Ultrasound Equipment

Ultrasound outpaces its counterparts

While ultrasound machines outpace every other imaging modality, the rapid evolution of ultrasound smart probes is changing the landscape.

The ultrasound equipment market has been growing at a tremendous pace, with projections going up by the hundreds of millions each year. Riding on the tails of the exponential growth in computing power and the miniaturization of hardware, ultrasound has benefitted tremendously. Over the past 20 years, there has been a dramatic improvement in image quality, resulting in ultrasound images that often rival those of CT, and even MR. Speed and ease-of-use has improved significantly and, at the same time price points have decreased.

The ultrasound equipment market has been growing at a tremendous pace, with projections going up by the hundreds of millions each year. Riding on the tails of the exponential growth in computing power and the miniaturization of hardware, ultrasound has benefitted tremendously. Over the past 20 years, there has been a dramatic improvement in image quality, resulting in ultrasound images that often rival those of CT, and even MR. Speed and ease-of-use has improved significantly and, at the same time price points have decreased.

Ultrasound is poised to continue its growth trend and outpace every other imaging modality. The decreased size and cost of ultrasound units, combined with machine learning and automation, will simultaneously add value to today’s users, as well as bring ultrasound to completely new markets. Moreover, ultrasound is expected to move from a diagnostic tool to a screening tool. And continued improvement in image quality, automation, ease-of-use, and faster connectivity will bring ultrasound to new environments, outside of the hospital or clinic and, hence, expand the broader global market place.

Indian market

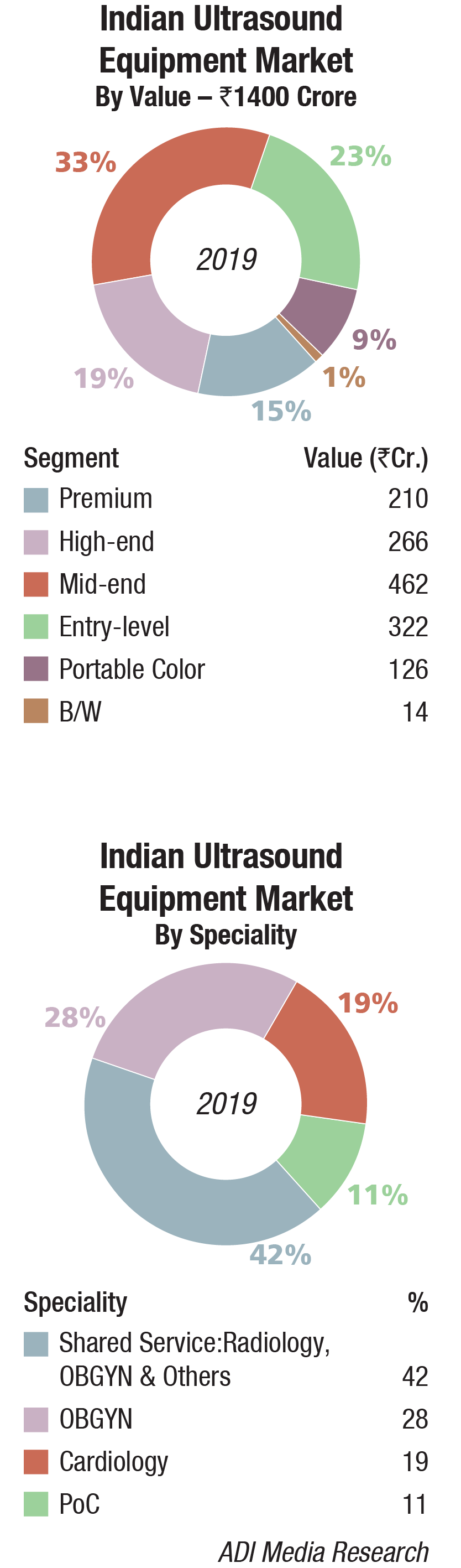

The Indian ultrasound equipment market in 2019 is estimated at Rs 1400 crore. The market was slow as against an average annual growth of 7–8 percent, the market in 2019 saw a 4 percent growth.

