MB Stories

Ultrasound survives the COVID-19 crisis

The prospects for medical imaging modalities, as ultrasound, that fall somewhere in between essential and non-essential equipment during the COVID-19 crisis are not as cut and dried.

The novel coronavirus (COVID-19) is now a global pandemic and confirmed cases and deaths are dramatically escalating. Beyond its human toll, COVID-19 is having a sizable economic impact. Many nations have shut down all non-essential businesses, which has devastated the global economy. National governments are now providing stimulus packages, which are injecting money into specific markets to address the severity of COVID-19 and its implications.

Nearly every industry has been touched in one way or another by COVID-19, but the healthcare market has experienced one of the most direct impacts. For many medical equipment markets, the pandemic’s impact is largely predictable—systems essential to diagnosing, monitoring, and treating COVID-19, like ventilators, patient monitoring solutions and digital X-ray, are experiencing exceptionally high demand and receiving the necessary funding, leaving little remaining budget for non-essential systems like magnetic resonance imaging (MRI) and interventional solutions. However, the prospects for medical imaging modalities, such as ultrasound, that fall somewhere in between essential and non-essential equipment are not as cut and dried.

Indian Market Dynamics

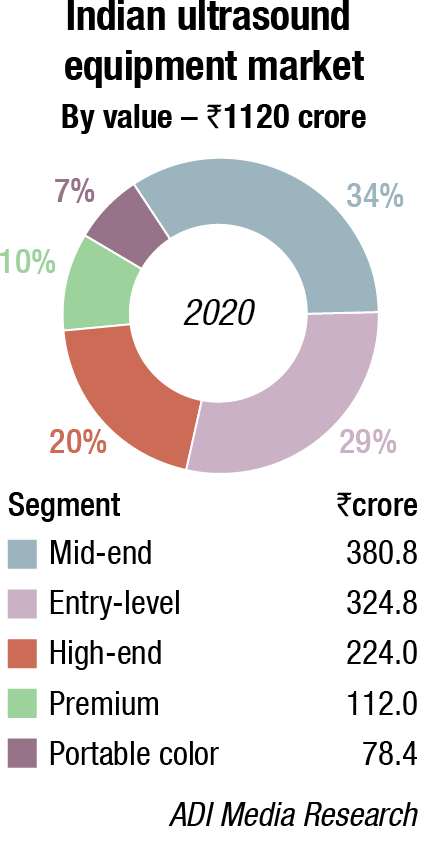

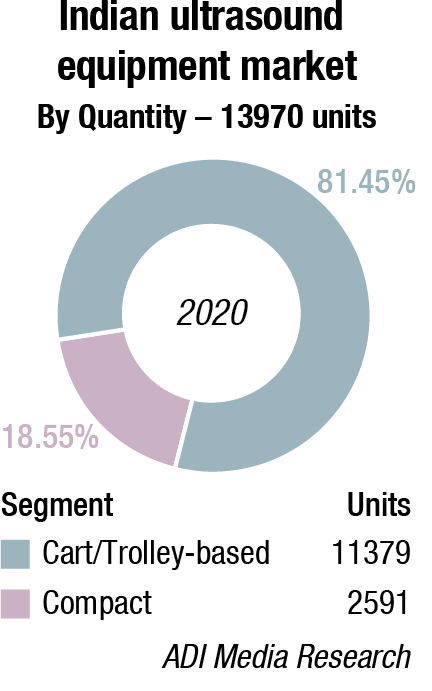

The Indian ultrasound market in 2020 is estimated at `1120 crore, by value and 13970 units, by quantity. The market saw 8 percent decline by value and a 4 percent decline by quantity over 2019, indicating a shift away from the premium segment. This includes the refurbished machines, estimated at `40-50 crore in 2020.

By value, the market share of the premium segment in 2020 declined by 5 percent. The high-end and mid-end continued to have similar market shares as 2019. The entry-level gained a 6 percent share in 2020, over 2019.

By type, in a total market of 13970 units, the Cart/Trolley-based machines dominated with 81.45 percent share, and the balance 18.55 percent was contributed by the compact machines.

GE continues to dominate this market with a huge lead over Philips, the next in the chain. Mindray and Samsung are neck-to-neck, while BPL and Sonosite are also aggressive players. Other brands that have presence include Trivitron, Hitachi, Sonoscape, Esaote and Konica, and some Chinese brands.

COVID-19 prompted ultrasound to make the jump from a clinical to a domestic setting. Novice users are being empowered to use a tool that, to this day, many primary care physicians cannot.

Firstly, most handled scanners come with built in presets that can be used to quickly garner key measurements. A heart’s auto ejection fraction, or a fetus’s estimated due date for example, can be automatically calculated by the system’s tools. Another enabler is tele-ultrasound, where live ultrasound images are transmitted through teleconferencing to experts to guide novice users. AI will also play a key part in assisting novices to use ultrasound, both in terms of AI-enabled image capture assistance alongside automated anatomy navigation. Furthermore, AI can also compare the acquired image to standardized criteria, to ensure that it meets clinical standards. Finally, the most consumeresque aid of all, vendors have released simple to understand YouTube tutorials.

