MedTech

Ventilator sales take a hit in 2019

Innovation in the mechanical ventilation market continues to move forward at an exciting pace. Areas of focus include technology to improve patient outcomes, clinical workflow, and adding value to improve financial performance.

Automation, ease-of-use, and enhanced safety features are reshaping ventilator technology as respiratory departments fight alarm fatigue and healthcare-associated infections like VAP. Technology is evolving, protocols are becoming more stringent, and technicians are becoming more educated on how to utilize and care for the equipment. Since their initial appearance, mechanical ventilators have become more sophisticated, and expanded their application from the intensive care unit (ICU) to the respiratory medicine ward and even to patients’ homes for long-term treatments. This was the result of combining the advances in understanding of respiratory physiology, pathophysiology, and clinical management of patients together with technological progress in mechanical, electronic, and biomedical engineering.

Nowadays, this evolution is still rapid, with new devices and an increased number of ventilation modes and strategies being introduced to improve outcomes, patient-ventilator interactions, and patient care. Engineering has played, and is still playing, a relevant role in this process, not only in improving the technical performance of the ventilators but also in contributing to a better understanding of respiratory physiology and pathophysiology, and of how different ventilation strategies interact with the respiratory system.

Future ventilators will have smart algorithms that will project the trend, and estimated weaning time, based on patient history. More intelligence will be built into the alarm-management system, which not only ensures safety but is also capable of warning about potential hazards. Remote monitoring of critical parameters will help to ease the work of doctors as well as service personnel. Technological advancements will also reduce the footprint of ventilators, while enhancing the features with advanced blowers and smart batteries that can really work for long hours, independent of pneumatic and electrical source.

Indian market

Indian market

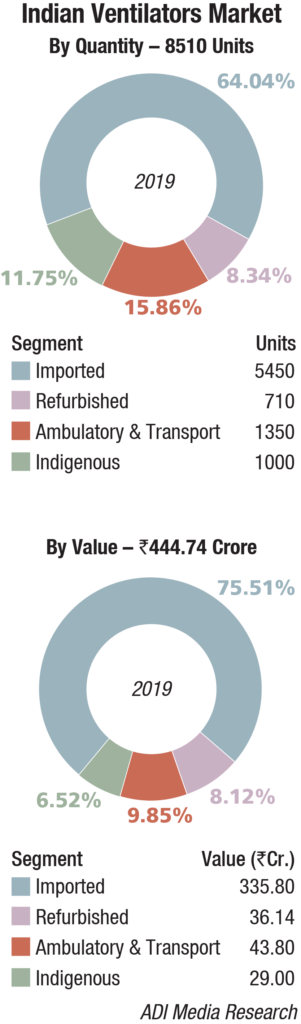

The Indian ventilators market in 2019 is estimated at 8510 units, valued at Rs 444.74 crore. The imported equipment continues to dominate the segment with a 75 percent share by value, and 64 percent share by units. The market saw an 8.5 percent decline by volume. The indigenous systems continued to hold sway at 1000 units. The decline was contributed by various imported machines – new, refurbished, and ambulatory models.

Procurement was largely done by government-run hospitals. HLL placed an order for 1286 units on Hamilton, at an average unit price of Rs 8 lakh. Draeger received two orders from the Maharashtra government, 260 numbers from DMER and 320 numbers from MCGM. The vendor also received an order for ambulatory models from the Hyderabad and Telangana state governments for about 108 and 35 units respectively. Schiller received orders from the Odisha, Tamil Nadu, and Kerala state governments for a total of 350 units, at an average unit price in the vicinity of Rs 11 lakh. Air Liquide received an order of 127 numbers each, for the next three years, of the ambulatory model from the Tamil Nadu state government. Mindray continued to gain strength in Tier-II and Tier-III cities. The vendor received an order of about 200 numbers from Government e-Marketplace (GeM), at an approximate average unit price of Rs 12.5 lakh.