The consolidation-acquisition drive among hospitals in 2019 put procurement on the backburner. Radiant Life Care acquired a 49.7 percent stake in Max Healthcare while Columbia Asia was busy in its attempt to sell its Indian hospital operations for about Rs 1800–2000 crore. It was in preliminary talks with strategic and financial investors, including Manipal Health Enterprises, Bain Capital, and Temasek Holdings. Fortis Hospitals was busy with its founders declared guilty by the courts, and takeover by IHH Healthcare Bhd. stalled. Until IHH came on board, Fortis was in such a state that there was no sufficient investment in CapEx, and with the debt rates high, the hospital was in an unsustainable situation.

The government procurement in 2019 was good. Orders were placed by Tamil Nadu Medical Services Corporation Limited (TNMSCL), All India Institute of Medical Sciences (AIIMS), Odisha State Medical Corporation Limited (OSMCL), and the Indian Navy for its warship submarines among others.

By segment, the high-end and mid-end segments saw growth, albeit miniscule. Prices declined further in the entry-level models. The black-and-white systems continue to find relevance in the Indian market.

The portable market continues to gain traction. Apart from GE Healthcare, Philips Healthcare, Siemens Healthineers, and Fujifilm Sonosite, which together hold an 80 percent share globally, yet to debut in the Indian market and popular overseas, are a handheld start-up, Butterfly Network; and Hologic, a leader in women’s health imaging, which has partnered with handheld ultrasound producer Clarius to re-brand and sell the Clarius L7 as the Viera.

The application was primarily in radiology and obstetrics and gynecology, which had a combined share of 70 percent. Cardiovascular ultrasound is also a popular technique with Indian physicians.

Trends that had started a couple of years back gained popularity. The rapid growth of transcatheter structural heart procedures and the need for increased use of echocardiography as an integral part of the structural heart team, has given rise to the new subspecialty of interventional echocardiography. With the rise of transcatheter structural heart-repair procedures over the past few years, cardiac ultrasound, especially 3-D/4-D transesophageal echocardiography (TEE), has become extremely important to guide these procedures.

Major Vendors in Indian Ultrasound Equipment Market – 2019* |

||||

|---|---|---|---|---|

| Tier I | Tier II | Tier III | Tier IV | Others |

| GE | Philips and Mindray | Samsung | Siemens and Sonosite | Sonoscape, Esaote, Toshiba, Trivitron BPL, Konica and Cura |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian ultrasound equipment market. | ||||

| ADI Media Research | ||||

Miniaturization of imaging and computing components and increased computing power available in ever-smaller packages have also made it possible to reduce the size of ultrasound imaging systems. These are pushing the portable systems market. A deterrent in India is the tightening of the PNDT Act.

Global market

The global ultrasound market is projected to reach USD 8.4 billion by 2023 from USD 7.5 billion in 2019, at a CAGR of 5.9 percent, estimates MarketsandMarkets. Factors, such as the increasing prevalence of target diseases; rising patient preference for minimally invasive procedures; technological advancements; increasing number of diagnostic centers and hospitals; and growing public and private investments, funding, and grants, are driving the growth of the global ultrasound market. However, stringent government regulations may restrict the growth of this market to a certain extent in the coming years.

On the basis of device display, the color ultrasound devices segment is expected to grow at the highest CAGR during 2018–2023 with the benefits offered by these devices, such as better image quality and higher image resolution. Also, the growing availability of advanced color ultrasound devices, coupled with the continuous decline in product cost across major countries, and expanding distribution networks of major manufacturers across emerging countries, are expected to support the growth of this market segment over the next 4 years.

In 2019, Europe is expected to account for the largest share of the global ultrasound market. This can be attributed to the large number of ongoing clinical research projects in the field of ultrasound, expansions in the clinical applications of focused ultrasound (and the early commercialization of these devices in Europe), and the significant healthcare expenditure across mature European countries (such as Germany, France, the UK, Italy, and Spain).

In 2019, Europe is expected to account for the largest share of the global ultrasound market. This can be attributed to the large number of ongoing clinical research projects in the field of ultrasound, expansions in the clinical applications of focused ultrasound (and the early commercialization of these devices in Europe), and the significant healthcare expenditure across mature European countries (such as Germany, France, the UK, Italy, and Spain).