Cost is still a barrier to increased adoption, but as that falls, it will just take one vendor, one provider, one insurer, just one company with a novel strategy, to strike on the right model, which is both helpful and lucrative, before the floodgates open and ultrasound at home is an everyday occurrence.

Global Market Dynamics

Healthcare providers are using ultrasound systems for the triage, monitoring, and diagnosis of COVID-19 patients, however, currently neither the World Health Organization (WHO) nor the Centers for Disease Control and Prevention (CDC) are recommending ultrasound as a primary diagnostic imaging tool. Despite this, government healthcare relief funds are allocating money for ultrasound systems, but far less than the amount being allocated to purchase other imaging equipment such as digital X-ray and ventilators. The outlook for the ultrasound market is especially unclear since government intervention is not expected to completely counteract the negative impact of COVID-19. To navigate the uncertain ultrasound market, it is important to consider some market dynamics.

Demand will be uneven

Diagnostic ultrasound can and is being used to diagnose COVID-19 in patients. The existing installed base of ultrasound imaging systems, regardless of the intended application, is being deployed to intensive care units (ICUs) where patients suffering from COVID-19 are receiving treatment and continuous monitoring. Despite this effort, demand for equipment will still be high and governments will seek to purchase necessary equipment. Healthcare expenditure allocated to ultrasound will be used primarily to purchase to point-of-care (POC) and primary care systems, causing unit shipments for these segments to spike during the crisis. POC and primary care equipment are ideal for treating sick patients in crowded hospitals because of the systems’ speed, portability, and ease of use.

“Recent advances in ultrasound includes real time imaging, miniaturization of equipment with high frequency wireless, electronic, and endoscopic probes which help in interventional procedures and cardiology. Android devices coupled with wireless transducer makes ultrasound easier. Contrast agents improve visualization of blood flow which causes tissue enhancement. Shear wave elastography helps characterization of liver and breast lesions. Therapeutic uses-high intensity focused ultrasound (HIFU) for treating conditions like fibroids.”

“Recent advances in ultrasound includes real time imaging, miniaturization of equipment with high frequency wireless, electronic, and endoscopic probes which help in interventional procedures and cardiology. Android devices coupled with wireless transducer makes ultrasound easier. Contrast agents improve visualization of blood flow which causes tissue enhancement. Shear wave elastography helps characterization of liver and breast lesions. Therapeutic uses-high intensity focused ultrasound (HIFU) for treating conditions like fibroids.”

Dr BYT Arya, Consultant Radiology, Manipal Hospital

While not to the same extent as POC and primary care equipment, healthcare providers will also purchase general imaging ultrasound equipment to be used during the crisis. General imaging equipment may be viewed as a viable long-term investment since it can be used to diagnose and monitor COVID-19 patients and then repurposed for many other applications once the pandemic passes.

Conversely, the demand for new larger, dedicated systems will be drastically diminished since elective procedures are being cancelled and delayed and funding is being allocated elsewhere.

With healthcare providers directing their full attention toward the pandemic, their capacity to purchase any non-essential equipment will be severely limited. Instead of purchasing new equipment, practitioners are electing to extend the life of older systems during the crisis.

Supply chains are being disrupted

Even in situations where ultrasound systems are in high demand, the supply of ultrasound equipment will be limited to meet the needs.

The presence of COVID-19 and its subsequent impact on the patient population has resulted in a shutdown of vast portions of the global economy, resulting in disrupted supply chains, limited materials, and workforce, and slowed or stopped manufacturing. Additionally, many manufacturing plants are prioritizing or even being retooled to produce other medical supplies and equipment such as ventilators, since they have the greatest need.

Overall revenues will likely decline during the crisis

POC and primary care are the two smallest ultrasound market segments and only accounted for a combined 11 percent of ultrasound revenues in 2019. Even if POC and primary care revenues skyrocket in 2020, if the remaining 89 percent of the global ultrasound systems market struggles to the degree that is expected, the overall market will decline.

Specific clinical applications will be hit harder than others by the pandemic. For example, demand for obstetrician and gynecologist (OB/GYN) and cardiovascular systems, which respectively accounted for 20 percent and 18 percent of ultrasound revenues in 2019, will be very low during the crisis, since these systems are not related to COVID-19 and are typically less portable and more expensive than POC and primary care systems.

Even within this example, cardiovascular systems will likely fare better than OB/GYN since they are easier to repurpose for COVID-19 diagnosis. It is also expected that following the COVID-19 crisis, there will be a large patient population with secondary effects of the virus, requiring a medical diagnosis of cardiovascular-related problems.

The relatively low price of POC and primary care systems is a plus for healthcare providers but will contribute to the overall decline in revenues. Since the ultrasound product mixture is shifting away from expensive, dedicated systems and toward less-expensive POC and primary care systems, the overall average selling price for an ultrasound system will drop in 2020.