2019 saw the advanced version of portable ventilators, developed by Dr Deepak Agrawal, All India Institute of Medical Sciences (AIIMS), gain popularity. The basic model is sold for Rs 35,000 and the advanced version for Rs 45,000.

Global market

The global mechanical ventilators market is expected to reach USD 7.13 billion by 2026, registering a CAGR of 6.6 percent, according to Research And Markets.

Growing geriatric population and technological innovation in respiratory care devices are the major factors driving the market. Moreover, increasing incidence of chronic obstructive pulmonary disease (COPD) and respiratory emergencies is contributing to market expansion. On the other hand, budgetary constraints faced by the ventilator manufacturers and healthcare may impede this growth.

However, innovations in the field of positive airway pressure (PAP) devices and improvement in battery life of transport and portable devices are projected to have a positive impact on the mechanical ventilators market growth. According to the estimates by the WHO, currently, approximately 90 percent of COPD deaths occur in low- and middle-income countries. Therefore, rise in prevalence of such diseases along with the introduction and availability of portable, cost-effective, and easy-to-use products for the treatment of respiratory conditions is expected to drive the market in the years to come.

Critical care ventilators are expected to account for over 39 percent of the overall market share by 2026 owing to the technological advancements, such as spontaneous breathing trial (SBT) and AutoTrak.

Major Vendors* In Indian Ventilators Market – 2019 |

||

|---|---|---|

| Tier I | Tier II | Tier III |

| Getinge | GE, Vyaire, Hamilton, Schiller, Mindray, and Draeger | Covidien, Philips, Air Liquide, and Skanray |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian Ventilator market. | ||

| ADI Media Research | ||

Transport and portable product segment is expected to record the highest CAGR of 7.24 percent during 2020–2026. These devices are widely used in hospitals as they provide faster and continuous care to patients even prior to their arrival in the hospital premises

Americas is the largest player in the global medical ventilators market with more than 60 percent of the share under its name. The increasing prevalence of lifestyle-based diseases in the region has led to diseases like bronchitis, asthma, chronic obstructive pulmonary diseases, and other disorders. This is, in turn, driving the growth of the market in this region. Add to this, an increasing number of patients are reported to be in critical state, there is a rising addiction to smoking, a growing number of surgical procedures is being performed, and the presence of a vast pool of medical device manufacturers in developed countries like the US are all contributing to the overall growth of the American medical ventilator market.

Leading Ventilator Brands |

||

|---|---|---|

| Segment | Brand | |

| Imported | Getinge, Draeger, GE Healthcare, Schiller, Philips, Mindray, Covidien, Hamilton, Air Liquide, Vyaire (Carefusion, IMT Medical, and Fabian HFO), Salvia (Nidek), eVent USA (Rohanika and Trivitron), Lowenstein Germany (BPL), Oricare -Aeonmed China, Shenyang RMS Medical, and Meditek, UK | |

| Indigenous | Skanray, Max Meditech, Medisys (Premier), Air Liquide, Cardiolabs, Chandigarh, and AgVa Healthcare, Delhi | |

| Refurbished | Zigma, Medinnova, Technomed, Unitech, Max Impex; Vision Healthcare, Ahmedabad, and SV Medisystems, Haryana | |

Europe holds the second-spot in the global medical ventilator market standings whereas the Asia-Pacific region is expected to hold the fastest-growing market tag over the next 6 years. Lastly, the Middle East & Africa regional market is anticipated to showcase little progress with the lack of medical development and awareness.

Some of the major players in the global medical ventilators market include names like Medtronic, Becton, Dickinson and Company, Teleflex Incorporated, ResMed, Philips, Hamilton Medical, Allied Healthcare Products Inc., GE Healthcare, and others.