GE, Philips, Canon Medical Systems, Siemens AG, Hitachi, Samsung Electronics, Fujifilm Holdings Corporation, Esaote S.p.A., Mindray Medical, Shimadzu Corporation, Analogic Corporation, Carestream, Hologic, Mobisante, and Chison Medical Imaging are some of the major players operating in the global ultrasound market.

Market trends

2019 was a record year for the global ultrasound equipment market, with revenues increasing by 5.9 percent, tipping the market over the USD 7 billion mark for the first time. Despite the backdrop of global economic uncertainty, the ultrasound market is forecast to continue to grow relatively strongly in the coming years, with the following trends driving growth.

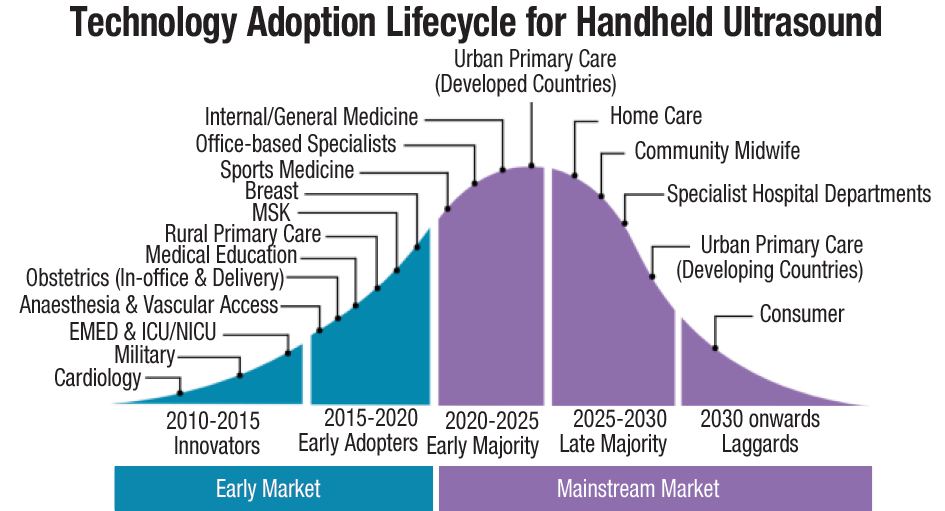

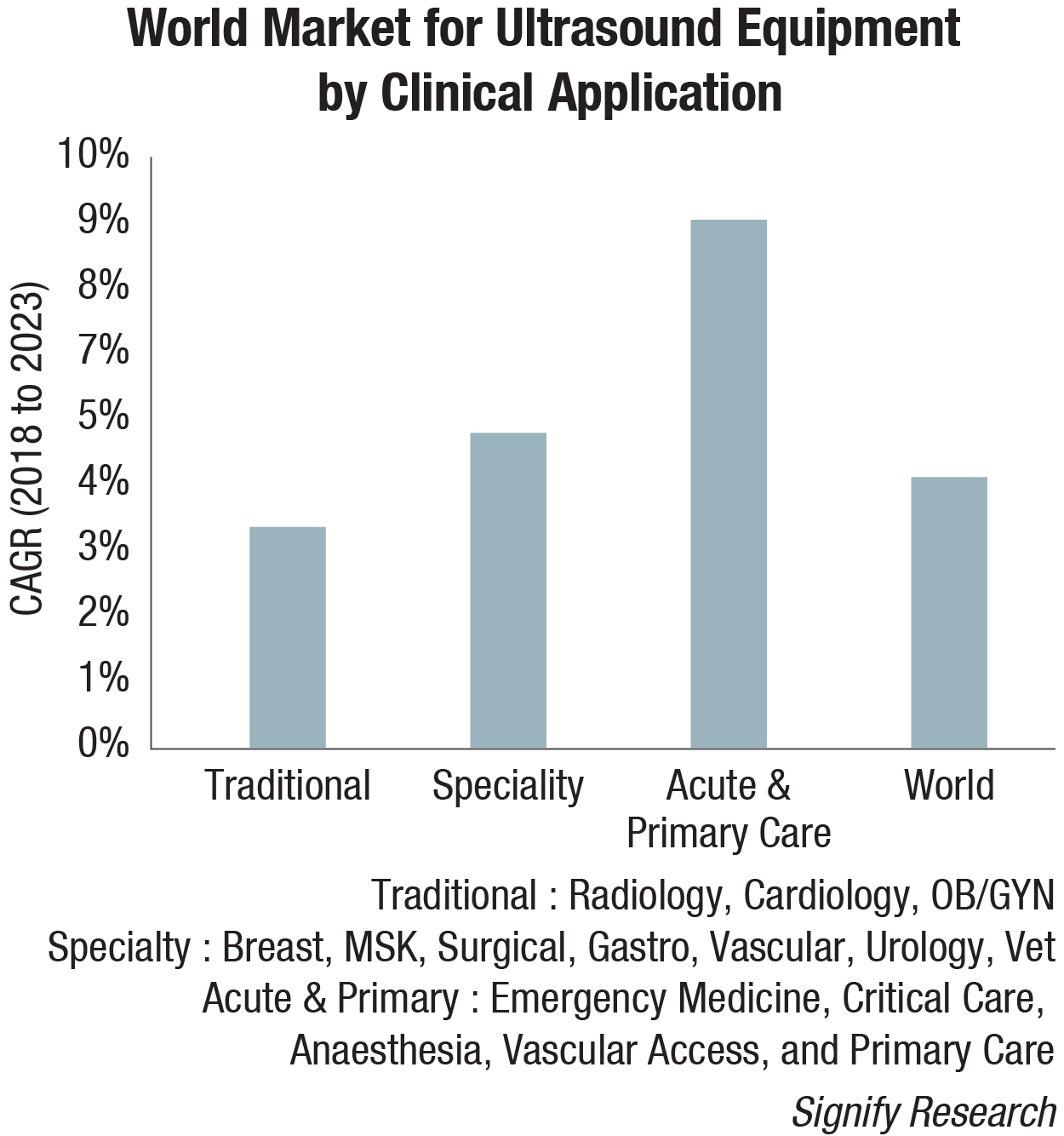

New users of ultrasound. Over the years, the use of ultrasound has gradually expanded beyond radiology, cardiology, and OB/GYN to a wide range of clinical specialties, including surgery, musculoskeletal, and gastroenterology, to name a few, expanding the customer base and driving additional revenue growth. This trend started out in developed countries, but more recently it has spread to developing markets too, particularly India and China, where specialty departments at larger hospitals now often have their own budgets to buy ultrasound. Additionally, ultrasound is gaining acceptance in acute and primary care settings, both as a screening and diagnostic tool, as well as for procedure guidance. With the use of handheld ultrasound gaining pace, this trend will accelerate in the coming years.