In 2019, the average cost for a POC system was USD 20,000 compared to USD 50,000 for the average cardiology, gastroenterology, urology, or breast system. Therefore, the presence of COVID-19 will have a larger impact on overall revenues than unit shipments.

The extent of the market decline will depend on the duration and toll of the crisis. The higher the prevalence of cases and the longer the pandemic lasts, the more dramatic the decline in revenues will be. If the coronavirus is contained and controlled quickly, less damage will be inflicted on the market.

However, if COVID-19 is deadlier and longer-lasting than anticipated, or if there is a reoccurrence in the fall, then the impact of the illness will increase. Since the full impact of COVID-19 is still to be determined, Omdia accounted for several scenarios in its update to the forecast of the ultrasound market.

“AI powered ultrasound is becoming closer to routine clinical applications in recent times. Ultrasound images involve many variations depending on the operator, patient, and the scanning machine. In AI, with the self-learning ability, deep-learning methods are able to harness exponentially growing graphics processing unit computing power to identify abstract and complex imaging features. This has given rise to tremendous opportunities for improving and optimizing ultrasound clinical workflow. Although obstetric and gynecological ultrasound are two of the most commonly performed imaging studies, AI has had little impact on this field so far. Nevertheless, there is huge potential for AI to assist in repetitive ultrasound tasks, such as automatically identifying good-quality acquisitions and providing instant quality assurance.”

“AI powered ultrasound is becoming closer to routine clinical applications in recent times. Ultrasound images involve many variations depending on the operator, patient, and the scanning machine. In AI, with the self-learning ability, deep-learning methods are able to harness exponentially growing graphics processing unit computing power to identify abstract and complex imaging features. This has given rise to tremendous opportunities for improving and optimizing ultrasound clinical workflow. Although obstetric and gynecological ultrasound are two of the most commonly performed imaging studies, AI has had little impact on this field so far. Nevertheless, there is huge potential for AI to assist in repetitive ultrasound tasks, such as automatically identifying good-quality acquisitions and providing instant quality assurance.”

Dr Sunil Eshwar, Lead Consultant, Obstetrics and Gynecology, Aster RV Hospital

Ultrasound market will rebound

For the most part, demand for ultrasound systems will only be delayed during the COVID-19 crisis, not cancelled. As a result, demand for systems unrelated to COVID-19 will be pent up resulting in elevated revenue growth in 2021 and 2022.

Ultrasound has the propensity to recover quicker than other medical imaging modalities because the equipment is quicker to manufacture and less expensive than systems like CT and MRI.

Additionally, many nations are expected to increase healthcare expenditure following the crisis to revamp their healthcare infrastructure to safeguard against a future pandemic. These efforts would drive strong demand for ultrasound systems, especially for POC, primary care, and general imaging equipment, in the short- and medium-term.

Long-lasting implications of COVID

While the world remains hopeful that it will stifle the virus and quickly return to normal, the pandemic will likely have long-lasting implications. One of the most significant consequences might be to the global economy.

The Organization for Economic Cooperation and Development (OECD) has warned that the illness is the biggest threat to the global economy since the 2008 financial crisis and drastically downgraded its 2020 global economic projections. If the global economy suffers as expected, it will likely take several years to fully recover. Along with a suppressed economy, if healthcare budgets are overextended during the battle against COVID-19, there will be little funding remaining for future investment in healthcare unless governments make it a priority.

The impact of COVID-19 will be unequal

The impact of COVID-19 varies dramatically on a geographic level. The epicenter of the pandemic appears to have shifted from the Asia-Pacific to Western Europe, and most recently to the United States. Countries with a well-equipped healthcare infrastructure, like Japan, will be able to mobilize resources to effectively combat the pandemic.

As a result, these nations’ death tolls and demand for new equipment will be minimized. Conversely, developing markets such as Mainland China lack an adequate installed base of equipment so they will have a high demand for systems during the crisis. Similarly, markets where POC and primary care systems are more present, like the United States and Western Europe, will be better prepared to treat the influx of patients since they have more equipment and training.

However, markets like many in the Middle East that heavily favor dedicated systems will be forced to repurpose equipment, purchase new systems, quickly learn POC techniques, or rely on other imaging modalities.

There are also stark differences in healthcare manufacturers’ abilities to endure the pandemic. Clearly, point-of-care and primary care ultrasound manufacturers will see high demand for their equipment and may even benefit from the situation. Most ultrasound manufacturers do not focus only on POC and primary care and are susceptible to the ailing market caused by COVID-19.

Such companies that have diverse portfolios and strong supply chains are better suited to withstand the crisis since they will be able to reorient their sales to focus on systems that are being purchased for healthcare relief. Manufacturers that specialize in dedicated systems unrelated to the diagnosis of COVID-19 will bear the brunt of the pandemic.

The future remains largely uncertain

Currently, the true impact that COVID-19 has had on the medical imaging industry still remains to be seen, as hospitals and imaging facilities strive to figure out this new normal, and the world slowly starts to open back up from the past nine months of isolation, as nonessential imaging exams and procedures were postponed. Medical professionals are still unsure what the new business model looks like, but have been dedicating much of their time to figure this out.