Technology trends

In the last two decades, several modes of ventilation have emerged from the successful merging of the ventilator and computer technologies. Staying abreast of emerging ventilator modifications can be a formidable and ongoing challenge for physicians. Dual-control ventilation modes were designed to combine the advantages of volume-control ventilation (guaranteed minute ventilation) with pressure-control ventilation (rapid, variable flow at a preset or limited peak airway pressure). These dual-control modes attempt to increase the safety and comfort of mechanical ventilation. Although these new technologies seem promising, no findings from randomized trials indicate improved patient outcomes (including mortality).

Dual-control, breath-to-breath, pressure-limited, time-cycled ventilation. This mode has been called pressure-regulated volume-control (PRVC), adaptive pressure ventilation, auto-flow, volume-control plus, or variable-pressure-control ventilation according to various commercial ventilators. This mode is under the dual control of pressure and volume. The physician presets a desired tidal volume, and the ventilator delivers a pressure-limited (controlled) breath until that preset tidal volume is achieved. The breath is essentially like a conventional pressure-controlled ventilation breath, but the ventilator can guarantee a predetermined minute ventilation. The advantage of this mode is that it gives the physician the opportunity to deliver a minimum minute ventilation at the lowest peak airway pressures possible

Dual-control breath-to-breath, pressure-limited, flow-cycled ventilation. This mode has been called volume-support ventilation (VSV) or variable-pressure-support, according to which ventilator is used. This mode is a combination of pressure support ventilation (PSV) and volume-control ventilation. Like PSV, the patient triggers every breath, controlling his or her own respiratory frequency and inspiratory time. This mode delivers a breath exactly like conventional PSV, but the ventilator can guarantee minute ventilation. The pressure support is automatically adjusted up or down according to the patient’s lung compliance and/or resistance to deliver a preset tidal volume. This mode is similar to the dual-control breath-to-breath, pressure-limited, time-cycled ventilation except that it is flow cycled, which means that the patient determines the respiratory rate and inspiratory time. The mode cannot be used in a patient who lacks spontaneous breathing effort. Volume support has also been marketed as a self-weaning mode. Therefore, as the patient’s effort and/or compliance or resistance improve, pressure support is automatically titrated down without the need for input from a physician or therapist.

Automode and variable support or variable-pressure control. This mode is basically the combination of the two modes described above. If the patient has no spontaneous breaths, the ventilator is set up in the PRVC mode. However, when the patient takes two consecutive breaths, the mode is switched to VSV. If the patient becomes apneic for 12 seconds, the ventilator switches back to PRVC mode. Automode and variable support or variable-pressure control was designed for automatic weaning from pressure control to pressure support depending on the patient’s effort. This ventilatory mode can also be used in conventional volume control and volume support. Again, the mode depends on the patient’s effort. No randomized trials have been conducted to evaluate this automode, and no evidence suggests that this type of weaning is more effective than conventional weaning.

Dual control within a breath. This mode has been called volume-assured pressure support or pressure augmentation according to various manufacturers. This mode can switch from pressure control to volume control within a single specific breath cycle. After a breath is triggered, rapid and variable flow creates pressure to reach the set level of pressure support. The tidal volume that is delivered from the machine is monitored. If the tidal volume equals the minimum-set tidal volume, the patient receives a typical pressure-supported breath, which makes this mode essentially like volume support. However, if the tidal volume is less than the set tidal volume, the ventilator switches to a volume-controlled breath with constant flow rate until the set tidal volume is reached. However, because of its complexity, this mode is rarely used.

Proportional assist ventilation. This mode was designed to decrease the work of breathing and improve patient-ventilator synchrony. The mode adjusts airway pressure in proportion to the patient’s effort. Unlike other modes in which the physician presets a specific tidal volume or pressure, PAV lets the patient determine the inspired volume and the flow rate. This mode requires continuous measurements of resistance and compliance to determine the amount of pressure to give. The support given is a proportion of the patient’s effort and is normally set at 80 percent. This support is always changing according to patient’s effort and lung dynamics. If the patient’s effort and/or demand are increased, the ventilator support is increased, and vice versa, to always give a set proportion of the breath. The patient’s work of breathing remains constant regardless of his or her changing effort or demand.