New uses of ultrasound. As well as the growing customer base, the use of ultrasound with existing customers is expanding, typically as a lower-cost and/or radiation-free alternative to other imaging modalities, such as MRI and CT. The global shift to value-based care as a replacement for the traditional fee-for-service approach will support this trend. For example, ultrasound is playing an increasingly important role as a screening tool for women with dense breast tissue. In acute care, ultrasound is increasingly being used for lung imaging to diagnose conditions, such as pleural effusion, pulmonary edema, and pneumothorax. In another example, the use of shear-wave elastography is expanding beyond hepatology (e.g., liver fibrosis) to other body areas, including breast, prostate, thyroid, and spleen. Musculoskeletal is another relatively untapped market for ultrasound, including orthopedics, rheumatology, and sports medicine.

Emerging markets. The ultrasound market in developed regions, such as Western Europe, North America, and Japan, is largely saturated and the outlook is for low- to mid-single-digit growth. While these markets will continue to account for the lion’s share of the world market, developing markets continue to represent a growth opportunity. In 2019, the fastest growth is forecast for Southeast Asia, Brazil, China, and India. That said, ultrasound market growth is slowing in many of the emerging markets, particularly China.

For several years, China has been the growth engine for the world ultrasound market, with consistently high double-digit annual growth. However, in more recent times, the world’s second-largest economy has entered a phase of slowdown and this is negatively impacting the ultrasound market. The annual growth rate dipped below 10 percent for the first time in 2019. With the Chinese OEMs capturing a growing share of the domestic market as they penetrate the high-end segment, China is becoming an increasingly tough market for the major multinational brands.

