

Indian market dynamics

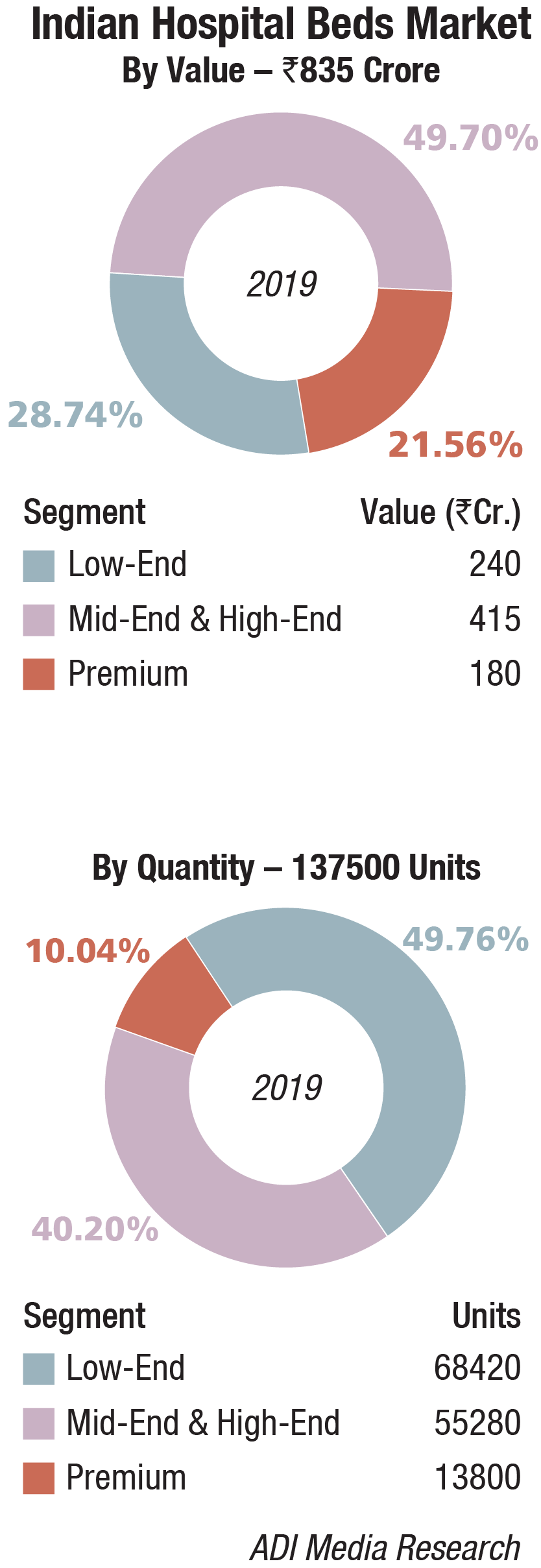

In 2019, the Indian hospital beds market is estimated at Rs 835 crore, with 137,500 units. While the market saw a 10 percent growth, the premium segment saw a 15 percent increase, by value. The discerning hospitals in Tier-II cities also are now shifting to premium beds.

The locally manufactured manual and motorized beds, both categories, continue to be relevant in smaller hospitals in Tier-II and III cities, and in hospital wards for the economically weaker sections of society.

This hospital beds segment is expected to continue to grow at 10–12 percent year-on-year, with 12,000–13,000 beds added every year.

A recent Crisil study observes that with insurance coverage of Rs 5 lakh under the Ayushman Bharat scheme (up from Rs 1-3 lakh under various government schemes), preference for private hospitals is rising. The study covering 41 leading domestic hospital firms revealed that the bed additions in tier II cities will be higher in future, resulting in better materialisation of latent demand and adoption of Ayushman Bharat schemes. This will be supported by a rise in bed occupancy rates to 75 percent from 60-65 percent. Crisil expects 60-70 percent of bed additions to come up in tier II locations in the next 2-3 fiscals.

A recent Crisil study observes that with insurance coverage of Rs 5 lakh under the Ayushman Bharat scheme (up from Rs 1-3 lakh under various government schemes), preference for private hospitals is rising. The study covering 41 leading domestic hospital firms revealed that the bed additions in tier II cities will be higher in future, resulting in better materialisation of latent demand and adoption of Ayushman Bharat schemes. This will be supported by a rise in bed occupancy rates to 75 percent from 60-65 percent. Crisil expects 60-70 percent of bed additions to come up in tier II locations in the next 2-3 fiscals.

Global market

The global hospital beds market is expected to reach USD 4750 million by 2027, with a CAGR of 5.3 percent from 2019 to 2027, predicts Absolute Market Insight. Increasing prevalence of chronic diseases, technological advancement in hospital beds, rise in cases of lifestyle diseases, growing geriatric population, and the increasing capacity of beds in private hospitals are the major factors leading to the high demand of hospital beds in the global market.