Automatic tube compensation. This mode is specifically used for weaning and is designed to overcome the resistance of the endotracheal tube by means of continuous calculations. These calculations deal with known resistive coefficients of the artificial airway (size and length), tracheal pressures, and measurement of instantaneous flow. These calculations allow the ventilator to supply the appropriate pressure needed to overcome this resistance throughout the entire respiratory cycle.

Way forward

With computer feedback systems, many modern ventilators allow the operator to make fine adjustments in tidal volume, airway pressures, and the timing of the respiratory cycle. The desired result is improved ventilator-patient interaction and limitation of ventilator-induced lung injury. These newer methods of mechanical ventilation are often based on attractive physiologic hypotheses, and they are interesting to implement. Each method has its proponents, but objective evidence has failed to show that any of the alternative methods of ventilation is more successful than conventional mechanical ventilation with proper attention to tidal volume. Most clinicians use alternative methods of ventilation only in cases when conventional mechanical ventilation has failed.

Industry Speak

Pankaj Nigam

Pankaj Nigam

Director, International Sales and Marketing,

Shenyang RMS Medical Tech Co. Ltd.

High-flow nasal cannula

A high-flow nasal cannula (HFNC) is a device used to provide extra oxygen to a patient or person in need of respiratory help. High-flow nasal cannula contains a lightweight tube, which then separates into two prongs; these separated prongs are placed in the nostrils of the patient, from which a mixture of air and oxygen flows. One end of the tube is attached to an oxygen supply, such as a portable oxygen generator. This cannula is normally attached to the patient by the tube hooking around the patient’s ears or by an elastic headband. Nasal cannula supplies oxygen in a flexible manner, which means the supply of oxygen depends upon the patient’s breathing rate and pattern. The benefit of the nasal cannula for the patients, who are having chronic stable respiratory problems, is that they can eat, talk, and drink while using it and also, it reduces the risk of carbon dioxide rebreathing.

Medical uses. High-flow therapy is useful in patients that are spontaneously breathing, but have an increased work of breathing. Conditions, such as general respiratory failure, asthma exacerbation, COPD exacerbation, bronchiolitis, pneumonia, and congestive heart failure, are all possible situations where high-flow therapy may be indicated.

Newborn babies. High-flow therapy has shown to be useful in neonatal intensive-care settings for premature infants, with infant respiratory distress syndrome, as it prevents many infants from needing artificial ventilation via intubation, and allows safe respiratory management at lower FiO2 levels, and thus reduces the risk of retinopathy of prematurity and oxygen toxicity. Due to the decreased stress of effort needed to breathe, the neonatal body is able to spend more time utilizing metabolic efforts elsewhere, which causes decreased days on a mechanical ventilator, faster weight gain, and overall decreased hospital stay entirely. High-flow therapy has been successfully implemented in infants and older children. The cannula improves the respiratory distress, oxygen saturation, and the patient’s comfort. Its mechanism of action is the application of mild positive airway pressure and lung-volume recruitment.

High-flow market overview. Numerous factors are driving growth in the global high-flow nasal cannula market. At the forefront is the ever-increasing number of respiratory disorders. Besides, soaring popularity and uptake of heated humidified high-flow nasal cannulas and increasing investments in research and development programs by companies to come up with better products leveraging more sophisticated technologies is also positively impacting sales. A noticeable trend in the market is the focus of local players on cost-effective products. Application-wise, the key segments of the global high-flow nasal cannula market are acute respiratory failure, acute heart failure, chronic obstructive pulmonary disease (COPD), carbon monoxide toxicity, sleep apnea, bronchiectasis, etc. The acute respiratory failure segment, of them, held a major share in the market in 2019. It was followed by COPD segment.