Handheld ultrasound. The handheld ultrasound market is growing rapidly, as the latest generation of ultra-portable devices gains acceptance among a diverse range of customer groups, from emergency medicine physicians and intensivists to internists and office-based specialists, and looking forward, primary care physicians. The expanding customer base, coupled with the increased availability of affordable handheld scanners, is forecast to boost global sales of handheld ultrasound by over 50 percent in 2019. By 2023, the global market for handheld ultrasound is forecast to exceed USD 400 million.

Artificial intelligence. Artificial intelligence (AI) will have a transformative impact on the market as it addresses some of the key limitations associated with ultrasound, namely, the shortage of trained sonographers and the relatively steep learning curve, high operator dependency both during image acquisition and interpretation, poor image quality for certain exam types, and the relatively lengthy exam time compared with other modalities. The first wave of ultrasound AI applications is entering the market and is mainly for image optimization (noise reduction) and automation of time-consuming and repetitive tasks, such as anomaly detection, image labeling, feature quantification, and classification. However, the greatest impact of AI will be guided ultrasound (ultrasound navigation), which will provide real-time support during image acquisition (i.e., probe placement and anatomy detection). The first AI-enabled guided-ultrasound systems are expected to be released in the second half of the year. These systems are expected to expand the user base by making ultrasound more accessible to novice users, particularly in acute and primary care.

Design challenges

Medical imaging, specifically ultrasound, is undergoing a significant transformation. In addition to high-performance cart-based ultrasound systems, it is now possible to use a handheld device to accomplish high-quality ultrasound imaging. Thanks to advancements in semiconductor technology, ultrasound smart probes are becoming smaller and portable, enabling access to healthcare beyond medical offices and hospitals. The day is fast approaching when most doctors will carry a smart probe unit in their pockets, similar to their stethoscope, by which they can not only hear, but also see inside the body – potentially leading to a market of a few million units worldwide within the next decade, complementing standard ultrasound systems. But shrinking the system down to a handheld device is no easy task and presents many challenges. Some of the most significant challenges smart probe designers face include:

Powering the unit. Powering a smart probe with very low noise and ensuring that the power supply itself does not consume high power are two tricky challenges. Designers of smart probe power supplies must work within a very small area and height, while achieving efficiencies greater than 90 percent with low power being consumed while idle, and most importantly, with low noise. Most manufacturers need their power supplies to switch below 1 MHz and synchronize to an external clock to minimize harmonics interference in the ultrasound operating frequency range of 2–20 MHz. The size vs. efficiency trade-off is a huge challenge.

Size. Twenty years ago, a 64-channel ultrasound system consisted of multiple A4-sized boards each for transmitting, receiving, analog-to-digital conversion, beamforming, and processing, which were interfaced to a backplane and connected to a standard computer. Today, a complete 64-channel smart probe front-end board needs to be smaller than the size of a credit card (85×54 mm). However, even with all the advancements in technology and high levels of integration, it is still no small feat to achieve this level of miniaturization.

Channel count. Processing a higher number of channels simultaneously leads to better image quality. Most cart-based scanners today have 128 channels or more. Initial smart probes had either eight or 16 channels integrated inside the probe head; these channels had to be connected to a larger system for processing. Currently, manufacturers are trying to integrate as many as 64 or 128 channels into the probe. To achieve such channel densities, they can now leverage new, commercial off-the-shelf devices, like the highly integrated front-end devices from Texas Instruments.

Power per channel. A 128-channel cart-based ultrasound scanner consumes about 500 W to 1 kW of total power. A handheld smart probe has a power budget of only 3–5 W, so it’s not too hot for the doctor to hold or the patient to feel, and it potentially can operate from a battery. This low wattage means that there’s no room for cooling mechanisms like fans, which could cause vibration and result in a blurry image. Designers must incorporate mechanisms to ensure that probes stay within their power budget, ranging from putting some devices to sleep while they are idle to completely powering off devices when they are not in use. Quick turn on/off is very important to help achieve this.