The healthcare sector has been witnessing a gradual inclination toward home-based services, from hospital-based services. This is mainly because healthcare services offered in hospitals, particularly during long duration of stays, are expensive. Long-term, home-based healthcare services reduce the overall costs for patients. This has been encouraging manufacturers and suppliers to increase their production capacities, in a bid to provide semi-automated and manual beds for home-based healthcare services.

Based on usage, acute care will account for the largest share of the global medical beds market in 2018, and is further projected to gain an uptick in its market share by 2023-end. Long-term care is also expected to witness a significant usage of medical beds in the near future, with shifting preference of patients toward home-based healthcare services. Sales of medical beds in psychiatric and bariatric care will reflect a sluggish expansion through 2023.

Non-intensive care applications of medical beds will account for nearly four-fifth share of the market over 2019 to 2023. Intensive care is likely to gain traction among medical beds applications in the near future, with increasing number of medical emergencies and surgeries fueling the requirement for post-operative care.

Increasing incidences of chronic diseases and neurological diseases owing to rising geriatric population has surged the prevalence of hospitalization across the globe. This has significantly fueled demand for medical beds in hospitals. Hospitals are anticipated to remain the most lucrative end-users of medical beds, with sales forecast to account for approximately USD 2300 million revenue by 2022-end. Ambulatory surgical centers will remain relatively less lucrative end-users of medical beds than hospitals during 2019 to 2023.

Electric beds remain a preferred choice among patients in the global medical bed market; however, sales of electric beds are expected to register the lowest CAGR through 2023. Semi-electric beds are expected to witness a steady expansion and will account for nearly USD 1000 million revenues by 2023-end.

Manual beds will also gain significant traction over 2019 to 2022, owing to their wide adoption in healthcare institutions that are devoid of sophisticated healthcare facilities. In addition, healthcare providers in rural regions depend highly on manual beds on the back of shortage in advanced medical facilities and affordability of manual beds.

Europe is anticipated to remain the largest market for medical beds, in terms of revenues. However, the market in Europe is projected to expand at a relatively lower CAGR than all the other regional segments through 2023. The market in the Middle East and Africa will expand at a similar CAGR as that of Europe’s through 2023.

China, as a part of its five-year plan, has targeted to add more than 85,000 hospital beds by the end of 2020. Developing countries too are proactively working toward enhancing their healthcare infrastructure.

Some of the major players operating in global hospital beds market are Stryker Corporation, Hilli Rom Holding. Inc., Getinge Group, Paramount Bed Co. Ltd., Invacare Corporation, Arjo Hunjtleigh, Meditech, and Jiangsu Yongfa Medical Equipment Co. Ltd.

Technology advances

Internet of Things (IoT). Many industries depend on the technological development of the world. Medical industries need to be more advanced as internet lists things. With the help of internet tools, doctors can monitor patients remotely and give medicines based on tracked information. The hospital bed not only helps patients but also helps to advance the health system around the world and provide medical and health status studies and ability to perform statistical analysis, data collection, and easy handling with the patient.. Recently, healthcare facilities have begun to use various specialized sensors in hospitals to improve health outcomes and overall construction efficiency. Technological developments in smart homes and life-saving hospitals allow people to stay indoors in a comfortable, secure, and independent way where they want to be. Internet solutions are options that can make living independently possible, easy, fun, less stressful, and faster. It provides massage therapy and mobility, takes some heavy duty that nurses usually do, saves lives in the end, and provides greater independence for the elderly and the disabled. Energy used to feed is clean energy, using solar energy. A hospital bed is a bed designed specifically for patients in hospitals or other people who need some forms of healthcare that can be used with voice commands and phone applications.

Smart bed technology with patient monitoring. The latest designs of bed platform now allow for continuous monitoring of patients’ heart and respiratory rates over 100 times per minute without ever touching them. This advanced smart bed is transforming inpatient care by integrating advanced sensing and analytics into the bed, offering a complete patient-safety platform to assist clinicians in providing the highest level of care.

Outlook

The industry will likely see more strategic partnerships and acquisitions as traditional market participants seek to innovate by tapping into the innovative energy of smaller, independent companies. As a core component of healthcare, the bed is the perfect hub for many tasks, such as communicating to a hospital information system (HIS), performing data analysis as a component of a future neural network, and performing inductive charging of patient-worn and other sensors.

The large installed base of hospital and care-home customers provides the ideal opportunity for transitioning to a service model by offering beds and consumables as a product-as-a-service value proposition. As part of that, smart hospital beds will offer patient analytics to enable cost-effective wards to communicate with the HIS and electronic hospital records and alert professionals to the health status of patients and the level of care required.

The need for sensor-fed predictive analytics is overwhelming in all customer segments. Operators who can offer solutions, which collect patient data and feed into a predictive patient-management solution to optimize workflows and facilitate bed turnover times, will prevail. As the future bed becomes increasingly sophisticated, it will become an even more critical component of a digital services infrastructure that helps professionals run more cost-efficient operations without sacrificing the health of patients.