Data processing. Data processing is impacted by multiple factors, including the number of channels, expected power consumption, and data transmission bandwidth. In a 64-channel system sampling at 40 MHz, the front end generates a massive 5.12 GB of data per second, which cannot be transferred directly to a tablet or a mobile device. Even if that data were transferred by some means, the device would not be able to process it in real time. Hence, this data must be pre-processed and converted to a manageable size before sending it to the display unit. The amount of processing is based on trade-offs between the display unit’s power, bandwidth, and processing capability. Most designers use ultra-low-power FPGAs and processors for data processing and controlling the front end.

Data transfer. For wired probes, interfaces like USB 3.1 and higher, using USB Type-C, can be an advantage when providing the necessary power and high data-transfer bandwidth to the display unit. But for a truly mobile smart probe, the data has to be transferred wirelessly. There are multiple wireless communication protocols like Wi-Fi (802.11n, 802.11ac, 802.11ad, or 802.11ax standards), which are available commercially; however, these can be limited by interference in their bandwidth when multiple devices use the same band. Other standards like 802.11ah (sub-1 GHz) exist, but have limited bandwidth.

Data interpretation. The biggest smart probe challenge is enabling the analysis of a large amount of data quickly and efficiently. Today, accurate interpretation requires many doctors to analyze the data, and there are significant capacity and time constraints. With high-speed connectivity, data can be sent to servers at remote locations for rapid analysis. With the rise of big data analytics and artificial intelligence, image comparison and interpretation can happen online in real time, resulting in an immediate diagnosis.

Way forward

The next big wave in medical imaging is coming in a very small size. As designers of smart ultrasound probes resolve challenges and get better devices to market at a lower and more affordable price – and in a smaller size but still with connectivity – the medical world will witness the rapid adoption of smart probes. From a hospital in a developed country to a telemedicine center in a developing country to diagnosing injured soldiers in the field, the rapid evolution of ultrasound smart probes is changing the landscape and helping provide better care.

Industry Speak

Brahadeesh M

Brahadeesh M

President – Imaging,

Trivitron Healthcare

Strong customer preferences toward image quality and equipment versatility

Over the years, ultrasound modality has become an inevitable part of healthcare delivery in India. The unique aspect of ultrasound modality is that it is non-invasive, radiation-free, and also has wide applications beyond modalities like radiology, cardiology, and obstetrics and gynecology.

The intra-operative ultrasound equipment with dedicated probes is crucial for care delivery in various clinical scenarios, like robotic surgery, urology, neurosurgery, surgical gastro, surgical oncology, and endo ultrasound (EUS). Ultrasound market is growing at a rapid pace in high-end and premium segments owing to such specialty applications. Hospitals increasingly prefer dedicated intra-operative ultrasound machines that are compatible with common disinfectant methods, for safe use in the operating room with superior image quality, and user-friendly workflow features like touchscreen display monitors. The customer preferences for veterinary ultrasound are shifting from mid- to high-end technologies.

Multispecialty hospitals are now looking for versatile equipment, with vast probe library that are suitable for various applications as this enables them to offer comprehensive solutions to their patients with better RoI for the hospital. There is a visible shift in the customer preferences toward high-end technology and superior-quality imaging for better clinical diagnosis. Recently, advanced technologies like Hitachi’s Carving Imaging have raised the bar for ultrasound image quality, and are useful to recognize even the smallest of tissue abnormalities, and to identify lesions early. Carving Imaging sculpts the image borders and masters the ultrasound imaging by eliminating even the slightest echoes across the image.

Workflow features like, Software TGC, which allows the users to save the settings and Protocol Assistant that guides the users through the exam, following pre-registered protocols, and hence reduces keystrokes by up to 40 percent, are preferred by users as it provides more flexibility in workflow and improves patient throughput significantly.

With government initiatives like Ayushman Bharat, we expect a major growth of super-value and value segments of ultrasound, and they will contribute to a significant market in the coming years.

Industry Speak

Hitesh Singh

Hitesh Singh

Product and Marketing Manager–Indian Subcontinent,

Fujifilm SonoSite India Pvt. Ltd.

Exploring new horizons with point-of-care ultrasound

Over the past two decades, the use of diagnostic ultrasound has gradually expanded beyond conventional radiology and cardiology segment to a wide range of other clinical specialties including anesthesia, critical care, emergency medicine, surgery, pediatrics, musculoskeletal, and nephrology, which constitutes the point-of-care (POC) segment. This trend started from the developed countries and now it has widely spread to the developing countries, particularly India and neighbor countries, where different specialty departments at medical institutions and larger hospitals now often have their own budgets to buy ultrasound machines.

The new generation of compact ultrasound devices are gaining acceptance amid diverse range of customer groups, from intensivists to internists and among office-based practitioners. The use of ultrasound is expanding day by day especially for performing interventional/pain management procedures as it is a cost-effective and radiation-free alternative to other imaging modalities, such as CT or Fluoroscopy. Nowadays, manufacturers are devising compact ultrasound systems, which are fully sanitizable and can be used in indoor hospital departments like OT, ICU, and IPD setup, and would help in infection control from the patient’s safety perspective.

The POC ultrasound (POCUS) does not limit its existence only to hospital environments but today it is extensively used in sports medicine, veterinary care, and for military expeditions. Compact ultrasound is also deployed as an important screening tool for early detection of tumors in women with dense breast tissues. In acute care settings, POC ultrasound is used for procedural guidance and cardiac evaluation, and it has established itself as a vital tool for examining lung to diagnose several pathological conditions (like pleural effusion, pulmonary edema, pneumothorax, and more). Another popular application area is the musculoskeletal ultrasound performed by orthopedics, rheumatologists, and sports medicine physicians.

The latest trend includes the incorporation of artificial intelligence (AI) tools in ultrasound devices, which can assist physicians in acquiring the right kind of diagnostic information. Beginners can take advantage of AI features to help them recognize life-threatening conditions, assist with probe alignment, and obtain the next steps in patient management. It is believed that AI technology in ultrasound devices will help in optimizing the physicians’ workflow while delivering a high diagnostic value, and will signify the dawn of a new technological era in the medical industry.

Industry Speak

Punervasu Vyas

Punervasu Vyas

Sr. Application Manager

Mindray Medical India Private Limited

Shearwave elastography – A noninvasive technique to fight CLD

In the evolution of chronic viral and non-viral liver diseases, liver fibrosis is a very important factor associated with diagnosis and eventually prognosis. Hence, a precise evaluation of the severity of fibrosis is necessary in those patients in order to perform a correct staging and, eventually, to take a decision regarding the treatment. Currently, liver biopsy (LB) seems to be the optimal method to evaluate changes in fibrosis over time. Nevertheless, LB has its shortcomings – the intra- and inter-observer variability, the sampling variability and, last, but not the least, the fact that LB is an invasive method, with morbidity and mortality greater than zero. Considering all these facts, noninvasive methods for the evaluation of liver fibrosis have become pivotal and were developed in the last few years, in order to reduce the number of LBs.

Taking into account the limitations of LB, a non-invasive method, namely, shearwave elastography, has proved to be an extremely efficient method of evaluation for LB staging, and chronic liver disease (CLD) studies.

Mindray Medical, after its acquisition of Zonare, has not only developed unique shearwave technology, but has also eliminated the existing lacunae in current shearwave elastography techniques.

Despite all of its benefits, shearwave elastography has its many pit falls, namely, inter-user and intra-user variations, patient position, patient BMI, scan depth, probe position, and most importantly repeatability. Mindray’s new and improved shearwave technologies STQ and STE provide numerous solutions to overcome the above gaps.

Motion stability index (M-STB) and the reliability index (RLB Map) both help to reduce the inter-user and intra-user variations, and also help the user optimize results by obtaining reliable and correct data every time.

STQ or sound-touch quantification is the industry’s first real-time point quantification, which also allows clinicians to adjust ROI size according to the target area. Being a real-time technology, it allows users to check for micro-variations in liver parenchyma, and also check for repeatability. Various statistical data results like, mean, median, STD, IQR, IQR/median, and the like, also allow for detailed statistical analysis.

STE or sound-touch elastography is also the industry’s first real-time 2D elastography available on both convex and linear transducers. Color map-based real-time 2D shearwave elastography provides clinicians the privilege to view the subtlest of changes in liver parenchymal diseases.

We at Mindray are fairly confident that with the new generation of shearwave elastography, we will surely add to the early diagnoses of liver diseases and reduce the number of deaths due to CLD in India.